The internet boom at the end of the 1990s is still fresh in everyone's mind. As a result, the challenge of valuing new economy firms arose. To put it another way, how to justify the billion-dollar stock market valuations of companies with no track record and massive negative earnings occurred.

Analysts developed new, more or less fair multiples, and the classic discounted cash flow approach was either abandoned or adjusted to accommodate the "new" types of businesses. Traditional, moderately growing companies were reintroduced into portfolios when the bubble burst, whereas professional investors avoided everything containing “dot com” or new technologies.

Companies that recognize the revolutionary power of technology and successfully incorporate it into their fundamental business models will be the winners in a world where growth is scarce and fierce competition.

The Covid-19 lockdowns of 2020 demonstrated and accelerated this. The outperformance of technology and technology-related companies serves as a stark reminder that the tech market is no longer limited to hardware, software, and internet behemoths. Furthermore, the tech-fueled expansion is far from ended.

The first and most crucial point to understand is that the new breed of tech companies has a far higher risk because they are priced to become successful significant corporations in the future, but not now!

While we all want to become wealthy by discovering the next Amazon, a firm that was not profitable for a long time but earned enormous riches for shareholders, the truth is that for every Amazon, there are thousands of other companies that never made it. So the chances of picking that one winning company that will go from no earnings to a lot of profits while still surviving are slim.

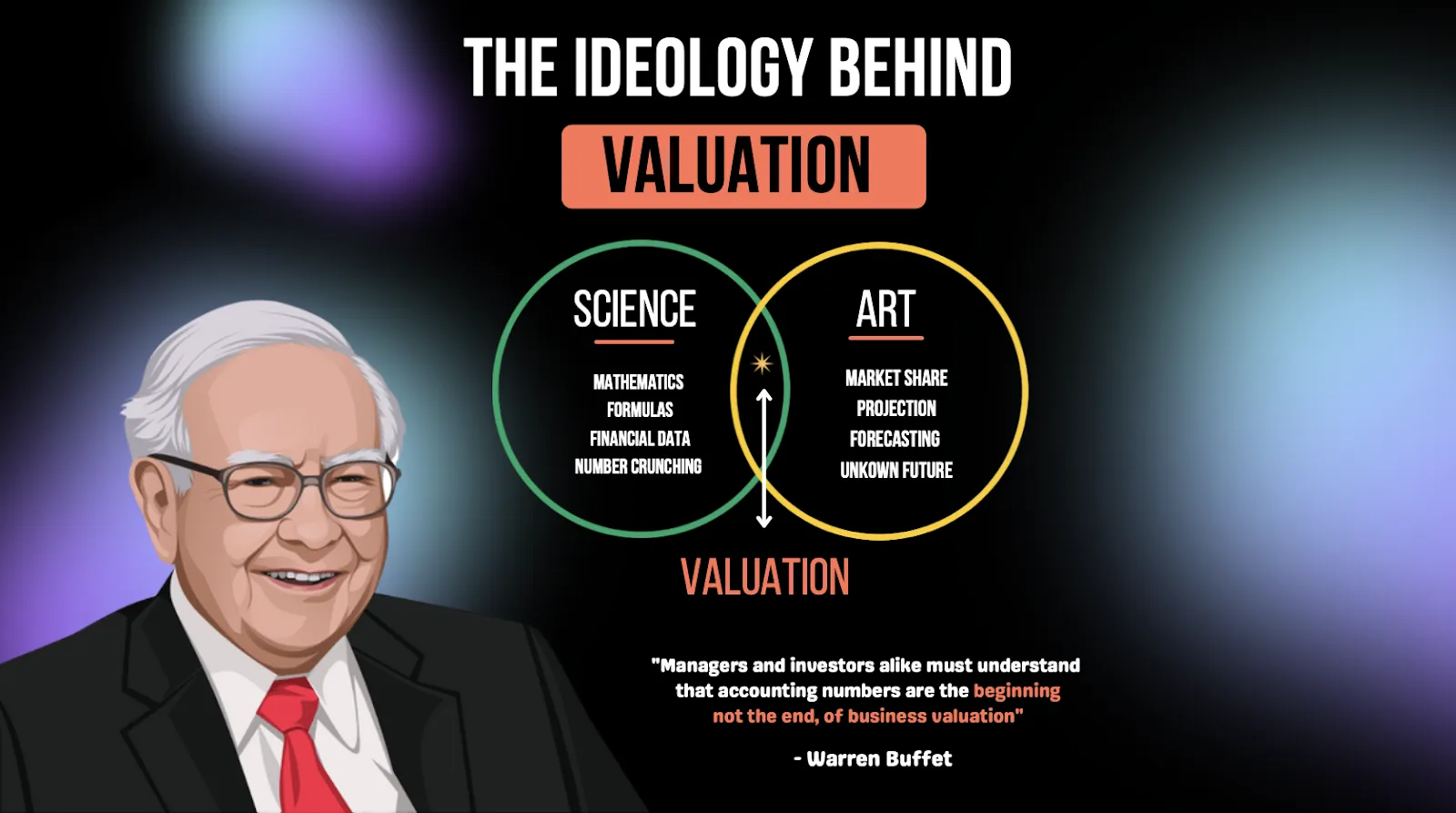

If we were to look at the ideology of valuation broadly, it would consist of existing data, past data, and predictable data. Based on these three pillars, the valuation of any company can be comprehended.

To value traditional companies, past data can be analyzed per existing financial data, and based on a predictable cash flow, the valuation can be ceased. But, perhaps, this is not sufficient for valuing high-growth companies.

Hence, it is imperative to consider aspects like market share and sound projection or forecasting of cash flows while combining the other three pillars to arrive at a fair valuation.

Thus, valuing high-growth companies is the intersection between the ideology of art and science.

There are a few things to keep in mind when examining some of the new-age high-growth and low-profit enterprises on the Indian exchanges. Many of these observations apply to traditional enterprises, but especially to those whose value is predicated primarily on future growth.

If you're considering investing in Indian companies, you probably feel our country will continue to grow. India's per capita GDP is currently $2,000. As it rises to $4000, the opportunity for tech-first enterprises to benefit from incremental growth due to internet and smartphone adoption would be substantially greater than for traditional businesses. Learn why we are bullish on the India growth story.

Some industries and sectors will perform better than others as India develops. For example, it is reasonable to assume that Indians will purchase more things digitally than now.

However, the question to consider is how much more excellent the target market for the firm can grow. This is when the surprise comes in. Any company that operates in a rapidly growing category will benefit significantly from tailwinds in that market. Thus, when it comes to private market investors (VCs and PEs), their virtual bets are on sectors and companies with significant growth potential.

Identifying an underdog who can become a market leader is more complex than identifying an existing market leader. As a result, being a market leader or among the top two in the industry provides a considerable valuation premium, which boosts a company's capacity to raise additional cash, increasing its chances of succeeding and becoming the leader.

This has emerged as the essential metric for determining whether a company is a market leader and gauging market expansion.

Given this situation, a high number of internet users could be persuaded to sign up for a business or service in exchange for a few hundred rupees worth of freebies, providing a simple way to inflate a company’s “user” base artificially.

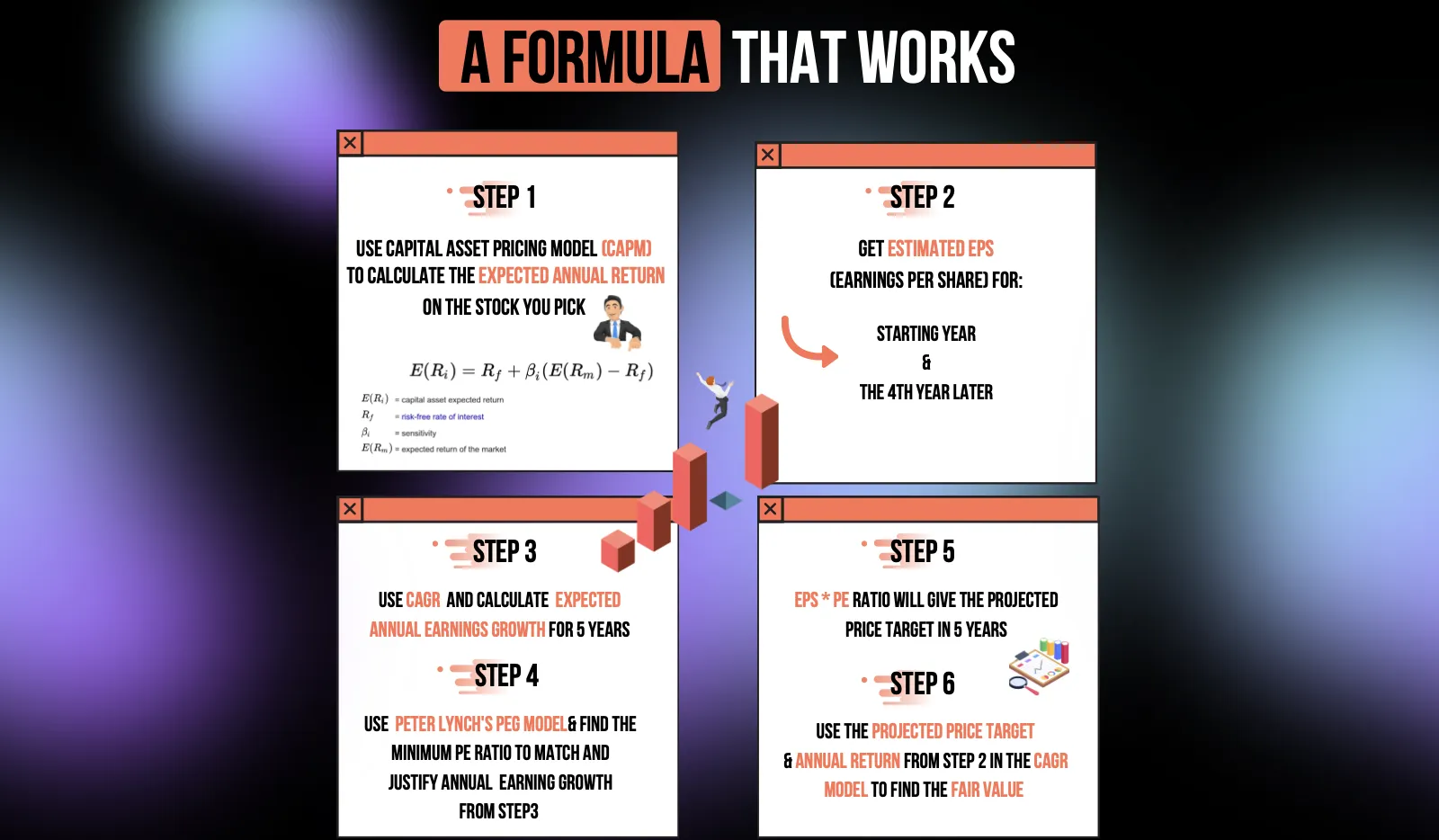

Apart from the four-pointers mentioned above, a formula can be applied to gauge the fair valuation of a listed company.

Many organizations that aim to show steady development and survive entirely on their ability to raise capital until they reach enormous profits are doomed to fail since the liquidity source supporting them can dry up at any time. However, a small fraction of those will almost certainly be at the top of the list of stocks with the most significant percentage gains on the stock market in the future.

However, the investor's chances of picking such rare wins are stacked against him.

What exactly is a high-growth company?

A high-growth company is a business that is experiencing rapid and substantial increases in its revenue, earnings, or market share compared to its industry peers. These companies often reinvest their earnings to fuel further expansion rather than distributing profits to shareholders. High-growth companies are typically found in industries with significant growth potential, such as technology, biotech, or emerging markets.

Why is valuing high-growth companies different from traditional valuation?

Valuing high-growth companies is different from traditional valuation because these companies often have uncertain and potentially volatile futures. Traditional valuation methods, like discounted cash flow (DCF), rely on stable and predictable cash flows. High-growth companies may not have such predictability, making it necessary to use alternative methods like market multiples or scenario analysis to account for their growth prospects and risk.

How do you project future growth for high-growth companies?

We use a combination of historical data, industry trends, financial modeling, and evaluation of management capabilities to project the future growth of high-growth companies. Our methodology incorporates sensitivity analyses and external factors like regulation and economic conditions to offer a comprehensive growth projection.

How do you address the uncertainty and volatility of high-growth businesses?

To handle the inherent uncertainty and volatility in high-growth companies, we employ strategies like portfolio diversification, regular performance monitoring, and scenario analyses. We also differentiate between short-term and long-term projections to better manage risks and expectations.

How can I account for changing market dynamics in my valuation?

Account for changing market dynamics by regularly updating your assumptions and reevaluating the company's prospects. Stay informed about industry trends, competitive pressures, and macroeconomic factors that could impact the company's growth. Incorporate these insights into your valuation model and be prepared to adapt your analysis as the market evolves.

How often should I revalue a high-growth company?

The frequency of revaluation for a high-growth company can vary based on its specific circumstances and the rate of change in its industry. However, it's generally advisable to revalue high-growth companies more frequently than stable businesses. Quarterly or semi-annual valuations may be appropriate, but in rapidly evolving industries, even more frequent updates might be necessary to capture changing dynamics and ensure that your investment thesis remains valid

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios