In this month's markets & macros review, we celebrate Sensex hitting 60k!

This is a glorious milestone for Indian markets and the growth story is just getting started. The world is betting on India’s cyclical recovery and the economy is entering a new age with Unicorn startups coming in with IPOs to spearhead the increase in market capitalization. While we are not immune to short term corrections, analysts at Goldman Sachs predict that India is entering a new age of growth similar to China a few years back and we might see new age sectors like ecommerce, fintech and SaaS redefine the markets.

But for now, let’s do a review of the month that was for the Indian markets.

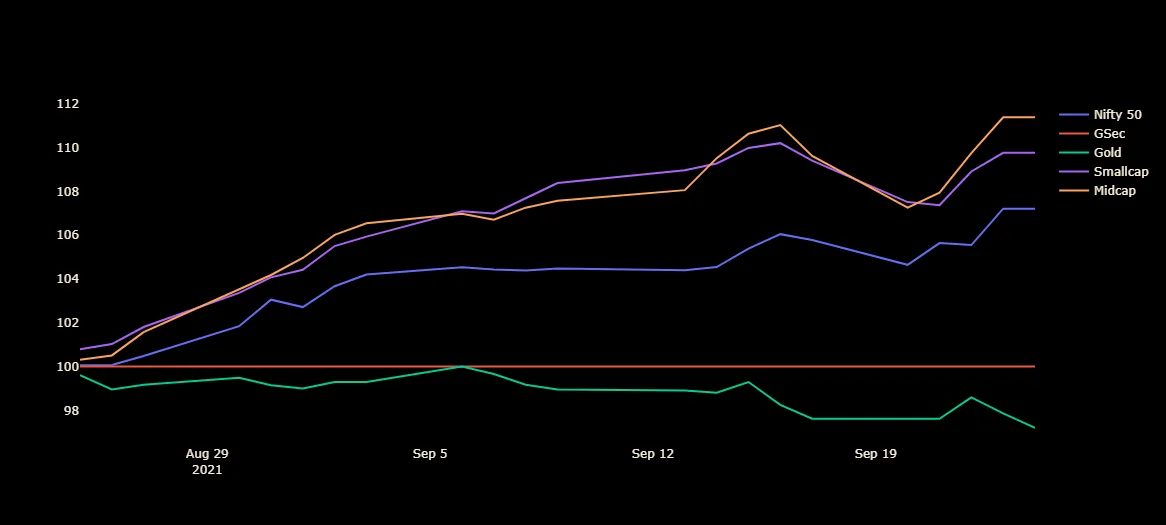

Broad Markets

Looking at broad market indices this month, we see that the Midcaps & Smallcaps have outperformed Large Caps and Gold & Bonds are not performing.

The outperformance of smaller stocks is rebound after last month's correction and typically such rebounds in a favorable market last long.

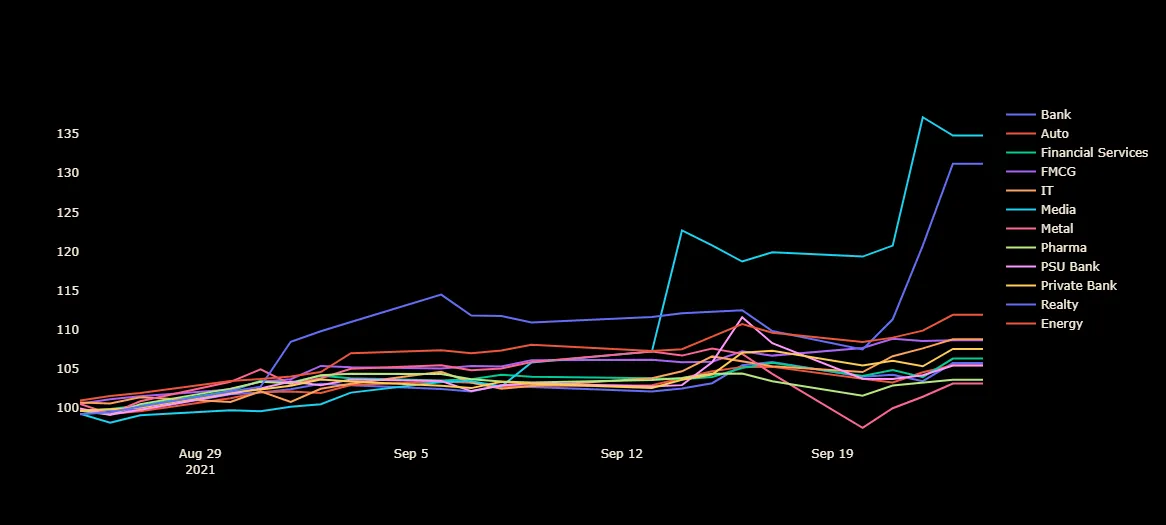

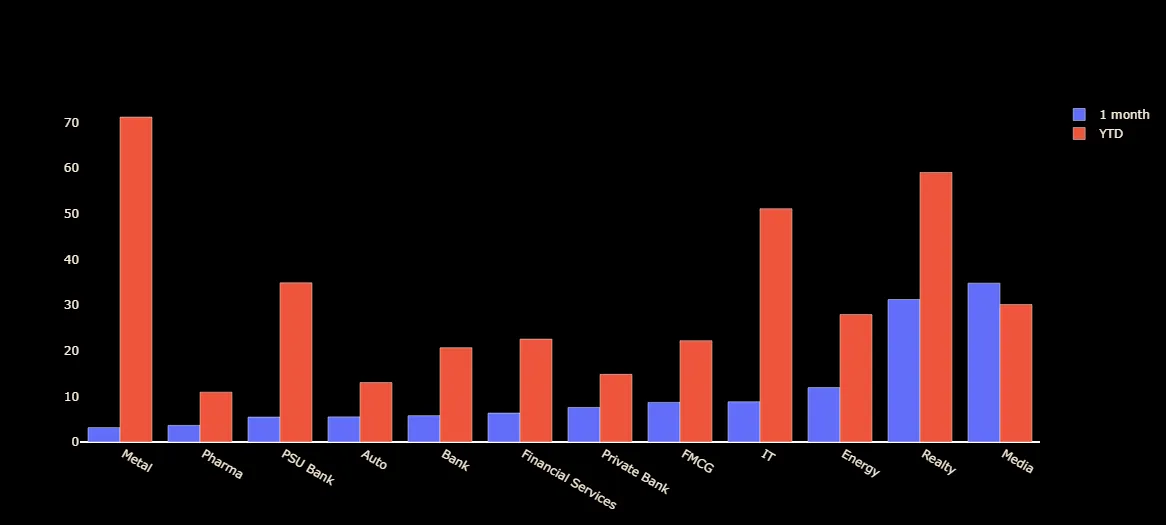

Sectors

Metals underperformed, IT continued the string performance but the best performers were Media after Zee, Sony merger and Real Estate, which is having a boom.

Energy and FMCG were strong but Pharma and PSU Banks lagged.

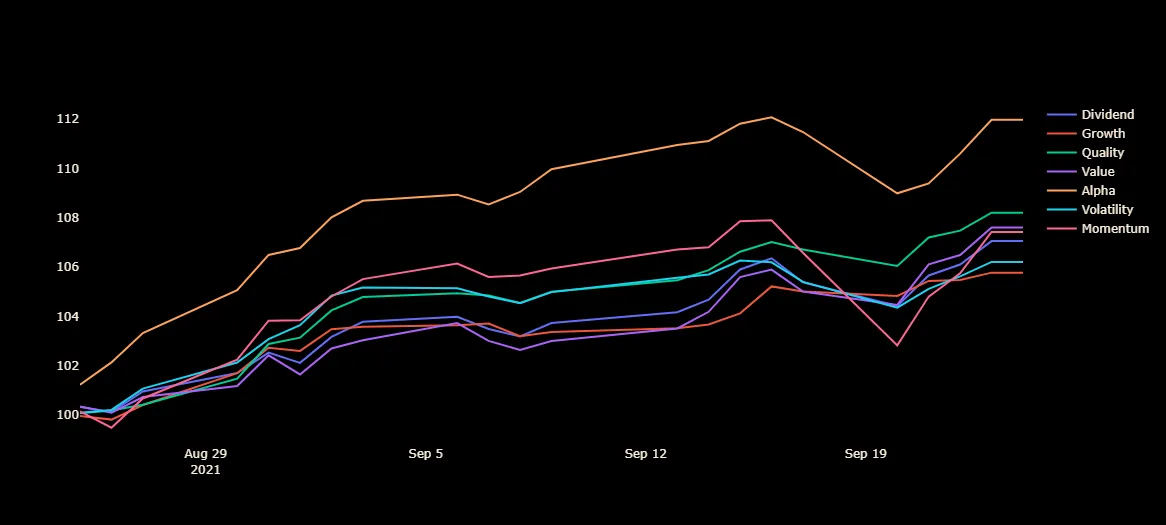

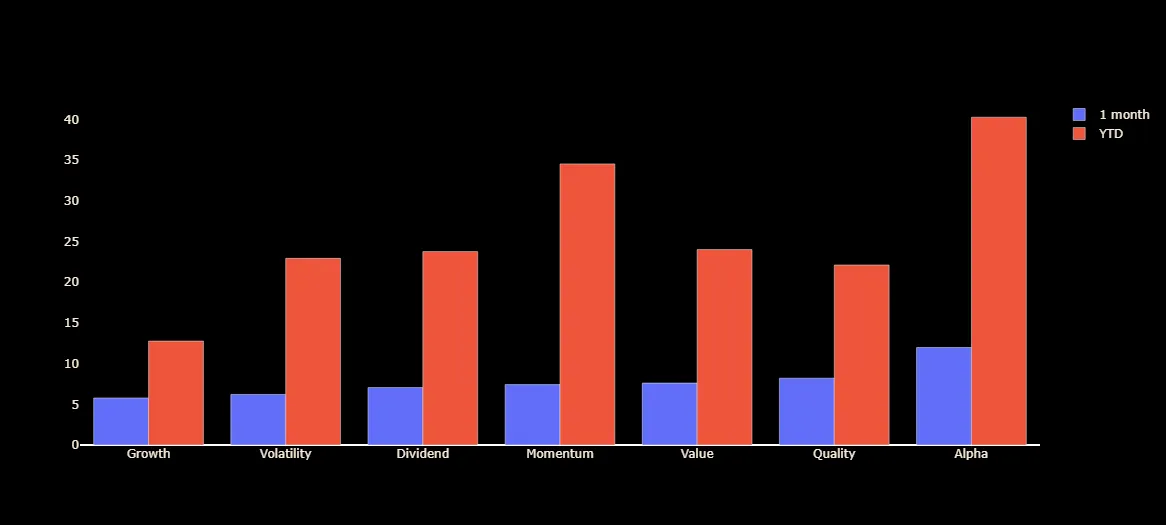

Factors

Among factors, alpha came back strongly after the correction last month. Quality was strong and Momentum index also made a comeback.

The strong performance of Alpha and Momentum is indicative of the end of the correction in August.

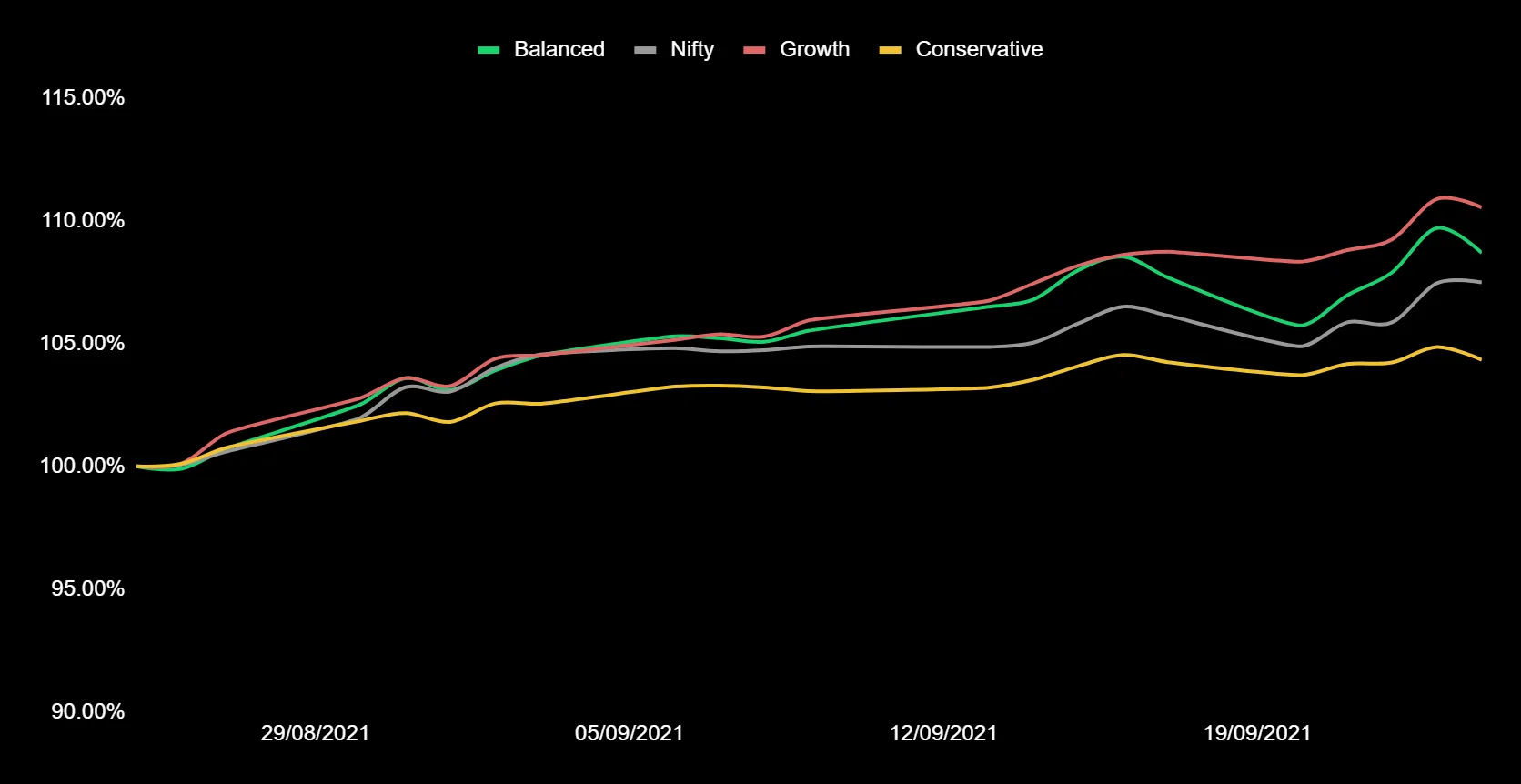

Performance

Let’s look at our multi-factor portfolios - balanced, growth & conservative first. We have allocated momentum & growth in 2021, which has led to strong performance.

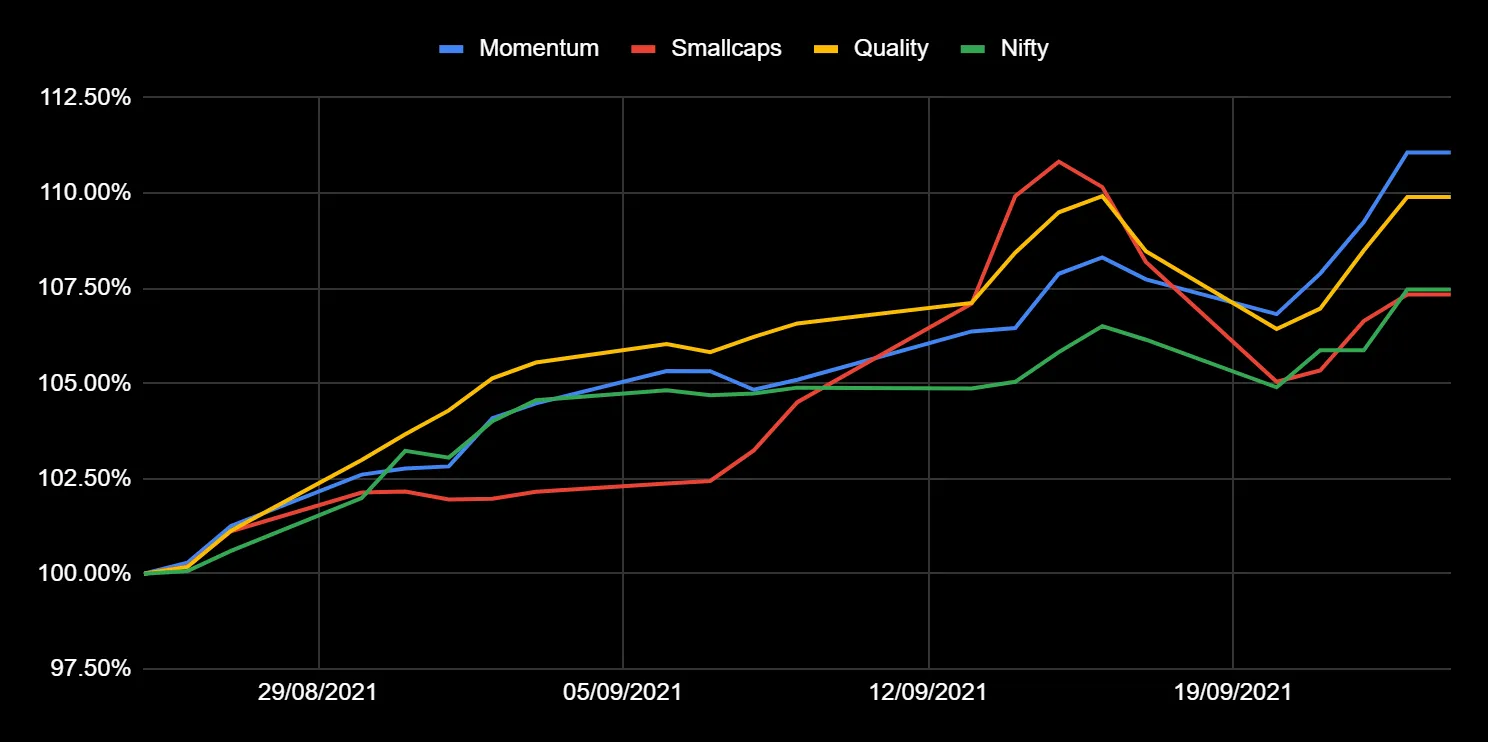

Among the thematic portfolios, momentum has seen very rapid growth. Smallcaps & Quality have been picking pace recently.

We see good outperformance over the index in all our core and thematic portfolios in 2021.

Outlook

Earnings are starting in October and we expect strength in earnings for this quarter. With the run up to the festive season and a lot of IPO activity, we expect the markets to stay strong.

The real estate sector seems to be in a sweat spot as it is bottoming out in terms of volumes and prices. Sectors like Hospitality and Consumer Discretionary could also see strength in the festive season as the Covid fears subside.

The IT sector is seeing strong demand and is buoyed up by the Freshworks IPO. The fears from China led to a crash in Metals prices but demand for metals is strong in the growing economy globally.

We are excited about the coming month and the next week’s rebalance should see allocations shifting to favorable sectors.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart