What Happens Next? Our Strategy for 2025

by Sonam Srivastava5 min read

Wright Research Strategy 2025

The Kumbh Mela Coincidence : Decoding Market Patterns

by Naman Agarwal5 min read

Explore the effect of Mahakumbh 2025 on Stock Market and Different Sectors , which is estimated to create an economic impact of Rs 2-3 Lakh Crores.

Wright Portfolios 2024 Wrapped: A Year of Growth & Evolution

by Sonam Srivastava5 min read

Wright Portfolios 2024 Wrapped: A Year of Growth & Evolution

Why Does Momentum Work? A Behavioural Anomaly

by Sarah Essessien5 min read

Learn about momentum investing, a trading strategy driven by market trends and behavioral biases like herding, confirmation bias, and overconfidence. Discover why momentum investing works, its risks, and why it thrives in markets like India.

How Do Interest Rates, Inflation Rate & Exchange Rates Affect the Stock Market?

by Sarah Essessien5 min read

Explore the intricate relationship between interest rates, inflation, and exchange rates, and their impact on stock markets in the UK, India, and the US.

Art of Patient Investing, Especially When Stock Markets Are Volatile

by Sarah Essessien5 min read

Discover the power of patient investing—a disciplined strategy focused on long-term growth, market cycles, and compounding. Learn how diversification, quality investments, and a long-term perspective can help you build sustainable wealth and navigate market volatility.

Behavioral Biases Are a Part of Investing - But You Can Beat Them.

by Emily Olley5 min read

Learn how to identify and overcome cognitive biases like anchoring, emotional bias, loss aversion, and herding in stock investing.

Accounting Frauds Increase When Liquidity Crunches and Stock Markets Crash

by Emily Olley5 min read

Explore the critical relationship between accounting frauds, liquidity crunches, and stock market crashes. Learn how economic downturns expose hidden frauds, with insights from major scandals like Satyam, Enron, and Bernie Madoff.

Womenomics: Growth in Women’s Contributions to the Labour Force in Recent Decades

by Emily Olley5 min read

Explore how the growth in women's contributions to the labor force has revolutionized economies worldwide, including India. Learn about drivers, successes, challenges, and investment implications of this transformative trend, featuring companies like Titan, Nykaa, and Mamaearth.

Capital Asset Pricing Model (CAPM): Definition, Formula, and Benefits

by Madhav Agarwal5 min read

Discover the Capital Asset Pricing Model (CAPM) and its role in modern finance. Learn how CAPM evaluates the relationship between risk and expected return, its formula, benefits, assumptions, and limitations.

Optimal Rebalancing Frequency: How Often Should You Rebalance Your Momentum Portfolio?

by Sonam Srivastava5 min read

Illustration depicting various factors influencing the optimal rebalancing frequency for a momentum portfolio

Revolutionizing Finance: AI's Impact on Quantitative Trading in India

by Alina Khan5 min read

Explore how artificial intelligence (AI) and machine learning are transforming quantitative trading, offering unprecedented data analysis, risk management, and strategy development capabilities.

Types of Quant Investment Strategies To Know in 2024

by Alina Khan5 min read

Explore diverse quant investment strategies of 2024 – from statistical arbitrage to AI. Learn pros, cons, & future trends. Uncover the evolving landscape of quantitative investing

What Are Alternative Investments? Definition and Types

by Alina Khan5 min read

Discover what alternative investments is – their importance, strategies, benefits, & risks. Learn how to invest wisely in diverse opportunities.

AI Meets Finance: Revolutionizing the Indian Stock Market with Machine Learning Insights

by Sonam Srivastava5 min read

AI Meets Finance: Revolutionizing the Indian Stock Market with Machine Learning Insights

Best Quantitative Investment Strategies of 2024

by Siddharth Singh Bhaisora5 min read

Explore the top quantitative investment strategies in 2023. Gain insights into data-driven approaches for maximizing portfolio performance using quant strategy. Read more.

Four Years of Wright Momentum: Mastering the Art of Building a Successful Momentum Strategy

by Sonam Srivastava5 min read

Four Years of Wright Momentum: Mastering the Art of Building a Successful Momentum Strategy

Why Quant Funds are Gaining Popularity in India: Unraveling the Rise of Algorithmic Investing

by Alina Khan5 min read

Explore the rise of quantitative funds in India's investment landscape. Understand how these data-driven, algorithmic strategies are reshaping investing, offering insights into their popularity, challenges, and impact on traditional finance.

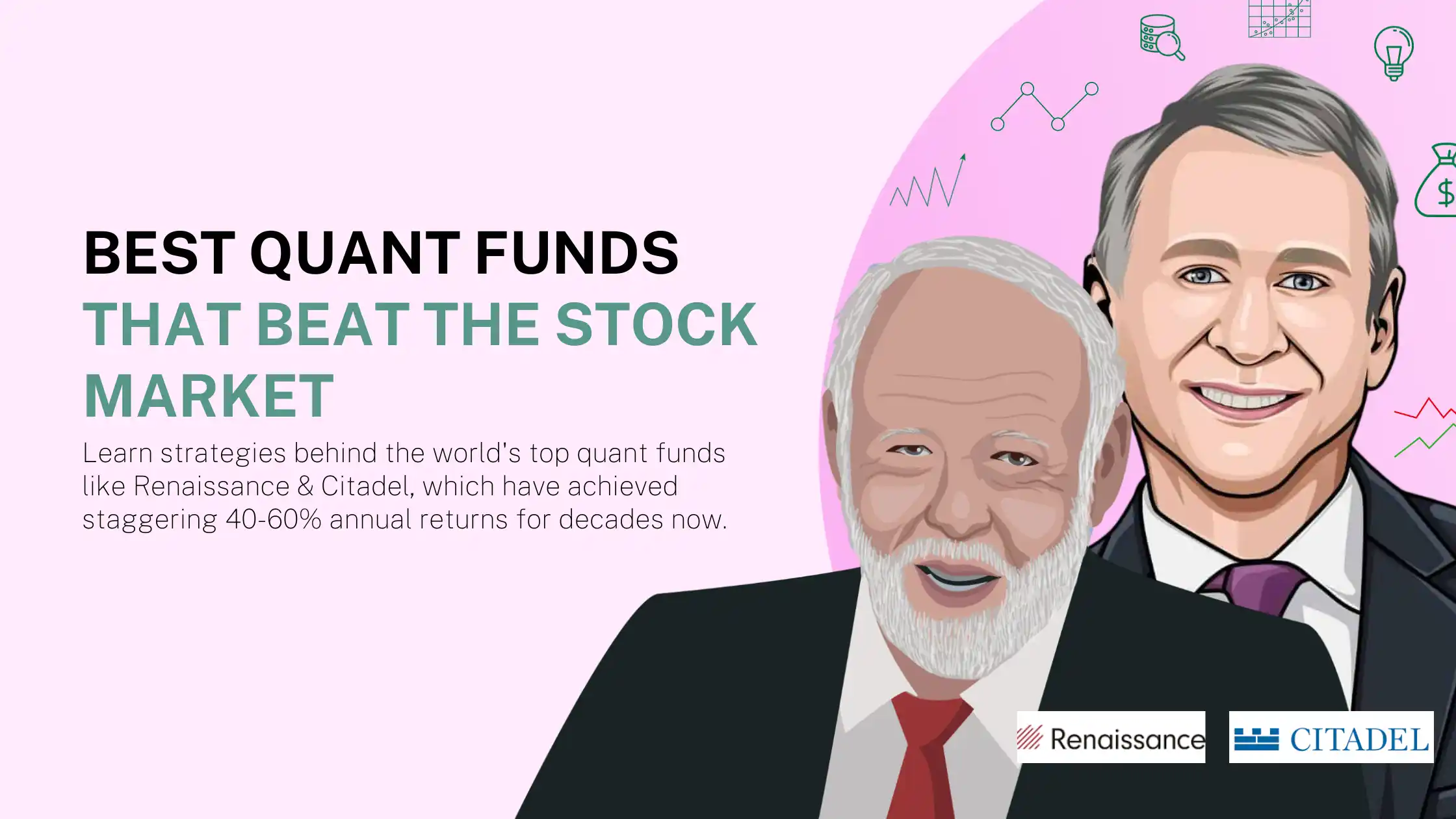

Best Quant Funds That Beat The Stock Market

by Siddharth Singh Bhaisora5 min read

Learn strategies behind the world's top quant funds like Renaissance & Citadel, which have achieved staggering 40-60% annual returns for decades now. Uncover secrets of top quant funds', geniuses like Jim Simons, top quant funds differentiating factors & what investors can learn from top quant funds

All About Alpha: Is Your Investment Generating Alpha?

by Siddharth Singh Bhaisora5 min read

There is a debate between skill and investment outcomes. How alpha is generated for investment portfolios? Alpha Can Be Luck, Risk or Skill. Which One Is Yours? Is Your Investment Portfolio Giving You Alpha? Can Alpha Disappear? These are some of the questions we answer in this blog! Read now!

Pairs Trading Strategy - Nifty & Bank Nifty | Statistical Arbitrage

by Akashdeep Bhateja, Himanshu Agrawal5 min read

Discover the power of pairs trading strategy in India with Wright Research. Explore the art and mathematics behind pairs trading. Learn more.

Top Indicators For Momentum Investing

by Sonam Srivastava5 min read

Discover the power of momentum investing in our latest article! Learn about key indicators used by seasoned investors, the role of behavioral finance, and strategies like time series, relative, and dual momentum.

The Art of Minimizing Impact Costs with Execution Algorithms

by Sonam Srivastava5 min read

The Art of Minimizing Impact Costs with Execution Algorithms

Transforming the Investment Landscape with Wright Research - Founder’s Desk

by Sonam Srivastava5 min read

Transforming the Investment Landscape with Wright Research - Founder’s Desk

Artificial Intelligence in Investing

by Sonam Srivastava5 min read

Artificial Intelligence in Investing

History of Momentum Investing and its Strategies ⚡️

by Sonam Srivastava5 min read

Uncover Momentum Investing: Definition, Smallcase Integration, India-specific Strategies. Explore benefits & history at Wright Research for growth potential.

Decoding the market craziness with data

by Sonam Srivastava5 min read

Decoding the market craziness with data

Earning Momentum Definition and Strategy

by Sonam Srivastava5 min read

Unleash earnings momentum strategy power. Define, calculate, and see its impact on management, revenue. Maximize investment potential with the factor. Check now.

Bye 2022. You wont be missed!

by Sonam Srivastava5 min read

We had big hopes for you 2022, but needless to say, you turned out to be one of the craziest years for investors. Here’s looking back at 2022 - obviously with memes!

Emerging Investment Themes for 2023

by Sonam Srivastava5 min read

As 2022 comes to a close, most of the world still faces stubbornly high inflation, aggressive interest-rate hikes and geopolitical tensions. But Indian market already has some exciting themes emerging that can bring a lot of color to our portfolios.

India vs Emerging Markets

by Sonam Srivastava5 min read

India has left behind the emerging market by a wide margin over the past few years in terms of stock market growth rate. But are we also over-valued?

Markets @ All-Time High | Factors to Watch

by Sonam Srivastava5 min read

Ever since the inflation numbers have eased and the US FED has hinted at a slower rate hike, the market euphoria has returned. Nifty is almost touching the all-time high of 18600, and we have seen the FIIs return to India!

Multi Factor Investing: Strategies, Benefits, & Best Multi-Factor ETFs

by Sonam Srivastava5 min read

Find out how multifactor investing can help you to enhance your portfolio by exploring strategies, benefits and the top multi-factor exchange traded funds in India.

The Multibaggers of Momentum

by Sonam Srivastava5 min read

Explore the concept of Multibagger Momentum. Discover the best multibagger stocks, learn how to find & understand the key characteristics that drive their success in the stock market.

No Gyan, Only Data

by Sonam Srivastava5 min read

Are you tired of all the investment gyan ever present on the internet? I know that I am. Every other investment manager is rattling off about the long-term story and the strength of the Indian market. So we thought that this week, we would not join the bandwagon!

Earnings - Do they even matter?

by Sonam Srivastava5 min read

Earnings release is a huge event every quarter. Let's analyse if that actually matters...

Benefits of Algo Trading and Its Strategies

by Siddhart Agarwal5 min read

Discover what algo trading is and learn about its benefits & strategy types. Understand how algo trading works, its profitability in India. Explore now.

Performance

by Sonam Srivastava5 min read

The biggest USP for Wright Research portfolios is our strong investment philosophy. It is a great thing that this philosophy has also led to a fantastic performance.

Risk Management at Wright Research

by Sonam Srivastava5 min read

Learn how to manage risk effectively. Our comprehensive guide covers key strategies and insights to navigate the complex world of financial risk.

Momentum Investing: Risk, Reward & Everything Else

by Sonam Srivastava5 min read

Explore the world of momentum investing in India. Learn what it is, discover effective strategies, and assess the pros and cons of this investment approach.

Artificial Intelligence in Investing

by Sonam Srivastava5 min read

Artificial Intelligence can create a competitive edge to extract actionable insights in the complex framework of the financial markets

Regime Modeling

by Sonam Srivastava5 min read

One of the underlying principles of our investment philosophy is that the markets do not always stay the same.

Asset Allocation To Protect and Grow Your Investments

by Wright Content Team5 min read

One of the biggest problems new investors face is placing all their eggs into one basket or stock, hoping to get rich quickly. What often happens is that new investors “blow up” their portfolio and st

Unveiling the Power of Factor Models: A Comprehensive Guide to Factor Investing for Optimal Returns

by Sonam Srivastava5 min read