- Tools

Get your

financial

Advise - Services

Get your

financial

Advise - About

-

News & Blogs

-

Start Investing

Find the

Perfect Portfolio

- Sign In

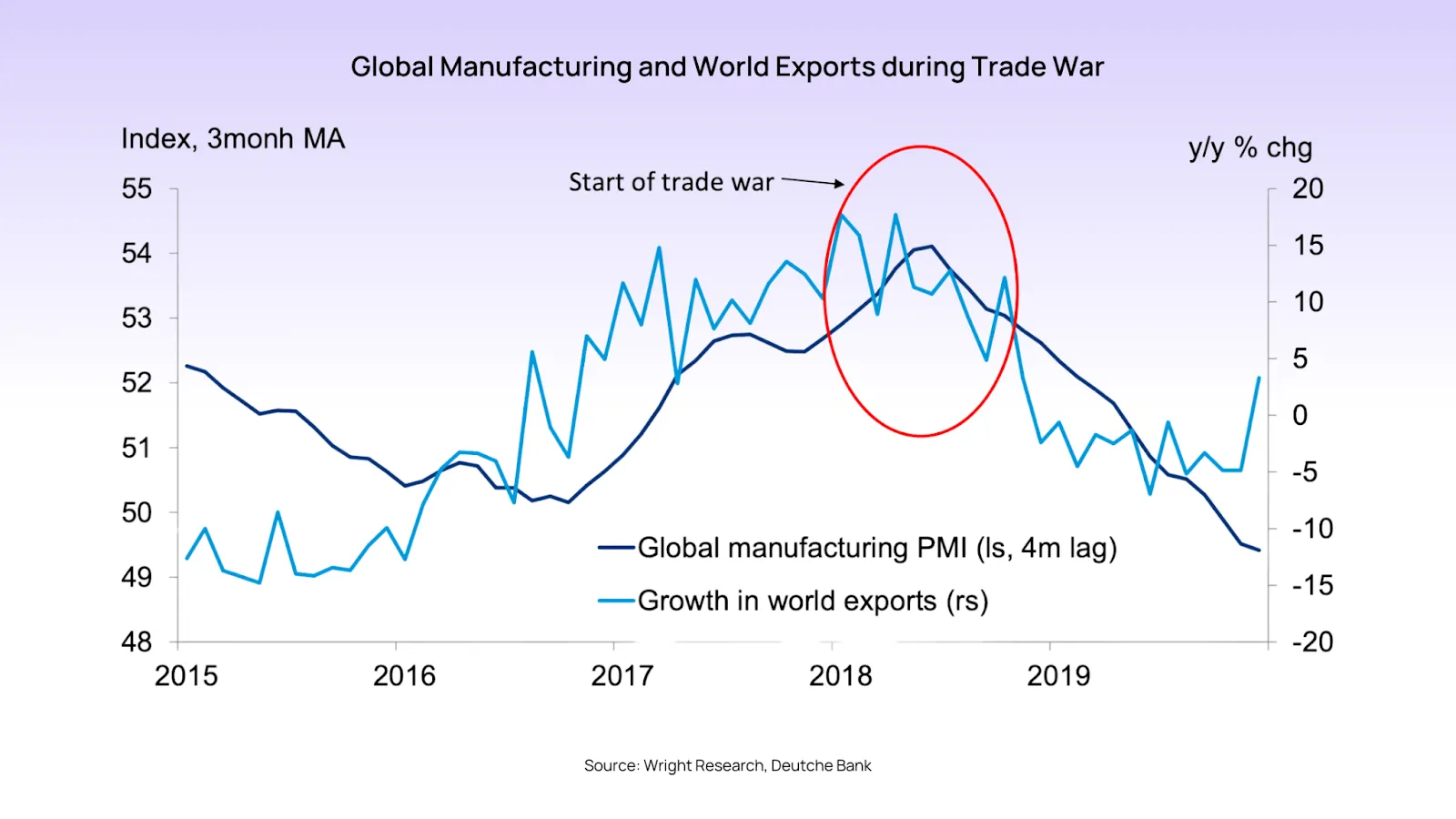

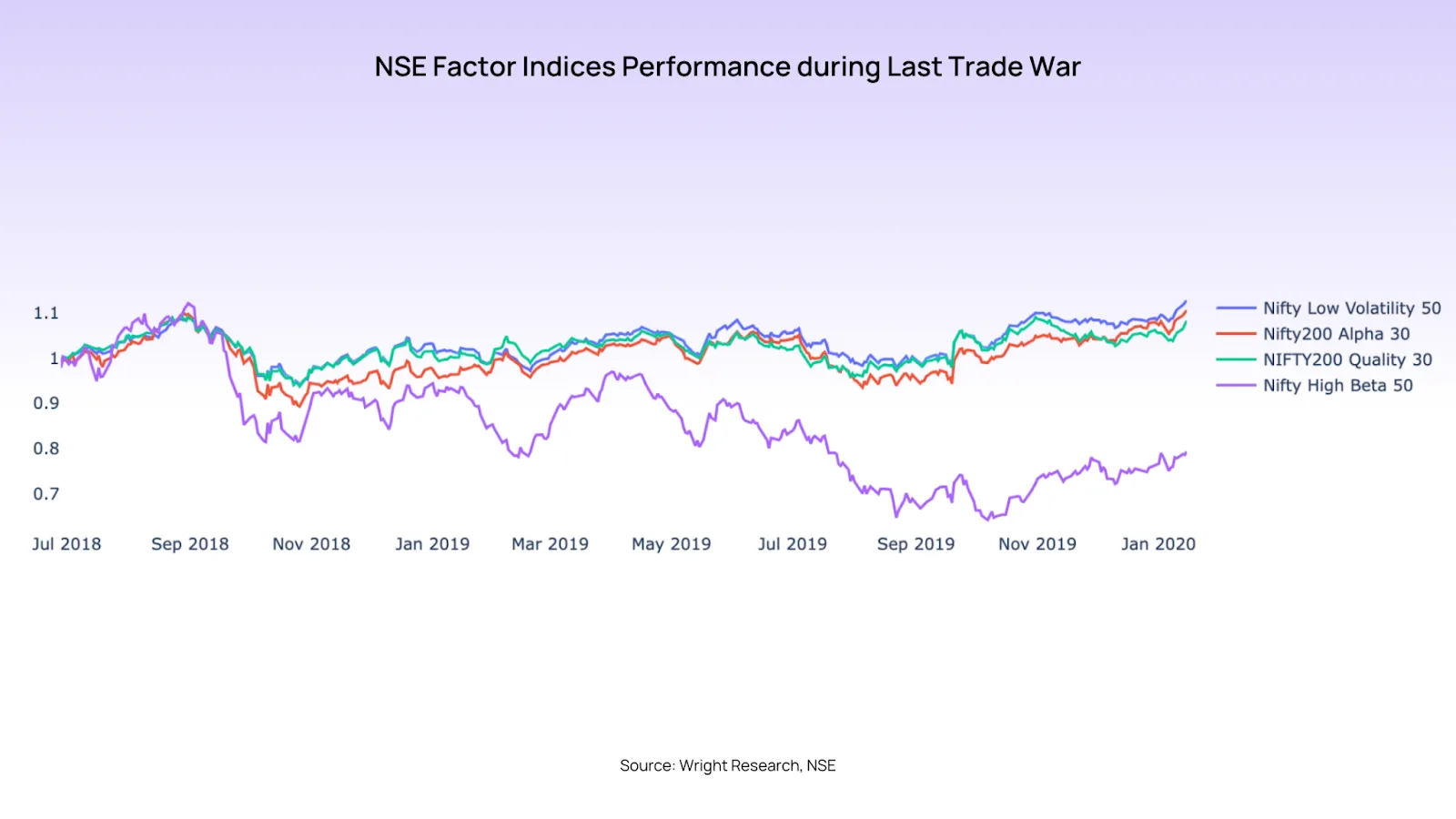

Manufacturing sentiment declined globally, with the Global Manufacturing PMI falling below 50 during the peak of the trade war. The uncertainty surrounding tariffs also impacted business investment, leading to delays in capital expenditure decisions across industries. These market trends provide a relevant backdrop for the 2025 trade escalation.

Manufacturing sentiment declined globally, with the Global Manufacturing PMI falling below 50 during the peak of the trade war. The uncertainty surrounding tariffs also impacted business investment, leading to delays in capital expenditure decisions across industries. These market trends provide a relevant backdrop for the 2025 trade escalation.

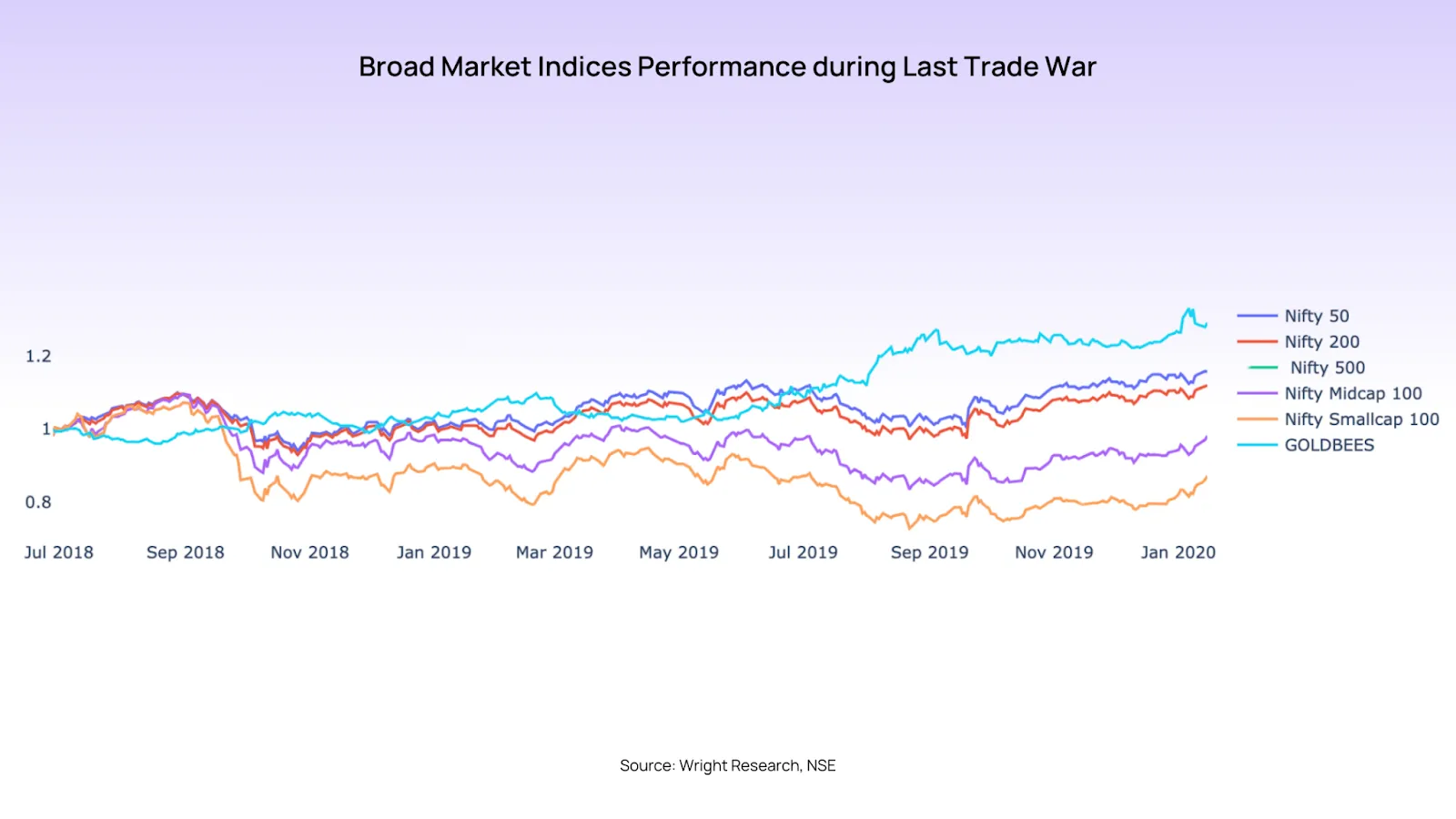

Performance comparison with other emerging markets

Performance comparison with other emerging markets