by Sonam Srivastava

Published On March 27, 2022

Have you watched one of the movies where the plot is tense, and there’s a tricky problem at hand, and suddenly someone applies data and pattern detection techniques and finds a solution?

Factor Investing is an effort to do the same for long-term investing. Factor investing is an effort to use data and algorithms to find distinguishable patterns in the market that can help us consistently outperform the market at low risk.

Factors are indicators that can help describe stock returns. When you try to get into the details of the factors influencing market returns, you’ll find that they are very intuitive to understand.

Factors are of two main types - macroeconomic and style factors. Macroeconomic factors are broad-based, like the GDP growth rate, inflation, unemployment, etc.

Style factors are more nuanced and are a quantitative way to describe strategies for outperformance. Each of these style factors would have proponents among quantitative investors and all types of investors.

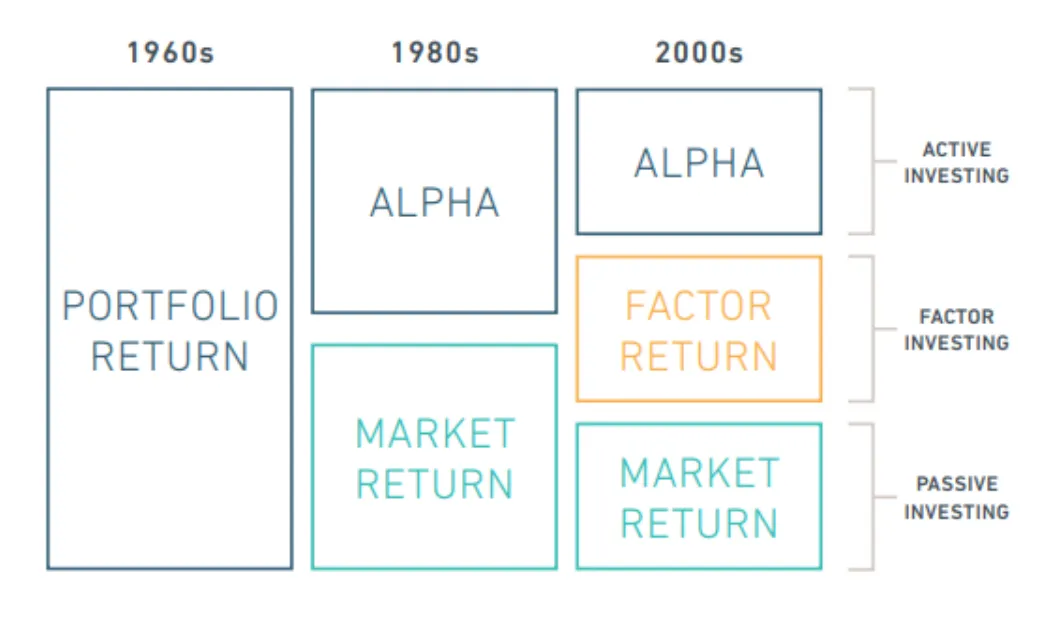

Factor Investing, also known as Smart Beta, is an investment strategy that aims to systematically capture specific factors or characteristics that historically have influenced the performance of stocks and other financial instruments. Instead of solely relying on traditional market capitalization-weighted indexes, Factor Investing seeks to enhance portfolio returns and manage risk by focusing on factors that have demonstrated the potential to outperform the broader market over time.

Factor Investing revolves around identifying and targeting specific factors that are believed to drive stock performance. Some of the most common factors include:

Value: This factor aims to capture the premium associated with stocks with low prices relative to their fundamental value.It focuses on stocks that are considered undervalued relative to their intrinsic worth, often indicated by low price-to-earnings (P/E) ratios or low price-to-book (P/B) ratios.

Size: This factor says that small-cap stocks exhibit greater returns than portfolios with just large-cap stocks.

Momentum: This factor bets on the outperformance of stocks that have historically exhibited strong returns.

Quality: Stocks with strong corporate governance and consistent earnings with low debt are called quality stocks that tend to outperform.

Volatility: This factor bets on the phenomenon that stocks with low volatility earn greater risk-adjusted returns than highly volatile assets.

Factors allow investors to find stock themes that fit their risk appetite and enable them to invest in a unique opportunity. Investors can get exposure to multiple factors, thus increasing their diversification and consistency or returns. Tactical allocation to Factors, while challenging, can be highly lucrative.

Factors being data-driven can focus on a broad universe. They capture all significant fundamental anomalies in the market and behavioral biases. They allow the investors to get greater diversification, thus lowering their drawdowns.

Factors can be served in a passive or an active basket. As these baskets are data and technology-driven, they have low expense ratios.

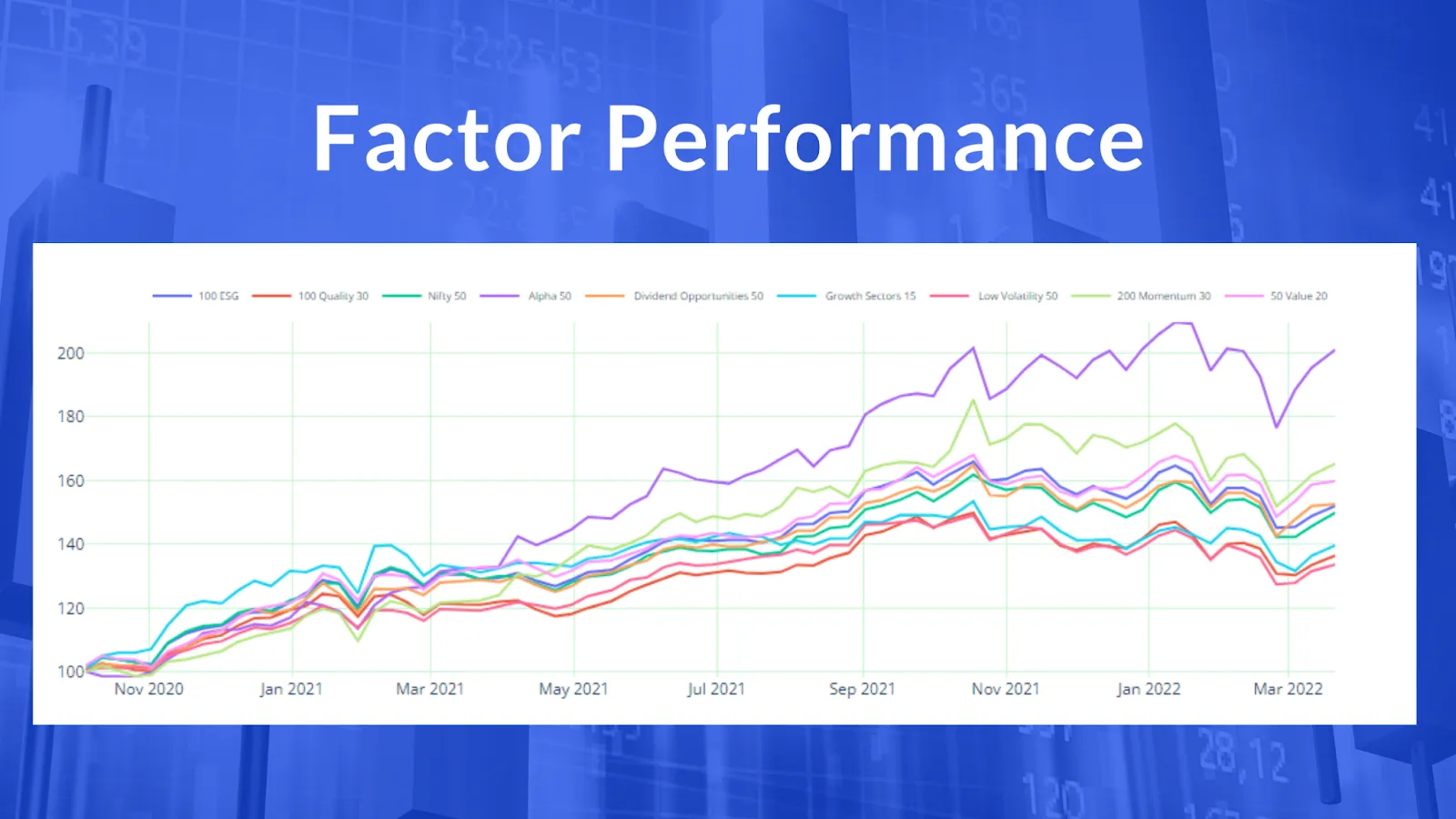

Factor returns can be cyclical, and any factor will not work all the time. On the other hand, a single factor can have extended periods of underperformance like the value factor had in the last couple of years when Momentum outperformed.

So, it is always a good idea to trust an investment advisor that guides you with a tactical allocation to factors. Factor maths is also quite complex, so investors should generally trust practiced researchers in the field.

The NSE has published factor Indices since 2017, and there are some ETFs available for the same as well. In addition, Robo-advisors like Wright Research also publish curated factor or smart beta strategies, which are very popular on smallcase.

Talking about the relative performance of Factors in India, Momentum or Trend Following has always been an influential factor for Indian investors because India has gone through strong growth markets.

Quality is also a factor that works well in India, along with Size or betting on smaller stocks. In times of volatility, Value or Low Volatility factors outperform the market.

What is factor investing, and how does it differ from traditional investing?

Factor investing is an investment strategy that targets specific factors (e.g., value, quality, momentum) believed to influence stock performance. It differs from traditional investing, which typically follows market-cap-weighted indexes and does not focus on specific factors.

Can you provide examples of factor investing strategies?

Factor investing strategies can be single-factor or multi-factor based. Single-factor strategies focus on one specific factor such as value, size, momentum, quality, or low volatility. For instance, an investor following a value factor strategy would invest in stocks that are undervalued or cheap in comparison to their intrinsic value.

Multi-factor strategies, on the other hand, combine several factors to create a diversified portfolio. For instance, a multi-factor portfolio might include both high momentum and high-quality stocks. These strategies seek to balance risk and reward by capitalizing on the strengths of different factors.

How does factor investing work in the Indian market?

Factor investing in the Indian market involves focusing on specific factors such as value, size, momentum, quality, or low volatility, which have historically been shown to drive stock performance. Investors or fund managers select stocks based on these factors instead of market capitalization. For instance, a value-based strategy in the Indian market would involve investing in stocks that are undervalued compared to their intrinsic value.

Are there mutual funds in India that utilize factor investing strategies?

Yes, there are several mutual funds in India that employ factor investing strategies. These funds, also known as smart beta funds, aim to outperform traditional market-cap weighted indices by selecting stocks based on specific factors such as value, quality, size, momentum, or low volatility. Examples include DSP Quant Fund, ICICI Prudential Alpha Low Vol 30 ETF, and UTI Nifty200 Momentum 30 Index Fund.

What factors have shown strong performance in factor investing in India?

In the Indian context, factors such as momentum, quality, and size have shown strong performance. Momentum investing has been influential due to India's robust growth markets. Quality stocks, especially those with good corporate governance and consistent earnings, have also done well. Moreover, smaller stocks or those with lower market capitalization (the size factor) have been known to outperform their larger counterparts in India.

How can I incorporate factor investing into my investment portfolio?

Factor investing can be incorporated into your portfolio by first understanding which factors align with your investment goals and risk tolerance. Then, you can choose stocks that reflect those factors. Diversifying your investments across various factors can help manage risk. It's often beneficial to consult a financial advisor to help guide your factor investment choices and strategies.

What research and studies support the effectiveness of factor investing?

Several research studies support the effectiveness of factor investing. For example, the "Fama-French Three Factor Model," a seminal study by Eugene Fama and Kenneth French, demonstrates that three factors—market risk, size, and value—can explain a portfolio's returns. Another influential study, "Profitability, Investment, and Average Return," by Robert Novy-Marx, suggests that profitability is a robust predictive factor for stock returns. These studies, among others, provide substantial empirical evidence supporting factor investing's efficacy.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart