by Sarah Essessien

Published On Nov. 8, 2024

The relationship between interest rates and the stock market is a fundamental aspect of financial economics that directly impacts investment decisions, corporate strategy, and economic policy. Understanding this relationship is crucial as it influences how investors allocate their assets, how companies manage their finances, and how policymakers design economic interventions. In particular, the interplay of interest rates, inflation, and exchange rates—the 'trifecta' of economic indicators—creates a complex dynamic that can either stimulate or hinder economic growth and market performance.

Interest rates serve as the primary tool for central banks to regulate economic activity. When interest rates rise or fall, they send ripples across financial markets, affecting the cost of borrowing, the yield on savings, and the overall economic outlook. These changes, in turn, have significant implications for the stock market, affecting everything from corporate profitability to investor sentiment. This report aims to explore these dynamics, focusing specifically on the UK and Indian markets, with comparative insights from the US market to provide a broader understanding.

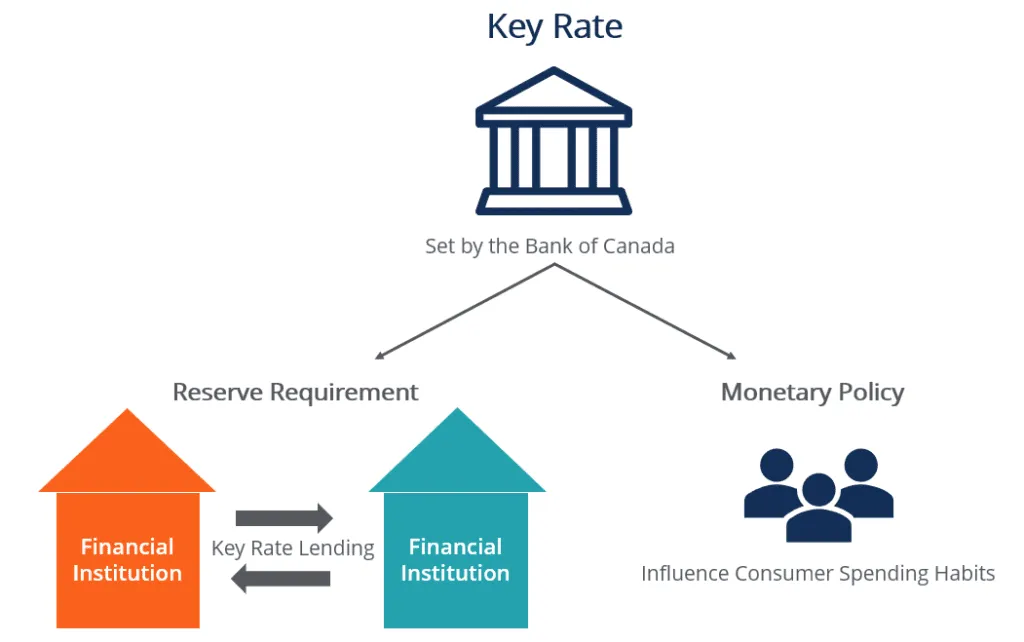

Interest rates are the cost of borrowing money or the return on savings, typically set by central banks like the Bank of England, the Reserve Bank of India (RBI), and the Federal Reserve in the United States. These rates influence the economy by controlling the flow of money. When central banks raise interest rates, borrowing becomes more expensive, which can slow down economic activity. Conversely, lowering interest rates makes borrowing cheaper, encouraging spending and investment.

Central banks adjust interest rates as part of their monetary policy to achieve economic objectives, such as controlling inflation, managing unemployment, and stabilising the currency. For instance, the Bank of England uses the base rate to influence short-term interest rates across the economy, impacting everything from mortgages and loans to savings rates. The RBI similarly utilises the repo rate, which is the rate at which it lends money to commercial banks, as a primary tool to manage liquidity and inflation in the Indian economy.

Inflation represents the rate at which the general level of prices for goods and services rises, eroding purchasing power. Central banks monitor inflation closely because it affects economic stability and growth. When inflation is high, central banks may increase interest rates to cool down the economy and prevent the economy from overheating. Conversely, when inflation is low, central banks might lower interest rates to encourage spending and investment.

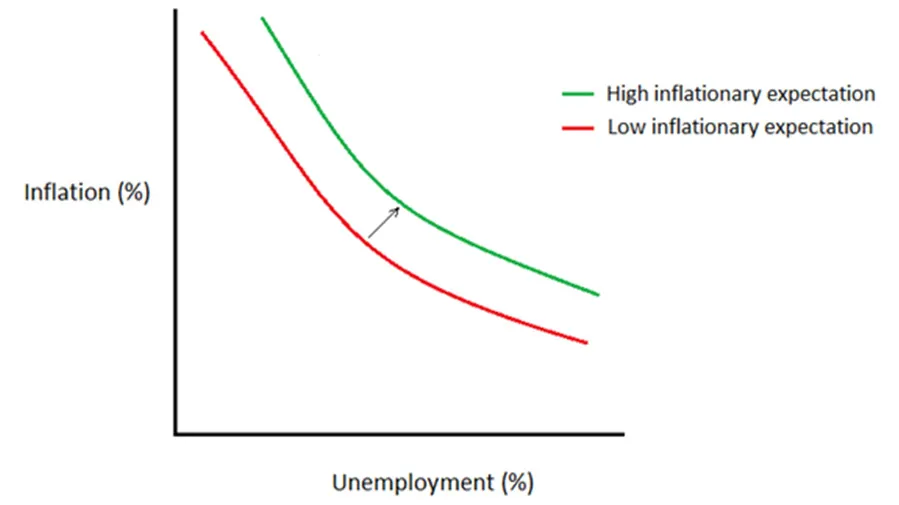

The relationship between interest rates and inflation is often encapsulated in the concept of the Phillips Curve, which suggests an inverse relationship between the rate of inflation and the unemployment rate.

While this model has faced challenges, particularly in the face of stagflation, it still provides a framework for understanding the basic interaction between inflation and monetary policy. For example, recent interest rate hikes by central banks globally have been largely motivated by the need to curb inflation, which has been driven up by supply chain disruptions and economic recovery post-pandemic.

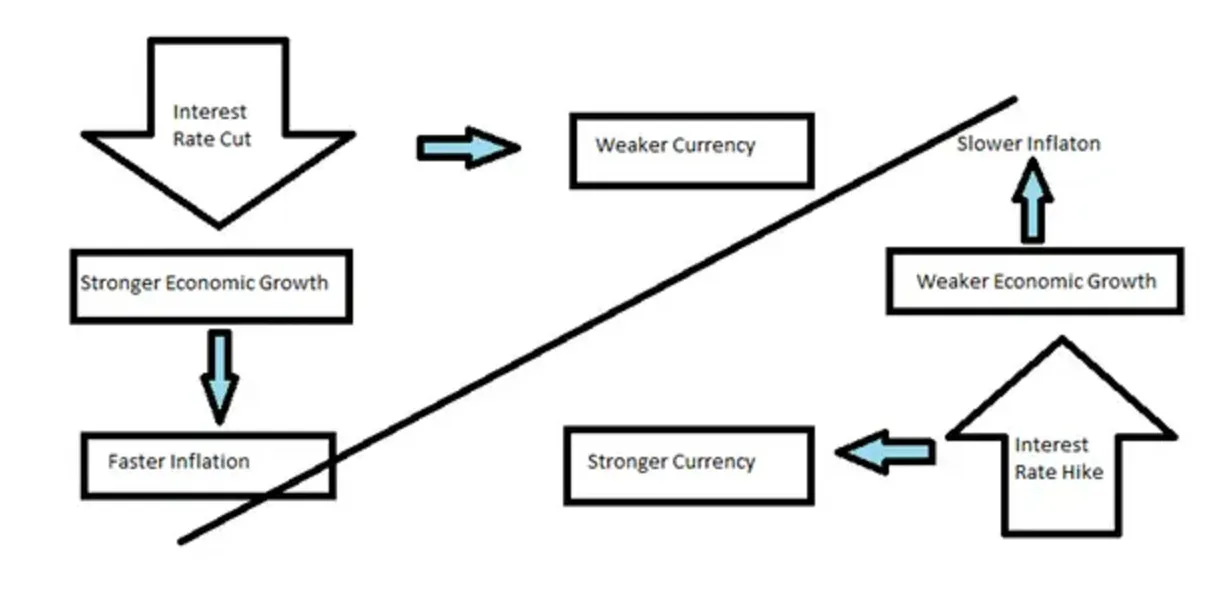

Exchange rates, the value of one currency relative to another, are influenced by interest rates and inflation. Higher interest rates attract foreign investment, increasing demand for the domestic currency and leading to appreciation. Conversely, lower interest rates may lead to currency depreciation as investors seek higher returns elsewhere. This relationship is crucial for countries like the UK and India, where foreign investment plays a significant role in the economy.

For example, if the Bank of England raises interest rates, it could lead to an appreciation of the British pound, making UK exports more expensive but imports cheaper. This shift can affect the stock prices of companies that rely heavily on exports. In India, the RBI's interest rate decisions significantly impact the Indian Rupee's value, affecting trade balances and the performance of export-oriented industries.

The interplay between interest rates, inflation, and exchange rates forms a complex system where changes in one component can have cascading effects on the others. Interest rate adjustments influence inflation and exchange rates, which in turn affect the economic conditions that drive stock market performance. For instance, a hike in interest rates may be aimed at controlling inflation but can also lead to a stronger currency, impacting international trade and investment flows.

This trifecta impacts investor sentiment, corporate earnings, and overall economic stability, all of which are reflected in the stock market. High interest rates can reduce corporate profitability by increasing borrowing costs, making it more expensive for companies to finance operations and growth. This can lead to lower stock prices as future cash flows are discounted at higher rates. Conversely, low interest rates can boost stock prices by reducing the cost of capital and encouraging investment in higher-yielding assets, such as equities.

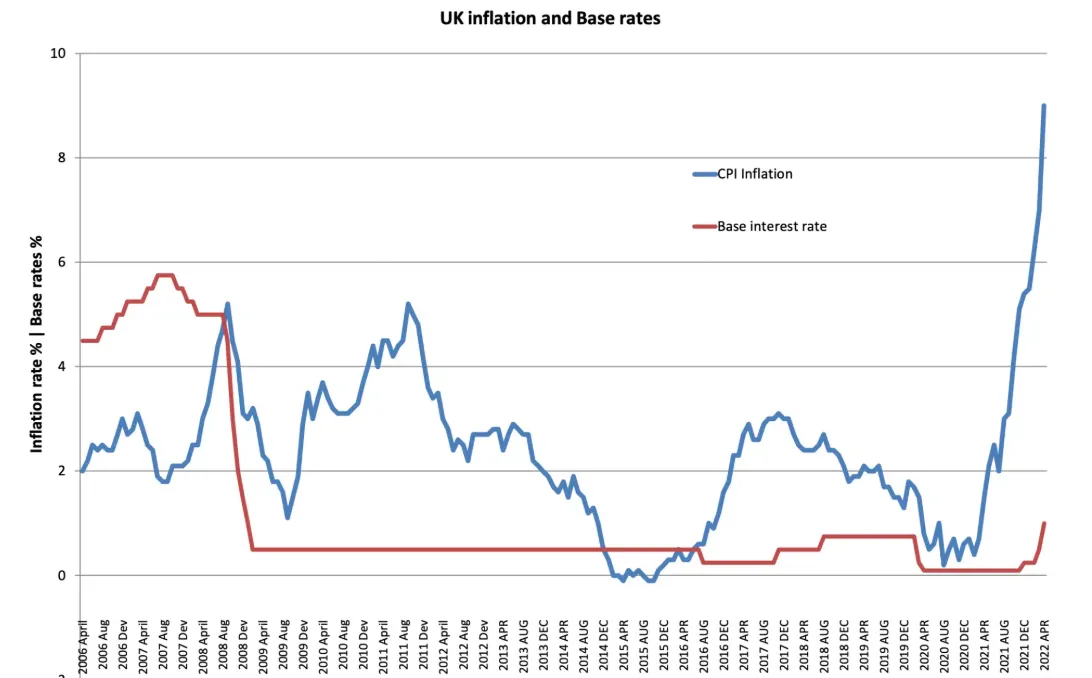

The UK stock market has historically shown sensitivity to changes in interest rates set by the Bank of England. During the 2008 financial crisis, the Bank of England slashed interest rates to a record low of 0.5% to stimulate the economy. This move led to a rally in the FTSE 100 index as lower borrowing costs boosted corporate profitability and investor sentiment. Conversely, the gradual rate hikes from 2017 to 2018, aimed at controlling inflation and stabilising the economy, caused temporary market corrections as investors adjusted their portfolios to account for higher borrowing costs and the reduced appeal of equities compared to fixed-income assets.

More recently, following the initial economic recovery from the COVID-19 pandemic, the Bank of England began signalling potential rate hikes to curb inflation, which had surged due to supply chain disruptions and increased consumer demand. These signals caused increased volatility in the UK stock market, particularly in interest-rate-sensitive sectors like real estate and utilities.

3.2. Case Study: Impact of Interest Rates On The Indian Market

India's stock market, represented by indices like the NIFTY 50 and the BSE SENSEX, has also responded dynamically to changes in the Reserve Bank of India's (RBI) interest rate policies. Following the 2008 global financial crisis, the RBI reduced the repo rate to spur economic growth, which supported a significant rally in Indian equities. However, when inflationary pressures began to rise due to global commodity prices and domestic factors, the RBI increased rates, leading to corrections in the stock market.

A notable instance was in 2013 when the "taper tantrum" triggered by the US Federal Reserve's tapering announcement led to capital outflows from emerging markets like India. The RBI responded with rate hikes to stabilise the rupee and control inflation, causing volatility in the stock market. More recently, the rate cuts in response to the economic slowdown due to the COVID-19 pandemic provided a boost to market liquidity and supported a strong recovery in the stock market .

3.2. Case Study: Impact of Interest Rates On The US Market

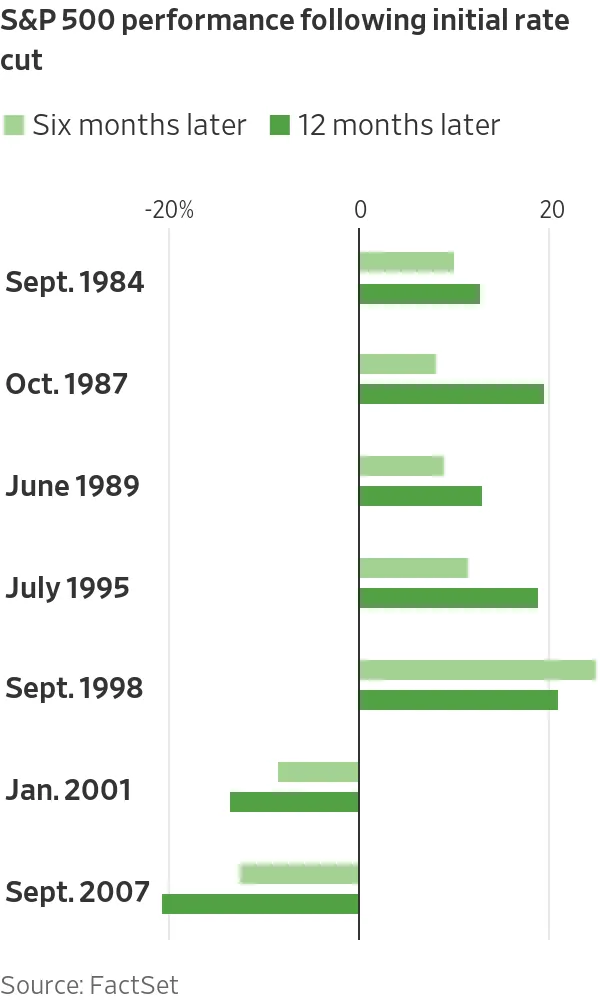

In the United States, the Federal Reserve's interest rate policies have long been a critical factor in stock market performance. During the early 1980s, under Chairman Paul Volcker, the Fed raised interest rates to combat high inflation, which led to a significant slowdown in economic activity and a bear market. In contrast, the low-interest-rate environment maintained after the 2008 financial crisis, and during the COVID-19 pandemic, led to substantial rallies in the stock market as borrowing costs were low and liquidity was high.

The recent rate hikes initiated by the Federal Reserve in response to inflationary pressures have led to increased market volatility. The tech-heavy NASDAQ, which houses many high-growth but rate-sensitive companies, experienced significant corrections as investors recalibrated their expectations of future profits under higher borrowing costs. This dynamic illustrates the delicate balance the Fed must maintain between fostering economic growth and controlling inflation.

Interest rates directly impact the cost of capital for businesses. When interest rates rise, the cost of borrowing increases, leading to higher expenses for companies that rely on debt financing. This can reduce profit margins, deter expansion plans, and lower expected future cash flows. In turn, the valuation of these companies' stocks tends to decrease, as investors apply higher discount rates to future earnings. Conversely, when interest rates are low, borrowing is cheaper, encouraging investment and expansion, which can boost corporate profits and stock valuations.

Interest rate changes influence investor behaviour and market sentiment significantly. Higher interest rates generally lead to a shift from equities to fixed-income securities, as bonds become more attractive with higher yields. This shift can result in lower demand for stocks, leading to market sell-offs. Lower interest rates, however, can drive investors toward equities in search of higher returns, boosting stock prices. Market sentiment is also affected by the perceived direction of economic policy; expectations of rising rates can create uncertainty and trigger pre-emptive portfolio adjustments.

Changes in interest rates can affect exchange rates, which, in turn, impact international trade and the competitiveness of domestic companies. Higher interest rates attract foreign capital, leading to an appreciation of the domestic currency. A stronger currency makes exports more expensive and less competitive on the global market, potentially reducing the profitability of export-driven companies. In contrast, lower interest rates can lead to currency depreciation, boosting exports but increasing the cost of imports, which can contribute to inflationary pressures.

Different sectors respond differently to changes in interest rates. For example:

Financial Sector: Banks and financial institutions often benefit from rising interest rates because they can charge more for loans relative to the interest they pay on deposits.

Real Estate and Utilities: These sectors, which rely heavily on borrowing, can suffer when rates rise due to increased financing costs.

Technology and Growth Sectors: High-growth sectors are sensitive to interest rate changes because their valuations are based on future earnings, which are discounted more heavily when rates rise.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns.

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions.

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Skip Password

By signing up, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with Password →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Log in with OTP →

By logging in, you agree to our Terms and Privacy Policy

"I was drawn to Wright Research due to its multi-factor approach. Their Balanced MFT is an excellent product."

By Prashant Sharma

CTO, Zydus

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

Answer these questions to get a personalized portfolio or skip to see trending portfolios.

(You can choose multiple options)

Investor Profile Score

We've tailored Portfolio Management services for your profile.

View Recommended Portfolios Restart