The 2022 Budget will be looked at from two critical angles. First, the expectation of a boost to economic growth through capital expenditure, and second, the ability to contain fiscal deficit in the increasingly uncertain global economy. Medium & Small Industries, Agriculture, and the consumer sector are still struggling from the repercussions of the pandemic led lockdowns which need stimulus.

On the other hand, if the fiscal deficit is not under control Indian economy could be in trouble when the US Fed raises interest rates. This year, the Government exceeded tax collection but fell drastically short of divestment targets, giving a high fiscal deficit. In the following year, the government should target meeting the divestment targets, providing a boost to Infrastructure to revive the economy, and providing relief to consumption-led sectors struggling after the pandemic.

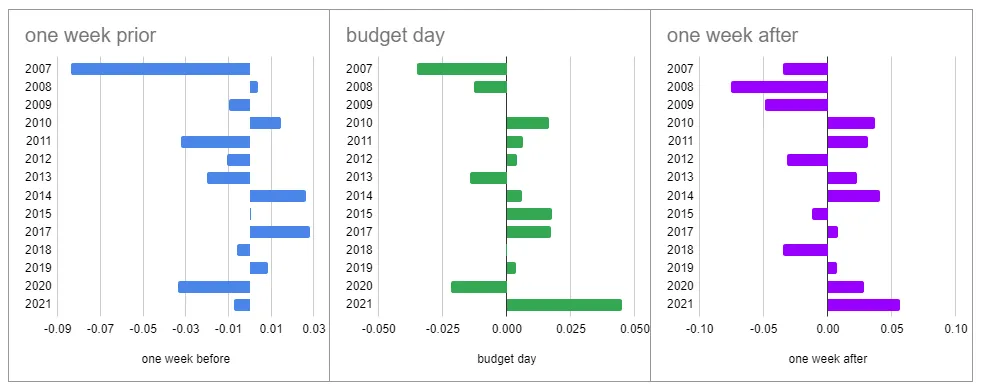

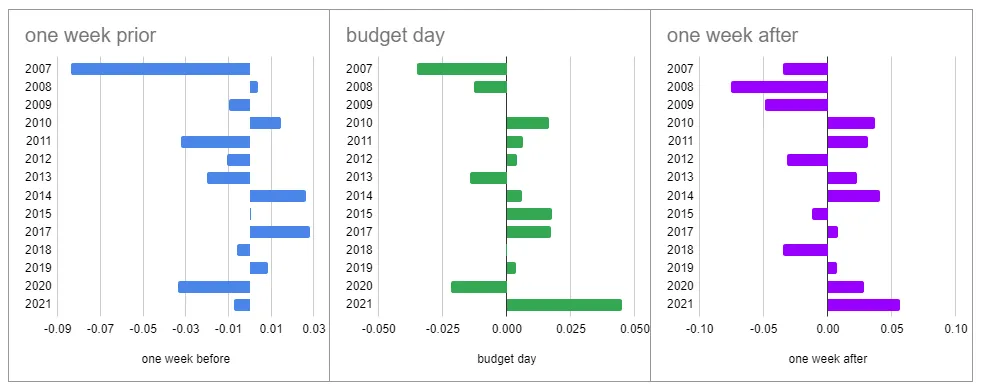

History of Budget Weeks

If you look at the history of budget weeks, the pre-budget week has been negative in 8 of the previous 14 budgets. So we could expect the next week to be volatile as well.

The budget day has been joyous 8 out of 14 times, and the performance on Feb 1st would depend on how the Government delivers on growth. One week after the budget, we saw the market be positive 8 out of 14 times, which would depend on the budget announcements.

Sectors

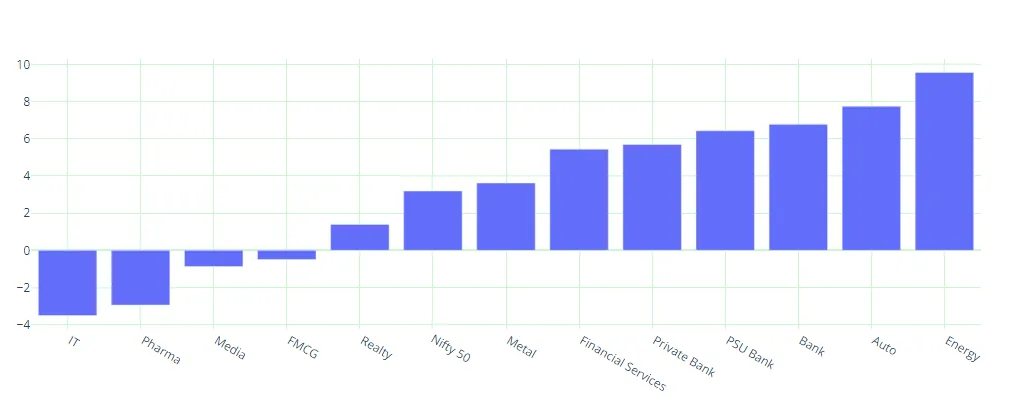

We expect Infrastructure to get the highest focus in the Budget, and the Finance Minister has also hinted at a focus on the Infrastructure sector. The corporate sector is doing well, with low-interest rates, tax burden, and PLI schemes, but the Rural and MSME sectors are struggling, so the government might focus there. Also, this being an election year of UP and Punjab, the government might incentivize the agriculture sector. Aid is also expected for hospitality and transport sectors struggling post-pandemic. In addition, sustainable Energy and Electric Vehicles can get tax breaks.

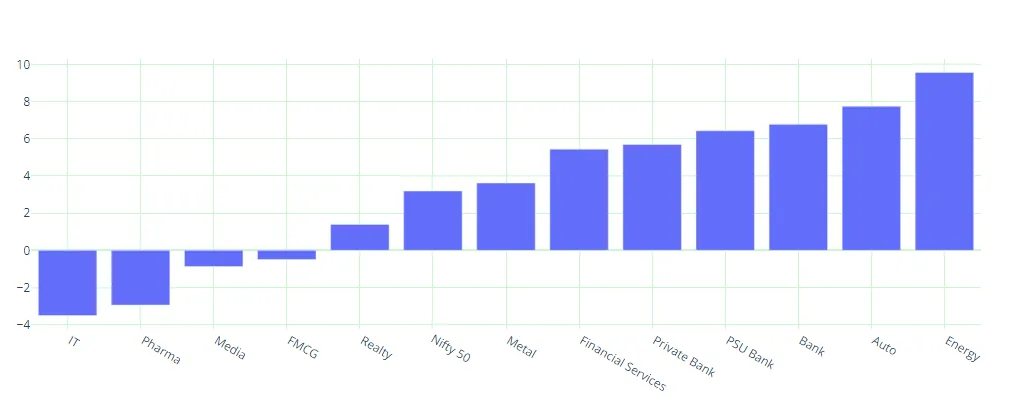

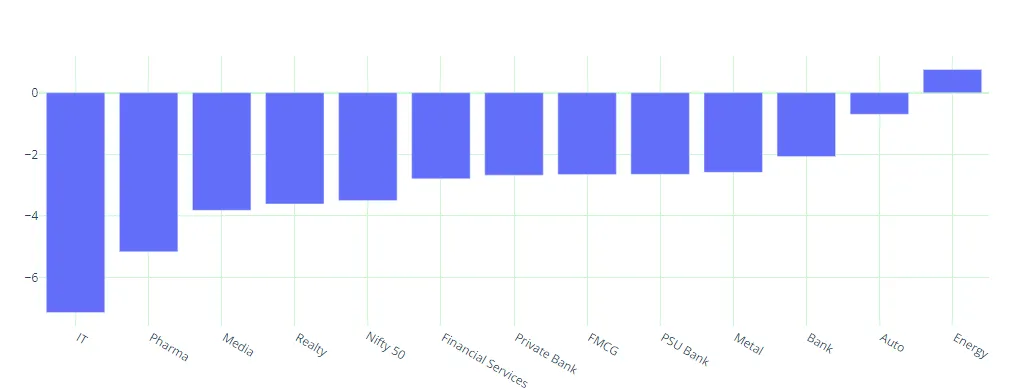

Looking at the last one month’s performance, Banking and Financials have picked up along with Auto and Energy.

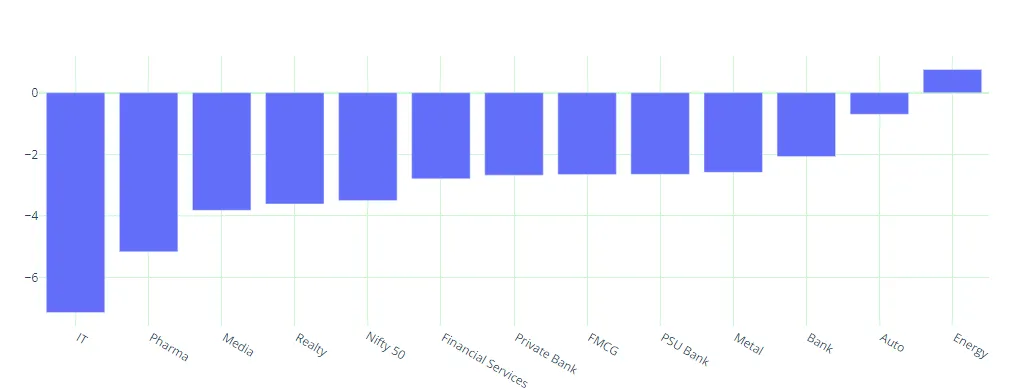

However, every sector has suffered primarily due to the global meltdown in the last month. IT and Pharma have fared the worst .

Portfolio Performance

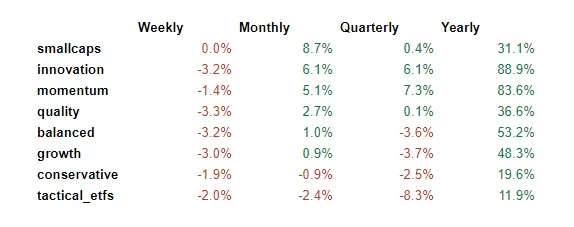

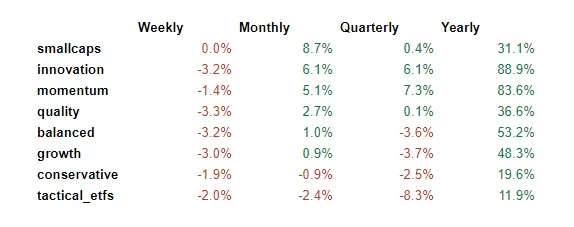

Looking at our portfolio performance, last week was volatile, even though the performance has been strong on a month-on-month basis, especially for small-caps, innovation, and momentum portfolios.