by Siddharth Singh Bhaisora

Published On Dec. 15, 2024

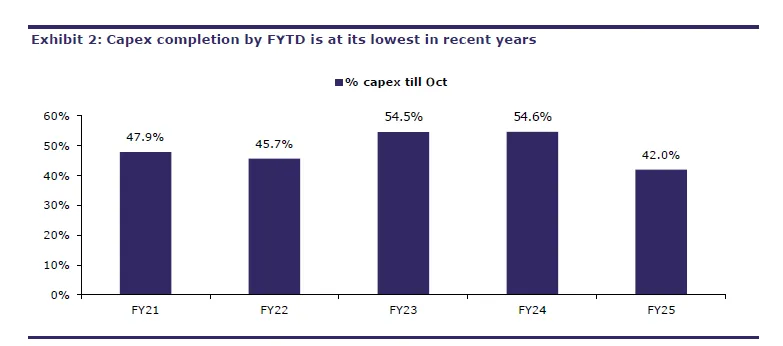

In the last decade, India has witnessed a significant surge in government-led capital expenditure, which has grown five-fold since 2014. This uptick in investment has primarily been directed toward critical infrastructure, including national highways, railways, and air connectivity. However, there has been a slowdown in capex completion in FY25 - which is at a 5 year low of 42% as of October 2024.

Reports are suggesting that India is poised for a significant recovery in capital expenditure (capex) in the second half of FY25, driven by robust government initiatives and a strategic focus on infrastructure development. While the first half of FY25 saw a sluggish capex performance due to elections and monsoons, strong signals from recent government spending patterns and project bid accelerations indicate a promising turnaround.

India is also at a pivotal moment in its development journey, with ambitious plans to become a developed nation by 2047. At the core of this transformation lies a robust focus on capex, infrastructure development, and the collaboration between public and private sectors. An analysis of recent developments and expert insights reveals a cohesive strategy where government investment in infrastructure and private sector engagement will be pivotal for sustainable and inclusive growth.

Investment has emerged as a cornerstone of India’s growth story. Gross Fixed Capital Formation, a measure of investment activity, has increased to 30.8% of GDP in FY24 from an average of 28.9% between FY15-19. This growth has been supported by public sector capex and household investments in real estate. However, private sector capex continues to lag, with a durable recovery still awaited.

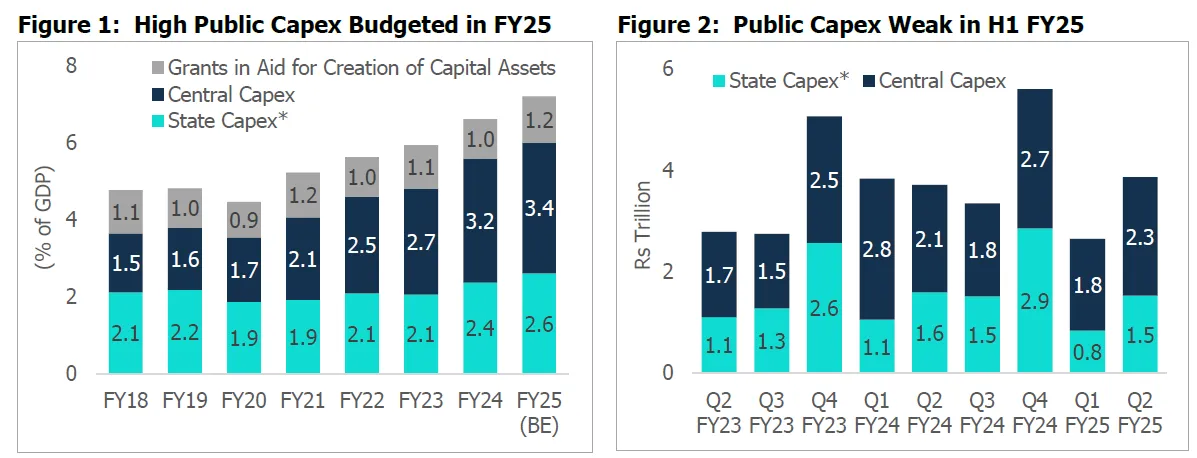

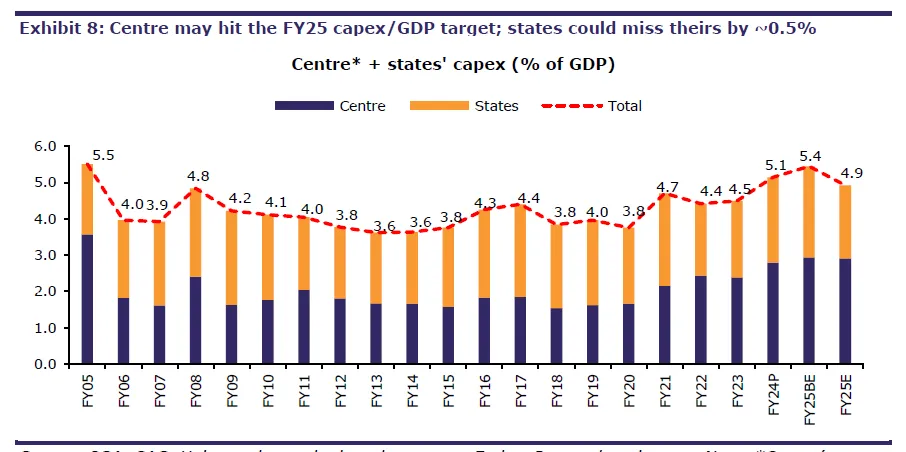

Public sector capex has been a key driver of growth in recent years, with the central government’s allocation for FY25 rising to 3.4% of GDP, more than doubling from 1.6% of GDP in FY19. However, the execution has faced challenges. In the first half of FY25, central capex contracted by 15.4% YoY, while state capex fell by 10.5% YoY. This slowdown was partly due to restrictions on spending during the general elections related restrictions and geopolitical uncertainties.

Central Capex: Contracted by 35% YoY in Q1 FY25 to ₹1.8 trillion but recovered by 10.3% YoY in Q2.

State Capex: Declined by 21% YoY in Q1 FY25 to ₹0.8 trillion and continued to shrink by 3.8% YoY in Q2. States achieved only 28% of their budgeted targets in H1 FY25, reflecting implementation bottlenecks.

To address these challenges, the central government has increased the allocation for 50-year interest-free loans to states from ₹1.3 trillion in FY24 to ₹1.5 trillion in FY25. However, states utilized only ₹1.1 trillion of the previous year’s allocation, raising concerns about the effective deployment of funds.

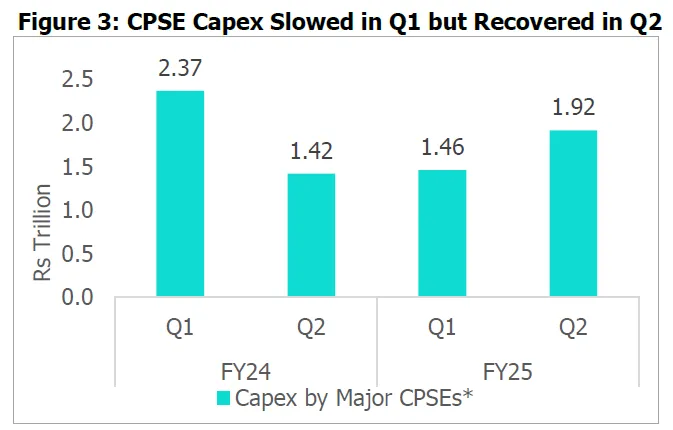

The capex performance of major Central Public Sector Enterprises (CPSEs) in the first half of FY25 reflects a challenging but recoverable trajectory:

Decline in Q1 FY25: CPSE capex experienced a steep 38.4% YoY decline in Q1 FY25, amounting to ₹1.46 trillion. This contraction can likely be attributed to election-related restrictions and broader macroeconomic headwinds, such as geopolitical uncertainties and high borrowing costs.

Recovery in Q2 FY25: Q2 brought some relief with a significant recovery in CPSE capex, which rose to ₹1.92 trillion. While this improvement is encouraging, it was insufficient to fully offset the first-quarter contraction.

H1 FY25 Performance: Overall, CPSE capex contracted by 10.8% YoY in the first half of FY25, totaling ₹3.4 trillion, achieving just 43.6% of the annual target. This indicates a need for substantial acceleration in the second half of the fiscal year.

Annual Target and Growth Ambition: The government has set an ambitious annual capex target of ₹7.7 trillion for FY25, a 4.9% increase from the previous year’s target of ₹7.4 trillion. Meeting this goal will require CPSEs to significantly ramp up their investments in H2 FY25.

CPSEs will need to address bottlenecks, including procurement delays and project implementation challenges, to meet the annual target. Additionally, given the multiplier effect of CPSE investments on the economy, underperformance could dampen broader economic activity and employment generation. A stronger policy focus may be required to ensure timely disbursement of funds, streamlined approvals, and prioritization of high-impact projects.

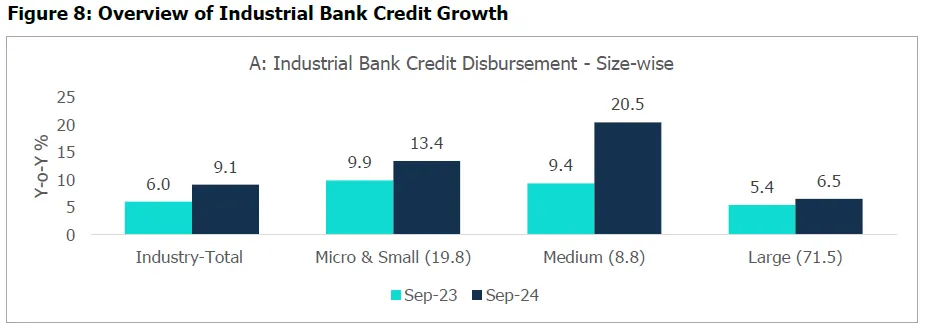

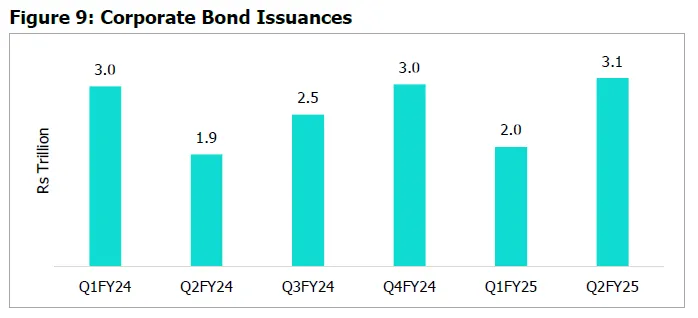

India’s capex trends are closely linked to the availability of financing, with bank credit, corporate bonds, and foreign investments playing crucial roles.

Industrial bank credit grew by 9.1% YoY as of September 2024, with large industries receiving a 6.5% increase in credit. Growth was particularly strong in sectors like chemicals, engineering, and food processing.

Corporate Bond Issuances fell by 33.7% YoY in Q1 FY25 due to election uncertainties but rebounded with a 67.9% increase in Q2. This should increase as private sector capex increases. Additionally, the impending interest rate cut cycle by RBI will result in more corporate bond issuances as a result of lower cost of borrowing capital.

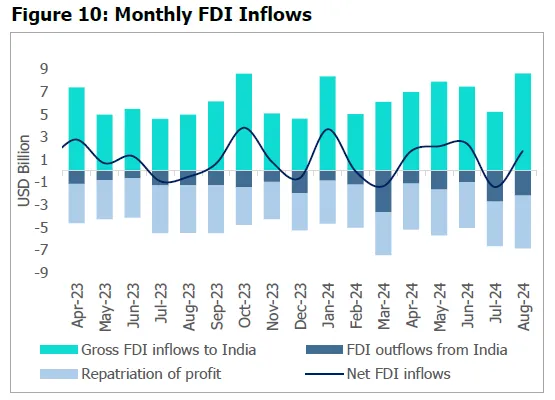

Net FDI inflows fell by 64% YoY in FY24 due to profit repatriations but recovered by 103% YoY in the April-August period of FY25, supported by India’s growing role as an alternative manufacturing hub.

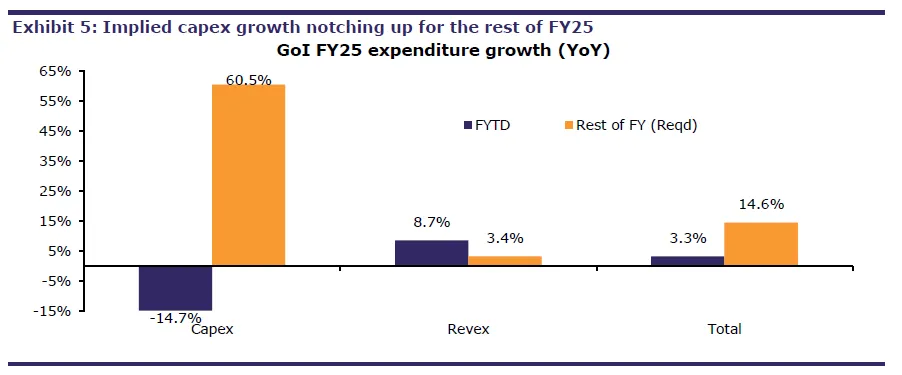

India's capital expenditure is set to accelerate further in the second half of FY25, with reports predicting a robust 25% YoY increase. Overall government expenditure is expected to rise by 15% year-on-year in the second half of FY25. This rise comes despite challenges like the slowing pace of private investment and fiscal constraints during the first half of FY25. The government has so far taken a balanced approach by prioritizing infrastructure investment over welfare-driven populist measures. This strategy is critical for creating long-term economic assets and fostering sustained growth.

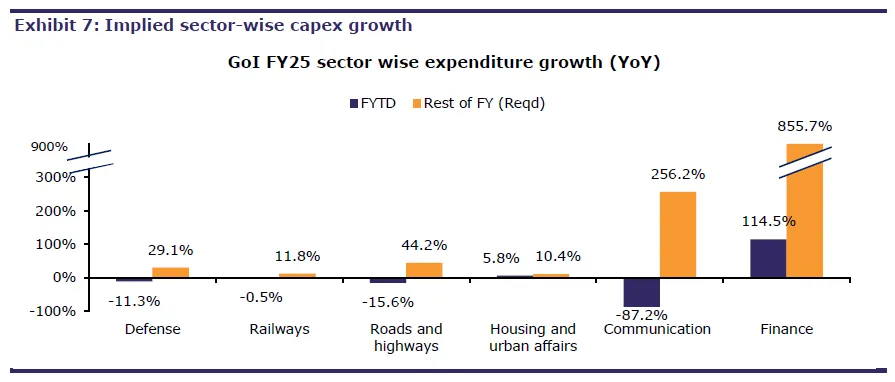

The central government is set to lead the charge in boosting capex, with defense, roadways, and communication sectors identified as the primary beneficiaries. In the 2nd half of FY25 new projects are expected to be rolled out and executed. The FY25 capex target of Rs 48.2 trillion, while ambitious, is likely to see strong sequential growth even if the annual goal remains unmet. The government has already achieved 51% of its total expenditure in the first 7 months of FY25, demonstrating its commitment to meeting capex targets. However, some states, including Punjab, Assam, Karnataka, Maharashtra, and Rajasthan, have bucked this trend and recorded double-digit growth in their capex during the first half of FY25.

The central and state governments have shown a renewed focus on capex in the second half of FY25. States like Punjab, Assam, Karnataka, Maharashtra, and Rajasthan have demonstrated double-digit growth in capex, setting a positive precedent for other states to follow. The combined efforts of central and state governments are expected to fuel a broader recovery in public investment, bolstered by projects in road development and power generation.

A closer look at capex dynamics shows that while railways have outperformed their annual run-rate and may not contribute significantly to second-half seasonality, defense and roadways are expected to show sharp sequential increases. Notably, communication infrastructure is also anticipated to see a substantial uptick, reflecting the government’s focus on digital connectivity.

Government liquidity trends underscore a strategic pivot toward increased spending. The central government’s estimated cash surplus balance has declined dramatically from Rs 2,671 billion in 1HFY25 to Rs 283 billion by late November 2024. This dwindling surplus, coupled with the use of ways and means advances in November, signals an impending surge in government expenditure, particularly in large-scale capex projects. This contrasts with the linear trajectory of revenue expenditure, further reinforcing the capex recovery narrative.

A significant concern amid India’s capex push is the rise of populist welfare schemes, particularly at the state level. According to Jefferies, states like Maharashtra have introduced welfare programs that cost ₹460 billion annually, raising fears of a populist wave that could strain public finances. With 14 out of 28 Indian states implementing similar schemes, covering approximately 120 million households, such expenditures account for 0.7-0.8% of India’s GDP.

The emphasis on welfare spending and the enforcement of a strict 3% fiscal deficit cap pose significant challenges to state-led capex initiatives. As a result, state governments are expected to fall short of their capex targets, with a projected undershoot of approximately 0.5% of GDP in FY25. This shortfall places an even greater onus on the central government to drive capex momentum. The central government has maintained a clear focus on long-term development rather than short-term populism. By prioritizing infrastructure investments, it seeks to build a foundation for sustained economic growth that benefits all sections of society. The government’s ability to strike this balance will be critical in achieving its 2047 vision.

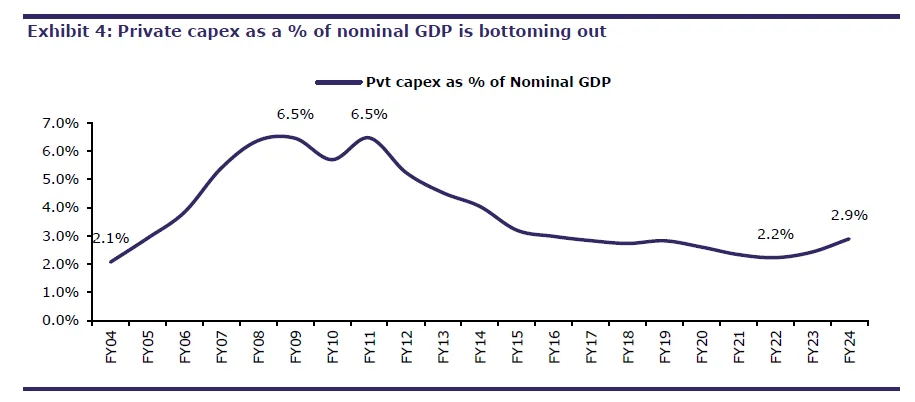

While public sector investment continues to grow, private sector capex remains sluggish, but there are early indications of a revival in capex activity. The share of private capex as a percentage of nominal GDP, which had been declining, is beginning to bottom out, suggesting a gradual resurgence. This trend aligns with the broader economic recovery and the government's push for private sector participation in infrastructure development.

India INC needs to increase its investment momentum, emphasizing the importance of private enterprises in driving economic growth. Despite significant capacity expansions by conglomerates like the Aditya Birla Group, private sector participation in capex has not kept pace with the government’s efforts. Reluctance to invest and a preference to operate at higher capacities have contributed to a slowdown in growth, which hit a seven-quarter low of 5.4% in the July-September period of 2024. However, businesses must rise to the occasion, leveraging the enabling ecosystem created by the government to drive the economy forward. India has the potential to become a global manufacturing and service hub, thereby rewiring global supply chains and elevating its economic standing.

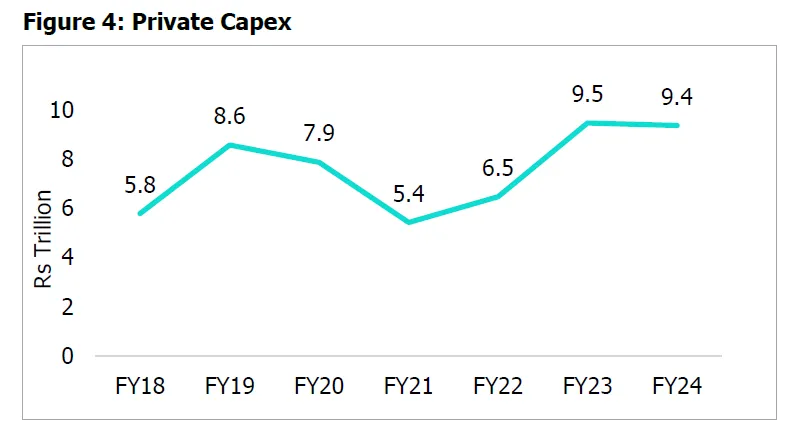

Private capex remained subdued in FY24, totaling ₹9.4 trillion, slightly lower than ₹9.5 trillion in FY23. The top-performing sectors for private investment included oil and petrochemicals, power, and telecom, which together accounted for over 45% of total capex.

However, several sectors, such as iron and steel, healthcare, and retail, saw significant declines.

Growth Sectors: Oil and petrochemicals (19.2% growth), telecom (19%), and chemicals (19.4% growth) led the way.

Declining Sectors: Healthcare (-50.1%) and retail (-55.3%) suffered sharp declines in capex.

Order Book Trends: The order books for capital goods companies grew by 23.6% in FY24 and by 10.3% in H1 FY25, indicating a potential uptick in private capex.

The anticipated capex revival offers attractive opportunities across multiple sectors. Capital goods, commercial vehicles, and infrastructure financing could be interesting plays to capitalize on this recovery in capex.

India's national highway network has expanded dramatically, growing 1.6 times to 146,195 kilometers by November 2024. This growth is underpinned by projects worth ₹8.2 trillion, highlighting the government's determination to enhance connectivity and logistics. Such infrastructure improvements are essential for India's long-term economic trajectory, aligning with the vision of transforming the country into a developed nation by 2047.

The defense sector is expected to see significant sequential growth, driven by increased government spending and strategic initiatives. Similarly, the roadways sector is set to benefit from accelerated project execution and enhanced budgetary allocations.

The railways sector, which has already exceeded its annual run-rate, may not experience strong second-half seasonality but continues to be a stable performer in the overall capex ecosystem.

With the government prioritizing digital transformation, the communication sector is poised for substantial investment, underscoring its role as a key growth driver in the infrastructure landscape.

On the corporate front, sectors like power generation and renewable energy are leading the way in capex growth. With an aggregate investment of ₹9.4 trillion by 1,074 non-financial companies in FY24, the power sector is poised for robust growth. The sector’s capex is expected to grow at a CAGR of 13% between FY25 and FY28, with solar and wind energy investments growing at 10.7% and 16.4% CAGR, respectively. These investments are crucial for meeting India's energy needs sustainably while reducing dependence on fossil fuels.

The capital goods sector also shows promise, with order books increasing by 23.6% in FY24. Infrastructure firms, particularly those in road development, have experienced a 20.5% boost in new orders in the first half of FY25. This uptick in activity indicates that public sector capex is translating into tangible opportunities for private sector players, even as overall investment intentions remain muted.

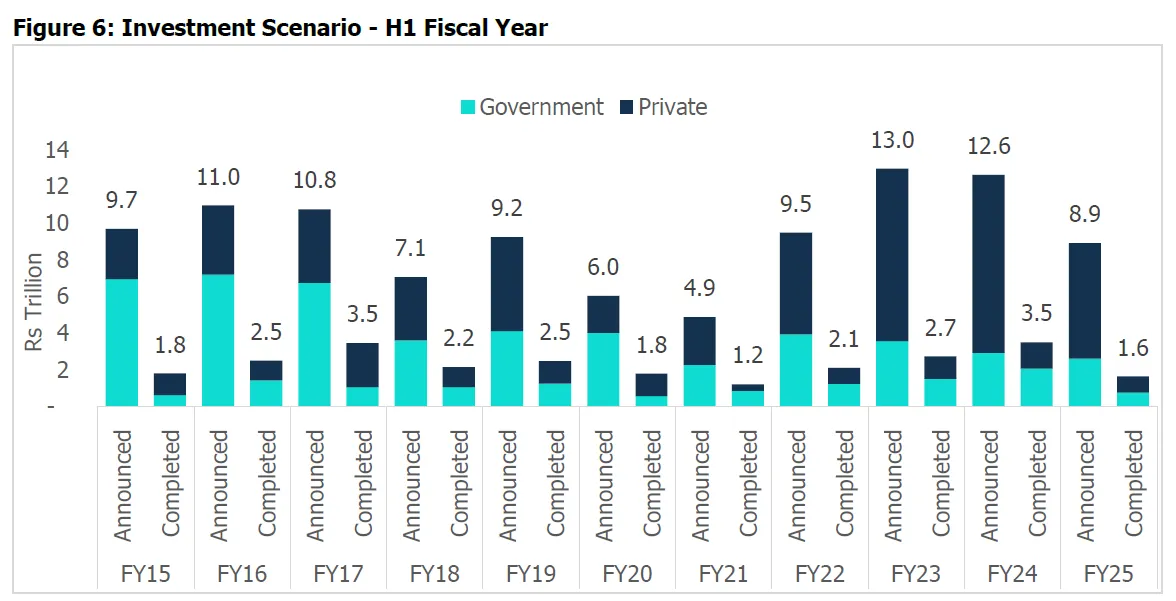

Data on new investment projects highlights a mixed scenario. Announcements in H1 FY25 declined by 29.5% YoY, while project completions fell by 53% YoY. However, private sector investments accounted for 71% of new announcements, reflecting a potential recovery in the medium term.

Both announcements and completions were below the half-yearly averages seen over the past decade. The primary driver of this decline was the weak performance in Q1 FY25, largely due to election-related restrictions and uncertainties. Both announcements and completions saw a recovery in Q2 FY25. However, the figures remain below the three-year quarterly average, indicating continued subdued momentum.

The slowdown in completions is concerning, as it points to delays in translating investment intent into tangible assets and economic activity. Lower announcements signal caution among businesses and governments, potentially reflecting broader economic uncertainties.

The revival of capex has far-reaching implications for India’s economic growth. Infrastructure development not only spurs economic activity but also creates employment opportunities and enhances the country’s competitiveness on the global stage. However, the success of this recovery hinges on effective execution, policy consistency, and sustained private sector participation. The central government’s proactive approach to capex, despite fiscal constraints, reflects its commitment to long-term economic growth. At the same time, state governments must strike a balance between welfare spending and infrastructure investment to ensure sustainable development.

The capex story for FY25 presents both opportunities and challenges. On the positive side:

Public capex is expected to recover in H2 FY25 as election-related restrictions ease.

The robust order book growth in capital goods and infrastructure sectors signals an improving private investment climate.

The power sector’s focus on renewable energy offers long-term growth potential.

India’s ambition to become a developed nation by 2047 hinges on its ability to sustain and scale its capex efforts while fostering greater private sector participation. The government’s focus on infrastructure development, power generation, and logistics provides a solid foundation for growth. However, headwinds such as subdued domestic demand, geopolitical tensions, and high borrowing costs remain significant challenges. Additionally, the risk of dumping from China due to its weak domestic demand could strain India’s industrial sectors.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart