by Abhishek Banerjee

Published On July 14, 2024

We as a society are taking steps to enter a world where we will have the power of AI in our fingertips. While Large Language Models have already made their foray into the scene, and have done wonders for people who use it to go through mundane tasks on a daily basis, the future promises so much more.

The integration of AI into various facets of our lives is a guarantee that our interaction with technology will be redefined, making it more intuitive and responsive to our needs. This potential extends into addressing more complex issues through data driven insights and predictive analytics. The promise of AI extends beyond simplifying existing tasks - it aims to catalyze innovation, foster new industries and reshape the economic landscape.

In a country like India, AI stands to significantly improve labor supply by automating routine tasks and facilitating skill development across various sectors. This technological shift can enable a larger portion of the population to engage in more productive and skilled work, effectively raising both the quantity and the quality of the labor force.

As is the case with revolutionary technology,AI’s rapid integration into society has not met with universal acclaim,stirring resistance and concerns. This pattern is not new, let us take the case when the handheld calculator was first invented, concerns were raised by educators and mathematicians alike about its influence on learning and problem solving. Weakened arithmetic skills, subpar problem solving abilities and the concern of a growing disparity between the rich and poor as calculators were expensive back then.

Interestingly, there were not a lot of concerns about redundancies. Although AI represents a far more significant technological leap than handheld calculators, prevailing forecasts are optimistic about its impact on the labor market. Rather than simply replacing jobs, AI is expected to enhance overall productivity. This potential to elevate and not just substitute human labor could transform industries by creating new roles and opportunities.

The current AI revolution, marked by rapid advancements in Artificial Intelligence and machine learning, brings a new set of pressing concerns that somewhat resonates with the debate of introducing calculators to the workforce. However, while the calculator debate primarily focused on the impact on individual skills and job tasks, the AI revolution encompasses a broader spectrum of potential implications.

As AI systems increasingly take over tasks traditionally performed by humans, the primary concern is automation and job displacement, highlighting urgent calls for workforce retraining. Other concerns such as the application of AI in decision making raises alarm about potentially biased algorithms and ethical dilemmas as well as the intense debates over privacy and security which underscore the misuse of potential information.

Despite both calculator protests and the AI revolution stemming from technological advancements, they differ in magnitude. The AI revolution has the potential to reshape entire industries and societal structures, making its implications far more pervasive and profound. This broader impact demands a more nuanced and proactive approach to integrate AI technologies into society, ensuring that their benefits are maximized while minimizing potential harms. Such an approach requires not only technological expertise but also a strong ethical framework and robust legal protections to guide the development and implementation of AI across various sectors.

Explore how Wright Research has taken charge of AI in our PMS Portfolios.

The integration of artificial intelligence into the Indian economy will enhance the supply of labor and not decrease it, a transformation underpinned by several nuanced economic effects unique to this burgeoning market. By automating routine tasks, AI liberates workers to undertake more complex roles, thereby increasing the average productivity per worker. This shift in labor dynamics is particularly pertinent in India, where a large segment of the workforce is engaged in repetitive and mundane, low-skill tasks across sectors like manufacturing, retail, and services.

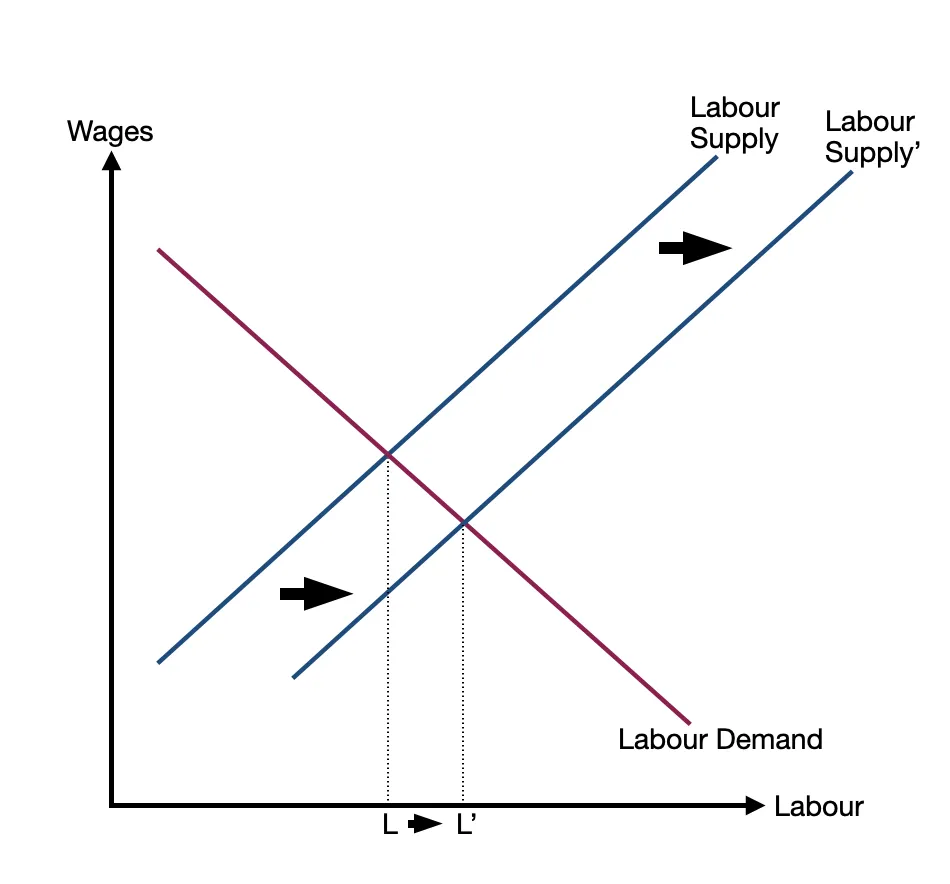

AI facilitates greater labor market inclusivity by enabling remote work and enhancing technologies and flexible job structures. This is crucial in a diverse and geographically varied country like India, where societal barriers often restrict workforce participation. For instance, AI-powered platforms can help integrate women who manage household duties with part-time remote work opportunities, thus increasing their participation in the workforce. Such similar instances will lead to an increase in the supply of labor which can be denoted by a rightward shift in the labor supply curve.

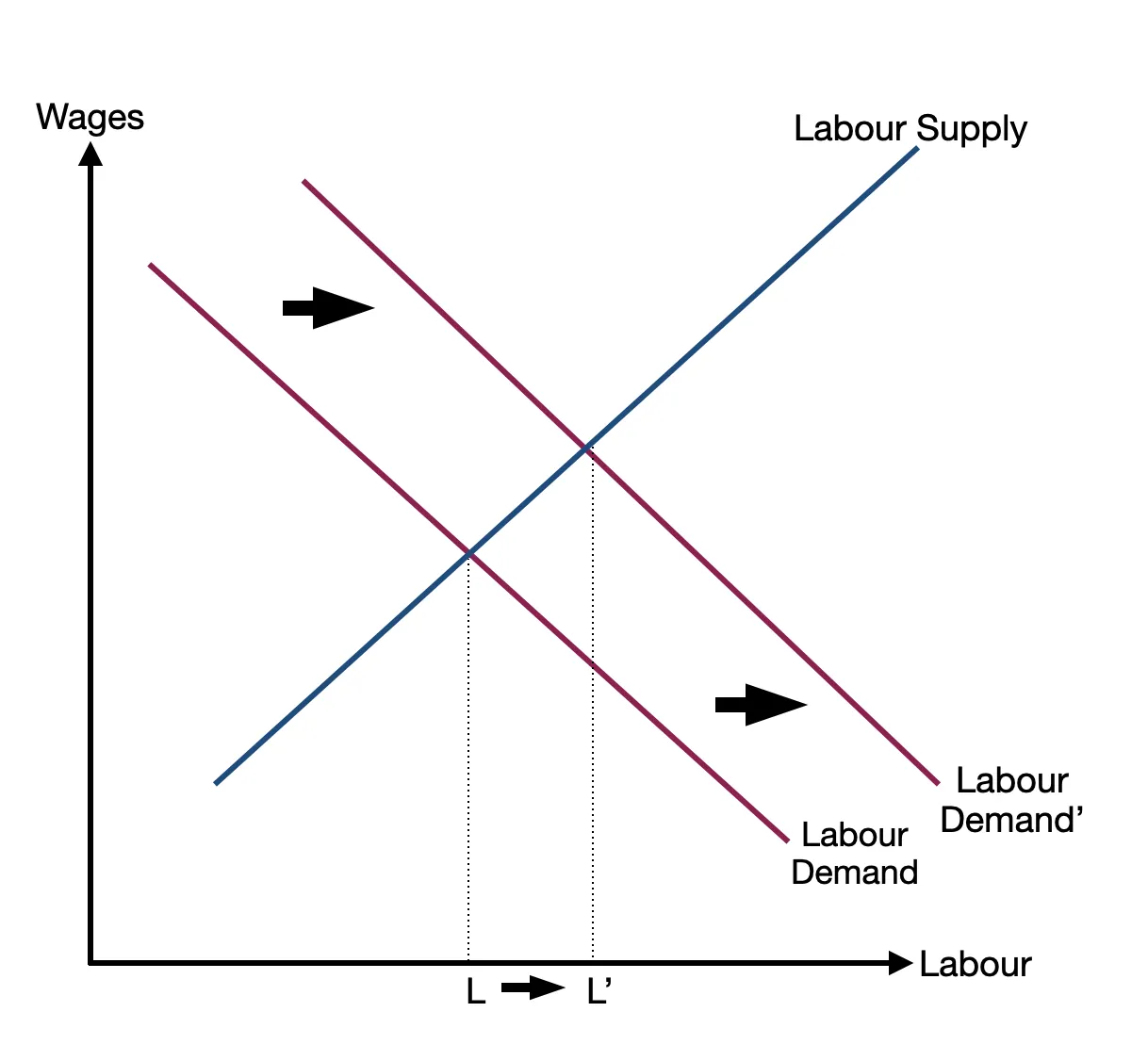

Additionally, the advent of AI in job matching and skills training is particularly transformative in the Indian context. Platforms utilizing AI for these purposes can reduce mismatch unemployment, where workers' skills do not align with job market demands. By providing targeted skills development and more efficient job matching, AI reduces structural unemployment and better aligns the workforce with emerging industry needs. This not only increases the quantity of labor but also its quality, with workers who are more adaptable and skilled in handling sophisticated, value-added tasks. Economically, these developments can be seen as a rightward shift in the labor supply curve, reflecting an increase in the effective labor force at any given wage level, combined with a potential upward shift in the labor demand curve as businesses expand operations and increase output leveraging AI efficiencies.

The journey from major technological breakthroughs to their integration into daily life is where true economic growth often materializes. AI isn’t meant to replace but rather to assist. When innovations such as AI reach full scalability, it sets the stage for continuous, incremental improvements.

AI-driven platforms in India now adapt in real-time, learning from new data, market trends, and user interactions. Each iteration, whether through updated algorithms or new data integration, refines these tools further, allowing for a more robust financial environment. Artificial Intelligence has dramatically transformed the finance industry.

AI excels in processing and interpreting vast amounts of data swiftly. In finance, structured data includes quantifiable information such as stock prices, trading volumes, and financial ratios. AI can sift through this data, identify trends and patterns that can predict market movements . On the other hand, unstructured data—which comprises news articles, social media feeds, and even video content—can be parsed and analyzed by AI using natural language processing (NLP) techniques. Market sentiment analysis is an area where AI can thrive. By aggregating and analyzing the sentiments expressed in news headlines, financial news, analyst reports, and social media, AI can gauge the general sentiment towards a particular stock or the market as a whole. This information is crucial as market sentiment can often drive short-term market movements as much as fundamental indicators.

AI extends its utility to personalized investment advice . By analyzing an individual’s past investment history, risk tolerance, and financial goals, AI-powered robo-advisors can offer personalized stock recommendations. These systems apply machine learning algorithms to match investment opportunities with the investor’s profile, optimizing for risk-adjusted returns. This not only democratizes financial advice—previously the domain of wealthy individuals with access to expert financial advisors—but also enhances the investment experience by tailoring choices to personal preferences and risk appetite.

AI is a powerful tool that augments human capabilities, enabling more precise decision-making based on a comprehensive analysis of both numerical data and human sentiment. This technological advancement allows for a more nuanced understanding of the market, tailored investment strategies, and, ultimately, a more dynamic and responsive financial landscape.

The transformation brought about by AI in the financial sector might not always make headlines like grand IPOs or market crashes do, but its impact is profound and undoubtedly pervasive. AI's capability in predictive analytics extends to aiding in more proactive investment decisions.

Here is a list of some of the best Artificial Intelligence Stocks to invest in India .

A challenge with such technological advancements is quantifying their impact on traditional economic metrics like GDP. The enhancements AI brings—such as increased labor participation through accessible financial services or improved investment returns through personalized strategies—are often not captured fully by conventional economic indicators.

The productivity paradox points out that significant technological impacts like those of AI are everywhere but may not always reflect immediately in productivity statistics. Yet, these technologies lower barriers, enhance efficiency, and ultimately expand the economic pie by creating more opportunities for participation and profit.

The rise of AI in stock trading has reshaped the financial landscape, ushering in a new era of innovation and efficiency. Advancements in artificial intelligence (AI) technology have revolutionized how stocks are bought, sold, and analyzed. AI algorithms, powered by machine learning and data analytics, have become indispensable tools for traders and investors seeking a competitive edge.

Traditionally, stock trading relied heavily on human intuition, expertise, and analysis. However, the exponential growth of data availability and computing power has enabled AI algorithms to process vast amounts of data with unprecedented speed and accuracy. These algorithms can analyze market trends, historical data, news articles, social media sentiment, and other relevant factors in real-time, uncovering hidden patterns and correlations that human traders may overlook.

Furthermore, AI algorithms are not influenced by emotions such as fear, greed, or uncertainty, which can cloud human judgment and lead to irrational decisions. Instead, AI trading systems make decisions based solely on predefined parameters and objective market data, leading to more disciplined and consistent trading strategies. AI in stock trading also enhances risk management by continuously monitoring market conditions and adjusting strategies as needed. This capability helps in minimizing losses and maximizing returns, making AI-driven trading systems highly effective in volatile markets.

The integration of AI in stock trading is not without challenges. Ensuring the robustness and transparency of AI models is crucial to avoid unforeseen risks. Additionally, regulatory frameworks must evolve to address the ethical and operational implications of AI in trading.

Computerized trading algorithm systems execute trades at speeds and volumes beyond human capability, processing vast amounts of data to make rapid decisions. This has led to increased market efficiency but also heightened volatility and susceptibility to rapid, self-reinforcing trends. Algorithmic trading can exacerbate market movements due to its inherent nature of following pre-set rules and trends. When market conditions trigger these algorithms to buy or sell, the resulting activity can amplify existing trends, causing significant price swings. This phenomenon was evident during recent market corrections where algorithmic strategies quickly shifted from buying to selling, intensifying the downward pressure.

The 1987 stock market crash, known as Black Monday, highlighted the dangers of algorithmic trading through a "poisonous feedback loop," where similar trading algorithms reinforced each other's actions, leading to a massive selloff. Despite advancements since then, the risk of such feedback loops persists as algorithmic trading continues to grow. To counteract the potential for extreme volatility, mechanisms such as circuit breakers have been implemented on major trading platforms. These tools temporarily halt trading during steep selloffs, providing a buffer against panic-driven market movements and allowing time for rational decision-making.

A financial research firm conducted a study comparing AI-powered trading algorithms with human traders in managing a diversified portfolio of stocks over one year. The AI algorithms utilized machine learning techniques to analyze market data and execute trades, while human traders relied on their experience and intuition. The results revealed that AI algorithms outperformed human traders in terms of risk-adjusted returns and consistency of performance. AI identified profitable trading opportunities more efficiently and executed trades with greater precision, resulting in higher profits and lower drawdowns.

In another study focusing on high-frequency trading (HFT) strategies, researchers compared AI-based trading systems with human traders in capturing short-term market inefficiencies. AI algorithms employed complex mathematical models and algorithmic trading strategies to exploit micro-level price movements, while human traders manually identified and capitalized on these opportunities. The findings showed that AI-based HFT systems consistently outperformed human traders in profitability and execution speed. AI processed vast amounts of market data in real-time and executed trades with millisecond precision, providing a significant advantage in capturing fleeting market opportunities.

A hedge fund conducted a case study comparing AI-driven sentiment analysis tools with human analysts in predicting stock price movements based on social media sentiment. AI algorithms analyzed millions of social media posts and news articles to gauge investor sentiment towards specific stocks, while human analysts performed similar analysis manually. The results indicated that AI-driven sentiment analysis tools significantly outperformed human analysts in predicting short-term price movements. AI identified sentiment shifts and market trends more accurately and quickly, enabling timely and informed trading decisions.

Researchers conducted a comparative analysis of portfolio management strategies, evaluating the performance of AI-based robo-advisors versus human financial advisors. AI robo-advisors utilized machine learning algorithms to construct and rebalance portfolios based on investor risk preferences and market conditions, while human advisors used traditional investment strategies and market analysis techniques. The study found that AI robo-advisors consistently outperformed human advisors in portfolio returns, risk management, and cost efficiency. AI optimized portfolio allocations and mitigated risk more effectively, resulting in superior investment outcomes for clients.

AI's integration into the financial sector in India is less about replacing humans and more about augmenting our capabilities, enabling us to make better decisions, manage risks more efficiently, and engage in the financial markets more actively. The invisible efficiencies of AI do not flash before our eyes but instead build a foundation for a more inclusive and robust economic future.

As we continue to harness these subtle powers of AI, the focus should not only be on the innovations but also on the incremental improvements they bring about. Whether through an app that guides a new investor or a complex algorithm that predicts market trends, AI investment strategies are here to become a mainstay.

Other interesting articles to explore to understand quantitative investing in detail:

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart