The US elections are being closely watched which is becoming a highly competitive scenario, particularly in the swing states, which have historically been critical in deciding the outcome. States like Arizona, Georgia, Michigan, Nevada, North Carolina, Pennsylvania, and Wisconsin are witnessing tight races, with exit polls indicating only a 1% lead for Harris in national averages. This suggests that the results could go either way, with both candidates having a realistic chance of victory.

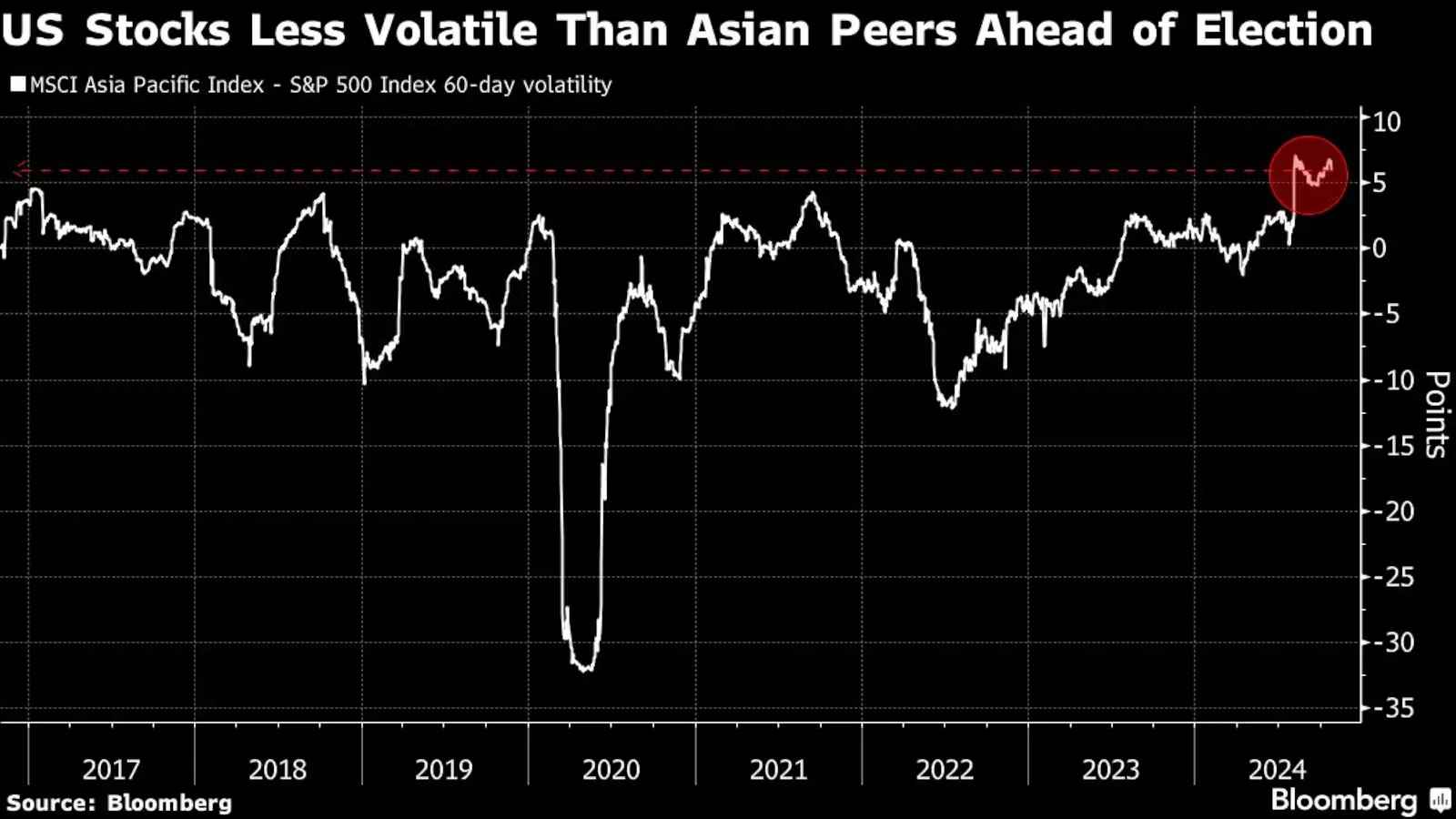

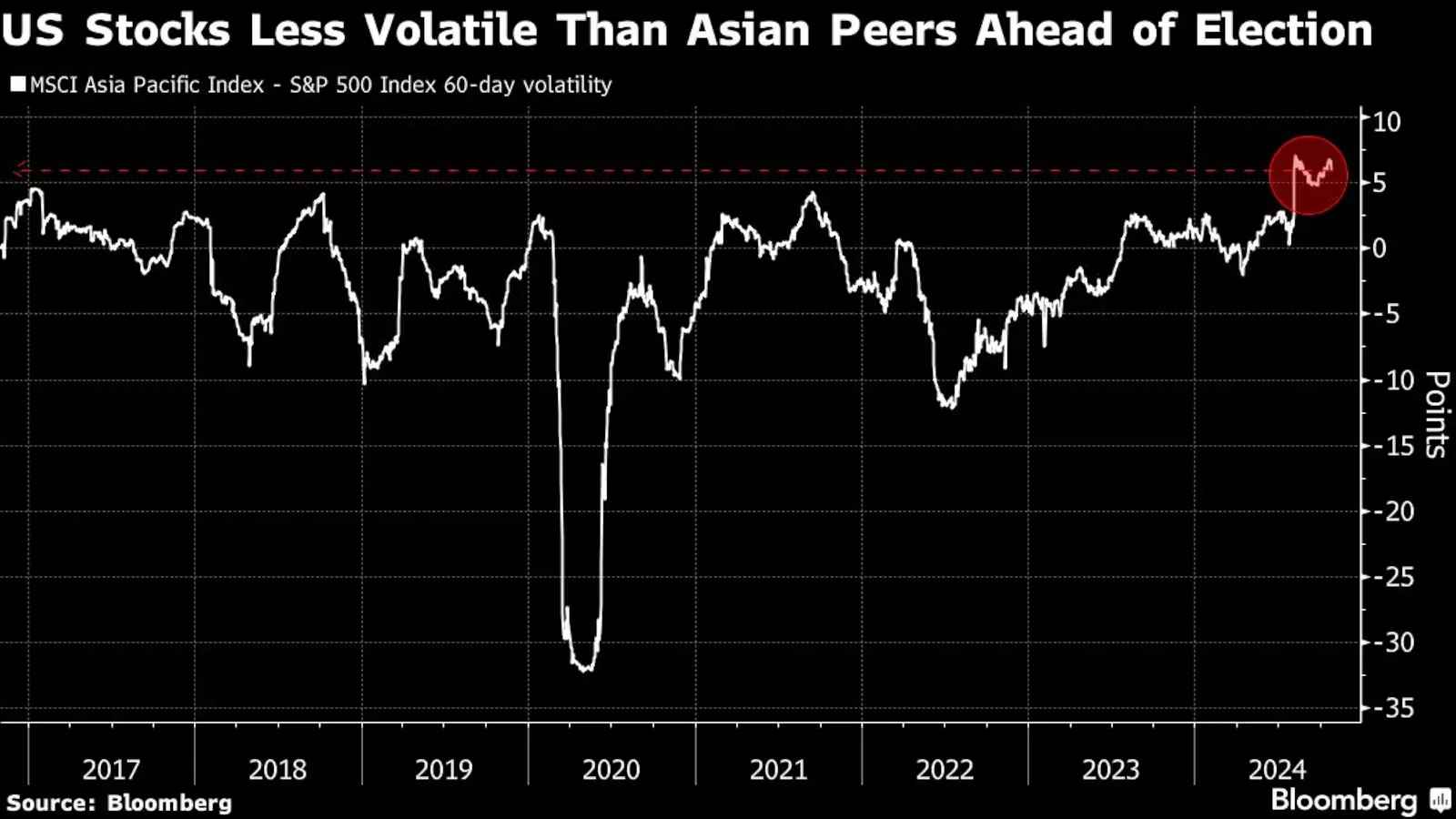

Amid approaching US elections, US stocks remain relatively stable compared to the turbulent Asian & Indian stock markets, which have been swayed by Chinese fiscal stimulus speculation , Israel-Iran war and Jap an's upcoming national vote . S&P 500's 60-day volatility is notably lower than that of the MSCI Asia Pacific Index, the largest gap since 2017.

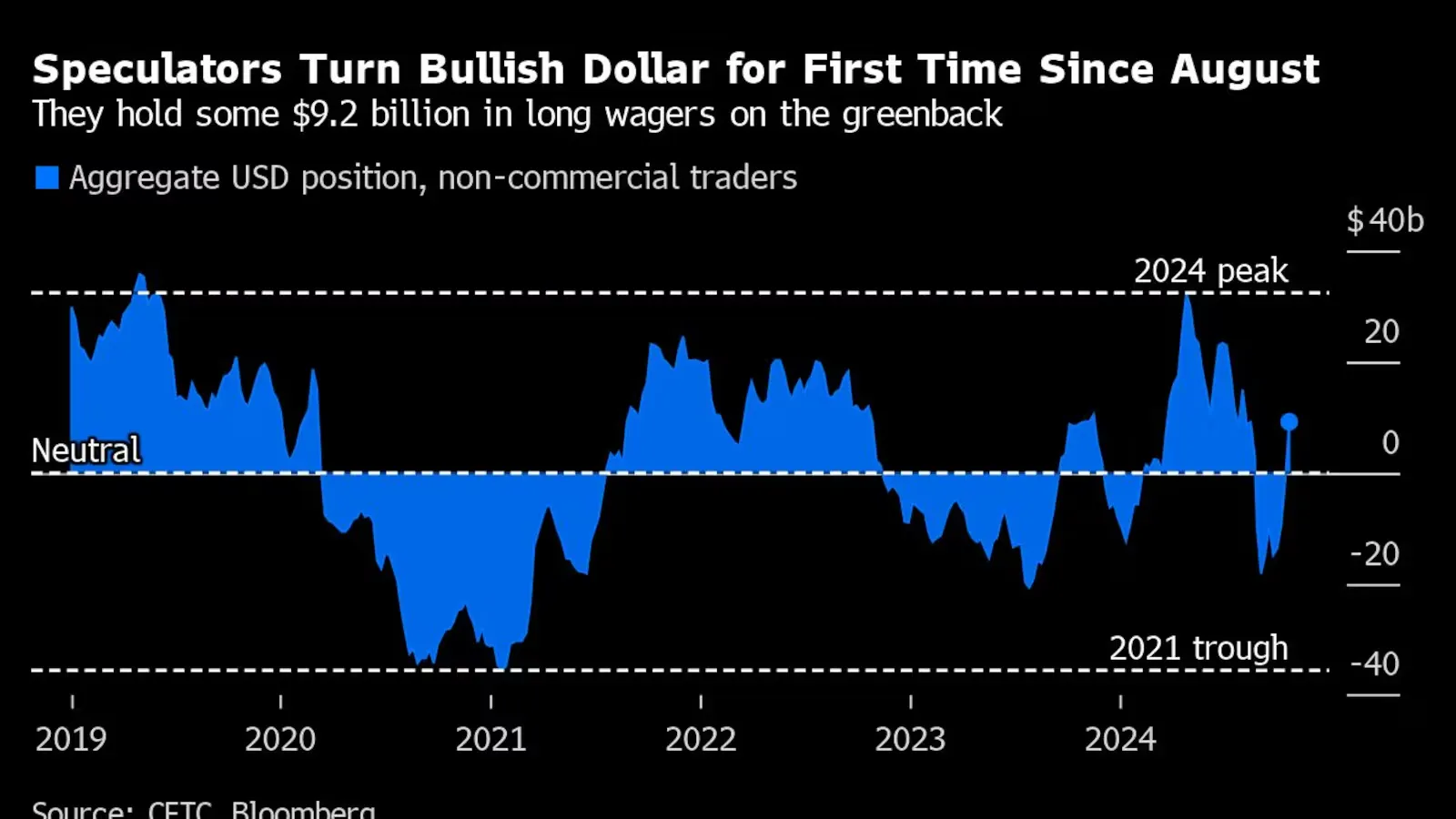

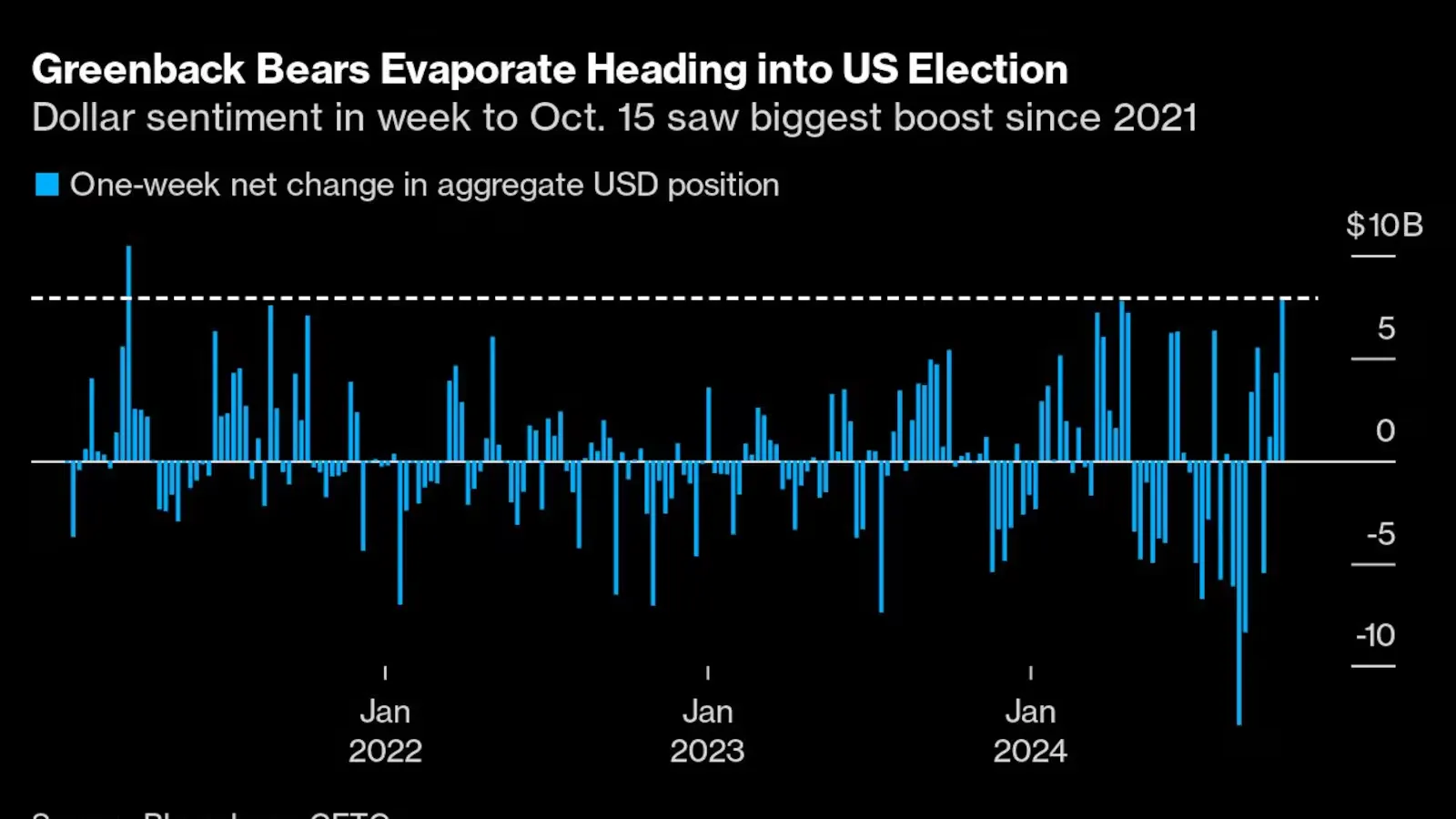

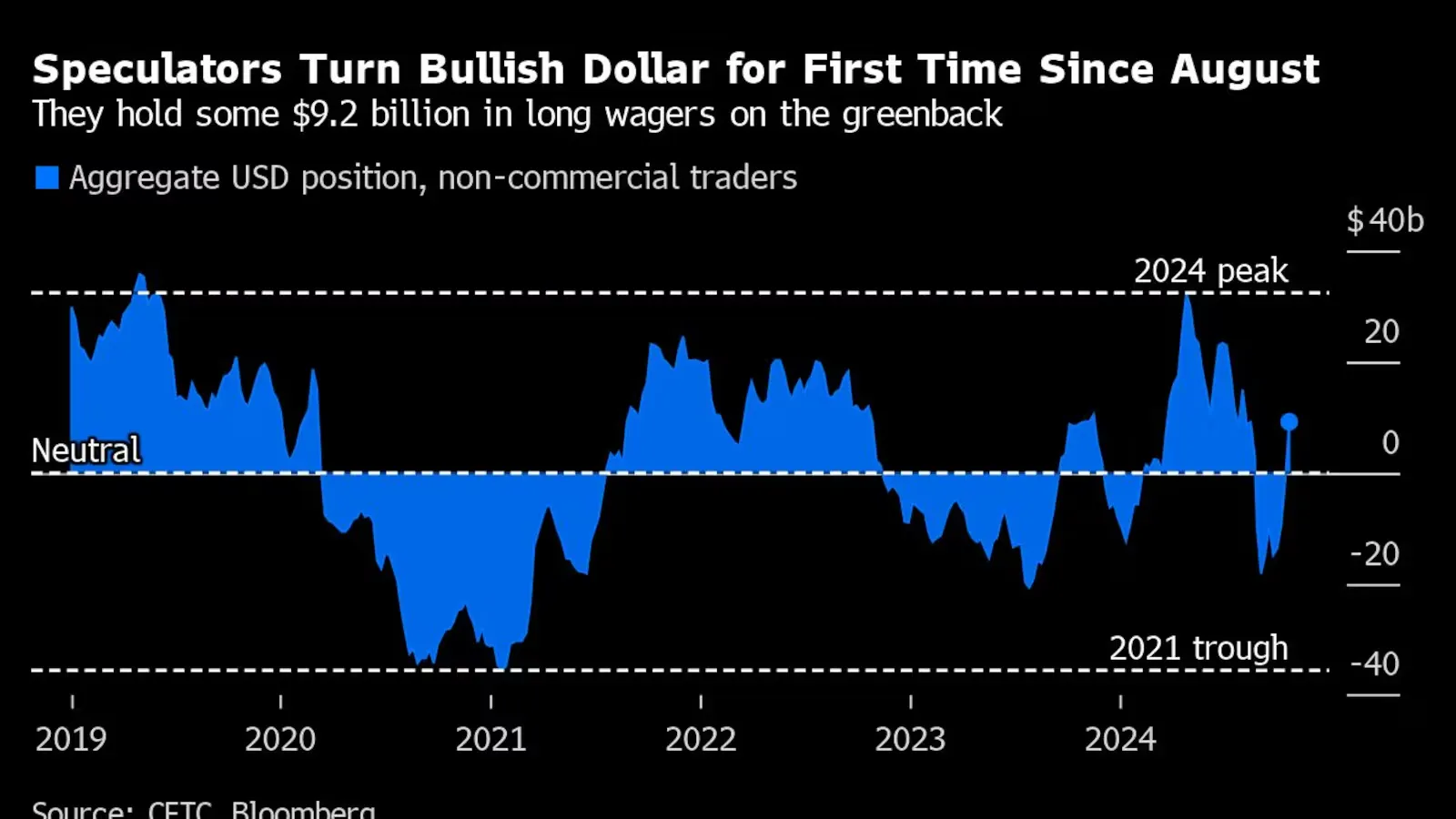

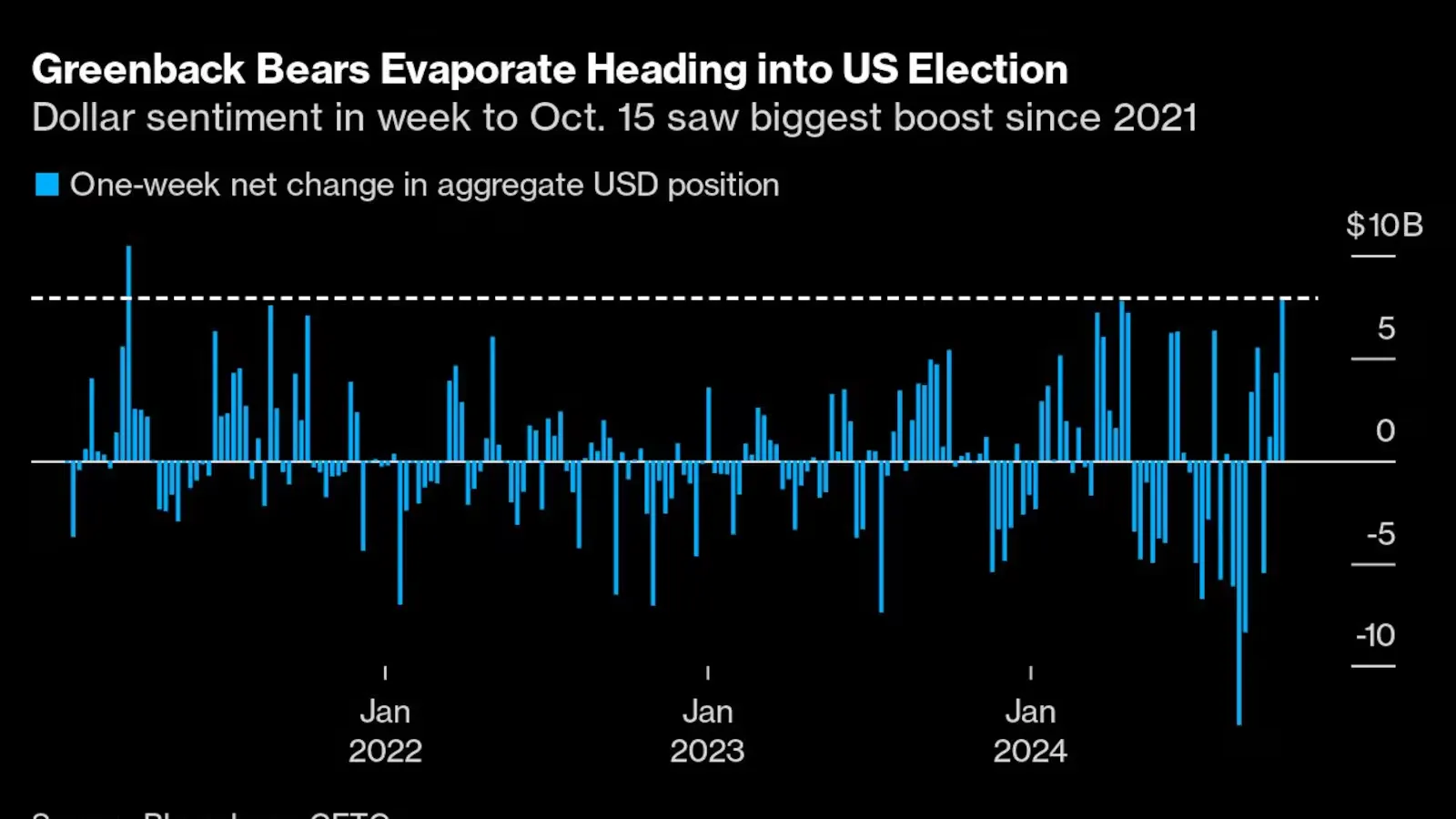

Currency markets reflect a strong shift toward the US dollar as speculative traders position themselves in anticipation of election-driven volatility. Hedge funds, asset managers, and other speculators have built a bullish dollar stance, holding $9.2 billion in net long positions — a sharp reversal from previous bearish bets.

This trend is fueled by robust US economic indicators, signaling stability that contrasts with global uncertainties, and by a hedging preference for the greenback amid election risks. The Bloomberg dollar index has risen about 3.2% in October, nearing a 2 year high.

Options markets underscore the heightened caution, with increased demand for hedges against large currency moves. Major currencies with close trade ties to the US, such as the euro, yen, and yuan, are trading at discounts, reflecting risk aversion. Further, leveraged funds increased bearish bets on the Mexican peso, reflecting broader caution around emerging markets vulnerable to US election outcomes.

Investors are increasingly turning to gold as a hedge against inflation and economic uncertainty ahead of the US election. Gold hit record highs, with fund inflows reaching their highest levels since July 2020, as investors brace for potential inflationary pressures and populist policies. The gold strategy is part of a broader approach to safeguard portfolios against the election’s economic implications. However, a downturn in payroll data or heightened recession fears could push investors to rotate back into bonds.

Other notable trends include a move away from bonds and into artificial intelligence stocks, with Nvidia shares reaching all-time highs and US 10-year bond yields spiking to 4.2%, their highest since July. Hedge funds are also significantly bullish on the US dollar, reflecting a belief that a Republican win could drive inflation, widen the budget deficit, and possibly revive trade tensions with China. Let’s get into the impact of US elections on US & Indian stock markets.

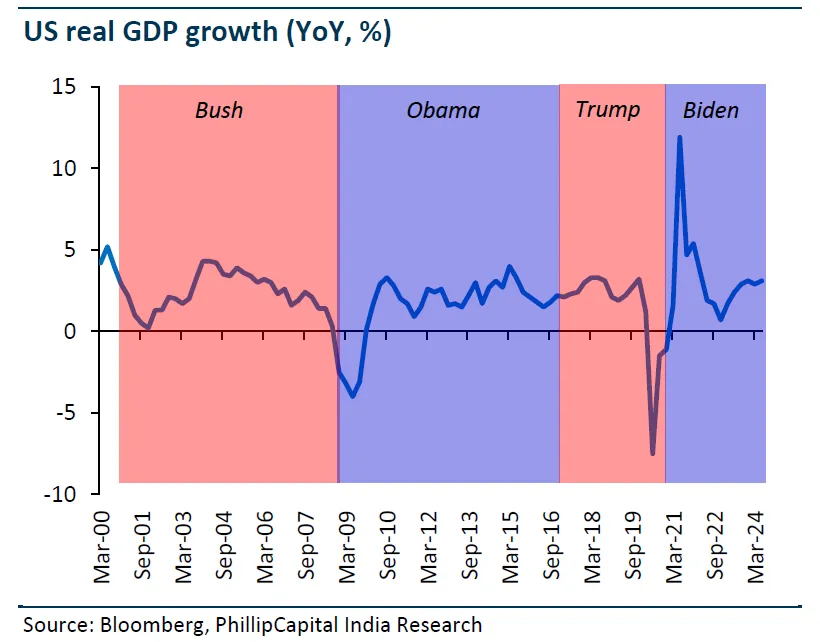

While Republican policies have historically emphasized corporate and tax incentives to spur immediate growth, Democrats have focused on stable recoveries and fiscal responsibility.

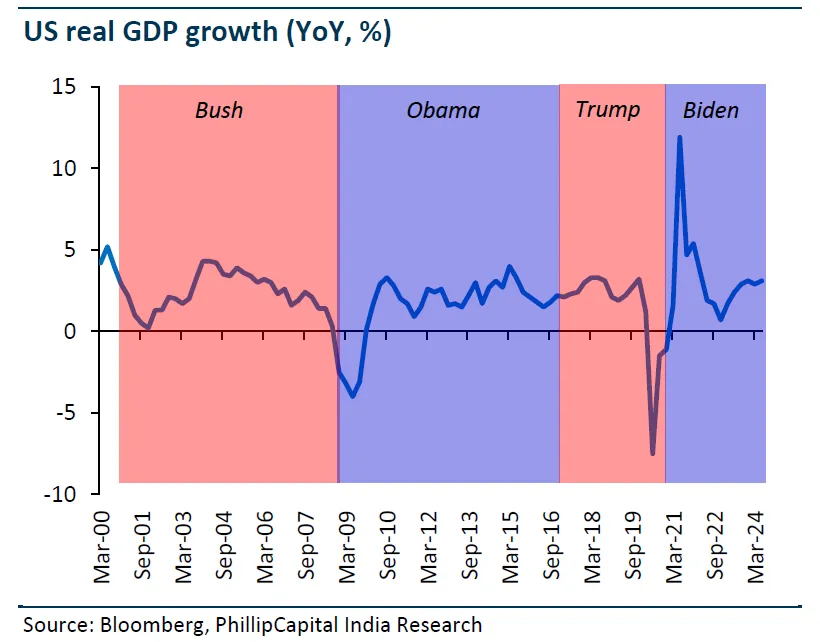

US GDP Growth

George W. Bush (Republican, 2001-2008): The early 2000s saw a robust GDP growth, averaging 3.7% in 2004-2005, especially after the 2001 recession. However, the 2008 global financial crisis severely impacted growth, ending his tenure on a recessionary note.

Barack Obama (Democrat, 2009-2016): Tasked with economic recovery post-recession, Obama oversaw moderate average growth of 2.3% as the economy gradually rebuilt. His administration prioritized stimulus and recovery efforts, leading to stable but modest growth.

Donald Trump (Republican, 2017-2020): Quarterly GDP growth averaged 2.6% during Trump’s term. The economy initially showed strong momentum, but the COVID-19 pandemic induced a sharp recession in 2020, leading to a significant downturn.

Joe Biden (Democrat, 2021-2024): Biden’s presidency delivered 2.4% average growth from 2022-2024. Despite initial recovery from COVID, inflationary pressures and global uncertainties, like the Russia-Ukraine war, created headwinds that tempered growth rates.

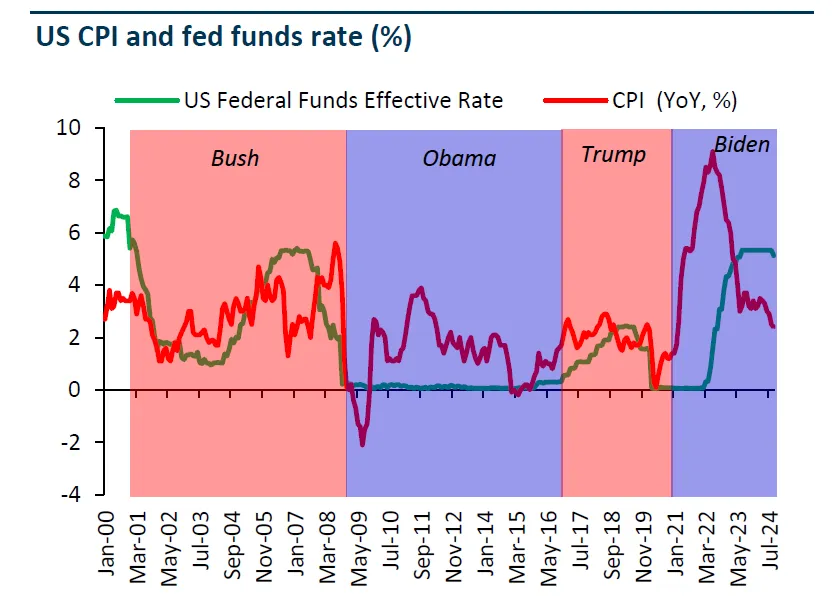

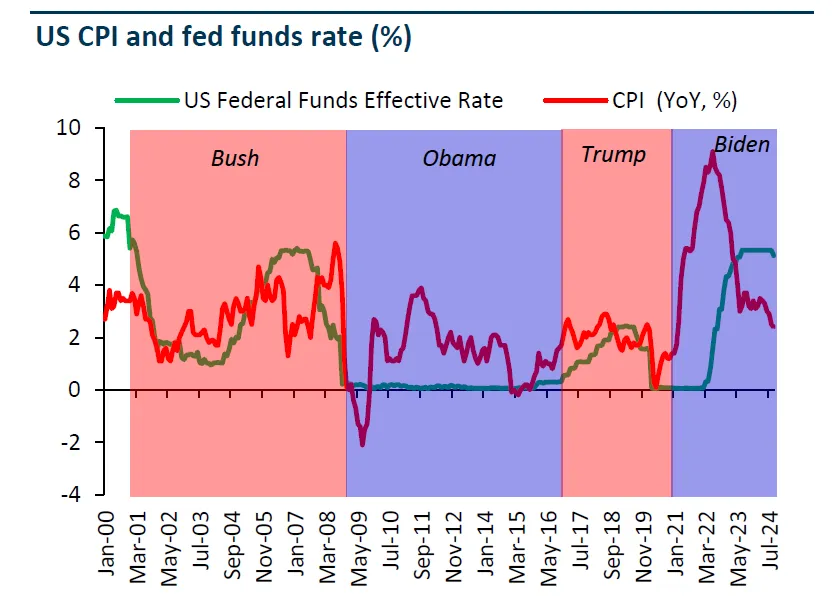

US Inflation and Interest Rates

Bush: Inflation was volatile, spiking to 5.6% in July 2008 due to rising energy prices. The Fed raised interest rates to curb inflation, reaching 5.3% in 2007 before drastically cutting them to 0% amid the recession.

Obama: Inflation averaged a modest 1.4%, with rates near zero for most of his presidency. The Fed made a slight rate increase in 2016 as inflation began rising.

Trump: Inflation stayed near target with occasional spikes in 2018, leading the Fed to increase rates to around 2.5%. COVID-19 caused inflation and interest rates to plummet as economic activity halted.

Biden: Inflation surged to 9.1% in June 2022, driven by post-pandemic demand and the Russia-Ukraine conflict. The Fed responded with aggressive rate hikes from March 2022 to July 2023, holding them steady until a slight cut in September 2024.

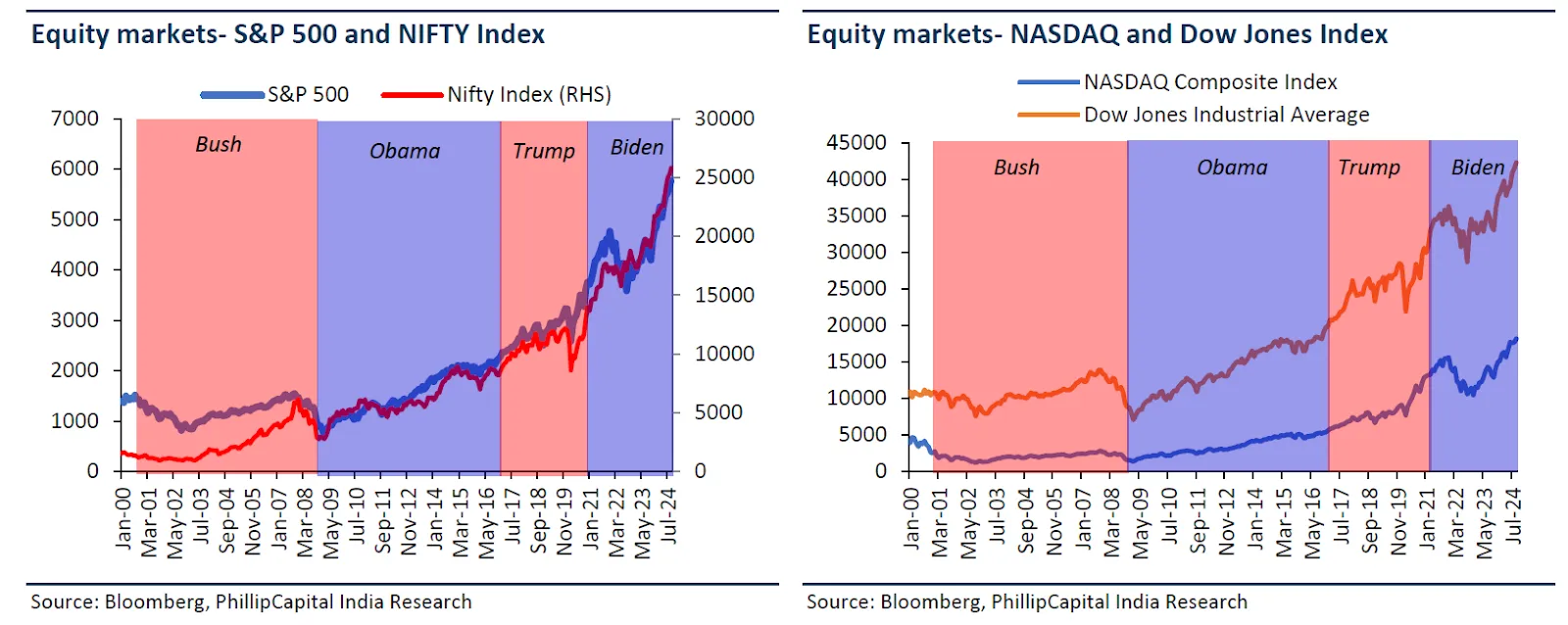

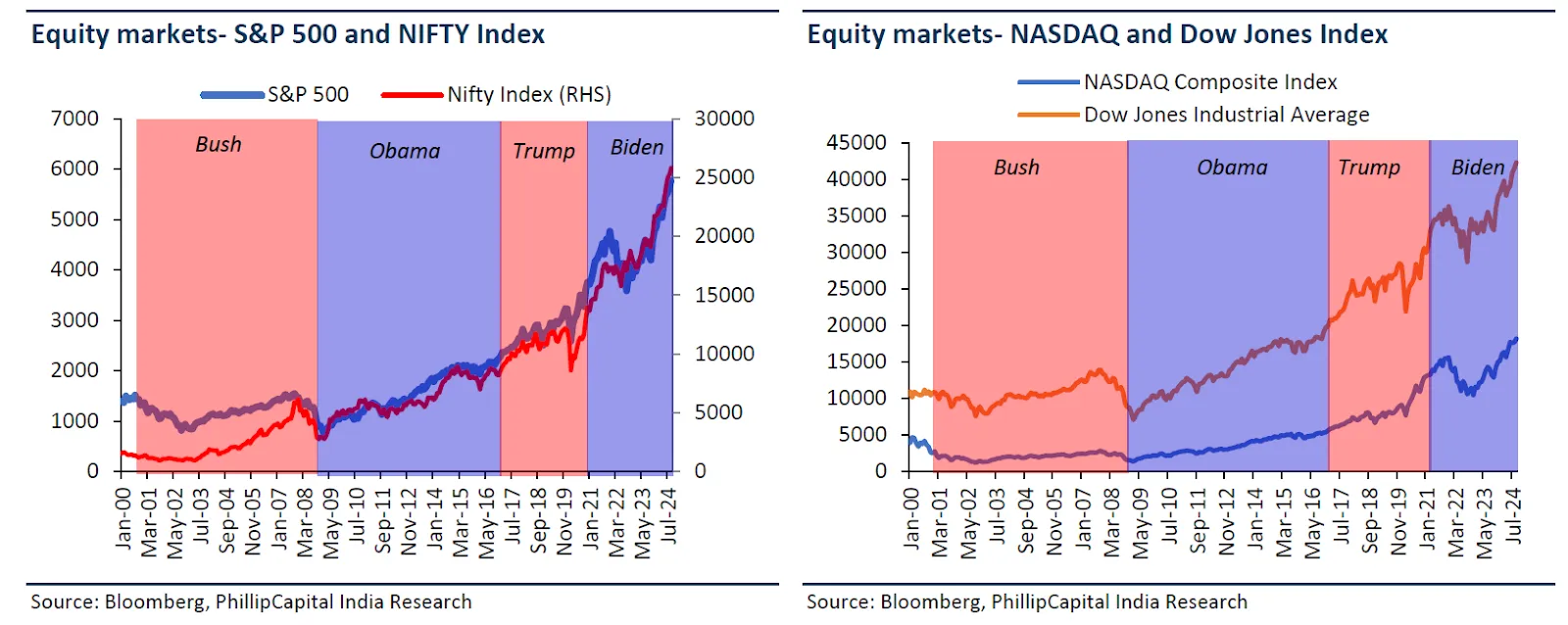

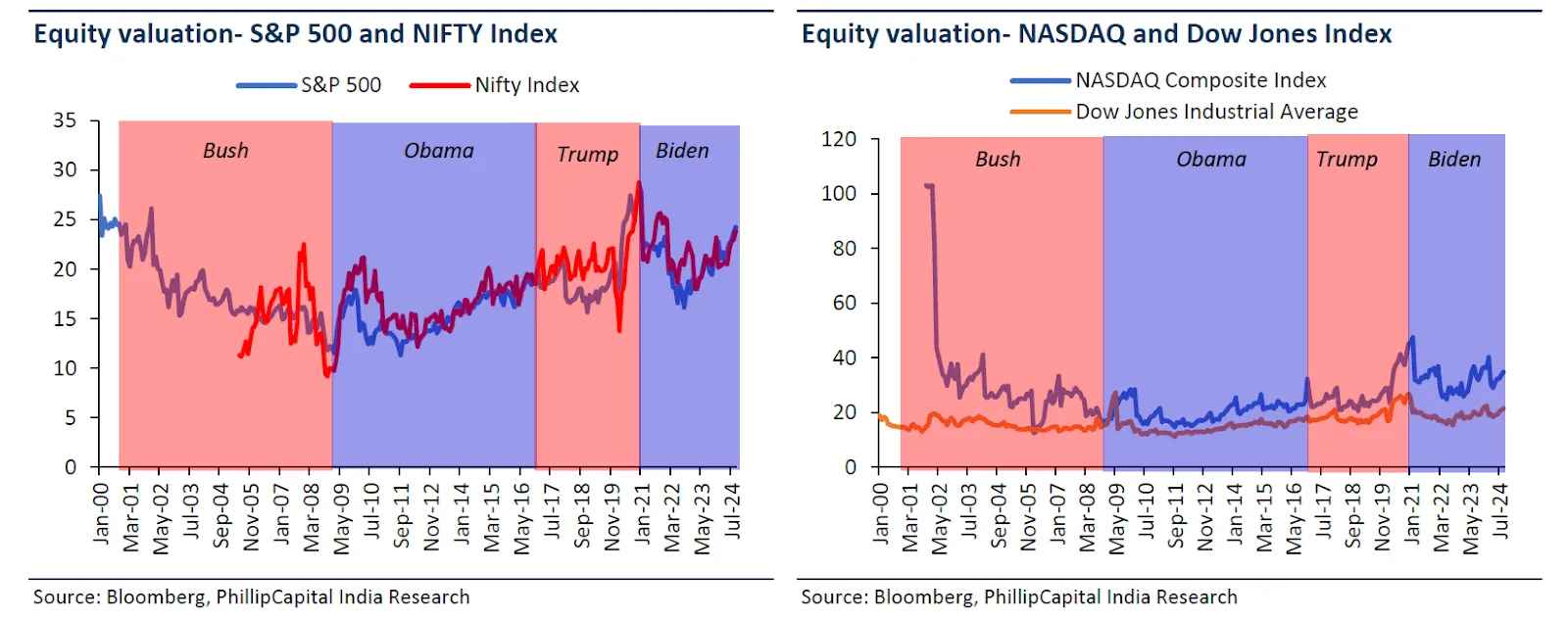

Bush: US equity indices showed mixed performance, with the S&P 500, Nasdaq, and Dow Jones seeing 13%, 3%, and 28% growth, respectively, though these gains were capped by the 2008 crisis.

Obama: Equity markets rebounded, with S&P 500 up 89%, Nasdaq rising by 119%, and Dow Jones by 78%. Indian markets also grew by 55% as foreign investments returned to emerging markets.

Trump: S&P 500, Nasdaq, and Dow Jones saw impressive growth of 65%, 130%, and 54%, respectively, fueled by tax cuts and deregulation. The Indian market rose by 63% during this period, benefitting from global liquidity.

Biden: US equity indices continued to perform well, with gains of 55% (S&P 500), 39% (Nasdaq), and 41% (Dow Jones). Indian equities surged by 89%, supported by strong inflows and economic resilience.

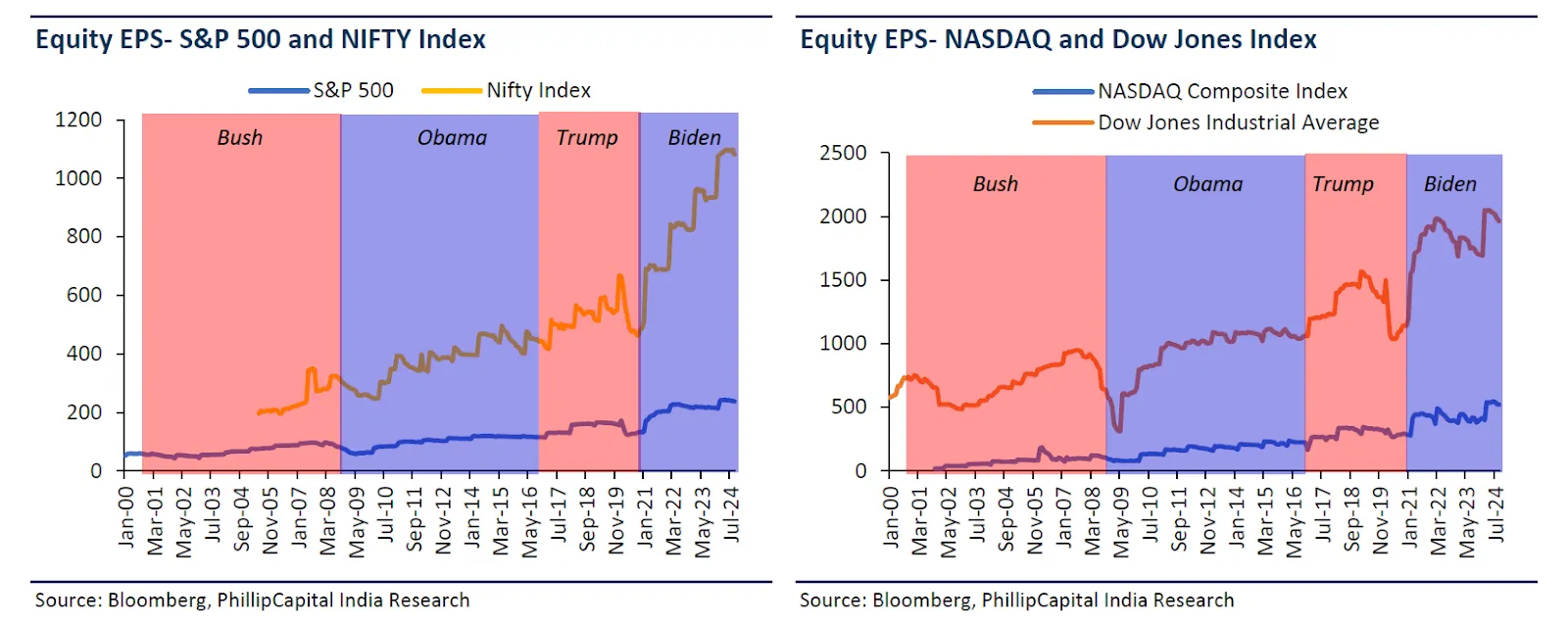

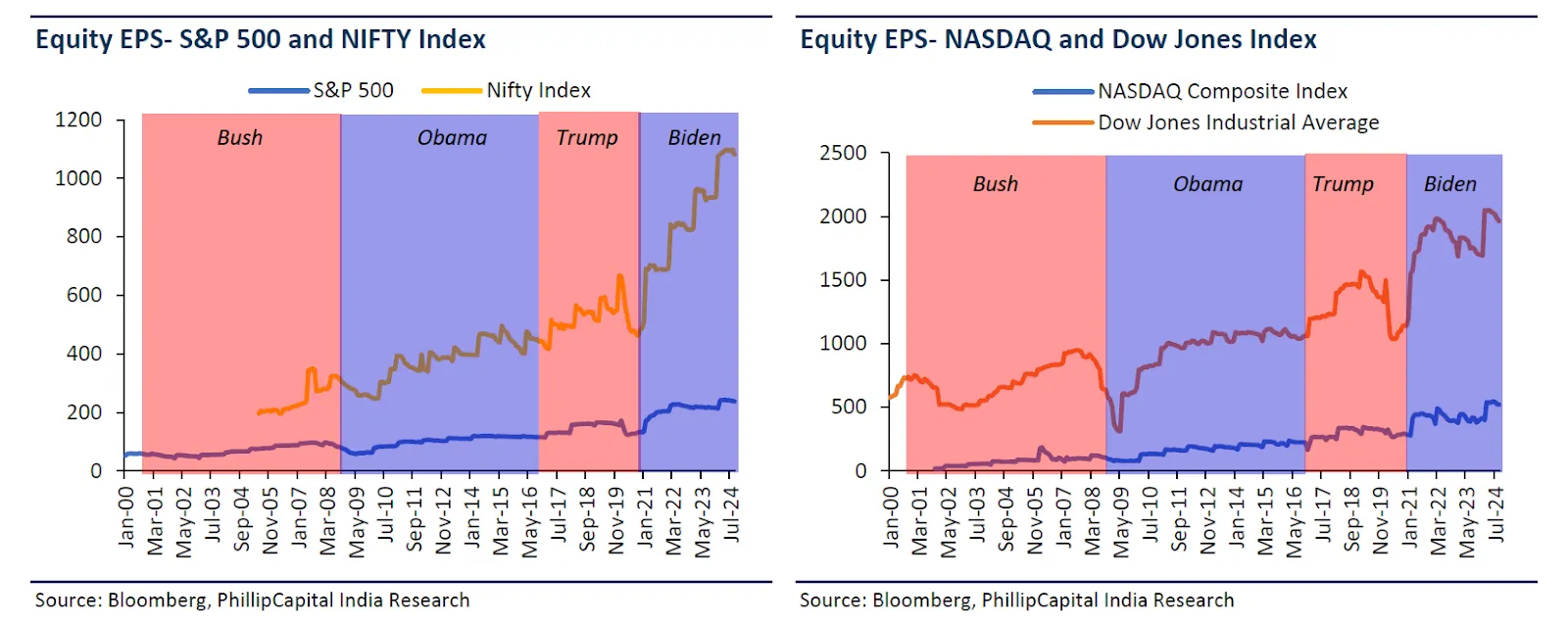

Corporate Earnings Growth - US v/s India

Biden has overseen the highest CAGR in EPS growth for the S&P 500 (78%), Nasdaq (82%), and Dow Jones (64%). Corporate earnings benefited from the post-COVID economic recovery and strong consumer demand.

Trump saw healthy EPS growth of 52% (S&P 500), 37% (Nasdaq), and 25% (Dow Jones), driven by corporate tax cuts and deregulation, which boosted profit margins.

Obama: India’s NIFTY recorded significant EPS growth of 77% during his administration, while US indices saw more modest gains as companies focused on stabilizing post-recession.

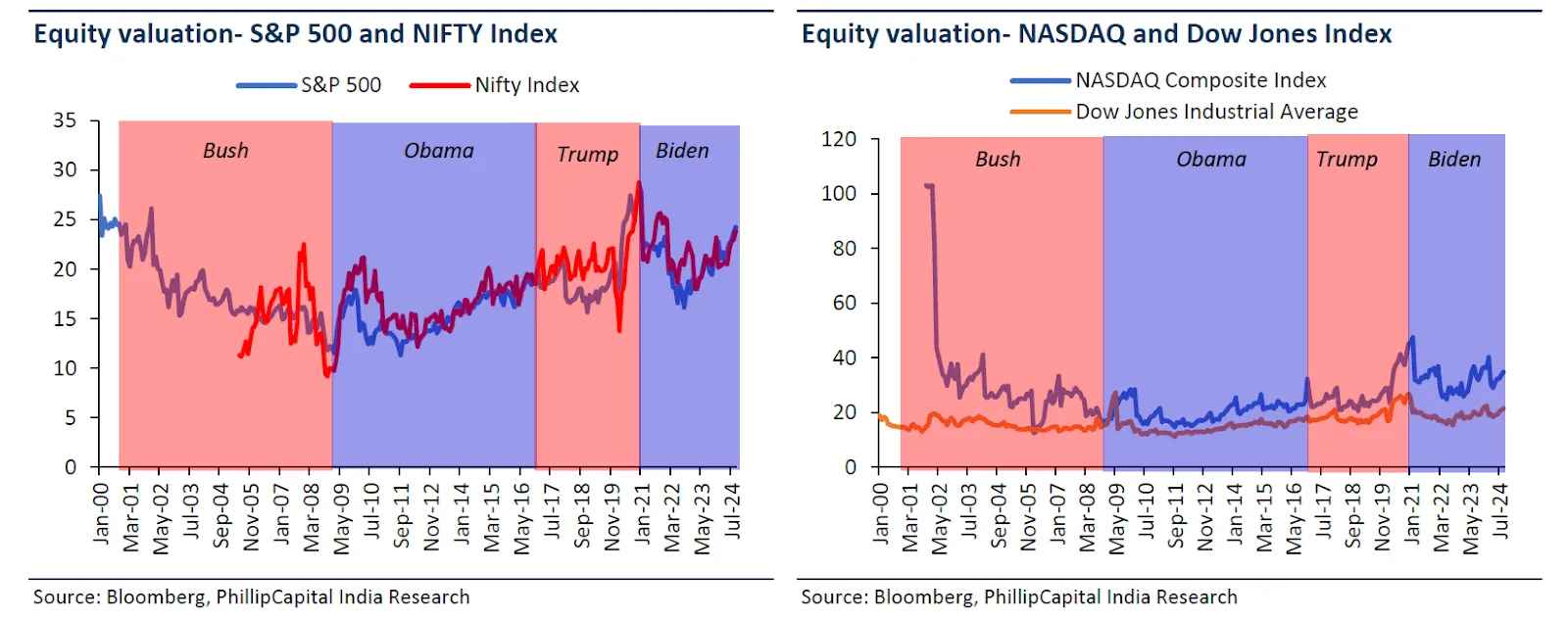

Market Valuations - US v/s India

Bush: Valuations were relatively lower, with average NIFTY PE at 15x, reflecting more conservative market sentiment.

Obama: NIFTY’s PE ratio rose to 16x as emerging markets gained traction.

Trump: US market valuations increased as corporate tax cuts boosted profitability, pushing NIFTY’s valuation up to 21x as global investors sought growth in Indian equities.

Biden: PE ratios continued to rise, especially in the S&P 500 and Nasdaq, as accommodative monetary policy and strong corporate earnings lifted valuations. NIFTY’s valuation has peaked at around 22x during Biden's tenure.

US President Policy Differences: Kamala Harris vs. Donald Trump

The policy initiatives of Kamala Harris and Donald Trump highlight stark differences that will shape the economic and geopolitical direction of the United States and, consequently, its relationships with countries like India.

1. Economy and Taxes:

Democrats under Harris are focusing on reducing food costs, offering incentives for first-time homebuyers, and maintaining the Federal Reserve’s independence. They also plan to raise corporate tax rates and increase taxes on stock buybacks.

Republicans led by Trump propose reducing corporate taxes to encourage business investments and are focused on controlling inflation. Trump is also likely to challenge the Fed’s independence, which could lead to changes in monetary policy if he replaces the current Chair.

2. Trade and China:

Both parties are aligned on the need to restrict trade with China. This has long-term benefits for India, which is seen as a preferred alternative for global supply chains. However, Trump's aggressive stance on imposing tariffs on imports, particularly from China, could lead to trade disruptions and a re-emergence of trade blocs.

Democrats are likely to continue with a balanced approach, supporting tariffs but avoiding full-scale trade wars.

3. Energy and Defence:

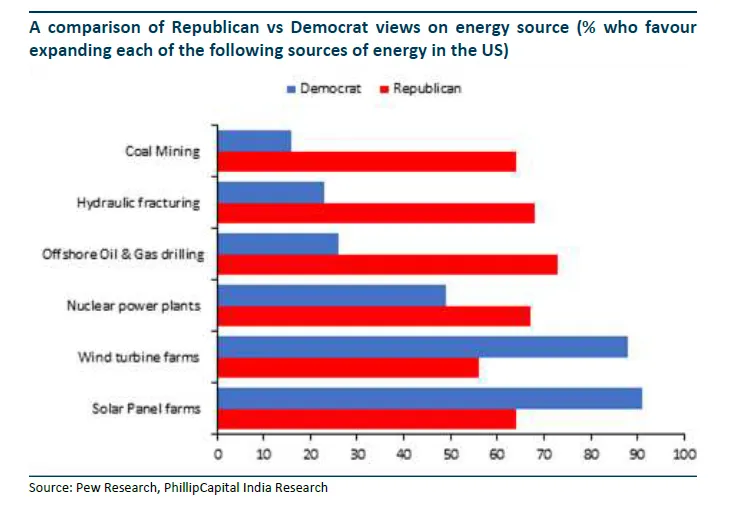

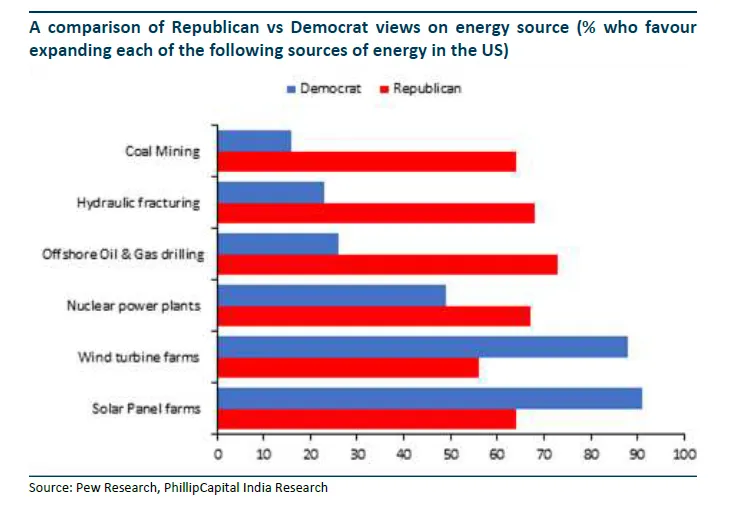

Energy: Democrats emphasize clean energy initiatives, promoting electric vehicles and renewable energy projects. On the other hand, Republicans prioritize traditional energy sectors, offering incentives for oil and gas drilling, and seeking to roll back green energy benefits.

Defence: Both parties agree on expanding defence spending, but their strategic focus varies. Democrats, including Harris, are supportive of military aid to Ukraine, reflecting a broader global engagement. Trump, however, focuses on strengthening alliances with countries like Israel and is more selective about international military commitments.

4. Immigration and On-shoring:

Both candidates support stricter immigration rules and promote on-shoring to increase domestic production. However, the approach differs. Democrats propose moderate reforms with enhanced border security, while Trump is likely to pursue more aggressive measures to curb illegal immigration and prioritize American businesses.

Celebrate the Festive season with 30% off on all our portfolios. Use code CELEBRATE30.🌍💰

Visit Now

Impact of US Elections on India Depending on Who Wins The Presidential Race?

Historically, macroeconomic and equity performance in the US and India have been relatively stable under both Democratic and Republican administrations. However, Trump’s approach to de-globalization could introduce more volatility in emerging markets, impacting equities and currencies. For India, the long-term benefits of the US anti-China stance are likely to persist regardless of the election outcome, but Trump’s protectionist policies could challenge immediate export growth. India has significant stakes in the outcome of the US elections, particularly in areas like trade, technology, energy, and defence cooperation.

Economic and Trade Ties: With the US moving away from reliance on Chinese manufacturing, India stands to gain as a trade and investment partner. Both parties’ emphasis on restricting Chinese imports can bolster India's position as a manufacturing hub, though Trump’s aggressive tariff policies could have broader implications for global trade. If Harris wins, her administration may foster a more stable and predictable trade environment, benefiting Indian exporters.

Technology Cooperation: The Democratic platform supports subsidies and incentives for U.S. semiconductor suppliers, which aligns with India's plans to become a global semiconductor manufacturing hub. Republicans under Trump have focused on addressing national security concerns with social media companies, which may impact tech collaborations with Indian firms.

Energy Collaboration: A Democratic win would likely see expanded cooperation in renewable energy projects, aligning with India’s green energy goals. Conversely, a Trump-led administration could prioritize fossil fuels, potentially slowing down clean energy collaborations.

Defence and Geopolitical Strategy: India’s defence ties with the US have grown under both Republican and Democratic administrations. Harris's stance on supporting Ukraine aligns with India's cautious engagement on the global stage. Trump's focus on strengthening ties with Israel and a more insular approach could affect broader defence collaborations, but bilateral deals with India would likely continue.

Impact of a Kamala Harris Presidency on India

If Kamala Harris wins, her administration is likely to maintain policies similar to those under President Biden, which have generally been favorable to India:

Trade Policies: Harris is expected to uphold the current trade dynamics, which have allowed Indian exports to flourish. This continuity would likely support India’s export sector, which has grown under Biden's relatively stable trade policies.

Immigration Policies: Harris may promote more accessible pathways for high-skilled immigrants, beneficial for India's IT and tech talent pool. Easing H-1B visa restrictions would also directly support the Indian IT sector, allowing skilled workers to access US markets more easily.

Geopolitical Engagement: Harris is likely to continue Biden’s strategy in Asia, strengthening India-US relations through multilateral platforms like the Quad and G20. This continuity could solidify India’s role as a strategic partner, especially in countering Chinese influence in the Indo-Pacific.

Impact of a Donald Trump Presidency on India

Trump's return to office would bring a more protectionist approach with a focus on "America First" policies, which could have both positive and negative implications for India:

Trade and Tariffs: Trump's protectionist stance includes broader tariffs on imports, potentially affecting Indian exports’ competitiveness. However, his strong stance against China could make Indian goods more attractive relative to Chinese imports in the US market. Trump has previously criticized India’s trade policies, referring to it as a “tariff king,” suggesting that he may push for more balanced trade, potentially by pressuring India to reduce its tariffs on US goods.

Currency and Immigration: Trump may take a hard line against perceived currency manipulations, which could impact India's trade advantage. His stance on immigration, particularly H-1B visas, would be more restrictive, posing challenges for Indian professionals working in the US.

Geopolitical Strategy: While Trump’s approach to foreign policy may be more transactional, he is likely to view India as a crucial ally in balancing China’s power. His softer approach towards Russia aligns with India's strategy of maintaining ties with Moscow, which could indirectly benefit India's geopolitical interests. However, Trump’s reluctance to engage deeply in multilateral forums could limit collaborative efforts in the Quad and similar alliances.

Sectoral Impact on India

IT Sector: Mitigated Risks from Immigration Policies

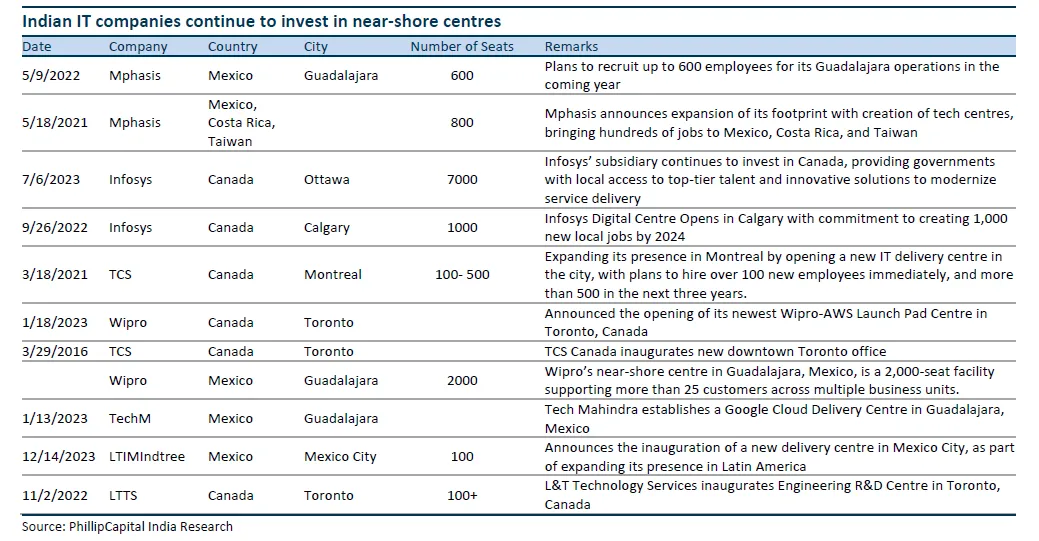

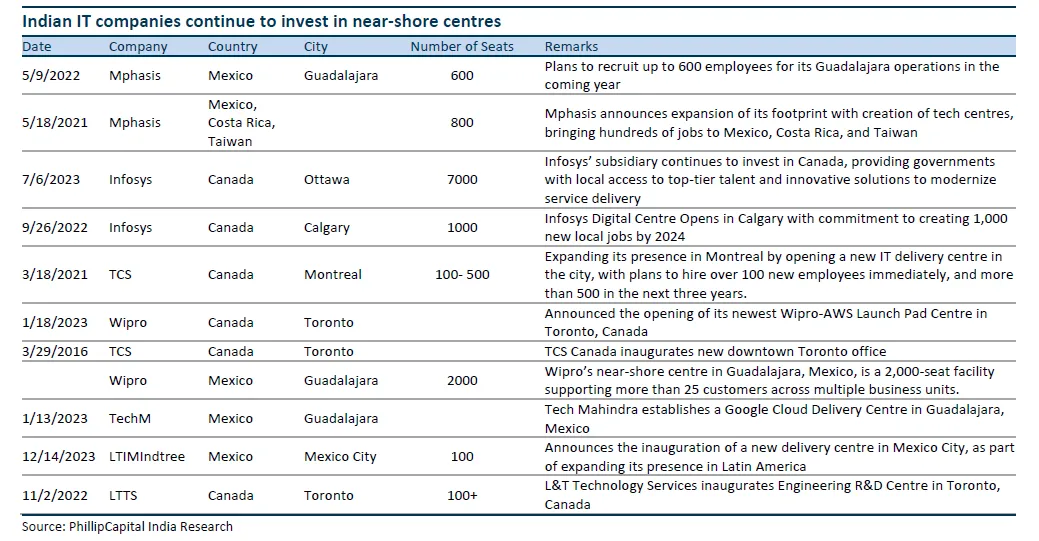

Indian IT firms could face challenges under a Trump administration due to his anti-immigration stance. However, these companies have adapted to minimize reliance on US visas by increasing local hiring, using subcontractors, and establishing near-shore delivery centers in North America.

Local Hiring: Indian IT companies have expanded their workforce in the US, Mexico, and Canada, ensuring that more roles are filled by local employees, reducing dependency on H-1B visas.

Subcontractors: By using subcontractors with existing work visas, companies can quickly deploy staff to client sites without the delays associated with visa processing for employees from India.

Near-Shore Centers: Centers in Mexico and Canada allow Indian IT firms to offer services within similar time zones as the US, enhancing client comfort while keeping costs lower than fully onsite operations.

Auto Sector: Mixed Impacts with Potential Upsides

A Trump victory could lead to both positive and negative outcomes for India’s auto sector:

Infrastructure Spending: Trump’s pro-manufacturing stance and increased infrastructure investment could benefit Indian suppliers to the Class 8 truck market, like Bharat Forge and RK Forgings, as demand for heavy vehicles may increase.

EV Policy Shift: Trump’s skepticism toward EV incentives may curb US EV demand, potentially affecting Indian component suppliers, such as Sona BLW and SAMIL, which rely heavily on the EV market. However, a rise in hybrid vehicles could mitigate this impact, allowing companies like Sona BLW to supply components for both EV and internal combustion powertrains.

Tariffs on Imports: Trump’s hard stance on auto imports, particularly from China, could lead to higher tariffs, creating an opportunity for Indian firms to increase exports to the US. Additionally, heightened national security concerns over Chinese-made vehicles might benefit Indian suppliers of affordable EVs.

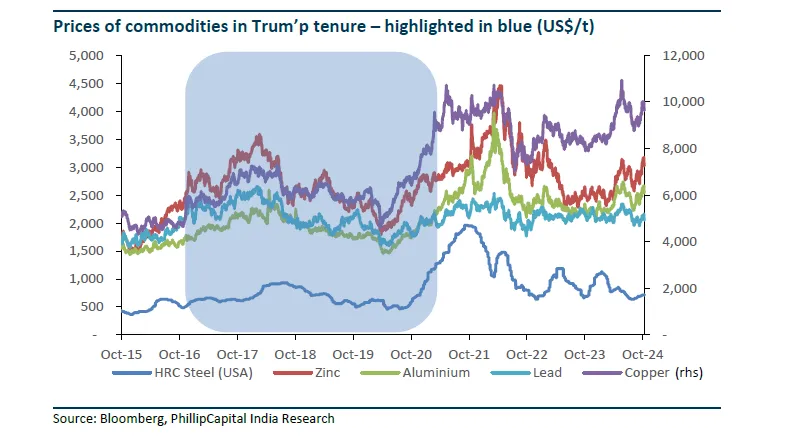

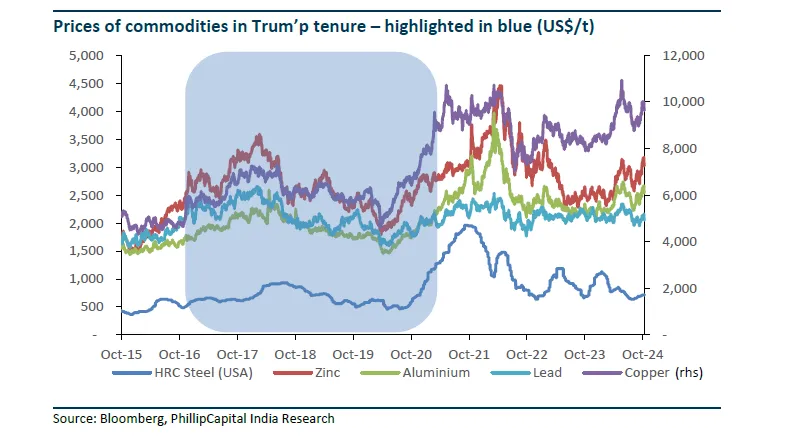

Commodities Market: Boosted Demand under Trump

Metals: Trump’s focus on domestic infrastructure and protectionist policies, including a potential border wall, could drive up demand for metals. Historically, commodity prices rose after Trump’s 2017 election, indicating potential market optimism for Indian metal exporters.

Energy Sector: Trump’s oil and gas-friendly policies could spur US production, leading to lower global prices. This scenario would benefit Indian oil refiners and gas utilities, as lower energy prices reduce import costs and allow for long-term gas contracts aligned with India’s energy transition goals.

Pharmaceuticals: Neutral to Slightly Adverse Impact

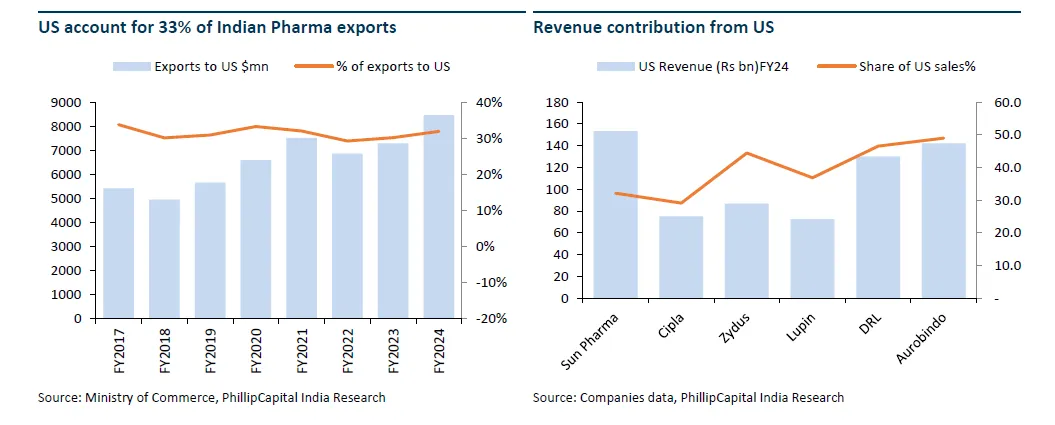

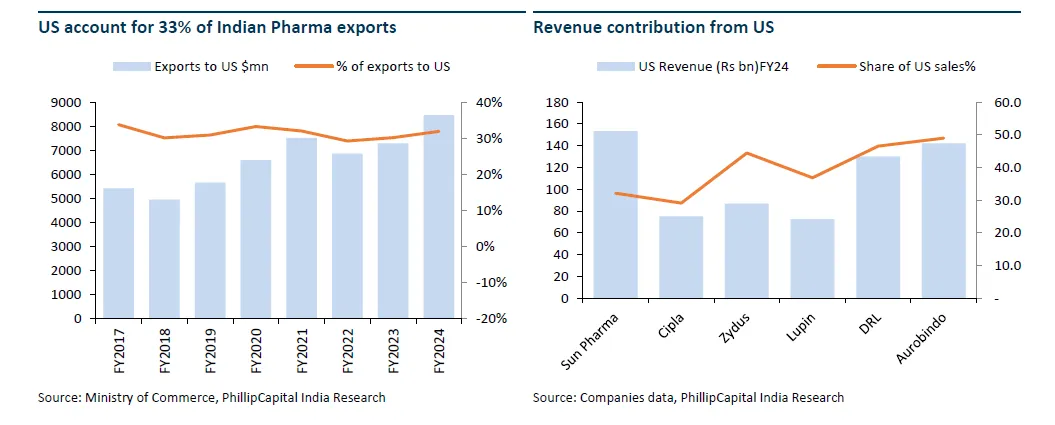

The US is the largest market for Indian pharma, with exports exceeding $8.46 billion in FY24. Both political parties have proposed drug cost reductions, which may challenge Indian generic manufacturers but are unlikely to significantly impact export volumes.

Drug Price Control: Democrats aim to lower drug costs through the Inflation Reduction Act, targeting Medicare price negotiations and capping insulin prices, which could keep generic drug prices under pressure.

Compliance and Competition: Under Trump, Indian pharma faced intense regulatory scrutiny and competitive pricing challenges. His policies promoted price competition by allowing drug imports from Canada and setting international reference prices. A similar trend could resume if Trump wins , impacting Indian pharma profits.

Volume Stability: While cost-cutting initiatives may reduce margins, US reliance on affordable generics ensures sustained demand for Indian exports, keeping overall volumes stable despite pricing pressures.

Oil & Gas: Benefits from Increased US Production

Trump’s policies, favoring fossil fuels over renewables, could lead to higher US crude and natural gas production, potentially depressing global oil prices.

Lower Crude Prices: Increased US output could keep global oil prices in check, benefiting Indian refiners by reducing input costs and easing consumer expenses.

Natural Gas: Rising US gas production could facilitate long-term contracts with Indian utilities, supporting India’s goal of increasing the natural gas share in its energy mix.

Defence: Enhanced Indo-US Cooperation

Both candidates are likely to emphasize the Indo-Pacific, where India plays a strategic role against China. However, their approaches differ:

Harris’s Approach: Harris is expected to continue Biden’s focus on deeper defense cooperation with India, promoting joint military exercises and defense technology transfers. However, she may prioritize human rights issues, potentially complicating bilateral defense trade if tied to India’s domestic policies.

Trump’s Approach: Trump’s approach would be more transactional, focusing on arms sales and strategic deals without imposing conditions on India’s internal policies. His tough stance on China aligns with India’s strategic interests, which could accelerate defense partnerships.

India’s Partnerships: To ensure continuity, India may seek formal defense designations like STA-1 and Major Defence Partner status, fostering long-term stability in bilateral ties. India’s relationship with Russia could also be a contentious point, with Trump likely to be more accommodating than Harris.

Celebrate the Festive season with 30% off on all our portfolios. Use code CELEBRATE30.🌍💰

Visit Now

Final Thoughts on Trump vs. Harris Presidency on Indian Economy

Harris's presidency would mean continuity and stability in India-US relations, particularly in trade, defence, and immigration, supporting India's export sectors and skilled workforce. A Trump victory would bring more unpredictable shifts, with a focus on protectionism that could challenge Indian exports but benefit India in the US-China trade competition. Indian & US investment stock market portfolios are already witnessing sector rotations from cyclicals to defensives .

Indian businesses across IT, auto, pharma, and energy sectors should prepare to adapt to either scenario. Regardless of the outcome, the strategic alignment between India and the US in defense and trade, especially in countering China’s influence, remains strong. As India continues to build resilience in its export-driven industries, it stands to benefit from both Harris's and Trump’s policy stances in ways that promote long-term growth and stability.