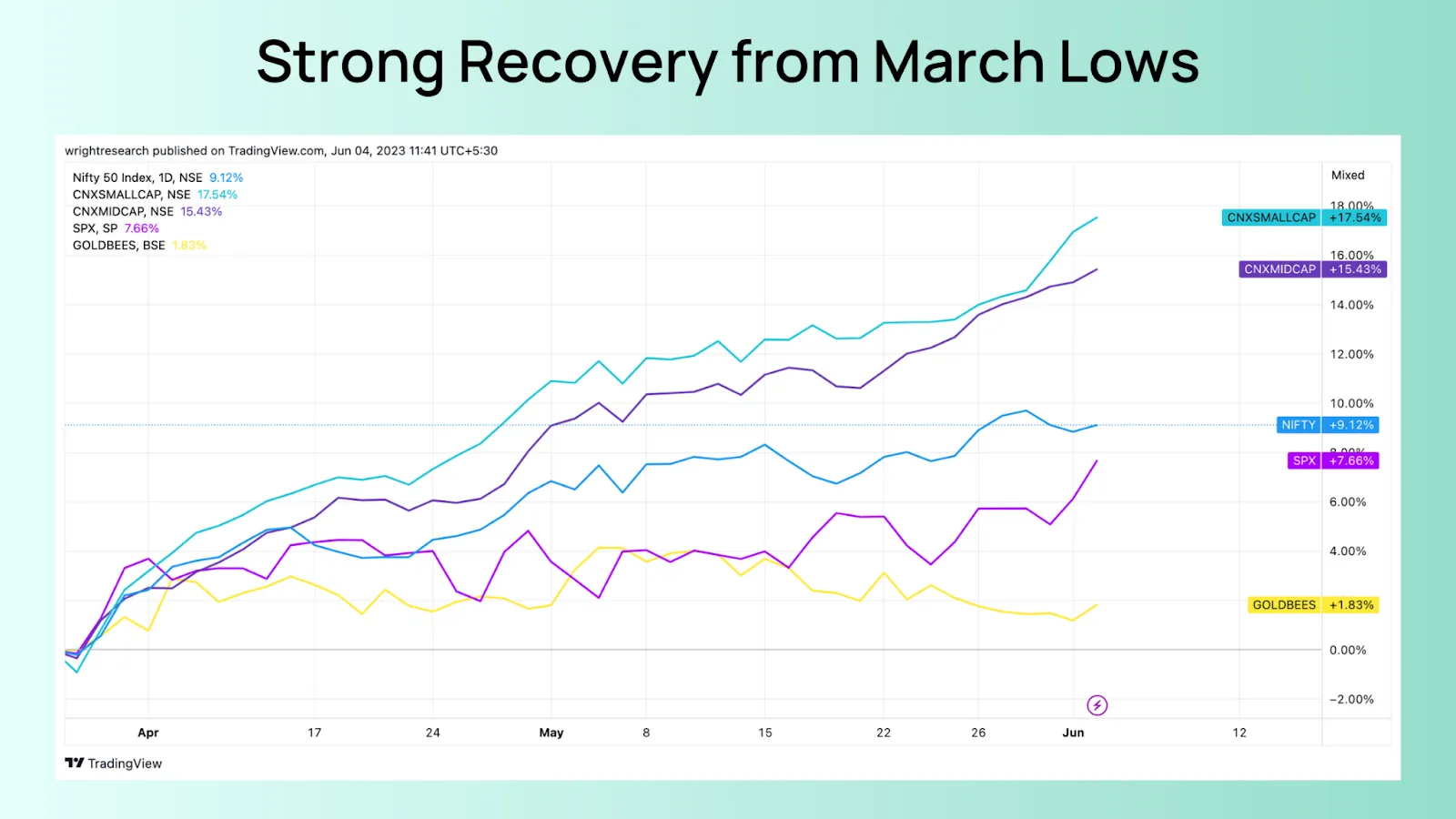

The Indian market has indeed been performing exceptionally well since April 2023, as reflected in the robust performance of our portfolio strategies.

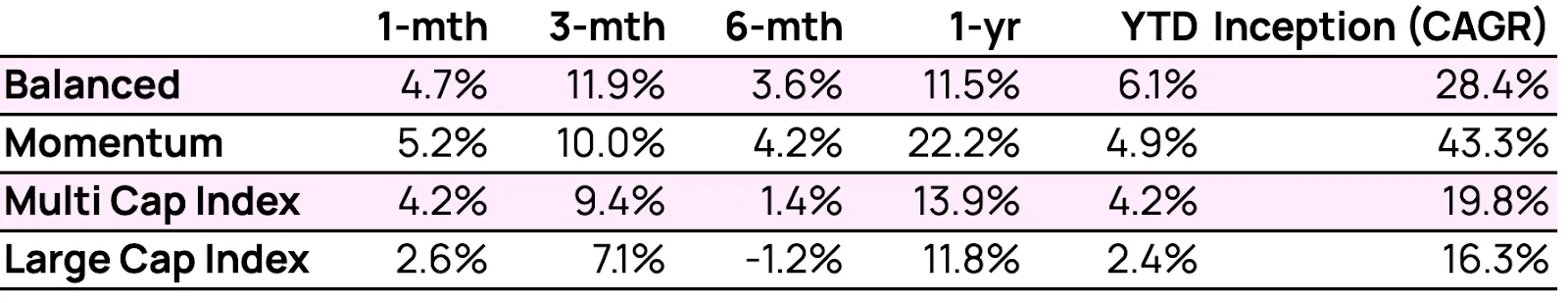

The Momentum strategy, with a one-month return of 5.2%, has generated a significant 43.3% return since inception, speaking to the robustness of the strategy. The Balanced portfolio, with a one-month return of 4.7%, has shown strength over the last quarter, delivering an 11.9% return. This indicates a consistency in performance that has resulted in an impressive 28.4% CAGR since inception.

In comparison, the Multi Cap Index and Large Cap Index have generated less impressive returns over the short term, but still offer considerable potential, especially for investors seeking to mitigate risk. They returned 4.2% and 2.6% over the past month, respectively, showcasing the steady growth in these segments of the market.

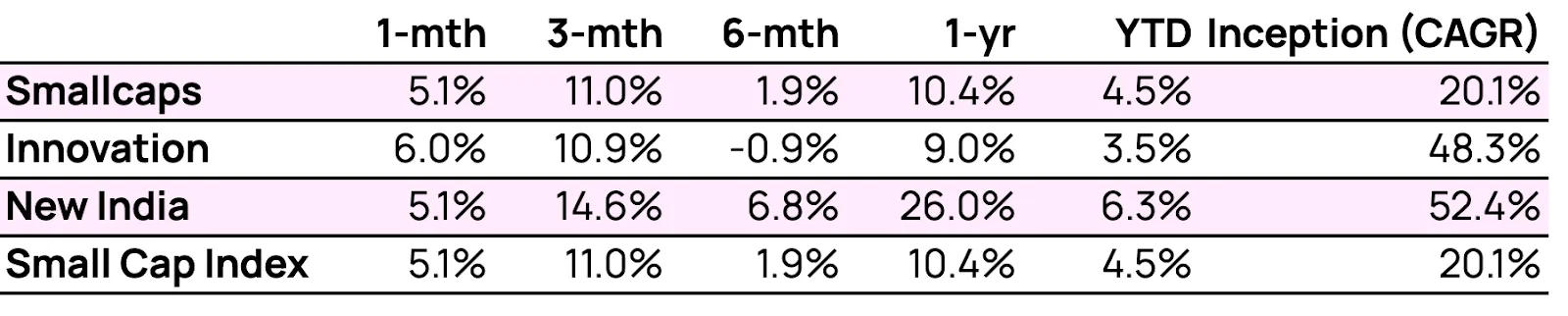

Looking at the portfolios with more smallcap exposure, the Smallcaps, New India and Innovation portfolios have also returned a healthy returns over the last month.

Given this performance, the prospect of a pause in rate hikes presents an intriguing scenario. With inflation appearing to slow down, the market might witness a supportive environment for businesses and consumers alike, which could lead to better economic conditions. Coupled with strong capital formation in the Indian economy, these macroeconomic factors create a conducive environment for further growth.

Furthermore, the robust GDP data that has been coming out of India reinforces the positive outlook for the country. This indicates a strengthening of the economic portfolioamentals that underpin the market's growth.

In light of these factors, we believe the next period will be quite interesting for the Indian market. With a confluence of strong performance, positive economic indicators, and potential for growth, there are plenty of reasons to remain optimistic about the prospects of our portfolio strategies. However, as always, it is crucial to stay attuned to any changes in the economic landscape and be prepared to adjust strategies accordingly.

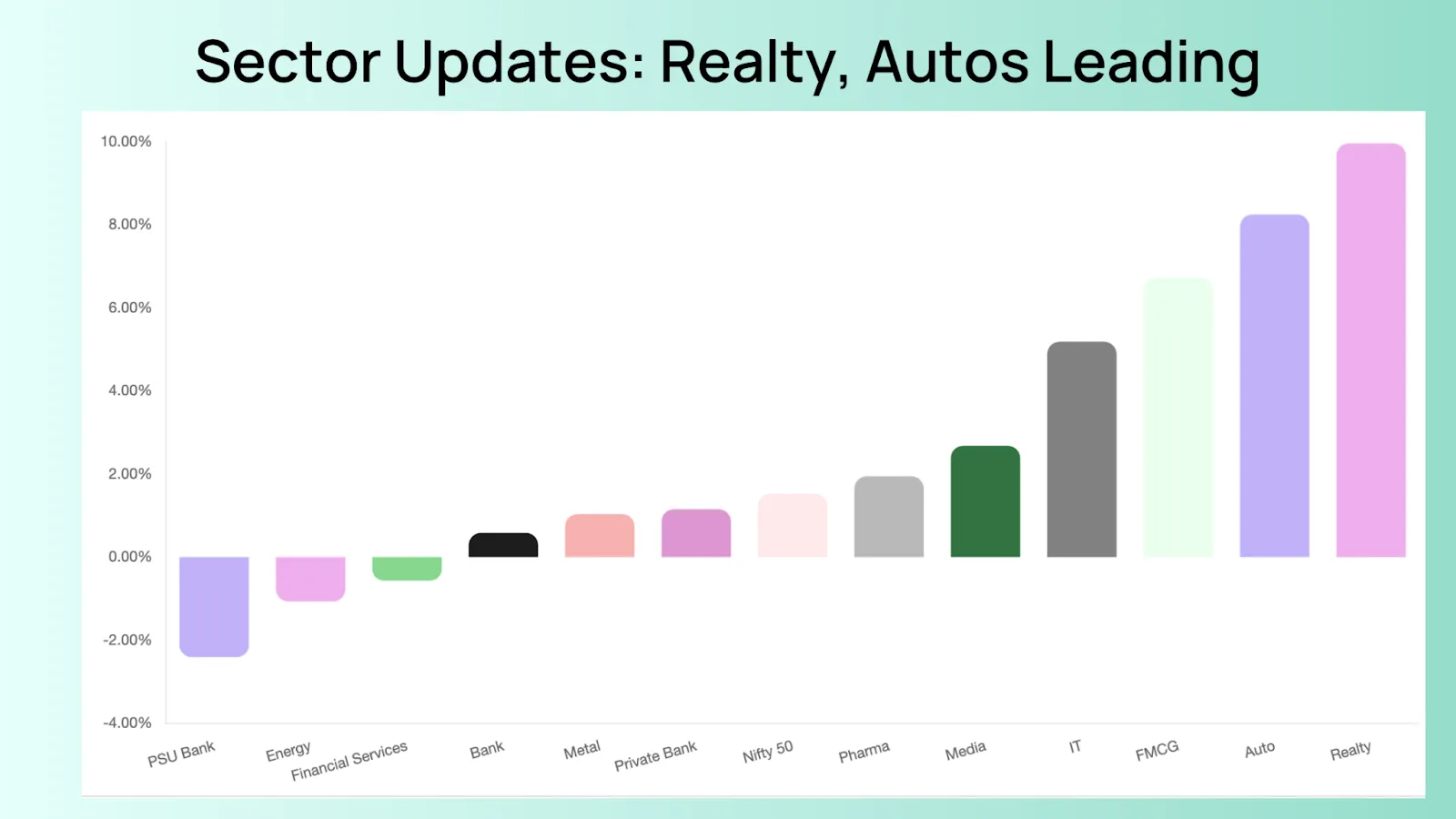

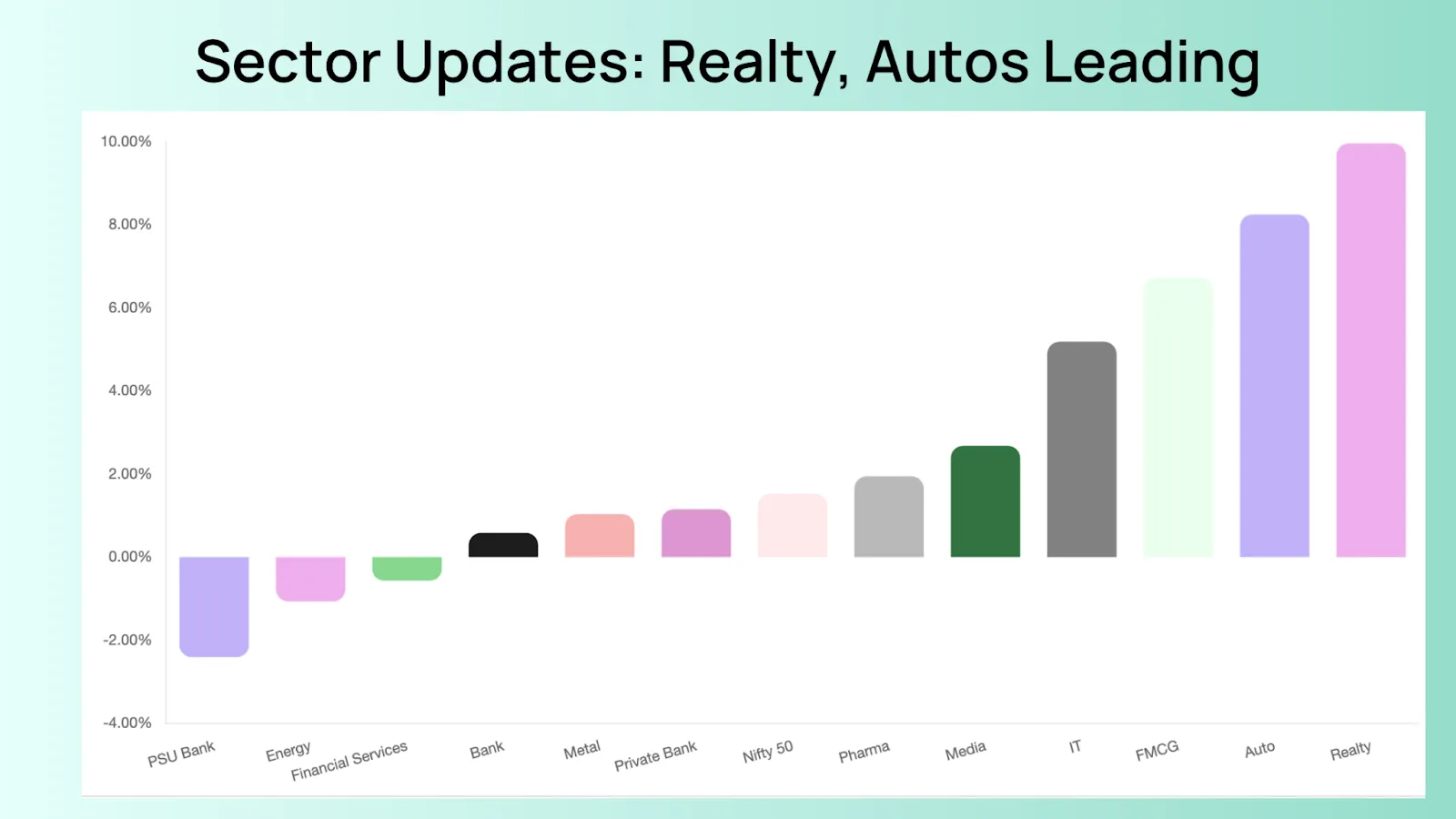

Talking about Sectors, Banks have been leaders overthe last month followed by Pharma, Financial Services and Auto. IT and Metals have lagged.

Amid these uncertainties, the importance of constructing resilient investment portfolios cannot be overstated. Specific sectors provide promising investment opportunities - capital goods and infrastructure companies could gain from the government's infrastructure push and increased capital expenditure; banking stocks may benefit from a resilient economy and improving credit conditions; pharmaceutical companies are likely to see steady demand, and the IT sector might gain from the digital transformation wave.

However, caution is warranted for sectors vulnerable to global volatility, like IT due to its exposure to foreign markets and commodity-linked sectors that are influenced by commodity price fluctuations. In this volatile environment, a well-diversified portfolio and robust risk management strategy will be the guiding lights for investors.

Momentum and Alpha are making a comeback while the bear market factors - value and dividend are lagging. If this is a sign of what the future holds, we are getting excited!

The Momentum strategy has showcased robust performance, notably outpacing both the Multi Cap and Large Cap Index in recent times. Over the last month, the Momentum strategy has yielded a return of 5.2%, as compared to the Multi Cap Index's return of 4.2% and the Large Cap Index's return of 2.6%.

When we expand the timeline to a three-month period, the outperformance of the Momentum strategy continues. It has returned 10.0%, while the Multi Cap and Large Cap indices have given returns of 9.4% and 7.1% respectively.

This superior performance could be attributed to the nature of the Momentum strategy, which leverages market trends and is geared towards stocks that have been showing an upward trajectory. The strategy's inherent propensity to ride positive market trends appears to have worked exceptionally well in the current market environment.

The Balanced strategy has shown remarkable resilience and strength in its recent performance. Over the last month, the Balanced portfolio has delivered a return of 4.7%, demonstrating a steady upward trend. This pattern of growth extends to the three-month period as well, where the Balanced portfolio provided an impressive 11.9% return.

The balanced strategy's longer-term performance is also noteworthy. Over a six-month horizon, despite fluctuating market conditions, it managed to deliver a return of 3.6%, and over a one-year horizon, it gave a strong return of 11.5%.

Year-to-date, the Balanced portfolio has achieved a return of 6.1%, showcasing its potential to provide steady returns even in volatile market conditions. Since inception, the strategy has performed exceptionally well, with a compound annual growth rate (CAGR) of 28.4%, which is commendable.

Overall, the Balanced strategy has proven to be a robust and consistent performer, demonstrating its ability to provide stable returns across varying market conditions. The recent performance data suggests that the strategy has been adept at mitigating risk while capturing growth opportunities, which is the hallmark of a well-constructed balanced portfolio.

The Smallcaps portfolio and the Small Cap Index have demonstrated strikingly similar performance across all considered time frames. On a 1-month and 3-month basis, both have achieved identical returns of 5.1% and 11.0% respectively, suggesting that the Smallcaps portfolio has successfully mirrored the index in the short term.

Over a 6-month period, the Smallcaps portfolio and the Small Cap Index again showed identical returns of 1.9%. The similarity extends to the 1-year return as well, with both posting a 10.4% return.

Year-to-date, both the Smallcaps portfolio and the Small Cap Index have provided a 4.5% return, further exemplifying their mirrored performance.

In terms of inception to date, both have achieved a CAGR of 20.0%, demonstrating an equivalent long-term growth rate.

These results indicate that the Smallcaps portfolio has been highly efficient in tracking the Small Cap Index, providing investors with nearly identical returns across all examined periods.

The Innovation portfolio has displayed remarkable performance when compared to the Large Cap Index, surpassing it on all measured timeframes. In the short term, the Innovation portfolio achieved a 7.0% 1-month return, significantly outperforming the Large Cap Index's 2.6% gain. Similarly, on a 3-month basis, the Innovation portfolio returned 11.9%, again outperforming the Large Cap Index by 4.8%.

However, over the 6-month period, the Innovation portfolio shows no gain with a 0.0% return, yet it still outperforms the Large Cap Index that recorded a -1.2% loss. On a 1-year basis, the Innovation portfolio's return is marginally lower than the Large Cap Index at 10.0% compared to 11.8%. Year-to-date, the Innovation portfolio achieved a 4.4% return, slightly surpassing the Large Cap Index's 2.4% gain

The New India portfolio has shown exemplary performance compared to the Large Cap Index, exceeding it across all timeframes. In the short term, New India outperformed the Large Cap Index by 2.9% over the 1-month period, with returns of 5.5% compared to 2.6% for the Large Cap Index. Over the 3-month period, the outperformance is even more pronounced at 7.9%.

Over a 6-month period, New India returned an impressive 7.2%, far outstripping the Large Cap Index that experienced a 1.2% decline. The 1-year performance of New India is particularly noteworthy, delivering returns of 26.5% which is more than double the 11.8% return of the Large Cap Index.

Year-to-date, New India again outperforms the Large Cap Index by a substantial margin of 4.3%.

*Kindly note that this is a display of factual performance of our curated model portfolios validated using the performance calculation methodology here. This is not an informational blog and not a solicitation to buy any of our investment products.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart