by Sonam Srivastava

Published On April 20, 2024

As we edge closer to the mid-point of 2024, India continues to be a beacon of robust growth amidst a global panorama of uncertainty. With projections naming it as potentially the fastest-growing major economy, India's financial markets are buzzing with activity and optimism. This growth is not just a statistic but a dynamic force driving the aspirations of millions and reshaping the contours of the Indian market. Factors such as increasing domestic consumption, substantial foreign investments, and significant governmental reforms play a pivotal role in sculpting this vibrant economic scenario. However, this landscape is not without its challenges, including inflationary pressures and geopolitical tensions that could influence economic stability.

The question of how elections affect stock market in India is a critical one for investors. Elections can lead to significant volatility in the stock market, as uncertainty about the outcome often causes fluctuations. And as investors it is important to understand how elections affect stock market in India. Historically, the period leading up to an election affects the stock market in India by causing increased trading activity and price swings, as investors speculate on potential policy changes. The results of an election affect stock market in India by either boosting investor confidence if the outcome is favorable or causing declines if the outcome is perceived as negative. Understanding how elections affect stock market in India can help investors make more informed decisions and prepare for potential market movements.

In this critical juncture, the upcoming 2024 elections loom large, promising to be a decisive moment for India’s economic and political future. Historically, election years in India have been pivotal in influencing market sentiment and investor behavior. The anticipation of political stability, potential policy continuity, and reformative agendas typically drive positive market performance both before and after the elections. Investors and market analysts closely watch the run-up to the elections, as the political parties' platforms can provide significant clues to future economic policies.

The 2024 elections are expected to be no different. With the likelihood of a stable government, as suggested by early opinion polls and market reactions, there could be substantial implications for both short-term market volatility and long-term economic policies. These elections not only test the waters of political fortitude but also serve as a bellwether for investor confidence and economic strategies moving forward.

As we dive deeper into this analysis, we will explore how these elections could shape market outcomes and highlight the critical economic indicators that investors should watch. This understanding will be crucial for anyone looking to navigate the complexities of investing in an election year, providing a roadmap for making informed decisions amidst the electoral ebbs and flows.

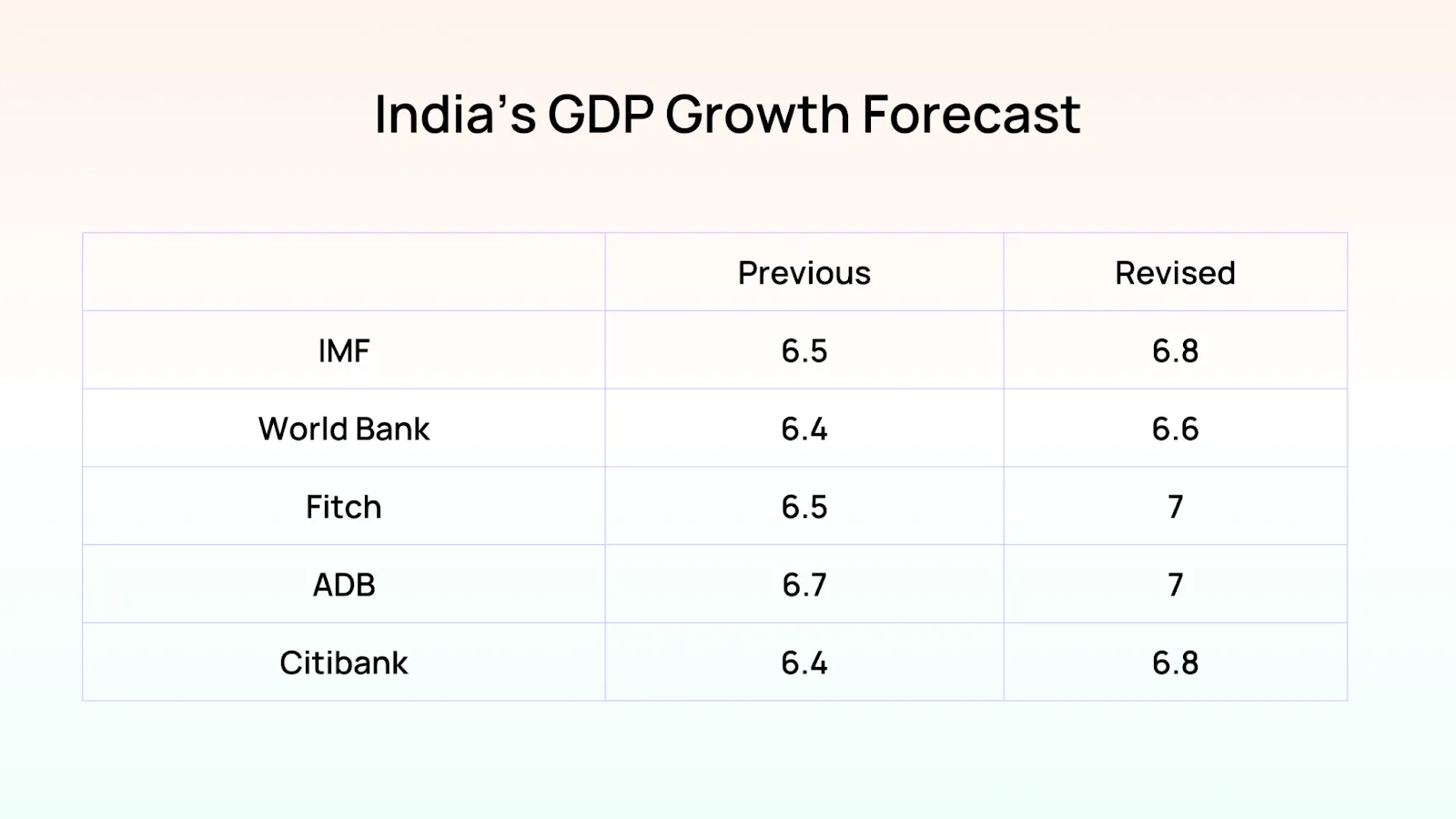

India's economic forecast for 2024 remains highly optimistic, positioning it as one of the fastest-growing major economies globally. A mix of sustained internal and external factors underpins this growth. Domestically, India is benefiting from increased government spending on infrastructure, a booming digital economy, and rising consumer demand. Internationally, the country is attracting more foreign direct investments thanks to its political stability and improvements in business regulations.

Despite challenges such as potential inflation and global supply chain disruptions, India’s economic resilience is bolstered by its diversified industry sectors, innovative technology startups, and strong services sector. These elements are critical as they drive current economic activities and lay a robust foundation for future growth.

The general sentiment among investors toward the Indian market is cautious optimism. While short-term market volatility is expected, the long-term outlook is viewed favorably. Investors are encouraged by the potential for economic stability and continued policy reforms expected after the 2024 elections. Such a stable and reformative backdrop is anticipated to enhance market confidence and drive equity performance.

Investors are advised to treat market dips as strategic opportunities to enhance and diversify their portfolios, particularly in sectors poised for growth due to governmental policies or global economic trends. The sentiment is buoyed by the expectation of a steady government that typically ensures a more predictable business and economic environment, fostering easier decision-making and policy implementation.

Though tempered by high market valuations and overheating in certain sectors, the investment climate promotes a strategy of balanced engagement—capitalizing on immediate opportunities while planning for long-term gains. This approach is essential in the Indian context, where economic dynamics often offer diverse investment prospects for those with strategic insight and patience.

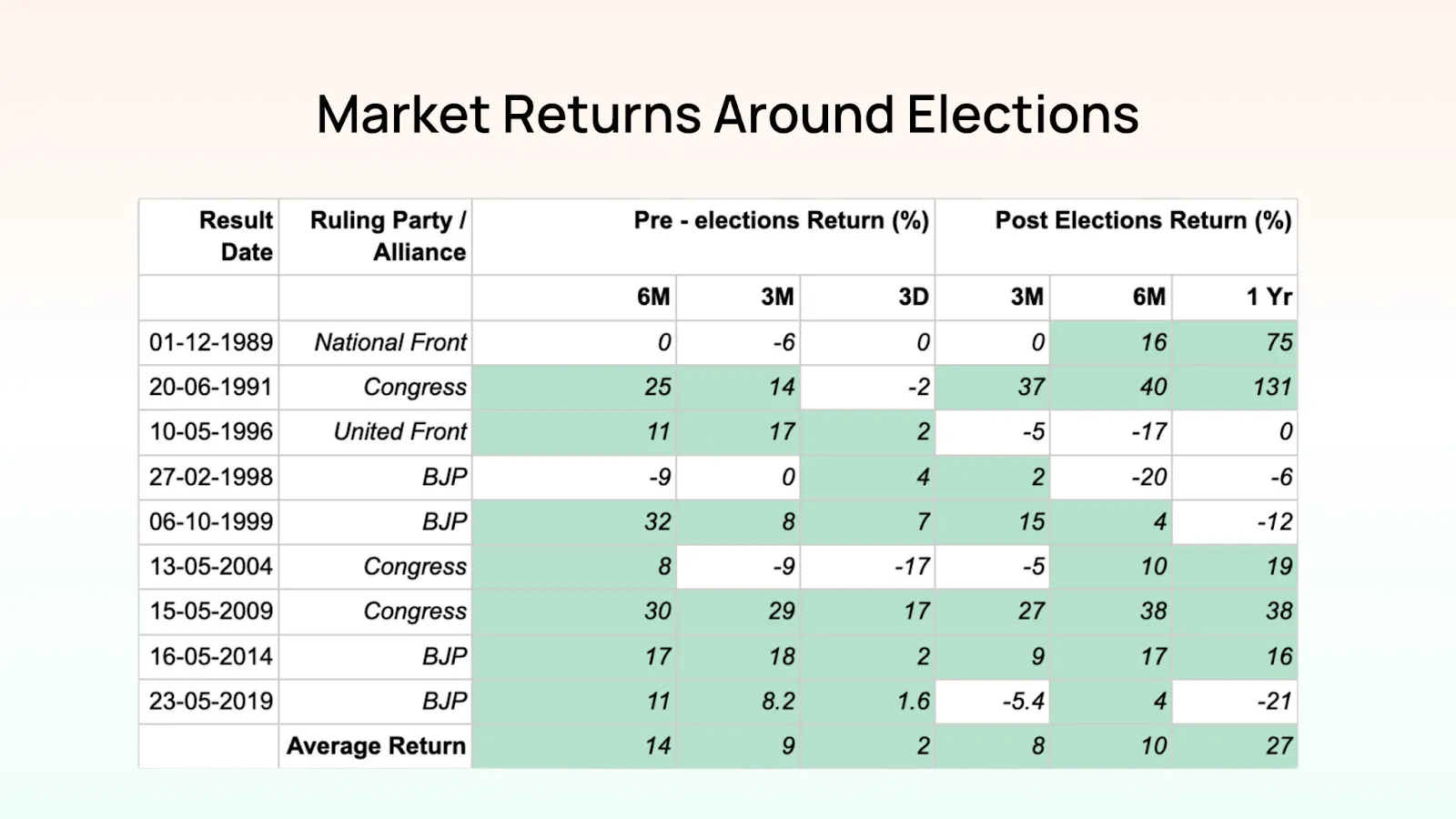

Election years in India have traditionally been times of heightened market activity and investor interest, reflecting the anticipation and uncertainty surrounding potential policy changes and government stability. A review of historical market data shows a clear pattern: markets tend to perform well both in the run-up to the election and in the aftermath, driven by the expectations of continuity in economic policies and a stable political environment.

Analyzing data from past election cycles, it is evident that the six months leading up to the elections usually see a rise in market indices as investors begin to position their portfolios favorably based on predicted election outcomes. For instance, previous elections have shown an average market return increase, demonstrating positive investor sentiment spurred by prospective governance stability and anticipated reformative measures. Furthermore, this uplift typically continues post-election, as confirmed policies and government formations provide a clearer direction for market movements.

The 2024 elections are poised to be a pivotal event, with early forecasts suggesting a favorable outcome for the incumbent government, which is generally perceived as pro-reform and market-friendly. Such expectations can significantly influence market behavior, leading to increased investments in sectors likely to benefit from continued or new government policies.

Current opinion polls and market analysis suggest that if the election results align with these forecasts, the market could see an upsurge similar to previous years where pro-reform parties or coalitions gained power. Conversely, any unexpected political outcomes could lead to market volatility, as investors reassess their positions and strategies based on the new political landscape.

The impact of election results on the stock market can be substantial. For example, the table from historical election data highlights how markets have responded to different governments and their policy orientations. Positive market reactions were noted when governments perceived as reform-oriented were elected, such as during the re-election of a reform-minded administration which saw substantial market gains in the subsequent months.

In contrast, election results that brought unexpected or less market-friendly governments led to short-term market declines. However, it is crucial to note that the initial reactions of the market post-election do not always predict longer-term trends. Markets have shown resilience and an ability to adjust to new political contexts over time.

For the 2024 elections, if the outcomes are as predicted and a reform-oriented government is re-elected or formed, the markets may continue their upward trajectory, buoyed by investor confidence in stable and supportive economic policies. On the other hand, unexpected results could lead to initial shocks and adjustments in the market, though historically, such impacts have been temporary as the market adapts to new realities.

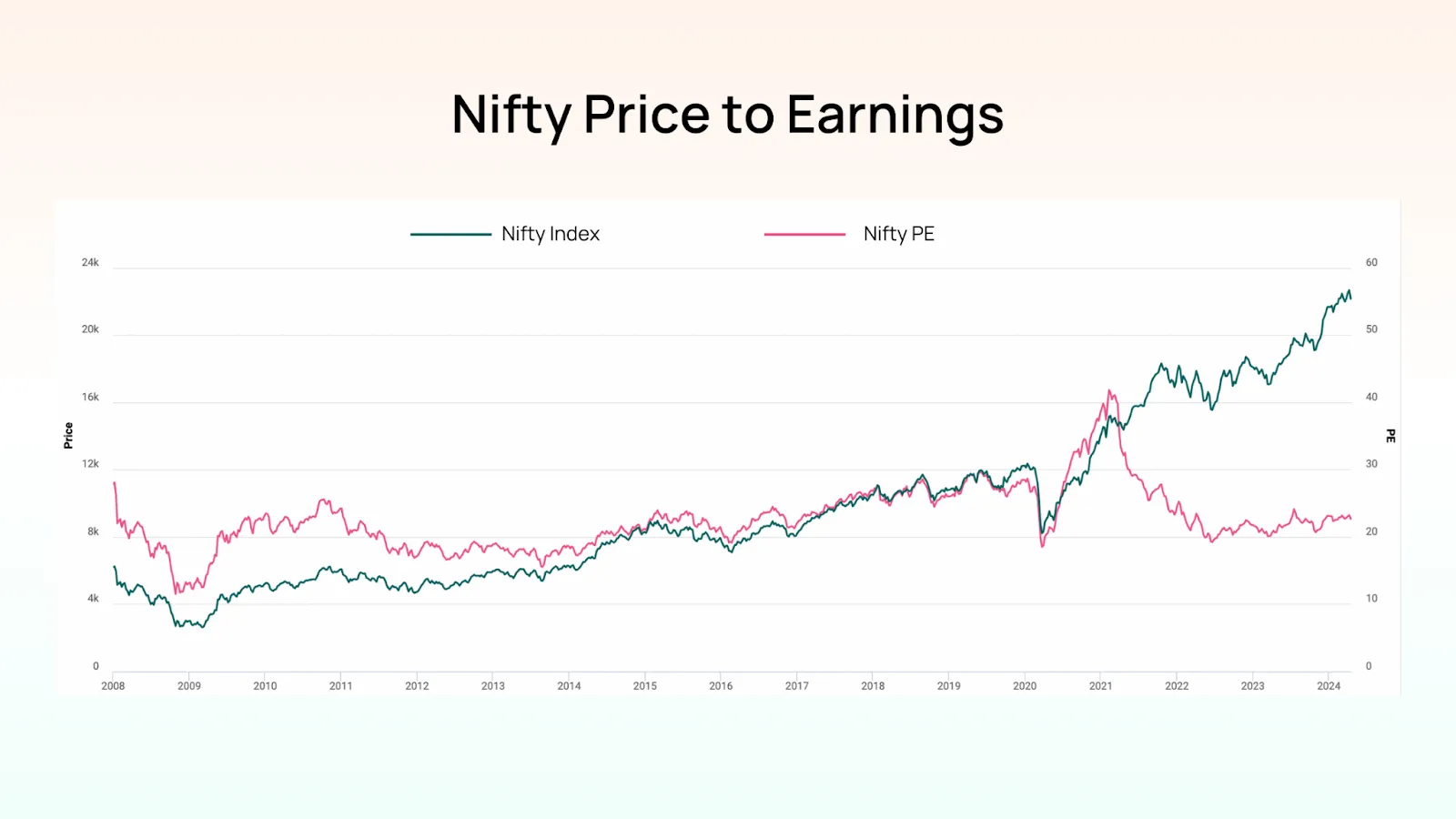

The current valuations of stocks and other assets are a snapshot of how the market values the future earnings potential of companies. High valuations can suggest that markets are perhaps overly optimistic about future growth prospects, making them vulnerable to corrections if the expected earnings growth does not materialize. On the other hand, low valuations may indicate undervaluation or potential opportunities for investors.

In India, market valuations have been high, reflecting expectations of strong future growth. However, such levels of valuation necessitate careful analysis as they may lead to compressed future returns if the growth in earnings does not keep pace with these expectations. Investors need to assess whether high valuations are justified by the underlying fundamentals and potential earnings growth of the companies they are investing in.

US Interest Rate Changes: As a major global economic player, the United States' monetary policy has a far-reaching impact on global markets, including India. US interest rates influence global capital flows, with lower US rates typically leading to increased investment in emerging markets like India for higher returns. However, if the US raises rates, it can lead to capital outflows from emerging markets as investors seek safer returns in US assets, impacting Indian market liquidity and currency exchange rates.

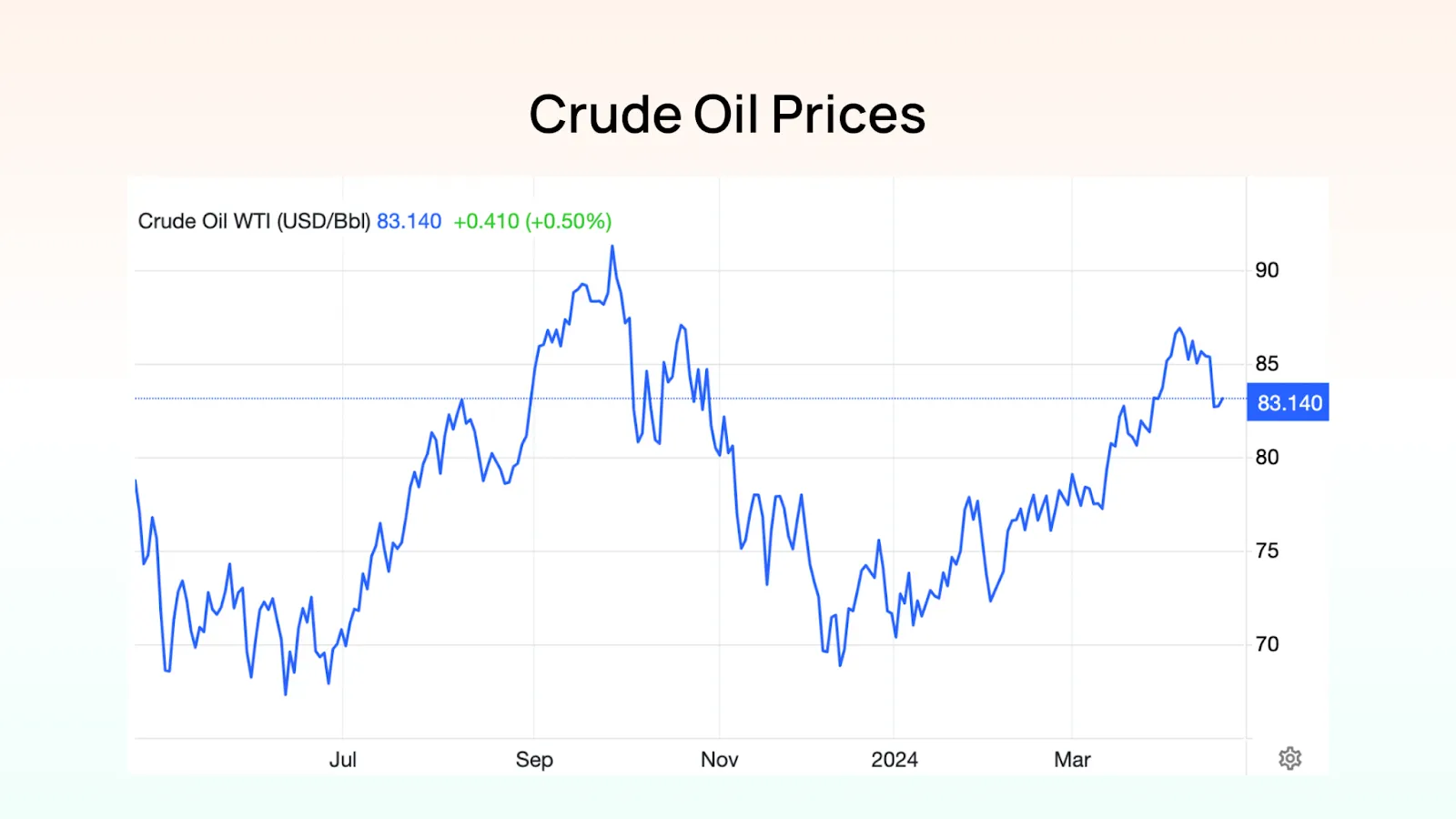

Oil Prices: As a major importer of oil, India’s economy is particularly sensitive to changes in oil prices. Higher oil prices can exacerbate the trade deficit and fuel inflation, which in turn could lead to higher interest rates and reduced economic growth. Conversely, lower oil prices can help to improve India’s balance of payments and control inflation, supporting growth.

Global Economic Tensions: Tensions such as trade wars, geopolitical conflicts, or other international disputes can lead to uncertainty in global markets, impacting India through various channels including trade, investment, and commodity prices. For instance, geopolitical tensions involving oil-producing regions can lead to spikes in oil prices, affecting the Indian economy.

The performance disparity between large caps and small to mid caps can often be significant, particularly in a volatile market or during election cycles. Large cap stocks, typically comprising well-established companies, offer stability and are generally considered safer investments during uncertain times. They are less volatile, often pay regular dividends, and have a consistent performance history. For 2024, expectations lean towards large caps performing better than their smaller counterparts, due in part to their robust fundamentals and ability to leverage economies of scale during economic recoveries.

Conversely, small and mid cap stocks are often more sensitive to economic changes and can exhibit higher volatility. However, they also present greater growth potential, which can translate to higher returns. The key for investors is timing and market sentiment, which can significantly sway the performance of these stocks. During election years, small and mid caps can benefit from policies targeting economic stimulation, but they also carry higher risks due to their sensitivity to market sentiment and liquidity conditions.

During volatile periods and election cycles, a strategic approach to investing is crucial. Investors should consider defensive investing by allocating a larger portion of their portfolio to large caps or sectors that are less sensitive to economic cycles, such as utilities or consumer staples. These sectors tend to perform reliably regardless of the economic climate.

Another strategy is to engage in tactical asset allocation, adjusting portfolios towards sectors that might benefit from the election outcomes based on the policies of the likely winners. For example, increasing allocation to construction and materials sectors might be advantageous if a government is favorable to infrastructure development is expected to come into power.

Election outcomes can lead to significant market volatility, as markets respond to the uncertainties associated with potential changes in government policies. The risk of policy paralysis, where crucial economic reforms are stalled or reversed, can affect investor confidence and market stability. Economic uncertainties such as inflationary pressures, interest rate changes, and global economic slowdowns also pose risks that can affect market performance and investment returns.

Despite these risks, elections and economic shifts also create opportunities. For instance, policy announcements related to sectors such as renewable energy, digital infrastructure, or manufacturing can provide investment opportunities in these areas. Market dips caused by temporary uncertainties may present buying opportunities for investors with a long-term perspective.

As we look towards the horizon of 2024, the interplay of economic indicators, election outcomes, and market dynamics presents a complex but navigable landscape for investors. We've explored the robust growth projections for India, which maintains its position as one of the fastest-growing major economies globally, despite potential economic headwinds. This growth is underpinned by strong fundamentals across various sectors and is expected to attract significant domestic and international investment.

The discussion highlighted how historical market performance during election years typically shows positive trends, suggesting that investors might see beneficial outcomes from aligning their portfolios with the anticipated political and economic environment. However, the unpredictability tied to elections necessitates a balanced approach to investing, with a mix of both caution and opportunism.

The analysis also underscored the different performance trajectories expected between large caps and small to mid caps, with the former likely offering more stability and resilience during volatile periods. Meanwhile, small to mid caps, although riskier, could deliver greater returns, especially if targeted government policies support their underlying sectors.

Importantly, as volatility is a hallmark of both election cycles and periods of economic adjustment, using market dips as strategic buying opportunities can be an effective way to enhance long-term investment returns. This approach, often advocated by seasoned analysts, involves buying quality assets at lower prices during market downturns, thus setting the stage for potential upside as markets stabilize and recover.

As we move closer to the elections and navigate through 2024, it is crucial for investors to remain informed, agile, and prepared for fluctuations. Developing informed strategies, staying updated on market and economic trends, and maintaining a diversified investment portfolio are essential steps in ensuring that one can handle market volatility effectively and capitalize on the opportunities it may present.

In conclusion, while the upcoming year may carry its share of uncertainties, it also holds considerable promise for those ready to engage with the market thoughtfully and strategically. Investors are encouraged to harness these dynamics to their advantage, turning potential challenges into valuable opportunities for growth and profitability.

Also Read:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart