*This title is not original but a copy of AQR's paper Quality minus Junk that our Quality minus Junk portfolio is inspired by.

Quality Investing in owning the best companies for the long term. A quality company is one which is safe, profitable, well managed and growing. This strategy scouts these high quality stocks using a quantitative method to filter quality and invests in only high quality companies.

Benjamin Graham, the founding father of value investing used to classify stocks as either Quality or Low Quality. He also observed that the greatest losses result not from buying quality at an excessively high price, but from buying Low Quality at a price that seems good value.

Quality investing gained credence in particular after the burst of the Dot-com bubble in 2001 when investors witnessed the spectacular failures of companies such as Enron and Worldcom. These corporate collapses focused investors’ awareness on quality, which may vary from stock to stock. Investors started to pay more attention to quality of balance sheet, earnings quality, information transparency, and corporate governance quality.

Quality in the Indian market is a popular strategy, with a majority of India's traditional analysts and fund managers having a preference for high quality stocks instead of junk. Most popular proponents of this type strategy are Saurabh Mukherjea of Marcellus PMS who talks about consistent compounders, companies with moats and monopolies which are the characteristics of high quality companies.

Quality is a defensive portfolio based on fundamentals only.

Methodology

Quality of a company is quantified by looking at:

Profitability:All else equal, more profitable companies should command a higher stock price. We focus on the stock's return on equity, return on assets, asset turnover, gross margin and other profitability ratios to quantify profitability.

Growth:Investors should also pay a higher price for stocks with growing profits. We measure growth as the prior year growth in each of our profitability measures.

Safety:Investors should also pay, all-else-equal, a higher price for a safer stock. We use stock beta, leverage, risk of bankruptcy to rank stocks based on safety.

Overall quality of a stock is a sum of the three quality metrics normalized over all stocks in our universe.

We invest in the high quality stocks while maintaining diversification and minimising overall risk.

Performance

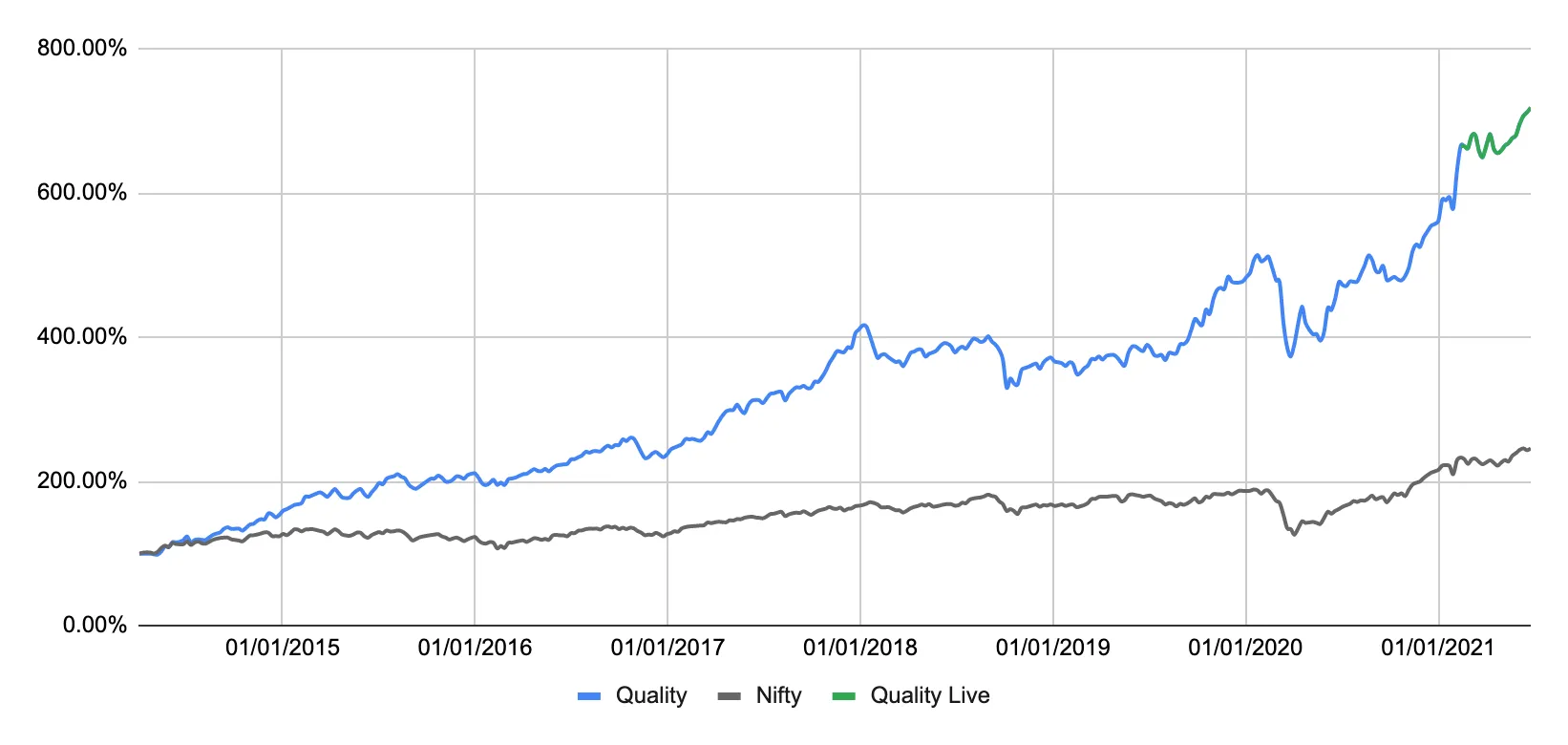

The high quality portfolio backtested as per our criteria has given a 35% annualized return in the last 7 years of backtest. The portfolio is medium risk with a low beta and has moderate drawdowns when compared to the index. It has exposure to large caps and mid cap stocks.

Why Quality and who can Invest?

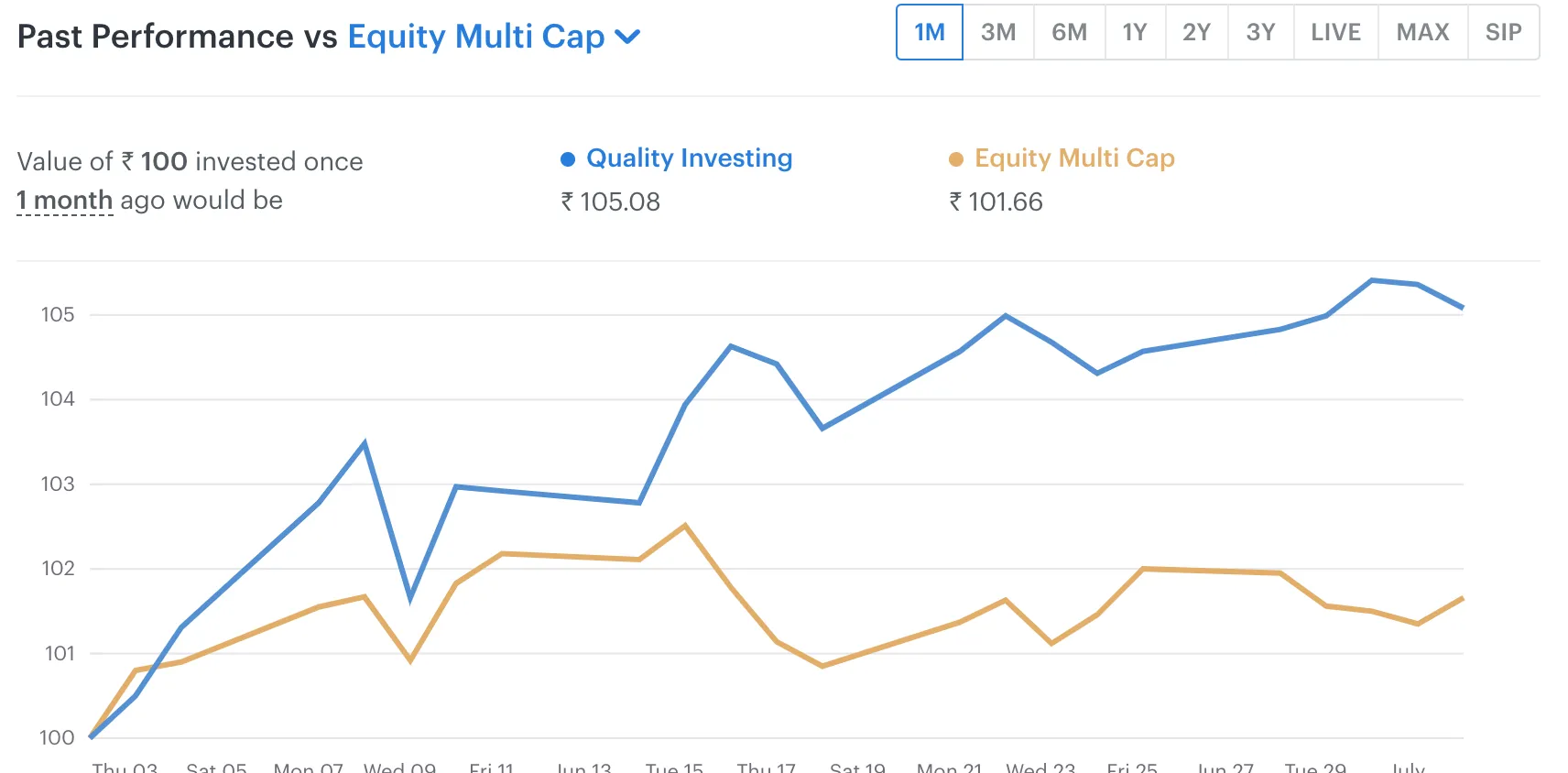

We started the standalone quality portfolio on smallcase 3 months ago where it has given a 9.16% return and has been picking up pace last month as the momentum returns have slightly dampened.

Quality like mentioned above is a strong factor in the Indian market and being more defensive than the momentum portfolios can give a very balanced returns and do well even in frothy markets.

This is most suitable for balanced to low risk investors looking for exposure to high quality companies. We have put yearly charge of 1.5% of AUM on this portfolio and a minimum investment requirement of around 30,000.

With momentum frothing, now is a good time to look out for qualityover junk.And this portfolio just might help!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart