by Sonam Srivastava

Published On Aug. 7, 2023

Trading has been an essential part of human civilization for centuries. But in the modern age, with the evolution of technology, the nuances of trading have become far more sophisticated. One such nuance, often overlooked by many, is the "impact cost." Coupled with the advancement of execution algorithms, understanding this element becomes pivotal for anyone involved in the trading world.

Before we delve into the intricacies of execution algorithms, let's demystify the concept of impact cost. In today's era of digital trades and discount brokers, the promise of zero trading costs is dazzling. But beneath this allure lies a hidden, often overlooked cost, that plays a crucial role in trading, especially in scenarios involving large order sizes in illiquid stocks.

The impact cost represents the difference between the anticipated trading price and the actual executed price. It's the cost that traders incur due to the price movement resulting from their trading activity. In simpler terms, when you're making a significant purchase or sale, your very action can sway the market price. This price fluctuation, although sometimes marginal, can accumulate over time, especially for institutional traders who transact in vast volumes. So, while you might be saving on brokerage, the impact cost can still nibble at your profits.The Significance of Order Execution Algorithms: A Deep Dive into Order Books

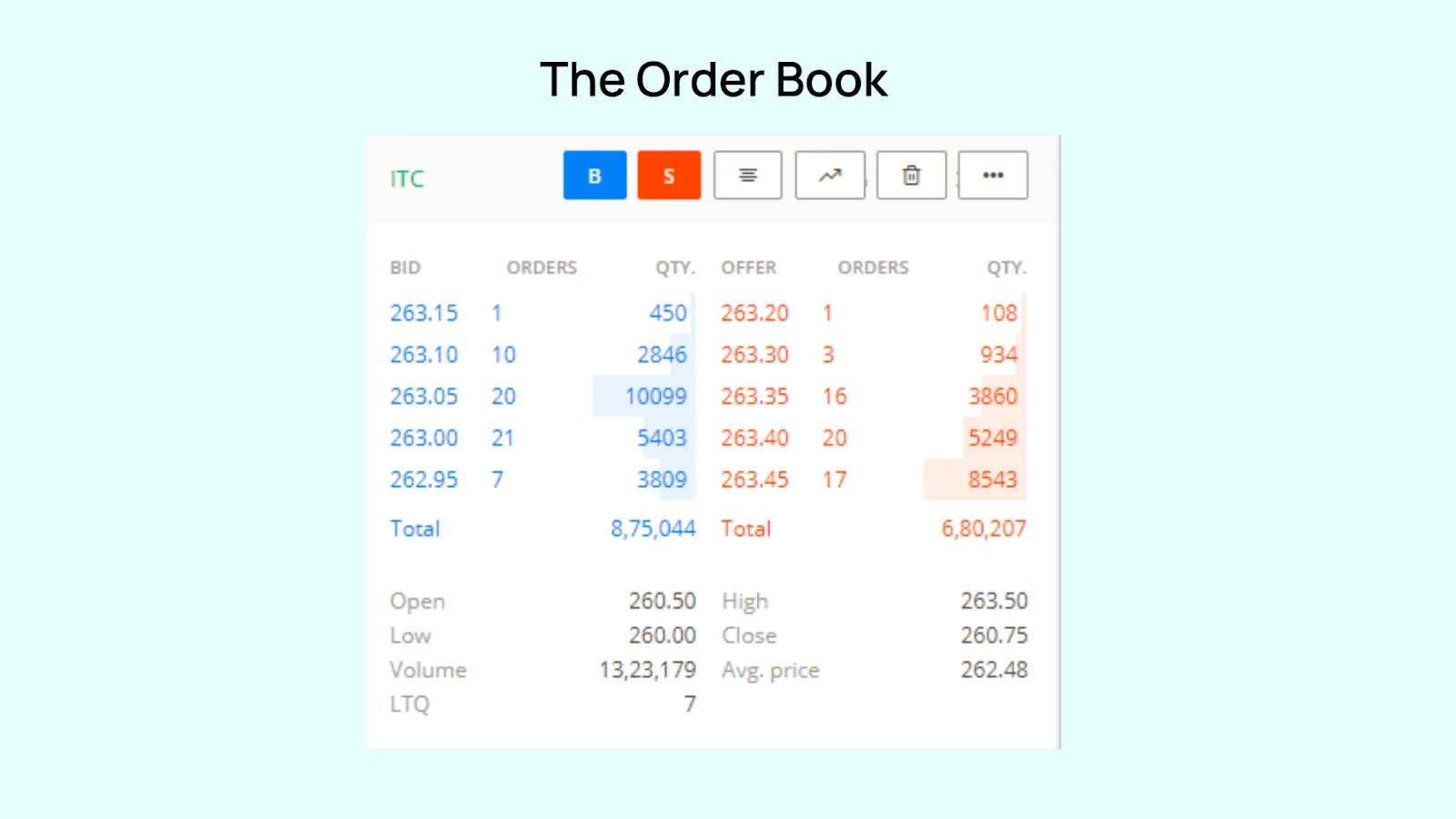

To truly understand the value of order execution algorithms, it's pivotal to fathom the mechanics of an order book. This tool organizes market orders by price and timestamp, with Buy Orders (Bids) sequenced by descending price and Sell Orders (Asks) by ascending. When two buy orders share identical prices, the earlier one gets priority. The trading landscape revolves around “Market Orders” and “Limit Orders”. Limit Orders allow traders to set purchase or sale price boundaries, while Market Orders guarantee volume but at unpredictable prices. Though Limit Orders often yield better average prices, they risk not fully executing, depending on their aggressiveness. Order execution algorithms merge the attributes of both order types, aiming to secure optimal prices while fulfilling desired quantities. These algorithms play an essential role in modern trading, optimizing transactions for efficiency and profitability.

Given the challenges presented by impact cost, the financial sector has seen the development and implementation of execution algorithms. These are intricate computational strategies crafted to execute financial orders with unparalleled efficiency. But what makes them so indispensable in contemporary trading?

1. Optimal Prices: At the heart of every trade lies the desire for the best possible price. Execution algorithms ensure this by analyzing market conditions in real-time and making decisions that provide traders with optimal prices for their orders.

2. Reduced Market Impact: These algorithms are adept at minimizing the market impact of trades, thereby reducing the associated impact costs. For large organizations and institutional traders, this quality is invaluable.

3. Swift Executions: In high-frequency trading environments, where microseconds can mean the difference between profit and loss, the speed of these algorithms is unmatched.

In the dynamic world of trading, execution algorithms have emerged as invaluable tools. These intricate systems are designed to ensure optimal trading outcomes by catering to specific market needs and conditions. Let's delve deeper into some of the most popular execution algorithms:

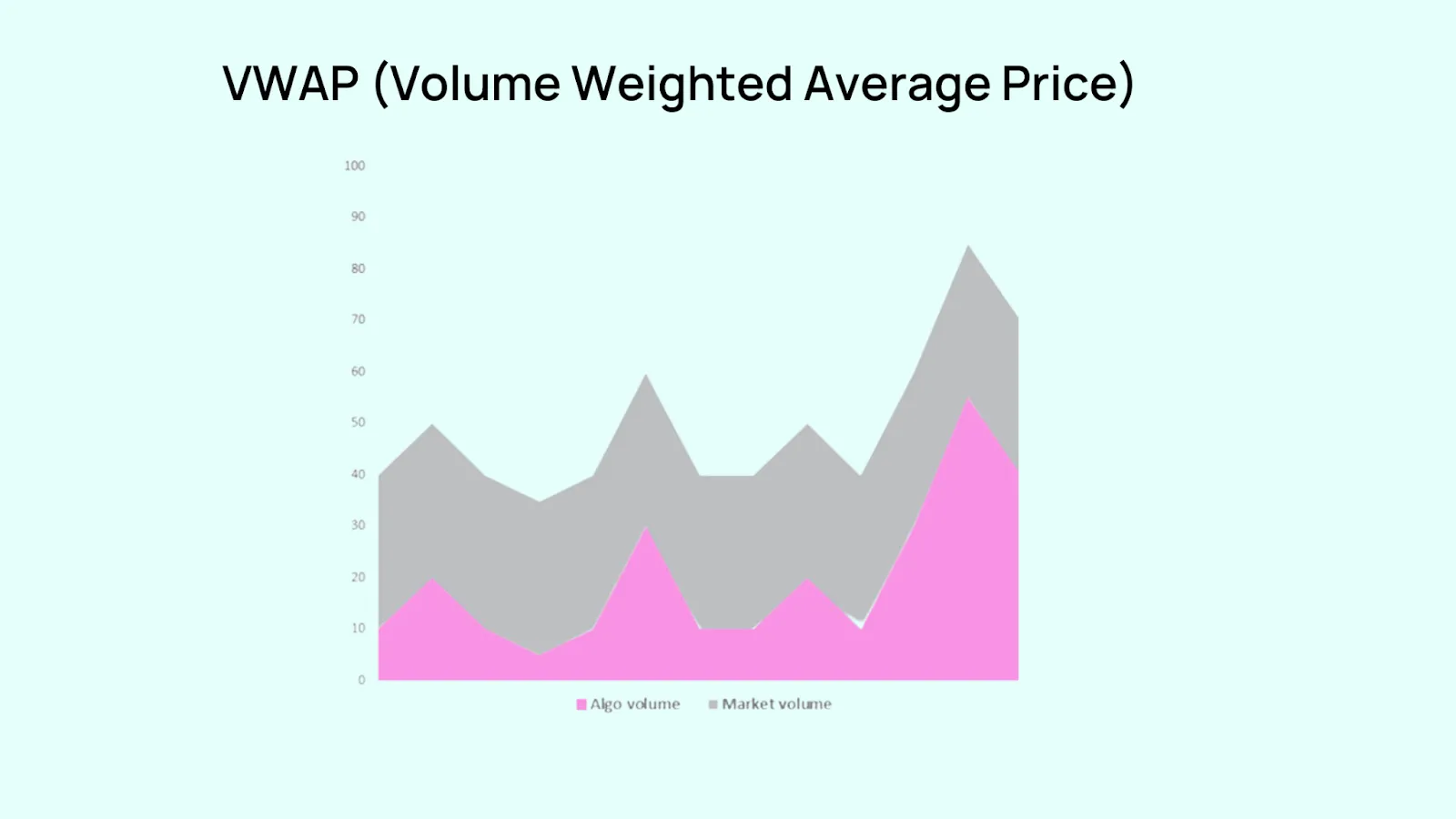

- Objective: To achieve an average trading price, taking into consideration the volume of shares traded over a set timeframe.

- Ideal Scenario: Especially beneficial for institutional traders aiming to move vast quantities of shares or assets without causing a significant shift in the market price.

- Advantage: Offers a benchmark, enabling traders to measure trade efficiency and ensures a more uniform trade distribution.

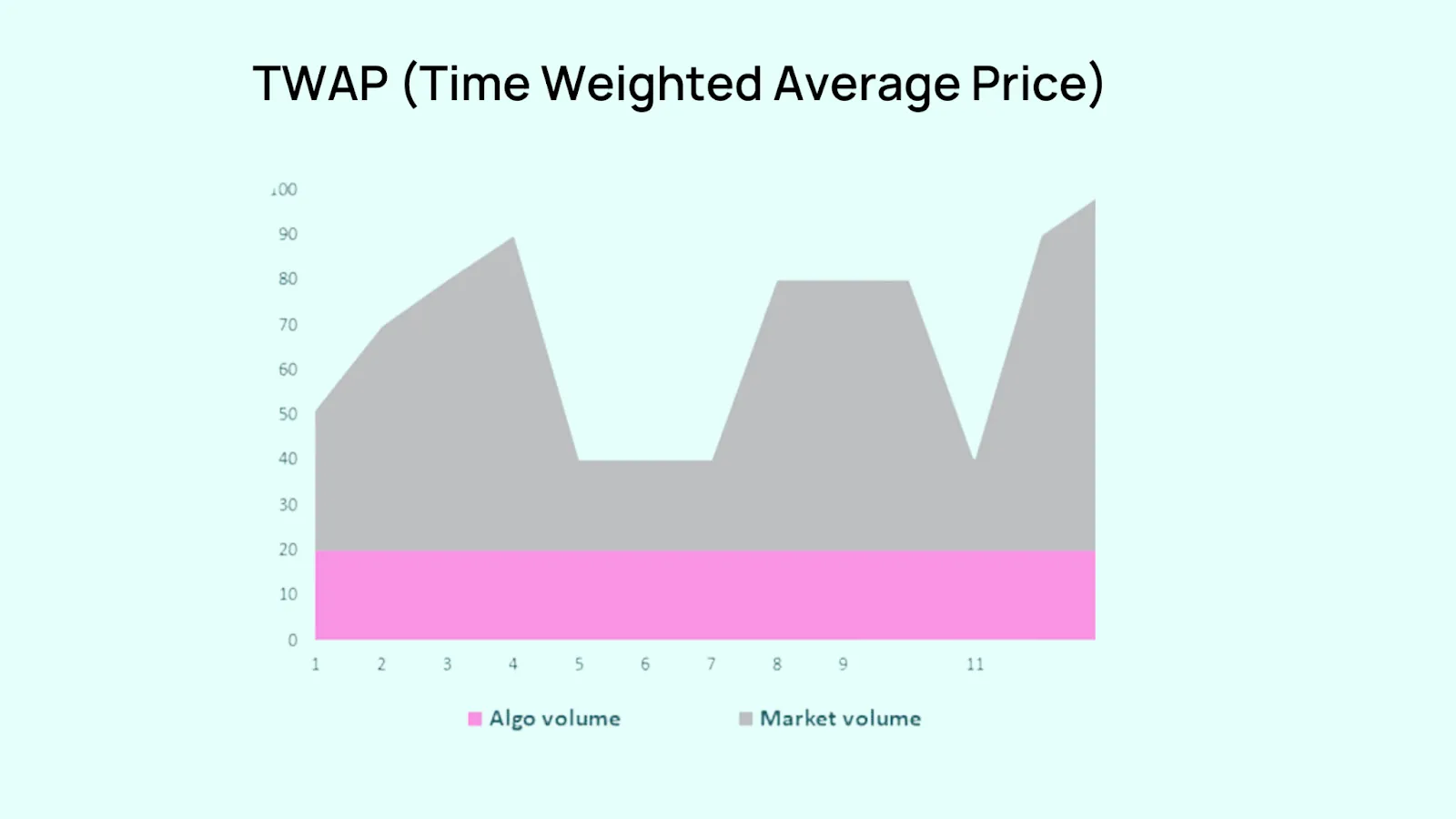

- Objective: To average out the trade price by evenly executing orders over a set period.

- Ideal Scenario: Markets that are prone to swift price fluctuations can benefit from this method as it aids in reducing market impact.

- Advantage: Spreading out the trades helps in mitigating the effects of market volatility.

- Objective: Executes trades in proportion to a specified percentage of the market volume.

- Ideal Scenario: For traders who want their trades to mirror market activity.

- Advantage: It’s a fluid strategy that adjusts according to the real-time volume, ensuring traders remain aligned with market movements.

- Objective: To mask the true size of an order by breaking it into smaller, publicly visible chunks.

- Ideal Scenario: For institutional traders or entities who don’t want to alert the market about their trading intentions, especially when dealing with large volumes.

- Advantage: It prevents substantial orders from causing dramatic price movements and keeps trading intentions concealed.

- Objective: To hold off until the very last feasible moment to execute a trade.

- Ideal Scenario: Highly useful in auction settings or when a trader anticipates a favorable price movement towards the end of a trading period.

- Advantage: Can capture potentially favorable price points and minimizes exposure time in the market.

- Objective: Balances the cost associated with the delay of an order against the market price at the time of order placement.

- Ideal Scenario: When a trader wants to minimize the opportunity cost associated with not executing an order immediately.

- Advantage: It takes into account both the urgency of the trade and the potential impact on the market, ensuring a balance between timeliness and cost.

Each of these algorithms offers a unique approach to trade execution. The choice of algorithm typically hinges on the specific needs of the trader, the nature of the asset being traded, and prevailing market conditions. As markets continue to evolve, so too will these algorithms, further refining the art and science of trading.

With the rise of technologies like artificial intelligence (AI) and machine learning, the next generation of execution algorithms promises to be even more adaptive, resilient, and intelligent. These tools can analyze vast amounts of data in real-time, learn from market patterns, and continuously enhance their trading strategies. Thus, the future will witness execution algorithms that not only minimize impact cost but also proactively adapt to the ever-evolving dance of market dynamics.

Trading, in essence, has always been about making the right decisions at the right time. As markets grow more complex and globalized, tools like execution algorithms will become indispensable. They not only safeguard against hidden costs but also ensure that traders can navigate the tumultuous waters of global finance with confidence and efficiency.

In this ever-evolving landscape of trading, those armed with knowledge and the right tools will undoubtedly be at the forefront. So, whether you're a seasoned trader or just beginning your journey, understanding the nuances like impact cost and harnessing the power of execution algorithms could be your keys to success.

Happy trading, and may the algorithms be ever in your favor!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart