The IndusInd Saga 2025 : A Wake-Up Call on Derivative Risks

by Naman Agarwal5 min read

IndusInd Bank faces a ₹1,500 crore loss due to a derivatives hedging lapse, impacting its financials and stock price. Will RBI intervene? Read more.

The Importance of Continuous Monitoring in Financial Risk Management for Investments

by Alina Khan5 min read

Continuous monitoring in investments acts as an early warning system, helping you identify and manage risks before they impact your portfolio. Learn how to implement it effectively.

Risk Management with Candlestick Patterns: A Comprehensive Guide

by Alina Khan5 min read

Learn how these patterns, rooted in 18th-century Japan, offer insights into market sentiment and future movements, enabling traders to make informed decisions.

Risk Management Strategies in Financial Management: Assessing, Mitigating, and Hedging Risks

by Alina Khan5 min read

"Delve into effective risk management strategies for financial markets in India. This article explores key approaches for managing market, credit, operational, and liquidity risks, offering insights for businesses and investors on navigating uncertainties.

Understanding Mutual Fund Risks: A Comprehensive Guide for Investors in India

by Alina Khan5 min read

Identify the different types of risks involved when investing in mutual funds in India, such as market risk, interest rate risk etc.Get unique insights into managing these risks through diversification, risk assessment, a long-term perspective, regular monitoring, and professional advice,.

Building a High Risk, High Return Portfolio: A Step by Step Guide

by Akashdeep Bhateja5 min read

Comprehensive guide to high-risk, high-return investing - understand the methodology of constructing a robust alpha portfolio, and understand the critical considerations and strategies to aggressive investing. High-growth sectors, asset allocation, risk management, & more to strategize investments.

Find Out What Portfolio Risk Is & How to Reduce It

by Alina Khan5 min read

Explore the intricate dynamics of portfolio risk, the various types, and the art of risk management. From asset allocation to diversification, learn how to calculate and mitigate potential financial loss. Discover tools, examples, and strategies to navigate the investment landscape, balance returns.

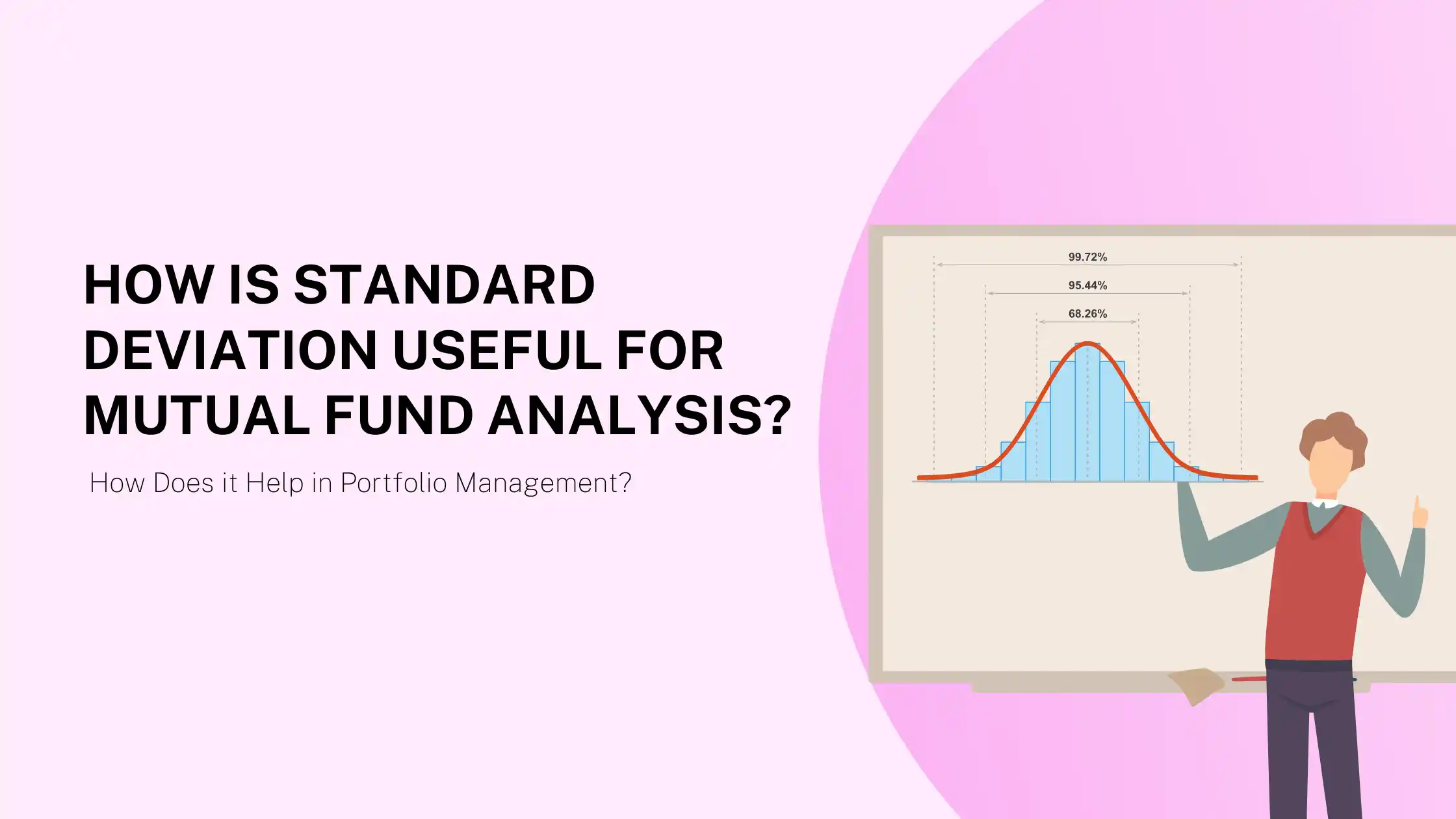

What is Standard Deviation in Mutual Fund and How Does it Help in Portfolio Management?

by Alina Khan5 min read

Uncover the significance of Standard Deviation in mutual fund investments and its impact on portfolio management. This comprehensive guide explains how this statistical tool measures volatility, assists in diversification, and aids in making informed investment decisions. Read now!

This week in investing memes

by Sonam Srivastava5 min read

Let’s unwrap the market with some charts and some high-quality memes!

Investor Questions Answered - Diwali Edition

by Sonam Srivastava5 min read

Diwali is a season that brings in luck! Where should we invest this Diwali and what to look out for in the next year? Find out…

Market Volatility Decoded

by Siddhart Agarwal5 min read

In this week’s blog post, we try to analyze the distinct reasons that alarmed the markets in the past 5-7 trading sessions. We also attempt to highlight a silver lining among this chaos and conclude with a performance report of our portfolios.

Risk Management at Wright Research

by Sonam Srivastava5 min read

Learn how to manage risk effectively. Our comprehensive guide covers key strategies and insights to navigate the complex world of financial risk.

How to handle panic in the markets?

by Sonam Srivastava5 min read

The crash in Adani stocks on Jun 14th shook our portfolios, In this post we talk about this scenario and how we handled it.

What happens to your momentum portfolio in times of risk?

by Sonam Srivastava5 min read

As the subscribers are growing in our high risk high return momentum portfolio, there are increasing number of investor queries and concerns about what happens to these portfolios in the times of risk.

How much do you pay for your Wright portfolio?

by Sonam Srivastava5 min read

The Wright Research portfolio look extremely attractive when you look at our smallcase pages but there costs built in. In this post we explore how much the performance decreases due to costs.

Investor Risk Profiling

by Team Wright5 min read

A risk profile is an evaluation of an individual’s willingness and ability to take risks. A risk profile is important for determining a proper investment asset allocation for a portfolio.

Portfolio Optimization Methods

by Sonam Srivastava5 min read