Invest with knowledge & safety.

Every investor should be able to invest in right investment products based on their needs, manage and monitor them to meet their goals, access reports and enjoy financial wellness.

For disclosures refer to disclosures

By using the website www.wrightresearch.in and any of its pages (hereafter the “Site”), you confirm that you have reviewed, understand and agree to the following important legal information and terms of use (the “Terms”). If you do not agree to the Terms, please exit the Site immediately.

The Terms are subject to change at any time without notice and access to, and use of the Site may be restricted or terminated at any time. You are therefore advised to review these terms each time you access this website.

Access to and use of the Site as well as the Terms are governed by India law. The place of jurisdiction is Mumbai.

Further access to the website might also be subject to the laws applicable in the relevant jurisdiction from which the same is being accessed.

The information, products, data, services, tools and documents contained or described on this site (the “Content”) are for information purposes only and constitute neither an advertisement or recommendation nor an offer or solicitation to buy or sell investment instruments, to effect any transaction or to enter into any legal relations.

The financial products mentioned on this site are not suitable for all investors. Prior to making investment decisions investors should conduct a thorough investigation and obtain all necessary professional advice for all issues, including your eligibility to make such investment in terms of the applicable law.

Nothing on this site constitutes investment, legal, accounting or tax advice, or a representation that any investment or strategy is suitable or appropriate for individual circumstances, or otherwise constitutes a personal recommendation for any specific investor. Wright Research recommends that investors independently assess, with a professional advisor, the specific financial risks as well as legal, regulatory, credit, tax and accounting consequences.

The Content is not intended for use by or distribution to any individual or legal entity in any jurisdiction or country where such distribution, publication or use would be contrary to the law or regulatory provisions or in which members of the Group of Companies controlled by Wryght Research & Private Ltd. (individually and together “Wright Research”) does not hold the necessary registration or license. Individuals or legal entities in respect of whom such prohibitions apply, whether on grounds of their nationality, their place of residence or on other grounds, must not access or use the site.

Wright Research provides no warranty and makes no representations of any kind whatsoever regarding: (1) the currency, accuracy or completeness of the content; (2) the results to be obtained by any user of the Site; or (3) any third party content accessible on or through the Site.

Except to the extent required by current laws and/or regulations, Wright Research, including its directors, agents, employees or subcontractors: (1) disclaims any and all express or implied warranties and conditions including without limitation warranties and conditions as to quality and fitness for a particular purpose; and (2) does not warrant that the Site, any content (including any third party content), goods and services referred to therein will be uninterrupted or error free, that defects will be corrected or that the Site, the servers from which it is available or any connected website is free of viruses, trojan horses, worms, software bombs or similar items or processes or other harmful components. In order to safeguard against viruses, it is advisable to use up-to-date versions of browsers and to install and continuously update antivirus software. Users should strictly avoid opening e-mails of unknown origin or unexpected e-mail attachments.

Any data, including but not limited to financial market data, quotes, notices, research or other financial information accessible through this Site, have been obtained from carefully selected sources believed to be reliable. All such information is provided “as is” to the user without express or implied warranties of any kind, including warranties of quality, originality, non-infringement of intellectual property or fitness for any particular purpose.

The information and opinions in the Site are descriptive of Wright Research as a whole and the products and services described may not be available to or suitable for all investors. The fact that a user accesses the Site does not make him a client of Wright Research and you are requested to refer to paragraph 3 above.

Any expressions of opinion, estimates and projections on the Site are those of the authors at the date of writing. They do not necessarily reflect the view of Wright Research and are subject to change at any time without prior warning. Wright Research and its contractual partners may discontinue, or make changes in, the information, data and documents, and the products or services described herein, at any time without prior notice. Any information marked with a date is published as of this date only and no obligation or responsibility is undertaken to update or amend any such information.

To The Maximum Extent Permitted By Current Laws And/Or Regulations, Wright Research, Including Its Directors, Agents, Employees, Sub-contractors And Its Sales Partners Disclaim Any And All Liability For Losses Or Damages (Direct Or Indirect) Of Any Kind Whatsoever Arising Directly Or Indirectly As A Result Of (1) The Content, Accuracy, Completeness Or Otherwise Of The Content Or Any Links Or Third Party Content; (2) Any Errors In Or Omissions From The Site; (3) Use Of Or Access To The Site; (4) Any Inability To Access Or Use The Website For Any Reason.

To The Full Extent Permitted By Current Laws And/Or Regulations, Wright Research Shall Not Be Liable For Any (1) Loss Of Profits Or Revenue Or Savings Or Other Economic Loss, (2) Loss Of Business Or Goodwill, (3) Loss Of Or Damage To Data, (4) Incidental Or Special Loss, (5) Wasted Or Lost Management Time, Or (6) Indirect Or Consequential Loss Arising From Use Of Or Access To The Site, Even If Advised Of The Possibility Of Any Such Loss Or Damage Or If Such Loss Or Damage Was Foreseeable.

Unless accompanied by an explicit statement to the contrary, all content on this Site is protected by copyright, database rights, or other intellectual property rights, and is the property of Wright Research.

Except as otherwise specifically agreed in writing or to the extent necessary to use the Site in accordance with these Terms, you shall not: (1) copy the Site in whole or in part (except to make backup copies solely for disaster recovery purposes); (2) display, reproduce, create derivative works from, transmit, sell, distribute, rent, lease, sublicense, time-share, lend or transfer or in any way exploit the Site in whole or in part; (3) embed the Site into other products; (4) use the Site in any timesharing arrangement; (5) create function calls or other embedded links from any software program to the Site; (6) remove or obscure any copyright notice of Wright Research or any of its suppliers; (7) use any trademarks, service marks, domain names, logos, or other identifiers of Wright Research or any of its third party suppliers; or (8) save to the extent permitted under by law, reverse engineer, decompile, disassemble, or access the source code of the Site.

Nothing on the Site is designed to grant any license or right to use any image, trademark or logo. No act of downloading or otherwise copying from the Site will transfer any legal entitlement to any software or material on the Site to you. Wright Research reserves all intellectual property rights (such as copyright and trademark rights) to all material on the Site, and will enforce such rights to the full extent of applicable law.

Statements on this site may contain information obtained from third parties, including ratings from rating agencies such as Standard & Poor’s, Moody’s, Fitch and other similar rating agencies, and research from research providers Reproduction and distribution of third-party content in any form is prohibited except with the prior written permission of the related third party. Third-party content providers do not guarantee the accuracy, completeness, timeliness or availability of any information, including ratings or research, and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such content. Third-party content providers give no express or implied warranties, including, but not limited to, any warranties of merchantability or fitness for a particular purpose or use. Third-party content providers shall not be liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees or losses (including lost income or profits and opportunity costs) in connection with any use of their content, including ratings or research. Credit and/or research ratings are statements of opinions and are not statements of fact or recommendations to purchase, hold or sell securities. They do not address the market value of securities or the suitability of securities for investment purposes and should not be relied on as investment advice.

Wright Research and/or its board of directors, executive management and employees may have or have had interests or positions or traded or acted as market makers in securities referred to on the Site. Furthermore, such entities or persons may have or have had a relationship with or may provide or have provided corporate finance or other services to or serve or have served as directors of companies referred to on the Site.

The past is not an indication of the future performance of an investment. The value of investments may be subject to fluctuations and investors may not get back the amount invested. Changes in rates of foreign exchange may also cause the value of investments to go up or down.

Please note that all your actions while using this Site may be recorded and analyzed for various purposes, including security, marketing and system monitoring purposes.

Links to third-party websites on the Site are provided solely for your convenience as pointers to information on topics that may be useful to users of the Site. Wright Research has no control over the content on such third-party websites nor are such websites monitored by Wright Research. Activating some links to third-party websites on this Site may cause you to leave this Site. No warranties or liability concerning the content of such websites are made, including assurances that it is correct, accurate, complete, true, up-to-date or fit for any particular purpose. Nor does Wright Research warrant that such website or content is free from any claims of copyright or trademark or other infringement of the rights of third parties or that such site or content is free of viruses or other harmful components. No guarantee as to the authenticity of documents on the Internet is given.

Using links to third-party websites provided on this Site is at your sole discretion and at your own risk.

Please note that third-party websites are not subject to Wright Research data protection policy and Wright Research is not responsible for the policies they apply with regard to collection and treatment of your personal data. We recommend that you carefully read the terms of use and data protection policies governing the third-party website before using it in order to check how it protects your personal data and privacy.

For information on the kind of data collected, the purpose for which it is collected, how it is processed, to whom it may be disclosed and the security measures that have been put in place to protect it, please consult the Wright Research Data Privacy Policy under the following link:

This Site contains information on derivatives and research material. You will only be able to access detailed information on these subjects after indicating your country of origin. You will then be given access to information on derivatives and research material of Wright Research authorized for distribution in your jurisdiction. When obtaining access to such information you are required to pay particular attention to any accompanying legal information.

These Terms are for the benefit of Wright Research its successors and assigns. Wright Research may assign or transfer any of its rights under these Terms. Wright Research may delegate or subcontract the performance of any obligation under these Terms.

You can cancel your membership any time by contacting our team at info@wrightresearch.in and get a refund. You will be refunded the subscription amount on pro-rata basis with minimum deduction of one month from the date you submit for cancellation and refund. Allotment/ Refund time of response – 10 working days.

The Wright Research and its subsidiaries (“Wright Research”, “we” or “us”) welcome you to our website, mobile applications and other services provided via electronic means (together referred to as “Electronic Services”) and appreciate your interest in our products and services.

Wright Research attaches importance to appropriate data protection. This page explains how we treat your personal data in connection with your use of our Electronic Services (“Privacy Policy”).

By continuing to use the Wright Research Electronic Services, you confirm that you are 18 years of age or older. Please note that we may amend this Privacy Policy from time to time. The applicable version is always the current one, as referenced above.

For disclosures refer to disclosures

Protecting your privacy and treating the personal data of all users of our Electronic Services in accordance with the law is important to us. We understand that by using our Electronic Services you may be entrusting us with personal information (“data”) and assure you that we take our duty to protect and safeguard this data very seriously. This Privacy Policy therefore explains the kind of data we process when using our Electronic Services, the purpose for which we process it, how we process it, whom we may disclose it to and the security measures we have put in place to protect it.

This Privacy Policy applies to all data we obtain through your use of our Electronic Services. It does not apply to data we obtain through other channels nor to Electronic Services of third parties (“third-party Electronic Services”), even if you access them via a link in our Electronic Services or even if they are necessary for the operation of our Electronic Services. We have no influence on the content or privacy policy of third-party Electronic Services and therefore cannot assume any responsibility for them.

When you use our Electronic Services, details of your usage may be automatically registered by our backend systems (such as your IP address, browser, http-header user agent, device-specific information the content you accessed, including time and date of access, usage and user interaction, and the redirecting website from which you came to our Electronic Services). We also process personal data such as your name, address, e-mail address, phone number, date of birth, gender and other data transmitted to us if you register for the usage of our Electronic Services or if you complete a registration form or comment field for a newsletter, product demos, etc..

We process the data based on the following legal grounds:

We process the data for the following purposes:

We process all your personal data in accordance with the applicable laws on data protection and for as long as required.

Wright Research only discloses Electronic Services usage data to third parties as permitted by law, if we are legally obliged to do so or if such disclosure becomes necessary to enforce our rights, in particular to enforce claims arising from a contractual relationship. Within this scope as well as for the purpose of optimising our products and services, we may transmit data within the Wright Research Group between Group companies in India or abroad. Furthermore, we may disclose data to external service providers if this is necessary for the provision of products and services. Such service providers may not use the data for any other purpose than to process the order in question. All of the above persons and entities that may receive data must observe the applicable national and international data protection laws as well as the data protection standards of Wright Research.

Where so prescribed by applicable legislation, Wright Research may on request or under an ongoing duty to provide information disclose data to supervisory authorities, judicial authorities or other persons of authority.

Wright Research will make every effort to take appropriate technical and organisational security measures to ensure that your personal data processed within the IT environment controlled by Wright Research is protected against unauthorised access, misuse, loss and/or destruction, taking account of the applicable legal and regulatory requirements.

Wright Research takes both physical and electronic process-specific security measures, including firewalls, personal passwords, and encryption and authentication technologies. Our employees and the service providers commissioned by us are bound by professional secrecy and must comply with all data protection provisions.

Additionally, access to personal data is restricted to only those employees, contractors and third parties who require this access in order to assure the purpose of data processing and the provision of products and services (need to know principle).

Wright Research would like to draw your attention to the fact that if you use our Electronic Services via an open network, this may allow third parties (e.g. app stores, network providers or the manufacturer of your device), wherever they are located, to access and process your data. Open networks are beyond Wright Research’s control and can therefore not be regarded as a secure environment. Any transmission of data via such open network cannot be guaranteed to be secure or error-free as data may be intercepted, amended, corrupted, lost, destroyed, arrive late or incomplete, contain viruses or may be monitored. In particular, data sent via an open network may leave the country – even where both sender and recipient are in the same country – and may be transmitted to and potentially processed in third-party countries, where data protection requirements may be lower than in your country of residence.

Where data is transmitted via an open network, we cannot be held responsible for the protection of this data and we accept no responsibility or liability for the security of your data during transmission. We, therefore, recommend avoiding the transmission of any confidential information via open networks.

The Wright Research Electronic Services use cookies for statistical purposes as a tool for our web developers and to improve the user experience. Cookies are small files which are stored on your electronic device to keep track of your visit to the Electronic Services and your preferences; as you move between pages, and sometimes to save settings between visits. Cookies help the builders of Electronic Services gather statistics about how often people visit certain areas of the site, and help in tailoring Electronic Services to be more useful and user-friendly.

Please note that most web browsers accept cookies automatically. You can configure your browser to not save any or only certain cookies on your electronic device or to always display a warning before receiving a new cookie. Deactivating cookies can, however, prevent you from using certain functions on our Electronic Services.

Remark: For some Electronic Services, cookies are only persistent during user session and will be deleted after the session is terminated.

We use various analysis tools from third parties such as Google Analytics for the purpose of reporting for Electronic Services. This involves the creation of pseudo-anonymised data and use of cookies to help analyse how users use our Electronic Services. The information about your use generated by these cookies, such as the

may be transmitted to third party servers located in countries and is used for analysis purposes.

Please refer to the previous section, “Cookies”, for information on deleting cookies.

The Wright Research Electronic Services may contain links to third-party Electronic Services that are not operated or monitored by us. Please be aware that such third-party Electronic Services are not bound by this Privacy Policy and that we are not responsible for their content or their principles regarding the handling of personal data. We therefore recommend consulting and checking the individual privacy policies or terms of use of third-party Electronic Services.

According to applicable data protection laws and regulations, you may have the following rights:

You also have a right of appeal (as far as this affects you) to the respective Data Protection Supervisory Authority.

If you have questions about the processing of your personal data, please feel free to contact us by using the following contact details:

Name of the person: Sonam Srivastava

Designation: Founder, CEO

Address: The Capital 815A/B-Wing, opp. ICICI Bank, G Block BKC, Bandra Kurla Complex, Bandra East, Mumbai, Maharashtra 400051 Telephone: 91-6360127635

Email: info@wrightresearch.in

This process note is the property of Wright Research. The document is to be used for internal purposes only. Any unauthorized, copying, disclosure, use or distribution of the material is strictly forbidden

Providing excellent service on a regular and consistent basis is very important for the organisation’s sustained growth. Wright Research (“WR”) believes that quick and effective handling of complaints as well as prompt corrective & preventive actions and processes are essential for providing our services. This policy document is to enable to put in place an effective and suitable mechanism for receiving and addressing complaints from investors with specific emphasis on resolving such complaints fairly and expeditiously.

Objective of this policy document is to ensure that:

Definitions:

The various channels available to Investors for registering the complaints are as follows:

liaise with the other relevant departments (like Investment Advisory, Operations, Accounts, Legal, Compliance etc).

General Turn Around Time (TAT) for response to complaint is (from the receipt of the valid complaint in writing):

Note: The above TAT can change depending upon the nature and complexity of complaint.

If an investor is not satisfied with the resolution provided through various channels or the method of handling complaint; the investor can escalate the issues to the next higher level i.e. to the Managing Director of the Company. Such escalation should be made in writing and should be delivered in the hard copy to the Corporate Office of the Company

This Code of Ethics (“Code”) has been adopted by Wright Research and is designed to comply with Securities and Exchange Board of India (Investment Advisers) Regulations, 2013 [sub-regulation (9) of regulation 15]

This Code establishes rules of conduct for all employees of Wright Research and is designed to, among other things, govern personal securities trading activities in the accounts of employees, immediate family/household accounts and accounts in which an employee has a beneficial interest. The Code is based upon the principle that Wright Research andits employees owe a fiduciary duty to Wright Research's clients to conduct their affairs, including their personal securities transactions, in such a manner as to avoid (i) serving their own personal interests ahead of clients, (ii) taking inappropriate advantage of their position with the firm and (iii) any actual or potential conflicts of interest or any abuse of their position of trust and responsibility.

The Code is designed to ensure that the high ethical standards long maintained by Wright Research continue to be applied. The purpose of the Code is to preclude activities which may lead to or give the appearance of conflicts of interest, insider trading and other forms of prohibited or unethical business conduct. The excellent name and reputation of our firm continues to be a direct reflection of the conduct of each employee.

Pursuant to the Investment Advisers Regulation, both Wright Research and its employees are prohibited from engaging in fraudulent, deceptive or manipulative conduct. Compliance with this section involves more than acting with honesty and good faith alone. It means that the Wright Research has an affirmative duty of utmost good faith to act solely in the best interest of its clients.

Wright Research and its employees are subject to the following specific fiduciary obligations when dealing with clients:

In meeting its fiduciary responsibilities to its clients, Wright Research expects every employee to demonstrate the highest standards of ethical conduct for continued employment with Wright Research. Strict compliance with the provisions of the Code shall be considered a basic condition of employment with Wright Research. Wright Research's reputation for fair and honest dealing with its clients has taken considerable time to build. This standing could be seriously damaged as the result of even a single securities transaction being considered questionable in light of the fiduciary duty owed to our clients. Employees are urged to seek the advice of Sonam Srivastava, the Investment Advisor, for any questions about the Code or the application of the Code to their individual circumstances. Employees should also understand that a material breach of the provisions of the Code may constitute grounds for disciplinary action, including termination of employment with Wright Research.

The provisions of the Code are not all-inclusive. Rather, they are intended as a guide for employees of Wright Research in their conduct. In those situations where an employee may be uncertain as to the intent or purpose of the Code, he/she is advised to consult with Sonam Srivastava. Sonam Srivastava may grant exceptions to certain provisions contained in the Code only in those situations when it is clear beyond dispute that the interests of our clientswill not be adversely affected or compromised. All questions arising in connection with personal securities trading should be resolved in favor of the client even at the expense of the interests of employees.

An investment adviser shall act honestly, fairly and in the best interests of its clients and in the integrity of the market.

An investment adviser shall act with due skill, care and diligence in the best interests of its clients and shall ensure that its advice is offered after thorough analysis and taking into account available alternatives.

An investment adviser shall have and employ effectively appropriate resources and procedures which are needed for the efficient performance of its business activities.

An investment adviser shall seek from its clients, information about their financial situation, investment experience and investment objectives relevant to the services to be provided and maintain confidentiality of such information.

An investment adviser shall make adequate disclosures of relevant material information while dealing with its clients.

An investment adviser advising a client may charge fees, subject to any ceiling as may be specified by the Board, if any. The investment adviser shall ensure that fees charged to the clients is fair and reasonable.

An investment adviser shall try to avoid conflicts of interest as far as possible and when they cannot be avoided, it shall ensure that appropriate disclosures are made to the clients and that the clients are fairly treated.

An investment adviser including its representative(s) shall comply with all regulatory requirements applicable to the conduct of its business activities so as to promote the best interests of clients and the integrity of the market.

The senior management of a body corporate which is registered as investment adviser shall bear primary responsibility for ensuring the maintenance of appropriate standards of conduct and adherence to proper procedures by the body corporate.

The concept of class of investors (typically termed as accredited investors or qualified investors or professional investors) who have an understanding of various financial products and the risks- returns associated with them and are able to take informed decisions regarding their investments is recognized globally by many securities and financial market regulators.

Further, they are also considered to be capable of dealing in relatively riskier investment products due to their financial capacity and ability to absorb possible financial losses. The global regulators reckoned that these investors are sophisticated enough to not require extensive regulatory protection, and therefore, issuers of securities and providers of investment products/ services are offered a regulation-light regime, to offer their products/services to accredited investors.

Based on the above, it was envisaged by SEBI to introduce the concept of Accredited Investors in India with uniform eligibility criteria, accompanied by a flexible regulatory framework for the various securities market products and services may be beneficial to the development and growth of the Indian securities market.

Accordingly, SEBI (Portfolio Managers) Regulations, 2020 on August 03, 2021 and SEBI circular SEBI/HO/IMD/IMD-I/DF9/P/CIR/2021/620 dated August 26, 2021, introduced the concept of Accredited Investors and modalities for implementation of the framework for Accredited Investors.

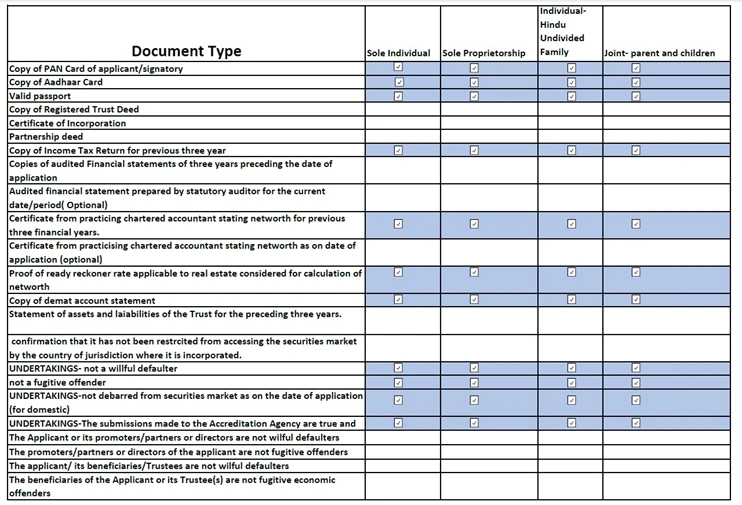

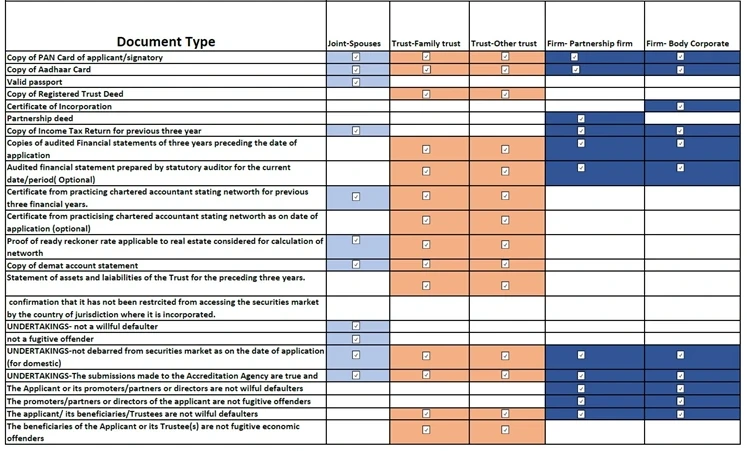

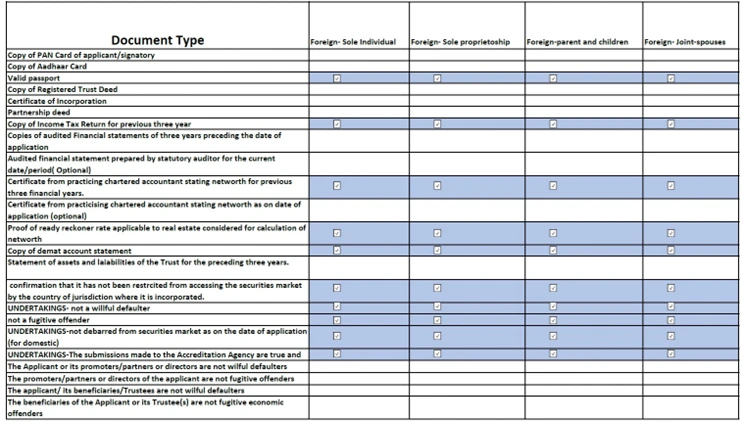

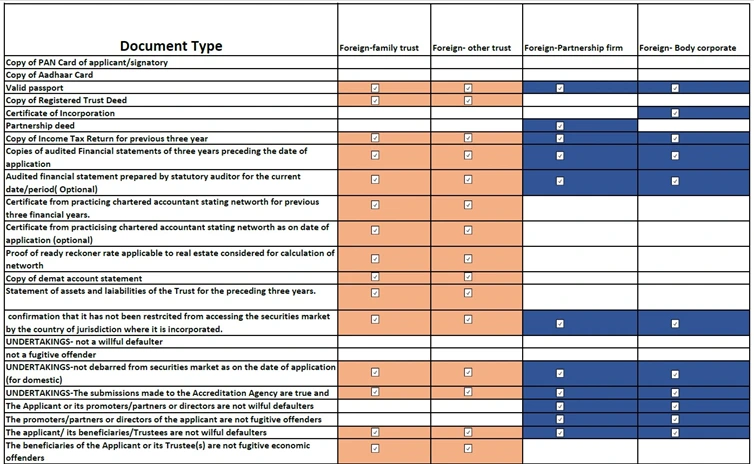

In view of the same, given below is the framework for Accredited Investors:

“Accredited Investor or AI” means any person who fulfills the applicable eligibility criteria and is granted a certificate of accreditation by an Accreditation Agency. Provided that the Central Government and the State Governments, developmental agencies set up under the aegis of the Central Government or the State Governments, funds set up by the Central Government or the State Governments, qualified institutional buyers as defined under the Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018, Category I foreign portfolio investors, sovereign wealth funds and multilateral agencies and any other entity as may be specified by SEBI from time to time, shall deemed to be an accredited investor and may not be required to obtain a certificate of accreditation.

“Accreditation Agency” means a subsidiary of a recognized stock exchange or a subsidiary of a depository or any other entity as may be specified by SEBI from time to time.

The following entities are currently notified as Accreditation Agency by SEBI:

“Large Value Accredited Investor” means an Accredited Investor who has entered into an agreement with the Portfolio Manager for a minimum investment of INR 10 crores.

| Particulars | Applicability |

|---|---|

| Contents of agreement specified under Schedule IV of SEBI (Portfolio Managers) Regulations, 2020 shall not apply to the agreement between the Portfolio Manager and Large Value Accredited Investor | Large Value Accredited Investor |

| The requirement of minimum investment of INR 50 lakhs per client shall not apply | Accredited Investor |

| The Portfolio Manager may offer discretionary or non-discretionary or advisory services for investment up to hundred percent of the assets under management in unlisted securities subject to the terms agreed between the client and the Portfolio Manager | Large Value Accredited Investor |

| The quantum and manner of exit load applicable to the client as provided under the PMS regulations shall not apply and shall be governed through bilaterally negotiated contractual terms | Large Value Accredited Investor |

The following persons shall be eligible to be considered as Accredited Investors:

| Category | Criteria |

|---|---|

| Individual |

|

| Hindu Undivided Family | |

| Family trust | |

| Sole proprietorship | |

| Body corporate | Body corporate Net worth greater than or equal to INR 50 Crore |

| Trust other than family trust | Trust other than family trust Net worth greater than or equal to INR 50 Crore |

| Partnership firmset up under the Indian Partnership Act, 1932 | Partnership firmset up under the Indian Partnership Act, 1932 Each partner independently meets the eligibility accreditation criteria for |

The eligibility criteria shall be reckoned as follows:

| Category | Particulars |

|---|---|

| Individual | The value of the primary residence shall not be considered for calculation of net worth |

| Karta of HUF | The value of the primary residence shall not be considered for calculation of net worth |

| Sole Proprietor | The value of the primary residence shall not be considered for calculation of net worth |

| Body Corporate | Net worth shall be calculated as under: Net worth = (Capital + free reserves) – (Accumulated losses + deferred expenditure not written off) |

| Trustee | Net worth shall be calculated as under: Net worth = (Capital + free reserves) – (Accumulated losses + deferred expenditure not written off) |

The Portfolio Manager may obtain additional undertakings from prospective investors in addition to the above.

Investors shall have the flexibility to withdraw their ‘Consent’ and discontinue availing benefits of accreditation, subject to the following:

| Investor Category | Fees and Charges (Rs.)* | ||

|---|---|---|---|

| BASL Processing Charges | BASL Certification Fees | ||

| For One Year Tenure | For Two Year Tenure | ||

| Individuals, HUFs, Family Trusts and Sole Proprietorships | Rs. 5,000/- | Rs. 5,000/- | Rs. 9,500/- |

| Partnership Firms | Rs. 5,000/- | Rs. 10,000/- | Rs. 19,000/- |

| Trusts (other than family trusts) | Rs. 5,000/- | Rs. 15,000/- | Rs. 28,500/- |

| Body Corporates | Rs. 5,000/- | Rs. 15,000/- | Rs. 28,500/- |

*plus taxes as applicable. Both Processing and Certification fees need to be paid at the time of submission of application. The Processing charges are non-refundable.

BASL shall issue its certificate to the eligible Accredited Investor applicants whose application has been approved by BASL. The relevant details including the validity period will be displayed on the certificate.

The investors are advised to visit www.bseasl.com for detailed user manual and updates notified by BASL from time to time

| Investor Category | Fees and Charges (Rs.)* | ||

|---|---|---|---|

| CVL Processing Charges | CVL Certification Fees | ||

| For One Year Tenure | For Two Year Tenure | ||

| Individuals, HUFs, Family Trusts and Sole Proprietorships | Rs. 5,000/- | Rs. 5,000/- | Rs. 9,500/- |

| Partnership Firms | Rs. 5,000/- | Rs. 10,000/- | Rs. 19,000/- |

| Trusts (other than family trusts) | Rs. 5,000/- | Rs. 15,000/- | Rs. 28,500/- |

| Body Corporates | Rs. 5,000/- | Rs. 15,000/- | Rs. 28,500/- |

Note:

The investors are advised to visit www.aia.cvlindia.com for detailed user manual and updates notified by CVL from time to time.

For the purpose of suspicious transactions reporting apart from `transactions integrally Connected', `transactions remotely connected or related need to be considered.

“Suspicions Transactions” means a transaction whether or not made in cash which to a person acting in good faith –

The main objectives of the PMLA are as follows:

Brokers being SEBI registered intermediaries have to comply with the spirit of anti money laundering provisions. To comply with PMLA, the following three specific parameters should be observed, which are related to the overall `Client Due Diligence Process':

For the purpose of CDD, Broker is dealing with institutional clients. According to SEBI regulation / rules Institutional clients includes:

According to SEBI, all trades done by institutional clients should be settled through Clearing House. In clearing house trade, trades are settled by the Broker and custodian of the respective client.

In view of above, following steps to be taken to comply with `Customer Due Diligence' process before registering as client:

Before registering a client, obtain antecedent information. Verify independently information submitted by client but not limited to his identity, registered office address, correspondence address, contact details, occupation, Promoters /Directors, source of income, experience in securities market, PAN no. SEBI Registration No. etc. Obtain as many as information. Generally Institutional clients are recognized at global level. We need to verify clients identity and origin using services of Bloomberg, Reuters, internet services or any other reliable, independent source documents, data or information. After verifying information, registration form along with other supporting documents should be approved by the Compliance Officer designated for verification.

After completing the registration process, the client account should be verified by an independent employee to check the actual beneficial ownership and control of the particular account. We need to obtain the details with respect to Shareholders, Promoters from the client and it has to be verified independently. In this process we should find out who is authorized to operate the client's account and who is ultimately controlling the account. Also verify the sources of funds for funding the transaction. We also have to take care at the time of settlement regarding the nature of transaction, movement / source of transaction, etc. Periodically ask for client's financial details to determine the genuineness of transaction

The “Beneficial Owner” is the natural person or persons who ultimately own, control or influence a client and / or persons on whose behalf a transaction is being conducted. It also incorporates those persons who exercise ultimate effective control over a legal person or arrangement.

Periodically we need to conduct due diligence and scrutiny of client's transactions and accounts to ensure that transactions are being conducted in knowledge, to find out the risk profile, source of funds, etc. At regular interval, ongoing due diligence and scrutiny need to be conduct i.e. perform ongoing scrutiny of the transactions and account throughout the course of the business relationship to ensure that the transactions being conducted are consistent with the Organization’s knowledge of the client, its business and risk profile, taking into account, where necessary, the customer's source of funds.

Before registering client, we need to identify the following details of the prospective client:

The following safeguards are to be followed while accepting the clients:

The parameters of clients into low, medium and high risk should be classified. Clients of special category (as given below) may be classified as higher risk and higher degree of due diligence and regular update of KYC profile should be performed.

We can also evaluate whether there is suspicious trading in determining whether to freeze or close the account. Should be cautious to ensure that it does not return securities or money that may be from suspicious trades. However, we can consult the relevant authorities in determining what action should be taken when it suspects suspicious trading.

Acceptance of clients through Risk-Based Approach:

The clients may be of a higher or lower risk category depending on circumstances such as the customer's background, type of business relationship or transaction etc. We should apply each of the clients due diligence measures on a risk sensitive basis. We should adopt an enhanced customer due diligence process for higher risk categories of customers. Conversely, a simplified customer due diligence process may be adopted for lower risk categories of customers. In line with the risk-based approach, we should obtain the type and amount of identification information and documents necessarily dependent on the risk category of a particular customer.

Clients of special category (CSC):

CSC clients include the following:

The above mentioned list is only illustrative and we should exercise independent judgment to ascertain whether new clients should be classified as CSC or not.

Record Keeping:

For the purpose of the record keeping provision, we should ensure compliance with the record keeping requirements contained in the SEBI Act, 1992, Rules and Regulations made there-under, PLM act, 2002 as well as other relevant legislation, Rules, Regulations, Exchange Bye-laws and Circulars.

Records to be maintained should be sufficient to permit reconstruction of individual transactions (including the amounts and type of currencies involved, if any) so as to provide, if necessary, evidence for prosecution of criminal behavior.

Should there be any suspected drug related or other laundered money or terrorist property, the competent investigating authorities would need to trace through the audit trail for reconstructing the financial profile of the suspect's account. To enable this reconstruction, organizations should retain the following information for the accounts of their customers in order to maintain a satisfactory audit trail.

Organization should ensure that all client and transaction records and information are made available on a timely basis to the competent investigating authorities.

The following document retention terms should be observed:

In situations where the records relate to on-going investigation or transactions, which Have been the subject of a suspicious transaction reporting, they should be retained until it is confirmed that the case has been closed.

Monitoring of transactions:

Regular monitoring of transactions is required for ensuring effectiveness of the Anti Money laundering procedures.

Special attention required to all complex, unusually large transactions / patterns which Appear to have no economic purpose. Internal threshold limits to specify for each class of client's accounts and pay special attention to the transaction, which exceeds these limits.

Should ensure that the records of the transaction are preserved and maintained in terms of the PMLA 2002 and that transactions of suspicious nature or any other transaction notified under section 12 of the act are reported to the appropriate authority. Suspicious transactions should also be regularly reported to the higher authorities / head of the department.

Further the Compliance Department should randomly examine select transaction

undertaken by clients to comment on their nature i.e. whether they are in the suspicious

Transactions or not

.

Whether a particular transaction is suspicious or not will depend upon the background, details of the transactions and other facts and circumstances. Followings are the circumstances, which may be in the nature of suspicious

Transactions:-

Any suspicion transaction needs to be notified immediately to the designated Principal Officer. The notification may be done in the form of a detailed report with Specific reference to the client's transactions and the nature / reason of suspicion. However, it should be ensured that there is continuity in dealing with the client as Normal until told otherwise and the client should not be told of the report /suspicion. In exceptional circumstances, consent may not be given to continue to operate the Account and transactions may be suspended, in one or more jurisdictions concerned in the transaction, or other action taken.

Wright Research has designated Ms. Sonam Srivastava, as the Principal Officer for due compliance of anti money laundering policies related to PMS Activities. She will be responsible for implementation of internal controls & procedures for identifying and reporting any suspicious transaction or activity to the FIU – IND.

Wright Research has designated Mr. Siddharth Singh Bhaisora, as the Principal Officer for due compliance of anti money laundering policies related to RIA Activities. She will be responsible for implementation of internal controls & procedures for identifying and reporting any suspicious transaction or activity to the FIU – IND.

The particulars given in this Disclosure Document have been prepared in accordance with SEBI (Investment Advisers) Regulations, 2013.

The purpose of the Document is to provide essential information about the Investment Advisory Services in a manner to assist and enable the prospective client/client in making an informed decision for engaging Investment Advisor before investing.

For the purpose of this Disclosure Document, Investment Adviser is “Wright Research & Capital Pvt Ltd” company registered with the Securities and Exchange Board of India as an Investment Advisor under SEBI (Investment Advisers) Regulations, 2013 vide registration no. INA100015717 dated Jan 12, 2021 having its registered office at 103, Shagun Vatika, Prag Narayan Road, Lucknow 226001, India.

WR was originally started as a trademark name for the investment advisory services given by Sonam Srivastava and the registration got transferred to private limited company “Wryght Research & Private Limited” The current Principal Officer for the RIA department is Mr Siddharth Singh Bhaisora

In the capacity as advisers WR aligns its interests with those of the client and seeks to provide the best suited advice based on clients risk profile. WR first tries to understand the client's return expectations, risk taking ability & goals, which in turn helps to arrive at an asset allocation suitable for the client. WR conducts frequent portfolio reviews and suggests any corrective action/s if required.

WR will provide Advisory Services which shall be in the nature of investment advice, and may include buying and selling the securities for an for an agreed fee structure and which may be for a definite period of time and which may vary / change from time to time, entirely at the Client’s risk. The detailed terms and conditions are as per the agreement executed between client and WR.

No action has been taken against the Individual or the Company as an Investment Adviser by any regulator.

“Disclosure with respect to compliance with Annual compliance audit requirement under Regulation 19(3) of SECURITIES AND EXCHANGE BOARD OF INDIA (INVESTMENT ADVISERS) REGULATIONS, 2013 for last and current financial year are as under :

| Financial Year | Compliance Audit Status | Remarks |

|---|---|---|

| FY20-21 | Completed | |

| FY21-22 | Completed | |

| FY22-23 | Completed | |

| FY23-24 | Completed |

No other affiliations or intermediaries have been registered.

WR do not have any distribution or execution arrangement with the issuers of the securities, that WR advises on. The fellow subsidiaries of WR may receive distribution commission/referral fee or similar income in respect of the product or securities for which investment advice is provided to the client by WR. The indicative commissions received by fellow subsidiaries are available on the website.

WR does not recommend services of any stock broker or intermediary to a client. WR does not have any commission sharing agreement with any intermediary for recommending the services either as a stock broker or as other intermediary.

Although WR is not registered as a broker with SEBI, it is not actively engaged into any proprietary trading. It might invest in financial products / securities in the future.

WR is a separate legal entity which has an independent activity of providing the Investment Advisory services. WR does not provide any other services in stock broking, depository, research, portfolio management and distribution of mutual funds and third party products.

Clients are requested to go through the detailed key features, performance track record of the product, or security including warnings, disclaimers etc. before investing as and when provided by the Investment Advisor. Such product materials may also be available towww.sebi.gov.inorwww.nseindia.comorwww.bseindia.com.

WR and the Investment Advisers of WR who provide the investment advice to the clients, shall draw the client’s attention to the warnings, disclaimers in documents, advertising materials relating to an investment product/s which he/she/they is/are recommending to the client/s.

We trust that, before executing on the advice of the Investment Adviser, our Relationship Manager at WR has provided you with all the information about the products, risk factors etc. and you have gone through all the relevant information about the product being advised and have sought requisite clarification about the same.

WR shall maintain complete confidentiality of all information provided by the client/s and shall not disclose any such information, without your prior consent except if such disclosure is required to be made in compliance with any applicable law or regulatory direction. WR will obtain information pertaining to your orders/transactions/portfolio/funds availability/securities availability etc. from the individual Investment Adviser to enable us to provide you with informed and appropriate advice.

Wright Research & Capital Pvt Ltd may, from time to time, hold certain stocks recommended in the model portfolios within its Portfolio Management Services (PMS), which operates independently and separately from the research analyst team. There is a strict segregation of duties between the portfolio manager responsible for PMS research, investment, and management, and the research analyst responsible for model portfolio recommendations under our RA services. This structure eliminates any conflict of interest, as the PMS team operates independently and does not share stock insights, advice, or inputs with the research analyst team. Robust internal controls are in place to monitor and mitigate any potential conflicts, maintaining transparency and prioritizing client interests.

The detail of investor relation officer who shall attend to the investor queries and complaints is mentioned below:

Name of the person: Siddharth Singh Bhaisora

Designation: Investment Advisor

Address: The Capital 815A/B-Wing, opp. ICICI Bank, G Block BKC, Bandra Kurla Complex, Bandra East, Mumbai, Maharashtra 400051 Telephone: 91-6360127635

Email: info@wrightresearch.in

In case of any grievances the investors may email to info@wrightresearch.in

Wryght Research & Capital Pvt Ltd is registered with SEBI as a Research Analyst with INH000017295 as the SEBI registration number. The registered office address of Wryght Research & Capital Pvt Ltd is 102, Shagun Vatika, Prag Narayan Road, Lucknow 226001, India. The CIN number of the company is U67100UP2019PTC123244.

The content and data available in the material prepared by the company and on the website of the company, including but not limited to index value, return numbers and rationale are for information and illustration purposes only. Charts and performance numbers do not include the impact of transaction fee and other related costs. Past performance does not guarantee future returns and performances of the portfolios are subject to market risk. Data used for calculation of historical returns and other information is provided by exchange approved third party vendors and has neither been audited nor validated by the Company. Detailed return calculation methodology is available here. Detailed volatility calculation methodology is available here.

Information present in the material prepared by the company and on the website of the company shall not be considered as a recommendation or solicitation of an investment. Investors are responsible for their investment decisions and are responsible to validate all the information used to make the investment decision. Investor should understand that his/her investment decision is based on personal investment needs and risk tolerance, and information present in the material prepared by the company and on the website of the company is one among many other things that should be considered while making an investment decision. Investments in securities market are subject to market risks. Read all the related documents carefully before investing.

Registration granted by SEBI, membership of BASL (in case of RAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The purpose of the Document is to provide essential information about the Research Analyst Services in a manner to assist and enable the prospective client/client in making an informed decision for engaging Research Analyst before investing.

Wright Research (WR), in its capacity as a SEBI-Registered Research Analyst, is dedicated to providing in-depth and objective research and market analysis. WR specializes in generating insights based on data-driven methodologies and market research, aimed at helping clients and investors make informed decisions. Our research covers a wide spectrum of securities, industries, and market trends, without providing personalized research analysis or engaging in client-specific risk profiling. WR focuses on delivering research reports and recommendations based on publicly available data, financial reports, and market conditions.

WR provides Research Analyst services that include the publication of research reports, security analysis, and market insights. These services are delivered through various means, such as reports, newsletters, and digital platforms. WR does not engage in executing transactions or managing individual portfolios, nor does it provide personalized advisory services like risk profiling or client-specific investment recommendations. All decisions based on WR’s research are made solely by the client, and WR assumes no responsibility for the outcomes of such decisions. The terms of use for WR’s research services are governed by the agreements and disclosures made available to all clients, and WR reserves the right to amend or update these terms as necessary.

No action has been taken against the Individual or the Company as an Research Analyst by any regulator.

No other affiliations or intermediaries have been registered.

WR do not have any distribution or execution arrangement with the issuers of the securities, that WR publishes research on.

WR does not recommend services of any stock broker or intermediary to a client. WR does not have any commission sharing agreement with any intermediary for recommending the services either as a stock broker or as other intermediary.

Although WR is not registered as a broker with SEBI, it is not actively engaged in to any proprietary trading. It invest in financial products / securities.

WR is a separately identifiable department which has an independent activity of providing the Research Analyst services. WR does not provide any other services in stock broking, depository, and distribution of mutual funds and third party products. We provide portfolio management services as well.

Clients are requested to go through the detailed key features, performance track record of the product, or security including warnings, disclaimers etc. before investing as and when provided by the Research Analyst. Such product materials may also be available to www.sebi.gov.in or www.nseindia.com or www.bseindia.com.

WR and the Research Analysts of WR who provide the research analysis to the clients, shall draw the client’s attention to the warnings, disclaimers in documents, advertising materials relating to an investment product/s which he/she/they is/are publishing in the research.

We trust that, before executing on the research of the Research Analyst,we have provided you with all the information about the research, risk factors etc. and you have gone through all the relevant information about the research and have sought requisite clarification about the same.

WR shall maintain complete confidentiality of all information provided by the client/s and shall not disclose any such information, without your prior consent except if such disclosure is required to be made in compliance with any applicable law or regulatory direction

Wright Research & Capital Pvt Ltd may, from time to time, hold certain stocks recommended in the model portfolios within its Portfolio Management Services (PMS), which operates independently and separately from the research analyst team. There is a strict segregation of duties between the portfolio manager responsible for PMS research, investment, and management, and the research analyst responsible for model portfolio recommendations under our RA services. This structure eliminates any conflict of interest, as the PMS team operates independently and does not share stock insights, advice, or inputs with the research analyst team. Robust internal controls are in place to monitor and mitigate any potential conflicts, maintaining transparency and prioritizing client interests.

The detail of investor relation officer who shall attend to the investor queries and complaints is mentioned below:

License Holder Name: Wryght Research & Capital Private LimitedClient’s queries / complaints may arise due to lack of understanding or a deficiency of service experienced by clients. Deficiency of service may include lack of explanation, clarifications, understanding which escalates into shortfalls in the expected delivery standards, either due to inadequacy of facilities available or through the attitude of staff towards client.

|

Sr.No. |

Month |

Carried forward from previous month |

Received |

Resolved* |

Pending# |

|

18 |

Jun, 2022 |

0 |

0 |

0 |

0 |

|

19 |

Jul, 2022 |

0 |

0 |

0 |

0 |

|

20 |

Aug, 2022 |

0 |

0 |

0 |

0 |

|

21 |

Sep, 2022 |

0 |

0 |

0 |

0 |

|

22 |

Oct, 2022 |

0 |

0 |

0 |

0 |

|

23 |

Nov, 2022 |

0 |

0 |

0 |

0 |

|

24 |

Dec, 2022 |

0 |

0 |

0 |

0 |

|

25 |

Jan, 2023 |

0 |

0 |

0 |

0 |

|

26 |

Feb, 2023 |

0 |

0 |

0 |

0 |

|

27 |

Mar, 2023 |

0 |

0 |

0 |

0 |

|

28 |

Apr, 2023 |

0 |

0 |

0 |

0 |

|

29 |

May, 2023 |

0 |

0 |

0 |

0 |

|

30 |

Jun, 2023 |

0 |

0 |

0 |

0 |

|

31 |

Jul, 2023 |

0 |

0 |

0 |

0 |

|

32 |

Aug, 2023 |

0 |

0 |

0 |

0 |

|

33 |

Sep, 2023 |

0 |

0 |

0 |

0 |

|

34 |

Oct, 2023 |

0 |

0 |

0 |

0 |

|

35 |

Nov, 2023 |

0 |

0 |

0 |

0 |

|

36 |

Dec, 2023 |

0 |

0 |

0 |

0 |

|

37 |

Jan, 2024 |

0 |

0 |

0 |

0 |

|

38 |

Feb, 2024 |

0 |

0 |

0 |

0 |

|

39 |

Mar, 2024 |

0 |

0 |

0 |

0 |

|

40 |

Apr, 2024 |

0 |

0 |

0 |

0 |

|

41 |

May, 2024 |

0 |

0 |

0 |

0 |

|

42 |

June, 2024 |

0 |

0 |

0 |

0 |

|

43 |

July, 2024 |

0 |

0 |

0 |

0 |

|

44 |

August, 2024 |

0 |

0 |

0 |

0 |

|

45 |

Sep, 2024 |

0 |

0 |

0 |

0 |

|

46 |

Oct, 2024 |

0 |

0 |

0 |

0 |

|

47 |

Nov, 2024 |

0 |

0 |

0 |

0 |

|

48 |

Dec, 2024 |

0 |

0 |

0 |

0 |

|

49 |

Jan, 2025 |

0 |

0 |

0 |

0 |

|

50 |

Feb, 2025 |

0 |

0 |

0 |

0 |

|

51 |

Mar, 2025 |

0 |

0 |

0 |

0 |

|

52 |

Apr, 2025 |

0 |

0 |

0 |

0 |

|

53 |

May, 2025 |

0 |

0 |

0 |

0 |

|

54 |

Jun, 2025 |

0 |

0 |

0 |

0 |

|

55 |

Jul, 2025 |

0 |

0 |

0 |

0 |

|

56 |

Aug, 2025 |

0 |

0 |

0 |

0 |

|

57 |

Sep, 2025 |

0 |

0 |

0 |

0 |

|

58 |

Oct, 2025 |

0 |

0 |

0 |

0 |

|

Grand Total |

0 |

0 |

0 |

0 |

|

Received from |

Pending last month |

Received |

Resolved |

Pending over 3 months |

Average resolution time |

Total pending |

|

Investors |

0 |

0 |

0 |

0 |

0 |

0 |

|

SEBI Scores |

0 |

0 |

0 |

0 |

0 |

0 |

|

Other Sources |

0 |

0 |

0 |

0 |

0 |

0 |

*Inclusiveof complaints of previous months resolved in the current month.

#Inclusiveof complaintspending as on the last day of the month.

|

SN |

Year |

Carried forward from previous year |

Received |

Resolved* |

Pending# |

|

1 |

2020-21 |

0 |

0 |

0 |

0 |

|

2 |

2021-22 |

0 |

0 |

0 |

0 |

|

3 |

2022-23 |

0 |

0 |

0 |

0 |

|

4 |

2023-24 |

0 |

0 |

0 |

0 |

|

5 |

2024-25 |

0 |

0 |

0 |

0 |

|

GrandTotal |

0 |

0 |

0 |

0 |

*Inclusiveof complaints of previous years resolved in the current year.

#Inclusiveof complaintspending as on the last day of the year.

Client’s queries / complaints may arise due to lack of understanding or a deficiency of service experienced by clients. Deficiency of service may include lack of explanation, clarifications, understanding which escalates into shortfalls in the expected delivery standards, either due to inadequacy of facilities available or through the attitude of staff towards client.

|

Sr.No. |

Month |

Carried forward from previous month |

Received |

Resolved* |

Pending# |

|

1 |

July, 2024 |

0 |

0 |

0 |

0 |

|

2 |

August, 2024 |

0 |

0 |

0 |

0 |

|

3 |

Sep, 2024 |

0 |

0 |

0 |

0 |

|

4 |

Oct, 2024 |

0 |

0 |

0 |

0 |

|

5 |

Nov, 2024 |

0 |

0 |

0 |

0 |

|

6 |

Dec, 2024 |

0 |

0 |

0 |

0 |

|

7 |

Jan, 2025 |

0 |

0 |

0 |

0 |

|

8 |

Feb, 2025 |

0 |

0 |

0 |

0 |

|

9 |

Mar, 2025 |

0 |

0 |

0 |

0 |

|

10 |

Apr, 2025 |

0 |

0 |

0 |

0 |

|

11 |

May, 2025 |

0 |

0 |

0 |

0 |

|

12 |

Jun, 2025 |

0 |

0 |

0 |

0 |

|

13 |

Jul, 2025 |

0 |

0 |

0 |

0 |

|

14 |

Aug, 2025 |

0 |

0 |

0 |

0 |

|

15 |

Sep, 2025 |

0 |

0 |

0 |

0 |

|

16 |

Oct, 2025 |

0 |

0 |

0 |

0 |

|

Grand Total |

0 |

0 |

0 |

0 |

|

Received from |

Pending last month |

Received |

Resolved |

Pending over 3 months |

Average resolution time |

Total pending |

|

Investors |

0 |

0 |

0 |

0 |

0 |

0 |

|

SEBI Scores |

0 |

0 |

0 |

0 |

0 |

0 |

|

Other Sources |

0 |

0 |

0 |

0 |

0 |

0 |

*Inclusiveof complaints of previous months resolved in the current month.

#Inclusiveof complaintspending as on the last day of the month.

|

SN |

Year |

Carried forward from previous year |

Received |

Resolved* |

Pending# |

|

1 |

2024-25 |

0 |

0 |

0 |

0 |

|

GrandTotal |

0 |

0 |

0 |

0 |

*Inclusiveof complaints of previous years resolved in the current year.

#Inclusiveof complaintspending as on the last day of the year.

Client’s queries / complaints may arise due to lack of understanding or a deficiency of service experienced by clients. Deficiency of service may include lack of explanation, clarifications, understanding which escalates into shortfalls in the expected delivery standards, either due to inadequacy of facilities available or through the attitude of staff towards client.

|

Sr.No. |

Month |

Carried forward from previous month |

Received |

Resolved* |

Pending# |

|

1 |

Apr, 2023 |

0 |

0 |

0 |

0 |

|

2 |

May, 2023 |

0 |

0 |

0 |

0 |

|

3 |

June, 2023 |

0 |

0 |

0 |

0 |

|

4 |

July, 2023 |

0 |

0 |

0 |

0 |

|

5 |

Aug, 2023 |

0 |

0 |

0 |

0 |

|

6 |

Sep, 2023 |

0 |

0 |

0 |

0 |

|

7 |

Oct, 2023 |

0 |

0 |

0 |

0 |

|

8 |

Nov, 2023 |

0 |

0 |

0 |

0 |

|

9 |

Dec, 2023 |

0 |

0 |

0 |

0 |

|

10 |

Jan, 2024 |

0 |

0 |

0 |

0 |

|

11 |

Feb, 2024 |

0 |

0 |

0 |

0 |

|

12 |

Mar, 2024 |

0 |

0 |

0 |

0 |

|

13 |

Apr, 2024 |

0 |

0 |

0 |

0 |

|

14 |

May, 2024 |

0 |

0 |

0 |

0 |

|

15 |

June, 2024 |

0 |

0 |

0 |

0 |

|

16 |

July, 2024 |

0 |

0 |

0 |

0 |

|

17 |

August, 2024 |

0 |

0 |

0 |

0 |

|

18 |

Sep, 2024 |

0 |

0 |

0 |

0 |

|

19 |

Oct, 2024 |

0 |

0 |

0 |

0 |

|

20 |

Nov, 2024 |

0 |

0 |

0 |

0 |

|

21 |

Dec, 2024 |

0 |

0 |

0 |

0 |

|

22 |

Jan, 2025 |

0 |

0 |

0 |

0 |

|

23 |

Feb, 2025 |

0 |

0 |

0 |

0 |

|

24 |

Mar, 2025 |

0 |

0 |

0 |

0 |

|

25 |

Apr, 2025 |

0 |

0 |

0 |

0 |

|

26 |

May, 2025 |

0 |

0 |

0 |

0 |

|

27 |

Jun, 2025 |

0 |

0 |

0 |

0 |

|

28 |

Jul, 2025 |

0 |

0 |

0 |

0 |

|

29 |

Aug, 2025 |

0 |

0 |

0 |

0 |

|

30 |

Sep, 2025 |

0 |

0 |

0 |

0 |

|

31 |

Oct, 2025 |

0 |

0 |

0 |

0 |

|

Grand Total |

0 |

0 |

0 |

0 |

|

Received from |

Pending last month |

Received |

Resolved |

Pending over 3 months |

Average resolution time |

Total pending |

|

Investors |

0 |

0 |

0 |

0 |

0 |

0 |

|

SEBI Scores |

0 |

0 |

0 |

0 |

0 |

0 |

|

Other Sources |

0 |

0 |

0 |

0 |

0 |

0 |

*Inclusiveof complaints of previous months resolved in the current month.

#Inclusiveof complaintspending as on the last day of the month.

|

SN |

Year |

Carried forward from previous year |

Received |

Resolved* |

Pending# |

|

1 |

2023-24 |

0 |

0 |

0 |

0 |

|

2 |

2024-25 |

0 |

0 |

0 |

0 |

|

GrandTotal |

0 |

0 |

0 |

0 |

*Inclusiveof complaints of previous years resolved in the current year.

#Inclusiveof complaintspending as on the last day of the year.

Each portfolio’s return is calculated from its Index value. To understand how index values are calculated and used to derive portfolio returns, please refer to following sections

An index value allows the user to measure the change in the value of a portfolio relative to its value on a historical date. For example, let's assume that portfolio A was created on 1st Jan 2020. The index value of A on that day was 100. Suppose the index value of the portfolio on 31st March 2021 was 127. We can calculate the absolute return of A between the above-mentioned dates as (127/100)-1 * 100 = 27%.

Lets understand this with an example. Portfolio TEST was created on 1st Jan 2014. The creator of the portfolio will rebalance TEST once in 3 months.Let's call the first version of TEST as TEST 1.0. The stocks and weights in TEST 1.0 portfolio are as below:

|

Stocks |

Weights |

|

A |

30% |

|

B |

20% |

|

C |

15% |

|

D |

35% |

To calculate the index values, the portfolio creation date, constituents of the portfolio and their respective weights are required. On the date of creation of the portfolio, the index value is set to 100. This can also be understood as a hypothetical Rs.100 investment in TEST 1.0. The calculation on 1st Jan 2014 is as below:

Index value: 100

|

Date |

Weight |

Closing price |

No. of shares |

Index Value |

|||||||||

|

A |

B |

C |

D |

A |

B |

C |

D |

A |

B |

C |

D |

||

|

1-Jan-14 |

30% |

20% |

15% |

35% |

176.5 |

101.4 |

105.9 |

52.1 |

0.17 |

0.20 |

0.14 |

0.67 |

100.00 |

|

2-Jan-14 |

30% |

20% |

15% |

35% |

174.3 |

105.8 |

103.3 |

51.5 |

0.17 |

0.20 |

0.14 |

0.67 |

99.67 |

|

3-Jan-14 |

30% |

20% |

15% |

35% |

172.0 |

104.2 |

100.9 |

50.9 |

0.17 |

0.20 |

0.14 |

0.67 |

98.22 |

|

4-Jan-14 |

30% |

20% |

15% |

35% |

172.0 |

104.2 |

100.9 |

50.9 |

0.17 |

0.20 |

0.14 |

0.67 |

98.22 |

|

5-Jan-14 |

30% |

20% |

15% |

35% |

172.0 |

104.2 |

100.9 |

50.9 |

0.17 |

0.20 |

0.14 |

0.67 |

98.22 |

|

6-Jan-14 |

30% |

20% |

15% |

35% |

168.8 |

103.9 |

101.2 |

51.1 |

0.17 |

0.20 |

0.14 |

0.67 |

97.86 |

On 1st Jan 2014, the portfolio contained 4 stocks A, B, C and D. The weights of these stocks were 30%, 20%, 15% and 35% respectively. The closing prices of the stocks on that day is used to calculate the hypothetical number of shares that can be bought, assuming Rs.100 is invested in the portfolio. “100 * weight of the stock” will give the amount of money that can be invested in a specific stock. This number is divided by the closing price of the stock to derive the number of shares of that stock. Finally, by multiplying the number of shares of each stock with the stock’s closing price and adding the output for all the stocks, the index value is derived. Of course on the first day, the index value is the same as the amount invested, i.e 100.The number of shares of each stock will remain the same till the next rebalance date. Each trading day, the closing stock prices are multiplied by the number of shares. The sum of these data points will be the index value for that specific date.

Rebalancing is the process of reviewing the stocks and their respective weights to ensure that it remains true to the theme or strategy of the portfolio.Continuing with the same example, let's assume The TEST portfolio gets rebalanced on 31st March 2014. The index values leading upto the rebalance date were as below:

|

Date |

Weight |

Closing price |

No. of shares |

Index Value |

|||||||||

|

A |

B |

C |

D |

A |

B |

C |

D |

A |

B |

C |

D |

||

|

26-Mar-14 |

30% |

20% |

15% |

35% |

176.8 |

100.7 |

88.0 |

65.8 |

0.17 |

0.20 |

0.14 |

0.67 |

106.54 |

|

27-Mar-14 |

30% |

20% |

15% |

35% |

183.7 |

100.1 |

89.5 |

67.5 |

0.17 |

0.20 |

0.14 |

0.67 |

108.97 |

|

28-Mar-14 |

30% |

20% |

15% |

35% |

190.2 |

100.3 |

92.7 |

68.8 |

0.17 |

0.20 |

0.14 |

0.67 |

111.39 |

|

29-Mar-14 |

30% |

20% |

15% |

35% |

190.2 |

100.3 |

92.7 |

68.8 |

0.17 |

0.20 |

0.14 |

0.67 |

111.39 |

|

30-Mar-14 |

30% |

20% |

15% |

35% |

190.2 |

100.3 |

92.7 |

68.8 |

0.17 |

0.20 |

0.14 |

0.67 |

111.39 |

|

31-Mar-14 |

30% |

20% |

15% |

35% |

191.8 |

100.3 |

91.8 |

70.4 |

0.17 |

0.20 |

0.14 |

0.67 |

112.65 |

In the rebalance, the weights of both A and D were reduced and a new stock E was added to the portfolio. Let’s call this new portfolio TEST 2.0. Post rebalance, the stocks and their corresponding weights were as below:

|

Stocks |

Weights |

|

A |

20% |

|

B |

20% |

|

C |

15% |

|

D |

30% |

|

E |

15% |

On 31st March, the Rs.100 that was initially invested in the portfolio had grown to Rs.112.65. The latter amount is the one that should be reinvested.A simple of way calculating the new number of shares is by multiplying 112.65 * weight of stocks in the rebalanced portfolio and dividing the output by closing price of the individual stocks. Continuing the earlier process, these new numbers of shares can be multiplied by the daily close price of respective stocks and their summation could be the new index value. The index values calculated using this method will be as below:

Index value: 112.65

|

Date |

Weight |

Closing price |

No. of shares |

Index Value |

||||||||||||

|

A |

B |

C |

D |

E |

A |

B |

C |

D |

E |

A |

B |

C |

D |

E |

||

|

31-Mar-14 |

20% |

20% |

15% |

30% |

15% |

191.8 |

100.3 |

91.8 |

70.4 |

373.6 |

0.12 |

0.22 |

0.18 |

0.48 |

0.05 |

112.65 |

|

1-Apr-14 |

20% |

20% |

15% |

30% |

15% |

189.4 |

105.7 |

93.4 |

68.5 |

368.2 |

0.12 |

0.22 |

0.18 |

0.48 |

0.05 |

112.72 |

|

2-Apr-14 |

20% |

20% |

15% |

30% |

15% |

193.5 |

116.4 |

94.1 |

69.2 |

365.1 |

0.12 |

0.22 |

0.18 |

0.48 |

0.05 |

115.94 |

|

3-Apr-14 |

20% |

20% |

15% |

30% |

15% |

189.6 |

114.1 |

94.2 |

68.4 |

363.6 |

0.12 |

0.22 |

0.18 |

0.48 |

0.05 |

114.51 |

|

4-Apr-14 |

20% |

20% |

15% |

30% |

15% |

190.3 |

118.9 |

92.2 |

70.4 |

361.9 |

0.12 |

0.22 |

0.18 |

0.48 |

0.05 |

116.18 |

|

5-Apr-14 |

20% |

20% |

15% |

30% |

15% |

190.3 |

118.9 |

92.2 |

70.4 |

361.9 |

0.12 |

0.22 |

0.18 |

0.48 |

0.05 |

116.18 |