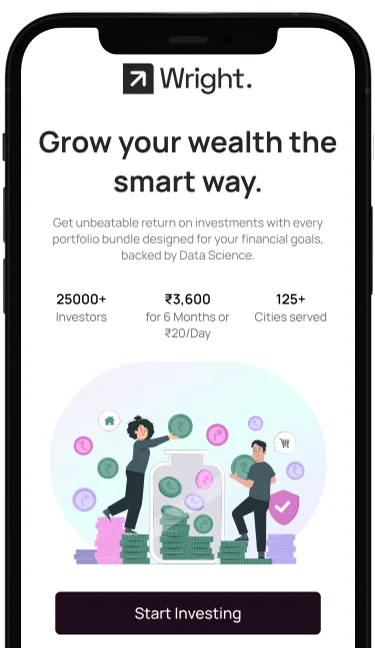

Grow Your Wealth

the Smart Way.

We're revolutionizing the way India invests with data and AI-driven quantitative models.

25,000+

Investors

₹3,600

for 6 Months or ₹20/Day

₹500 Cr+

Invested (AuA)

Why Invest with Wright Research?

Factor Investing

Analyzing 100+ factors helps us

identify best investments for you.

Momentum Investing

Momentum is the strongest factor in India and an important part of our philosophy

Artificial Intelligence

We use AI & machine learning models to forecast risk and reward in the market.

Explore Our Portfolios

Find the best investment portfolios built for maximum returns at low risk.