India’s commodities, precious metals, and mining sectors are navigating a complex landscape in early 2025. Domestic steel production is rising, and demand remains robust, but a surge in imports has pressured prices – prompting the government to consider safeguard duties. Meanwhile, China’s latest policy signals indicate only modest economic support, with credit growth restrained and housing still sluggish, weighing on global metal prices. At the same time, global factors like trade protectionism, steel overcapacity, currency swings, and the evolving inflation outlook are influencing India’s metals and mining industry. In this newsletter, we break down recent developments, key drivers, and impacts on major Indian companies in a clear, jargon-free manner, with charts and tables to illustrate trends.

Imports Surged, Exports Lagged – India Turns Net Steel Importer

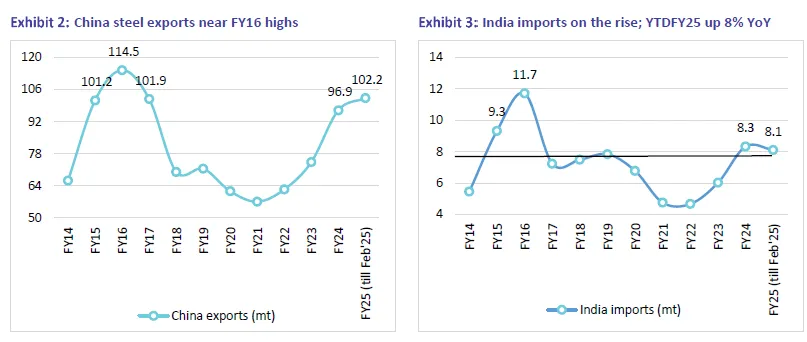

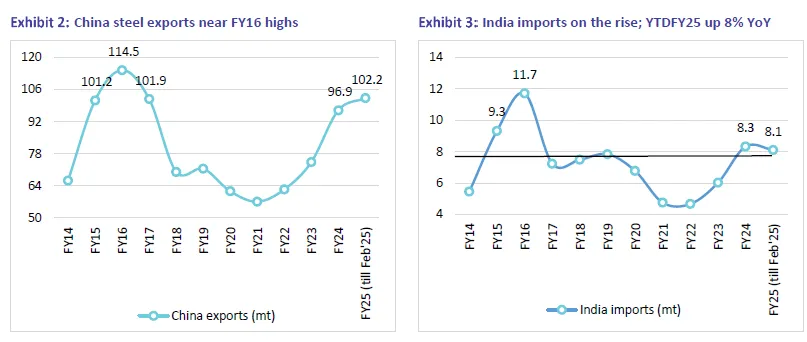

India’s steel demand continues to grow at a healthy pace, outshining most major economies. In 2024, India’s steel consumption is estimated to have jumped about 11%, even as global steel demand fell ~1% (China’s demand slid ~3.5% amid a real estate slump). For 2025, Indian steel demand is forecasted to rise another 8–9%, far ahead of the tepid ~0.5–1.5% uptick expected globally. This demand is fueled by steel-intensive construction in housing and infrastructure, as well as steady need from engineering and manufacturing sectors. However, there is oversupply in the domestic market due to imports. In April 2024–Feb 2025, India’s finished steel imports climbed to about 8.1 million tonnes, up 8.3% year-on-year and reaching a five-year high. Conversely, exports of steel from India fell sharply over the same period (down ~6% in 2024), due to weaker international demand and competitive pricing from other exporters. This combination resulted in India becoming a net importer of steel. That extra supply weighed on prices and inventory levels.

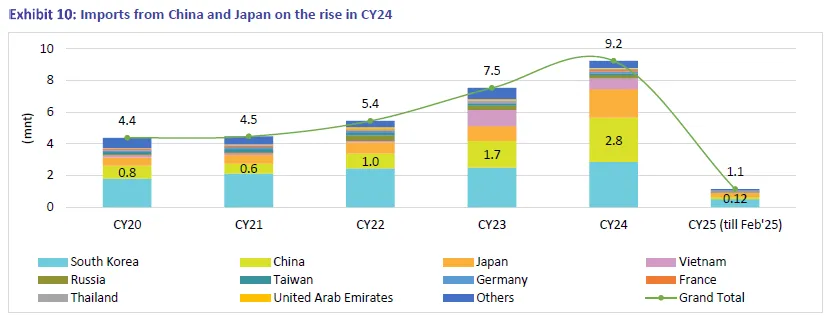

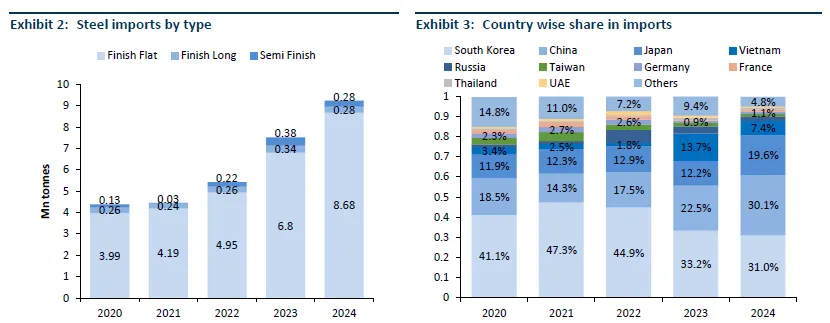

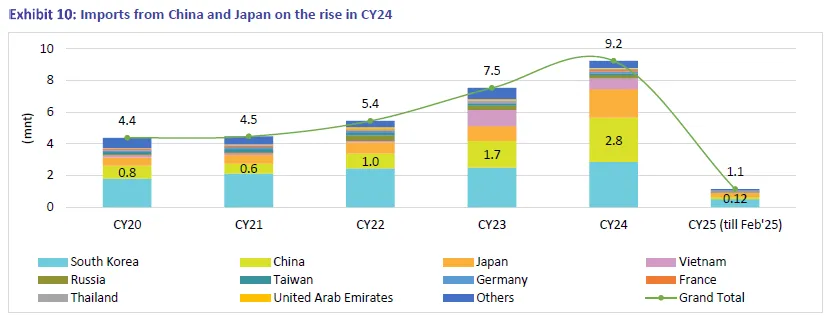

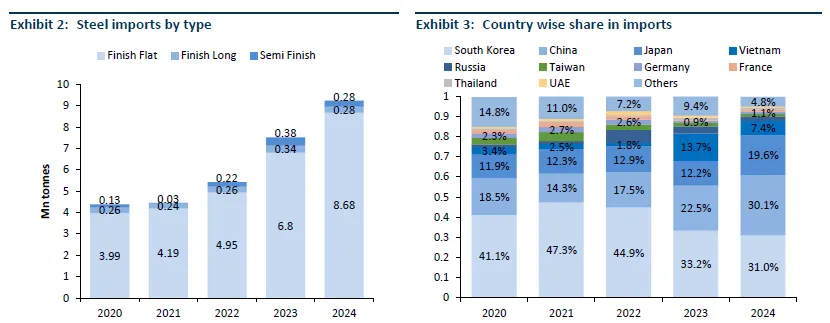

Where is the steel coming from? Import data show significant increases from China, Japan, and Vietnam in particular. Traditionally, China exported mostly value-added steels (galvanized, alloy, stainless) to India. But between 2022 and 2024, Chinese finished steel exports to India jumped 2.4x, and remarkably, Hot-rolled coil (HRC) – a benchmark flat steel product – imports from China rose 28-fold as Chinese mills sought outlets for surplus product. Japanese and Vietnamese steelmakers also diverted material to India.

As a result, by FY25, about 88% of India’s flat steel imports have been coming from just four countries: South Korea, China, Japan and Vietnam. This concentration has heightened concerns about dumping, especially with China’s exports near record highs.

On the export side, Indian steel shipments abroad dropped in 2024 due to a combination of uncompetitive prices (domestic prices were higher than global in many cases) and soft overseas demand. India’s steel exports were also previously curtailed by an export duty in mid-2022 (since lifted), and despite its removal, exporters faced challenging conditions in 2024. The slack was quickly filled by others: China’s steel exports, for example, surged to around 102 million tonnes in 2024 (up ~17% YoY), reaching levels close to its 2015 peak of ~110 MT. This flood of Chinese steel into world markets kept international prices low and made it harder for Indian steel to find buyers overseas. Hence, much of India’s incremental production stayed onshore, exacerbating the domestic glut in late 2024.

Domestic Steel Production & Demand – Strong Growth Amid Import Pressure

Domestic steel production has expanded to meet the booming demand. In the April 2024–January 2025 period, India’s crude steel output reached 111.3 million tonnes, up 4.4% year-on-year. (For context, the country’s installed capacity has grown rapidly in recent years, from ~142 MT in 2019-20 to ~180 MT in 2023-24.) Medium and small steel producers led the supply increase in 2024 – their output jumped 11–14%, while the top seven producers saw flat growth as many undertook maintenance shutdowns. This kept overall 2024 production growth modest (~5.2%), even as demand raced ahead, leading to a reliance on imports and inventory drawdowns to fill the gap.

Government infrastructure spending is providing an ongoing boost to domestic steel consumption. The Union Budget FY2025-26 raised capital expenditure by 10% to ₹11.2 trillion– a robust increase aimed at roads, railways, housing, and even new areas like shipbuilding and green energy. Infrastructure and construction account for about 69% of India’s steel use. Industry participants note that while the capex push remains strong, it’s a bit less aggressive than the ~30% annual growth seen in government spending during 2021–24.

Safeguard Duty to the Rescue For Steel Industry

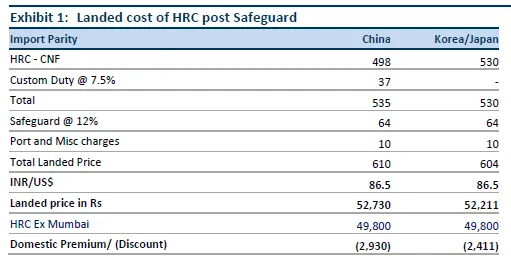

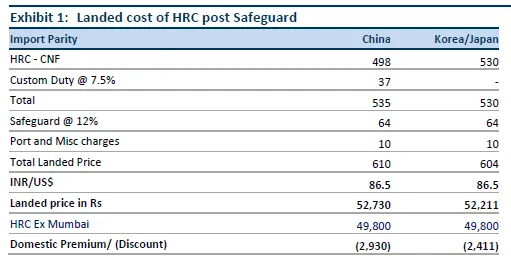

The influx of low-priced imports through 2024 created an oversupply situation, driving Indian steel prices down for much of last year. HRC steel saw domestic prices decline about 9% in 2024, while cold-rolled coil prices fell ~7%. Facing escalating imports and the risk of India becoming a “dumping ground” for surplus global steel, the Indian government moved to protect its domestic industry. In March 2025, a provisional 12% Safeguard Duty was recommended to the Finance Ministry on a range of flat steel products for 200 days. The safeguard is intended to give breathing room to domestic producers. The domestic price of HRC in India has seen an increase by approximately INR 3,000 per tonne as producers anticipate the safeguard duties. With the implementation of the duty, further price hikes in the range of INR 500–1,000 per tonne are expected. This increase is driven by the protection from cheap imports and is expected to help stabilize margins for Indian producers

While the safeguard duty offers immediate relief to steel manufacturers, it does not guarantee a permanent solution. The Indian market is expected to face oversupply in FY26 due to increased domestic production. Therefore, Indian steel producers, including major players like Tata Steel, JSW Steel, JSPL, and SAIL, will likely look toward export markets to absorb the surplus. A boost in global demand, particularly from China, which is expected to reduce exports, could further support steel prices.

Market Impact on Major Steel Companies

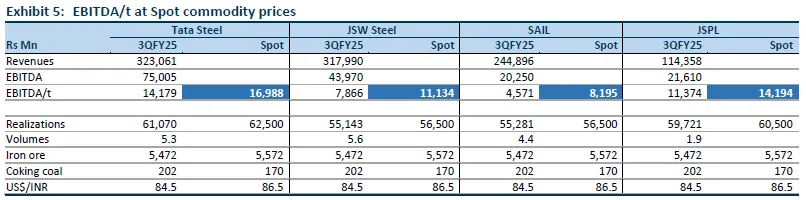

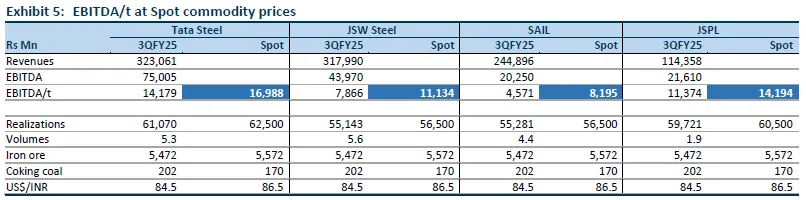

The steel safeguard duties are expected to benefit major Indian players. Tata Steel, JSW Steel, JSPL, and SAIL, which have already ramped up their production capabilities, are poised to gain from these protective measures. In fact, their earnings are projected to improve, thanks to better margins and the anticipated rise in steel prices.

Tata Steel, with its significant presence in both the domestic and international markets, is expected to benefit the most. Following the expected approval of the safeguard duty, these companies are likely to see an increase in their EBITDA as domestic steel prices strengthen. This move will also help Indian companies withstand the pressure from cheap imports, which have been a concern for years.

China, the world’s largest consumer and producer of most commodities, plays an outsized role in shaping global metal prices. China as of now is not unleashing major stimulus, and its credit growth continues to slow, tempering the outlook for metal demand.

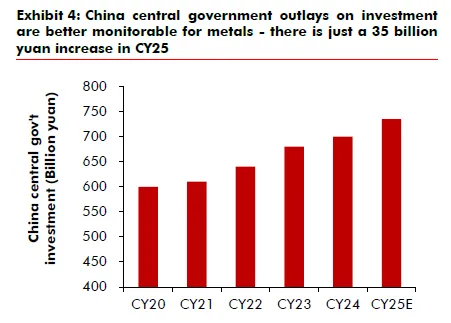

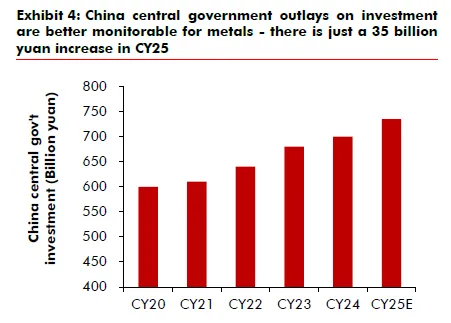

As of 2025, China’s economic policies indicate a more cautious approach. Despite an increase in the fiscal deficit target for 2025, set at 4.0% of GDP, this appears less expansionary than it first seems. Much of the increased deficit stems from declining revenues due to weaker domestic demand, low inflation, and soft exports, rather than aggressive government spending.

In fact, China’s planned increase in government expenditure is modest at just 4%, primarily absorbed by rising debt servicing costs. Analysts suggest that the fiscal measures, including local government bonds for infrastructure, may only support a modest 15 million tonnes of steel demand, far below the levels seen during previous stimulus-driven booms. Consequently, while the fiscal stance provides some support to metals demand through infrastructure projects, it lacks the explosive growth that has historically fueled commodity booms.

On the monetary front, China’s credit growth is showing signs of restraint.There is a continuation of a trend where China’s credit impulse has steadily slowed since the peak levels of the 2010s. A weaker credit impulse translates into slower demand for commodities like steel, aluminum, and copper, as China’s economic activity has been historically driven by debt-fueled booms in the property and infrastructure sectors.

Despite some measures to support the housing market, such as lowering mortgage rates and easing purchase restrictions in certain cities, the recovery in real estate remains fragile. This, combined with tighter credit conditions, suggests that metal demand from China may not reach the levels needed to drive significant price increases globally. As a result, metal prices, including steel and iron ore, are likely to remain subdued in 2025, with China continuing to export excess supply rather than seeing a major domestic rebound in demand. For countries like India, this environment of weak demand from China offers some relief on the cost side but limits upside potential in global metal prices.

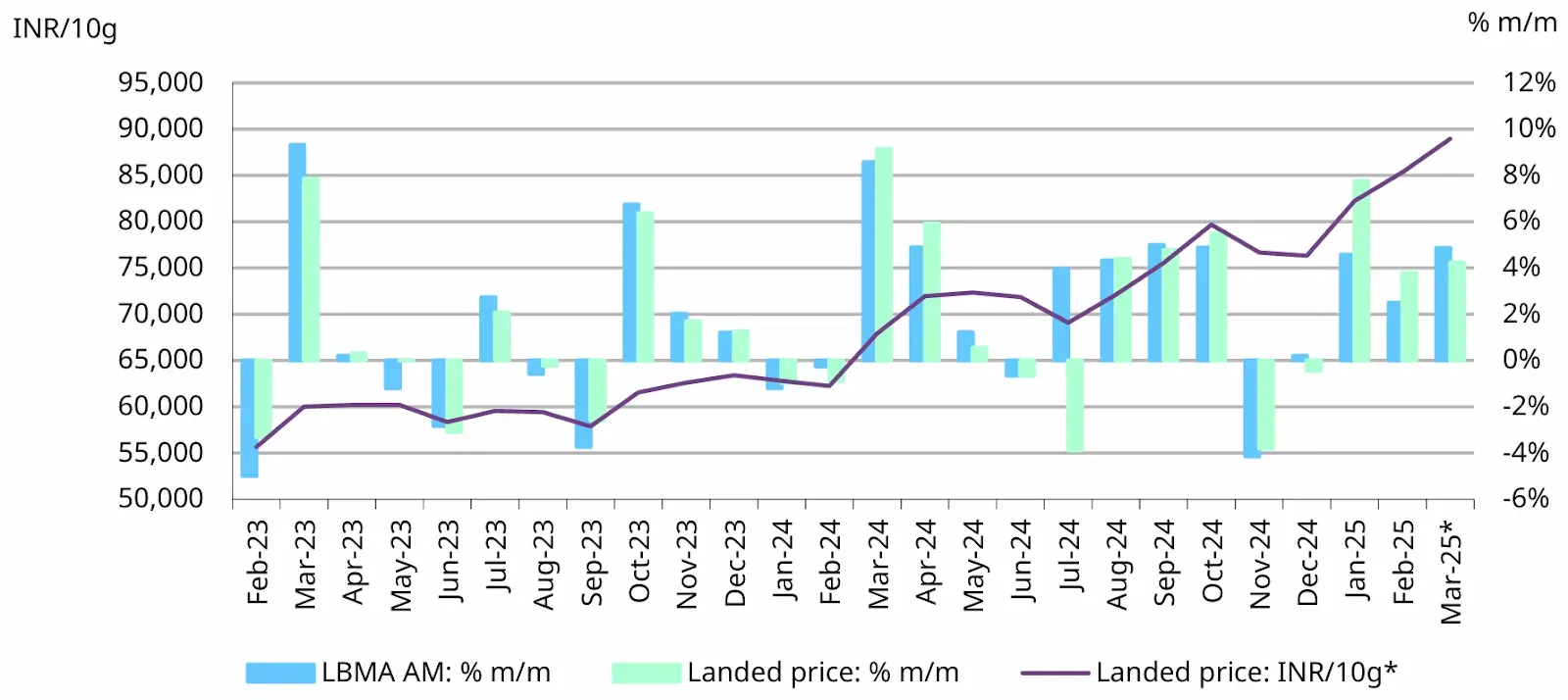

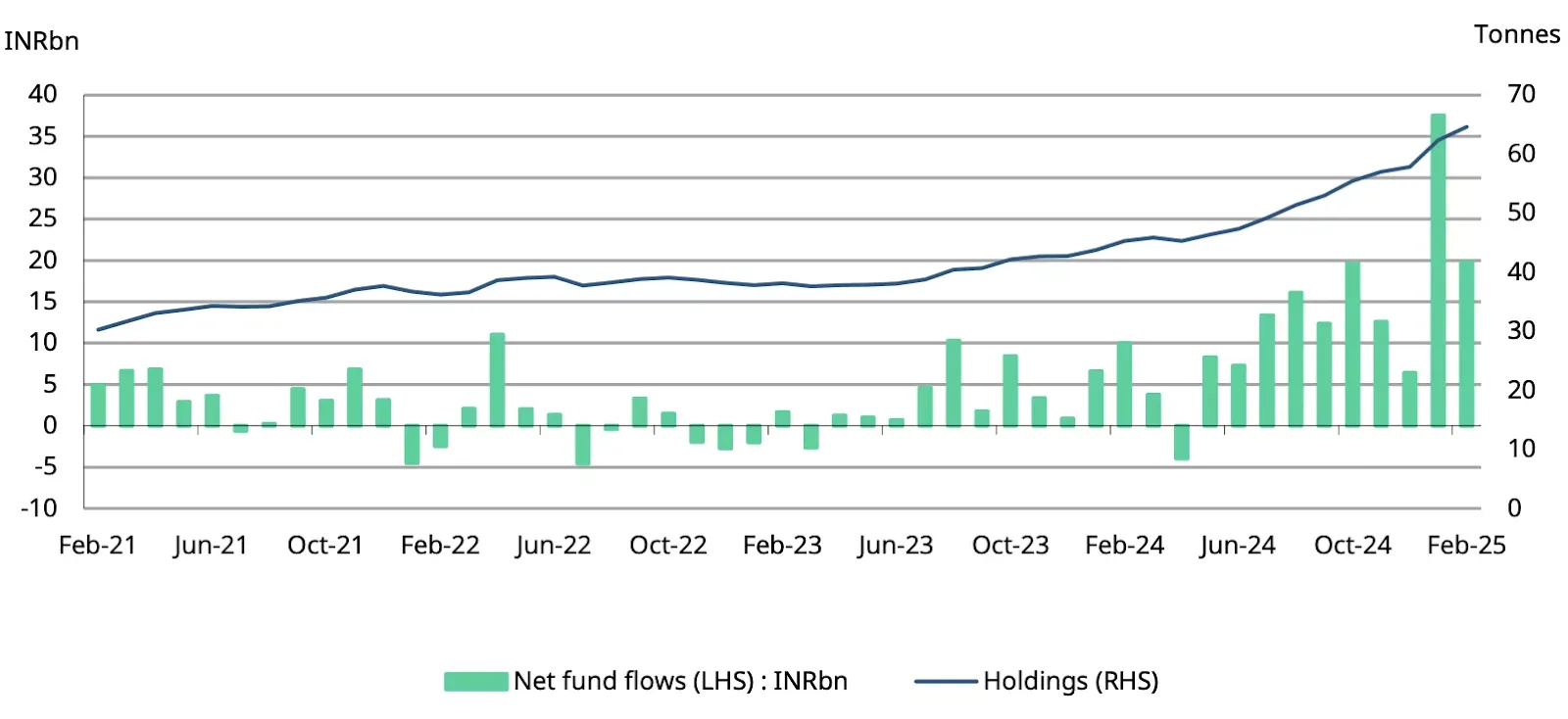

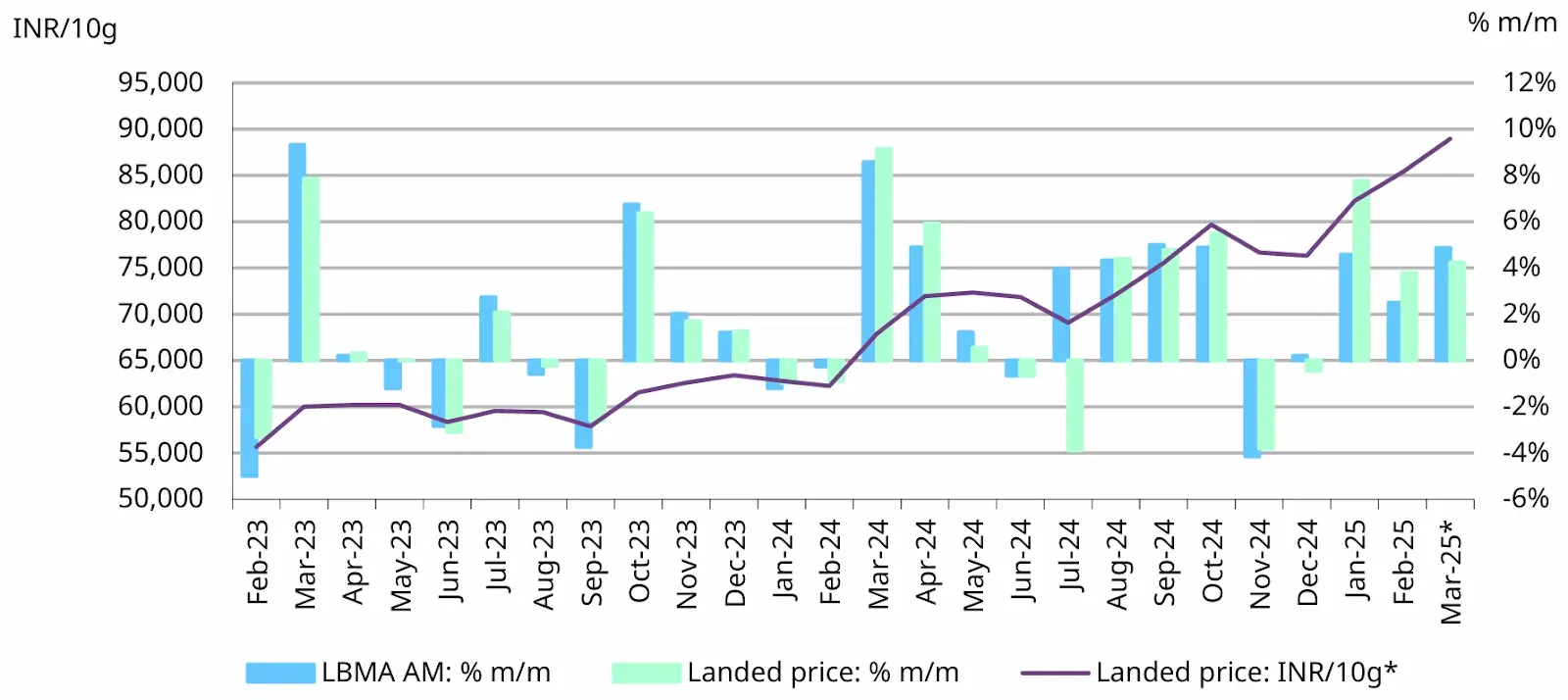

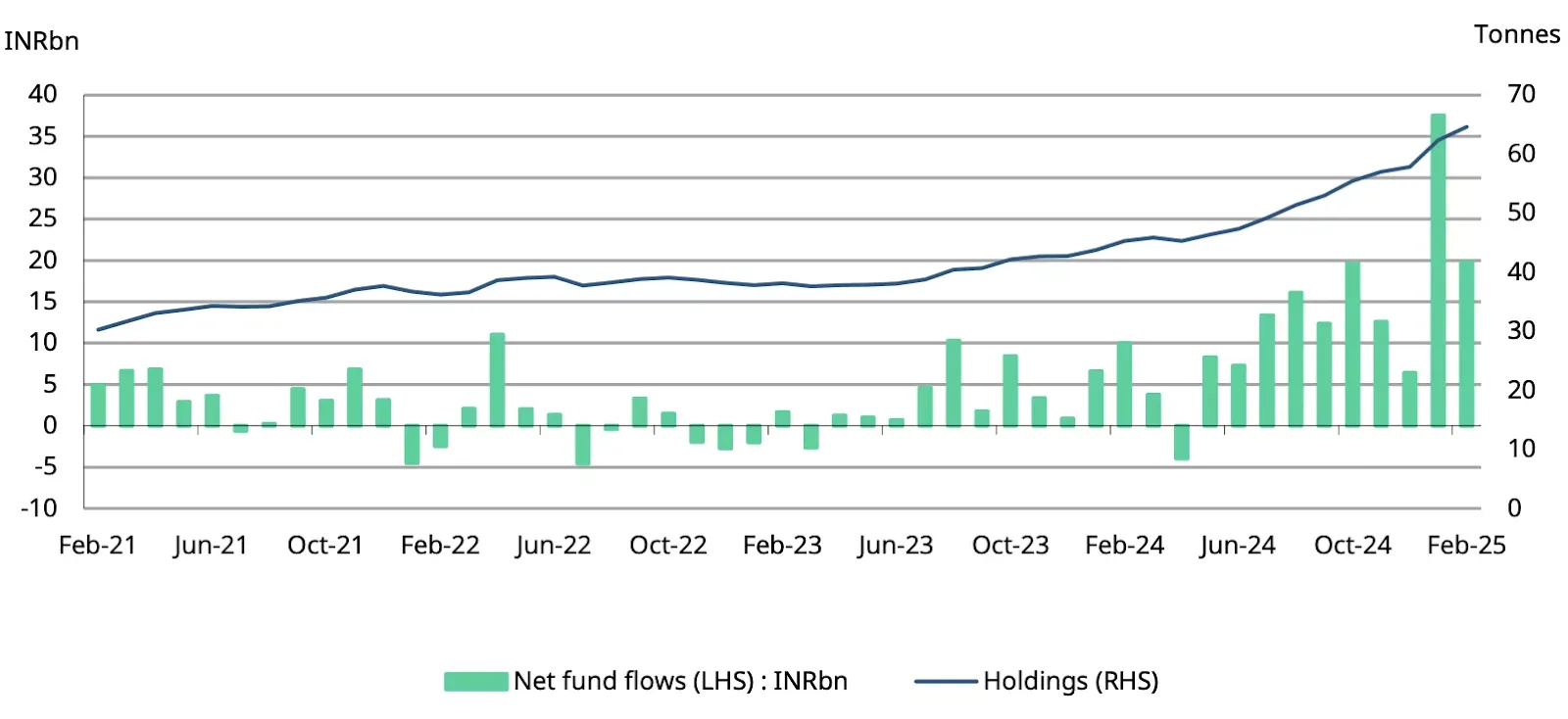

Gold prices have been on a tear in 2025, reaching all-time highs. Gold’s momentum is “unprecedented” – the metal has set 13 new record highs so far this year and even crossed the psychological $3,000/oz threshold in mid-March. In USD terms, gold is up about 12% year-to-date (through mid-March), and even more in rupee terms – domestic gold prices are up ~17% YTD to roughly ₹89,000 per 10 grams. The additional jump in INR price reflects a slight depreciation of the rupee and local market dynamics.

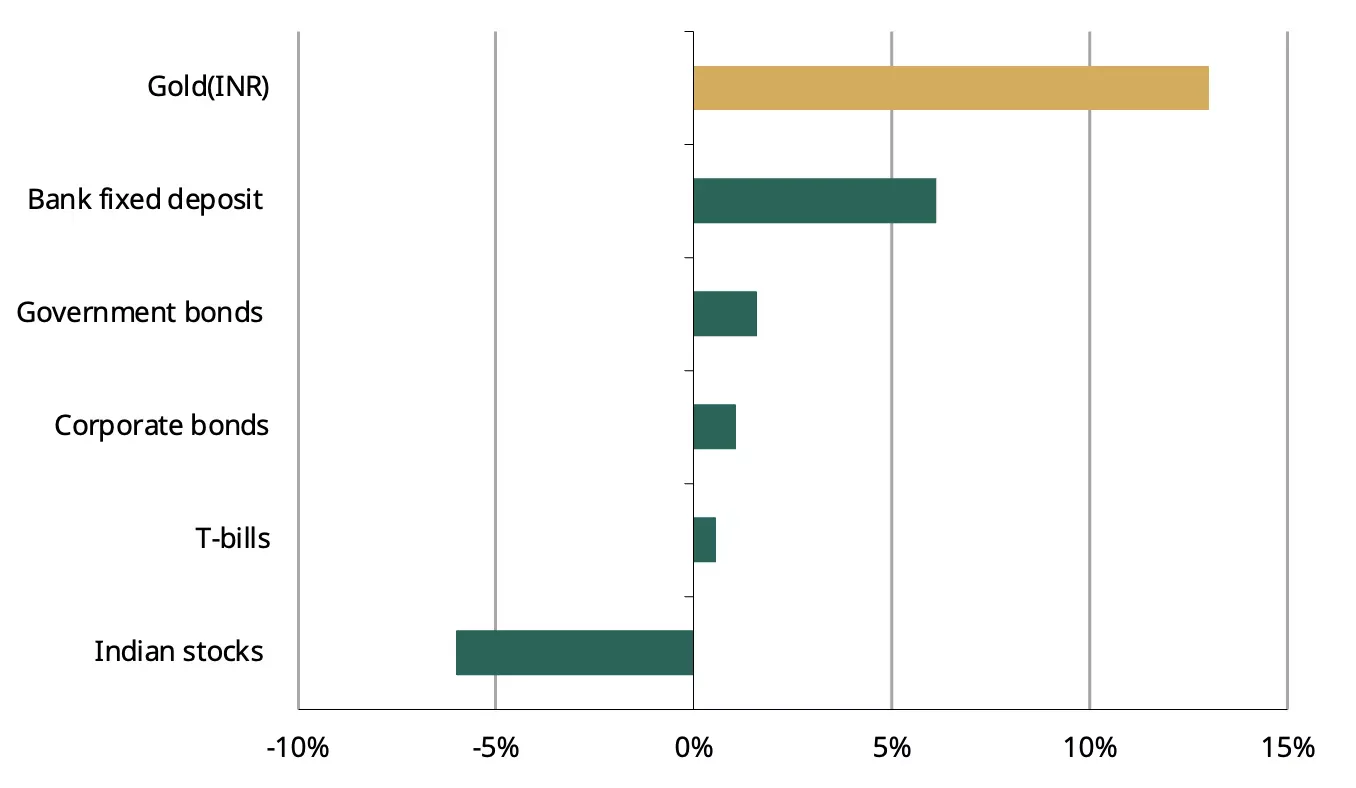

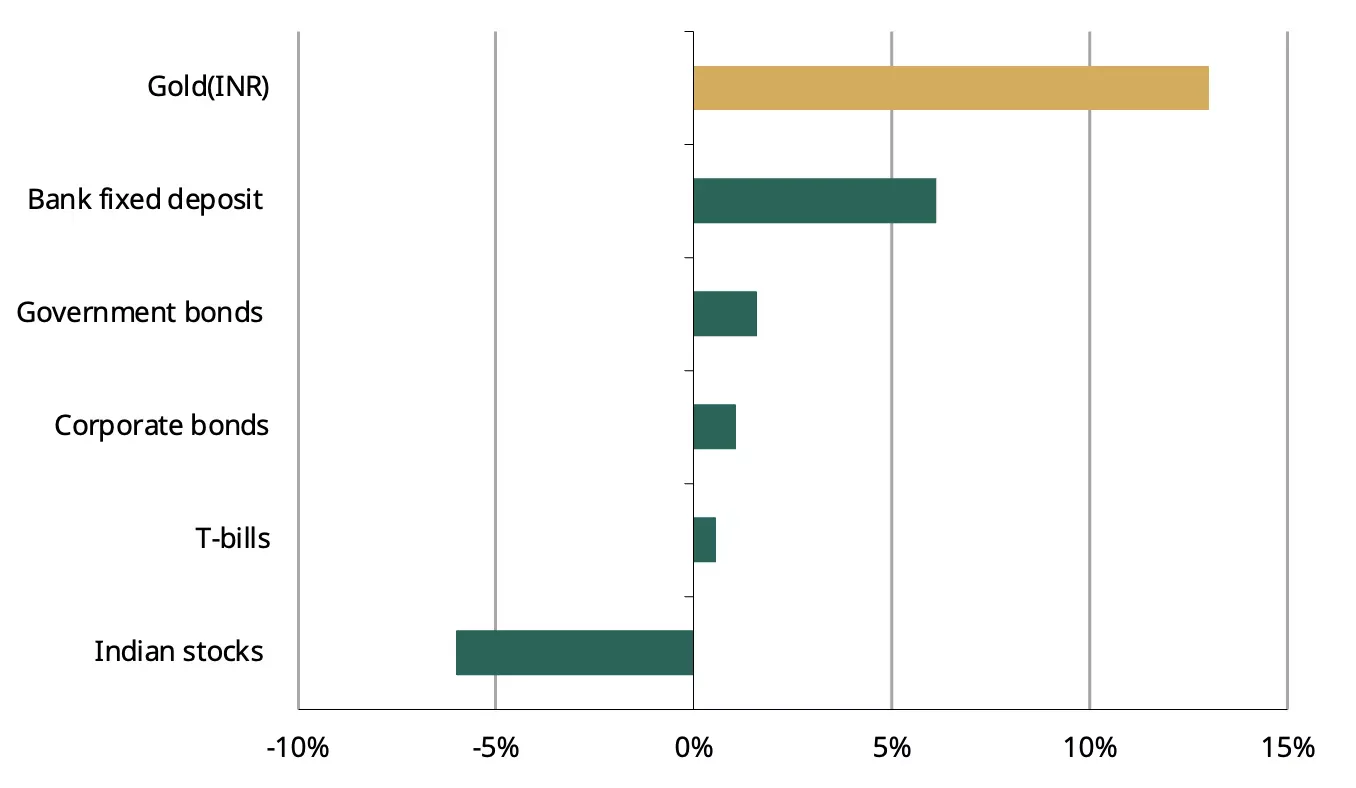

This rally is driven by a confluence of factors: economic and geopolitical uncertainty, a weaker dollar, easing interest rates globally, and persistent inflation concerns have all fueled investor demand for gold. Gold has far outperformed other asset classes in India this year, delivering about 13% returns versus negative returns for domestic equities and modest gains in bonds.

It’s worth noting that such high prices have dampened traditional jewelry demand in India – February gold imports fell to an 11-month low, as consumers sold old gold and held off new purchases. However, investment demand (for bars, coins, gold ETFs) remains steady, underscoring gold’s role as a safe-haven and portfolio diversifier in the current climate.

Silver has likewise benefited from the precious metals upswing, though its move has been less dramatic than gold’s. Overall, the strength in precious metals prices bodes well for mining companies in that space and reflects the cautious global economic sentiment prevalent in 2025.

Why Are Gold and Equities Rising Together?

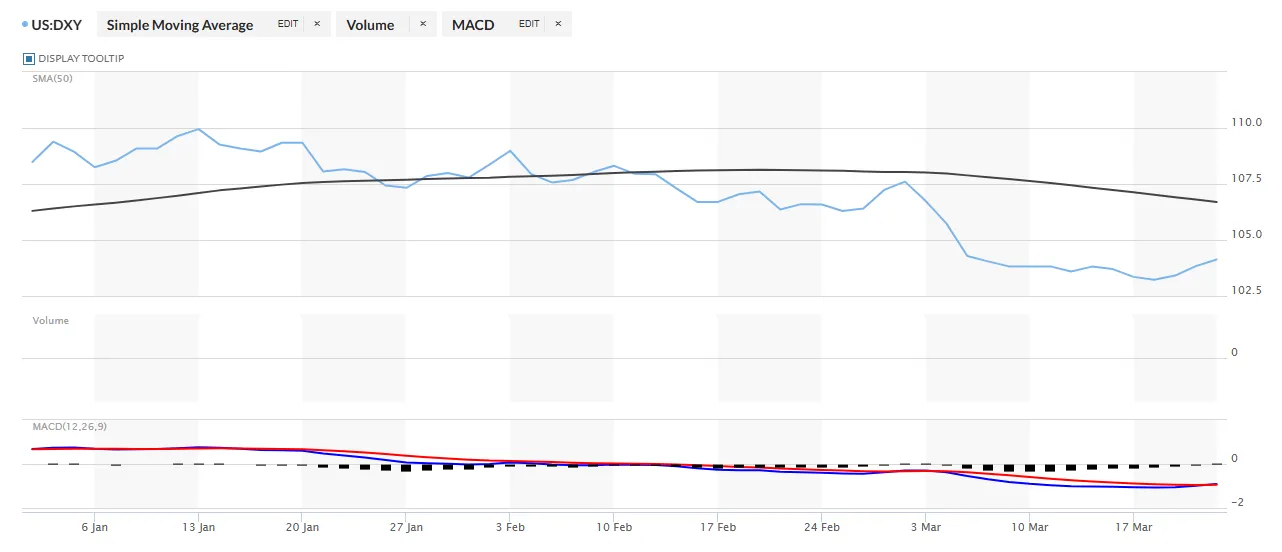

In a rare twist, gold and equities have been rising together, defying their historical inverse correlation. Gold prices have surged by over 4% this month, reaching record highs, while the Nifty 50, India's equity benchmark, has also gained about 3.5% this month. Typically, these two asset classes move in opposite directions—gold rises during periods of uncertainty, and equities tend to perform well when economic indicators signal strong growth. However, both asset classes are being supported by the same factors: a weakening dollar and expectations of further interest rate cuts by the US Federal Reserve.

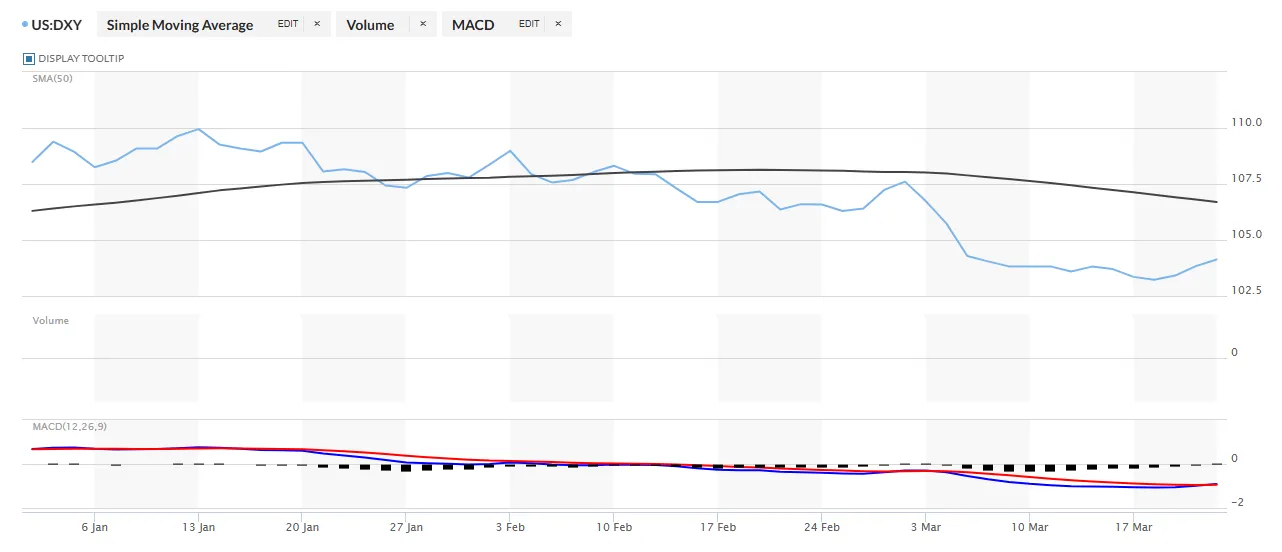

The Dollar Index, which tracks the US dollar against a basket of other major currencies, has dropped nearly 5% this year, from 108.5 in December 2024 to around 103.4 in mid-March. This decline has made gold cheaper for foreign buyers, enhancing its appeal as a safe haven. Additionally, a weaker dollar encourages foreign investment in emerging markets like India, as investors seek higher returns with reduced currency risk, which has boosted stock markets. Furthermore, expectations that the US Fed will reduce interest rates later this year have had a dual impact—lower rates typically make gold more attractive as it reduces yields on bonds and raises inflation concerns, which supports the price of the yellow metal. Simultaneously, rate cuts weaken the dollar, which is beneficial for India’s stock market as it strengthens the rupee, lowers borrowing costs, and boosts corporate earnings.

Despite the rise of both gold and equities, experts caution that this trend may be short-lived. Gold’s rise is largely due to heightened geopolitical risks, uncertainty surrounding US tariffs, and a weaker dollar, along with strong demand from countries like India and China. On the other hand, equities are rebounding from a recent correction, driven by investor optimism over improving economic conditions and corporate earnings.

Global Market Conditions: Trade Tensions, Overcapacity, and Macro Trends

Beyond China, several global factors are shaping the operating environment for India’s metals and mining sectors:

Trade Protectionism Worldwide: Many economies are erecting barriers against cheap steel. In 2024 alone, 67 new anti-dumping investigations on steel were initiated globally – the highest in years - which means steel flows are getting rerouted. As traditional markets close off to surplus steel (especially from countries like China, Russia, Iran), suppliers target any open market – and India, until now, had relatively low import duties.

Steel Overcapacity: The perennial problem of excess steel capacity remains, especially in China which produces ~50% of the world’s steel. Despite talk of rationalization, China’s crude steel output is still around 1 billion tonnes, and capacity utilization is not high. Other regions also added capacity during boom years (India itself, Middle East, etc.). Global capacity overshot demand by a considerable margin in recent years, leading to high exports and low prices. The Chinese government has mandated production cuts and is pushing industry consolidation to curb oversupply.

Currency Fluctuations: Over the past year, the USD had been strong, but in early 2025 the dollar index softened somewhat as markets anticipated future Fed rate cuts. The Indian rupee, however, has depreciated modestly (around 1–2% YTD). A weaker rupee makes imported commodities more expensive in local terms, which ironically gives some protection to domestic producers by raising import costs. But also raises input import costs – a double-edged sword that companies must manage via hedging and pricing strategies.

Inflation and Interest Rates: The global inflation outlook is significantly better than a year ago – major central banks saw inflation peaking in 2022-23 and have since hiked rates aggressively. By 2025, inflation is cooling in many regions (US, Europe), though still above targets. The expectation of easing financing conditions later in 2025 is one factor supporting a mild global steel demand uptick forecast. Lower interest rates would stimulate construction and auto demand somewhat, and also reduce interest expenses for heavily indebted companies in metals/mining.

Conclusion & Outlook

As of March 2025, the Indian commodities, metals, and mining sector is at an interesting juncture. Domestically, the story is largely positive – demand is robust, policy is supportive (if only temporarily in some cases), and companies are regaining pricing power after a year of headwinds. Investors (both institutional and retail) can take heart that India remains a growth leader in steel and metal consumption. Government infrastructure impetus, albeit a bit toned down from the frenzy of prior years, still provides a solid backbone for steel demand. The implementation of safeguard duties should stabilize the market in the short term, allowing the industry to better utilize new capacities and strengthen balance sheets.

In the precious metals realm, gold’s shining performance reminds investors of the value of diversification and the impact of macroeconomic shifts (like interest rates and dollar moves) on commodities. While base metals and bulk commodities are more tied to industrial cycles, gold’s record run is a barometer of global risk sentiment – one that bears watching as we move through 2025 and get more clarity on the trajectory of global growth and monetary policy.

The overall tone is cautiously optimistic, with recognition that the worst of the down-cycle may be over, but also that global uncertainties could test the resilience of this recovery. As always, a balanced approach, cost discipline, and focus on core demand drivers will be key for navigating the road ahead in the commodities and metals arena.