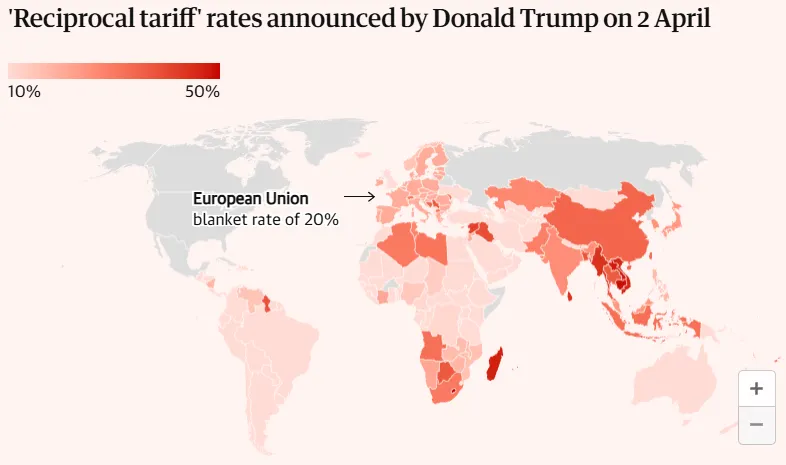

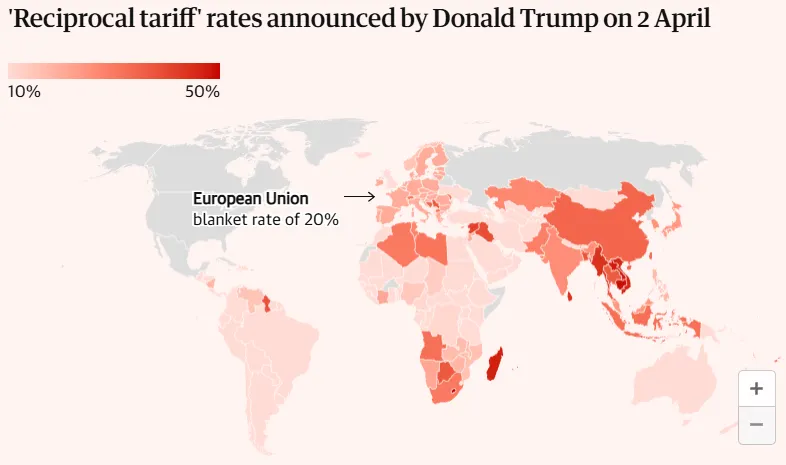

In an era of intensifying trade protectionism and shifting geopolitical priorities, the United States has taken a decisive step by implementing a sweeping tariff regime. On April 2, in what he dubbed “Liberation Day,” President Donald Trump unveiled a sweeping new trade policy aimed at addressing America’s massive $1.2 trillion trade deficit, against all trading partners. The move marked a dramatic shift in U.S. economic strategy, as Trump rolled out a two-tier tariff regime designed to penalize what he described as decades of unfair trade practices. The first measure is a universal base tariff of 10% on all imports, significantly higher than the average pre-Trump tariff rate of around 2.5%. This blanket duty is scheduled to take effect on April 5 and is intended to broadly discourage imports while encouraging domestic production.

In addition to the baseline tariff, Trump introduced country-specific “reciprocal tariffs”, which will take effect from April 9. The aim of these tariffs is to level the playing field in international trade and reduce the U.S. trade imbalance by targeting countries with disproportionate trade surpluses, such as India, China, Vietnam, and the European Union.

The tariffs were framed as a necessary step toward achieving a “golden age” of American self-sufficiency - an American first approach. However, critics warn that such aggressive protectionism could spark retaliatory measures and further destabilize the global economy - rekindling fears of a return to the dark days of protectionist trade wars. This article dissects the rationale behind Trump’s tariff policy, impact across the world and evaluates the potential repercussions across key Indian industries.

Reciprocal Tariffs - A Policy Born of Nationalism, Not Economics

Trump's reciprocal tariffs are meant to reconfigure global supply chains amidst rising domestic calls to rebalance global trade and punishing reliance on foreign production. Economists and policymakers have widely criticized the rationale, warning that these moves could backfire both economically and geopolitically. Trump’s new tariff strategy marks a significant shift from targeting specific trade barriers to focusing primarily on trade imbalances and reducing the US trade deficit.

How Did the Trump Administration Calculate Reciprocal Tariffs?

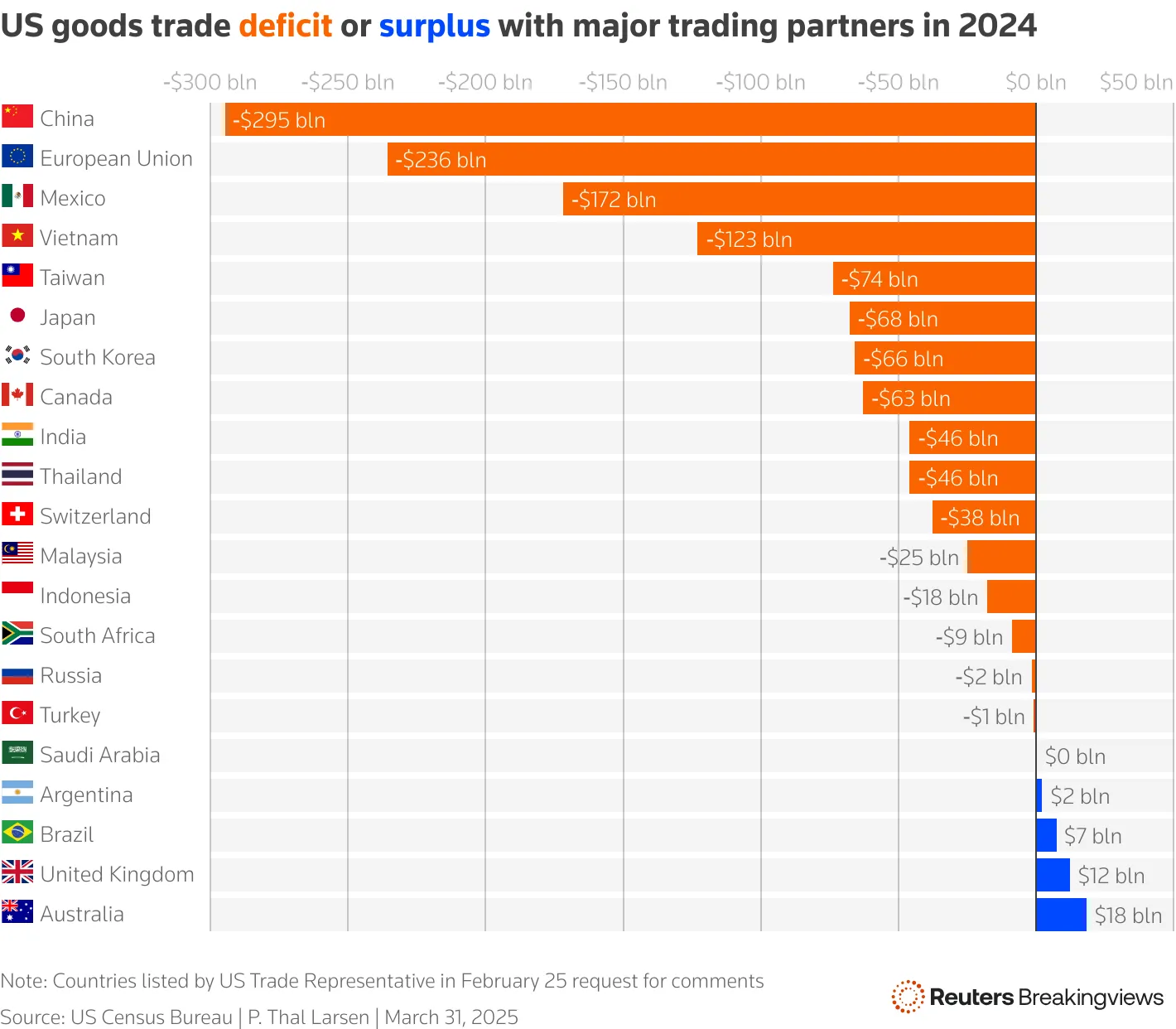

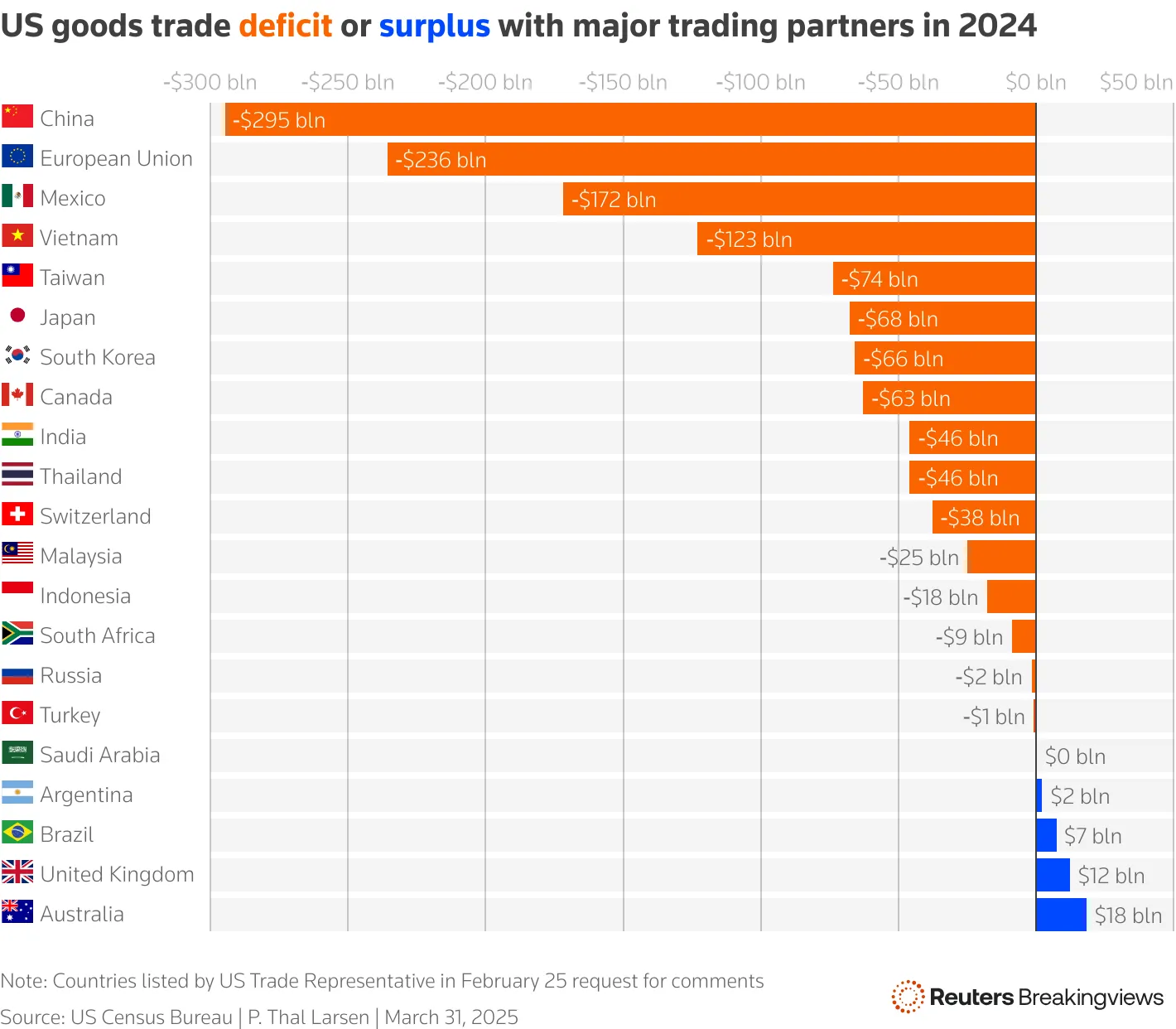

The calculation of most reciprocal tariffs was done using a country's trade surplus with the US, divided by its total exports, and then halved that percentage. Trump framed this approach as a gesture of goodwill, stating that Americans are “kind” and therefore won’t impose the full retaliatory reciprocal rate. For instance, China’s $295 billion surplus on $438 billion in exports yields a 34% tariff. However, some countries like the UK, Australia, and New Zealand got a flat 10% tariff. A caveat is that products containing at least 20% US-origin content are exempt from the tariffs.

But are the tariffs actually reasonable or fair to these countries?

Here is a summary of tariffs charged by countries to US & the reciprocal tariffs charged by US across countries:

Far from being proportional or empathetic, the tariff structure appears regressive and inconsistent, especially when viewed through the lens of economic vulnerability and trade balance. For example, Cambodia and Bangladesh, among the world’s poorest countries with per capita incomes of just $2,950 and $2,770 respectively, have been hit with some of the highest tariffs — 49% and 37%, despite accounting for a negligible share (1% and 0.5%) of the U.S. trade deficit.

In stark contrast, China and the European Union, which together account for over 45% of the total U.S. trade deficit and have much higher per capita incomes, received lower tariffs of 34% and 20%.

The logic appears even shakier when one considers that several wealthy nations with which the U.S. runs a trade surplus, like the UK, Brazil, Singapore, and Colombia, have not been spared. These countries face the same 10% base tariff despite their relatively balanced or favorable trade relationships with the U.S. This disparity raises questions about the coherence and fairness of the tariff formula, suggesting that it may serve more as a political or symbolic gesture rather than a well-targeted economic correction. Ultimately, a policy born of nationalism & not economics.

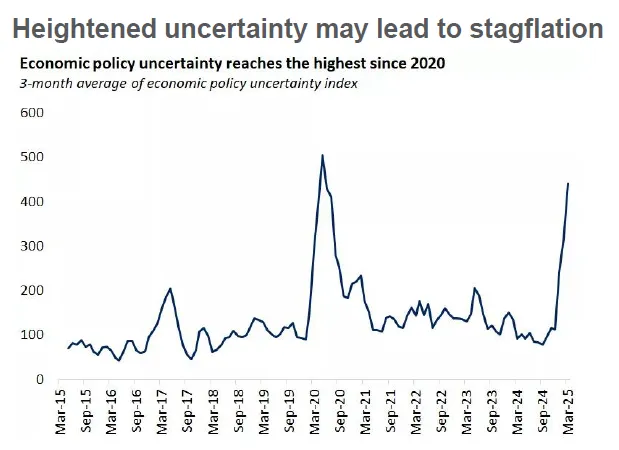

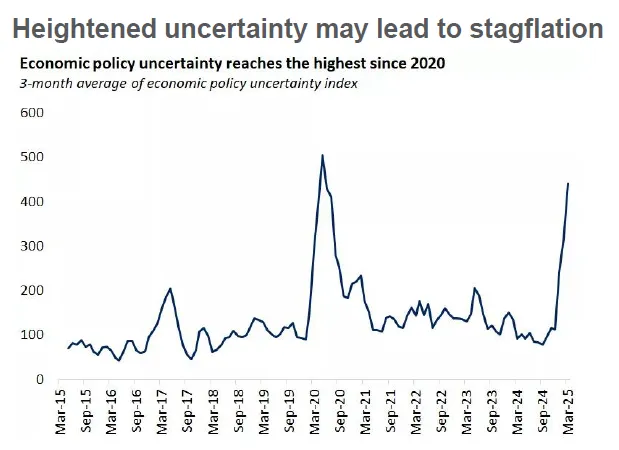

Latest data suggests that the new reciprocal tariff policy could push average US tariff rates to levels not seen since the 1930s. Simultaneously, economic policy uncertainty has surged to its highest level since 2020, as shown by the three-month average index. This heightened uncertainty, combined with rising trade barriers, raises the risk of stagflation—where slowing growth and high inflation occur together—especially amid growing fears of global retaliation and a possible rollback of aggressive trade measures - further adding to the uncertainty.

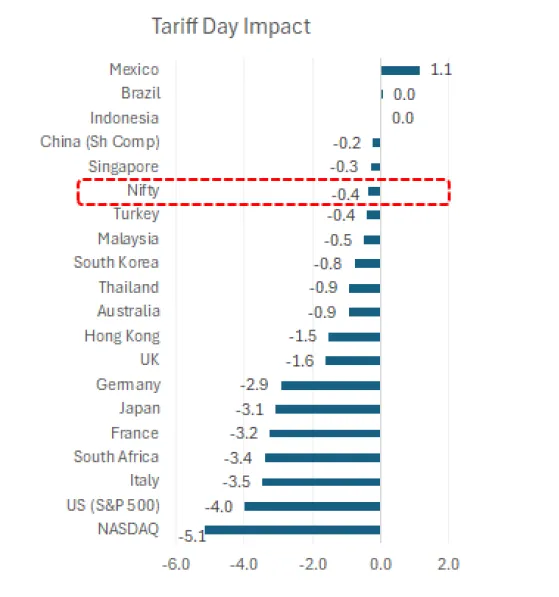

The financial markets also did not welcome the news. A sharp two-day sell-off followed the announcement, signaling investor concerns about the inevitable economic fallout. Analysts expect the tariffs to drive up consumer prices in the US, while also dampening global demand. Curiously, the US dollar—a traditional safe haven—has weakened since the tariffs were announced. This counters economic expectations, as protectionist measures usually boost currency values by improving trade balances. A weaker dollar could amplify inflationary pressures, further complicating the Federal Reserve’s already challenging balancing act.

Gold surged to a new all-time high of nearly $3,160 an ounce following President Donald Trump's announcement of sweeping reciprocal tariffs, which sparked renewed fears of a global economic slowdown. Investors rushed to the precious metal—traditionally seen as a safe haven—amid heightened uncertainty, especially since gold was one of the few commodities explicitly exempted from the new tariff regime. The sharp rise followed Trump's Rose Garden address and came on the heels of a strong 20% rally earlier in the year, fueled by central bank buying and strong Asian demand. Gold is increasingly becoming an attractive hedge against volatility in the current scenario.

Retaliatory Measures Incoming & Trade War Amplifying

China, the prime target of Trump's policy, has already responded swiftly with a blanket 34% tariff on all U.S. imports—eschewing the targeted responses often seen in trade disputes. EU bloc is also discussing ways to impose similar tariffs on US products. These moves have further spooked markets, increased volatility and may result in a full-blown trade war. Such tit-for-tat measures threaten to create a feedback loop of economic contraction. Oxford Economics warns that global GDP growth could dip below 2% in 2025, the weakest performance since the 2008 financial crisis, excluding pandemic years. This would mark a steep decline from the 3.2% recorded in 2024.

Adding to the problem for global economies is the limited scope for many governments to offset economic damage through the use of fiscal policy. Many economies, including the US, are still grappling with the debt overhang from massive pandemic-era stimulus programs. As a result, tax cuts or spending boosts to counteract a tariff-induced slowdown are unlikely.

Decoding the Impact of US Reciprocal Tariffs on India

India has been hit with a 26% tariff—one of the higher rates among major economies. The move was accompanied by a detailed report from the U.S. Trade Department, which pointed fingers at India’s increasingly protectionist policies since 2014 as the primary rationale for the punitive measure. The report highlights India’s steep WTO bound tariff rates, particularly in agriculture, where duties average a staggering 113.1% and can go as high as 300%. What troubles U.S. exporters, the report claims, is not just the high rates but India’s unpredictability in tariff policy, frequently raising duties without notice or consultation through annual budgets and ad hoc notifications.

The U.S. also criticized a wide range of India’s domestic policies, including its tariff hikes on solar and electronics, restrictive telecom import practices, and lack of transparency and consistency in regulatory processes. The absence of a uniform government procurement policy, inadequate IP enforcement, barriers to foreign direct investment in retail, and the dominance of state-owned entities in banking and insurance were also cited as signs of a non-level playing field for global competitors. In addition, agricultural subsidies and localized internet shutdowns were flagged as creating distortions and undermining the digital economy.

Indian Sectoral Impact Assessment

Indian government is analyzing the sectoral impact. No immediate trade deal at the moment, though negotiations are underway. In short, Electronics ($14bn), gems & jewellery ($9bn), textiles, IT will take a hit. Pharma exempt, which is a major relief. Potential tariff cuts on $23bn of US goods is also being explored as a trade-off.

1. Industrials

Despite being a key component of US imports, Indian industrial engineering exports to the US are relatively modest. Few Indian companies derive more than 7-8% of their sales from the US. Items like motors, wires, and cables are affected, but overall, the direct impact remains limited.

With nearly 55% of IT service revenue stemming from the US, this sector is among the most vulnerable. While services are not directly taxed under the executive order, the slowdown in US growth and potential recession risk could suppress discretionary IT spending. Analysts predict a 200-300 basis point drop in IT sector growth in FY26.

3. Oil & Gas

No direct impact is anticipated, thanks to tariff exemptions for energy products. However, broader macroeconomic repercussions such as a global GDP slowdown could push oil prices lower. The forecast remains around $70/barrel.

Direct exposure to the US market is minimal. However, weaker global demand could depress commodity prices. Metal exports to the US are not significant enough to warrant material concern, but the sentiment remains cautious.

5. Agro-chemicals

Agrochemical players face mixed fortunes. While B2C companies like Dhanuka and Bayer may benefit from reduced competition, B2B firms such as UPL and Sumitomo Chemical India could face margin pressure due to dumping from China or challenges in passing on cost hikes.

Companies like PI Industries (42% revenue from US) and Sharda Cropchem (36%) could be directly affected. The US market accounts for a substantial share of their revenue, and any increase in duties or logistical compliance could hurt their bottom lines.

6. Textiles and Apparel

With $8 billion worth of textile exports to the US in 2024, this sector is bracing for a significant impact. The price-sensitive nature of garments, combined with thin profit margins, makes the industry particularly vulnerable. A 27% duty could render Indian products uncompetitive. However, there's a silver lining: reciprocal tariffs on Bangladesh (37%), Sri Lanka (44%), and Vietnam (47%) are higher. This differential could potentially improve India's relative competitiveness in the medium term.

7. Pharmaceuticals

A crucial exemption spares pharmaceuticals from the new tariffs, reflecting their strategic importance. India remains a global leader in generics, and US dependence on Indian APIs and formulations continues. Nevertheless, concerns persist over the potential reclassification of certain products or compliance issues tied to origin-tracing.

8. Automotive Components and Two-Wheelers

While largely exempt from ad valorem duties under the executive order, automotive imports remain subject to a separate 25% tariff imposed under Section 232. Indian exporters could still face headwinds, particularly if the US intensifies its push for domestic auto manufacturing.

Policy Response and Strategic Outlook

The Indian government is likely to adopt a two-pronged strategy:

Trade Diplomacy: Engage in bilateral talks with the US to negotiate sector-specific relaxations, particularly for labor-intensive and price-sensitive sectors like textiles and agro-chemicals.

Domestic Stimulus: Policymakers have already initiated fiscal and monetary interventions, including:

A 25 basis point rate cut, with further cuts anticipated.

Tax rebates benefiting middle-income households.

Increased public capex to boost demand.

These measures aim to mitigate short-term pain and redirect focus toward domestic consumption and investment-driven growth.

Limited GDP Impact: India’s exports to the US constitute just around 2% of its GDP, cushioning the blow to the broader economy. Additionally, the fact that other countries have received even steeper reciprocal tariffs (e.g., Bangladesh, Vietnam) limits India’s relative disadvantage.

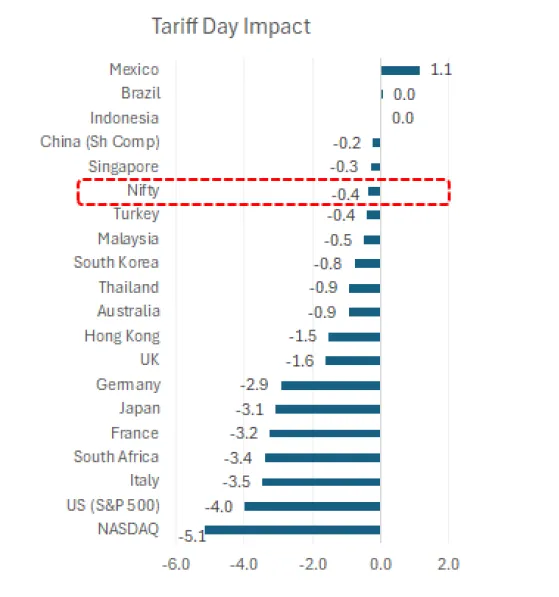

Global Market Volatility: The US contributes approximately 26% to global GDP, commands 48% of the global market cap, and holds 43% of foreign portfolio investment (FPI) assets under custody in India. As such, trade tensions and potential US inflation could spark heightened market volatility, particularly for Indian equities.

Impact on Investment Sentiment: Equity valuations remain mixed, with the Nifty 50 trading at 20x forward earnings - above its historical average. Any US recession triggered by trade frictions could dampen investor confidence. However, a weaker dollar, supported by inflationary fears in the US, could boost emerging markets, including India.

Realigning Priorities Amid Global Uncertainty

The US reciprocal tariff on Indian exports represents both a challenge and an opportunity. While several export-oriented sectors may face near-term pressure, the resilience of India’s domestic economy, strategic exemptions in key sectors, and favorable global positioning offer a cushion against prolonged disruption. In essence, the U.S. has turned the spotlight on India’s regulatory ecosystem, presenting the tariff not just as a trade tool, but as a critique of India’s domestic policy direction over the last decade.

India has emerged as a relative winner in the United States' latest tariff overhaul. Despite being hit with a 26% reciprocal tariff, India’s rate is moderate when compared to the harsher levies imposed on other nations such as Vietnam (46%) and Cambodia (49%). Market has largely priced in the anticipated tariff measures, with the limited implementation of counter-tariffs suggesting diplomatic flexibility. Rather than escalating into a full-blown trade war, the U.S. has signaled that it remains open to negotiation—a move that could stabilize global trade sentiment in the near term. While lower inflation and bond yields could support broader markets, they may also foreshadow the onset of an economic slowdown in the U.S., with possible ripple effects across global supply chains.

Amid this backdrop, India is uniquely positioned to benefit from the ongoing shift in global manufacturing away from China. Structural trends like decoupling from China, which began under the Biden administration, are set to accelerate under Trump’s trade policy. With exports currently around $750–800 billion compared to China’s $3.3 trillion, India has ample room for growth. Coupled with policy tailwinds, a skilled workforce, and geopolitical alignment with key Western economies, India could cement its role as a preferred trade partner. This is not just a temporary opportunity, but a structural shift in India’s favor that may redefine its role in the global economy.

As trade relationships evolve, India must sharpen its compliance framework, diversify export markets, and double down on domestic growth levers. In doing so, it can transform this short-term turbulence into a springboard for longer-term economic recalibration and global competitiveness.