by Siddharth Singh Bhaisora

Published On Aug. 11, 2024

The yen carry trade, one of the most influential and widespread financial strategies of the past decade, is experiencing a significant unwinding that is sending ripples across global markets. This trade, which involves borrowing yen at low-interest rates to invest in higher-yielding assets abroad, has been a cornerstone of global financial flows, particularly in the context of Japan's long-standing policy of ultra-low interest rates. However, recent developments in Japan’s monetary policy and global market conditions have triggered a dramatic reversal of this trade, with far-reaching consequences. We will look at what exactly is the Yen Carry Trade, how it led to the stock market crashes globally on 5th August and the impact of it on Indian and global markets both historically and in the current context.

The yen carry trade capitalizes on the difference between Japan’s near-zero interest rates and higher rates in other currencies, such as the U.S. dollar, Mexican peso, and New Zealand dollar. Investors borrow yen at minimal cost, convert it into higher-yielding currencies, and invest in assets like bonds, equities, or real estate in those markets. The steps involved are as follows:

Borrowing at Low Interest Rates: Investors take out loans in Japanese yen, benefiting from Japan's near-zero interest rates.

Converting to Higher-Yielding Currency: The borrowed yen is then converted into another currency, such as the U.S. dollar, which offers higher interest rates.

Investing in High-Yield Assets: The converted currency is used to invest in assets that promise higher returns, such as U.S. government bonds or equities.

For example, an investor borrows 1 million Japanese yen at a 0.1% interest rate. They convert this amount into U.S. dollars and invest in U.S. assets yielding 5% annually. The difference between the borrowing cost and investment return generates substantial profits, making the yen carry trade a highly attractive strategy.

The returns, typically around 5-6% annually, are driven by the interest rate differential and any depreciation of the yen during the holding period, which reduces the cost of repaying the yen-denominated loan.

The yen carry trade is not limited to a specific group of investors; it is utilized by a wide range of market participants:

Hedge Funds: These funds often employ the yen carry trade to maximize portfolio returns by leveraging low-interest-rate loans.

Institutional Investors: Large financial institutions, including pension funds and insurance companies, use this strategy to achieve higher yields on their investments.

Individual Investors: High-net-worth individuals and retail investors sometimes engage in carry trades through forex trading platforms.

Corporations: Multinational corporations may use carry trades to manage foreign exchange exposure and enhance returns on excess cash.

The yen carry trade has been a significant player in global finance for decades:

1990s and Early 2000s: As Japan maintained low interest rates, the yen carry trade gained popularity. Investors borrowed yen to invest in higher-yielding currencies like the U.S. dollar and Australian dollar.

2008 Financial Crisis: The unwinding of the yen carry trade contributed to market turmoil during the 2008 financial crisis. As global risk aversion spiked, investors rushed to repay yen loans, leading to a sharp appreciation of the yen and exacerbating market declines.

2015 Swiss Franc Crisis: Although not directly related to the yen, the sudden removal of the Swiss franc's peg to the euro by the Swiss National Bank caused similar turmoil, highlighting the risks of currency carry trades.

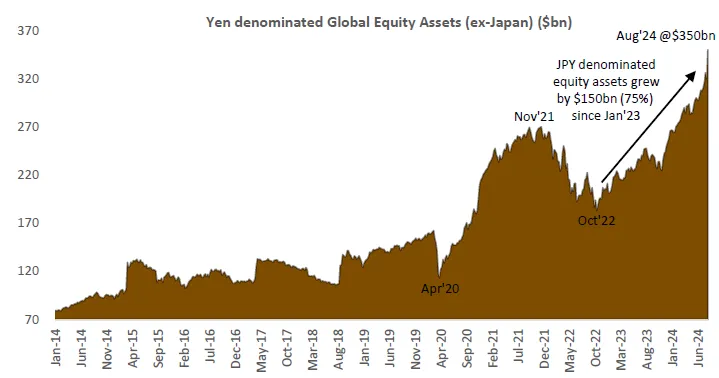

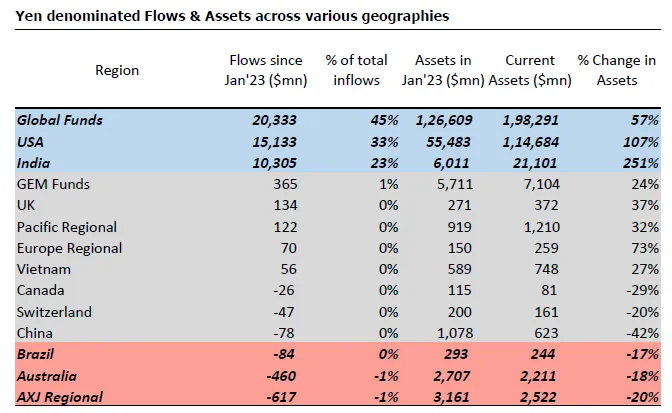

The global Yen carry trade has seen a significant surge since January 2023, driven by a sharp depreciation of the Japanese Yen against the US Dollar, with the exchange rate dropping from 127 to 162, a 27% decline. This currency movement has spurred a substantial increase in Yen-denominated assets in global equity funds (excluding Japan), rising from $200 billion to $350 billion over the past 18 months. Of this $150 billion increase, 30% came from direct inflows, while a notable 70% resulted from price appreciation of these assets. The inflows have been predominantly directed toward the United States, India, and global funds, with the US market capturing 33% of these funds, India 23%, and the remaining 45% flowing into global funds, primarily invested in US equities.

In India, the dynamics of these Yen flows are particularly interesting. Approximately 25% of the Yen inflows into Indian markets have been channeled into midcap funds, a segment that has seen robust growth and outperformance. The midcap index rallied by an impressive 42% from April to September 2023, driven by the influx of Yen-denominated capital.

This is a stark contrast to the allocation in the US and global markets, where Yen inflows have been primarily focused on large-cap funds. The inflow into Indian midcaps marks a strategic shift, as investors seek higher growth potential in this segment. Additionally, the Yen inflows into India have been largely from Japan-domiciled funds, with 80% of the $10.3 billion coming from these sources, indicating a strong interest from Japanese investors in the Indian equity market.

This trade has seen massive growth since 2013, driven by Japan's aggressive monetary easing under "Abenomics," which coincided with rising interest rates in the U.S. and a weakening yen. The scale of the yen carry trade is challenging to quantify precisely, but estimates suggest it may have reached as much as $350-$500 billion, with significant expansion occurring over the past few years.

This includes short-term external loans by Japanese banks as a rough measure, but this figure may either overstate or understate the reality. It could overestimate if these loans include commercial transactions or foreign business needs, but it might also underestimate the total if it excludes the significant yen borrowings by Japanese investors for domestic investments. Moreover, the leverage used by hedge funds and algorithmic trading strategies could significantly amplify these positions. Additionally, Japanese pension funds, insurers, and other investors have substantial foreign portfolio investments, totaling 666.86 trillion yen ($4.54 trillion) by March, with a large portion in interest rate-sensitive debt assets, underscoring the broader scope of yen-funded global investments.

The Bank of Japan (BoJ) recently raised interest rates from near-zero levels to 0.25%, marking a significant departure from its long-standing ultra-loose monetary policy. This move contrasts sharply with the U.S. Federal Reserve’s approach, which is inching closer to cutting rates. Why is that important?

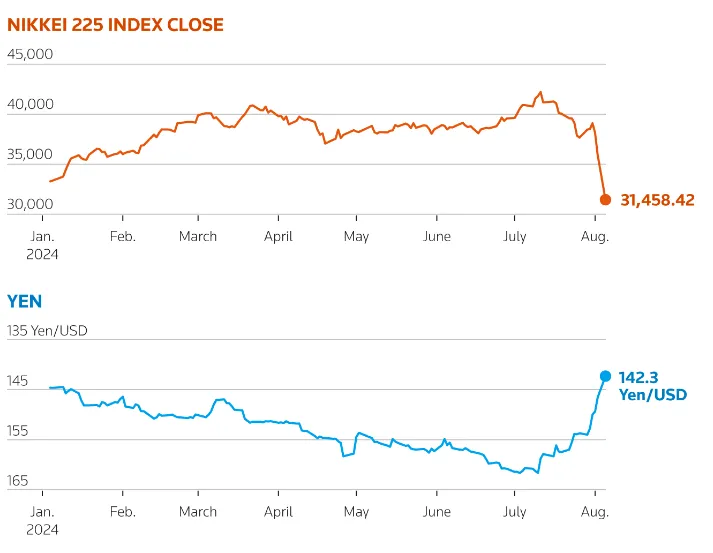

Well, the recent unwinding of the yen carry trade is primarily driven by this significant shift in Japan’s monetary policy. By tightening its monetary policy, raising interest rates for the first time in years and signaling the possibility of more hikes to come, the Bank of Japan is looking at controlling rising inflation and stabilizing the economy. This has led to a sharp appreciation of the yen, which has surged by 13% in just a month. The stronger yen has made it increasingly costly for investors to maintain their yen-funded positions, forcing them to unwind these trades rapidly.

The timing and magnitude of the BoJ’s actions caught many investors off guard, leading to a sudden and disorderly exit from yen carry positions. Expectations of imminent rate cuts in the United States, which would further narrow the interest rate differential, have exacerbated the situation, reducing the appeal of yen-funded trades and contributing to global market volatility.

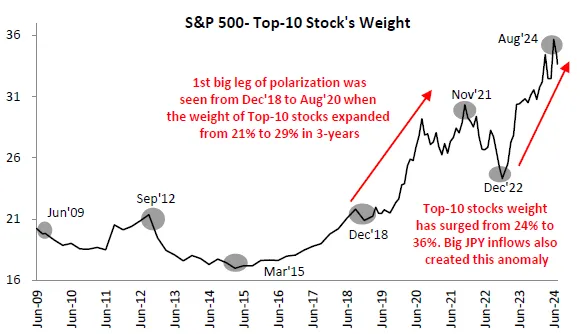

During 2017 to 2020, Yen-denominated funds began to flow out of the US markets in early 2017, with the outflows accelerating significantly in 2018. The impact of these outflows became particularly evident in 2018-2019, as the markets reacted to the withdrawal of capital. Fast forward to the present, the significant polarization observed in US markets since January 2023—where the weight of the top 10 stocks in the S&P 500 index surged from 24% to 36%—can be attributed to substantial Yen-denominated inflows. These inflows have heavily concentrated market performance around a few large-cap stocks, creating a skewed market dynamic.

However, the early signs of a reversal in the Yen carry trade are now emerging, as indicated by the recent underperformance of the S&P 500 weighted index relative to the equal-weighted index by 7% within a matter of weeks. This sharp movement is reminiscent of the market reactions seen during the 2017-2020 unwind period. The biggest risk in the current scenario lies in the top-heavy weights of the S&P 500 index. Should the Yen carry trade unwind gain momentum, the most significant impact could be felt by these large-cap stocks, which have been the primary beneficiaries of the inflows. To some degree, this has already led to a stock market crash on 5th August.

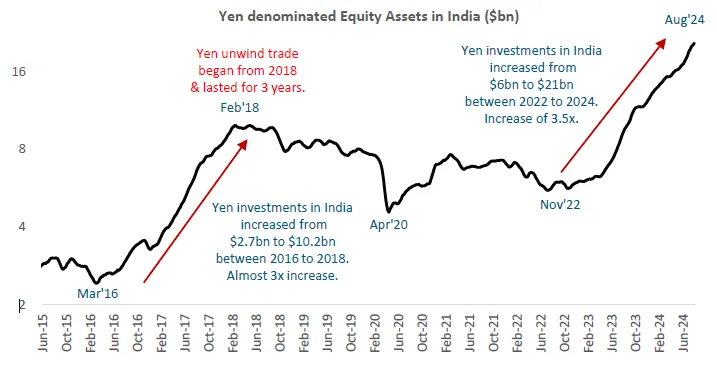

This recent surge in the Yen carry trade in India bears similarities to a previous wave between March 2016 and January 2018. During that period, the Yen depreciated by around 16% against the Indian Rupee, leading to significant inflows into Indian equity markets, particularly in midcap funds, which saw 10% of the total Yen inflows. This period also witnessed a broad expansion in domestic mutual fund investments. However, when the Yen carry trade unwound 2 years later starting in January 2018, yen denominated investments had nearly tripled from $2.7 billion to $10.2 billion. The breadth of the market was adversely affected, although domestic mutual fund inflows remained positive, albeit at a slower pace.

The current leg of the Yen carry trade, which began in March 2023, has seen even stronger flows into Indian midcap funds, accounting for 25% of the total Yen inflows. From Nov’22 to Aug’24, Yen denominated assets surged from $6 billion to $21 billion, reflecting a 3.5-fold increase. This has coincided with a surge in domestic mutual fund inflows into mid and small-cap schemes, largely driven by price momentum. The average monthly inflows into small-cap funds since March 2023 have been 1.5 times higher than the average of the previous two years. This suggests a reinforcement of the trend observed during the previous Yen carry trade cycle, where both foreign and domestic investors were increasingly seeking exposure to higher-growth segments of the Indian market.

The recent appreciation of the yen has led to a rush to unwind carry trades, resulting in a sharp selloff in global stock markets, including those in the U.S., Asia, and Europe. The rapid appreciation of the yen against other currencies has added to market volatility and uncertainty, and the shift in investment flows may redirect more capital into Japanese markets at the expense of other global markets. As investors liquidate their positions, they are not only repaying their yen-denominated loans but also selling off the assets they had purchased with those funds. This has contributed to significant volatility in stock and bond markets, particularly in sectors that had been popular targets for carry trades, such as emerging market assets and U.S. tech stocks.

The scale of this liquidation is still unfolding. Some analysts suggest that the bulk of speculative yen carry positions has already been unwound, while others believe further deleveraging could be on the horizon. The uncertainty surrounding the total size of the yen carry trade and the extent of remaining unwinding poses ongoing risks to market stability. For one, the reversal of capital flows could exert downward pressure on currencies and assets that had benefited from yen-funded investment, potentially leading to tighter financial conditions in those markets. This could be particularly challenging for emerging markets, which have already been grappling with the fallout from higher U.S. interest rates and a stronger dollar.

In Japan, the strengthening yen and tighter monetary conditions could also impact domestic economic recovery, particularly if the yen continues to appreciate significantly. A stronger yen reduces the competitiveness of Japanese exports, a critical component of the country's economic growth, and could dampen the earnings of Japanese companies.

Monitoring US Economic Data: The US unemployment rate has reached a nearly three-year high, and other economic indicators suggest a potential recession. Investors should closely monitor US economic data and Federal Reserve policies, as more aggressive rate cuts could further impact global markets. Also, the performance of U.S. tech stocks remains a key factor to watch, as they have been a major component of global investment portfolios.

Japanese Interest Rate Trends: Further rate hikes by the BoJ could continue to impact global investment flows and market stability.

Geopolitical Tensions in the Middle East: The situation in the Middle East remains volatile, with potential escalations in Tehran, Beirut, and Gaza. Investors should be prepared for continued instability in the region, which could impact global oil prices and broader market sentiment.

Military Intervention in Bangladesh: The political situation in Bangladesh is also a point of concern, particularly for India. The recent military intervention and the resignation of Prime Minister Sheikh Hasina create uncertainty that could affect regional stability and trade relations.

Shifts in Investment Strategy: There seems to be a shift towards defensive investments, with a preference for quality and value names over momentum plays. Investors should consider reallocating portfolios to more stable sectors while keeping an eye on market signals for potential breakouts.

Technology: Tech companies with high valuations, such as Apple, Microsoft, and Amazon, are often funded by speculative investments, including carry trades. The selloff in these stocks can be severe when the carry trade unwinds.

Financials: Banks and financial institutions involved in currency trading and international lending, such as Goldman Sachs and JPMorgan Chase, can be directly impacted by exchange rate volatility.

Real Estate: Companies with significant foreign debt exposure, such as real estate firms, may face increased debt servicing costs.

Emerging Markets: Stocks in emerging markets, including India, often see large inflows from carry trades. Companies like Tata Motors and Infosys, which attract significant foreign investment, can be affected.

India, as an emerging market, could also feel the effects of the yen carry trade unwinding, though the exact impact remains uncertain.

Pressure on Indian Markets: The global unraveling of carry trades could exert pressure on Indian equities, though the exact impact is uncertain.

Investment by Japanese Investors: Japanese foreign portfolio investors hold significant equities in India. A stronger yen might prompt these investors to sell, impacting the Indian stock market.

Debt Servicing Costs: Indian companies with long-term yen-denominated loans could face higher debt servicing costs due to the yen’s appreciation.

Infrastructure Funding: India has benefited from cheap capital from Japan for infrastructure projects. Higher interest rates in Japan could increase borrowing costs for such projects in the future.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart