Wright Portfolios 2024 Wrapped: A Year of Growth & Evolution

by Sonam Srivastava5 min read

Wright Portfolios 2024 Wrapped: A Year of Growth & Evolution

Transforming the Investment Landscape with Wright Research - Founder’s Desk

by Sonam Srivastava5 min read

Transforming the Investment Landscape with Wright Research - Founder’s Desk

Market & Performance Update - 4th June 2023

by Sonam Srivastava5 min read

Market & Performance Update - 4th June 2023

Decoding the market craziness with data

by Sonam Srivastava5 min read

Decoding the market craziness with data

Impact of Global Recession on Indian IT sector

by Sonam Srivastava5 min read

The Indian IT sector is a significant contributor to the global economy, generating billions of dollars annually. However, just like any other industry, it is affected by global economic downturns.

Bye 2022. You wont be missed!

by Sonam Srivastava5 min read

We had big hopes for you 2022, but needless to say, you turned out to be one of the craziest years for investors. Here’s looking back at 2022 - obviously with memes!

Emerging Investment Themes for 2023

by Sonam Srivastava5 min read

As 2022 comes to a close, most of the world still faces stubbornly high inflation, aggressive interest-rate hikes and geopolitical tensions. But Indian market already has some exciting themes emerging that can bring a lot of color to our portfolios.

Overvaluation, Rate Hikes and What Looks Attractive?

by Sonam Srivastava5 min read

Our market has been the most robust over the last year and is at a much higher valuation multiple than many emerging markets. Is this a concern during global recessionary fears.

India vs Emerging Markets

by Sonam Srivastava5 min read

India has left behind the emerging market by a wide margin over the past few years in terms of stock market growth rate. But are we also over-valued?

Markets @ All-Time High | Factors to Watch

by Sonam Srivastava5 min read

Ever since the inflation numbers have eased and the US FED has hinted at a slower rate hike, the market euphoria has returned. Nifty is almost touching the all-time high of 18600, and we have seen the FIIs return to India!

Multi Factor Investing: Strategies, Benefits, & Best Multi-Factor ETFs

by Sonam Srivastava5 min read

Find out how multifactor investing can help you to enhance your portfolio by exploring strategies, benefits and the top multi-factor exchange traded funds in India.

This week in investing memes

by Sonam Srivastava5 min read

Let’s unwrap the market with some charts and some high-quality memes!

The Multibaggers of Momentum

by Sonam Srivastava5 min read

Explore the concept of Multibagger Momentum. Discover the best multibagger stocks, learn how to find & understand the key characteristics that drive their success in the stock market.

No Gyan, Only Data

by Sonam Srivastava5 min read

Are you tired of all the investment gyan ever present on the internet? I know that I am. Every other investment manager is rattling off about the long-term story and the strength of the Indian market. So we thought that this week, we would not join the bandwagon!

Investor Questions Answered - Diwali Edition

by Sonam Srivastava5 min read

Diwali is a season that brings in luck! Where should we invest this Diwali and what to look out for in the next year? Find out…

Performance

by Sonam Srivastava5 min read

The biggest USP for Wright Research portfolios is our strong investment philosophy. It is a great thing that this philosophy has also led to a fantastic performance.

2 Years of Wright Research

by Sonam Srivastava5 min read

Celebrate the 2 year milestone with us! Use coupon code 2YEARS for 30% discount

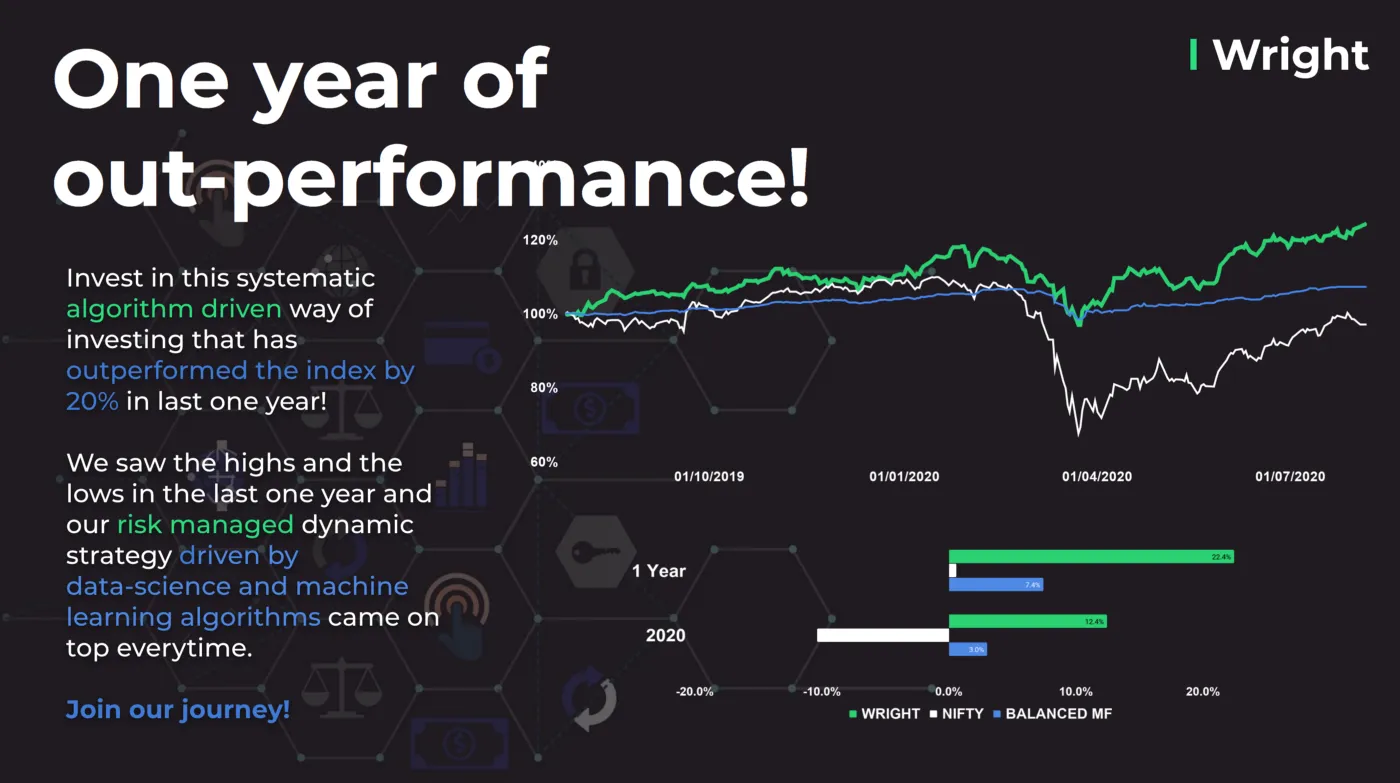

One Year of Outperformance

by Sonam Srivastava5 min read

Last week, Wright completed one year of offering our flagship portfolios to investors via smallcase! This first year of our journey has been the most incredible

Wright Views: August 2020

by Sonam Srivastava5 min read

Monthly newsletter for August commenting on the markets, economy, equity factors & our portfolio

Performance Update: Nine months and a market crash!

by Team Wright5 min read

We completed 9 months of live performance and survived a market crash!

Three month performance update

by Team Wright5 min read

We have completed 3 months since we started our multi asset tactical portfolios!

All you need to know about the Multi Factor Tactical portfolio

by Sonam Srivastava5 min read