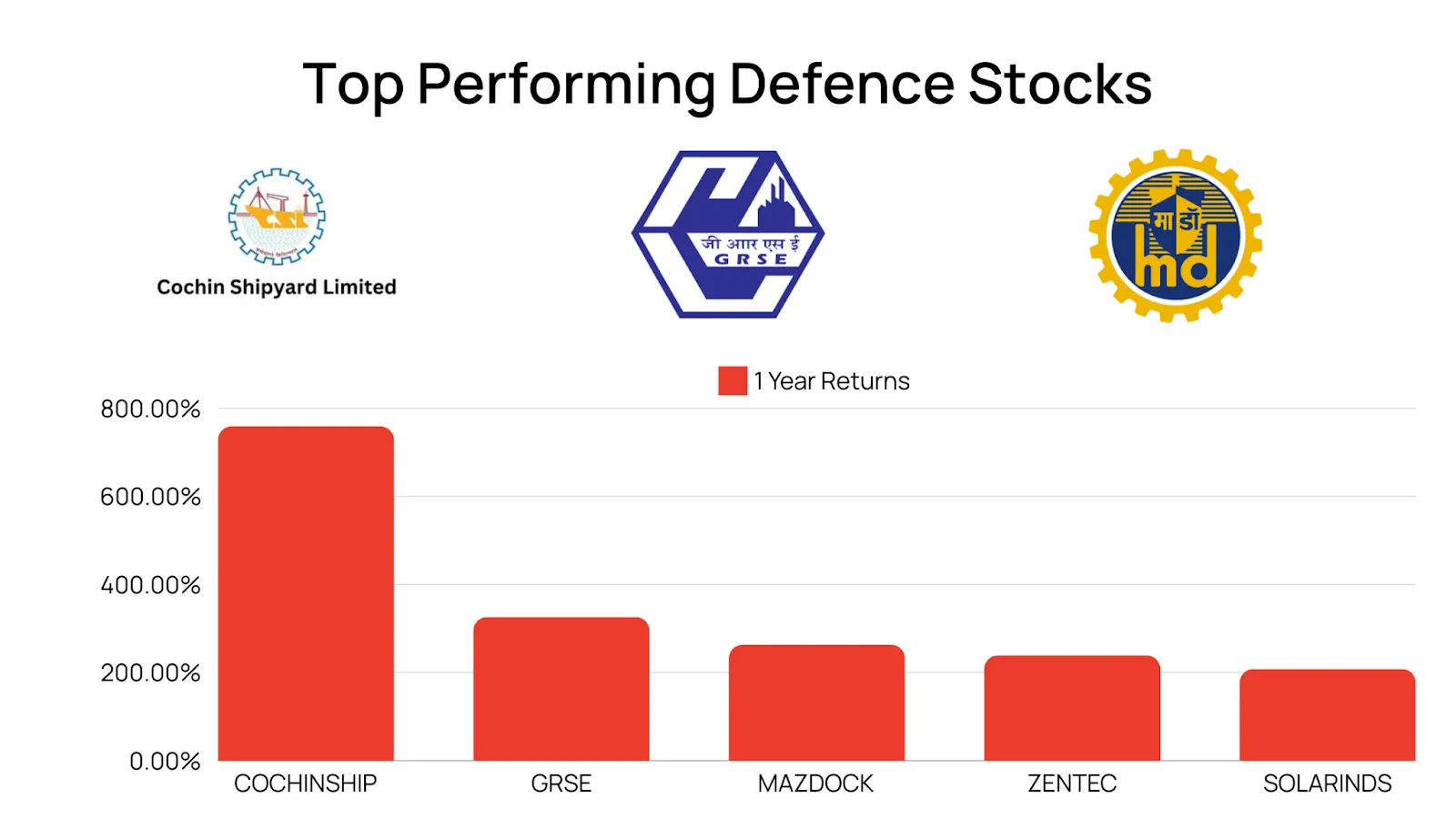

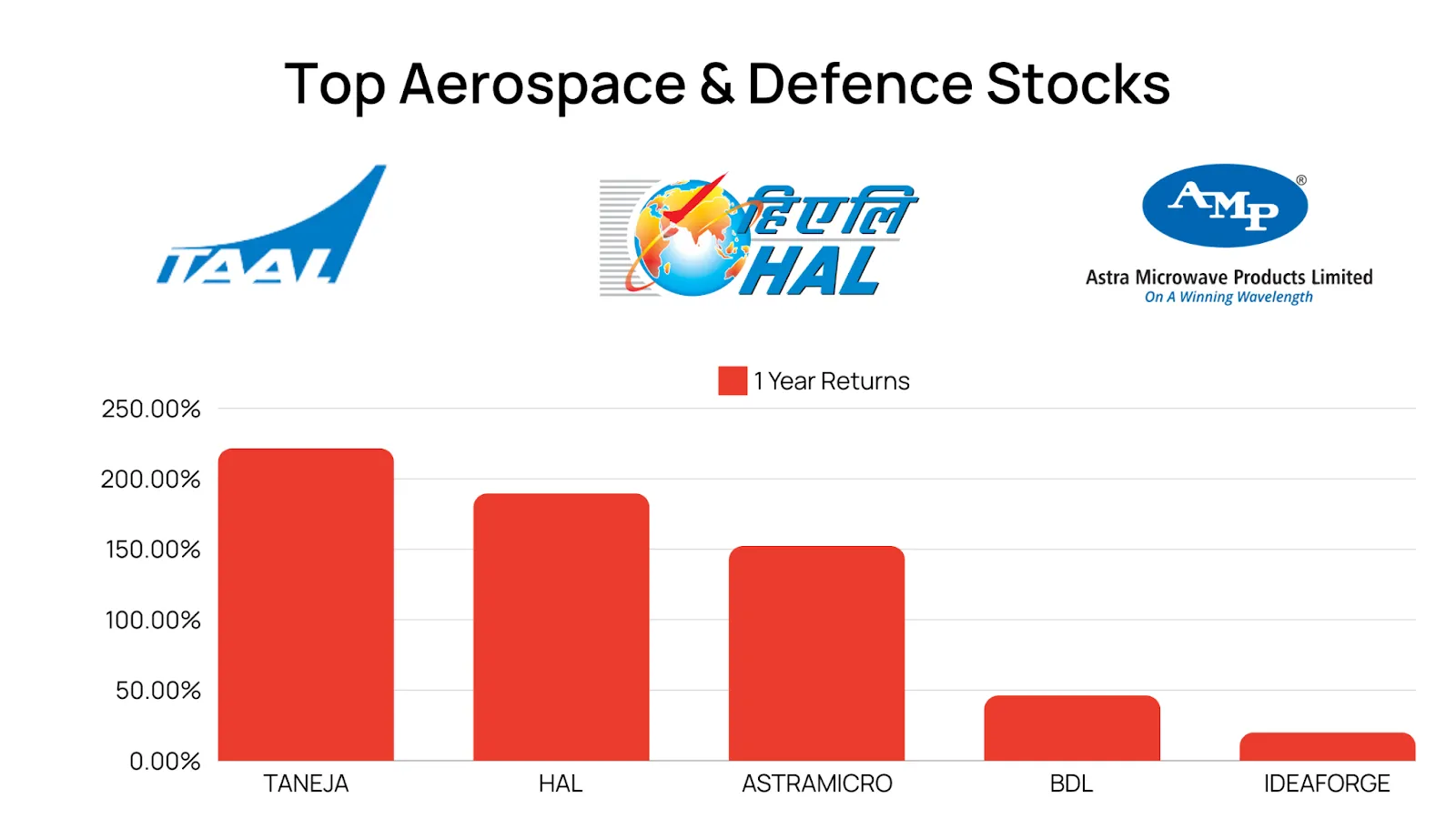

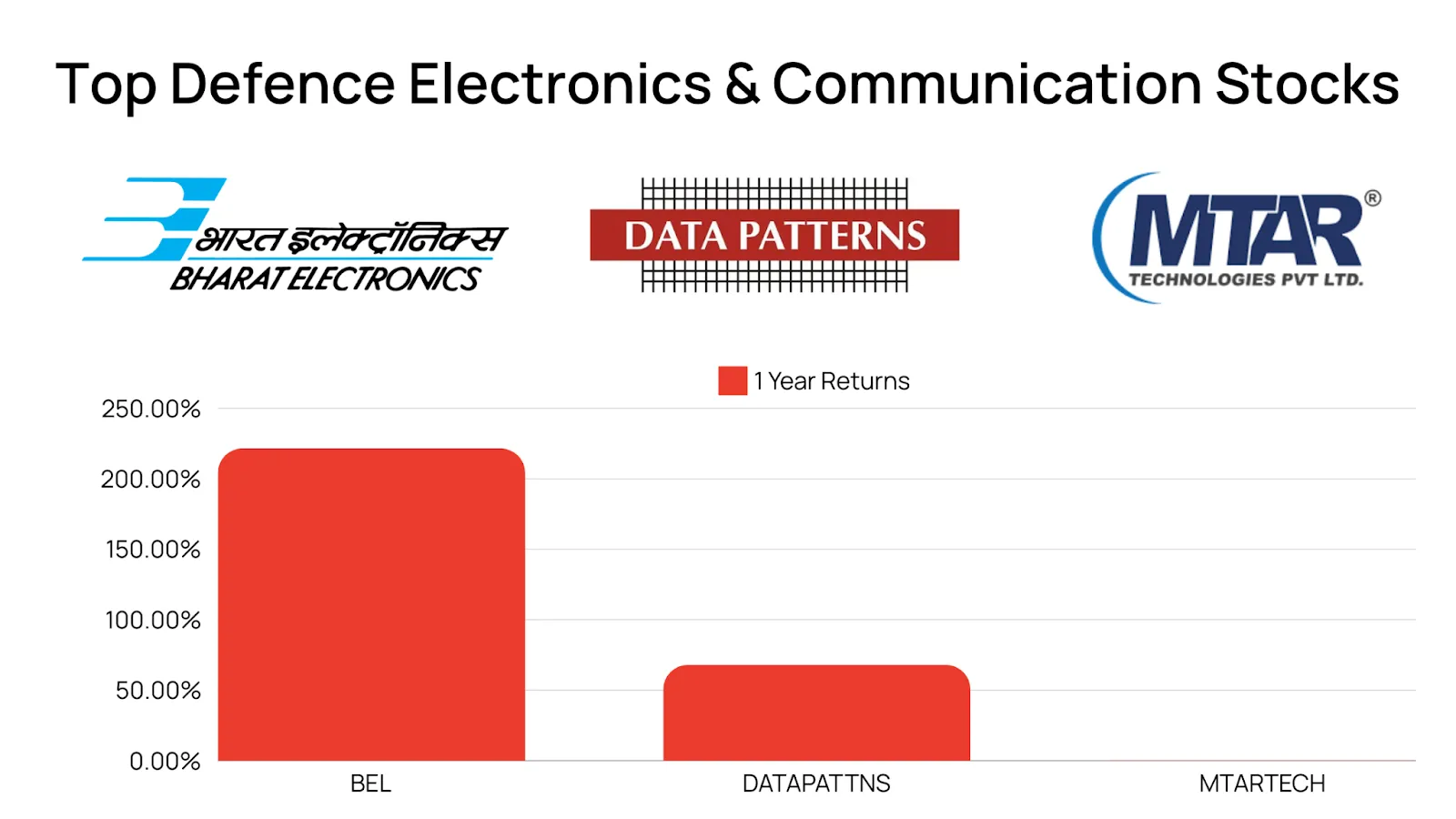

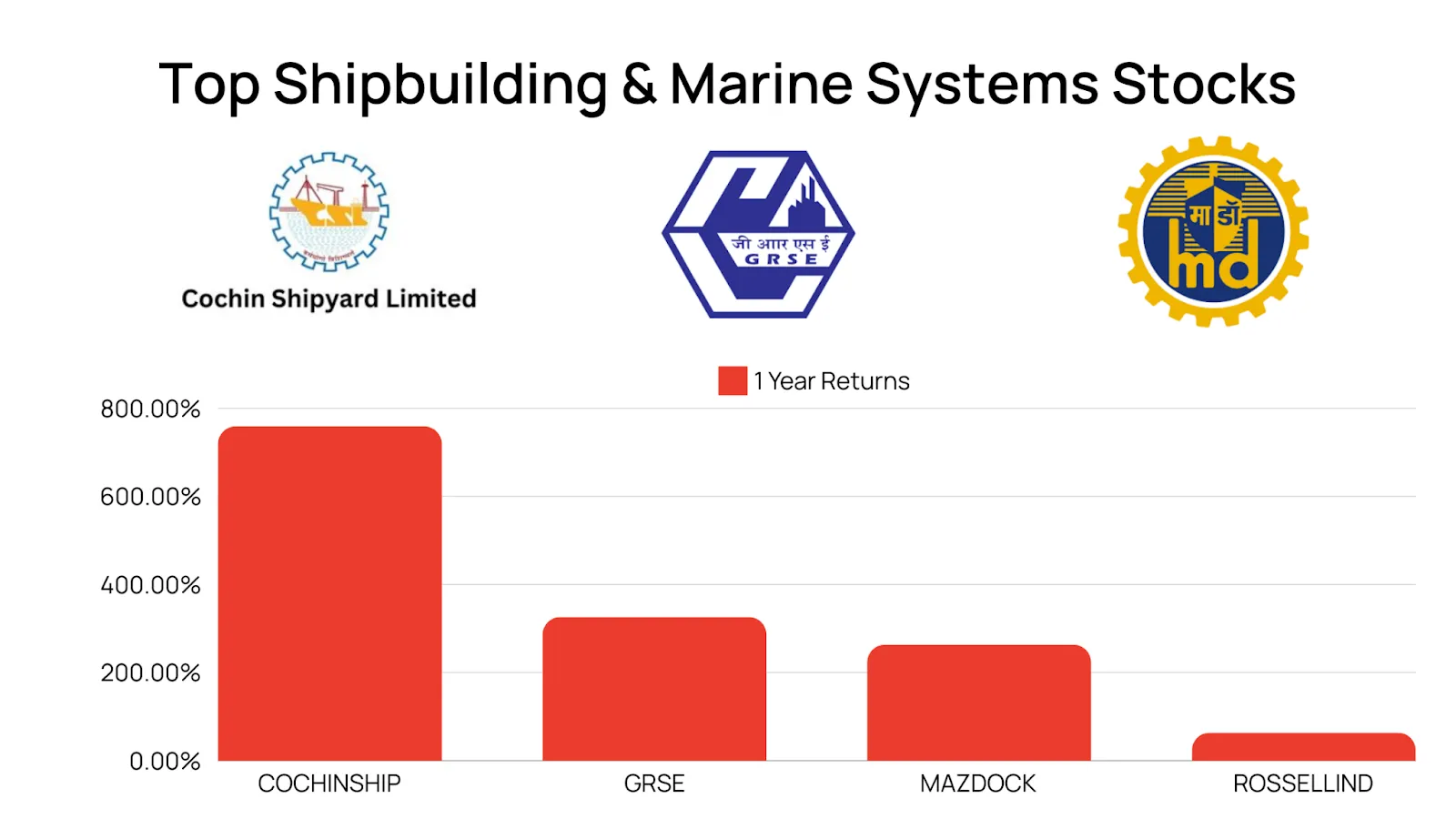

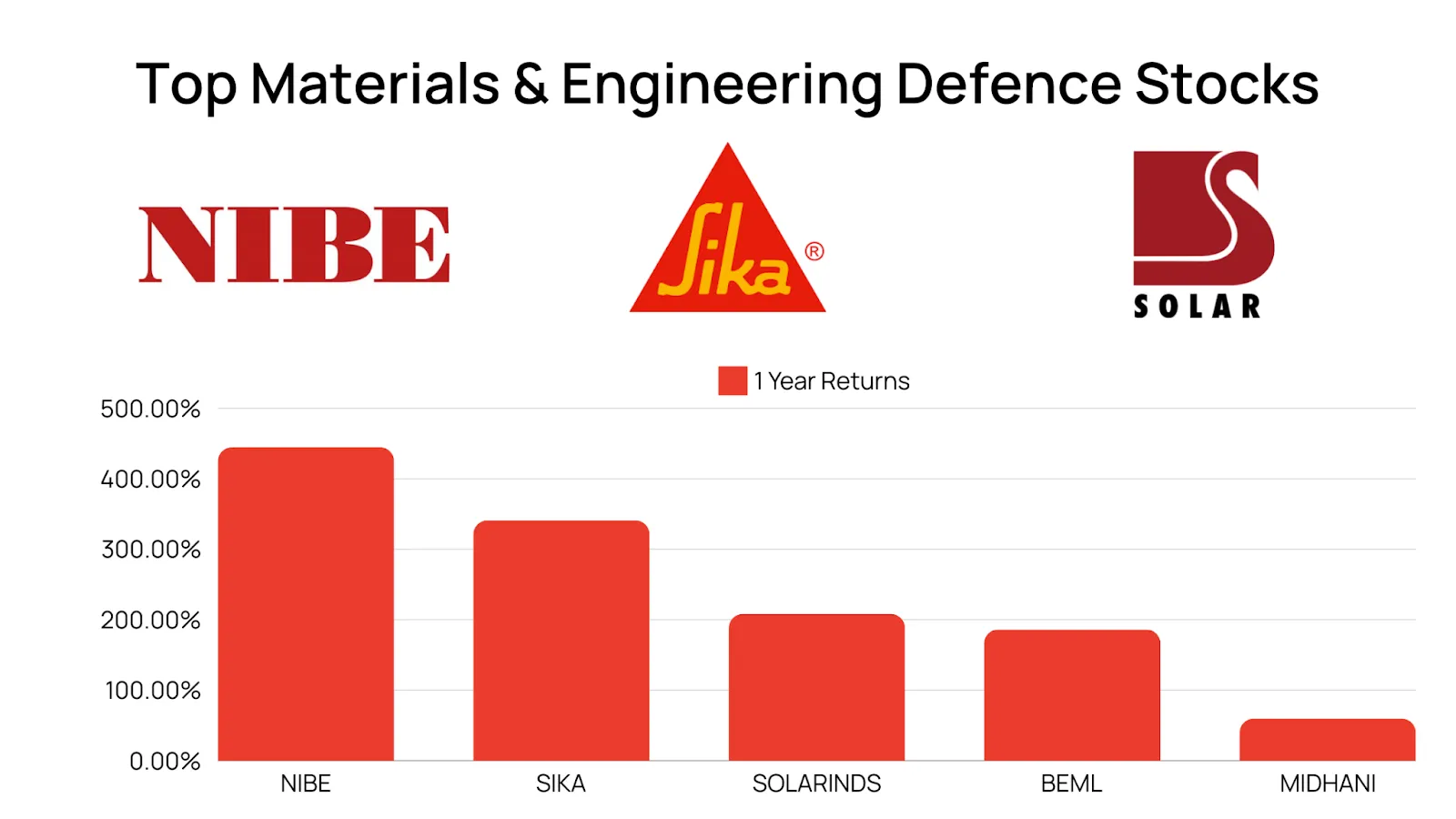

The Indian stock market has witnessed a period of impressive growth, but defense stocks have taken center stage, experiencing a meteoric rise in prices. Defence stocks on an average have grown more than 160% in the last one year.

This growth is backed by order book expansion and a drastic rise in the exports for Indian defence manufacturers. Indian defence exports have grown up with the size of 21,000 crores in FY 2324 which is 30 X rise from the export numbers 10 years back.

While the growing earnings and the expanding order books justify the price search right now but given the frenzy that the stocks have seen many investors speculate that the defence sector in India could have entered into the bubble territory.

In this blog we do drink deep into the defence value chain in India, why the stocks are growing and analyse if in fact the defence sector is in bubble territory or is the expensive valuation justified.

India has one of the world's largest military forces with a budget of over 67 billion dollars. It is the second largest defence importer behind Saudi Arabia making up 9.2% of global arms import. India has a goal of becoming among the top 5 global producers of the aerospace and defence manufacturing with annual export target of US$5 billion by 2025

The Indian defense industry thrives on collaboration between segments:

PSUs (e.g., HAL, BEL): Lead R&D, manufacture core equipment (aircraft, missiles), and maintain existing systems.

Private Players (e.g., L&T): Drive innovation through specialized equipment manufacturing and system integration.

Foreign Players (e.g., Boeing): Bridge technology gaps via joint ventures and advanced technology transfer.

Astra Microwave Products Ltd: Develops and manufactures microwave components for defense applications.

Bharat Dynamics Ltd: Manufactures guided missiles, torpedoes, and other ammunition.

Hindustan Aeronautics Ltd (HAL): Manufactures and supplies aircraft, avionics, space systems, and other defense equipment.

ideaForge Technology Ltd: Develops and manufactures unmanned aerial vehicles (UAVs).

Taneja Aerospace and Aviation Ltd: Manufactures aerospace components and subsystems.

Bharat Electronics Ltd (BEL): Manufactures and supplies electronic products for defense applications, including radars and communication systems.

Data Patterns (India) Ltd: Designs and manufactures electronic hardware and software solutions for the defense sector.

MTAR Technologies Ltd: Designs, develops, and delivers IT products and services, potentially including some for defense communication systems.

Zen Technologies Limited: Develops and manufactures state-of-the-art Combat Training Solutions.

Cochin Shipyard Ltd: Constructs and repairs commercial ships and warships.

Garden Reach Shipbuilders & Engineers Ltd (GRSE): Designs, constructs, and repairs warships and submarines.

Mazagon Dock Shipbuilders Ltd (MDL): Constructs and repairs warships, submarines, and other naval vessels.

Rossell India Ltd: Provides shipping services, potentially including transportation of military equipment and personnel.

BEML Ltd: Manufactures earthmoving and construction equipment, which can be used for defense infrastructure projects.

Mishra Dhatu Nigam Ltd (MIDHANI): Manufactures and supplies specialty aluminum for aerospace and defense applications.

Sika Interplant Systems Ltd: Provides industrial adhesives and sealants, potentially used in defense applications.

Nibe Ltd: Information on their specific defense involvement is limited, but they might manufacture components or provide engineering services.

Solar Industries India Ltd: Manufactures industrial explosives, potentially used for some defense applications.

The Nifty India Defence Index's performance over the past year and three years has been remarkable, with compounded annual growth rates of 177% and 89.5%, respectively, as of the end of May. This strong performance reflects the sector's resilience and growth potential, making it an attractive investment avenue.

On July 5 after Defence Minister Rajnath Singh announced record-high defence production growth for 2023-24, defence stocks rallied 13%. The production value reached Rs 1,26,887 crore, a 16.8% increase from the previous fiscal year, highlighting the government's commitment to developing India as a global defence manufacturing hub. Following the announcement, shares of major defence companies such as Bharat Dynamics, Bharat Electronics, Hindustan Aeronautics, Cochin Shipyard, and Data Patterns saw significant gains.

Defence Minister Singh has also set a target to export over Rs 50,000 crore worth of defence equipment by 2028-2029. The Motilal Oswal Nifty India Defence Index Fund raised Rs 1,676 crore during its New Fund Offer period, marking the highest collection for an equity index fund in India. The Nifty India Defence Index has shown impressive growth rates, further reinforcing the sector's robust outlook.

These developments show that the defense sector rally is going strong with a promising future for India's defence sector, especially driven by strategic government initiatives and strong market performance.

Several factors are fueling the recent surge in India's defense sector:

Modernization Drive: Aging military equipment is getting an upgrade, creating demand for new generation platforms.

Atmanirbhar Bharat Push: The "Self-Reliant India" initiative prioritizes domestic production, boosting local defense companies.

Indeginization Drive: In addition to this, the Ministry of Defence has started releasing indigenisation lists, which consists of equipment and platforms that the government aims to completely indigenise by December 2025 and are banning imports on certain defence equipment.

Increased Defense Spending: Focus on bolstering national security translates to larger budgets for defense procurement.

Growing geopolitical tensions highlight the need for self-reliance in defense equipment, driving domestic production.

Indian defense manufacturers are eyeing a larger global market share, creating additional growth potential.

This confluence of factors has ignited significant growth within the Indian defense sector, attracting investor interest.

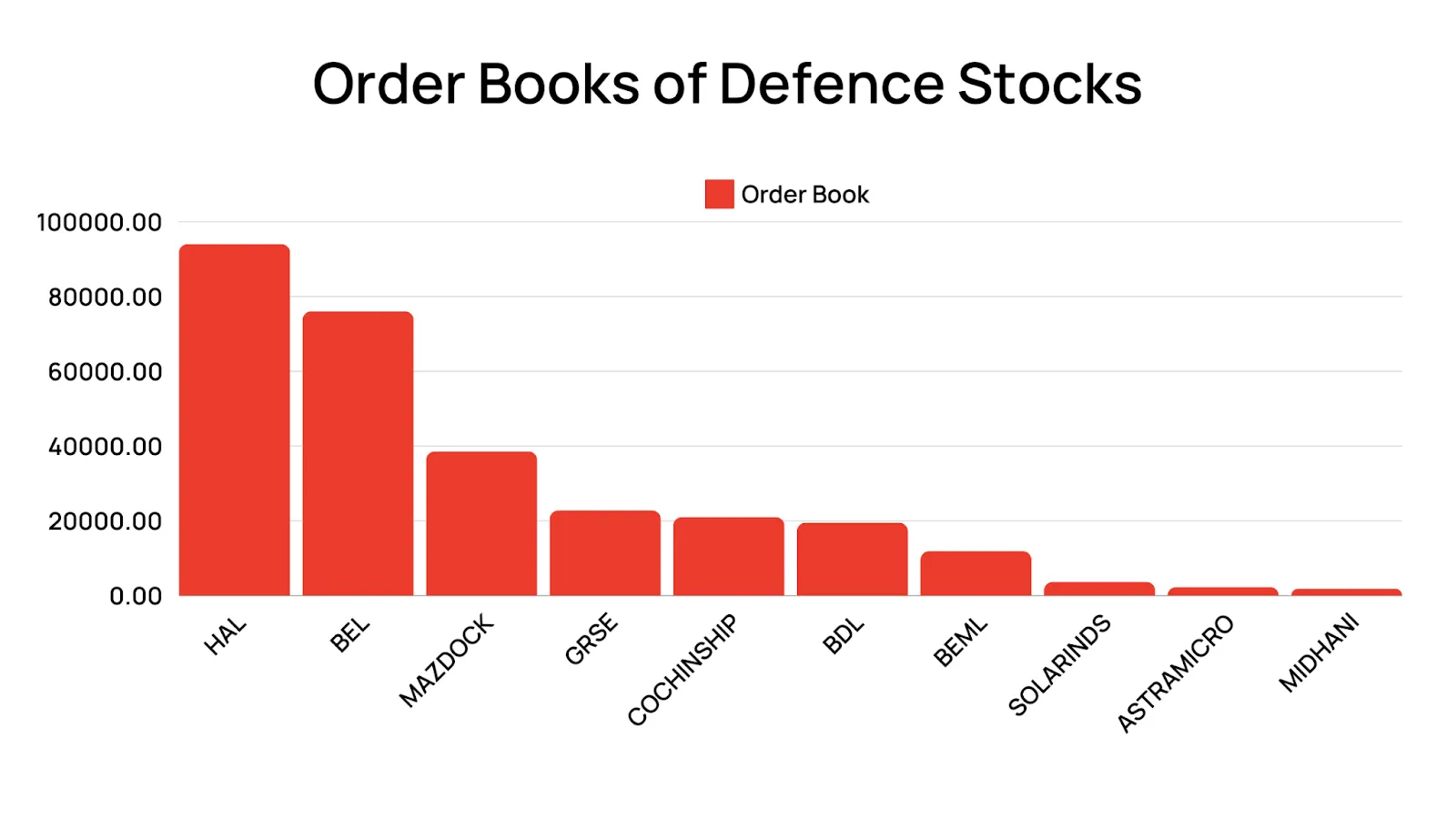

Major Indian defense companies are experiencing a surge in order books, reflecting strong government initiatives and modernization plans. Leading players like Hindustan Aeronautics Ltd (HAL) boast massive order books exceeding ₹94,000 crore, signifying significant demand for new-generation aircraft and weapon systems. Similarly, companies like Bharat Electronics Ltd (BEL) with a ₹76,000 crore order book and Mazagon Dock Shipbuilders Ltd (MDL) with a robust ₹38,561 crore order book showcase the growing demand across various defense segments.

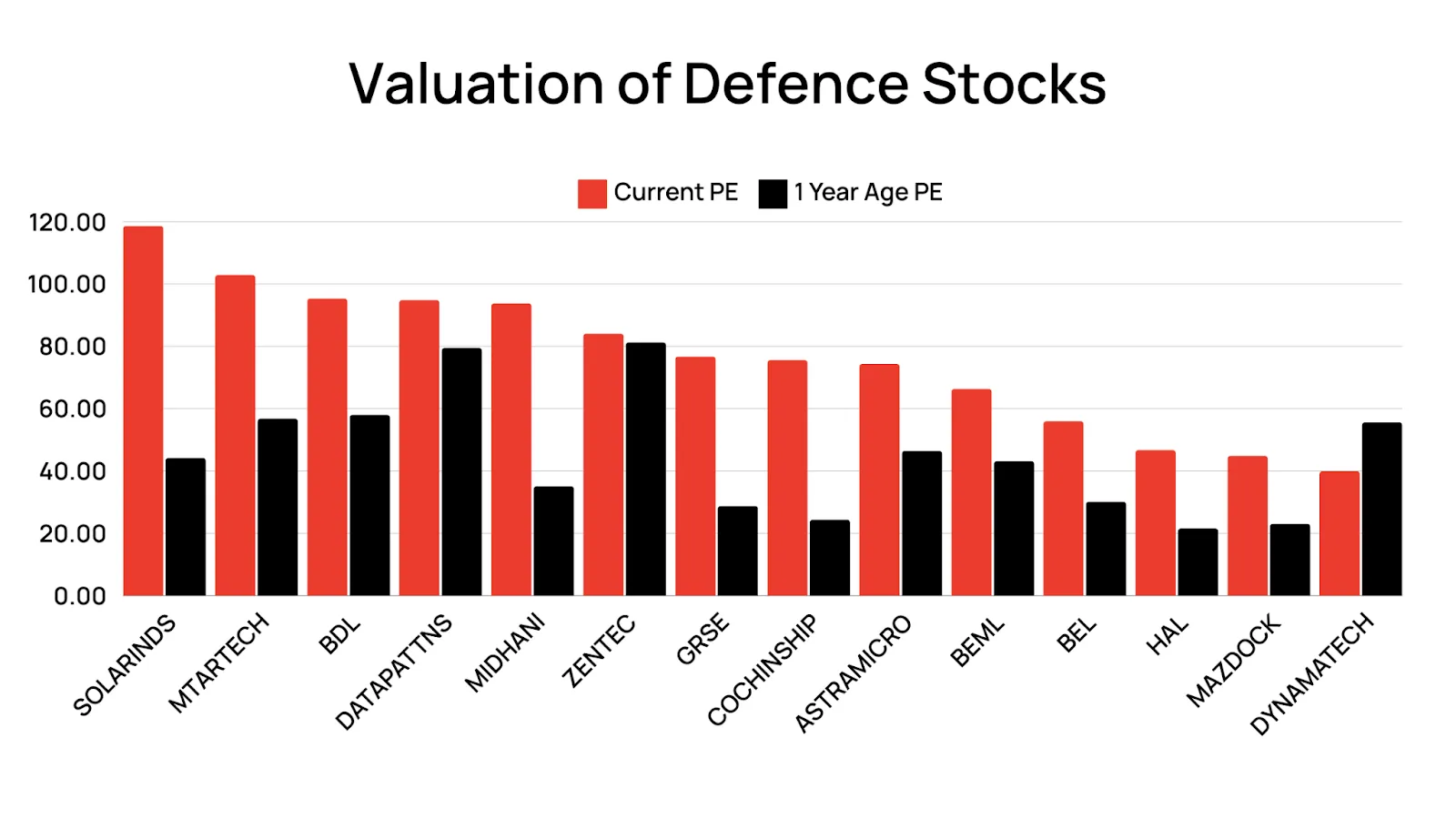

While a healthy order book is a positive indicator, a deeper analysis is required before concluding whether it entirely justifies current valuations. Traditional metrics like the P/E ratio, which compares a company's share price to its earnings, might not fully capture the nuances of defense contracts. Here's why:

Long Execution Cycles: Defense projects often have lengthy execution cycles spanning 5-10 years. This makes it challenging to accurately predict future earnings based on current order book values. Revenue recognition might be spread out over several years, potentially creating a mismatch between order book size and immediate profitability.

Investors should exercise caution when solely relying on order book size for valuation. Here are some potential concerns regarding stretched valuations that a large order book might not address:

Execution Risks: Defense projects are susceptible to delays due to unforeseen technical complexities or bureaucratic hurdles. These delays can disrupt cash flows and impact profitability, potentially leading to downward corrections in valuations.

Cancellation Risks: Defense contracts can be subject to cancellations or modifications based on budgetary constraints or changes in government priorities. Such cancellations can significantly impact a company's order book and future revenue streams, affecting valuations.

Hidden Costs: Order book values don't necessarily reflect the full project cost. Research & development expenses, raw material price fluctuations, and potential penalties for delays can all eat into profit margins, impacting the company's bottom line and potentially overestimating the value reflected in the order book.

The current market enthusiasm for defense stocks might lead to stretched valuations in some cases. While companies like MDL possess a substantial order book and a relatively lower PE ratio (44.9), a comprehensive analysis is necessary. Similarly, companies like BEL and HAL with high order books also have higher PE ratios (56.0 and 46.7 respectively), requiring a closer look at other financial metrics like return on equity (ROE) and return on invested capital (ROIC) to assess their true profitability and efficiency.

The recent surge in India's defense sector has captivated investors, but the question remains: is it a sustainable rally or a temporary bubble?

Let's delve into the factors that could propel continued growth and analyze potential risks to consider:

Sustained Government Spending: The Indian government's focus on modernization and self-reliance in defense promises continued high spending on military equipment. This translates into a predictable revenue stream for defense companies, fueling further growth.

Successful Project Execution: Timely and efficient execution of current defense projects is crucial. Successful completion not only fulfills critical national security needs but also builds confidence in domestic capabilities, potentially leading to even larger future contracts.

Export Ambitions Realized: If Indian defense manufacturers can successfully tap into the global defense market, it would be a significant growth driver. Increased exports would diversify revenue streams, reduce reliance on domestic contracts, and enhance the industry's global competitiveness.

Technological Advancements: Investing in R&D and fostering innovation are essential for developing cutting-edge defense technologies. This not only strengthens India's domestic capabilities but also positions it as a more attractive supplier in the international market.

Global Economic Slowdown: A global economic downturn could lead to tighter government budgets, potentially impacting defense spending plans. This could translate into reduced or delayed orders for defense companies, hindering growth.

Project Execution Delays: As mentioned earlier, delays in project execution due to technical complexities or bureaucratic hurdles can disrupt cash flows and impact profitability. This could lead to downward corrections in stock prices and dampen investor sentiment.

Changes in Government Policies: Shifting government priorities or changes in leadership could lead to alterations in defense procurement policies. This uncertainty could create volatility in the defense sector.

Geopolitical Fluctuations: Geopolitical tensions can be a double-edged sword. While heightened tensions might lead to increased defense spending in the short term, prolonged instability can create uncertainty and hinder long-term growth prospects.

The Indian defense sector undeniably possesses significant growth potential. However, it's crucial to maintain a balanced perspective – acknowledging the opportunities while remaining cautiously optimistic due to the inherent cyclical nature of defense spending and the ever-evolving geopolitical landscape. Here's why cautious optimism is essential of Defense Stocks:

Cyclical Nature of Defense Spending: Defense budgets often fluctuate based on perceived threats. While current spending is high, there's no guarantee it will continue indefinitely. Investors should be prepared for potential downturns.

Geopolitical Uncertainties: The global security landscape is constantly shifting. Unforeseen events or changes in regional dynamics could significantly impact defense priorities and spending.

The Indian defense sector is experiencing a period of robust growth, driven by government initiatives, modernization plans, and export ambitions. However, for investors considering entering this market, a clear understanding of the opportunities and challenges is critical.

Growth Potential is Real: The Indian government's focus on self-reliance and increased defense spending creates a fertile ground for domestic defense companies.

Order Books Tell Part of the Story: While a healthy order book is positive, it shouldn't be the sole factor driving investment decisions.

Look Beyond Valuations: Traditional metrics like P/E ratio might not fully capture the nuances of defense contracts due to long execution cycles and potential risks.

Risks Lurk Beneath the Surface: Global economic downturns, project execution delays, and geopolitical uncertainties can all negatively impact the sector.

Conduct Thorough Research: Analyze a company's financial health, track record, and future growth prospects beyond just order book size and current valuations.

While the current defence stocks rally is exciting, investors should be wary of getting carried away by the hype. The defense sector is inherently cyclical, and geopolitical realities can shift quickly. A balanced approach is key. Recognize the growth potential of the Indian defense sector while remaining cautiously optimistic due to the inherent risks involved.

By conducting thorough research, analyzing a company's fundamentals beyond order books, and adopting a cautious yet optimistic perspective, investors can navigate the complexities of the Indian defense sector and make informed investment decisions aligned with their risk tolerance and long-term goals.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart