- Tools

Get your

financial

Advise - Services

Get your

financial

Advise - About

-

News & Blogs

-

Start Investing

Find the

Perfect Portfolio

- Sign In

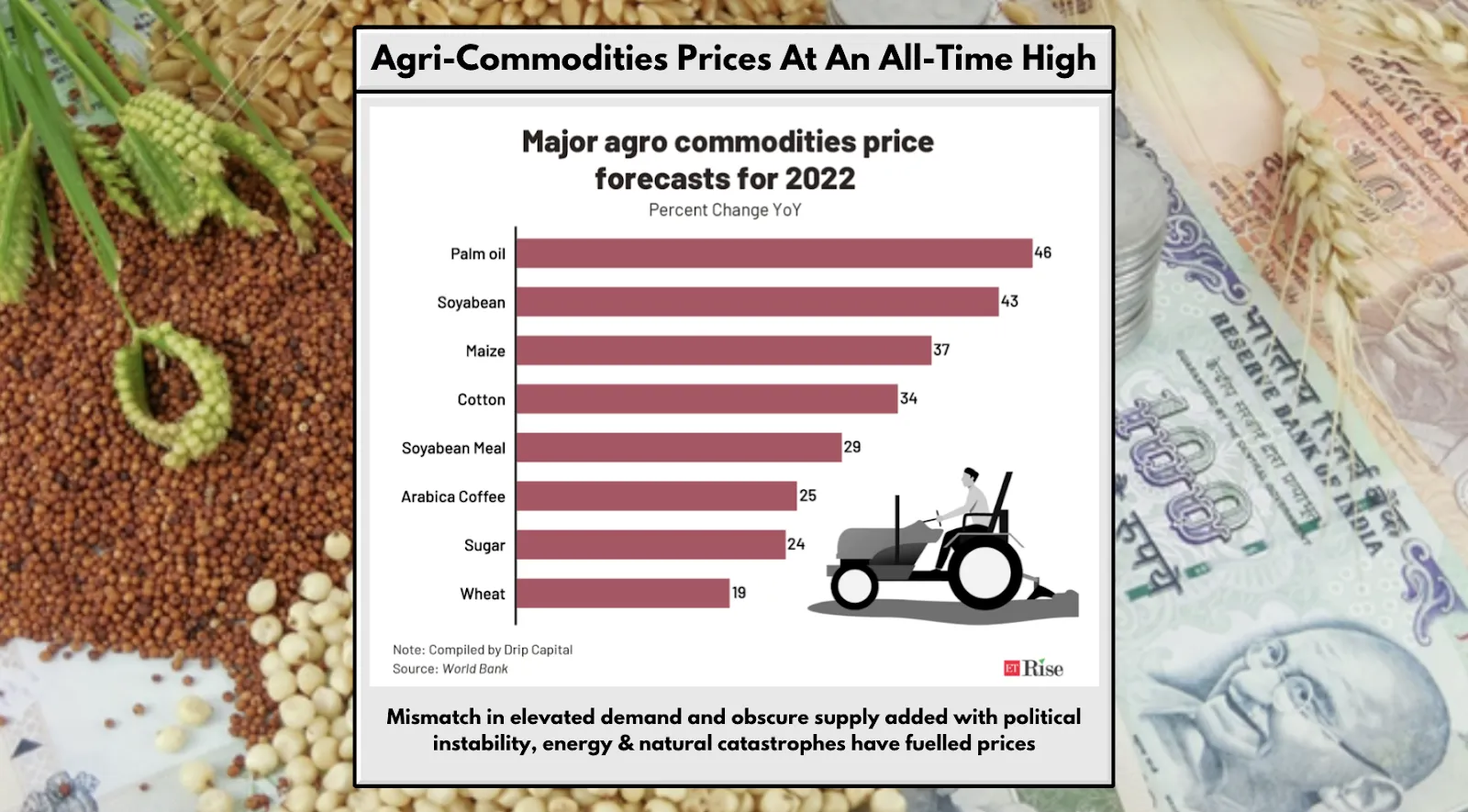

Also, India is in final talks to supply wheat to Egypt, the largest buyer in the world. Piyush Goyal (Minister of Commerce & Industry) has proclaimed that wheat exports are likely to cross USD 100 lakh tonnes this fiscal.

Also, India is in final talks to supply wheat to Egypt, the largest buyer in the world. Piyush Goyal (Minister of Commerce & Industry) has proclaimed that wheat exports are likely to cross USD 100 lakh tonnes this fiscal.