by Siddharth Singh Bhaisora

Published On July 12, 2023

Factor investing strategies are gaining traction among investors seeking to enhance their portfolio returns. These strategies involve targeting specific characteristics or factors, such as value, size, profitability, momentum, or low volatility, which have historically outperformed the broader market. Let’s deep dive into each of these using global data to understand Can Factor Based Investing provide higher returns?

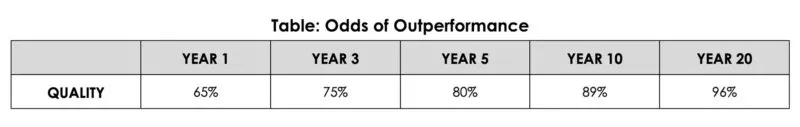

Quality factor investing focuses on companies with strong financial fundamentals, which are more likely to generate sustainable long-term returns for investors and are less likely to experience sudden decrease in their earnings figures or face financial difficulties during economic crises.

Companies with high margins, low leverage, stable earnings, high asset turnover, consistent growth, and low specific risk

Proven track record of success

Clear competitive advantage in their industry

Clear strategy for growth

Strong management teams with strong governance

Historically higher returns, especially in down markets

Possible higher costs for high-quality companies

Quality premium has been very persistent between 1927 to 2015. However, it’s crucial to remember that high-quality companies may be more expensive to invest in, and their future performance is not guaranteed.

As such many investors opt to implement quality along with other factors such as value, to not overpay for the company. Using quality & value factors is also a characteristic trait followed by Warren Buffet in his investing style.

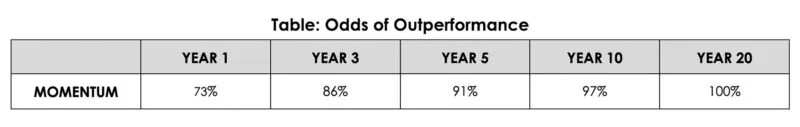

Momentum factor investing capitalizes on the market's tendency to underreact to positive news and overreact to negative news. Investors look for securities that have shown positive momentum in their price movements, expecting these securities to continue performing well in the short term.

Considers securities that have recently performed well

Requires a three month to one-year timeframe for examining past performance

High turnover strategy that may incur high transaction costs

Momentum premium has been very persistent between 1927 to 2015. Despite significant evidence that the momentum premium exists and persists, getting the momentum strategy right is difficult due to the high portfolio churn and excess transaction costs leading to lower than expected returns.

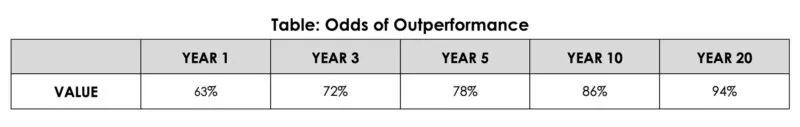

Value factor investing is one of the most well-known factor premiums. It posits that cheaper companies i.e. value companies, tend to outperform growth companies over the long term. However, this strategy is more suitable for long-term investors due to periods of underperformance, especially when we look at the 2005 to 2015 period.

Targets cheaper companies

Suitable for long-term investors

Explains stock performance from both a behavioral and risk perspective

Value premium has been persistent between 1927 to 2015 and chances of this strategy performing well increase as the investment horizon increases. From a risk perspective, value companies tend to outperform growth companies over time since value companies are riskier and hence have a higher discount rate than more stable companies. From a behavioural perspective, it relates to irrational exuberance i.e. where growth stocks are popular and favored by investors resulting in prices rising beyond their intrinsic value.

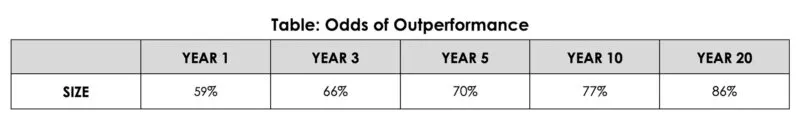

Small cap factor investing focuses on small cap stocks, which tend to outperform large cap stocks over long periods. However, it's important to control for quality when investing in small cap stocks, as many can fail or go bankrupt.

Prioritizes small cap stocks

Suitable for long-term investors

Requires quality control, focusing on profitable and financially stable companies

Size premium has been persistent between 1927 to 2015 and chances of this strategy performing well increase as the investment horizon increases. Small cap stocks are inherently riskier as they are more prone to macroeconomic shocks, may go bankrupt, may have poor risk management/ corporate governance and other such issues. It is important to control for quality when using the small cap factor and focusing on those companies that have shown profitability, have financial stability and due diligence of corporate systems

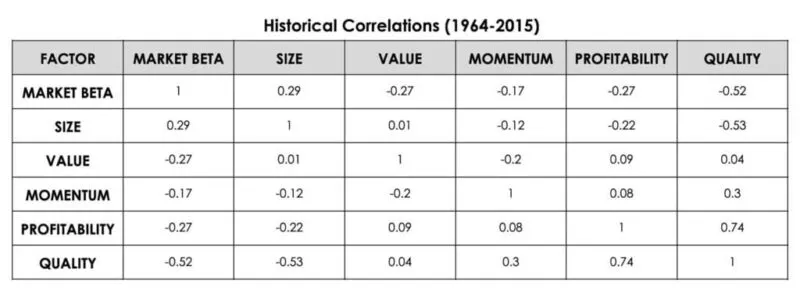

Multi factor investing combines certain positively correlated factors to achieve higher expected returns, or negatively correlated factors for greater diversification.

Combines different factors for increased returns or diversification

May use funds designed to capture these multifactor premiums

Here’s a table showing the historical correlation of factors. Understanding these relationships can help investors implement multi-factor strategies effectively.

Factor investing strategies can offer an effective way to diversify your portfolio and enhance returns. However, like any investment strategy, they come with risks and should be used as part of a balanced, well-researched investment approach.

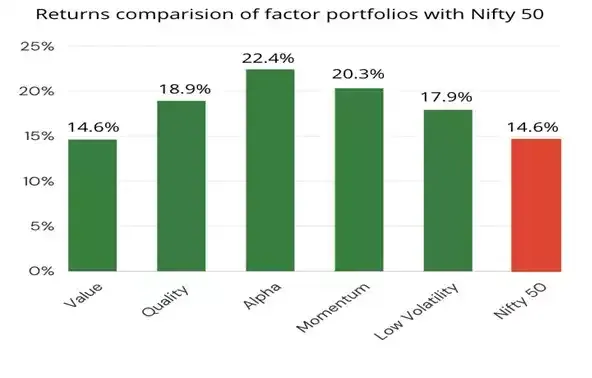

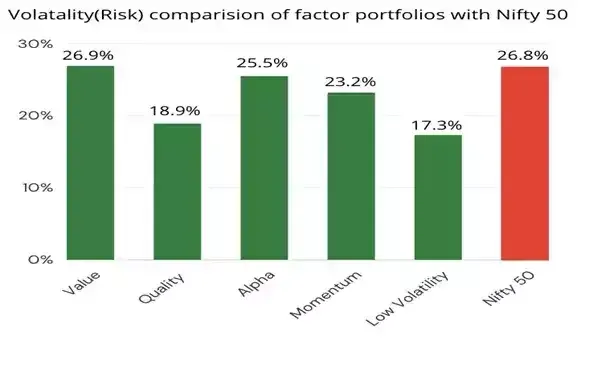

Here’s a brief overview of factor indices created by NSE for the period 1st April 2005 to 30th April 2022.

All factors, except value, have beaten the Nifty50. As explained earlier, factors experience cyclicality and as seen in the global research presented above along with NSE data, value hasn’t been performing well for the last 15+ years. However, over the last year or so the value factor has performed better.

From a volatility perspective all factors, except value, have lower risk than Nifty50. When we look at the low volatility factor, it has the lowest risk and has managed to outperform the Nifty50 over the 17 year period.

Explore Wright Research's Balanced Multifactor portfolio to understand how we have outperformed the index.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart