by Sonam Srivastava

Published On Sept. 30, 2021

Momentum Investing is one the most debated and yet the most popular factor influencing equity market returns. It is simply defined as the strong predictive power of past returns in influencing future returns.

A momentum-based investing approach can be confusing to investors who are often told that chasing performance is a mistake and it is impossible to time the markets.

Momentum is one of the strongest factors describing stock market returns globally, and it works incredibly well in India, given that India is a growth market.

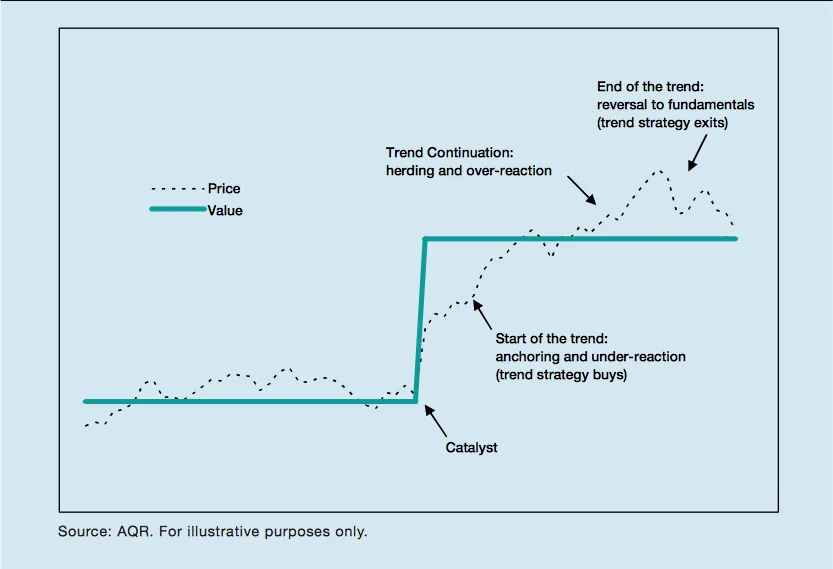

Many analysts and academics dismiss momentum, saying that the returns do not have any “real basis” and are “not linked to fundamentals.” However, momentum in stocks is not only strongly linked to fundamental changes in value, but also accounts for the irrational nature of stock market investors and captures important investor biases like initial under reaction, delayed overreaction, herding, and confirmation bias.

While trend following has been prevalent in the stock market since the 1800s, the first research-based severe study of momentum in the 1990s by researchers Jagdeesh and Titman. Researchers at AQR, Clifford Asness, Henry Markowitz have eventually been huge proponents of this factor, publishing research and running highly successful hedge funds based on it. The first ETF following the factor was introduced in 2015, and even NSE started publishing the returns of the momentum index over the last 2-3 years.

There’s no argument to the fact that stock price at any point in time represents the value of the underlying business in the long term. But investors are not 100% rational. Whenever any underlying news or event changes the stock’s intrinsic value, the price does not automatically adjust to a new value. Instead, investors typically react slow and adjust their estimates slowly.

As soon as a threshold number of investors recognize the opportunity in the stock, the stock starts forming a trend. Investors are also performance chasers, and they start herding into the stock, making the trend very pronounced.

A momentum strategy does not look at the underlying change of valuation but picks up opportunities in the market where such trends are being formed and gives a robust long-term return.

Momentum works best when markets are strong. If you think about it, a momentum investor is not “buying low and selling high” but “buying high and expecting prices to go higher.” So obviously, the strategy would flourish when markets stay strong.

Momentum is not a “buy and hold” but a high churn strategy. While the most profitable momentum strategies can capture long-term trends, there can be instances where the trend breaks and other stocks/sectors become more attractive. So, you will typically see a momentum investor churn more than a fundamental stock picker.

Momentum can come from anywhere. A momentum strategy is not biased towards large caps or small caps, towards any specific sector or stock. At various instances in the business cycle, different sectors pick up momentum.

Momentum is not perfect. Momentum-based stock picking can go wrong, especially in a risky emerging market like India. Looking at just the last year, Adani stocks and IRCTC, which were once momentum favourites, went through horrible volatility as the trend ended. So, it is prudent to work with risk controls when trading momentum in India.

Potential for high returns: Momentum investing has been shown to generate higher returns than other investment strategies over the long term. It is because momentum stocks tend to outperform the market over time.

Low risk: Momentum investing is a relatively low-risk investment strategy. It is because momentum stocks tend to be less volatile than other stocks.

Diversification: Momentum investing can help to diversify a portfolio and reduce risk. It is because momentum stocks are not correlated with other asset classes, such as corporate or government bonds and real estate.

Simple to implement: Momentum investing is a simple investment strategy that investors of all skill levels can implement.

Momentum Investing can give high returns but is fraught with high risk. As I said, momentum investing could have given you some great picks like Mindtree or Tata Elxsi over the last year but would also have brought Adani stocks and IRCTC into the mix.

When the trend breaks, analysts love to bash high momentum stocks for high valuations. Momentum has risks that can be handled in various ways.

Underperformance during trend breakdown. In a market like March 2020, momentum stocks took a massive dip (even though they sprung back even faster), and such is the nature of bear markets. It is best to deallocate from the strategy during difficult times.

Getting trapped in overvalued stocks. A system-based momentum would have had IRCTC before it crashed, but you can avoid these shock-prone stocks if you work with a profit target and a stop loss.

Diversification to the rescue. Diversifying your momentum portfolio to include several stocks and even limiting your exposure to sectors and industries can be a great way to lower the risk of momentum investing.

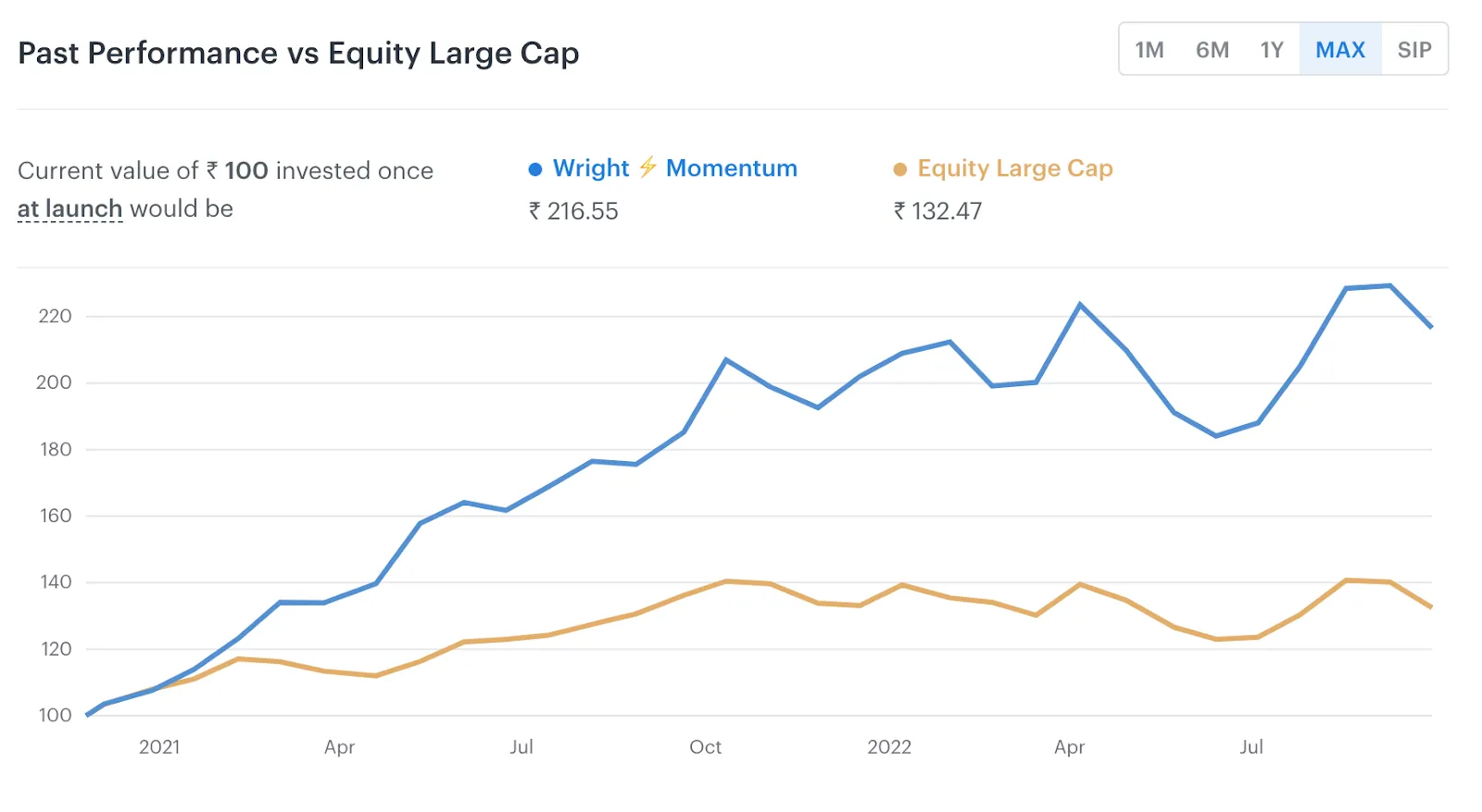

Momentum investing has had a dream run in the last couple of years in India, and in fact, it has had many such dreams runs in the previous two decades as India has been a high growth economy.

With the Indian economy gaining strength and experts forecasting a cyclical recovery, momentum should be the flavour in the next few years.

If your risk-taking ability allows it, you should not miss out on the fantastic opportunity that momentum provides and invest in well-managed momentum strategies.

Explore our top portfolio on smallcase the Wright Momentum Portfolio.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart