The news of India banning Tiktok and 59 other Chinese apps recently shook the Indian internet this week. This came following the recent clashes with Chinese troops in the Galwan Valley in Ladakh on 15th June in which 20 Indian soldiers lost their lives. Since then there have been growing calls in the country to boycott goods from the neighboring country. Chinese products, services, and investments are deeply entrenched in India’s supply chain and the nationalistic sentiment could potentially lead to a trade war between the nations.

Though such a scenario is neither immediate nor looming, let us understand the economic implications of such a trade war. Let’s start by looking at India-China economic relations.

China is India’s biggest trading partner in the world and India also has the largest trade deficit with China (which means that India imports more than it exports to China). This deficit has doubled in less than a decade.

What does India trade with China? Our primary exports are organic chemicals and raw materials like iron ore, slag, cotton, natural pearls, etc. We import finished goods like machinery, power-related equipment, telecom, organic chemicals, and fertilizers which overshadow our raw material based exports.

Foreign Direct Investment between the countries has not kept up pace with trade but China has entered the Indian market through venture investments in start-ups and penetrated the online ecosystem with its popular smartphones and apps. Chinese tech investors have put an estimated $4 billion into Indian start-ups. TikTok, the video app, had 200 million subscribers and had overtaken YouTube in India. Alibaba, Tencent, and ByteDance rival the U.S. penetration of Facebook, Amazon, and Google in India. Chinese smartphones like Oppo and Xiaomi lead the Indian market with an estimated 72% share, leaving Samsung and Apple behind.

Chinese products form a critical part of the supply chain for firms in many sectors in India. With the economy struggling to recover from the pandemic, any potential escalation between the two nations could escalate operational as well as supply-chain risks. India can look to find alternatives for Chinese products but such a step would be tedious and expensive.

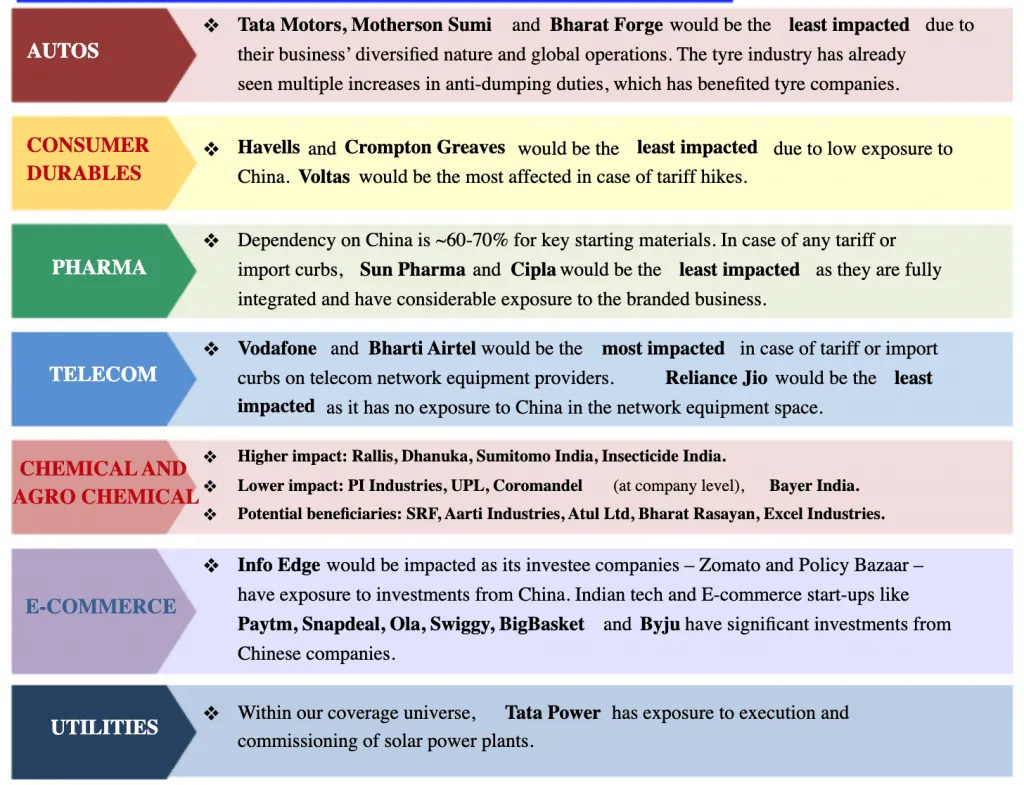

Key sectors affected would be :

This could be a great opportunity for startups in India to rise up to the occasion and build products and services for making India more self-dependent. Key infrastructure products allotted to Chinese firms could also come to Indian firms as a result of this escalation.

Which specific stocks stand to lose or gain?

According to areport by Motilal Oswalthe impact on stocks in the key sectors is:

As said before, the threat to your portfolio is in no way immediate or looming! If the situation escalates the stocks and sectors mentioned above that have direct exposure to China would get affected adversely, while some stocks would stand to gain or will be unaffected.

The behavioral impact on the overall market could also be adverse, for which we need to keep a lookout and dynamically adjust our asset allocation for yet another extraordinary situation if it escalates!

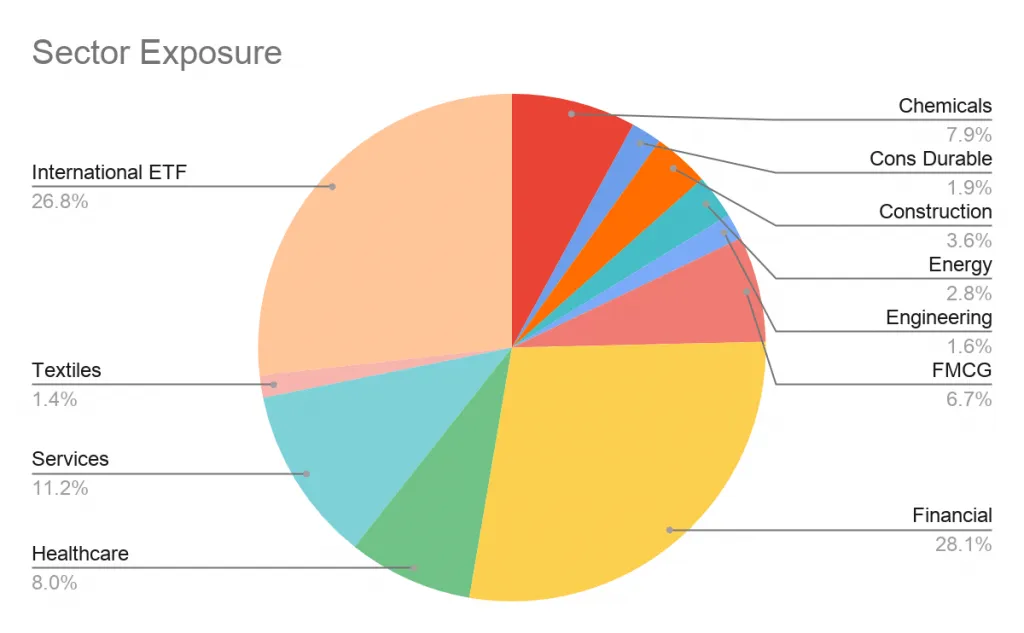

At Wright Research, our current allocation is expecting a favorable market for equities, but we will be cautiously watching the market and our model should adjust the allocation as it sees the risk.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart