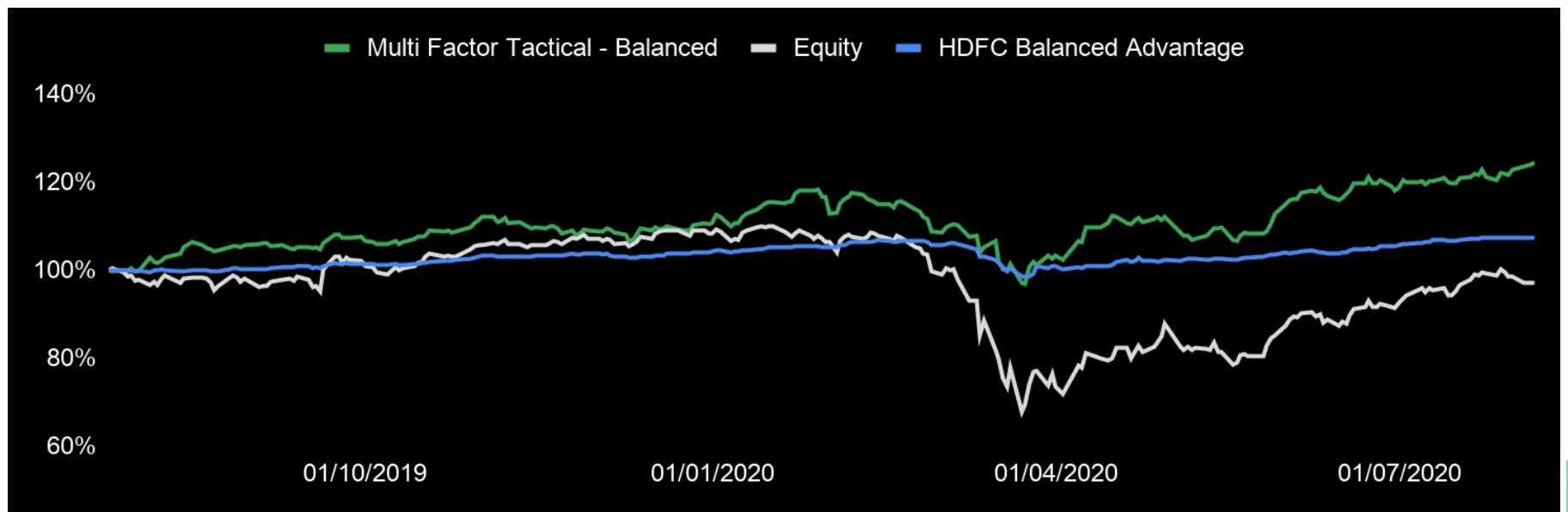

Last week, Wright completed one year of offering our flagship portfolios to investors viasmallcase! This first year of our journey has been the most incredible — while we found validation of our quant methods working well in the markets, the markets went through the biggest crash since 2008 due to the coronavirus pandemic and an emphatic recovery.

We stuck to our motto ofconsistent outperformance in all market conditionsand delivered across the board.

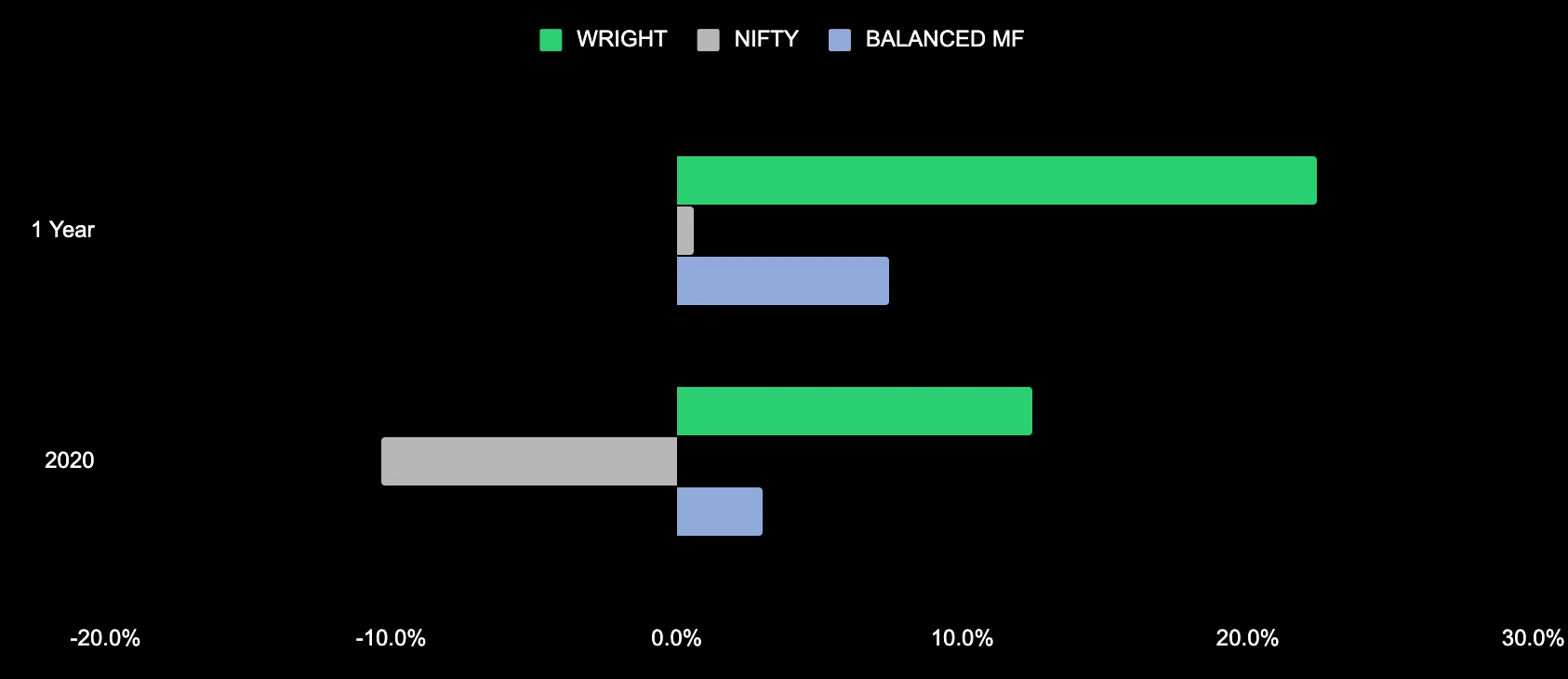

Compared to relevant benchmarks— in the one year our strategy gave 23.4 % return whereas the Nifty Index gave 0.2% return. The popular balanced mutual fund HDFC Balanced Advantage Fund gave 7.5% return in the same time.

Looking at the year 2020, we gave 11.1% return in 2020, Nifty gave -9.7% and the balanced mutual fund gave 3.0%.

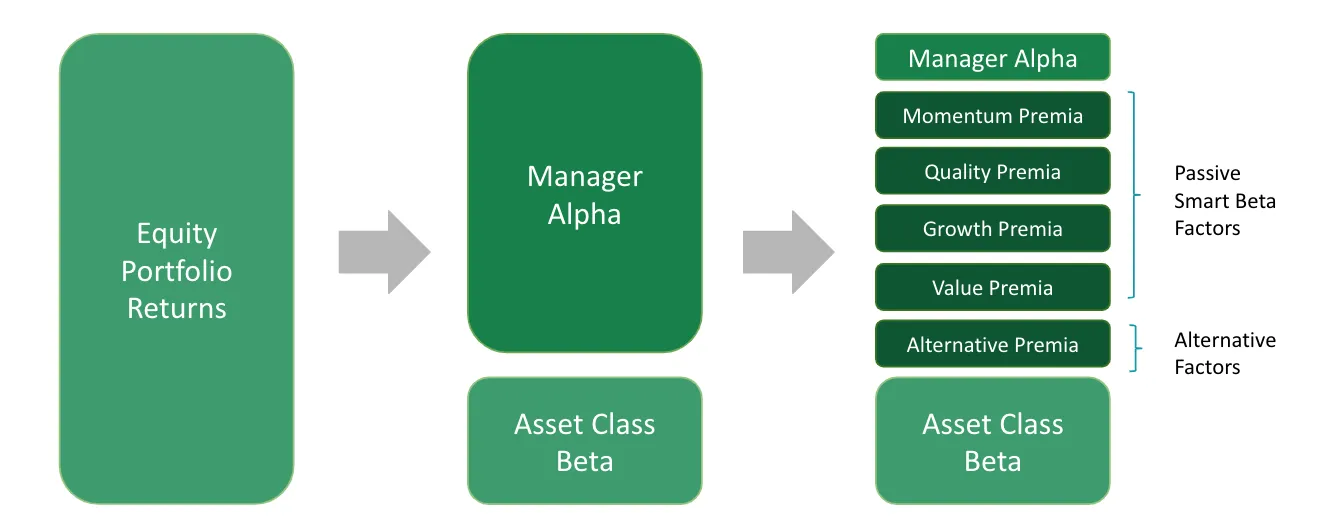

Our philosophy for investments is simple and transparent.

Equity Factors

We break down a portfolio’s performance into well known factors like value, momentum, growth, quality etc and tactically invest into the best performing factor based on the market conditions. We also use bond and gold ETFs in our portfolios for further diversification.

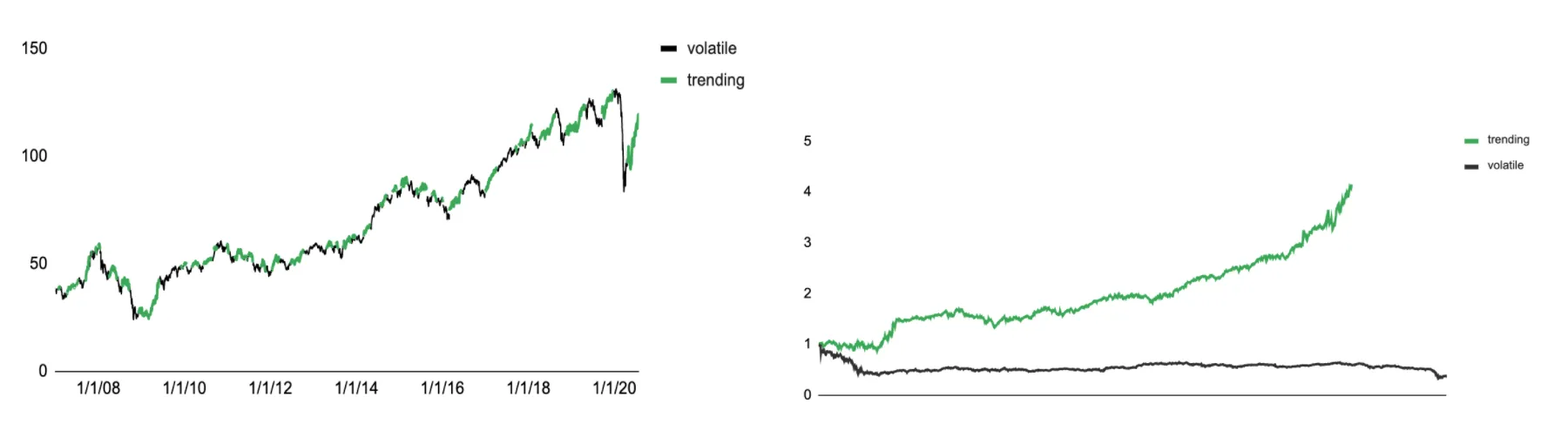

Market Regimes

We identify regimes in the markets — the risk on and the risk off. When the markets are trending — we invest in equity factors, when they are volatile we move to bonds, gold & low volatility factors. The reason for this is simple and intuitive — as seen below in trending markets, equities give exceptional returns while in volatile times it’s better to diversify to other avenues.

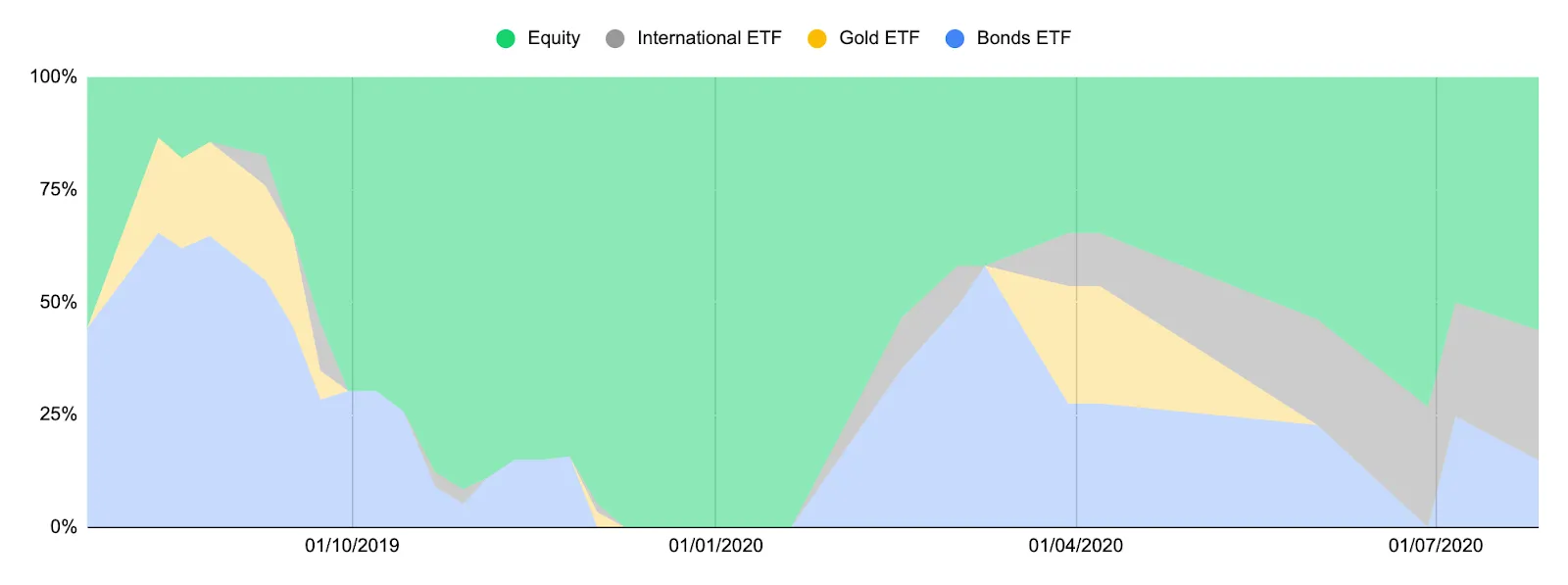

Our model deallocated to bonds and gold in early February and we further deallocated in March to save us from the Covid drawdowns and we quickly reverted to higher equity allocation in April to ride the recovery.

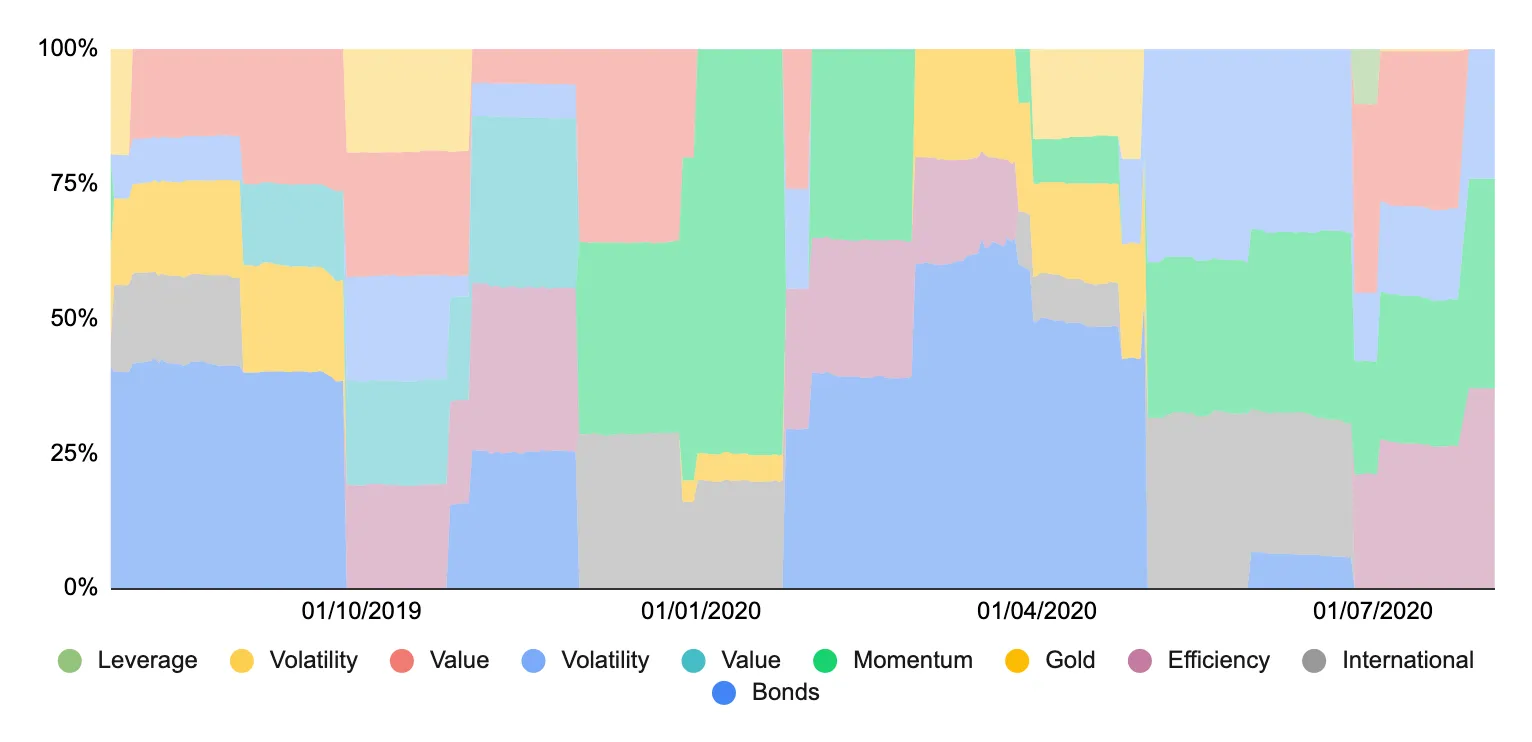

Among the equity factors, we were more allocated to low volatility factors in March while we moved to momentum and efficiency factors in April.

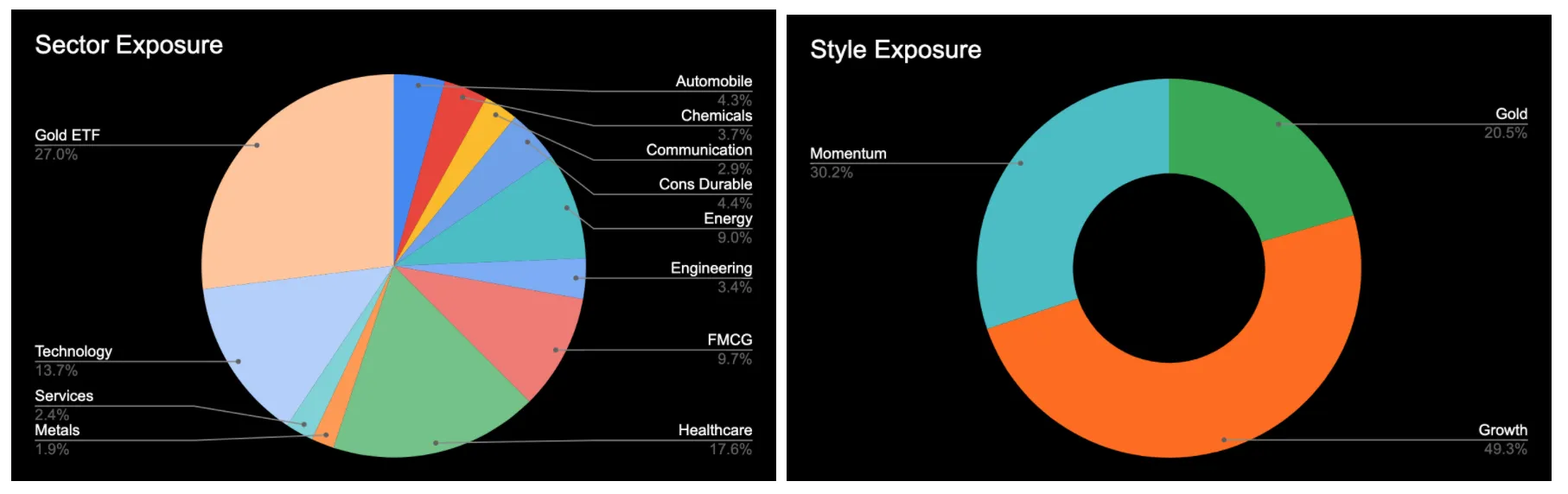

To guide through each rebalance, we are starting a monthly newsletter — Wright Views. Here we’ll explain the rationale behind each rebalance. We see that smallcaps are having a run and gold is picking pace, our bets are on high growth & high short term momentum stocks this month. Our broad allocations to sectors & styles look like this.

Check out more details in the first edition of Wright Views.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios