Earnings season is upon us, providing a vital window to assess shifting industry dynamics and macroeconomic developments. For Q3FY25, India’s economic outlook is marked by stable Real GDP growth forecast at 6% YoY and cooling inflation at 4.8%. Despite challenges like subdued urban consumption driven by weak wage growth and inflationary pressures, rural markets are showing resilience, supported by favorable monsoons and increased government transfers.

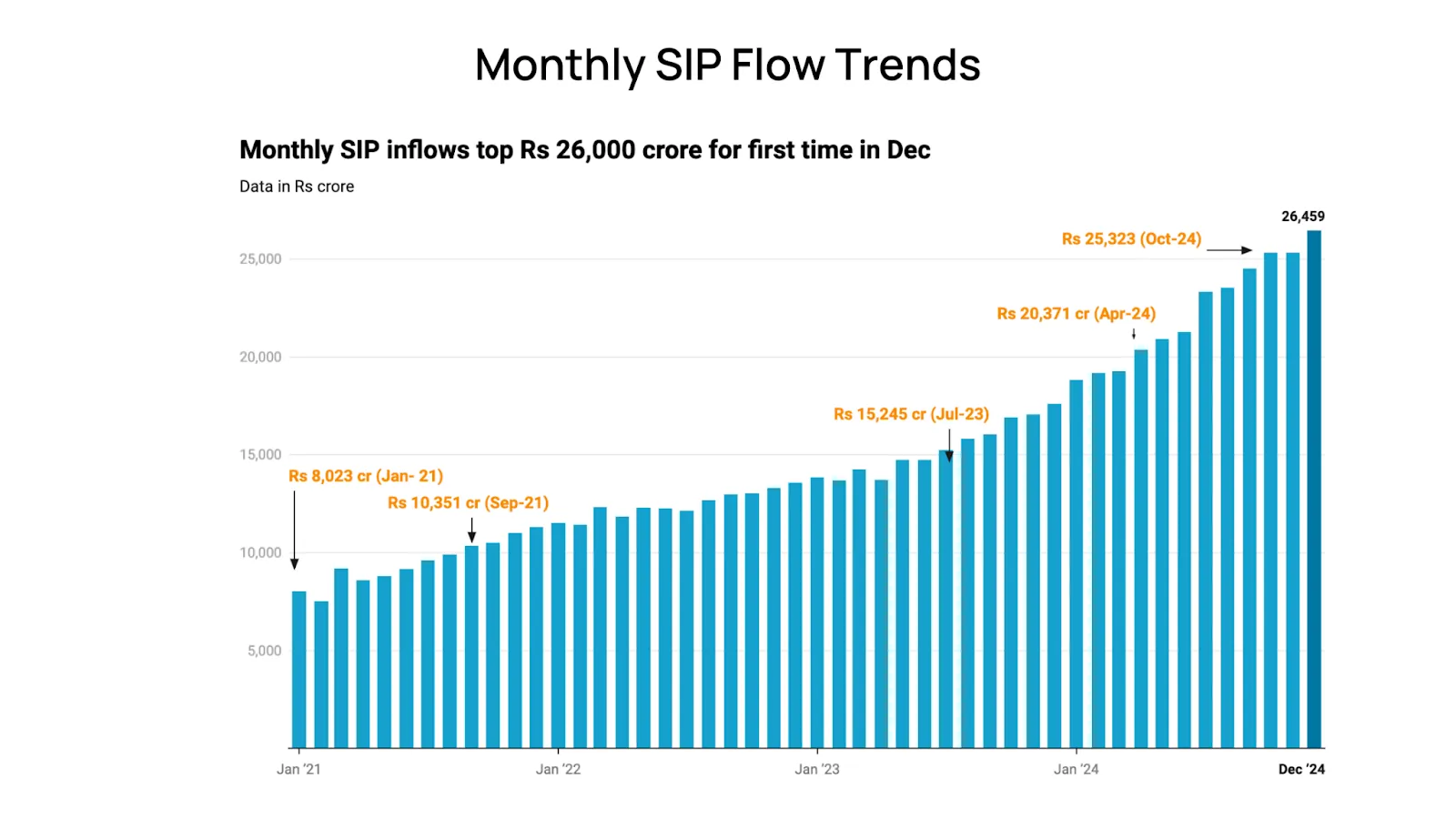

While private capital expenditure remains uneven, government-driven infrastructure spending has been a bright spot, bolstering sectors like construction and capital goods. Monthly SIP inflows have surged to INR 264 billion, reflecting strong retail investor confidence and growing mutual fund penetration in Tier-II and Tier-III cities. On the external front, export-oriented sectors face headwinds from weak global demand, although services exports have provided a buffer. Anticipated monetary easing by the RBI is likely to alleviate liquidity constraints, offering tailwinds to domestic demand-driven sectors.

Amid this mixed backdrop, certain high-growth sectors are poised to thrive. Consumer durables, agrochemicals, healthcare, financial services, internet-enabled services and fintech, as well as premium consumer discretionary segments, are likely to stand out this earnings season. Let’s explore these sectors in detail.

The consumer durables segment is positioned for substantial growth, driven by a combination of favorable seasonal demand, technological advancements, and evolving consumer preferences. Rising temperatures have spurred increased purchases of air conditioners and refrigerators, leading to a 12% YoY growth in volumes for key players such as Voltas, Blue Star, and LG. Additionally, demand for energy-efficient appliances has surged as consumers prioritize sustainability and cost savings. Urban markets are showing a strong inclination toward connected and smart devices, including IoT-enabled washing machines and air purifiers, which have grown 15% YoY in sales.

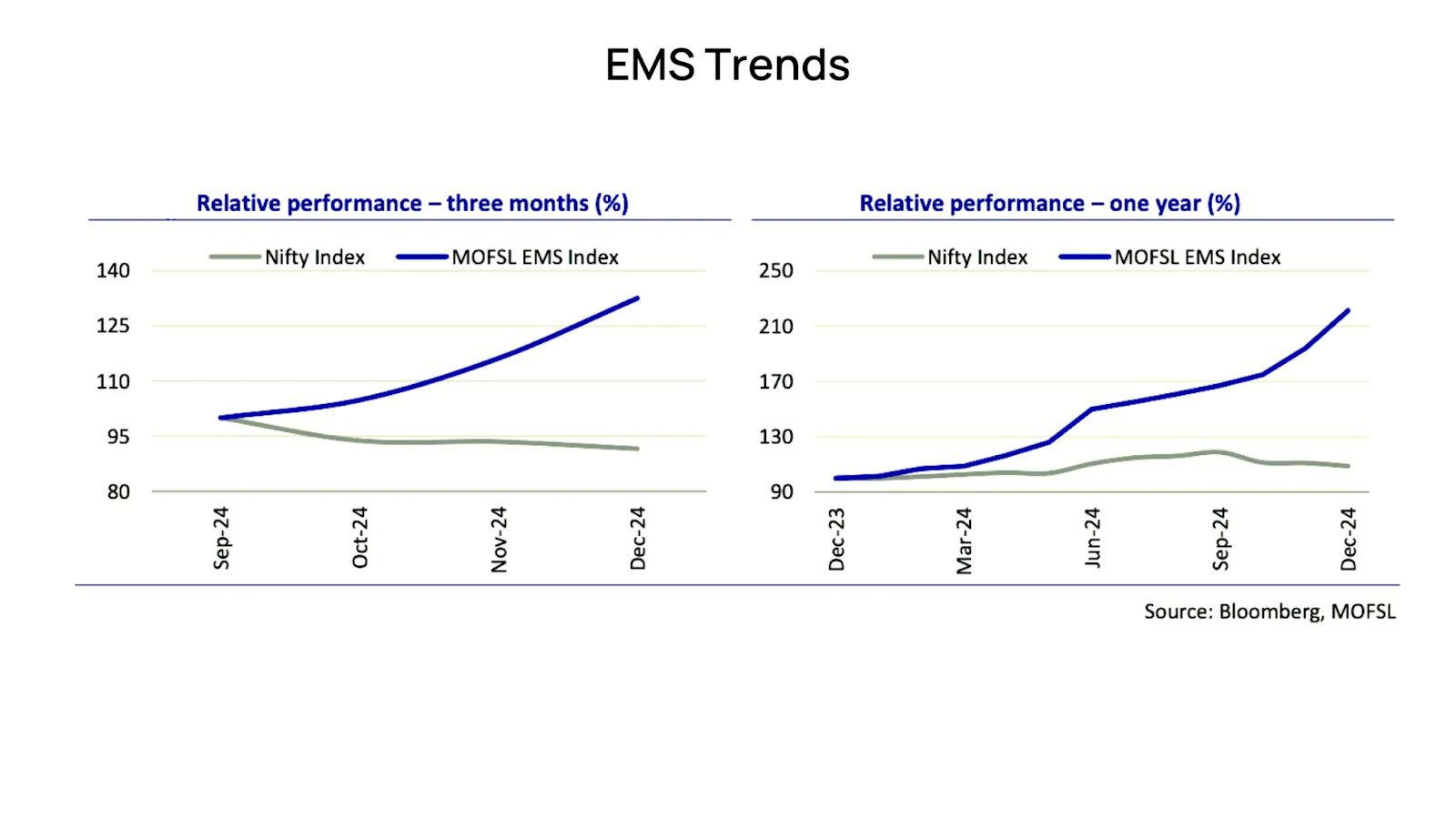

Meanwhile, the Electronics Manufacturing Services (EMS) segment is also witnessing a robust expansion, supported by government incentives such as the PLI (Production Linked Incentive) scheme. Key players like Dixon Technologies and Amber Enterprises are reporting double-digit revenue growth due to rising demand for locally assembled and manufactured components. Falling raw material costs, especially in steel and aluminum, are set to bolster margins across both consumer durables and EMS companies. Havells and Whirlpool are leveraging these cost advantages to enhance profitability while focusing on premium product offerings and innovative designs.

The government’s push for energy-efficient standards, coupled with rising disposable incomes in urban areas, has further fueled this trend. Analysts anticipate revenue growth of 15-18% in consumer durables and EMS for Q3FY25, supported by robust distribution networks, rising domestic demand, and innovative product launches.

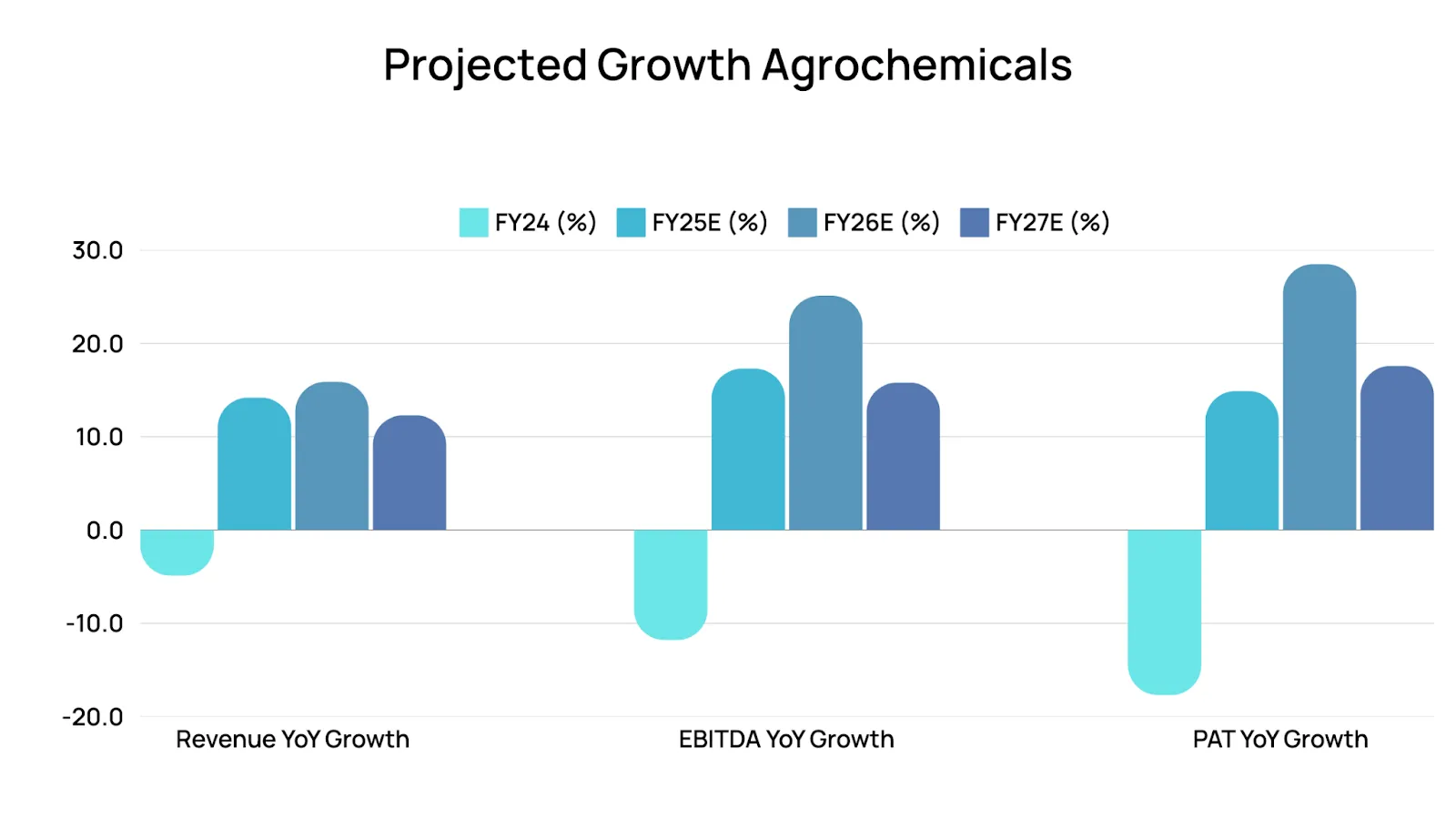

The agrochemical industry is experiencing significant tailwinds, underpinned by favorable monsoons, which have contributed to a 19% YoY increase in reservoir levels and improved soil moisture conditions. These developments have driven strong demand for crop protection products, with herbicide and fungicide sales witnessing a 15% and 12% YoY growth, respectively, surpassing insecticides. The domestic market is benefiting from an increase in acreage for key crops, while export-oriented firms are leveraging stabilizing global agrochemical prices, leading to a projected 10% YoY increase in revenue for the sector.

Key players like UPL and PI Industries are capitalizing on the shift towards specialty chemicals and value-added products, which offer higher margins and stronger resilience against commodity price fluctuations. UPL has reported robust growth in Latin America and North America, while PI Industries is expanding its product pipeline with new launches targeted at high-growth markets in Asia and Europe. Additionally, the government’s emphasis on self-reliance in agriculture and subsidies for advanced crop protection solutions are bolstering the sector’s outlook.

Analysts expect agrochemical companies to sustain double-digit EBITDA growth in Q3FY25, supported by operating efficiencies and export-driven demand recovery in key geographies.

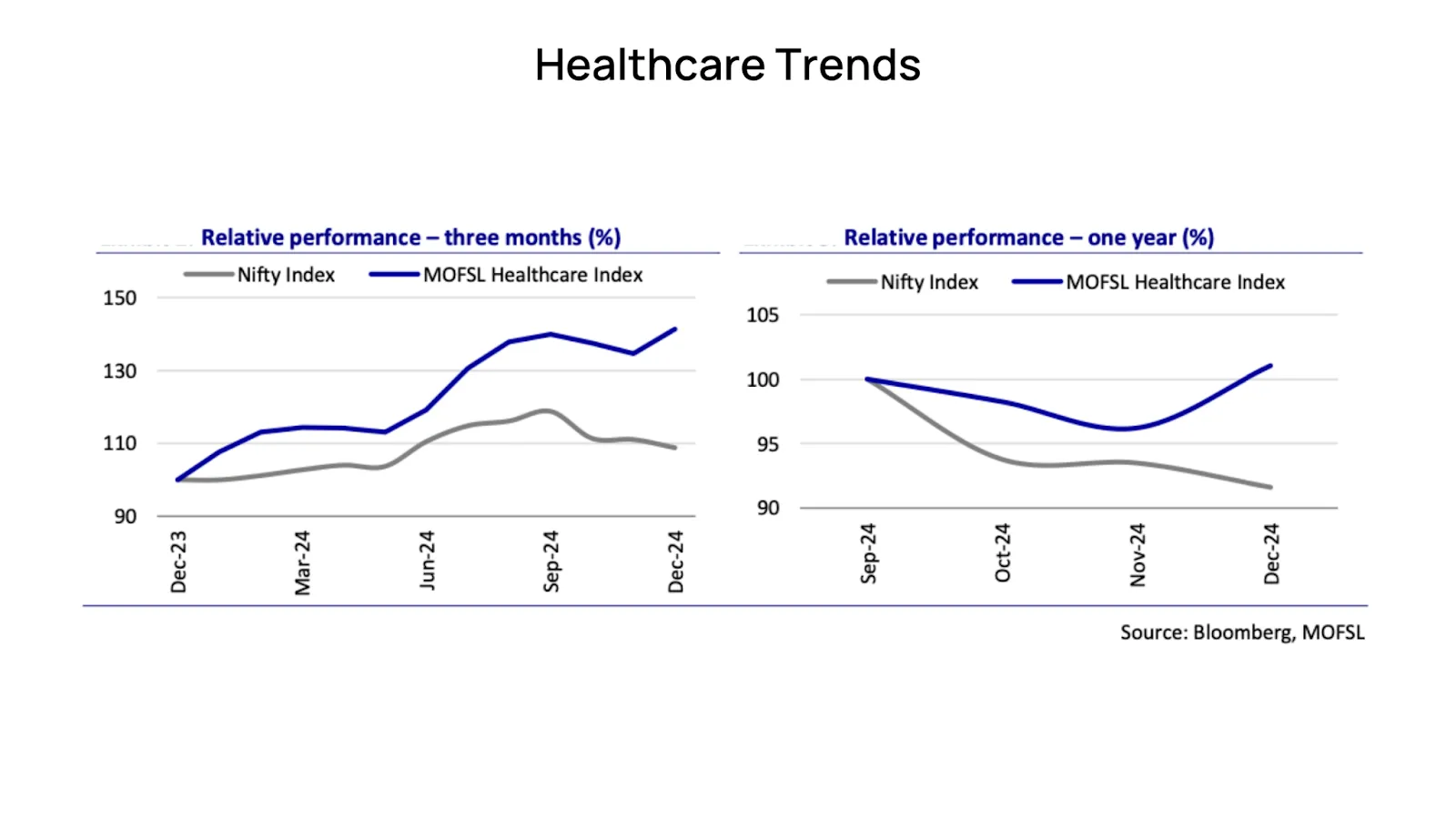

Healthcare is emerging as a dynamic growth sector, driven by increasing demand for specialized medical treatments, diagnostics, and hospital expansions into tier-II and tier-III cities. Hospitals have reported a 15% YoY growth in patient footfalls, with high-value segments such as oncology, cardiology, and orthopedics contributing significantly to revenue. The growing prevalence of lifestyle-related illnesses is further spurring demand for specialty care. Notable players like Apollo Hospitals and Narayana Health are investing heavily in expanding their footprints, especially in underserved regions, which is expected to boost long-term revenue streams.

Diagnostics chains are also thriving, with a 20% YoY increase in test volumes. Companies like Dr. Lal PathLabs and Metropolis Healthcare are expanding their test menus and partnering with insurance providers to make diagnostics more accessible. Additionally, advancements in technology such as AI-based diagnostic tools are enhancing operational efficiencies, leading to improved EBITDA margins across the sector. The government’s increased focus on public health infrastructure and private sector partnerships is expected to further drive growth. Analysts project a 17-20% increase in sector-wide revenues for Q3FY25, making healthcare one of the most resilient and promising industries in the current economic landscape.

The financial services sector continues to outperform, driven by strong growth in insurance, asset management, and retail banking. Life insurers like HDFC Life and ICICI Prudential are expected to post a 15% YoY increase in Annual Premium Equivalent (APE), bolstered by rising demand for ULIPs and hybrid insurance products. Recent regulatory clarity on bancassurance channels has also provided a boost to distribution networks, enabling insurers to tap into underpenetrated markets.

Asset management companies, including HDFC AMC and Nippon India AMC, are witnessing record SIP inflows, surpassing INR 264 billion monthly. This reflects growing retail participation from Tier-II and Tier-III cities, supported by targeted investor education campaigns and digital onboarding processes. Additionally, the introduction of thematic and flexicap mutual fund schemes has expanded the product mix, driving incremental inflows.

Banks remain resilient with stable credit growth, particularly in the retail and MSME segments. Lenders like Axis Bank and Kotak Mahindra Bank are focusing on fee-based income streams through wealth management and cross-selling initiatives. Analysts expect the financial services sector to sustain double-digit revenue growth in Q3FY25, underpinned by robust macroeconomic tailwinds and ongoing digital transformation across the ecosystem.

Internet-based services, particularly fintech players, are thriving as digital adoption accelerates across India. The number of active digital users has surged by 20% YoY, driving substantial revenue growth for payment gateways like Razorpay and lending platforms such as Lendingkart and KreditBee. This shift is underpinned by a 30% YoY increase in UPI transaction volumes, which have reached an all-time high, reflecting the growing reliance on digital payment ecosystems.

Companies offering buy-now-pay-later (BNPL) solutions, including Pine Labs and Simpl, are witnessing rapid adoption, particularly among younger demographics seeking flexible financing options. The BNPL market in India is projected to grow at a CAGR of 24% over the next five years, driven by rising e-commerce penetration and consumer preferences for deferred payments.

Additionally, subscription-based SaaS models are gaining prominence among businesses and consumers alike. Firms such as Zoho and Freshworks are expanding their offerings, focusing on scalability and integration, which have contributed to a 15% YoY growth in SaaS revenues. This predictable revenue stream has also led to improved valuations for leading players in the sector. Analysts expect internet-enabled services and fintech to continue their double-digit growth trajectory in Q3FY25, supported by innovative solutions and expanding market opportunities.

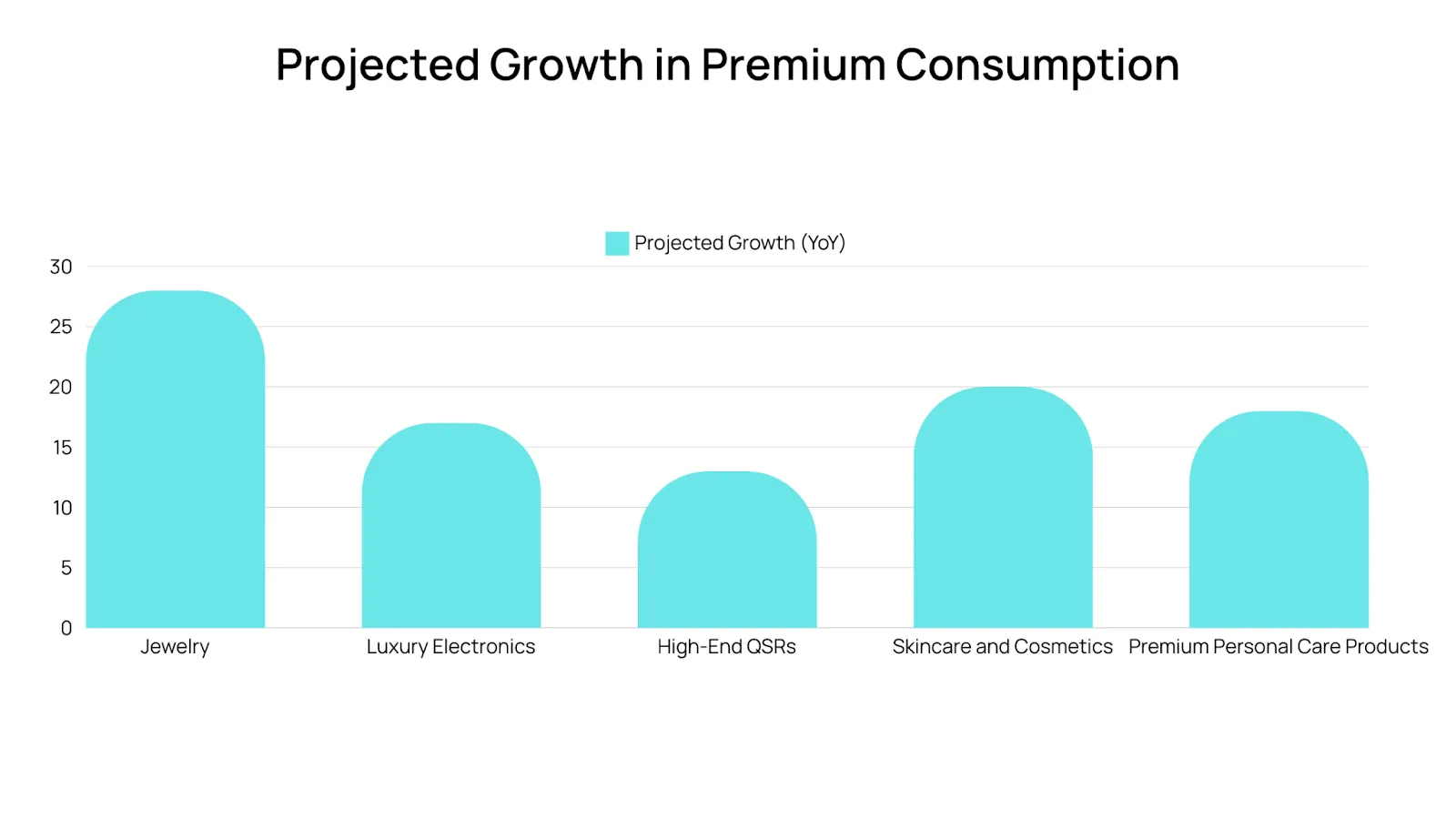

The premium consumer discretionary segment, including luxury goods and high-end QSRs, continues to thrive as aspirational consumption trends gain momentum. Jewelry sales have recorded a 28% YoY increase, underpinned by robust demand during the wedding season and an uptick in high-value purchases. Titan, for instance, reported a surge in store traffic and higher conversion rates, reflecting strong consumer sentiment.

Similarly, high-end electronics and personal care products have witnessed double-digit growth, fueled by rising disposable incomes in urban centers. Companies like Apple and Dyson are benefiting from a consumer shift toward premium gadgets and appliances, while brands like L'Oréal and Estée Lauder are capitalizing on the growing demand for luxury skincare and cosmetics. Analysts highlight that urban millennials and Gen Zs are driving this demand, with a strong preference for innovative and sustainable products.

Brands that leverage omnichannel strategies are particularly well-positioned to capture this opportunity. For example, luxury retailers integrating exclusive product launches across online and offline channels have seen a 15% higher customer retention rate. The introduction of loyalty programs and personalized shopping experiences is further enhancing customer engagement. Analysts project a 20% YoY revenue growth in this segment for Q3FY25, underscoring its resilience and growth potential in the evolving economic landscape.

While high-growth sectors hold promise, several challenges could temper their performance:

Rising Costs: Companies in sectors such as agrochemicals and consumer durables face higher input costs despite some moderation in raw materials. Effective cost management remains critical.

Export Headwinds: Agrochemical exporters may face delays in demand recovery in certain markets, despite stabilizing global prices.

Regulatory Shifts: The financial services and healthcare sectors are navigating evolving regulatory landscapes, which may impact near-term profitability.

Earnings season is a critical period for understanding market trends and identifying potential winners. While macroeconomic headwinds and sector-specific challenges persist, there are clear opportunities in consumer durables, agrochemicals, healthcare, financial services, internet-enabled services, and premium consumer discretionary sectors. Investors should focus on sectors with robust fundamentals, strong demand drivers, and the ability to adapt to shifting market conditions.

Diversification remains key. Balancing high-growth opportunities with defensive plays can help navigate uncertainties while maximizing returns. This earnings season, let the data guide your strategy as you capitalize on the evolving landscape of high-growth sectors.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart