by Siddharth Singh Bhaisora

Published On Dec. 28, 2023

It's time to set financial goals that are realistic and attainable. January is an ideal time to lay the groundwork for your financial success in the new year. It's not just about setting resolutions but also about making practical and straightforward financial decisions.

Here's a guide to help you set achievable financial goals for 2024 & set yourself up for success in your financial journey in 2024. We will also give you key insights from our users & experts on 3 main things to do in 2024.

Achieving financial stability requires setting realistic goals. Many people try to accomplish multiple financial objectives simultaneously, like maximizing retirement funds, paying off significant debts, and reducing spending. However, setting overly ambitious goals can lead to disappointment if they are not met. The problem with setting financial goals often lies in an 'all or nothing' mindset - a very extreme view point. This approach ignores the complexities of real life and can lead to failure by not acknowledging smaller, yet significant, progress.

For example, aiming to save Rs.50,000 monthly is commendable, but it's challenging if you're not already saving a smaller amount, like Rs.20,000. All of this will naturally depend on how much you earn, what is your budget and using this to understand what you can realistically save each month based on your current financial situation.

Start with achievable goals, such as saving Rs.10,000 per month. This might seem small, but it helps establish sustainable financial habits. It will give you the motivation and confidence to eventually achieve your larger financial objectives. This gradual approach ensures long-term success in managing finances.

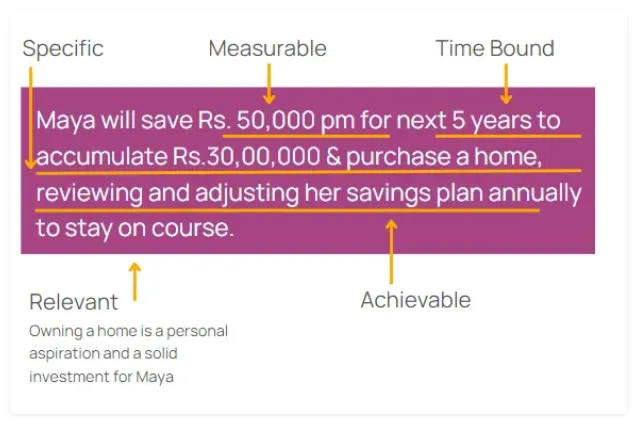

How can you set financial goals in the right way? You can frame it using the SMART framework which stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Using the SMART framework to define your financial goals, you have a clear plan for achieving your financial goals and your success.

Here is an example of Maya,

Specific: who wants to save enough money (Rs. 30 Lakhs as equity for down payment) for buying a house.

Measurable: She plans to do this by saving Rs.50,000 per month

Timebound: For the next 5 years

Achievable: She will review and adjust her plan every year as needed accounting for inflation, growth in her savings etc.

Relevant: Owning a home is a personal aspirational choice and could be a good investment for Maya

Setting financial goals for the new year doesn't have to be overwhelming. Start by aiming for manageable changes. The key to achieving goals is building discipline. If you break up your goal into smaller easily attainable goals. In finance terms, you can think of it as the benefits of compounding - start small, keep adding to it and get to your bigger goals.

A practical approach is to initially increase your savings by 1%. Regularly assess your budget every few months, and consider boosting your savings by an additional 1% each time. This gradual increase is more feasible than attempting a dramatic jump in your savings rate by 10 or 20%.

Keep in mind that your expenses will fluctuate. Some months, events like birthdays or holidays may lead to higher spending. In quieter months, you might spend less. Adapt to these variations by starting with modest adjustments in your financial habits. As your income grows, you'll find more opportunities to advance towards your larger financial objectives. Remember, small steps can lead to significant progress over time.

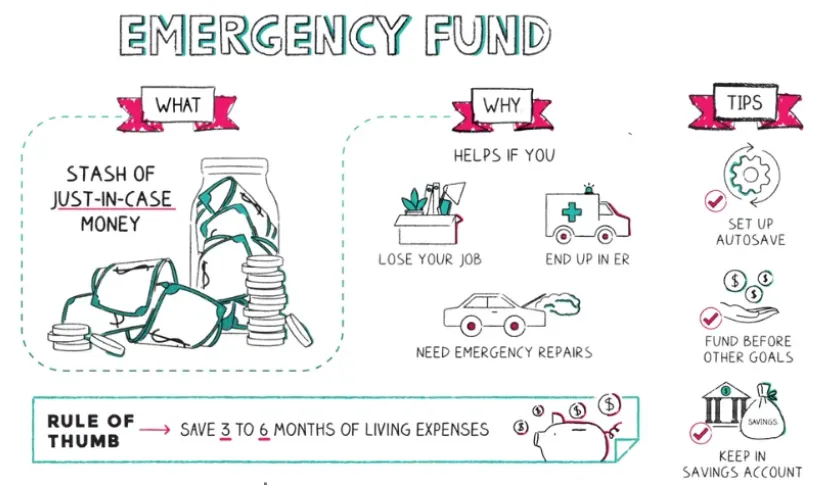

Achieving financial goals, like clearing credit card debt, is rewarding. However, unexpected expenses, such as emergencies, often disrupt this progress. We need to accept the inevitability of unforeseen costs. Such as a sudden car repair, medical emergency or an unplanned bill. By integrating this unexpected situation into your financial planning strategy will help prevent such events from derailing your financial objectives.

To combat unforeseen expenses, start an emergency fund. This fund should be separate from your regular savings, exclusively for emergency use. It provides a financial cushion, allowing you to cover unexpected costs without accruing significant debt. Typically you can keep upto 6 months of your expenses as part of the emergency fund. Keep it in a highly liquid account such as savings or liquid funds with fast redemption for quick access.

The key to setting achievable financial goals is a thorough awareness of your current expenses and spending patterns. Knowing where your money goes each month creates a foundation for realistic goal-setting tailored to your personal situation. Here’s a budget template you can follow, and I am sure you can find many apps and tools to help you track your expenses and income:

If you're new to budgeting, the process might seem overwhelming. A good starting point could be establishing a habit of tracking your monthly spending. This can be one of your initial financial goals for the year.

With a detailed understanding of your spending habits, you can make conscious choices about where to cut back or increase spending. This insight allows you to reallocate funds effectively towards your new financial goals, ensuring they align with your actual financial capacity.

We spoke to users of our portfolio review tool and financial planning tool to identify key themes & insights for that we all should look to apply to our financial habits for 2024.

Financial planning should be a continuous process. Regular monitoring and adjustment are necessary.

Review cash flows, cut unnecessary expenses, focus on emergency funds, adjust investment portfolios, and tackle high-interest debts.

Stay informed about financial calendars, and plan for both short and long-term goals.

For young professionals, set clear and achievable financial objectives. Consider equities & mutual funds for disciplined long-term investing and plan taxes early in the year.

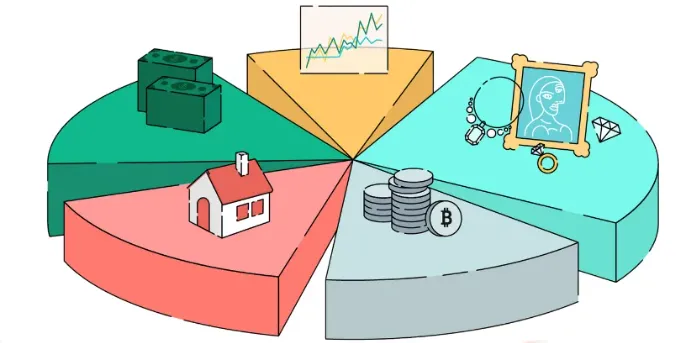

Diversification is a fundamental aspect of financial planning. It involves spreading investments across various asset classes like stocks, bonds, mutual funds, gold, and real estate to balance risk and return. This strategy doesn’t eliminate the risk of loss but is effective for achieving long-term financial goals with minimized risk.

Diversification is critical – avoid concentrating all investments in one area. But, also do not just simply rely only on past performance to help you guide your investment decisions. Find new and unique ways of understanding financial markets, the products you are investing in and how you can reduce the portfolio risk .

Read this interesting article to get more insights on diversification vs concentration .

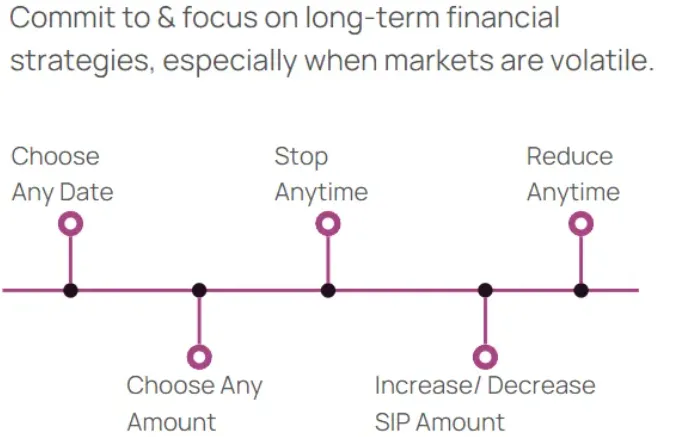

You have your well-defined financial goals and a workable budget that you can stick to. So stick to it! Stay focused on the path that will lead to your financials goals and help in your wealth creation journey! Embrace systematic investment plans (SIPs) for consistent investment, and prioritize financial education to ensure you are learning continuously.

Commitment to long-term strategies becomes important, especially when we consider long-term financial goals and when the markets are unpredictable. Use SIP (Systematic Investment Plans) , lumpsum investing when markets are down and STP (systematic transfer plans) to commit and focus on the long term financial goal. Asset allocation also becomes crucial, especially given market volatility. A disciplined approach and patience are vital for long-term wealth creation.

Maintain a laser focus on your long-term financial aspirations, sidestepping the distractions of fleeting market news or the siren call of instant gratification. By keeping your eyes on the prize, you ensure a steady journey towards your financial goals!

Read this article to learn more SIP Investment Guide & Navigating the Challenge: How to Deal with Loss-Making SIPs

A robo-advisor is a digital platform that uses algorithms to manage your investments similar to an investment advisor . When setting up an account, you'll answer questions about your investment goals, how long you plan to invest (time horizon), and your comfort with risk ( risk tolerance ). These factors determine the investment strategy tailored to your needs.

Based on your responses, the robo-advisors such as Wright Research select a mix of investments, often guided by modern portfolio theory. This theory aims to construct an optimal portfolio offering the maximum possible expected return for a given level of risk. The robo-advisor continually adjusts and rebalances your portfolio to align with your financial goals.

Ease of Account Setup: The top robo-advisor services offer a straightforward and fully online account setup process.

Automated Portfolio Management: They automatically handle portfolio rebalancing and reallocation, reducing the need for constant monitoring.

Risk-Adjusted Returns: Utilizing modern portfolio theory, robo-advisors aim to maximize returns for the level of risk you're comfortable with.

Robo-advisors such as Wright Research, offer a convenient, automated, and theoretically grounded approach to investing, making them a viable option for both novice and experienced investors seeking to achieve their financial goals.

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

Read the full article on Wright Research, 2023 Recap: Indian Stock Market Performance, Indian Economy & Wright Portfolios Performance in 2023

Other interesting articles to explore:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart