by Wright Research

Published On April 9, 2023

In the current market environment, high volatility, elevated interest rates, and geopolitical tensions pose challenges and opportunities for investors. Recent changes in taxation for debt mutual funds, stripping long-term tax benefits for those investing less than 35% of their assets in equities, have made bank fixed deposits (FDs) more competitive. In this blog post, we explore investment strategies to minimize risk and maximize returns, discuss factors to consider when selecting debt funds, and examine alternative investment options like arbitrage and equity savings funds.

Check out our video interview with Vinod Bhat of Aditya Birla MF talking about the correct allocation for volatile markets:

Equity markets constantly shift gears, with various sectors taking the lead at different times. One day, banking might be the trend, followed by infrastructure, and then technology. To thrive in such an ever-changing landscape, it's crucial to remain dynamic and adaptable, emphasizing diversification and systematic investing. For those with a high risk tolerance, investing in equities during this period can help keep the average purchase price low, potentially yielding long-term benefits!

Diversification: Spreading investments across various asset classes helps reduce risk and provide stable returns, especially during times of market volatility and geopolitical tensions. High-risk investors should still consider equities as a significant component of their portfolios to potentially achieve higher returns.

Dollar-Cost Averaging: Regularly investing a fixed amount mitigates the impact of market fluctuations, lowering the average cost per share over time, and making it a suitable strategy for both conservative and high-risk investors.

Focus on Long-Term Goals: Maintaining a long-term perspective helps avoid impulsive decisions based on short-term market movements or external factors. Equity investments, particularly for high-risk investors, should align with long-term financial goals.

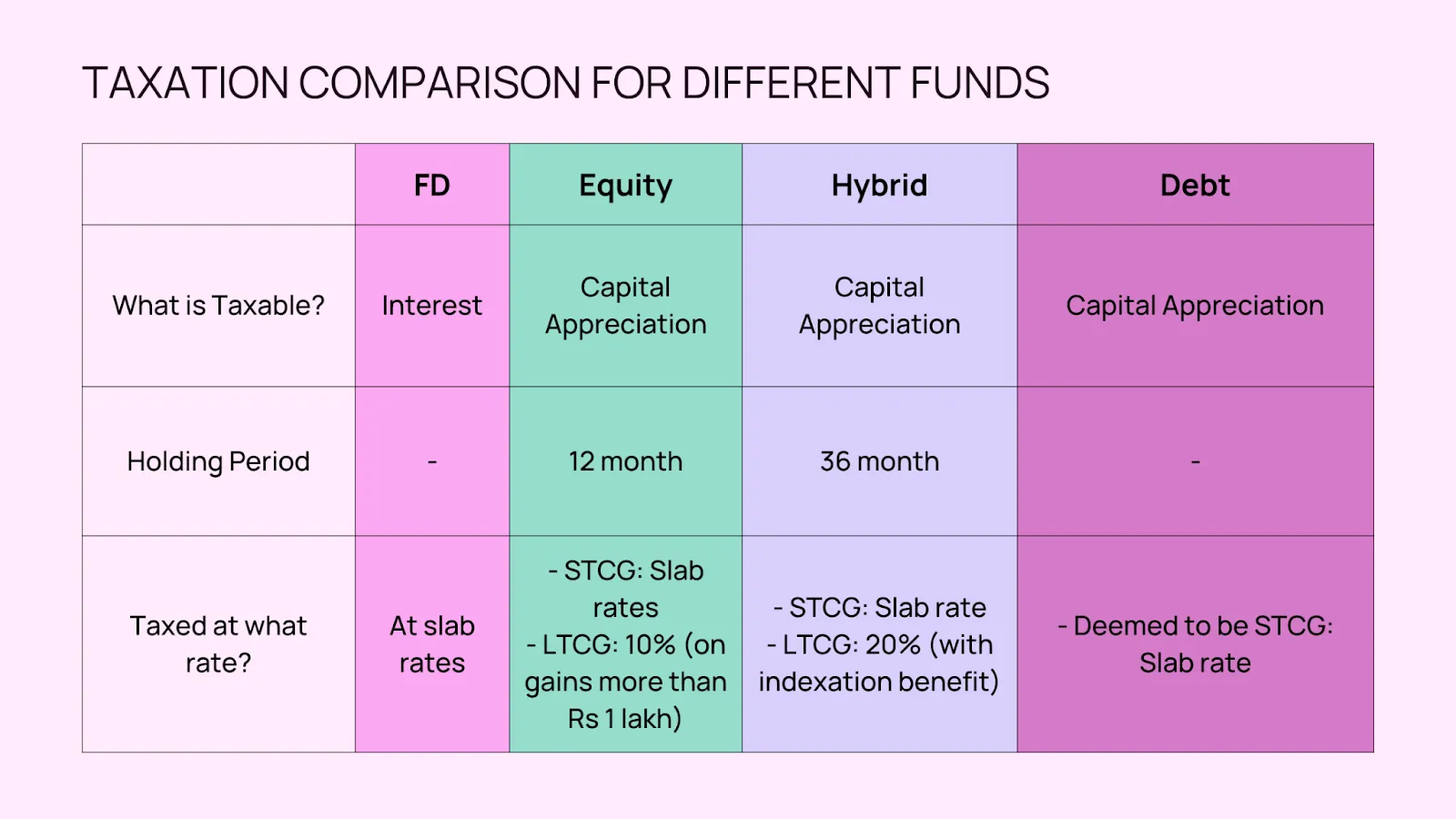

Debt Funds: Assess credit quality, duration, and expense ratio when selecting debt funds, particularly during a global banking crisis. However, recent taxation changes may reduce their attractiveness for some investors.

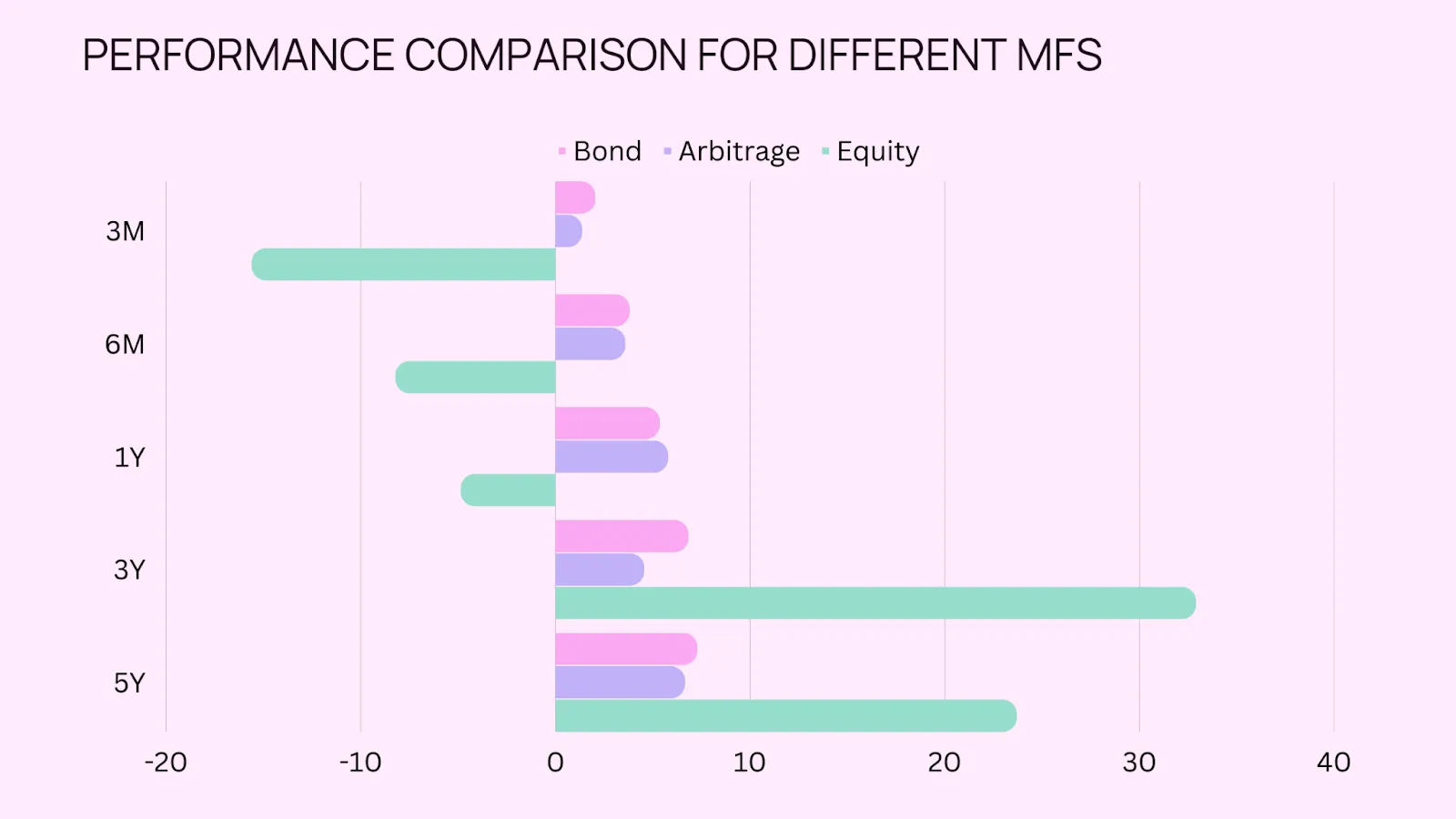

Arbitrage Funds: Suitable during periods of high market volatility, these funds capitalize on price differences between cash and derivatives markets and offer better tax benefits than debt funds.

Equity Savings Funds: As an alternative to debt funds, these funds invest in equities, debt, and arbitrage opportunities, potentially offering better tax benefits and higher returns while maintaining a lower risk profile.

Equities: Pros include the potential for higher returns and long-term capital appreciation. Cons include higher risk, susceptibility to market fluctuations, and geopolitical tensions.

Debt Funds: Pros include stable returns and low risk. Cons include sensitivity to interest rate changes, recent taxation changes diminishing their appeal, and potential credit risk during a global banking crisis.

Alternatives (Arbitrage & Equity Savings Funds): Pros include tax efficiency and potentially higher returns compared to debt funds. Cons include exposure to equity market risks and dependence on market volatility for returns (arbitrage funds).

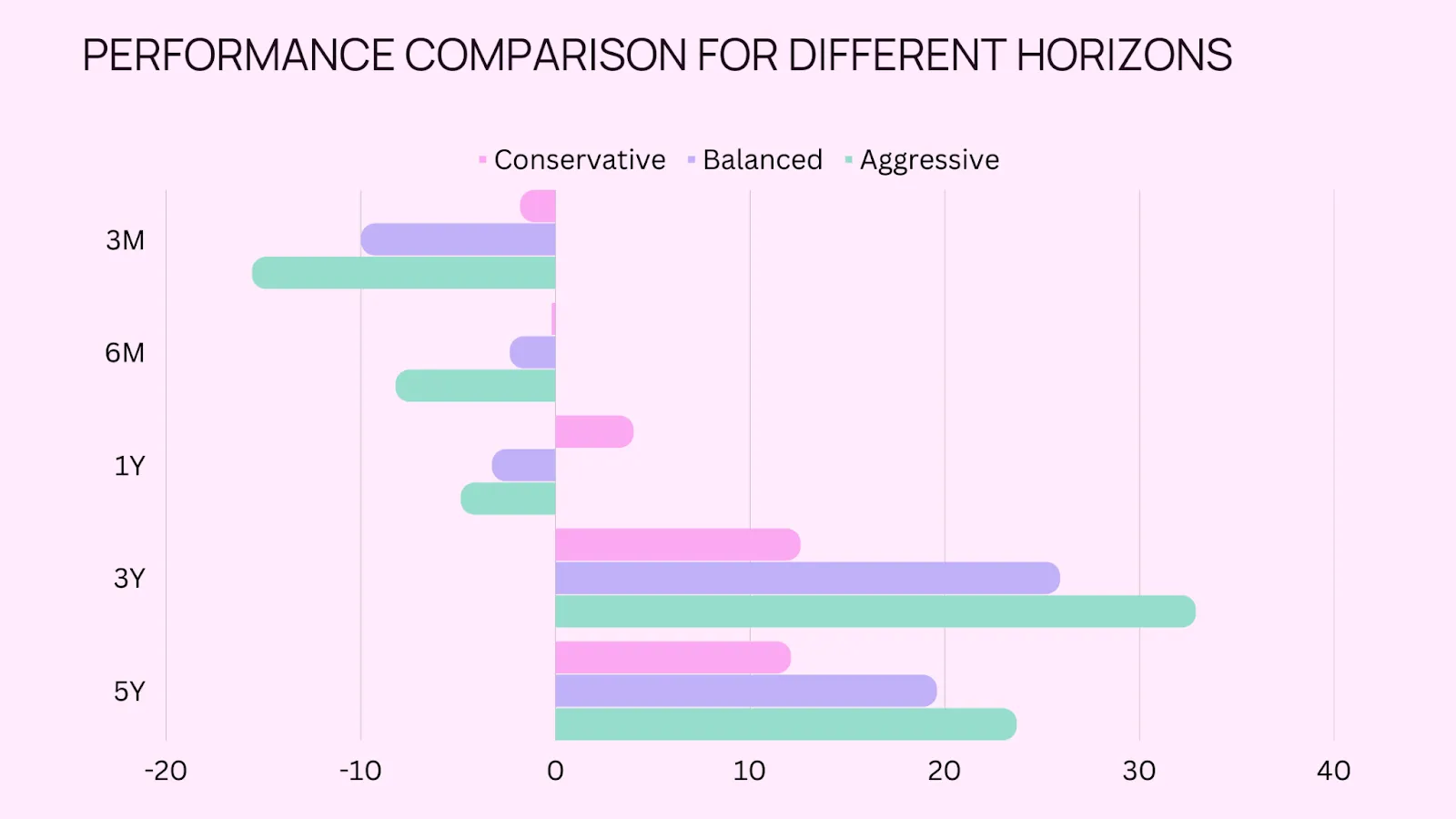

Investment Horizon: Consider your investment horizon when selecting funds. Short-term investors may benefit from low-duration debt funds or arbitrage funds, while long-term investors should consider equity savings funds or diversified options.

Risk Tolerance: Assess your risk tolerance before investing. Conservative investors should prioritize debt funds, while those with higher risk appetite may opt for equity savings funds or equities.

In conclusion, navigating market turbulence requires a proactive approach and understanding of various investment options. By considering adaptive investment strategies like diversification, dollar-cost averaging, and exploring alternative investments, investors can better adapt to the current market environment and the implications of recent taxation changes.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart