One of the underlying principles of our investment philosophy is that the markets do not always stay the same. Financial markets can change their behaviour abruptly. The behaviour of stock prices from one period to the next can be drastically different. This shift in financial markets is usually triggered by fundamental changes in macroeconomic variables, policies, or regulations.

We believe a successful investment strategy needs to be adaptive and should shift its participation behaviour as the market shifts its regimes.

Here’s a simple analogy to explain. But, first, look at the market in these two phases:

The market in 2021 was distinctly different from the market in 2022, and in 2021 chasing high-performance stocks would have been the reasonable strategy, while in 2022, it made sense to stay safer.

Our philosophy is to identify and anticipate these shifts in regimes so that we can dynamically shift our participation to take advantage of the shifting market behaviour.

For financial models, these models are of immense importance as someone participating systematically in the financial market needs to adapt their trading style and choice of instruments based on the market regimes to get a consistent performance. For example, choosing the right set of assets or sectors in a particular regime can provide significant alpha to a systematic investor. Similarly, for active traders, the optimal stop-loss limits and the choice of technical indicators can vary from regime to regime.

There are various ways in which people identify shifts in the regime in the market. The popular models fall into two categories:

Threshold Models

Predictive Models

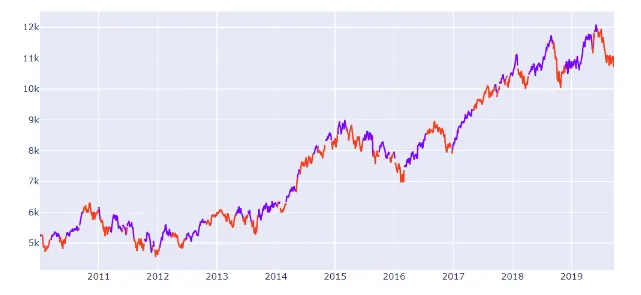

An observed variable crossing a threshold triggers a regime shift. For example, the prices below the 200-day moving average trigger a ‘bearish regime’ or a downtrend. This can be visualised by looking at the chart of Nifty and the 200-day moving average below:

Data scientists can use machine learning algorithms to input macroeconomic variables like GDP, unemployment, long-term trends, bond yields, trade balance, etc., and predict the next period's risk. In addition, time series models like the Markov Switching Autoregressive Model models are also prevalent in predicting shifts in the market.

When the model predicts a high-risk number, the market is in a risky regime. Conversely, the market is trending when the model predicts a low-risk number.

We use a predictive machine learning model that uses fast-moving macroeconomic variables in combination with technical indicators over the index to predict future risk in the market. We have seen our predictive model be highly accurate, and we dynamically adapt our participation in various strategies based on this model.

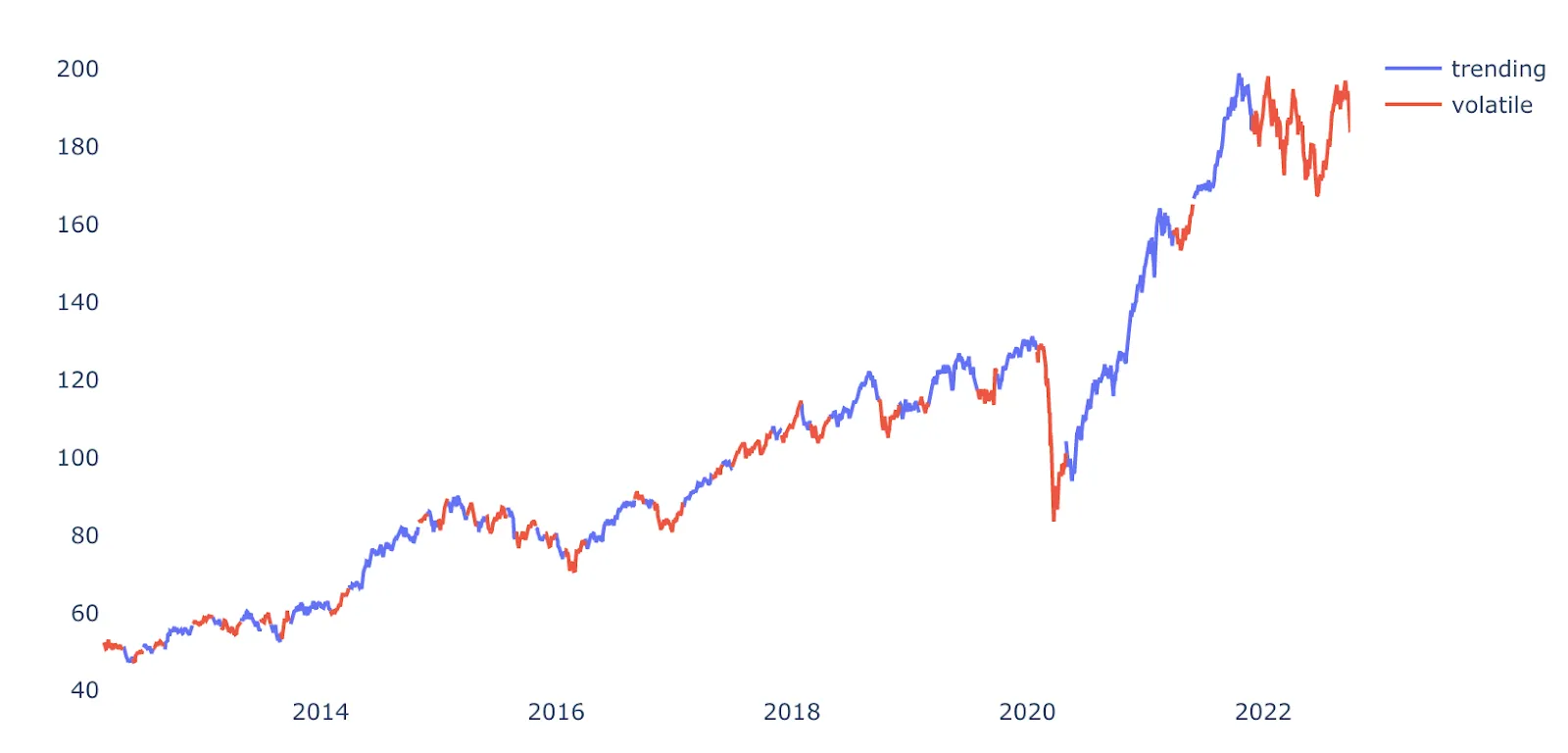

Here’s a snapshot of the regimes predicted by the model:

Notable times when the model has worked well for us in our live strategies:

2020 crash - our model was in risk territory even before the 2020 crash, and our allocation was in safer assets which we further increased as the crash escalated. This made our Balanced multi-factor strategy have a much lower drawdown than the market.

2021 October - our model identified a clear shift in regime in October 2020, which led to us deallocating away from equities then. This was a wise decision as the market volatility lasted for more than a year.

With a regime model that can forecast the next period of risk based on present market conditions, we can take a much more informed bet in the financial markets and adapt our risk appetite accordingly. Such models are a fundamental building block of an adaptive trading strategy.

Our philosophy is built to extract maximum performance for our portfolios in all market conditions, and the dynamic regime shift models empower our outperformance.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios