Risk Requiredis the risk associated with the return required to achieve the client’s goals from the financial resources available. Based on the client’s goal to say haveXamount innyears we determine the required rate of return based on his income and assets and classify him in a conservative, moderate or aggressive investor group and give him allocation to risky and risk-averse assets based on that.

Risk Capacityis the level of financial risk the client can afford to take. Following are the key metrics on which we base the risk taking capacity -

Risk Toleranceis the level of financial risk the client is emotionally comfortable with. This is more of a behavioural aspect of the client risk preferences and can be determined using a psychometric questionnaire. A sample questionnaire is attached in the appendix.

We evaluate the user risk profile based on following criteria:

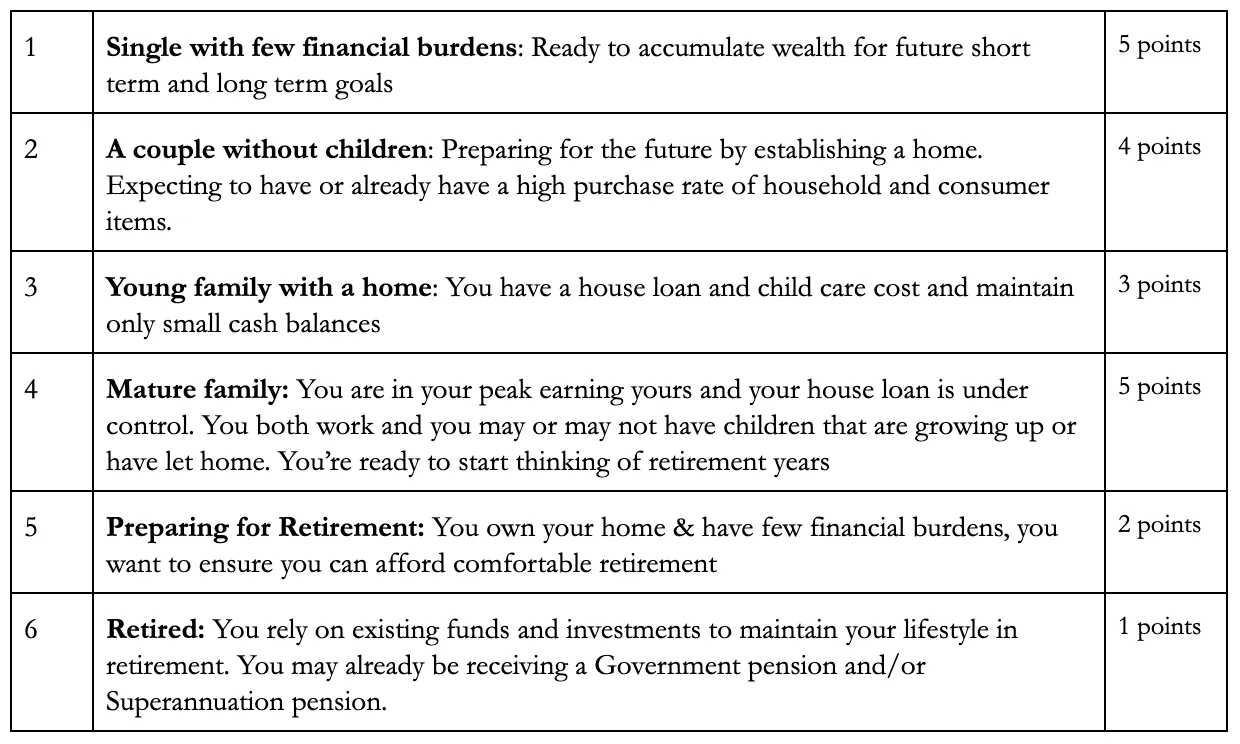

Which of the following describes your current stage in life?

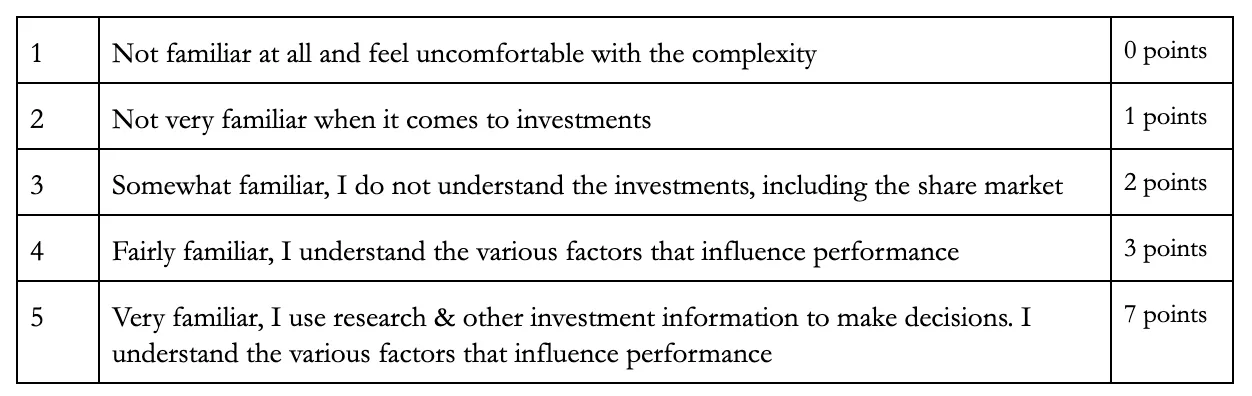

How familiar are you with investment matters?

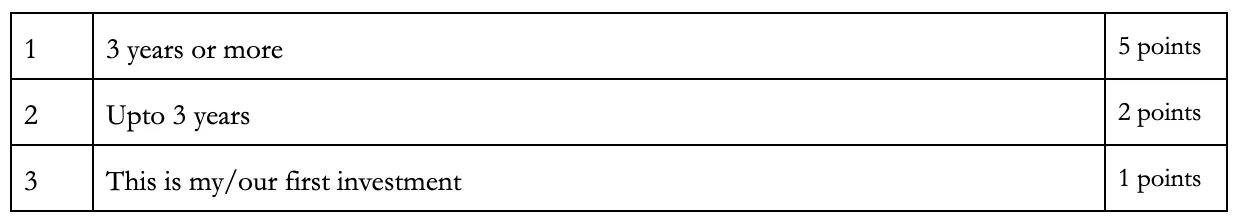

How long have you been investing, not counting your home or bank type deposits?

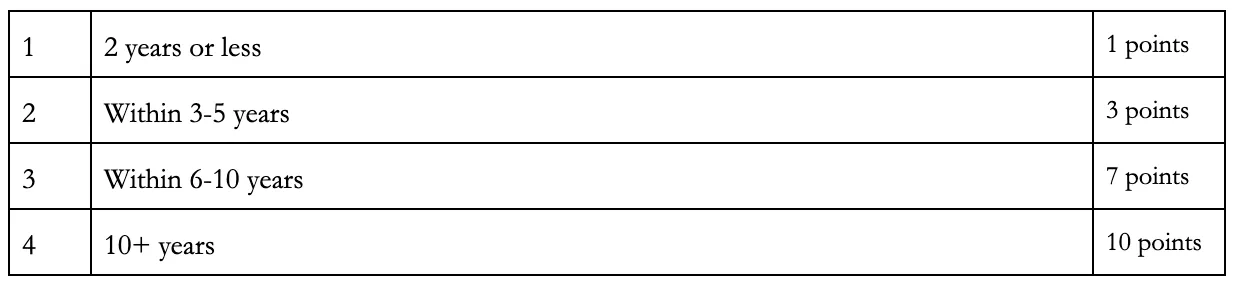

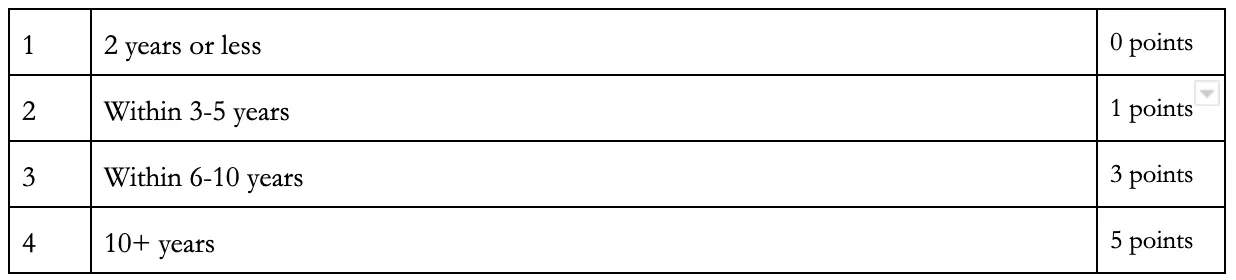

How long would you invest the majority of your money before you think you would need access to it?

Once you start using your invested money, how long would you need it to last?

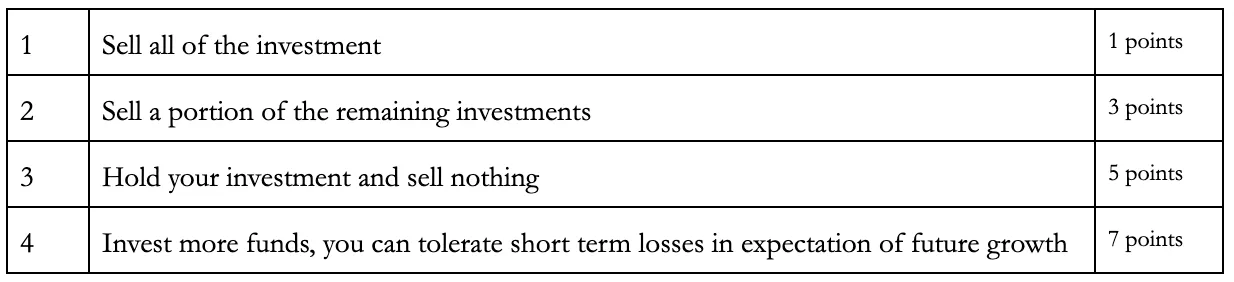

In January 2008, the Indian share market fell by more than 17% during a month. If the share market component of your portfolio fell by more than 20% what would you do ?

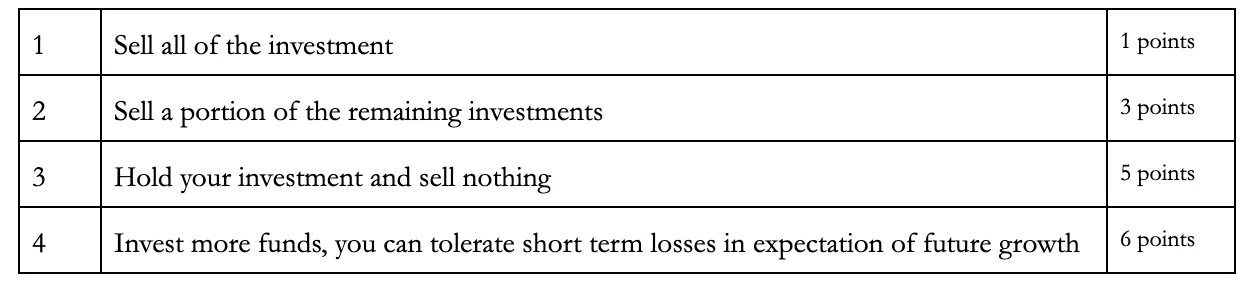

If your investment fell by more than 6% over a short period you would?

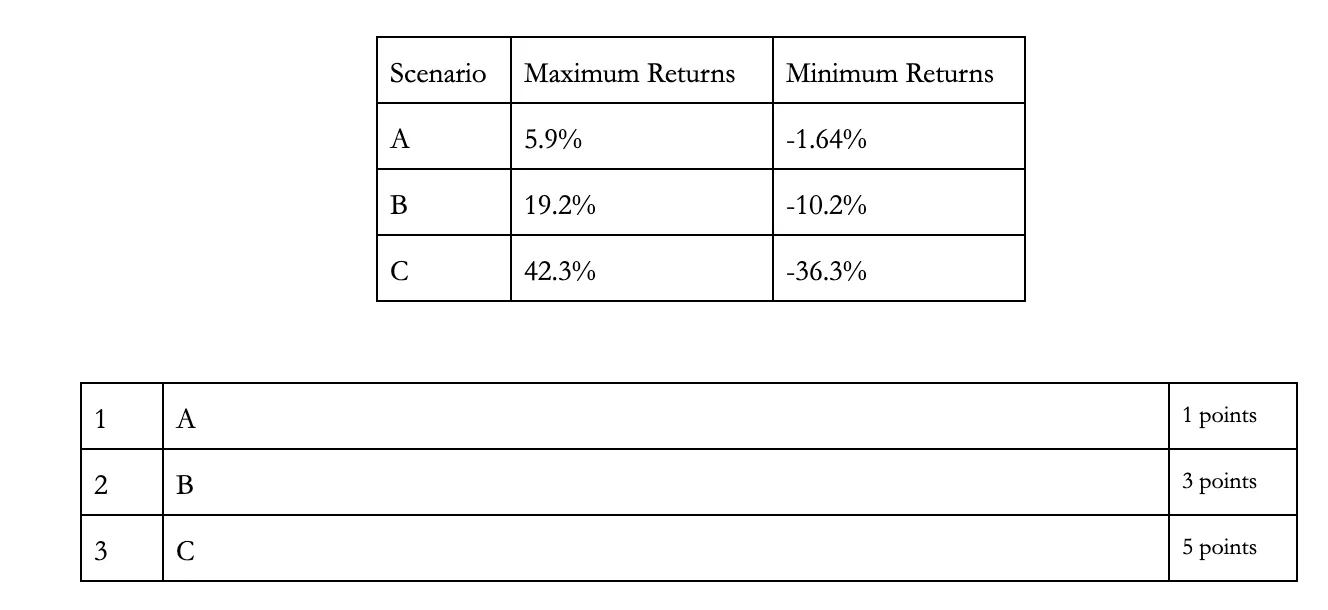

Which scenario is most preferable?

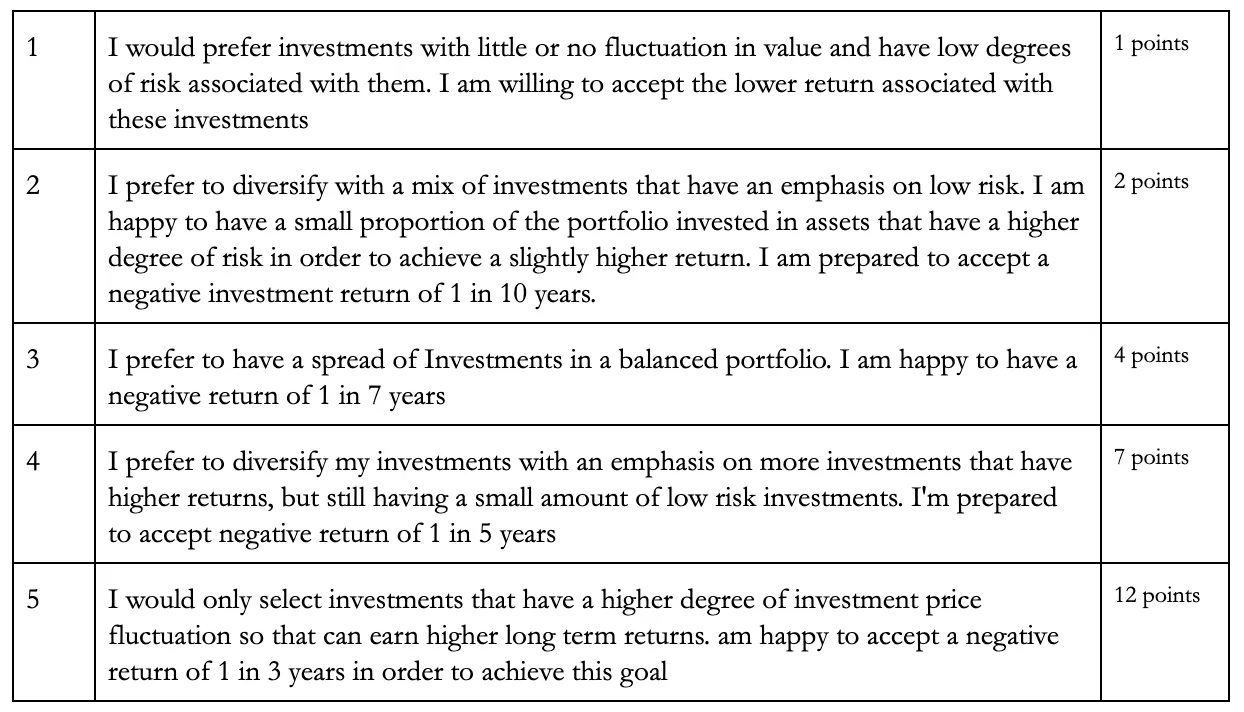

Which one of the following statements describes your feelings towards choosing an investment?

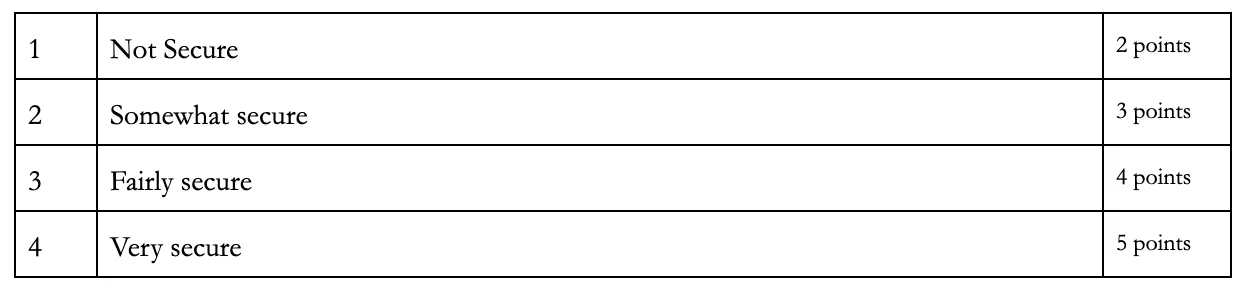

How secure is your current and future income from sources such as salary, pensions & other investments?

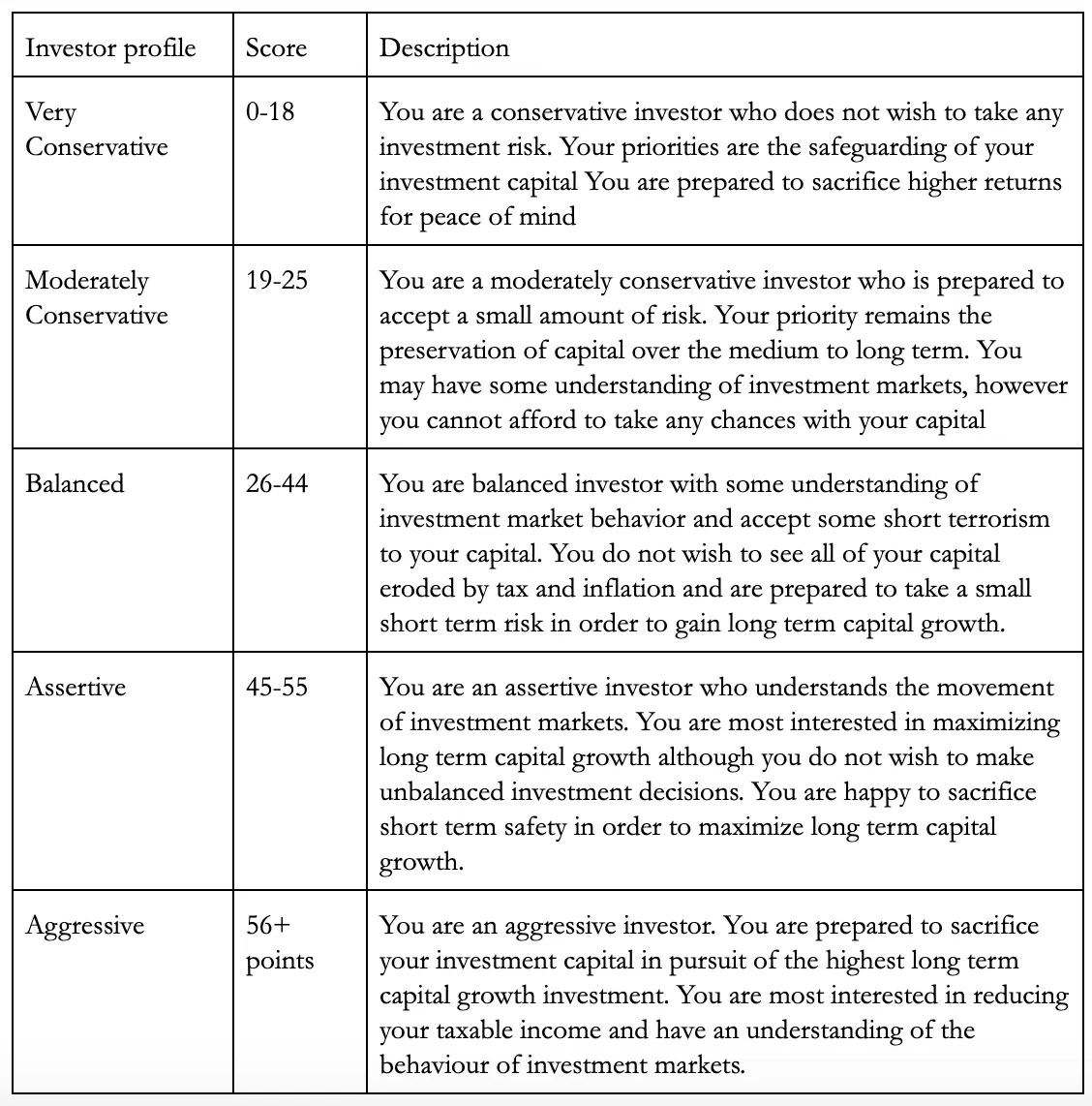

Add up the points you scored for each answer. Based on your score, your risk profile is defined as:

Head on to https://www.wrightresearch.in/update_risk/ with a user account to explore!

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart