Trading Psychology: How to Strengthen Your Trader Mindset?

by BG5 min read

Learn how trading psychology impacts success. Discover strategies to master emotions, improve discipline, and build a strong, profitable trader mindset.

Real Impact of Trump’s Reciprocal Tariffs On India & The World: Will India Actually Benefit?

by Siddharth Singh Bhaisora5 min read

President Donald Trump unveils sweeping reciprocal tariffs to address the $1.2 trillion U.S. trade deficit, sparking fears of global stagflation and trade wars. India faces a 26% tariff but emerges relatively well-positioned amid the global supply chain shift away from China.

New US-China Trade War & Its Impact on India

by BG5 min read

Explore how the 2025 U.S.–China trade war is reshaping India's economy, stock markets, and key industries. Learn from past trade wars to anticipate future challenges and opportunities.

The Kumbh Mela Coincidence : Decoding Market Patterns

by Naman Agarwal5 min read

Explore the effect of Mahakumbh 2025 on Stock Market and Different Sectors , which is estimated to create an economic impact of Rs 2-3 Lakh Crores.

Behavioral Biases Are a Part of Investing - But You Can Beat Them.

by Emily Olley5 min read

Learn how to identify and overcome cognitive biases like anchoring, emotional bias, loss aversion, and herding in stock investing.

Womenomics: Growth in Women’s Contributions to the Labour Force in Recent Decades

by Emily Olley5 min read

Explore how the growth in women's contributions to the labor force has revolutionized economies worldwide, including India. Learn about drivers, successes, challenges, and investment implications of this transformative trend, featuring companies like Titan, Nykaa, and Mamaearth.

Navigating the Future of Indian Equities Post-2024 Elections: Opportunities and Challenges

by Sonam Srivastava5 min read

Navigating the Future of Indian Equities Post-2024 Elections: Opportunities and Challenges

Power of Monopolies: Will Investing In Monopoly Stocks Give Higher Returns?

by Abhishek Banerjee, Siddharth Singh Bhaisora5 min read

See if monopoly stocks outperform the market. Explore the potential of investing in monopoly stocks and how their market dominance can lead to higher returns. Learn why Warren Buffett favors monopolies and how monopoly stocks outperform broader market indices like NIFTY 50 and NIFTY 500 Multi Cap.

Elections 2024 and Their Impact on the Stock Markets

by Sonam Srivastava5 min read

Elections 2024 and Their Impact on the Market and Other Major Economic Indicators

Indian Economic Outlook through Consumption and Inflation Trends

by Sonam Srivastava5 min read

Dive deep into India's economic landscape! Explore how consumption patterns, inflation management, and policy decisions shape the nation's growth trajectory and unlock insights for global investors.

The PSU Rally: Why are they Soaring and Should You Invest?

by Sonam Srivastava5 min read

Public Sector Undertaking Stocks Boom: Should You Join the Herd or Stay Alert?

Top Sectors to Invest in After the Interim Budget

by Sonam Srivastava5 min read

Exploring Investment Opportunities: Top Sectors Post-Interim Budget 2024

AI Meets Finance: Revolutionizing the Indian Stock Market with Machine Learning Insights

by Sonam Srivastava5 min read

AI Meets Finance: Revolutionizing the Indian Stock Market with Machine Learning Insights

Festive Season Forecasts a Bright Spark for India's Economic Revival

by Sonam Srivastava5 min read

Explore the economic impact of India's festive season, from surges in consumer spending to sectors thriving during festivals. Get insights on top investment picks.

Cricket and Commerce: The Economic Powerplay of the ICC World Cup 2023 in India

by Sonam Srivastava5 min read

Cricket and Commerce: The Economic Powerplay of the ICC World Cup 2023 in India

Why we are bullish on the India Growth Story?

by Siddharth Singh Bhaisora5 min read

Learn why Wright Research is bullish on the India Growth Story! With insights into investments, technology, demographic dividends, education, and more, discover how India's robust growth story is leading the nation towards a potential $10 trillion economy by the end of the decade.

Nifty @ All Time High, Adani stocks, Debt Ceiling - A Guide in Memes

by Sonam Srivastava5 min read

Nifty @ All Time High, Resurgence in Adani stocks, Debt Ceiling - A Guide in Memes

Emerging Trends in the Market Q1 FY24

by Sonam Srivastava5 min read

Emerging Trends in the Market Q1 FY24

Decoding the market craziness with data

by Sonam Srivastava5 min read

Decoding the market craziness with data

Impact of Global Recession on Indian IT sector

by Sonam Srivastava5 min read

The Indian IT sector is a significant contributor to the global economy, generating billions of dollars annually. However, just like any other industry, it is affected by global economic downturns.

Bye 2022. You wont be missed!

by Sonam Srivastava5 min read

We had big hopes for you 2022, but needless to say, you turned out to be one of the craziest years for investors. Here’s looking back at 2022 - obviously with memes!

Emerging Investment Themes for 2023

by Sonam Srivastava5 min read

As 2022 comes to a close, most of the world still faces stubbornly high inflation, aggressive interest-rate hikes and geopolitical tensions. But Indian market already has some exciting themes emerging that can bring a lot of color to our portfolios.

Overvaluation, Rate Hikes and What Looks Attractive?

by Sonam Srivastava5 min read

Our market has been the most robust over the last year and is at a much higher valuation multiple than many emerging markets. Is this a concern during global recessionary fears.

Markets @ All-Time High | Factors to Watch

by Sonam Srivastava5 min read

Ever since the inflation numbers have eased and the US FED has hinted at a slower rate hike, the market euphoria has returned. Nifty is almost touching the all-time high of 18600, and we have seen the FIIs return to India!

No Gyan, Only Data

by Sonam Srivastava5 min read

Are you tired of all the investment gyan ever present on the internet? I know that I am. Every other investment manager is rattling off about the long-term story and the strength of the Indian market. So we thought that this week, we would not join the bandwagon!

Investor Questions Answered - Diwali Edition

by Sonam Srivastava5 min read

Diwali is a season that brings in luck! Where should we invest this Diwali and what to look out for in the next year? Find out…

Earnings - Do they even matter?

by Sonam Srivastava5 min read

Earnings release is a huge event every quarter. Let's analyse if that actually matters...

Sectors that benefit from Rising Dollar

by Sonam Srivastava5 min read

The dollar has had a drastic rise above all other major global currencies and companies that export to US stand to gain.

Inflation and Fear of Recession in the US and Impact on India

by Sonam Srivastava5 min read

The US Fed has vowed to suppress growth to control inflation and keep raising interest rates until inflation reaches 2%. This is an evolving situation that can impact India.

Which sectors are gaining from the atmanirbhar initiatives?

by Sonam Srivastava5 min read

Stocks benefiting from the critical policies have a long way to go. In this post, we will drill down into the sectors and industries covered under these schemes, which will be crucial to spot these winners.

Why are FIIs buying into the Indian market?

by Sonam Srivastava5 min read

After months of constant selling from October 2021 to June 2022, foreign institutional investors (FII), are back in love with Indian markets and, to date, have purchased shares worth $ 5 billion.

Is festive season the time to bet on consumption?

by Sonam Srivastava5 min read

Consumer confidence is an economic indicator that measures the degree of optimism regarding a country's economy. Consumer confidence has been picking up in recent weeks.

All about bear markets. How to navigate one?

by Sonam Srivastava5 min read

Let’s no longer play around with it and call a spade a spade. We are in a bear market! Spoiled by bull markets most of our lives, many have no idea what bear markets are, how long they last, and what to do with our money when in one. In this post, we will enlighten you all about them.

Sector Rotation Strategy & Business Cycles

by Siddhart Agarwal5 min read

Maximize Returns with Sector Rotation Strategy. Identify stock market sector rotation opportunities in different business cycle phases. Explore Wright Research now.

We don't talk about bear markets, no, no, no

by Sonam Srivastava5 min read

The crash has unnerved everyone! Are we in a bear market? What happens next? How to manage risk? Lets find out

Inflation & It's Impact

by Sonam Srivastava5 min read

The markets have been routed over the past month after the central banks raised rates.Why are these central banks hiking rates and destroying our portfolios? The answer is INFLATION. In this post, we will look at inflation and try to predict the way. So gear up!

Can we Invest in Atmanirbhar 🇮🇳 theme?

by Sonam Srivastava5 min read

Even with the recent volatility in the Indian market, the stocks that have stayed resilient are the atmanirbhar India stocks. The term ‘AtmaNirbhar’ has evolved from a buzzword to a solid profitable strategy.

Key Investor Questions

by Sonam Srivastava5 min read

In the past few months and recent weeks there have been too many announcements to absorb. Furthermore, the global macro factors are also adding to investor ambiguity. So it makes sense to answer a few of the burning investor questions.

Falling Rural Demand vs Rising Agri Commodities

by Sonam Srivastava5 min read

The rural economy that was just recovering from supply shock during the pandemic has been hit afresh by the commodity inflation fueled by the Ukraine-Russia crisis. Can the momentum in agri-commodity prices revive it?

Decoding the Fund Flow

by Siddhart Agarwal5 min read

FIIs have sold equities worth $19.82 billion since October 1 last year. In 2008, FIIs sold $15 billion of shares during GFC. Yet, more surprisingly, the DIIs have kept the index stable. Why is this happening?

The Wild Commodity Price Rise

by Siddhart Agarwal5 min read

There has been a massive upsurge in crude, natural gas, metals, and agro commodities after the beginning of Ukraine's invasion by Russia. Let's explore the pressures and opportunities from the crisis.

The markets have been tough. Let’s dig in...

by Sonam Srivastava5 min read

Is the market volatility making you jittery? 🥶 Let's keep our long-term investor hats on 🎩 and try to understand the economics of war, the impact on India, and portfolio guidance. Let's dive in.. 🏊

Serving Consistent Market Returns

by Sonam Srivastava5 min read

At Wright Research, we believe that the market does not remain the same all the time. And as the market itself shifts its behavior, allocations within our portfolios also need to turn. This is why we like to follow a multi-factor approach in our stock selection and asset allocation.

What to expect in the run-up to the Budget?

by Sonam Srivastava5 min read

The 2022 Budget will be looked at from two critical angles. First, the expectation of a boost to economic growth through capital expenditure, and second, the ability to contain fiscal deficit in the increasingly uncertain global economy

India Inc Q2FY22 Earnings Snapshot

by Siddhart Agarwal5 min read

The cumulative net earnings of 42 Nifty50 businesses that have released their results so far increased by 19.2% YOY to Rs 1.12 trillion in Q2FY22. The consistent earning growth is indeed a new high.

The Growing Craze of IPOs in India

by Siddhart Agarwal5 min read

72 Initial Public Offerings (IPOs) were launched in India between January and September, raising a total of $330.66 billion. In addition, 33 IPOs are planned for this year, including Nykaa, Mobikwik, Paytm, and the well-known LIC.

This Diwali, add sparkle to your portfolio with Wright Research.

by Siddhart Agarwal5 min read

With Diwali approaching, now is the time for investors to assess their investment portfolio and add some luster to it with some exciting investing themes.

Markets at a Discount

by Sonam Srivastava5 min read

The markets rising rapidly over the last month took a nosedive last week, with small and mid-caps losing more than 5% as Nifty crashed 2%.

Regime Modeling

by Sonam Srivastava5 min read

One of the underlying principles of our investment philosophy is that the markets do not always stay the same.

Markets at 60k!

by Sonam Srivastava5 min read

In this month's markets & macros review, we celebrate Sensex hitting 60k!

Market Pulse - Deep Dive

by Sonam Srivastava5 min read

There's uncertainty in the equity markets and churn happening from cyclical to defensive sectors. Investor nerves are frayed!

The Burning Investor Questions

by Siddhart Agarwal5 min read

Is the market overvalued? Are we nearing price correction? Is this the right time to double down on investments? What about the FED tapering and rate hikes?

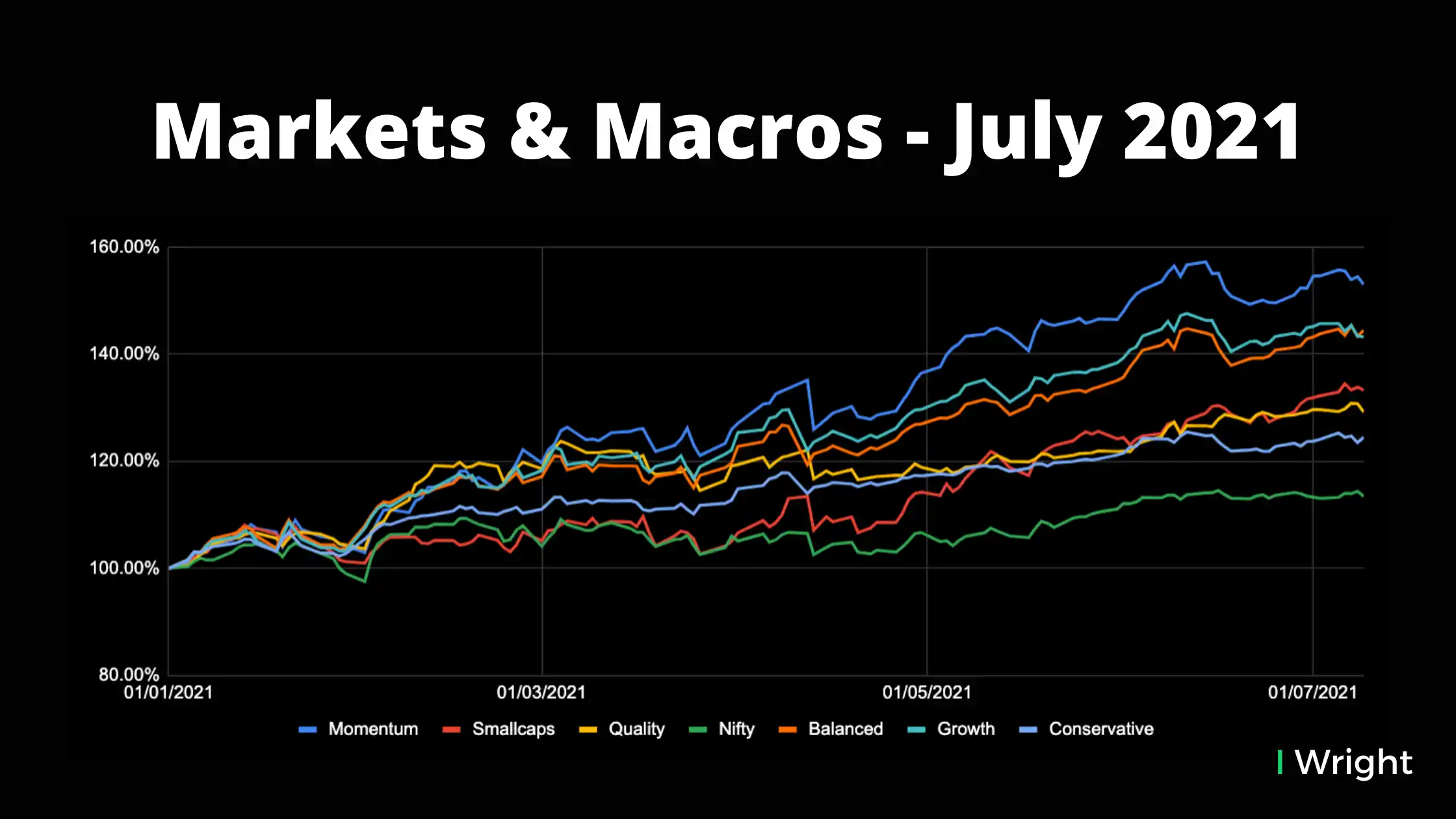

Markets & Macros - July 2021

by Sonam Srivastava5 min read

Once a month, it makes sense for us to take a pause and look at the markets & macros to make sense of all the noise. Here we look at markets, our performance and hits & misses

Riding the Tide of The Covid-19 Second Wave

by Sonam Srivastava5 min read

As the world is fighting the second wave of Covid19. How does this translate to conditions of the Indian Financial Markets?

Sector Rotation with Augment Capital

by Sonam Srivastava5 min read

Sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle

Wright Views: Post Elections 2020

by Sonam Srivastava5 min read

Monthly portfolio update and views on the US election results

Trading US Elections with Data Science

by Sonam Srivastava5 min read

US Elections are the one of most important events for the markets. There is a lot of fear in the market on the ongoing trend in the equity markets getting broken after elections

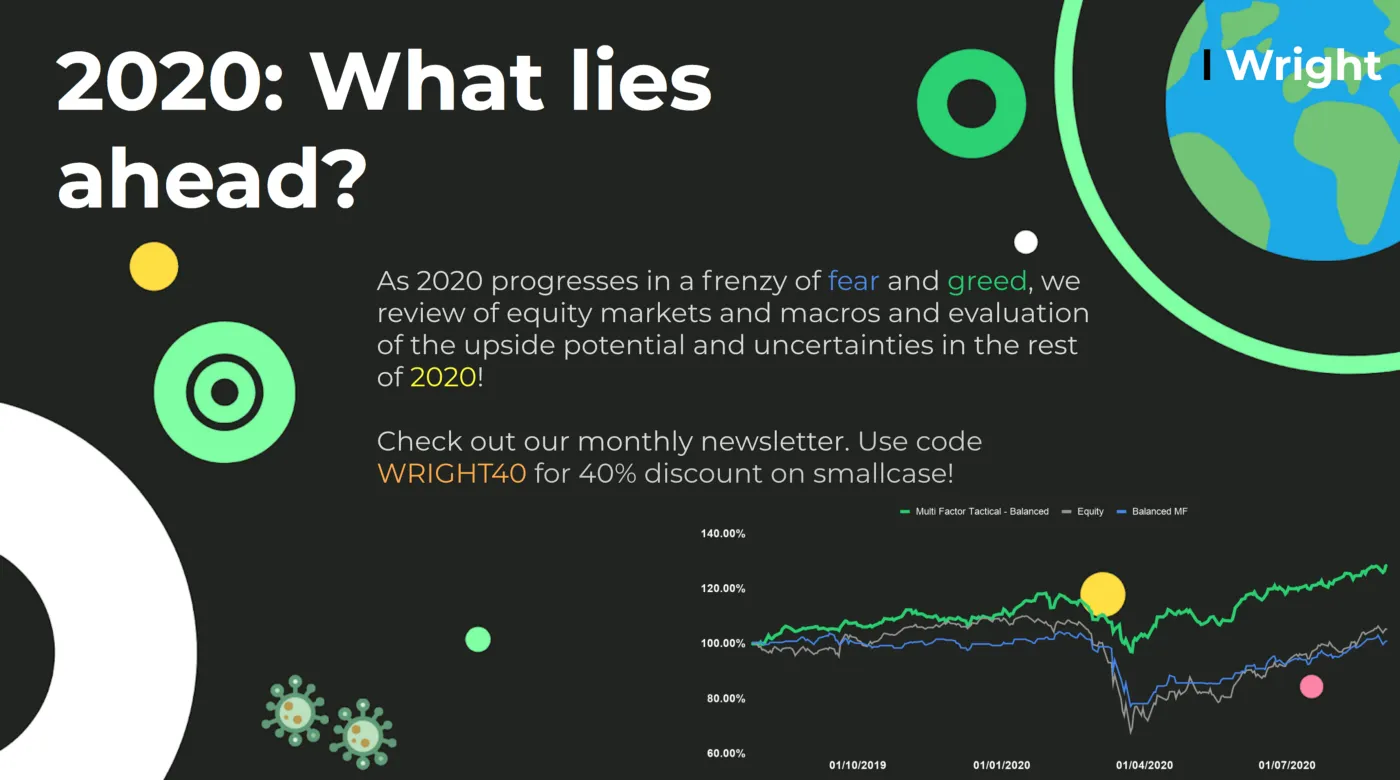

2020: What lies ahead?

by Sonam Srivastava5 min read

As 2020 progresses in a frenzy of fear and greed, we review of equity markets and macros and evaluation of the upside potential and uncertainties in the rest of 2020!

Economic Impact of India-China trade war

by Sonam Srivastava5 min read

Let us understand the economic implications of India-Chine trade war on your portfolio.

Macro Regime Prediction Model

by Jasmeet Singh5 min read

In this post we use macro economic variables to model stock market risk and returns

Covid – 19: Impact, Recovery & Investment Strategies

by Sonam Srivastava5 min read

Once again, India and the world are in the face of a crisis like no other.

Macroeconomic perspective on the Indian Economy

by Sonam Srivastava5 min read