When Momentum Loses Momentum, Can Quality Become A Winning Trade?

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Momentum investing has faced setbacks in 2023 and 2025, leading investors to question its viability. As factor investing remains cyclical, could quality stocks—with strong financials and stability—be the next winning trade?

Why Does Momentum Work? A Behavioural Anomaly

by Sarah Essessien5 min read

Learn about momentum investing, a trading strategy driven by market trends and behavioral biases like herding, confirmation bias, and overconfidence. Discover why momentum investing works, its risks, and why it thrives in markets like India.

Optimal Rebalancing Frequency: How Often Should You Rebalance Your Momentum Portfolio?

by Sonam Srivastava5 min read

Illustration depicting various factors influencing the optimal rebalancing frequency for a momentum portfolio

Should you invest in overlapping momentum investing strategies?

by Siddharth Singh Bhaisora5 min read

Can you overlap momentum investing strategies to outperform traditional momentum strategies? Jump into how similar but different momentum investing strategies can give higher risk-adjusted returns. We combine theoretical concepts along with practical research to answer this important question!

Greatest Momentum Investors Ever: A Look At Their Best Momentum Bets

by Siddharth Singh Bhaisora5 min read

Find the greatest momentum investors ever. We look at their strategies and achievements. From Richard Driehaus, the father of momentum investing, to Cathie Wood's innovative bets on disruptive technologies. Perfect for investors interested in momentum investing strategies. Read now!

Four Years of Wright Momentum: Mastering the Art of Building a Successful Momentum Strategy

by Sonam Srivastava5 min read

Four Years of Wright Momentum: Mastering the Art of Building a Successful Momentum Strategy

Building a Winning Portfolio: Factor Investing Strategies and Tips

by Sonam Srivastava, Akashdeep Bhateja5 min read

Discover how you can create a successful and diversified investment portfolio with the help of factor investing mutual funds as well as tips and tricks from experts.

What is momentum investing? All your questions answered for Wright Momentum & Alpha Prime Smallcase!

by Sonam Srivastava, Siddharth Singh Bhaisora5 min read

Learn the key differences between momentum investing, trading trend investing and more! We cover time horizon, best momentum factors, the right momentum smallcase and even discuss the best momentum portfolio management service (PMS). Get insights on popular momentum factors & risk management.

Top Indicators For Momentum Investing

by Sonam Srivastava5 min read

Discover the power of momentum investing in our latest article! Learn about key indicators used by seasoned investors, the role of behavioral finance, and strategies like time series, relative, and dual momentum.

Emerging Market Stocks: A New Era of Growth & Opportunities

by Sonam Srivastava5 min read

Explore the shift from bonds to stocks in emerging markets like India and China, driven by the various factors such as US credit rating downgrade by Fitch, growth opportunities, economic resilience, and investment strategies reflecting global changes. Read more about the rise of India and China.

Unleashing the Power of Momentum: Factors to Consider before Investing in Small Caps

by Sonam Srivastava5 min read

Explore the uptrends in small-cap stocks and the power of momentum investing. Dive into key factors fueling these trends, explore portfolio performances, and get an intricate look at sector and industry trends. A must-read for investors seeking to understand and tap into these promising trends.

Alpha Prime: Unveiling Our New Concentrated Momentum, High-Risk Investment Portfolio

by Siddharth Singh Bhaisora5 min read

Alpha Prime: Unveiling Our New Concentrated Momentum, High-Risk Investment Portfolio

What is Momentum Investing? A Comprehensive Guide to Understanding Momentum Investing

by Siddharth Singh Bhaisora5 min read

What is momentum investing? How were the early practitioners? What are the pros and cons of investing in momentum strategy? We answer all these questions & more about momentum investing! Read now!

Complete guide to Momentum Investing & the Wright Momentum Portfolio

by Siddharth Singh Bhaisora5 min read

Get a complete understanding of what is momentum investing, why you should invest in momentum strategies, the risk factors to consider when investing in momentum and more. Learn everything about Wright Momentum, how we invest in the momentum factor, the rationale behind our investment methodology.

What are the different types of Algo Trading?

by Alina Khan5 min read

Discover what is algorithmic trading with various types unveiled. Learn how these strategies work & their potential impact on the financial markets. Read More.

Market & Performance Update - 4th June 2023

by Sonam Srivastava5 min read

Market & Performance Update - 4th June 2023

What is the Momentum Investment Strategy?

by Alina Khan5 min read

Discover the Momentum Investment Strategy and its potential for maximizing returns in our comprehensive guide at Wright Research. Click to read more.

History of Momentum Investing and its Strategies ⚡️

by Sonam Srivastava5 min read

Uncover Momentum Investing: Definition, Smallcase Integration, India-specific Strategies. Explore benefits & history at Wright Research for growth potential.

Why Momentum Investing?

by Sonam Srivastava5 min read

Explore the insights into momentum investing strategies. Learn Why Momentum Investing works with expert analysis from Wright Research's informative blogs.

Emerging Investment Themes for 2023

by Sonam Srivastava5 min read

As 2022 comes to a close, most of the world still faces stubbornly high inflation, aggressive interest-rate hikes and geopolitical tensions. But Indian market already has some exciting themes emerging that can bring a lot of color to our portfolios.

The Multibaggers of Momentum

by Sonam Srivastava5 min read

Explore the concept of Multibagger Momentum. Discover the best multibagger stocks, learn how to find & understand the key characteristics that drive their success in the stock market.

Momentum is an amazing Long Term strategy

by Sonam Srivastava5 min read

There is recurring doubt among investors that Momentum might not be a strategy suited for the long term as it is trying to capture short-term trends. But if you look at the data, you’ll find that Momentum is, in fact, an excellent strategy for the long term.

Top Myths About Momentum Investing - Busted!

by Sonam Srivastava5 min read

Momentum Investing is simply defined as the strong predictive power of past returns influencing future returns. Unfortunately, a momentum-based investing approach can confuse investors, and so creep up several myths about Momentum Investing. In this post, we will set the record straight and bust som

One Year of Momentum - Investor Playbook

by Siddhart Agarwal5 min read

These days, momentum investing is all the rage. However, this rage is not irrational as a momentum approach is designed to profit from the bull market and, we have witnessed a dream bull run phase.

Momentum Investing: Risk, Reward & Everything Else

by Sonam Srivastava5 min read

Explore the world of momentum investing in India. Learn what it is, discover effective strategies, and assess the pros and cons of this investment approach.

Wright Momentum

by Sonam Srivastava5 min read

With the uncertainty in August behind us, the markets are back in their glory this September, and the (W)right way to get a flavor of the trending market is the Wright Momentum portfolio!

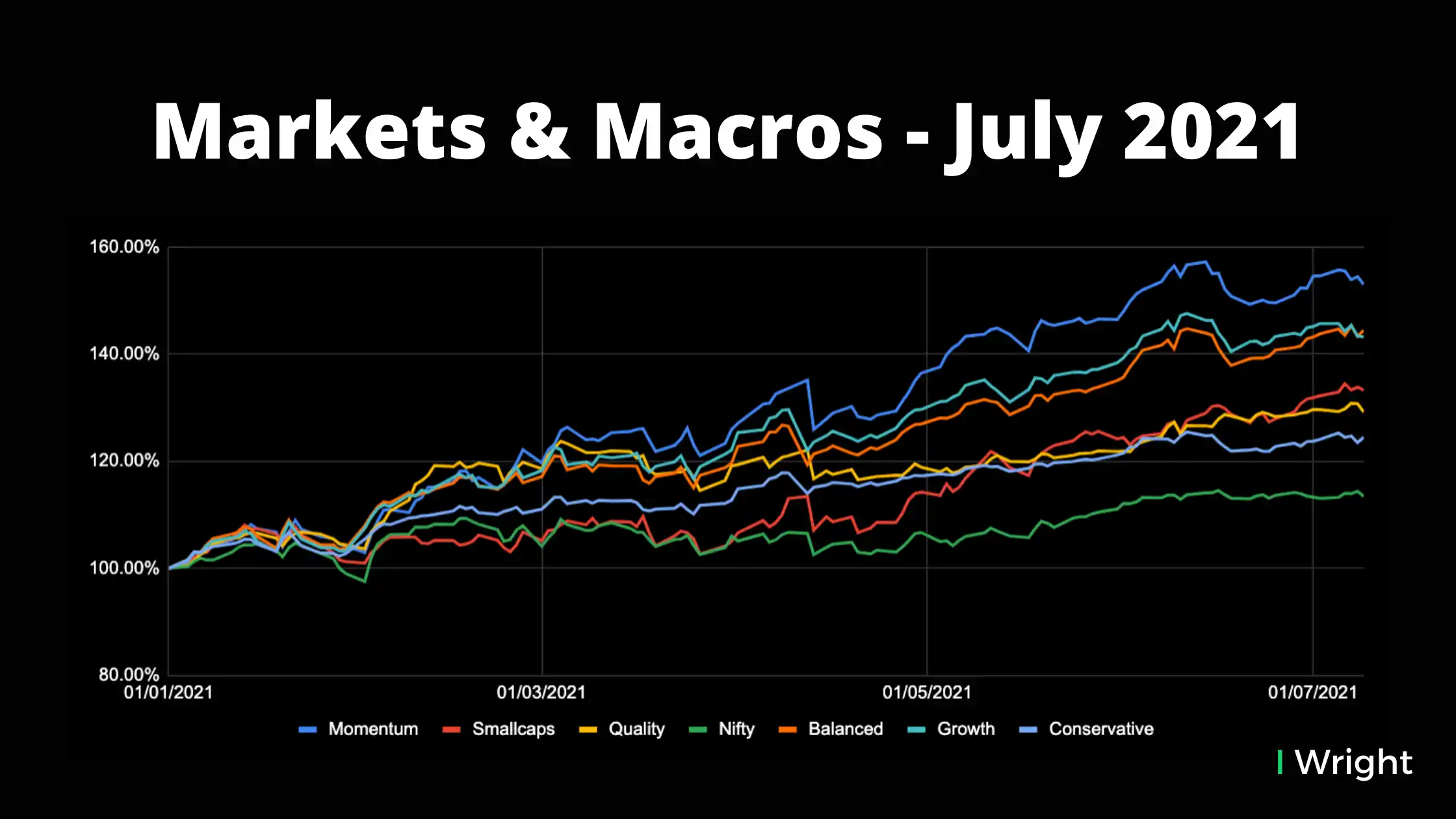

Markets & Macros - July 2021

by Sonam Srivastava5 min read

Once a month, it makes sense for us to take a pause and look at the markets & macros to make sense of all the noise. Here we look at markets, our performance and hits & misses

Momentum + Volatility Investing

by Aditya Bakde5 min read

In this post Aditya Bakde talks about how he used Wright Simulator to build a momentum & volatility strategy

Sector Rotation with Augment Capital

by Sonam Srivastava5 min read

Sector rotation strategies may help you align your portfolio with your market outlook and the different phases of the business cycle

Wright ⚡️Momentum

by Sonam Srivastava5 min read

Wright is launching a Momentum basket as a free for all research product, this portfolio invests in trending stocks

Wright Views: August 2020

by Sonam Srivastava5 min read