- Tools

Get your

financial

Advise - Services

Get your

financial

Advise - About

-

News & Blogs

-

Start Investing

Find the

Perfect Portfolio

- Sign In

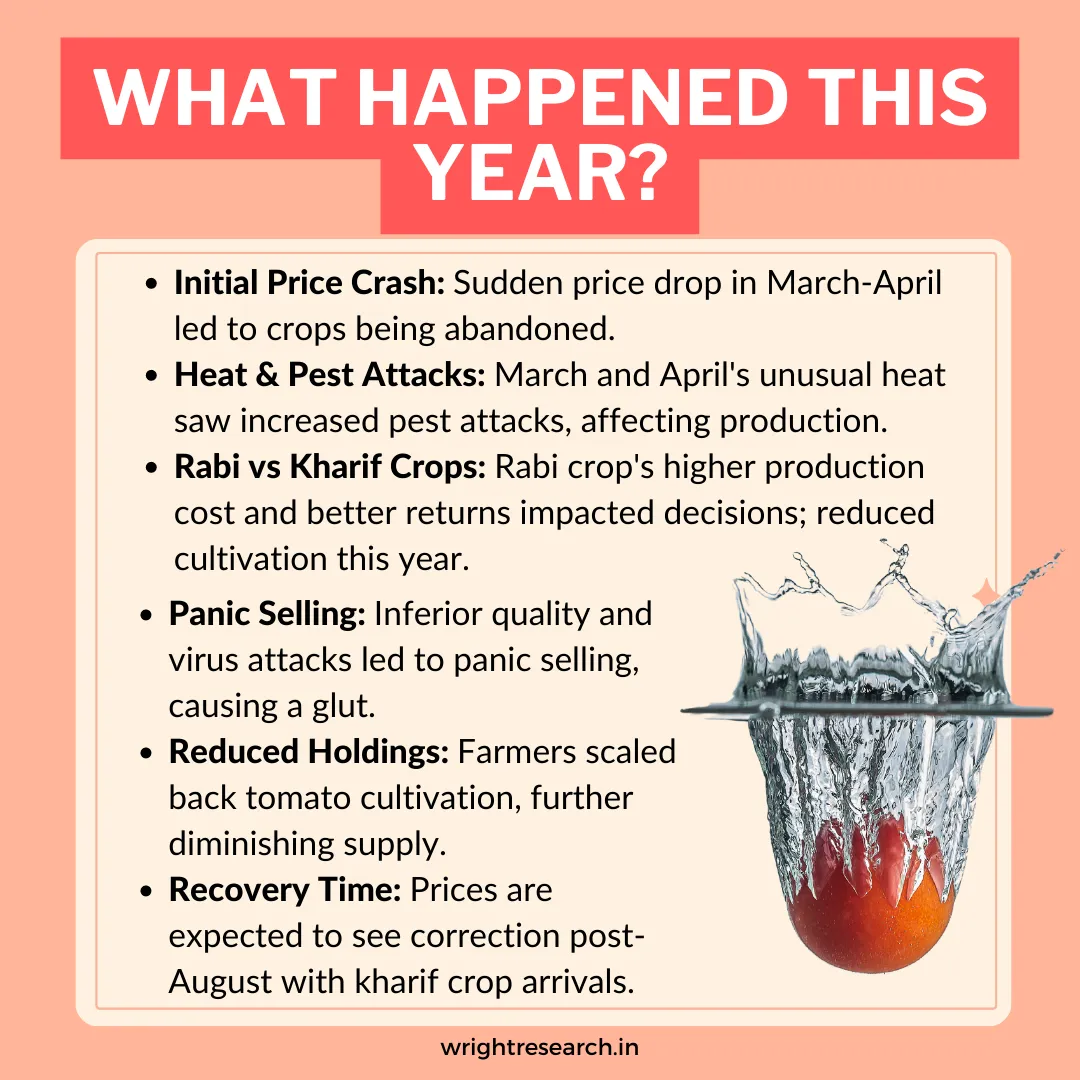

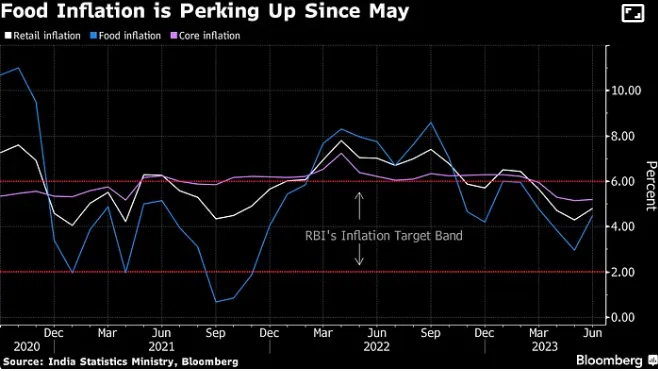

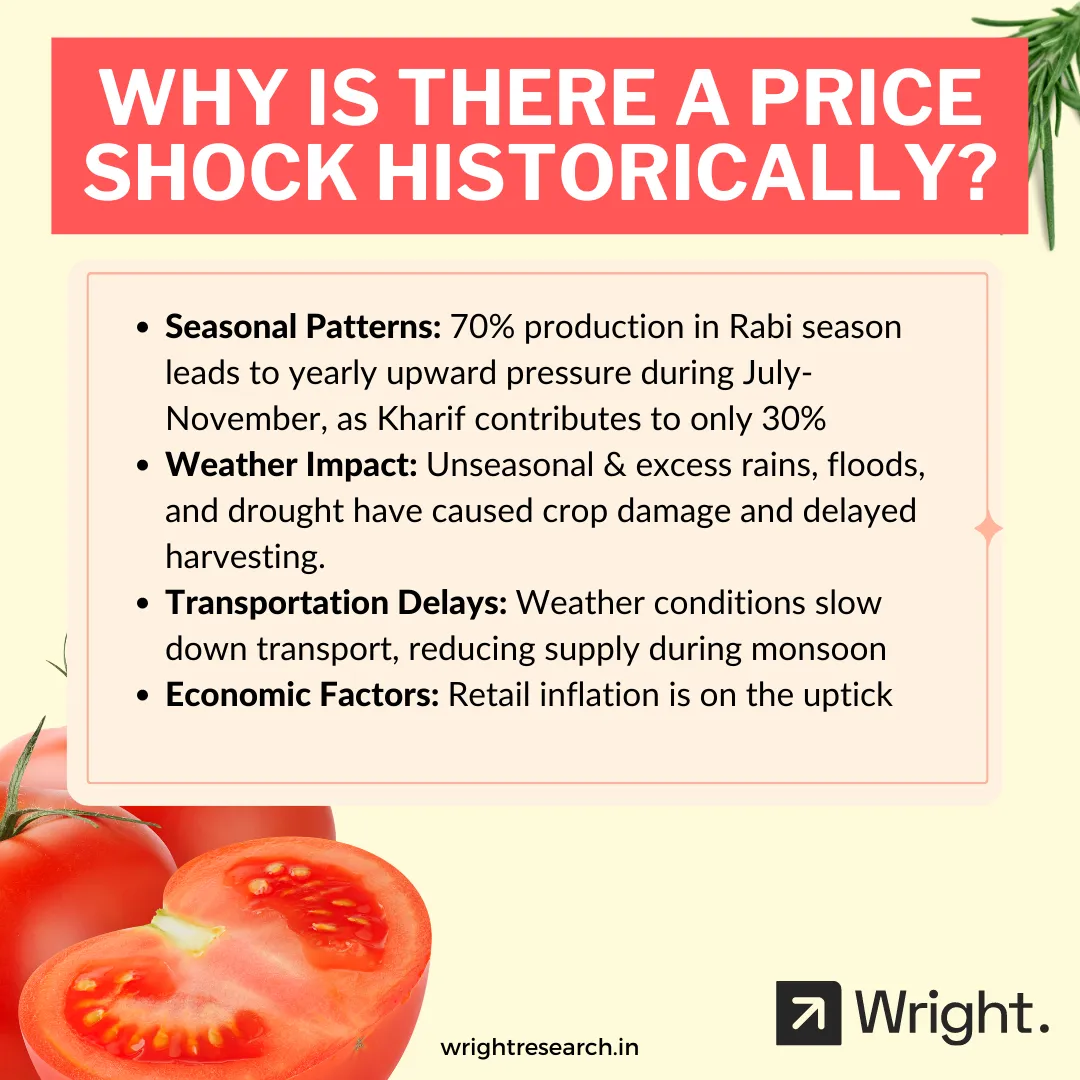

All of this leads to an inevitable short term demand and supply gap which leads to a surge in prices. But, what happened this year?

All of this leads to an inevitable short term demand and supply gap which leads to a surge in prices. But, what happened this year?