by Siddharth Singh Bhaisora

Published On Sept. 15, 2024

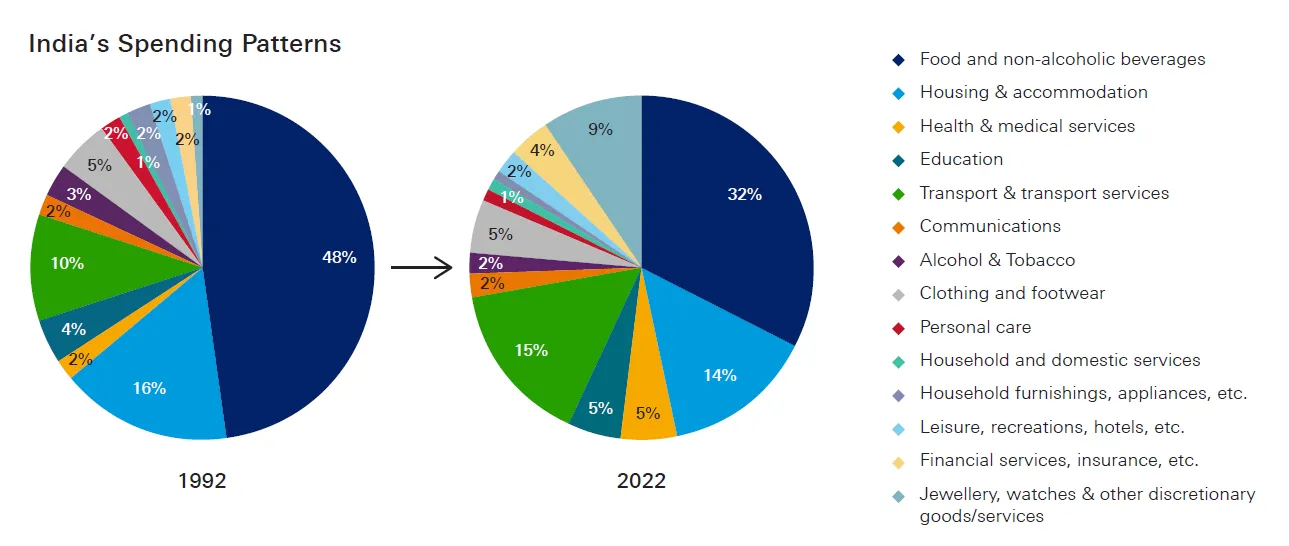

In FY24, India witnessed a significant recovery in consumer spending, marking a strong rebound from the decline seen in FY23. Key sectors such as FMCG, consumer durables, travel, and media led this growth, showcasing shifting consumer priorities and economic recovery post-pandemic. However, consumption patterns varied sharply between urban and rural areas, underlining the complexities of India's consumption landscape.

Private consumption accounts for over 60% of India's GDP, making it a crucial driver of the country's economic growth. India’s household consumption has doubled over the past decade, reaching $2.1 trillion in 2023, and is projected to make India the world’s 3rd largest consumer market by 2026.

With a population of 1.417 billion, India now stands as the most populous country in the world. A significant demographic advantage is its large working-age population, which exceeds 50% of the total population. This demographic structure supports sustained consumption growth, making India’s consumption story a long-term structural opportunity for businesses and investors. The large and growing consumer base, combined with rising incomes and increasing urbanization, positions India as a key driver of global demand in the coming years. Let’s look at the Indian Consumption story in depth.

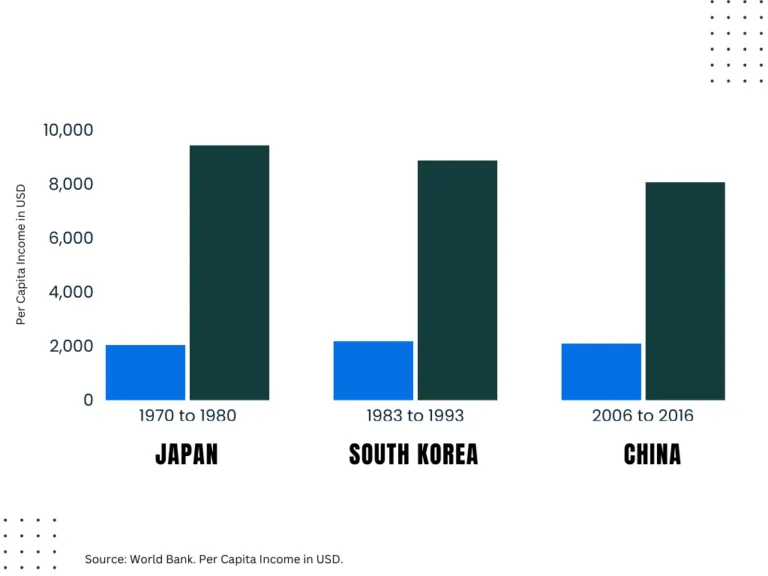

Countries like the United States in 1950s/60s, Germany in 1960s, Japan in 1970s, South Korea in 1980s, and China in 2000s have shown that once per capita income crosses certain thresholds, there is accelerated consumption - especially in discretionary categories like luxury consumption goods , electronics, and leisure.

China, after crossing the $2,000 mark in 2006, its per capita income quadrupled over the next decade. This period saw a boom in discretionary spending, including a 15.5% CAGR in residential air conditioner sales, a 10.7x increase in luxury car sales, and a surge in premium footwear and athleisure products.

India, with its per capita GDP now over $2,500, is positioned at this inflection point.. As disposable incomes rise, spending patterns are shifting, with consumers increasingly focusing on higher-end goods and services. This shift is expected to drive growth in sectors like luxury cars, electronics, branded apparel, and healthcare, paralleling China’s transformation.

However, unlike China, which relied heavily on exports to fuel its economic growth, India’s primary engine is domestic consumption. Domestic market is crucial for propelling India to the next stage of economic development. As incomes grow, spending on both essential and discretionary items will increase, creating a multiplier effect that boosts industries like consumer durables, automobiles, healthcare, and retail. India’s large, youthful population, coupled with rising income levels, provides a strong foundation for long-term growth in consumption-driven sectors.

Demographics: India’s population of nearly 1.5 billion is youthful and expanding. By the end of the decade, a significant portion of the population will be within the 25-45 age group, a key demographic for consumption. This mirrors patterns seen in other economies that experienced consumption booms with similar age profiles. As China faces demographic challenges, India’s youthful population presents a distinct advantage for sustained consumption growth.

Premiumisation: Indian consumers are increasingly opting for higher-quality and more diverse products. This trend, driven by rising incomes and affluent Indian households , is expected to grow, with around 80 million affluent households by 2030. As a result, brands are catering to this demand by offering premium products and services, helping drive overall consumption.

Digitalisation & Urbanisation: Increased digital access and urban expansion are further propelling India’s consumption story. Urban areas, in particular, are seeing a shift toward greater convenience, variety, and experiential purchases, reflecting changing consumer preferences.

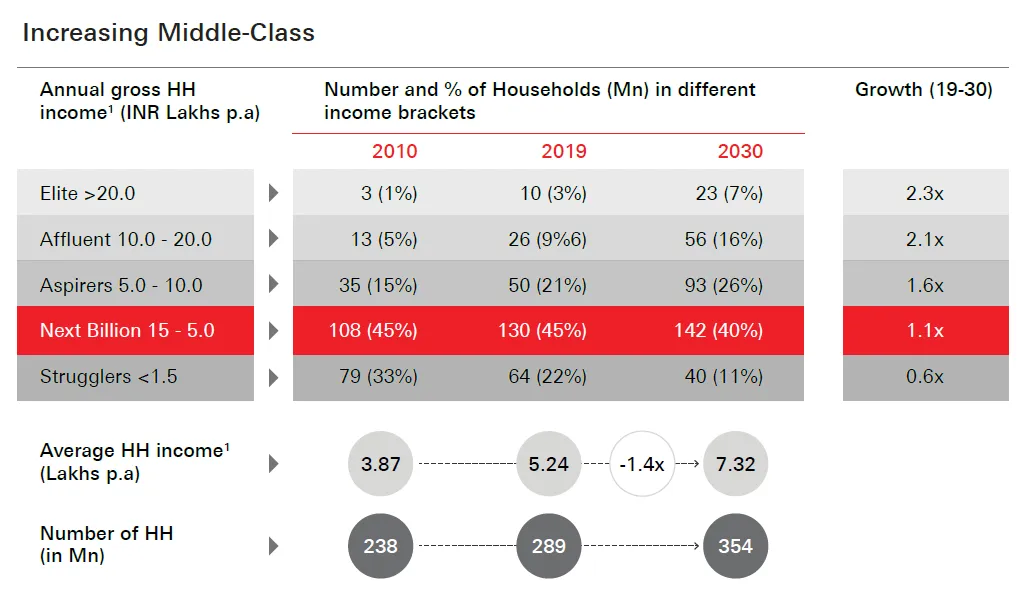

India’s consumption patterns are also being shaped by significant social changes, including the rise of nuclear families, increased female labor participation, and rapid urbanization. The growth of India's middle class from 2010 to 2030 is shown in the table below by HSBC, segmented by household income.

It shows significant shifts in income brackets, highlighting the growth of higher-income households.

The average household income is set to increase from INR 3.87 Lakhs p.a. in 2010 to INR 7.32 Lakhs p.a. by 2030, alongside a rise in the number of households from 238 million to 354 million.

This indicates a significant upward shift in income distribution, with the middle and upper classes expanding.

As urbanization accelerates and India shifts from joint to nuclear families, new consumption needs arise, particularly for convenience-driven products and services.

Smaller household sizes often lead to greater spending per capita on essentials, durables, and lifestyle products.

Female participation in the labor force has jumped from 23.3% in 2018 to 37% in 2023.

This increase in working women has expanded household incomes and shifted consumption patterns, with a greater emphasis on products and services that cater to dual-income households.

By 2047, over 60% of India’s population is expected to live in urban centers, up from the current 36%.

This migration will drive demand for urban-centric products, real estate, and services, while also accelerating the shift toward a consumption-driven economy.

Around 60% of new car buyers are under 35 years of age, reflecting a growing preference for premium features, safety, and environmental consciousness. SUVs and top-tier variants are increasingly popular among younger buyers seeking a superior driving experience.

The FMCG sector saw a robust recovery, with average spending increasing by 16.76% in FY24. This is a sharp turnaround from the 21.94% decline experienced in FY23, signaling that consumers are once again prioritizing daily essentials and discretionary goods after a period of cautious spending. The consumer durables sector also rebounded with a 3.74% increase in average spending following a 7.64% drop in FY23.

The aviation sector saw average spending grow by 6.36% in FY24, while railways posted an 8.16% increase.

India has doubled its airports in the past decade and aims to add 71 more in the next five years, boosting domestic air travel.

India has only 0.4 hotel rooms per million population, far below China (14.3) and the U.S. (9). As more people travel, demand for hospitality services will surge, making it a key growth area. This growth underscores the rise of India's travel economy, driven by millennials and improving disposable incomes.

Indians are increasingly valuing experiences like travel, leisure, and adventure, marking a shift in spending consumer behavior towards experiential consumption.

Media and entertainment also saw a significant boost, with average spending growing by 29.30% in FY24. The sector has evolved from being a discretionary luxury to an essential part of daily life, with consumers allocating more of their household budgets to entertainment.

E-commerce saw a decline in average spending of 14.61% in FY24, a notable recovery from the steeper 25.44% drop in FY23.

While this still represents a contraction, the smaller decline suggests that the sector is stabilizing, with recovery expected as digital adoption and online shopping continue to grow.

Similar to how Walmart expanded 28x in the U.S. from 1980 to 2000, India's retail sector is poised for rapid growth with rising incomes. International and local brands are expected to multiply their presence across the country.

The education sector showed a muted recovery, with average spending remaining relatively flat after a slight 1.61% decline in FY23, signaling a cautious return to pre-pandemic education-related expenses.

India’s healthcare spending is among the lowest in the world at 3.5% of GDP, with high out-of-pocket expenses due to low insurance penetration.

As incomes rise, healthcare spending will increase, with a shift towards better insurance coverage and higher investment in medical infrastructure. This could mirror the trend in Europe and China, where healthcare spending ranges from 7% to 12% of GDP.

Government efforts to increase public investment in healthcare to 2.5% of GDP will further drive this sector’s growth.

A notable disparity remains between urban and rural consumption patterns. Urban consumers continue to spend more on discretionary and lifestyle products, while rural consumers focus primarily on essentials. This divide presents both challenges and opportunities for businesses, which must adapt their strategies to cater to diverse consumer needs. Urban areas remain the dominant markets, but semi-urban and rural regions are increasingly contributing to overall consumption, reflecting a growing appetite for goods and services outside major cities.

ATM withdrawal data for FY24 shows an increase in cash usage across different regions, with metropolitan areas seeing a 10.37% rise in withdrawals, followed by increases in semi-urban (3.94%) and semi-metro (3.73%) regions. This trend indicates a broad-based economic expansion, where spending power is no longer confined to urban centers but extends to smaller towns and rural areas, underscoring the inclusivity of India’s growth story.

This premiumisation trend is driven by increasing disposable incomes, financing options, and changing consumer preferences for high-quality, feature-rich products across sectors. The trend of premiumisation in India’s consumption market continued strongly in the first half of 2024.

Vehicles priced over Rs 10 lakh accounted for 48% of all sales from January to June, up from 44% last year. Sales in this segment grew by 13%, twice the rate of overall vehicle sales (5.5%).

SUVs and larger vehicles now make up 63% of all passenger vehicle sales, driven by longer financing options and consumer preference for higher variants with better safety features.

This indicates a shift toward premium vehicles as consumers seek better quality and branded products.

Imports of luxury watches from Switzerland have surged by 45% over the past 2-3 years, reflecting increased demand for high-end goods.

Sales of luxury vehicles have grown at a 30% CAGR over the past three years, driven by increasing numbers of affluent consumers.

Luxury home sales have tripled in the past five years.

This mirrors a broader trend of consumers favoring quality over quantity as disposable incomes rise.

Premium smartphones priced above Rs 30,000 reached a record 20% market share by units sold, up from 17% last year. By value, this segment now represents 49% of the market.

Sales of 50-inch+ TVs rose from 21% to 24% of total sales.

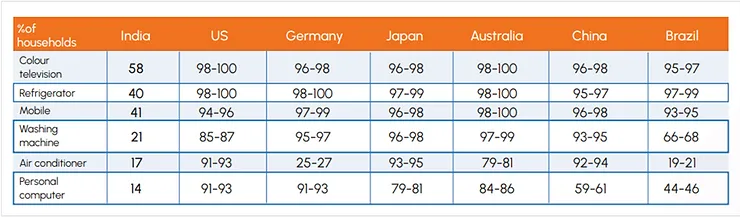

With only 21% penetration in India, there is ample room for expansion compared to the global average of 50%. The U.S. and China saw 2x growth in washing machine sales as incomes rose.

Amazon India reported that 81% of phones sold on its platform were 5G, and 2/3rds of TVs sold were large-screen and 4K models, driven by affordability schemes like no-cost EMIs.

Residential Air Conditioner (RAC) sales have reached a record 4 million units, driven primarily by first-time buyers upgrading from traditional fans. This growth in premium appliances underscores consumers’ willingness to invest in better living standards.

Discretionary premium products like bottled soft drinks and fabric softeners saw rapid growth.

Soft drinks crossed 50% penetration, with household consumption up by 250ml in two years.

Fabric softeners and washing liquids have also seen significant increases in consumer spending and volume consumption.

The "Prestige and Above" category for United Spirits has grown at a 12% CAGR over the past 4 years, while the lower-end popular category has declined by 20%.

With rising incomes, consumers are opting for higher-quality beverages rather than consuming more in volume.

Read this article to learn more about Understanding the Rise of Luxury Consumption From Affluent India

Global consumer products companies are increasingly betting on India’s long-term growth potential across various categories, ramping up their operations to capture the country's expanding consumer base. There is confidence in long-term growth driven by rising disposable incomes, urbanization, and evolving consumer preferences.

Reckitt, known for its health and hygiene products, highlighted India as part of its strategy to focus more on faster-growing emerging markets, including China and Africa. The company pointed to India as a thriving market where it expects rapid growth, particularly in its intimate wellness business. This is part of a broader strategy to shift its geographic mix towards markets with high growth potential, where consumer demand for health and hygiene products continues to rise.

Coca-Cola has also emphasized India’s importance, reporting a strong recovery in the second quarter of 2024 after a slow start earlier in the year. The company noted double-digit growth in volume in India during the second quarter, which significantly contributed to its overall Asia-Pacific performance. Coca-Cola's focus on India reflects the country’s growing beverage market and the company's ability to capitalize on increasing consumer spending in the region.

Nestle is eyeing India’s rapidly expanding coffee market as a significant growth area. The company noted that India is discovering coffee at a fast pace, similar to trends previously seen in China. Nestle’s confidence in a “positive future” for its coffee business in India over the long term underscores the shifting consumer preferences toward premium coffee products and the potential for market growth as coffee culture gains traction.

Colgate-Palmolive has also reported strong volume growth in India, specifically highlighting the success of its newly relaunched Colgate MaxFresh brand, which it identified as the fastest-growing core sub-brand in the country. The company’s optimism around India’s market rebound signals the ongoing demand for personal care products, supported by rising consumer incomes and increased focus on hygiene.

PepsiCo has identified India as a key growth market for both its snacks and beverages segments. The company’s management emphasized the long-term potential, noting that the opportunity for growth in India is “massive” when viewed over a decade. PepsiCo has been investing heavily in infrastructure and brand development to ensure it captures the increasing demand in India’s rapidly expanding consumer market.

Whirlpool, a major player in consumer durables, continues to see improving demand in India, positioning the country as an attractive growth market. Whirlpool expects sustained growth as consumers prioritize quality and durable goods.

India’s consumption loan portfolio grew by 15.2% year-on-year (YoY) to Rs 90.3 lakh crore as of March 2024, according to the latest CRIF High Mark report. This represents a slowdown compared to the 17.4% growth in the previous year, primarily due to a deceleration in the home loans segment, which makes up 40.1% of the total consumption loan portfolio by value.

The shift toward higher loan ticket sizes across categories such as personal, two-wheeler, and consumer durable loans signals evolving consumer preferences for more expensive goods and services, which could fuel further economic activity. However, the slowdown in home loan growth and MSME entity lending raises concerns about potential constraints in key sectors that drive broader economic growth.

The growth of home loans slowed to 7.9% YoY in FY24, a sharp decline from the 23% growth seen in FY23. This reduction was largely driven by muted growth in new loan originations, which rose by 9.2% in FY24 compared to 18.2% in FY23. Home loan originations shifted toward larger loans, with a noticeable increase in loans above Rs 35 lakh. The average loan size rose by 32% from Rs 20.1 lakh in FY20 to Rs 26.5 lakh in FY24.

In contrast, the personal loans segment continued its strong growth, rising by 26% YoY in FY24 despite regulatory changes. Higher-value personal loans, particularly those of Rs 10 lakh and above, gained a larger share in value-based originations. Although smaller loans under Rs 1 lakh still dominate in volume, this trend suggests a shift toward larger loan amounts as consumers seek more significant credit for personal needs. The robust growth in personal loans indicates sustained consumer confidence and spending, contributing to the overall consumption-driven growth of the economy.

Two-wheeler loans posted a 34% YoY growth in FY24, slightly higher than the 30% increase in FY23. The growth was largely driven by higher ticket-size loans, though the overall volume of loans grew at a slower pace of 13%, compared to 32% in the previous year. This trend reflects an increasing preference for more expensive two-wheeler models.

Auto loans also saw moderate growth, increasing by 20% YoY in FY24, down from 22% YoY in FY23. The automotive sector, while still expanding, shows signs of stabilization, indicating a possible shift in consumer priorities or market saturation in specific segments.

Consumer durable loans experienced strong growth of 34% YoY in FY24, up from 26% in the previous year, driven by the growing demand for high-value purchases. However, origination volumes grew at a slower pace of 8.5% in FY24 compared to 38.2% in FY23, signaling a move towards fewer but larger loans. This points to rising consumer demand for higher-end consumer goods, which could further stimulate economic activity in related industries.

The MSME (Micro, Small, and Medium Enterprises) lending segment showed mixed results. Individual MSME loans saw accelerated growth of 29% YoY in FY24, a substantial increase from 15% in FY23, reflecting stronger demand for personal credit among small business owners. However, entity-based MSME loans slowed considerably, growing only 6.6% YoY, down from 17.2% in FY23. This divergence indicates varying credit access or demand dynamics between individual entrepreneurs and formal business entities.

Microfinance lending posted a robust 27% YoY growth in FY24, up from 21% in FY23. The microfinance sector remains a vital source of credit for lower-income groups, and its expansion suggests an ongoing financial inclusion effort. Additionally, the report highlighted a rebound in non-banking financial companies (NBFCs), which continued to dominate volume-based originations while banks led in value-based originations.

India’s consumption growth is at a pivotal moment, driven by a combination of rising incomes, demographic shifts, and structural changes like digitalization and urbanization. Key factors include a young and growing population, increasing discretionary spending, digitalisation and the rise of premiumization, particularly in urban areas. As India transitions toward becoming one of the world's top consumer markets, sectors like consumer durables, retail, healthcare, luxury goods, FMCG, aviation, and e-commerce stand to benefit significantly.

This transformation is marked by rising per capita income and an expanding middle class, which is set to drive robust demand for both essential and high-end products. The increasing importance of semi-urban and rural markets further diversifies the consumption landscape, requiring businesses to adapt to evolving consumer preferences.

The comparison to other rapidly growing economies like China suggests that India's domestic consumption will be a critical driver of its economic expansion, reducing its reliance on exports. As disposable incomes rise and social dynamics evolve, demand for high-end products and services is growing, particularly in urban areas. This shift represents a significant opportunity for businesses targeting India's expanding middle class and affluent segments.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios