by Alina Khan

Published On Sept. 19, 2023

Manas is an entrepreneur in the EdTech sector, and has recently received Rs 2 crore from selling his startup. Being savvy enough, Manas reaches out to a financial advisor to help him figure out what to do with this capital. After understanding Manas’ goals, risk tolerance etc the financial advisor recommends Manas to consider portfolio management services (PMS) to invest his capital with the objective of funding his retirement years. Looking up “Best Portfolio Management Services” doesn’t yield many useful results for him - so let’s help him out and see How to Choose the Best Portfolio Management Services for Your Investments, and does PMS align with his aspirations and risk appetite?

Portfolio Management Service (PMS) refers to a professional financial service where experienced fund managers or experts manage an investment portfolio on behalf of individual investors or institutions. PMS provides tailor-made investment strategies, designed to achieve financial goals with the desired risk levels. It entails a diversified approach and includes a blend of assets like stocks, commodities, fixed income, real estate, and cash. The primary goal is to optimize your portfolio for returns while managing risks effectively.

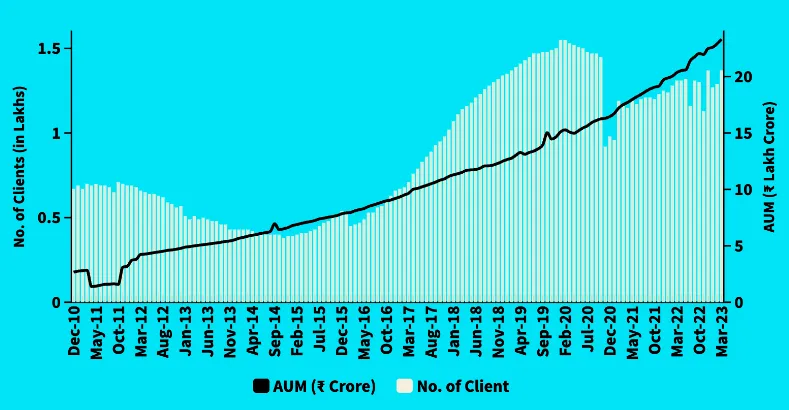

Growth in AUM & Number of Clients for Discretionary PMS

Read this article to understand What is Portfolio Management Service? There are different types of portfolio management services.

Professional portfolio managers have full discretion and authority to make investment decisions on behalf of clients without seeking any prior or explicit approval for investment decisions and trades. Choice of investment and timing of investing rests with the portfolio manager

Portfolio managers give investment ideas and recommendations, but clients retain the final say on executing investment decisions in terms of deciding where to invest and when to invest. Once the client has decided, they inform the portfolio manager who then executes what the client wants.

Similar to non-discretionary portfolio management services, in the advisory PMS model portfolios managers only suggest ideas while the client is responsible for where to invest, when to invest and executing the investments as well. The portfolio manager is not involved in the execution at all.

Understand the differences between Portfolio Management & Wealth Management .

Unlike mutual funds, where multiple investors pool their money and a fund invests that money in return for giving the investors unit or shares in the fund, PMS takes a segregated approach. Each investor's capital remains in an individual account, managed by an expert portfolio manager per a pre-decided investment mandate.

While mutual funds pool assets, PMS keeps them distinct. Each investor in PMS has a dedicated bank and demat account. This means you can monitor the health and composition of your investments daily.

Minimum ticket size for PMS is comparatively higher, with a minimum investment threshold set at Rs 50 lakh while investing in mutual funds can start with as low as Rs. 500 via SIPs.

PMS managers have the discretion to manage the portfolio, buy and sell stocks, etc. and have less regulatory restrictions compared to mutual funds. This can sometimes yield higher returns, especially if the manager explores less analyzed stocks, small cap stocks or under-the-radar stocks from emerging sectors or companies.

Investments under PMS are transacted in the investor's name, offering an unparalleled view into real-time actions. An investor can monitor buys, sells, and overall portfolio health anytime.

With greater rewards, there's often greater risk. The agility that PMS offers, while an advantage, can also swing the other way. Especially when the fund manager leans heavily on specific sectors or stocks. Hence, an extended investment horizon becomes essential to ride out the inherent volatility and reap the benefits of high-growth potential stocks. For someone like Manas, who is contemplating locking in his money until retirement, the risk associated with PMS can be a worthy trade-off, especially when coupled with the service's transparency benefits.

According to a survey conducted by the Reserve Bank of India, the majority of Indian investors cite wealth creation as their primary investment objective.

The journey to finding the ideal PMS begins with a deep introspection of your investment goals and risk tolerance. Are you aiming for long-term wealth creation, or is capital preservation your primary concern? Assess your willingness to withstand market volatility and potential losses. Having a clear understanding of your objectives and risk appetite will guide your PMS selection.

As of September 2021, there were over 200 SEBI-registered portfolio managers in India, offering various PMS options.

With a list of potential PMS providers in hand, conduct thorough research on each. Start by visiting their websites to understand their offerings and investment strategies. Pay attention to the types of clients they cater to; some may specialize in serving high-net-worth individuals, while others may have a broader client base.

A portfolio manager in India must have a minimum experience of five years in the securities market to be eligible for registration with SEBI.

The credentials and experience of the portfolio management team are critical. Verify if they have the requisite qualifications and expertise. Additionally, check if the PMS provider is registered with the Securities and Exchange Board of India (SEBI), ensuring compliance with regulatory standards.

Companies with longer durations in the business typically demonstrate some level of credibility and stability. Friends and family, especially those already availing PMS from a company, can give invaluable insights into their own experiences, performance of the fund, fee changes etc.

Transparency is non-negotiable if you are trusting in someone to manage your money like you do in PMS. Ensure that the Portfolio Management Service provides clear and comprehensive information about their fees, investment strategies, and portfolio composition. Lack of transparency can lead to misunderstandings and disputes down the road.

SEBI mandates that PMS providers disclose their track record, including performance, returns, and fees, in their marketing material.

For PMS providers that have a historical track record, examine the historical performance diligently. Review their track record, particularly during different market conditions. While past performance is not indicative of future results, it provides insights into their investment capabilities.

PMS fee structure is typically an initial fee and a performance fee. While a low fee can be enticing, it's essential to benchmark against peers. This fee also varies based on the type of PMS service: discretionary or non-discretionary. Keep in mind that higher fees do not necessarily equate to better performance. Consider how these fees align with your investment goals and expected returns.

PMS fees typically consist of management fees for discretionary PMS at 2-2.5% of assets under management or 0.5-1% for non-discretionary PMS, and performance-based fees for discretionary PMS at 10-20% of profits above a fixed or a variable hurdle rate.

Also make sure you are aware of other factors such as entry and exit loads before you commit to a PMS.

Evaluate the accessibility and convenience of managing your portfolio. Check if the PMS provider offers user-friendly online platforms or mobile apps for tracking your investments. Accessibility and ease of account management can significantly impact your overall experience.

As of 2020, SEBI introduced a riskometer for PMS to help investors gauge the risk associated with different PMS products.

Ensure that the PMS provider adheres to regulatory guidelines and has a clean compliance record. SEBI regulations aim to safeguard investor interests, so it's crucial to choose a provider who complies with these regulations.

Customization is a hallmark of PMS. Assess whether the provider offers customization options to tailor your portfolio to your specific needs. A one-size-fits-all approach may not align with your unique financial objectives.

Effective risk management is integral to PMS. Inquire about the provider's risk management strategies and how they handle adverse market conditions. Additionally, understand the frequency and comprehensiveness of portfolio reporting. Clear and regular reporting keeps you informed about the performance and composition of your portfolio.

SEBI requires PMS managers to provide monthly disclosures on its performance. These are accessible to investors as well.

According to a CFA Institute report, 68% of investors consider online reviews and testimonials when selecting an investment manager.

Look for client reviews and testimonials to gauge the satisfaction levels of existing clients. While individual experiences can vary, consistent negative feedback may be a red flag.

If feasible, conduct interviews with potential portfolio managers. This interaction allows you to assess their communication skills, understanding of your objectives, and alignment with your investment philosophy. It's an opportunity to ask questions and gain clarity on their approach.

After meticulous research and evaluation, it's time to make the final decision. Consider all the factors discussed, but also trust your instincts. Choose a PMS provider that aligns with your financial goals, offers a level of risk you are comfortable with, and instills confidence in their ability to manage your portfolio effectively.

Once invested, make sure to regularly monitor and assess performance of the PMS, go through the regular disclosures.

Performance: Compare returns with broader market indices like Sensex or Nifty, especially if your portfolio is equity-heavy.

Adherence to Investment Mandate: Ensure the PMS provider sticks to the agreed investment strategy and executes decisions promptly.

Rationale behind Investments: Engage with the fund manager to understand the logic behind specific investment choices.

Churning: Excessive portfolio churning might result in higher fees. Be wary of PMS providers who indulge in this to inflate their brokerage income.

Selecting the best Portfolio Management Service for your investments is a critical decision that warrants thorough research and due diligence. By defining your investment goals, assessing risk tolerance, researching providers, and considering factors like track record, fees , transparency, and customization options, you can make an informed choice that aligns with your financial aspirations.

Your financial journey is unique, and the right PMS provider should empower you to navigate the markets with confidence. Whether you are an individual investor looking to grow your wealth or an institution seeking professional portfolio management, the principles outlined in this guide can help you make a well-informed decision. In the end, the key to successful investing lies in the alignment of your chosen PMS with your financial goals and risk tolerance, ensuring a brighter financial future.

Wright Research, a robo advisor , has rapidly solidified its presence by managing over Rs 650 crore in Assets Under Advisory (AUA) under SEBI RIA license. With its new AI-driven quant-based PMS, the organization is poised to extend its impact on a larger scale. By democratizing AI-powered investment strategies, Wright Research contributes to the cultivation of a more informed, data-driven investment culture in India. It has recently launched its PMS service and is already a noteworthy player in the Indian market is "Wright Research," and is regarded as the best Portfolio Management Service provider in India.

Known for its customer-centric approach and robust investment strategies, Wright Research has garnered a reputation for delivering consistent and superior returns to its investors. Their expertise in active portfolio management, supported by in-depth research, sets them apart in the industry.

A hallmark of Wright Research's PMS is its utilization of artificial intelligence to drive investment strategies. This automated portfolio management service takes an advanced approach employing AI algorithms to analyze market data, identify trends, and uncover investment opportunities that might elude traditional methods. By harnessing the power of data-driven insights, the best PMS services in India empowers investors with a more informed and analytical approach to making financial decisions.

The best PMS services in India are from Wright Research which are designed to cater to a diverse range of investors, with a minimum ticket size of Rs 50 lakh. Investors gain access to a carefully curated basket of 20-30 diversified stocks, dynamically rebalanced on a monthly basis. This approach not only ensures a well-rounded investment portfolio but also provides the agility to adapt to market fluctuations and evolving trends.

The best PMS services in India provides 4 portfolios for investors to consider - the Wright Alpha Fund , Wright Factor Fund , Wright Factor Fund Hedged & Wright Debt Fund.

The portfolio manager for Wright Research’s quantitative PMS is Sonam Srivastava , an accomplished professional with over a decade of experience in quantitative research and portfolio management. An alumnus of IIT Kanpur, Sonam further honed her expertise with a master's degree in financial engineering from Worldquant University. Her credentials extend to HSBC, Edelweiss, and Qplum, where she has garnered significant experience in systematic portfolio management and quantitative trading.

Sonam's expertise has played a pivotal role in crafting Wright Research's distinctive data-driven, factor-based strategy. Under her guidance, Wright Research, the best PMS services in India, aims to unlock unique investment opportunities that align with clients' financial goals, thereby paving the way for an optimal growth trajectory. You can read more about the growth trajectory of Wright Research.

Wright Research's commitment to transparency, personalized services, and a proven track record makes them an ideal choice for investors seeking to maximize their investment potential and the best portfolio management service provider in India.

How do I determine my investment goals?

Determine your investment goals by assessing what you want to achieve financially, whether it's wealth creation, capital preservation, or income generation.

Can I use portfolio management services for retirement planning?

Yes, you can use portfolio management services for retirement planning by aligning your investment strategy with long-term retirement goals.

How should I check the track record of portfolio management services?

Check the track record of portfolio management services by reviewing their historical performance, returns, and adherence to regulatory standards, often available on their websites.

What questions should I ask during interviews with portfolio managers?

During interviews with portfolio managers, ask about their investment philosophy, risk management strategies, and how they tailor portfolios to clients' needs.

Is there a minimum investment requirement for portfolio management services?

Yes, there is a minimum investment requirement of INR 50 Lakhs as mandated by SEBI regulations.

What types of investment strategies do portfolio management services offer?

Portfolio management services offer various investment strategies, including growth, income, value, and sector-specific strategies, catering to different client preferences.

How long should the selection process for portfolio management services take?

The selection process for portfolio management services can vary but may take a few weeks to a few months, depending on the thoroughness of your research and interviews with potential providers.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart