by Siddharth Singh Bhaisora

Published On Nov. 10, 2024

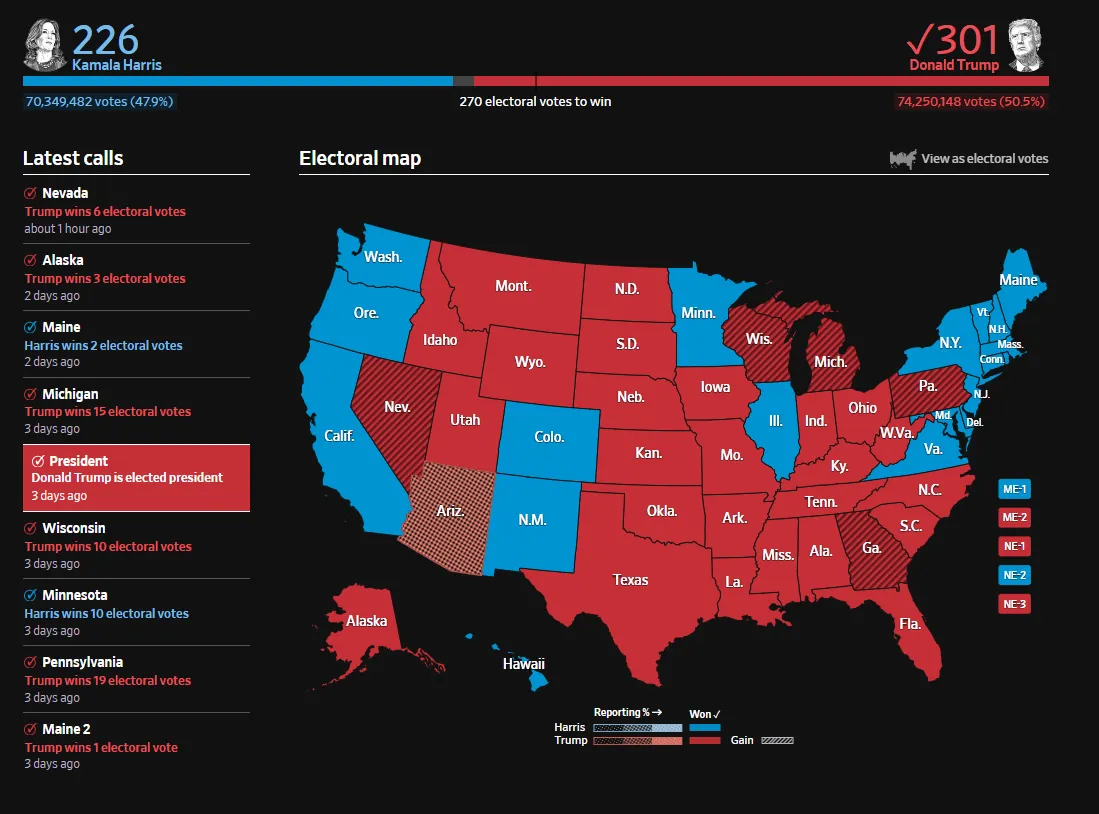

Donald Trump has clinched a second term as U.S. President in a closely contested election, defeating VP Kamala Harris. Republicans now have control over both the Senate and the House of Representatives. This election outcome, contrary to initial expectations, also includes Trump winning the popular vote. The implications of this Republican victory are extensive for global markets, as investors adjust to anticipated fiscal policies, tariffs, and sectoral impacts.

While the market has factored in some potential fiscal expansion and tariff-related inflation risks, it remains premature to assess the full economic impact of Trump’s second term. With the U.S. facing high fiscal deficits and debt levels, "economics will Trump politics," as practical fiscal concerns take precedence. Trump’s renewed term promises a range of policies aimed at growth, inflation control, and global trade re-balancing. WRITE

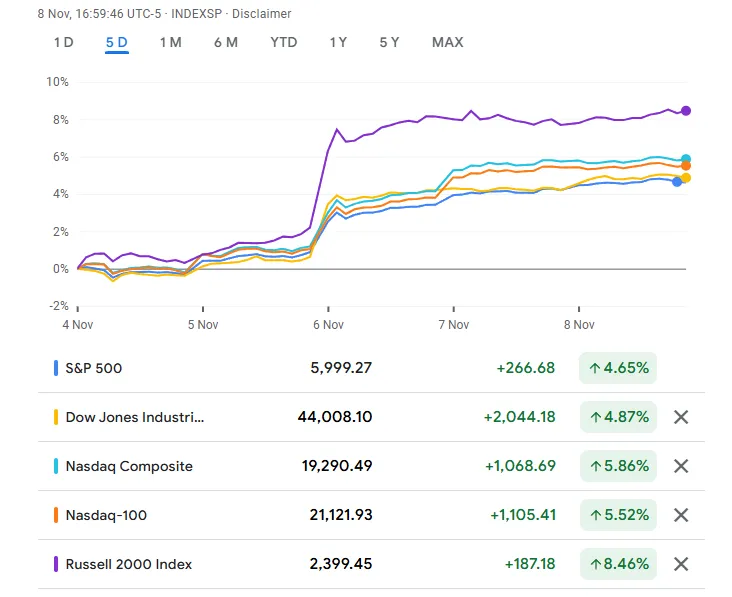

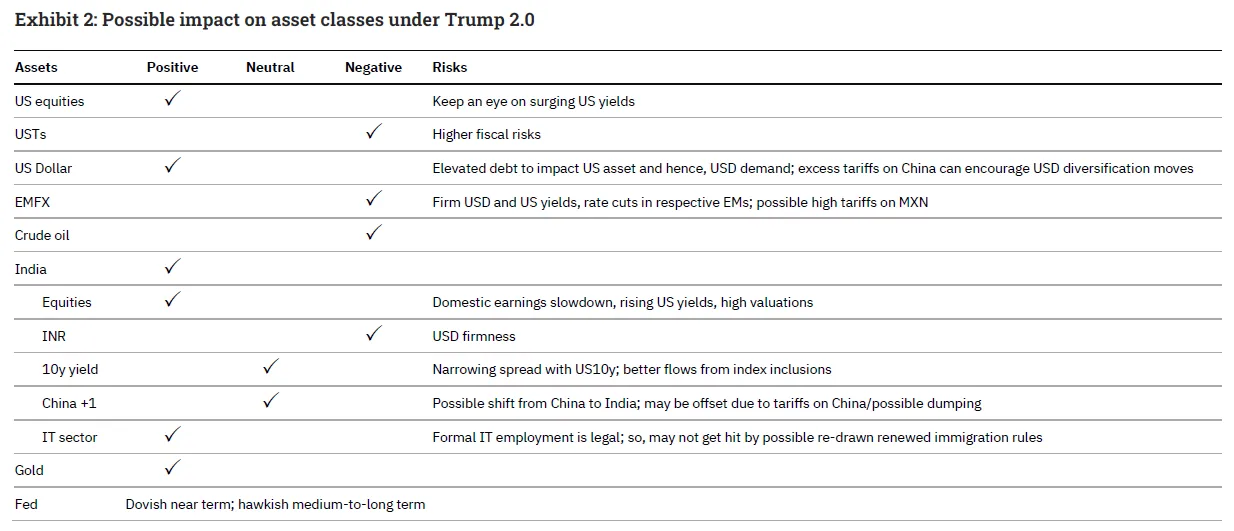

Trump’s second term is expected to support a bullish U.S. stock market environment, primarily due to the anticipated extension of the Tax Cuts and Jobs Act and relaxed regulatory policies, both of which are expected to spur economic growth. Projections indicate U.S. GDP growth could reach 2.4% in 2025 (compared to 2.1% under baseline assumptions), supporting earnings growth for U.S. companies.

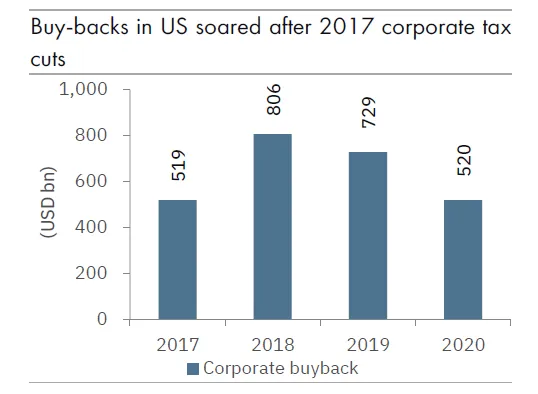

The corporate tax rate is likely to be cut further from 21% to 15% for domestic manufacturers, stimulating investment in American industries and expanding the stock rally beyond Big Tech. Lower corporate taxes should also lead to an increase in stock buybacks, similar to the trend seen after the 2017 Tax Cuts and Jobs Act, which saw buybacks rise from $519 billion in 2017 to around $800 billion in 2018, with growth persisting through 2019 and 2020. A combination of improved profitability, tax reductions, and stock repurchases should contribute to higher stock prices, attracting near-term inflows into the U.S. equity markets.

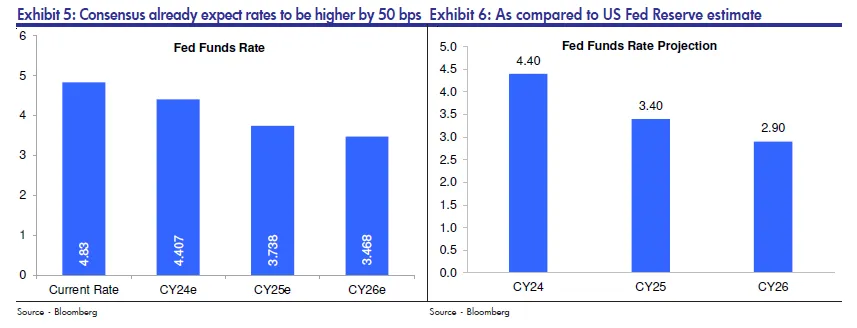

Under Trump’s policies, we expect the Federal Reserve to adopt a more hawkish stance in the long term, driven by rising fiscal risks and potential inflationary pressures. Fiscal expansion related to Trump’s campaign promises could increase the fiscal deficit as a percentage of GDP by an average of 219 basis points through 2026-2035, potentially pushing inflation upward.

If inflation remains elevated, the Federal Reserve may slow its rate-cut trajectory, with the U.S. 10-year Treasury yield potentially reaching 5% in the coming months. This rise in yields could strengthen the U.S. Dollar, impacting emerging market currencies, including the Indian Rupee (INR).

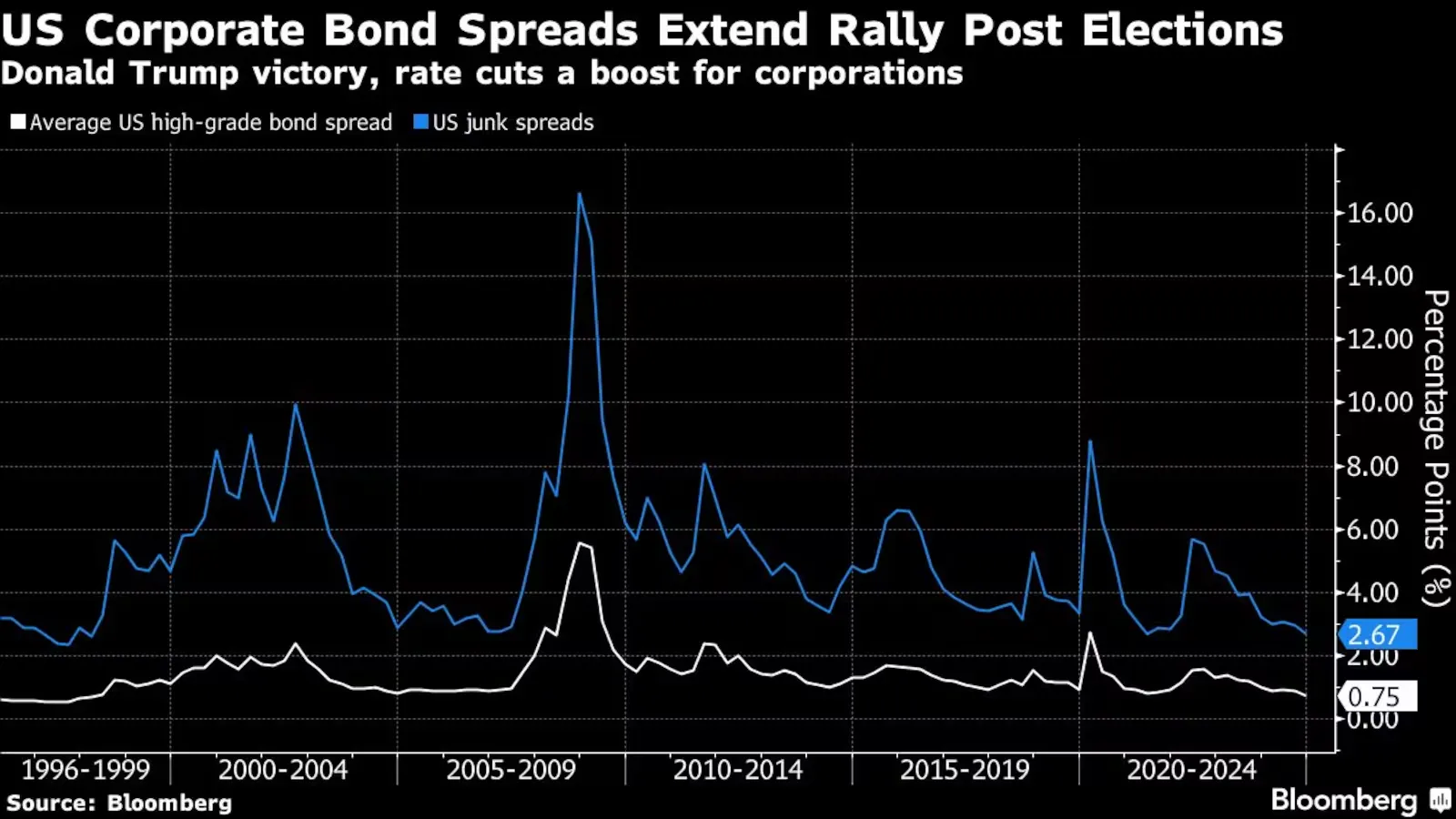

Since mid-September, the 10-year U.S. Treasury yield has risen by approximately 80 basis points, an unusually large move. This spike is driven by Treasury market uncertainty, while corporate bonds have remained more stable, absorbing some of the yield increases through tighter spreads.

With Republican control expected to bring expansionary fiscal policies and a higher deficit, the bond market may face ongoing volatility. This environment makes it challenging to find attractive entry points for long-term bonds, prompting a balanced duration strategy with a focus on medium-term (3-7 years) maturities to manage reinvestment risks without excessive exposure to duration. Long-duration, high-quality bonds should be retained primarily as a hedge against potential recession risks in the U.S.

With Republican control expected to bring expansionary fiscal policies and a higher deficit, the bond market may face ongoing volatility. This environment makes it challenging to find attractive entry points for long-term bonds, prompting a balanced duration strategy with a focus on medium-term (3-7 years) maturities to manage reinvestment risks without excessive exposure to duration. Long-duration, high-quality bonds should be retained primarily as a hedge against potential recession risks in the U.S.

Historically, pro-growth policies under Trump’s first term bolstered the U.S. dollar and bond yields, putting pressure on gold prices; by the end of 2016, gold had declined over 10% from Election Day levels. However,today there are heightened concerns over rising U.S. debt levels, which could potentially undermine the dollar’s status as a global reserve currency, providing long-term support for gold. Trump’s confrontational geopolitical stance, especially toward China, could also generate short-term volatility in gold prices. Still, gold’s role as a geopolitical hedge has historically provided only temporary price spikes, unless tensions have sustained economic impact.

Additionally, central banks, particularly the People’s Bank of China, continue to increase gold reserves to reduce dependence on the U.S. dollar and mitigate the risk of sanctions. For gold investors, central bank buying remains a more substantial long-term driver than the immediate election outcome.

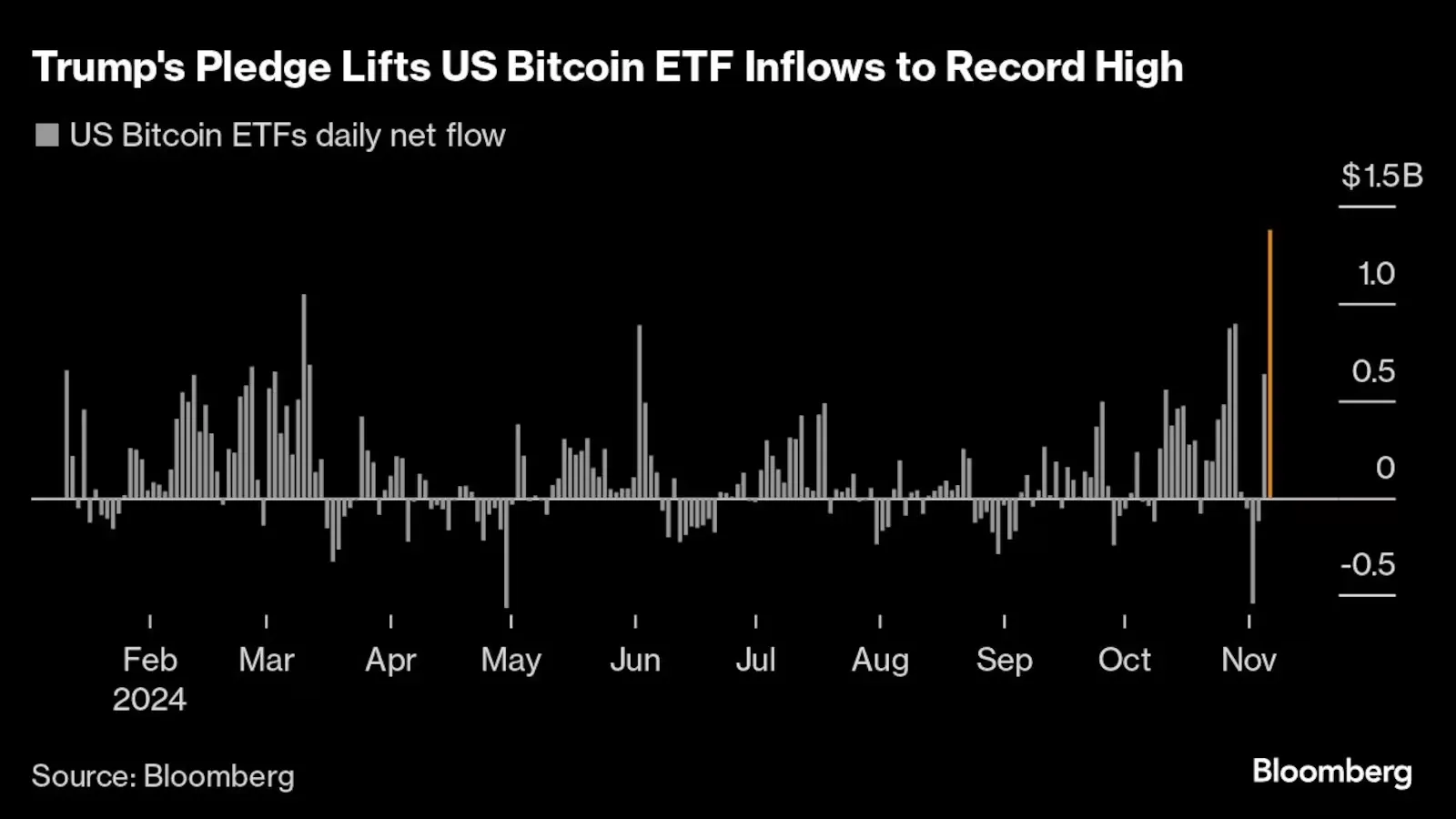

Bitcoin surged 9% to reach new all-time highs following Trump’s win. Republicans are expected to expedite regulatory clarity on stablecoins, self-custody, and anti-money laundering compliance, benefiting the broader crypto market. The rise in Bitcoin and Ethereum prices reflects market optimism about a stable regulatory environment; however, Solana’s underperformance compared to Ethereum highlights its vulnerability to regulatory ambiguity.

As the election results settle, crypto markets are likely to remain volatile, with expensive hedging due to anticipated moves from the Federal. If the Fed cuts rates more aggressively than expected, it could boost digital asset prices further. A pause in the Fed’s quantitative tightening could also support upward trends in crypto, as increased dollar liquidity would improve market sentiment for digital assets.

One of the key issues of Trump’s re-election for global markets includes the speed of tariff implementation, the scale of tariffs on China, and the possibility of universal tariffs impacting imports worldwide. The new U.S. administration may act quickly, potentially implementing tariffs on China as early as the first half of 2025 as investigations and frameworks from previous administrations remain in place.

There is speculation around a 10% universal tariff on all imports. Although this approach may be legally feasible, its untested nature could complicate implementation. A universal tariff would risk trade tensions not only with China but also with allies like Europe and Mexico, leading to bilateral disputes and potential retaliatory tariffs.

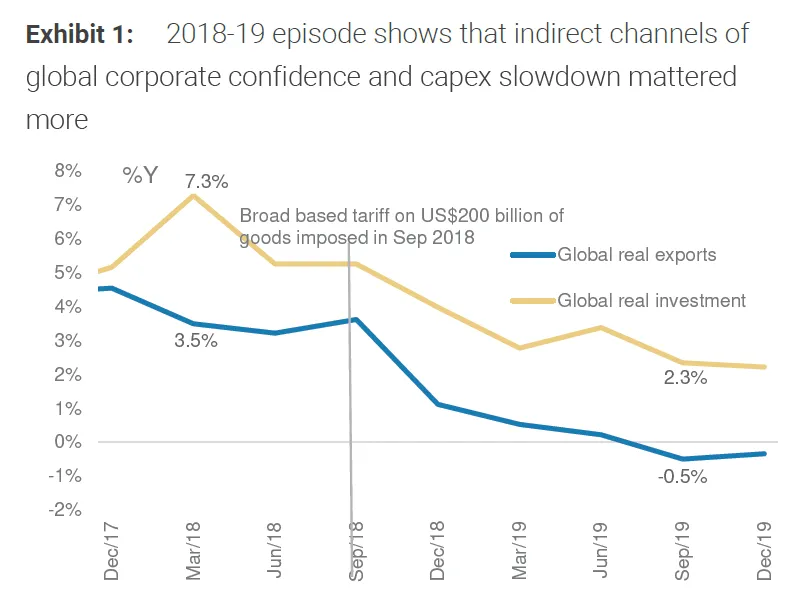

The 2018-19 tariff episode offers valuable insights into how indirect economic channels—such as global corporate confidence and capital expenditure cycles—can amplify the effects of tariffs. During this period, global capex and corporate sentiment slowed significantly, impacting Asia’s growth more heavily than the direct impact of tariffs on exports.

Global real exports and investment growth declined sharply following the imposition of tariffs in September 2018, primarily due to reduced corporate confidence and a slowdown in capex.

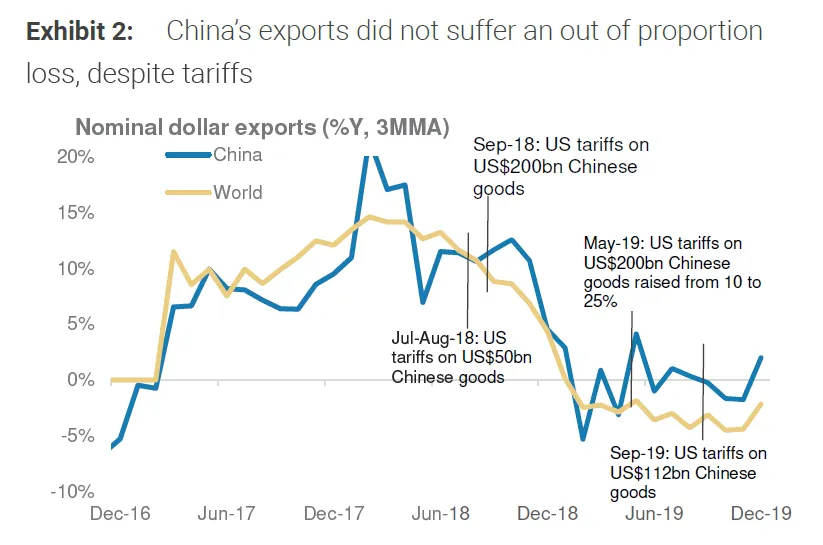

While China’s exports slowed, the decline was less severe than global export growth, suggesting that indirect effects had a broader global impact.

If the U.S. imposes a 50% tariff on Chinese imports, the impact on Asia’s growth may be less severe than during the 2018-19 period. Key factors supporting this outlook include:

Supply Chain Diversification: Since 2018, companies have invested in diversifying supply chains. Consequently, China’s reliance on U.S. markets has diminished, with U.S. revenue exposure for Chinese companies dropping from 5.7% in 2017 to 3.7% in 2024.

Reduced U.S. Share in Chinese Exports: The U.S. share in China’s exports has steadily declined, reducing China’s vulnerability to direct tariff impacts.

As a result, a 50% tariff may lead to a more contained hit to global and Chinese corporate confidence compared to 2018-19, particularly given the resilience built into global supply chains over the past seven years.

A combined 50% tariff on Chinese imports and a 10% universal tariff on all other imports would create a more complex economic landscape for Asia, potentially mirroring the economic slowdown seen in 2018-19:

Broader Impact on Global Confidence and Capex: A universal tariff would likely extend beyond trade tensions with China, leading to a larger hit on global corporate confidence, capex cycles, and the broader trade environment. The compounded effect could result in a global growth drag of around 0.9 percentage points or more, as seen in 2018-19.

Disruption to Supply Chain Diversification: A universal tariff could reduce the incremental benefits of supply chain diversification for Asian economies. Instead of favoring friend-shoring or near-shoring in Asia, companies may lean toward reshoring production to the U.S., reducing Asia’s attractiveness as a diversification alternative.

The impact of these tariffs will vary across Asian economies, influenced by each country's trade exposure to China and the U.S., as well as the degree of reliance on global trade cycles.

Asia ex-China’s sensitivity to a slowdown in Chinese exports, showing varied impacts across countries:

High Exposure: Australia and Indonesia are highly exposed to China, with exports heavily tied to the Chinese market. They are likely to feel a stronger impact from a slowdown in China’s export growth due to indirect channels.

Moderate Exposure: South Korea, Taiwan, Malaysia, and Thailand have moderate exposure, given their integration within Asia’s supply chains and reliance on trade.

Low Exposure: India, Japan, and the Philippines are relatively insulated, with lower shares of exports to China and higher resilience to tariff-driven disruptions.

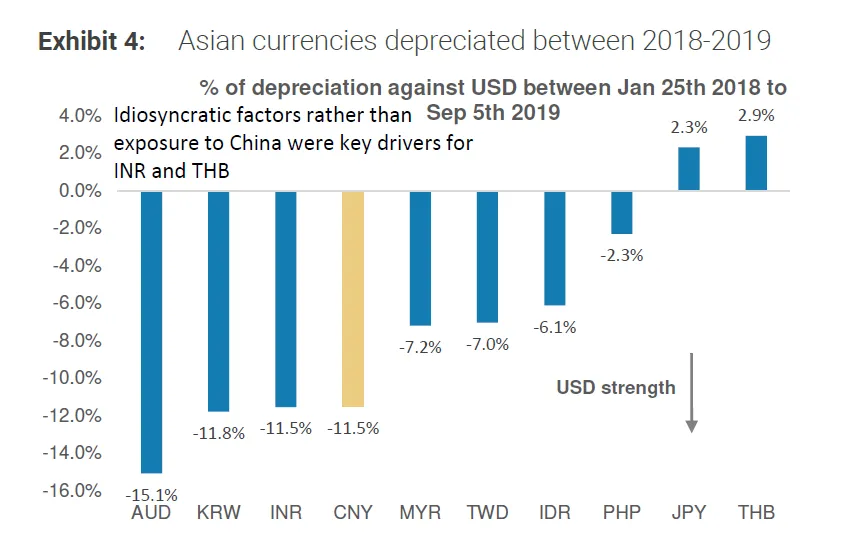

Currency depreciation in Asia during the 2018-19 period, illustrating the pressure that trade tensions can place on regional currencies. Currencies like the AUD, KRW, and INR experienced significant depreciation against the USD, driven by exposure to China and reduced investor confidence.

The Chinese government’s policy response will play a critical role in mitigating the economic impact of tariffs. During the 2018-19 cycle, China implemented supportive fiscal and monetary policies, which helped contain the growth drag to 1 percentage point. If similar policies are deployed this time, they could cushion the downside effects.

Global funds pulled out nearly $11 billion in October. This marks one of the most substantial outflows on record, pushing the MSCI India Index toward a technical correction and highlighting growing concerns that the country’s post-pandemic economic surge may be losing momentum.

High Valuations and Slowing Growth: India’s rapid economic growth and corporate profitability, coupled with a global pivot away from China, had made it an attractive investment destination. However, with Indian equity valuations now among the highest globally, and signs of slowing economic and earnings growth, investors are beginning to question the sustainability of the rally. The NSE Nifty 50 Index’s valuation is currently trading at over 21 times its 12-month forward earnings, significantly above its five-year average of 19.4 times.

Resurgent Chinese Stocks: Chinese stocks have made a comeback, driven by stimulus measures introduced in late September, further dampening India’s relative appeal. China’s rebound is shifting investor attention and capital flows, particularly as the valuation gap between the two countries' markets narrows.

Sector-Specific Concerns: Foreign investors traditionally target specific high-growth sectors in India. However, sectors like consumer staples and automotive are facing demand constraints as urban consumers cut back on spending. The urban middle-class, burdened by inflation and weaker job prospects, has reduced discretionary spending. Although rural demand has shown some resilience due to a favorable monsoon, it is insufficient to offset urban weakness, which affects nearly 500 million city dwellers.

India’s GDP growth, which exceeded 8% last year, is now projected by some economists to fall below 7% this fiscal year, underlining the challenges ahead. Slower growth prospects are impacting investor confidence, especially as equity valuations remain at a premium compared to other emerging markets in Asia.

Moreover, with the Nifty 50 losing 6.2% in October — its steepest monthly decline since March 2020 — and the MSCI India Index briefly dipping over 10% from its September 27 high, there are clear signs of market fatigue. The resilience of the Indian stock market may face further tests as foreign investors remain cautious.

While Trump’s “Make in America” agenda is expected to encourage U.S.-based production, some Indian manufacturing exports may face increased tariffs, particularly those competing directly with American products. However, the positive impact from Trump’s anti-China stance should offset some of these challenges for India.

Equity cash trading values dropped to their lowest in nearly a year as the NSE Nifty 50 Index approaches a technical correction, down 8% from its September peak.

The recent correction in the Nifty Index and declines in P/E and P/B ratios suggest that Indian equities, while previously highly valued, are now facing a valuation reset. This aligns with foreign investor concerns over high valuations and slowing economic growth. The P/E ratio’s fluctuation suggests that earnings growth has been inconsistent relative to price movements. High P/E values in 2021 likely reflected speculative optimism, while the current lower P/E indicates moderated expectations as earnings growth has slowed.

India's foreign exchange reserves have declined for five consecutive weeks, falling by $2.675 billion to $682.13 billion, as the Reserve Bank of India (RBI) intervenes to manage the rupee’s weakness. The rupee recently hit a record low of 84.3750 against the dollar due to foreign outflows and concerns over high valuations and slowing growth.

Investors may view the recent dip as a normalization of valuations, making Indian equities relatively more attractive than at peak valuations. However, continued caution is warranted, especially in sectors with high valuations or those vulnerable to macroeconomic shifts.

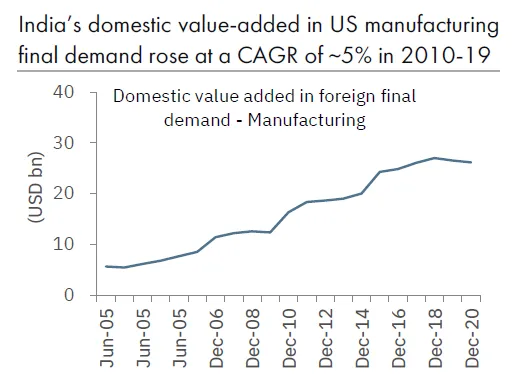

With India’s domestic value-added in U.S. manufacturing demand growing at a CAGR of approximately 5% from 2010-2019, India is positioned as a strong alternative to China among South Asian countries.

While Trump’s policies could encourage India as a strategic ally in counterbalancing China, recent developments suggest that India is also recalibrating its ties with China. The recent BRICS summit and initiatives like quicker visa approvals for Chinese nationals highlight a pragmatic approach by India. Recognizing that “Atmanirbhar Bharat” (self-reliant India) cannot entirely exclude Chinese investments, India is carefully balancing its economic ties with both superpowers.

India stands to benefit from Trump’s anti-China stance and the broader China+1 strategy , as U.S. and global companies look to diversify manufacturing outside of China. This could drive investments in Indian manufacturing, especially in electronics, AI, and EMS, as companies look for alternative production bases.

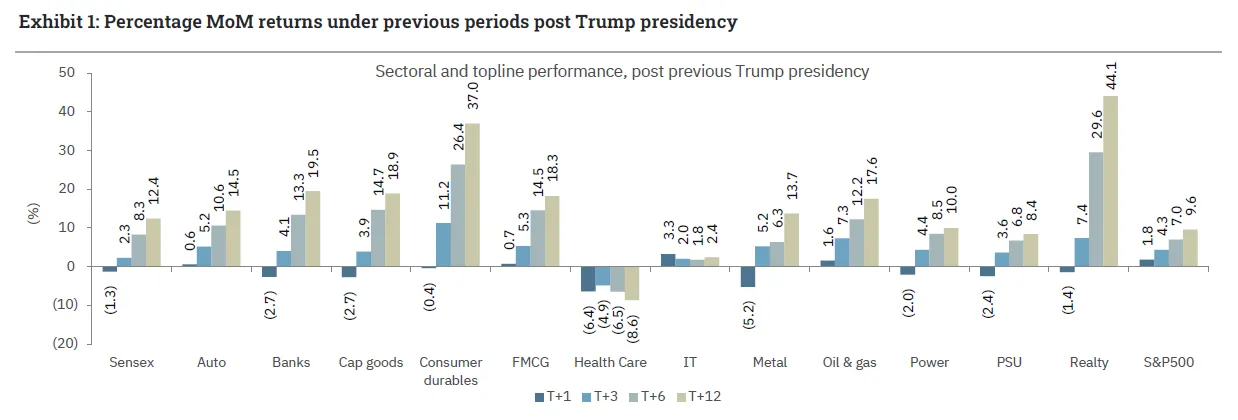

Trump’s policies are likely to spur risk-on sentiment globally, potentially supporting inflows into Indian equities, amid significant market volatility in the short term. Historically, sectors such as IT, pharma, and defense have benefited from U.S. partnerships and demand, and this is expected to continue under Trump 2.0. Following Trump’s previous presidency, certain sectors like IT, metals, and banks showed strong month-on-month (MoM) returns, reflecting market resilience in sectors linked to U.S. growth.

IT Sector: Corporate tax cuts in the U.S. could drive IT spending, indirectly benefiting Indian IT firms that derive a large share of revenue from U.S. clients. Additionally, the weakened INR could boost margins for Indian IT exporters. Anti-China sentiment may encourage the U.S. to shift business toward India for IT services and software support.

Pharma Sector: Indian pharma companies stand to benefit from Trump’s anti-China stance, especially in generic drugs and API supply. However, investors should monitor any potential U.S. measures on prescription drug price controls, as these could impact profitability for exporters in this segment.

Defense and EMS: With increased U.S.-India collaboration in the Indo-Pacific region, the defense sector is poised for growth, fueled by joint initiatives and technology transfers. Electronics Manufacturing Services (EMS) and high-tech sectors like AI and semiconductors are also likely to benefit as U.S. companies diversify supply chains from China.

Oil & Gas: Trump’s emphasis on U.S. fracking and oil production should keep global oil prices stable, which benefits India as a major oil importer . Lower oil prices help reduce India’s import bill, benefiting sectors such as Oil Marketing Companies (OMCs) and other industries reliant on crude oil derivatives.

While Trump’s presidency could open up new avenues for India, there are specific risks to consider:

Higher Tariffs on Indian Goods: Trump’s “Make in America” initiative could lead to increased tariffs on imported goods, potentially impacting Indian exports in textiles, automotive, and steel. India’s exports to the U.S. in categories such as textiles, automotive parts, and steel rely on components that may involve China, which could disrupt supply chains if tariffs increase.

Dumping Pressure from China: If Trump imposes more tariffs on China and China’s domestic economy remains weak, India could face increased dumping from China in sectors like steel and chemicals, heightening competition for Indian manufacturers.

Weakening Domestic Earnings and Valuations: Exhibit 2 highlights risks such as domestic earnings slowdown and high valuations, which could limit the upside for Indian equities. Over 50% of companies missed earnings expectations in Q2 FY25, indicating moderating growth. Rising U.S. yields could also weigh on foreign investment in Indian assets, adding to the pressure on valuations.

The Trump presidency presents a mixed outlook for India, with opportunities in IT, pharma, EMS, and defense sectors, balanced by risks from tariffs and geopolitical complexities. High valuations and moderating domestic earnings growth suggest that Indian equities may see limited upside, though domestic liquidity and demand for U.S.-linked sectors provide support. While India stands to benefit as a strategic U.S. ally in an anti-China context, its evolving ties with China introduce a nuanced dynamic in the U.S.-India-China triangle. The Trump administration’s aggressive trade stance could disrupt supply chains and intensify competition in global markets, with indirect impacts on India’s exports and industry.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart