- Tools

Get your

financial

Advise - Services

Get your

financial

Advise - About

-

News & Blogs

-

Start Investing

Find the

Perfect Portfolio

- Sign In

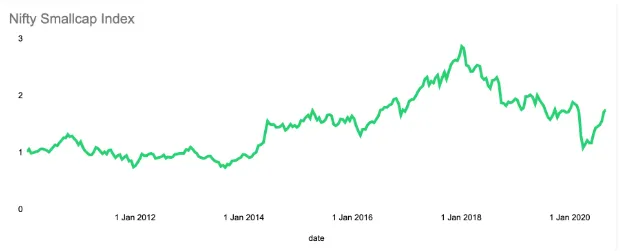

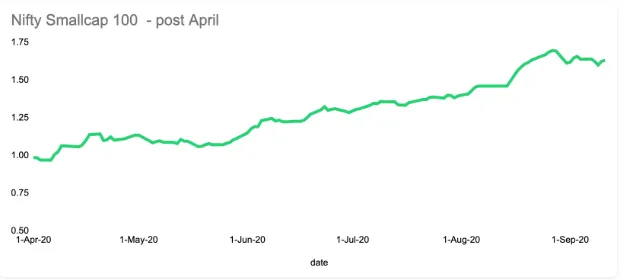

In 2020, post COVID, in the recovery rally in the markets, we see a similar rally and I cannot help but dig back my old passion for smallcap strategies to get this flavour. The recent notification of changes in SEBI regulations for mutual funds, calling for greater participation by multi cap mutual funds in smallcaps has also consolidated this rally and hopefully the smallcap upcycle continues in full swing.

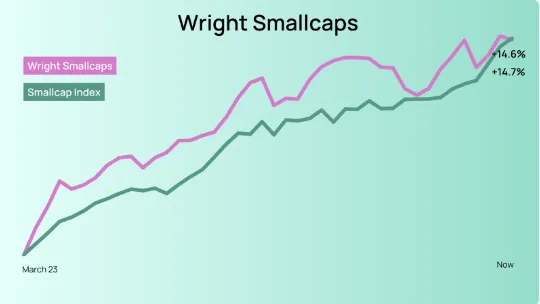

In 2020, post COVID, in the recovery rally in the markets, we see a similar rally and I cannot help but dig back my old passion for smallcap strategies to get this flavour. The recent notification of changes in SEBI regulations for mutual funds, calling for greater participation by multi cap mutual funds in smallcaps has also consolidated this rally and hopefully the smallcap upcycle continues in full swing. We have decided to offer a smallcap strategy as a satellite portfolio to not miss out on this irresistible rally.

We have decided to offer a smallcap strategy as a satellite portfolio to not miss out on this irresistible rally.