by Siddharth Singh Bhaisora

Published On Nov. 3, 2024

India saw a remarkable 32.8% growth in luxury goods sales in FY22, outpacing major markets like the US, Switzerland, Japan, and China. This rapid growth is a testament to the increasing appetite for luxury products among Indian consumers. Major brands like Dior, Louis Vuitton, Coach, and Balenciaga have expanded into India, often releasing India-exclusive collections. These brands are adopting a "glocal" approach, adjusting their strategies to appeal to Indian preferences. Indian companies like Reliance and Aditya Birla are also heavily investing in the luxury sector. Additionally, global investment firms are showing interest, indicating confidence in India’s luxury potential.

Yet, this growth story is complex and nuanced, characterized by a stark dichotomy in spending patterns. While a segment of the population is embracing luxury and discretionary spending, a vast majority still allocates most of their budget to necessities. Let’s look at the Indian luxury market in depth.

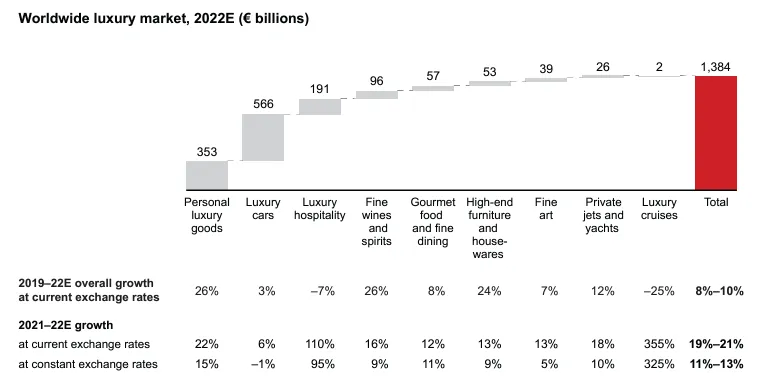

Despite uncertain macroeconomic conditions, the global luxury market reached a record high of €1.5 trillion in 2023, marking a solid growth rate of 8% to 10% at current exchange rates compared to 2022. This growth underscores the luxury sector's resilience, with luxury goods and experiences reaching new spending highs.

The global luxury industry spans 9 major segments, with luxury cars, luxury hospitality, and personal luxury goods collectively comprising over 80% of total spending. Spending growth across all segments resulted in an approximate €160 billion increase, maintaining momentum from 2022. Notably, luxury experiences surged back to pre-pandemic levels, driven by increased social interaction and a return to travel.

Personal luxury goods, considered the core of the luxury market, reached an estimated €362 billion in 2023, up by 4% from 2022 at current exchange rates (8% at constant exchange rates). However, growth rates showed a declining trend throughout the year due to mixed signals from different markets: a rebound in China contrasted with deceleration in the US and Europe. Only about two-thirds of luxury brands reported growth in 2023, compared to 95% in 2022. Inflationary pressures and ongoing investments balanced out average profitability, highlighting industry polarization.

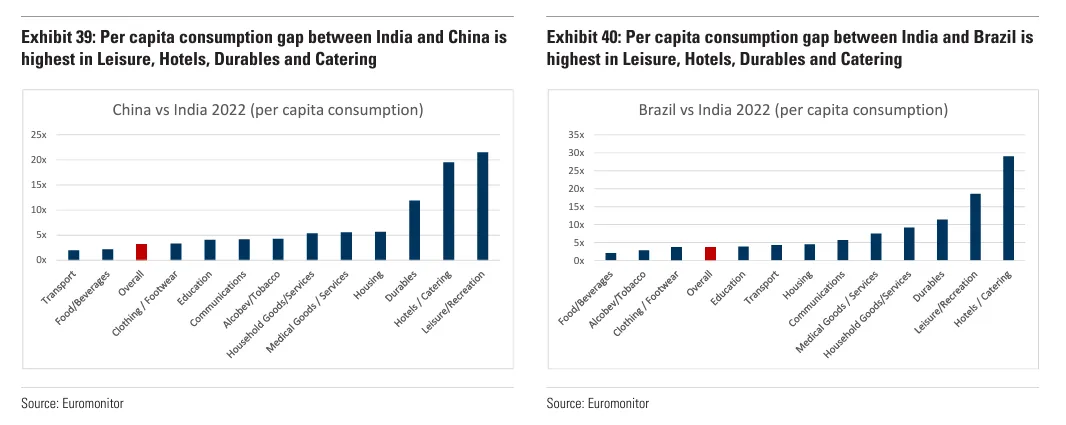

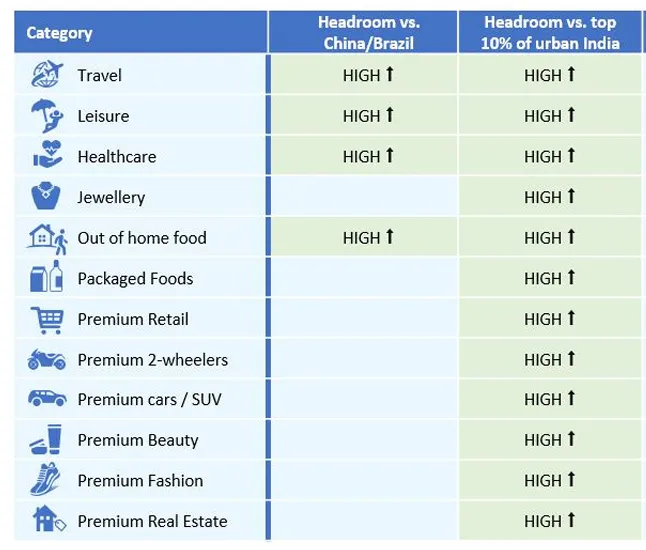

A comparative analysis of India’s per capita consumption with economies like China and Brazil—both of which have per capita incomes around $10,000—reveals significant disparities in consumption patterns. While overall consumption in these countries is approximately 2-3 times higher than in India, certain discretionary categories show even greater gaps. For example, per capita spending on leisure, hotels, recreation, out-of-home food, and durables in China and Brazil is roughly 18-20 times that of India. Medical services also see a sizeable disparity.

These differences suggest untapped potential in India’s affluent segment. As the size of Affluent India grows, a large portion of this population is expected to prioritize spending in these discretionary categories. Leisure and recreation, dining out, and durable goods are likely to see high growth rates, as Affluent India emulates consumption patterns typical of similar-income economies. This trend could drive explosive growth in sectors previously limited by lower income levels, helping India close the consumption gap with other $10,000-per-capita economies.

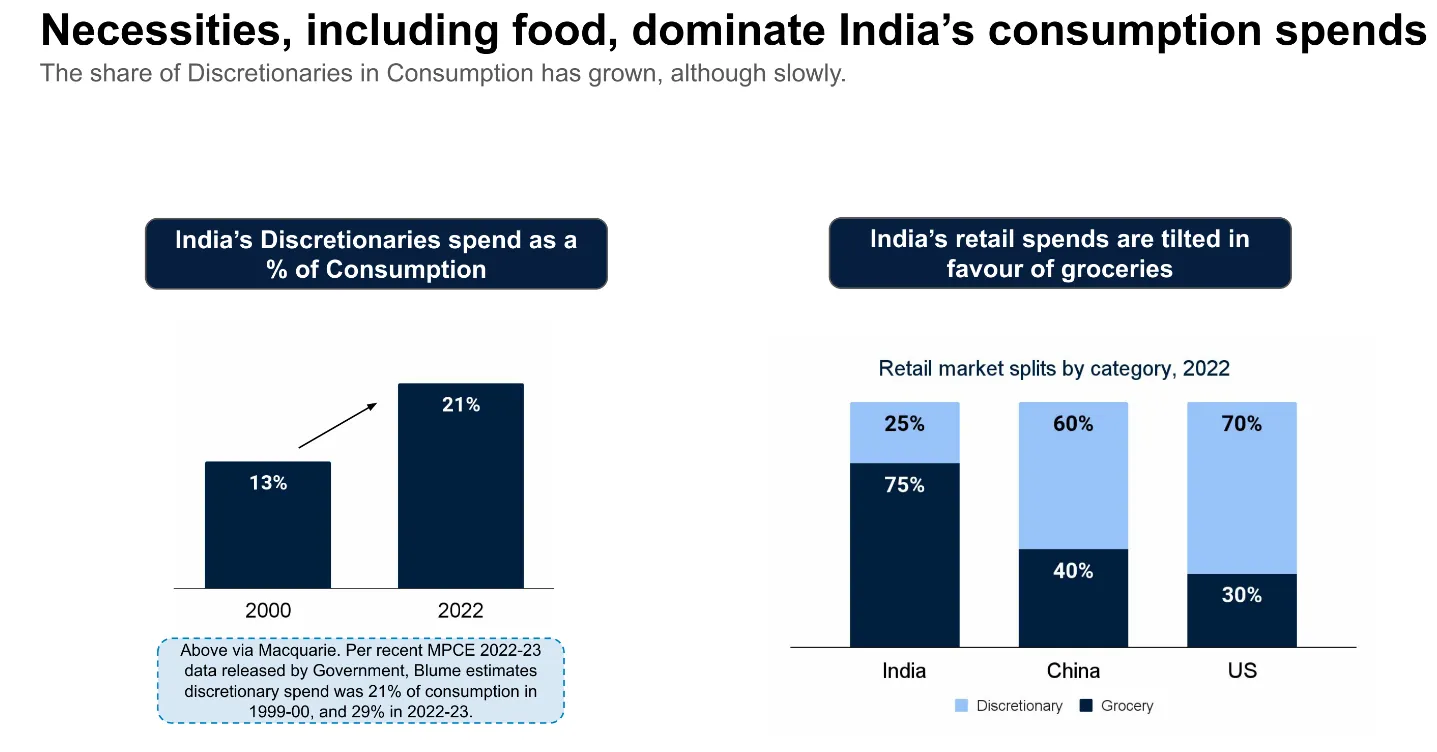

In India, essential goods continue to dominate household spending. Basic necessities like food and groceries account for a large portion of consumer expenditure, limiting the scope for discretionary spending among the broader population. Over the past two decades, there has been only a modest increase in the share of discretionary spending—from 13% of total consumption in 2000 to 21% in 2022. For most Indian households, prioritizing essentials is an economic reality, which keeps discretionary spending relatively low compared to other major economies.

This trend is reflected in the breakdown of retail spending. In 2022, around 75% of India’s retail expenditure went to groceries, leaving only a quarter for non-essential goods. This is in sharp contrast to countries like China and the United States, where discretionary spending makes up a larger portion of the consumer basket. This focus on essentials highlights the constraints on spending power for a large part of India’s population and underscores the challenges for brands aiming to expand their luxury and premium offerings in the country.

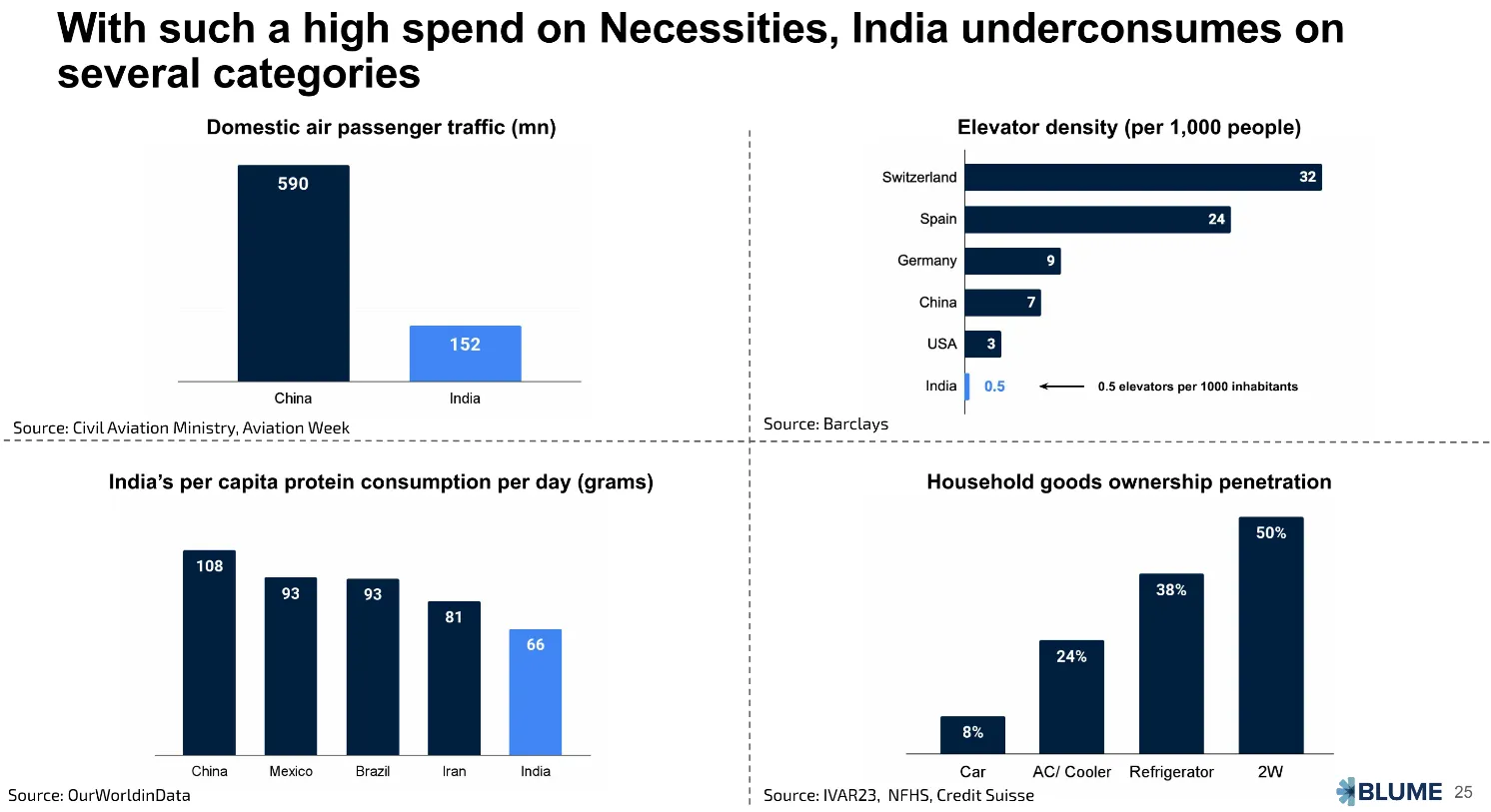

India’s focus on necessities has led to lower consumption levels across several non-essential categories. For instance, domestic air travel remains underpenetrated; with only 152 million passengers in 2022, India’s domestic air traffic is far below China’s 590 million. Similarly, infrastructure metrics like elevator density are low—India has only 0.5 elevators per 1,000 people, while Switzerland boasts 52. Even in terms of dietary habits, the average Indian’s daily protein intake is 66 grams, significantly lower than China’s 108 grams, reflecting a tendency towards lower-cost, carbohydrate-based diets.

Household appliance ownership also highlights the focus on essentials. Only 24% of Indian households own an air conditioner or cooler, and refrigerator penetration is at 38%. While urban and affluent segments are more likely to own these products, they remain luxury items for much of the population. These indicators illustrate India’s restrained spending patterns in categories that are often considered staples in other parts of the world.

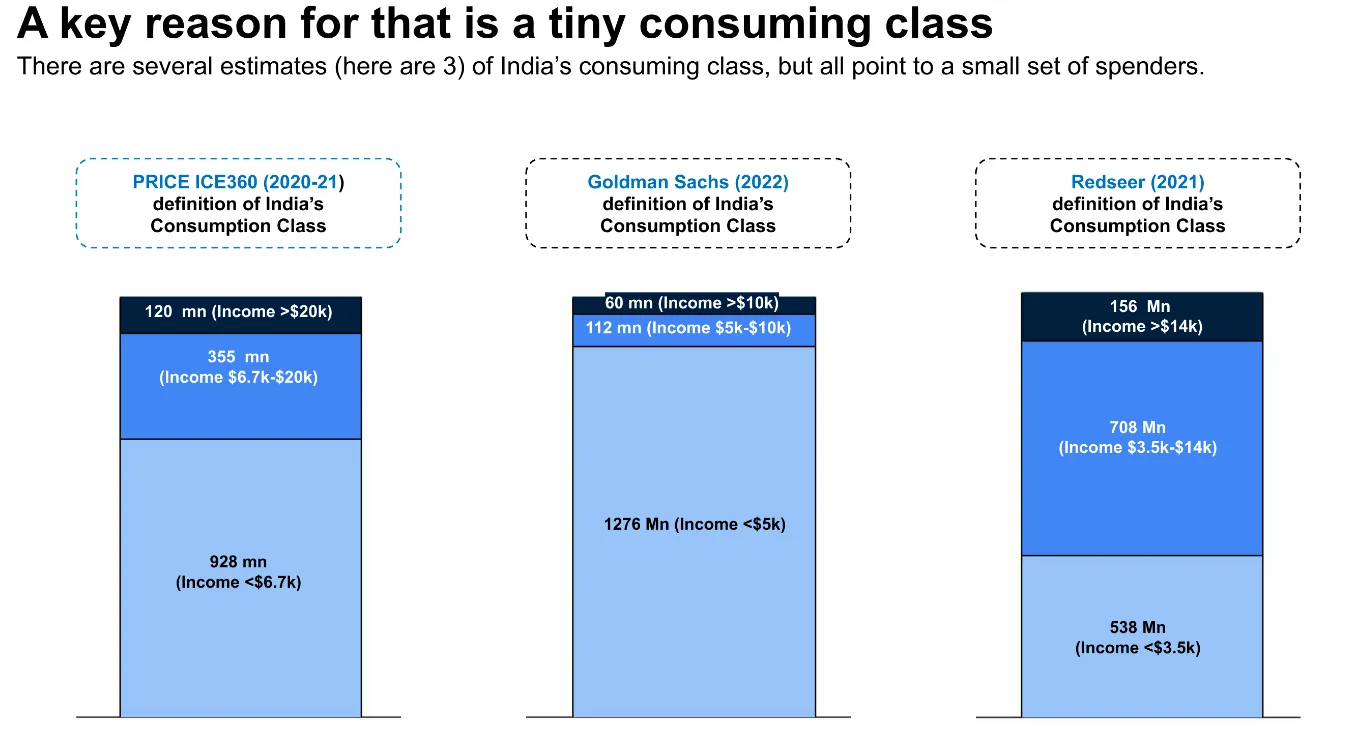

The constrained nature of India’s consumer market can be attributed to its relatively small consumption class. Various studies, including those by PRICE, Goldman Sachs, and Redseer, indicate that the high-spending consumer base is limited to a minority of the population. For example, Goldman Sachs estimates that only around 60 million Indians have an annual income above $10,000 - this is expected to grow to 100 million by 2027. In other words, while India has a large population, the number of consumers with substantial discretionary spending power is relatively small.

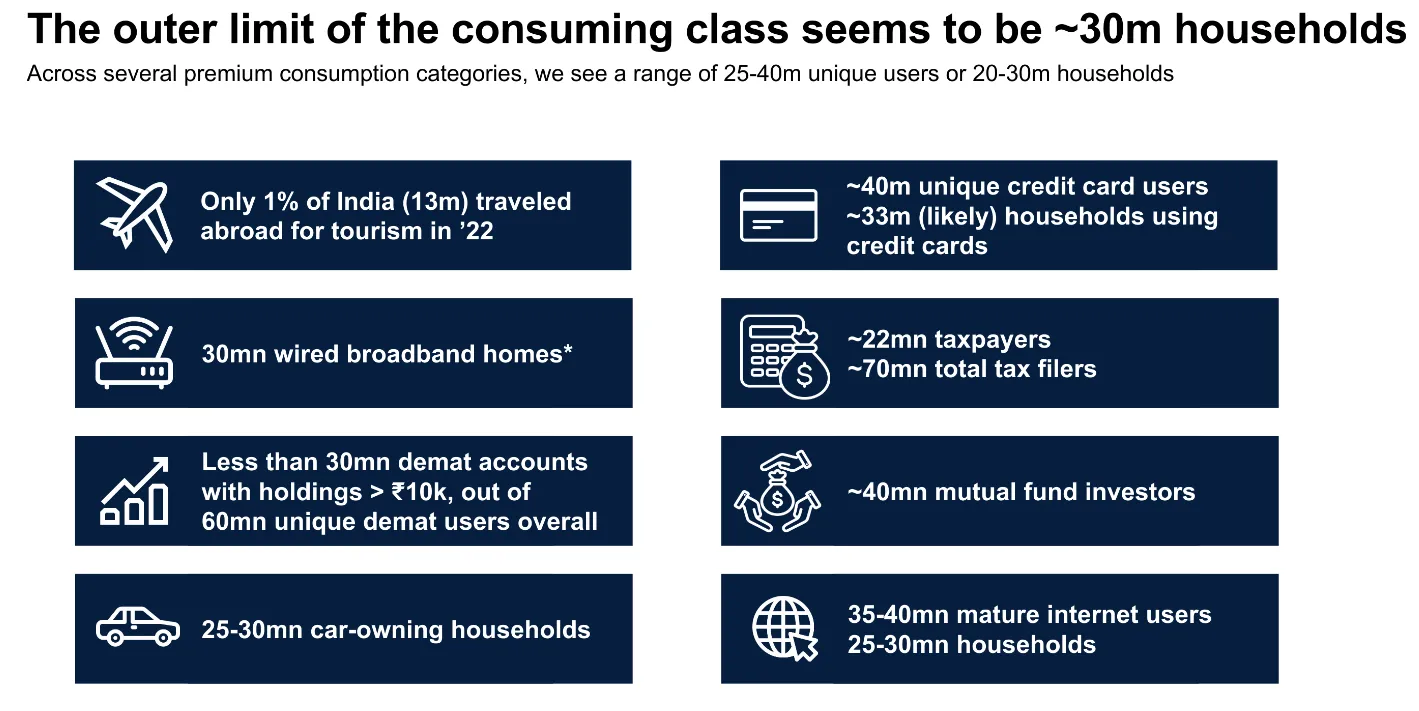

Further analysis suggests that the outer limit of this consumption class is about 30 million households, or roughly 20% of India’s total households. Indicators of premium consumption in India —such as broadband adoption, car ownership, credit card usage, and mutual fund investments—support this estimate. For instance, only 30 million homes have wired broadband, and there are fewer than 30 million demat accounts with holdings over ₹10,000. This means that while there is a core group with the means to afford premium goods, they remain a niche demographic.

Examples from this segment illustrate the concentrated consumption within Affluent India. For instance:

Travel and Leisure: India sees approximately 40 million flight passengers annually, indicating that air travel is primarily a service for affluent consumers.

Food Delivery and Quick Service Restaurants (QSRs): Online food delivery services attract 25-30 million monthly active users, largely drawn from Affluent India.

Jewelry: Titan’s jewelry business, a major player in India’s luxury jewelry market, has an annual customer base of less than 3 million. This suggests that high-end jewelry remains an exclusive category for affluent individuals.

Beauty and Personal Care: Nykaa’s online beauty business records around 10 million annual transacting consumers, a number that indicates that premium personal care is still largely concentrated within Affluent India.

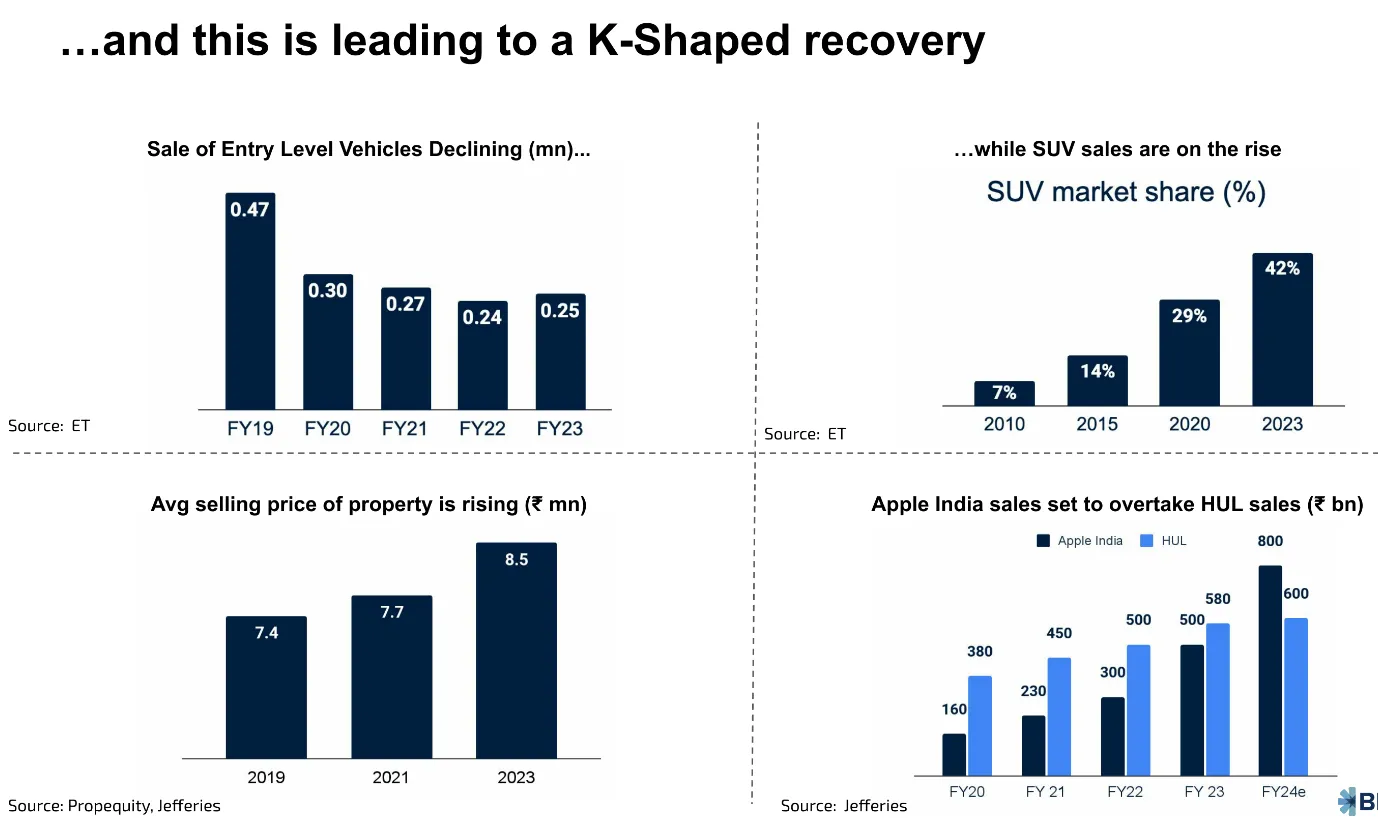

India’s economic recovery post-pandemic has followed a K-shaped trajectory, with different segments of the population experiencing divergent economic fortunes. For lower-income segments, the recovery has been slow, resulting in cautious spending on essentials. Meanwhile, wealthier consumers are exhibiting robust spending patterns on high-end goods, leading to growth in premium segments.

For instance, sales of entry-level vehicles have been declining, from 0.47 million units in FY19 to 0.25 million in FY23, indicating reduced demand among lower-income consumers. In contrast, SUV sales have surged, with the market share of SUVs rising from 7% in 2010 to 42% in 2023. This shift shows that while entry-level spending has declined, affluent consumers continue to purchase higher-end vehicles.

A similar trend is observed in real estate. The average selling price of property rose from ₹7.4 million in 2019 to ₹8.5 million in 2023, suggesting that premium real estate remains in demand. Furthermore, Apple’s sales in India have surged, positioning the tech giant to potentially surpass HUL in revenue by FY24. This shift reflects the strong appetite for premium technology products, even as broader consumption remains restrained.

India’s luxury market is on an accelerated growth trajectory, propelled by a rapidly expanding affluent class, higher disposable incomes, and a shift towards premium products. With India poised to become the world’s 3rd largest economy by 2027, this growth offers significant opportunities for luxury brands aiming to penetrate one of the world’s fastest-growing consumer bases. Indian consumer spending on luxury goods is forecasted to reach $32 billion by 2030.

The luxury market's consumer base is projected to expand to 500 million by 2030, underscoring India’s potential as a major luxury consumption hub. Contributing factors include consistent economic growth, stable monetary policies, and substantial credit expansion, driving an increase in purchasing power. The expanding affluent population represents a key consumer base for luxury brands.

India’s middle class is also on a significant upward trajectory, expected to constitute 61% of the total population by 2047, up from 31% in 2020–21. This group’s preference for premium products indicates strong potential for luxury and high-quality goods.

Luxury Jewelry: India’s wedding industry, valued at $50 billion in 2023, plays a significant role in luxury consumption. Over 50% of gold jewelry sales are driven by weddings, showcasing the cultural importance of luxury in celebrations. Luxury Jewelery segment is forecasted to reach around $2 billion in revenue in 2024.

Luxury Automobiles: Premium automobile brands, including Mercedes-Benz, BMW, and Audi, are experiencing substantial growth in India, meeting the aspirations of the affluent class.

Luxury Fashion and Apparel: High-end fashion brands are expanding their presence in the Indian market, targeting the evolving tastes and lifestyle aspirations of India’s affluent consumers.

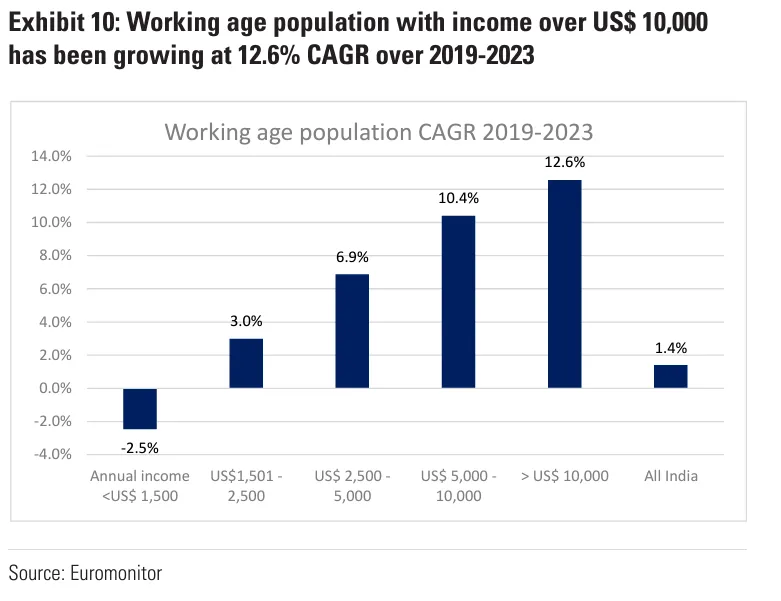

The rising affluence is reflected in the growth of the working-age population with an annual income exceeding $10,000. This demographic has grown at a CAGR of 12.6% from FY19 to FY23, significantly outpacing the overall working-age population growth rate of 1.4% during the same period, according to Euromonitor data. This accelerated income growth highlights the increasing purchasing power within the workforce, providing a stable foundation for sustained consumer demand in categories such as automobiles, electronics, and other high-end consumer goods.

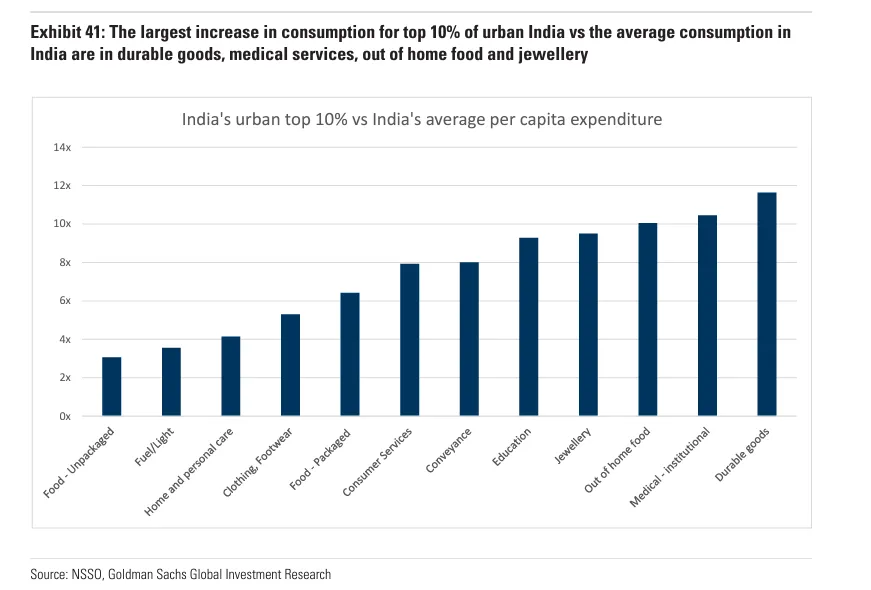

A second approach examines the consumption habits of the top 10% of urban India, which closely mirrors the profile of Affluent India, representing approximately 3.5% of the population. Comparing the top 10% of urban India’s spending with the national average highlights stark contrasts, which closely mirrors the profile of Affluent India, representing approximately 3.5% of the population. We see this particularly in categories such as durable goods, healthcare, jewelry, and out-of-home food.

For instance, per capita consumption in durable goods, healthcare, and jewelry among the top 10% of urban India is 8-10 times higher than the national average. As Affluent India grows, demand in these categories is expected to rise substantially. Durable goods, which include high-quality appliances, electronics, and furniture, are likely to see increased sales, as affluent consumers are more inclined to invest in these items. Healthcare services, including premium healthcare providers and wellness services, will also benefit, as more individuals prioritize health and wellness. Similarly, luxury goods like jewelry and dining experiences, including high-end restaurants and online food delivery, will cater increasingly to Affluent India, stimulating growth in these sectors.

Read this article to learn more about Indian Consumption Theme Is Rising: India’s Growing Middle Class & Shift Toward Premium Consumption

Several factors are contributing to the rise of India’s luxury market, even as the majority of the population remains focused on essentials. Economic stability and income growth have increased the purchasing power of a broad consumer segment, particularly among India’s affluent and growing middle class. Indian consumers increasingly seek premium and luxury experiences, with a shift toward brands that represent quality, exclusivity, and status. The rising number of affluent consumers, particularly in urban centers, is creating a favorable environment for luxury brands looking to establish a foothold in India.

Customization and Personalization: Indian consumers place high value on personalized products and shopping experiences.

Sustainability and Conscious Consumption: There is a growing demand for eco-friendly materials, fair labor practices, and locally sourced products, aligning with the global trend towards responsible luxury.

Cultural Relevance: Many luxury brands are adapting their offerings to reflect Indian cultural elements, appealing to consumers who value products that resonate with their heritage.

Online platforms have made luxury products more accessible to Indian consumers, with digital adoption facilitating widespread reach in India.

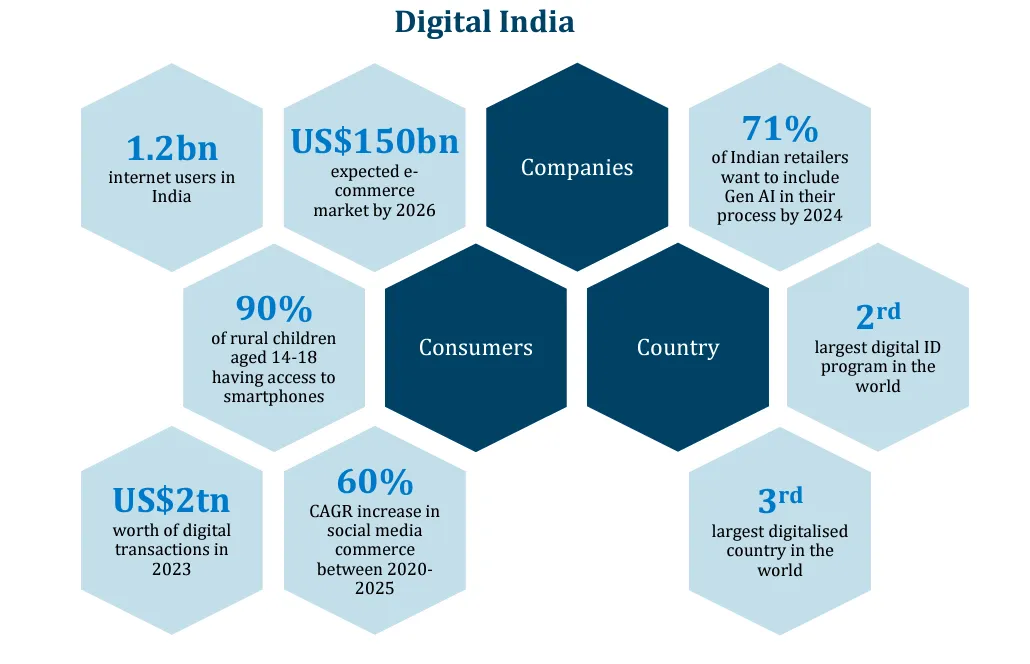

Digital Penetration: With 1.2 billion internet users, India is one of the most connected nations. This widespread connectivity has enabled the growth of e-commerce, expected to reach a market size of $150 billion by 2026.

Rural Digital Access: Notably, 90% of rural children aged 14-18 have smartphone access, highlighting digital inclusivity beyond urban areas.

Digital Transactions: In 2023, digital transactions in India totaled over $2 trillion, showcasing widespread adoption of cashless payments.

Social Media Commerce: Social media commerce is expanding rapidly, with a projected 60% CAGR from 2020 to 2025, driven by increasing digital engagement.

Government policies aimed at building the digital infrastructure, easing import duties and simplifying customs procedures are aiding the luxury sector’s growth and accessibility in India. India's robust Digital Public Infrastructure facilitates seamless interconnectivity, allowing for a wide range of digital services, such as UPI, Digilocker, Digi Yatra & more. These platforms empower consumers and encourage cashless and contactless payments, online shopping, and social media engagement.

Consumer attitudes have also shifted toward customization and responsible consumption, which companies address by integrating AI, machine learning, and IoT into their products and services. This approach aligns with the demands of a tech-savvy and socially conscious population.

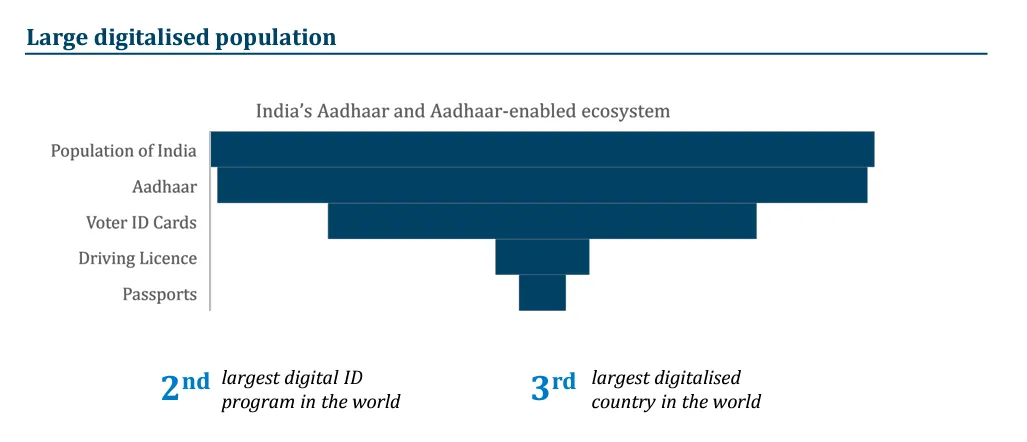

India's Aadhaar-based ecosystem ranks as the second-largest digital ID program globally, enhancing access to various services. This robust ID infrastructure supports digitalization across sectors, making India the third most digitalized country in the world.

India's credit ecosystem has evolved significantly, with growing adoption of credit cards and the Buy Now, Pay Later (BNPL) model. Notable trends include:

Increased Credit Card Usage: Credit card transactions reached INR1.67 trillion ($20 billion), with two-thirds attributed to online payments. Post-pandemic economic recovery and rising discretionary spending have driven this increase.

Personal Loan Growth: RBI has aimed to improve credit access, especially in underserved sectors. High borrowing rates are observed in agriculture, MSEs, medium enterprises, and housing.

As the affluent segment in India continues to grow, it is anticipated to have a disproportionate impact on certain consumption categories, especially those that derive a large portion of their demand from high-income consumers. Based on comparative data with similar economies (e.g., China and Brazil) and the spending patterns of the top 10% of India’s urban population, several categories show significant growth potential.

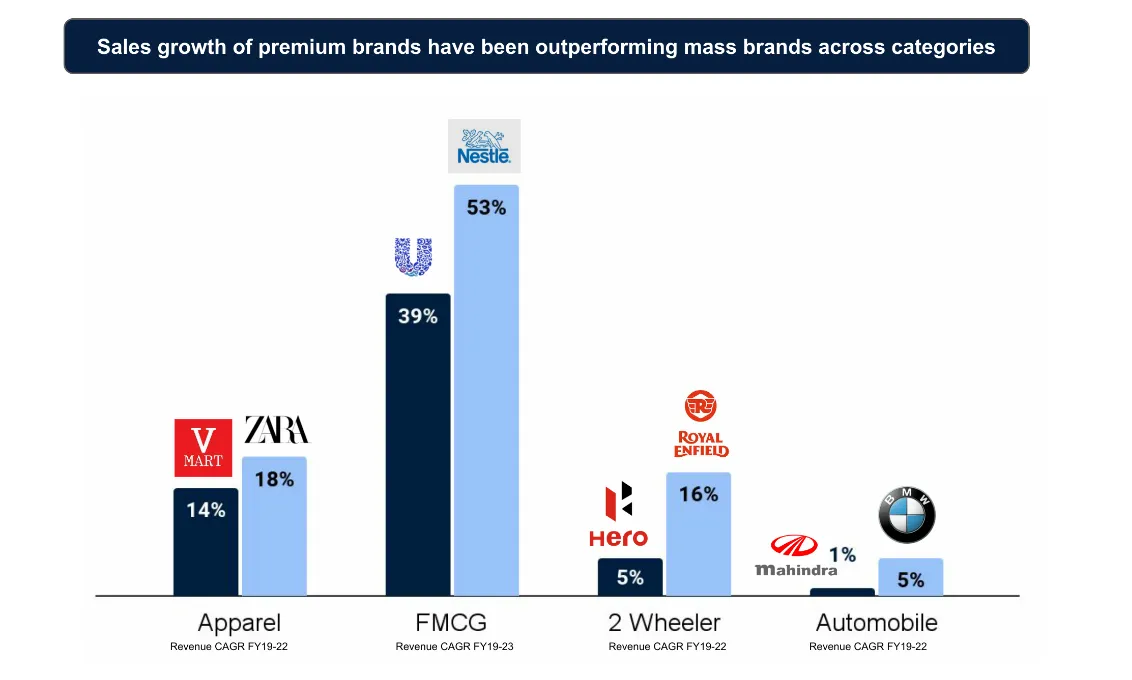

The revenue expectations for stocks catering to Affluent India have consistently seen upgrades over the past two years, demonstrating that these companies have outperformed market expectations. Notably, these gains have not been a result of broader consumption growth, which has been relatively muted. Instead, the growth in these stocks has been driven by the rising spending power of affluent consumers.

In contrast, stocks tied to broad-based consumption categories—such as mass-market personal care, basic two-wheelers, paints, mass footwear, and mass fashion—have experienced downgrades in revenue expectations. This indicates that, while general consumption has slowed, the premium segment is thriving. Companies exposed to Affluent India have delivered consistent positive surprises, outperforming expectations even in a challenging environment.

As the urban population grows and infrastructure improves, particularly in Tier 1 and Tier 2 cities, there is a shift toward discretionary spending among higher-income groups. This affluent demographic is more inclined to purchase high-end items, such as SUVs, premium real estate, and luxury technology. International brands like Apple have capitalized on this trend, seeing strong growth in the Indian market.

The high growth rate among affluent consumers in India, driven by double-digit CAGR over the past few years, suggests that premium categories are well-positioned for sustained expansion. As Affluent India’s population rises to an estimated 100 million by 2027, premium brands across travel, healthcare, jewelry, out-of-home dining, and retail are likely to benefit from increased demand. Furthermore, the potential for continued revenue upgrades in this segment provides a compelling case for investors to consider exposure to the Affluent India growth story.

However, the reach of luxury and premium brands remains limited to a niche demographic. While there are significant opportunities for high-end products, brands must recognize that true luxury demand is confined to a small segment of the population. For the majority, essential spending remains the priority, suggesting that a two-tiered approach may be more effective in India’s unique consumer market.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart