We are starting a monthly newsletter to be published along with each rebalance as Wright completes 1 year! In this newsletter we will try to understand the rationale for the rebalance looking at an overview of:

So let’s get started.

Markets

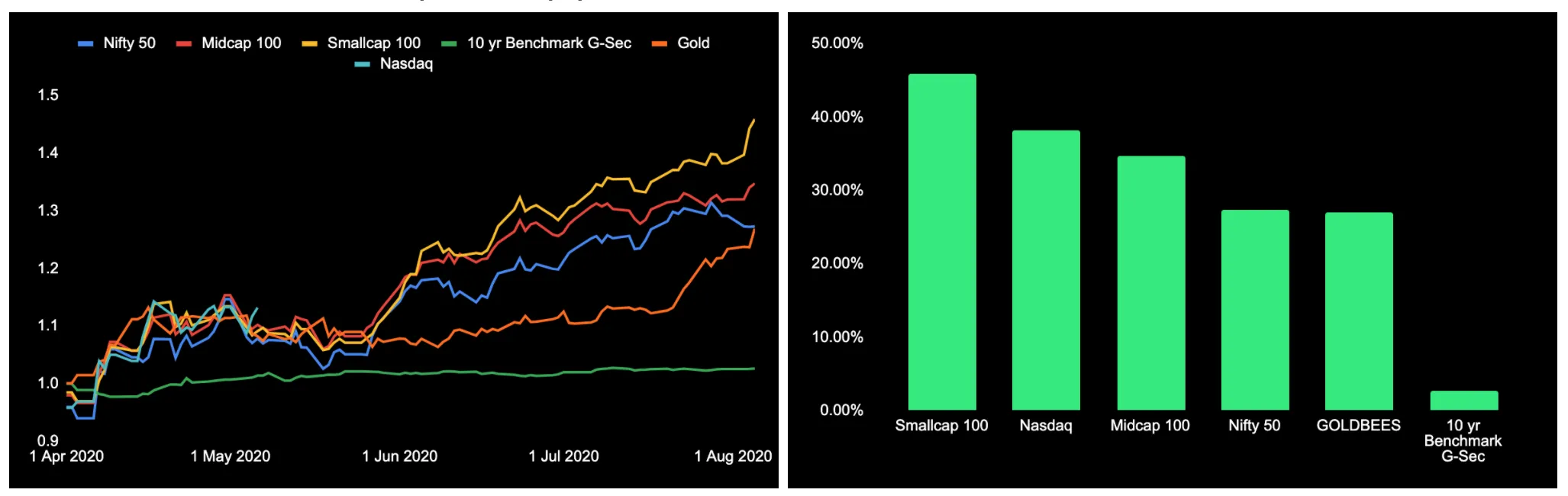

Broad Market Indices

Looking at the broad market indices — Nifty 50, Midcaps, Smallcaps, Government Securities, Gold and Nasdaq in the past 4 months, the smallcap index has the biggest run and is leading mid caps which in turn are leading large caps.

In the last month, Gold has picked up pace due to fears of consolidation.

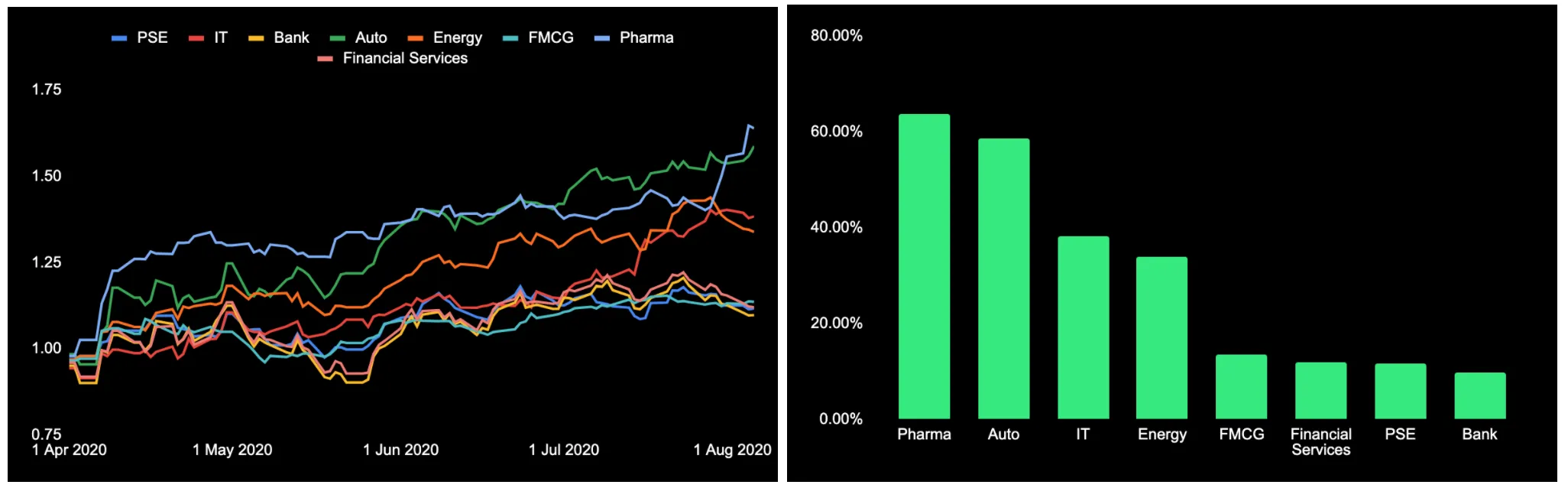

Sectors

Among major sectors, Pharma has had the biggest run followed by Autos. In the past month IT has really picked up pace. Banks & PSE are lagging behind.

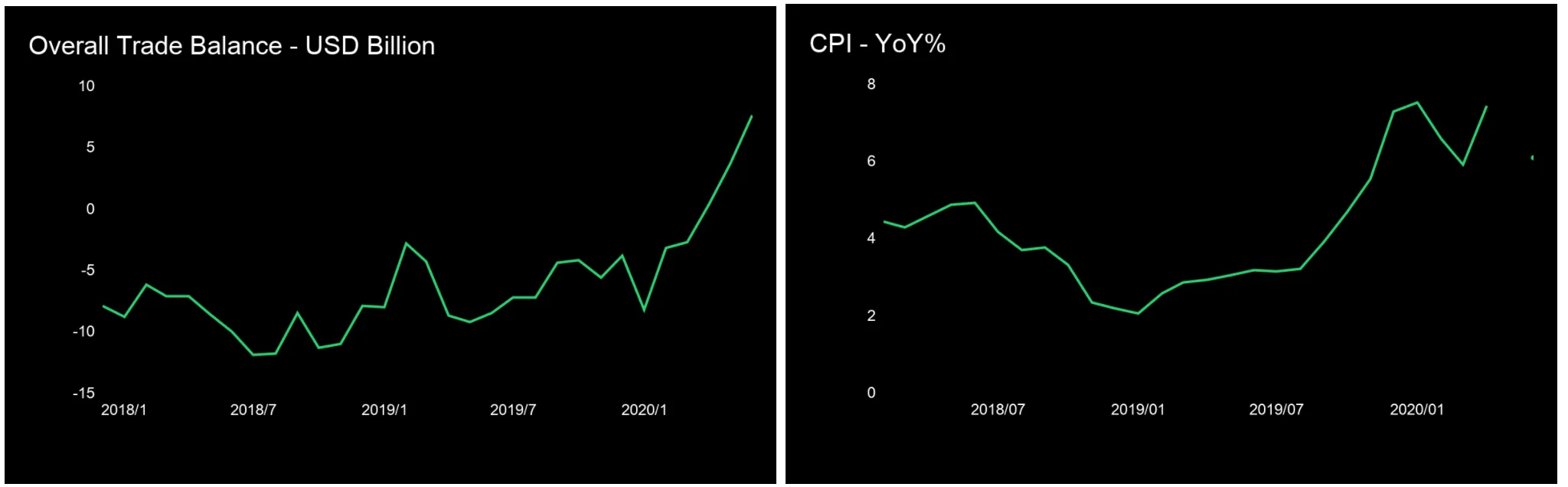

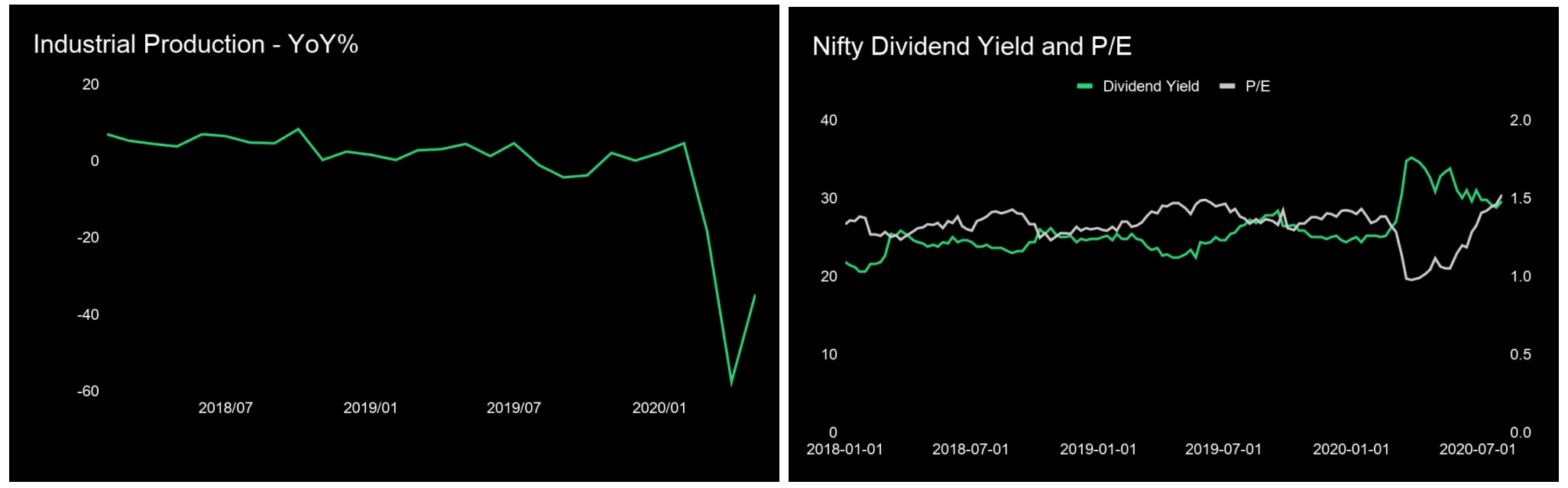

The economic indicators give a clue about the times to come. While COVID-19 cases & deaths are rapidly rising and widespread lockdown is still in place, India’s trade balance has gone in surplus for the first time since 2002 with imports shrinking faster than exports. Based on the latest data, inflation has been high due to food inflation. The industrial activity is picking up after lockdown, even though manufacturing is worst hit.

Looking at Nifty PE ratios, the PE has sharply come up to 30 after a sharp decline in March. The dividend yield has also come down after sharp rise in March.

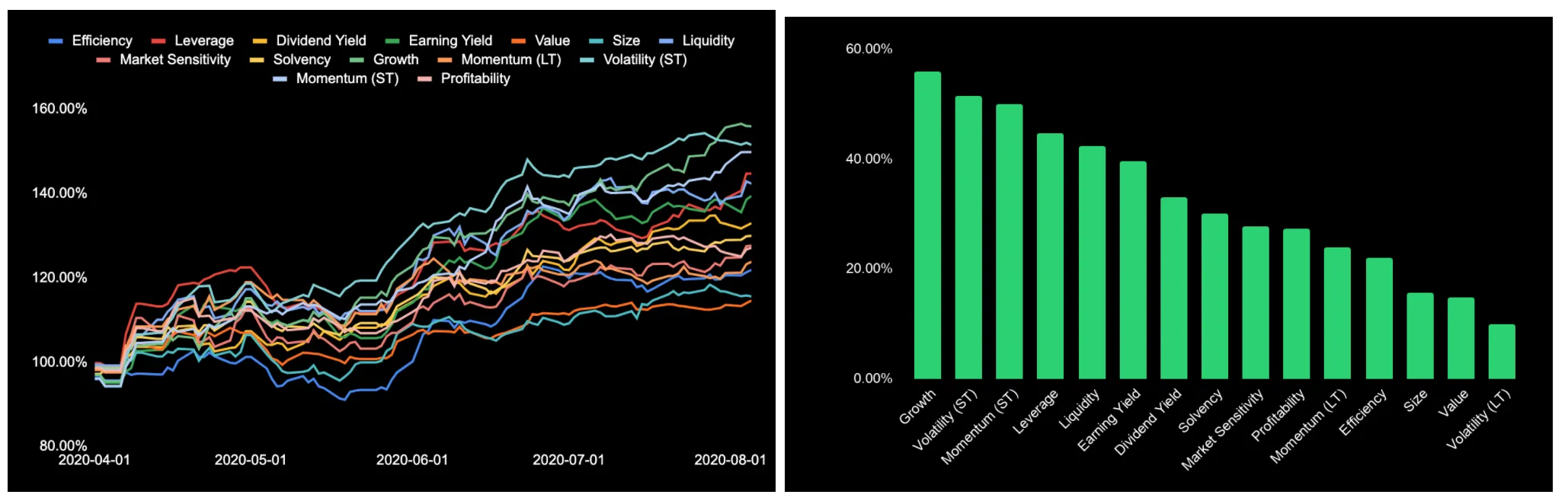

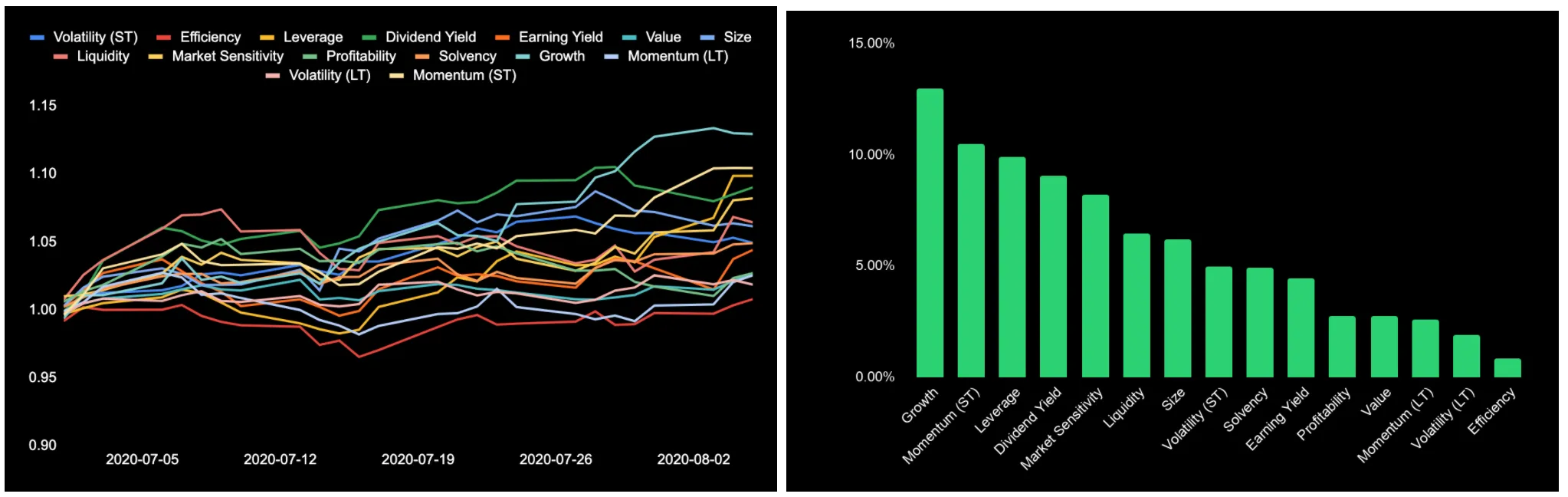

Equity factors are the building blocks of our portfolios (read more about factorshere). We saw that the Growth factor has had the steepest run in the recovery since April followed by short term momentum & low volatility factors.

In the last month again growth & short term momentum factors have dominated. The Size factor (low vs high) is also on the rise as seen by the smallcap run, but we condition our other factor for size as size is a dominant factor in India.

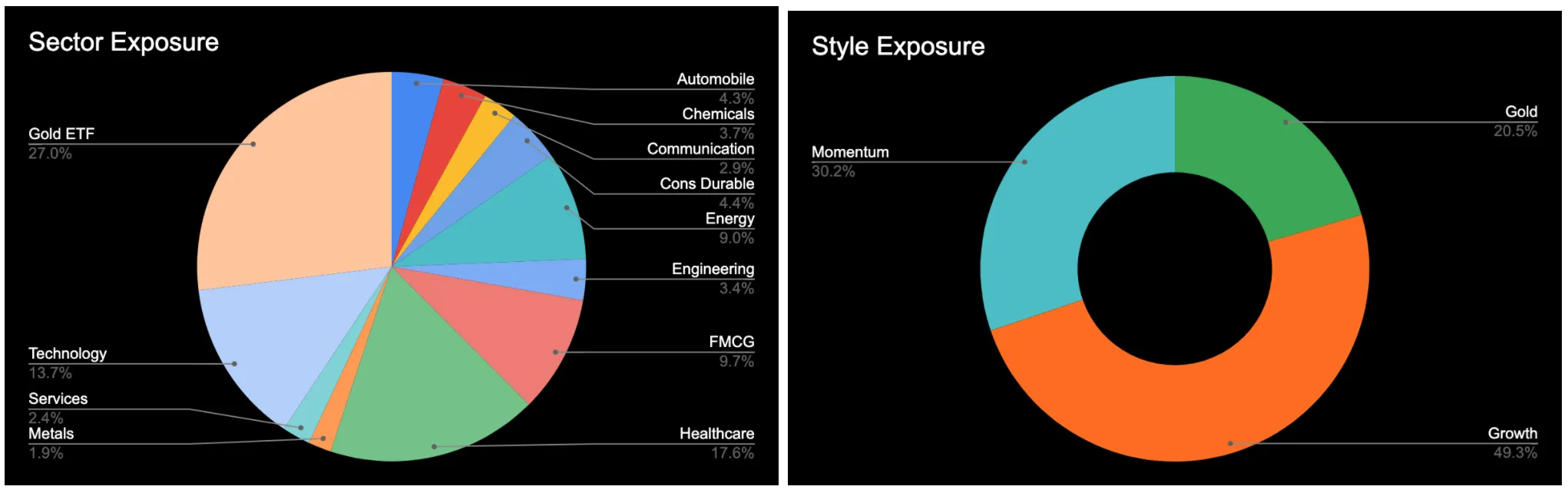

Our portfolio allocations are moving towards high growth and high short term momentum stocks in the larger universe that includes smallcaps. We are replacing the Nifty ETF allocation with Gold.

The notable additions are: Persistent Systems, Syngene, Adani Greens & Gold ETF. Notable removals are: NBCC, Nifty ETF, LIC Gilt ETF

Not disclosing the exact portfolio here, but the sector and style allocations look like:

We took note of the fact that the turnover is taxing for smaller portfolios with depository charges burdening the costs, we have been contingent on this and have kept the turnover controlled.

Discover investment portfolios that are designed for maximum returns at low risk.

Learn how we choose the right asset mix for your risk profile across all market conditions.

Get weekly market insights and facts right in your inbox

Get full access by signing up to explore all our tools, portfolios & even start investing right after sign-up.

Oops your are not registered ! let's get started.

Please read these important guidelines

It depicts the actual and verifiable returns generated by the portfolios of SEBI registered entities. Live performance does not include any backtested data or claim and does not guarantee future returns

By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Sign-Up Using

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Skip & use OTP to login to your account.

Your account is ready. Discover the future of investing.

Login to start investing on your perfect portfolio

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Login to start investing with your perfect portfolio

Forgot Password ?

A 6 digit OTP has been sent to . Enter it below to proceed.

Enter OTP

Set up a strong password to secure your account.

Your account is ready. Discover the future of investing.

By logging in, you agree to our Terms & Conditions

SEBI Registered Portfolio Manager: INP000007979 , SEBI Registered Investment Advisor: INA100015717

Tell us your investment preferences to find your recommended portfolios.

Choose one option

Choose multiple option

Choose one option

Choose one option

Choose multiple option

/100

Investor Profile Score

Congratulations ! 🎉 on completing your investment preferences.

We have handpicked some portfolios just for you on the basis of investor profile score.

View Recommended Portfolios