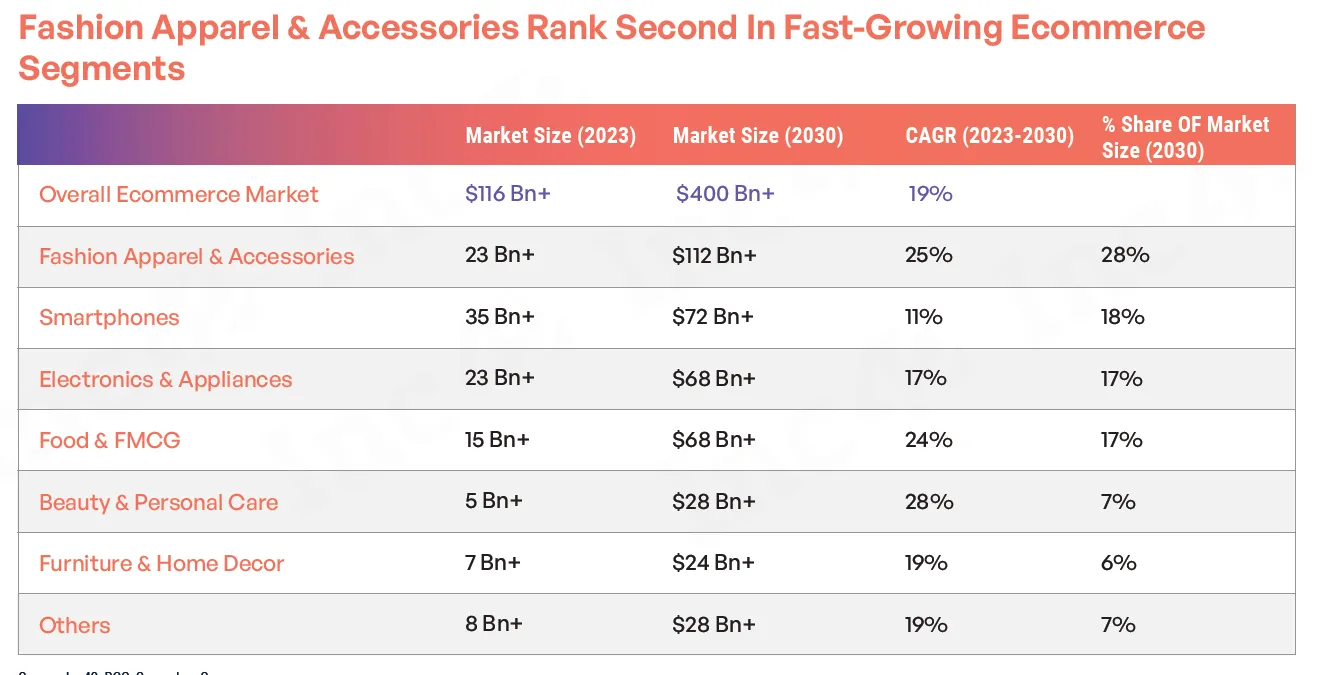

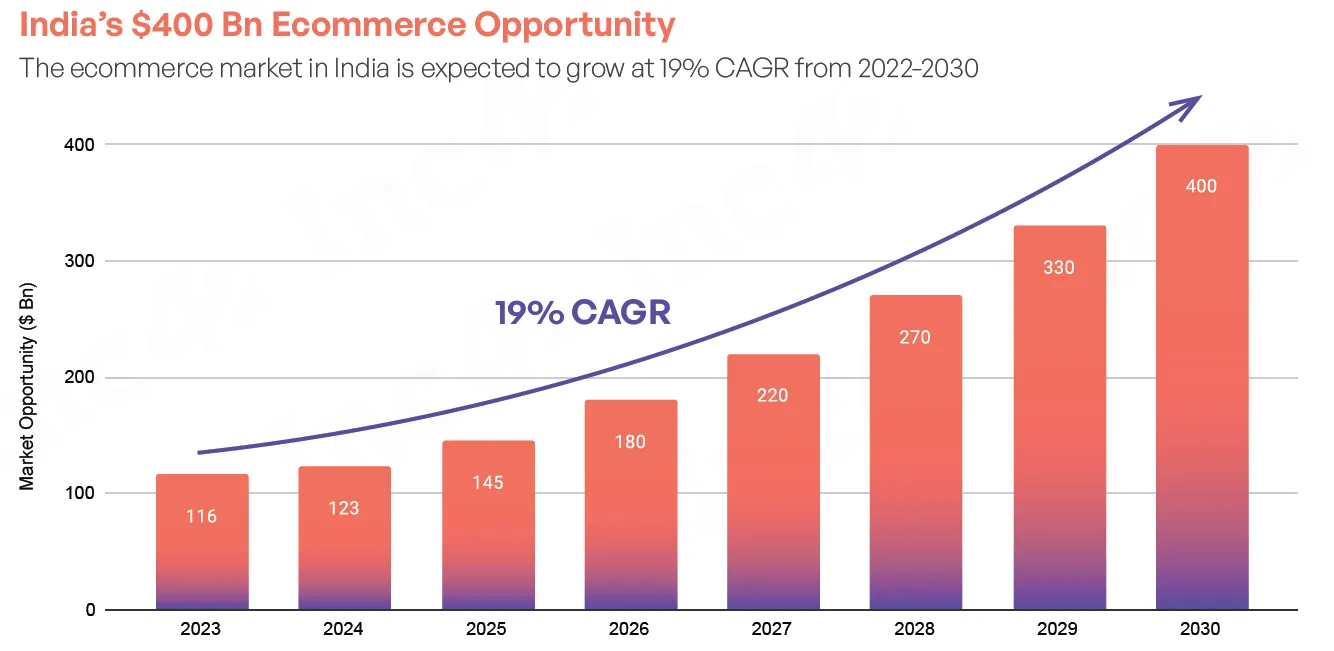

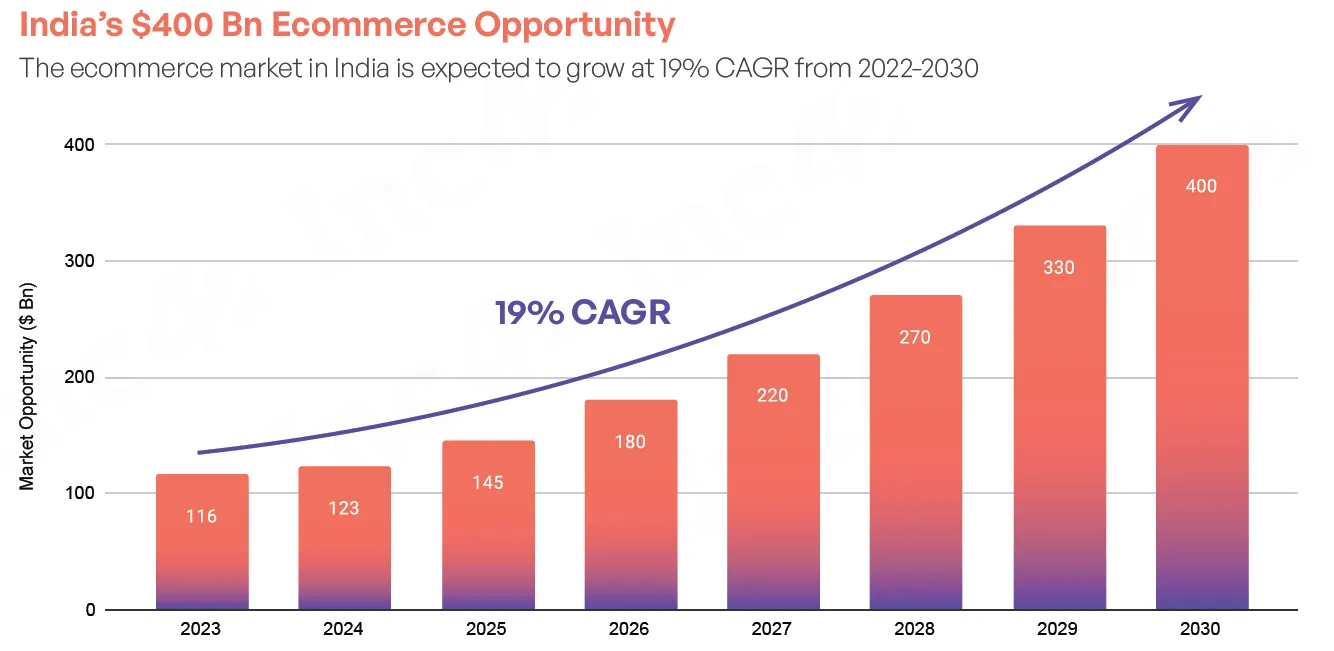

India’s e-commerce market, the eighth largest globally, has significant room to grow, with only 40% of its 1.4 billion population currently shopping online. The Indian e-commerce market is experiencing robust growth. The sector is set to grow at a 19% CAGR, reaching $400 billion by 2030.

However, e-commerce accounts for just 5% of total retail, highlighting untapped opportunities as consumers transition from physical retail.

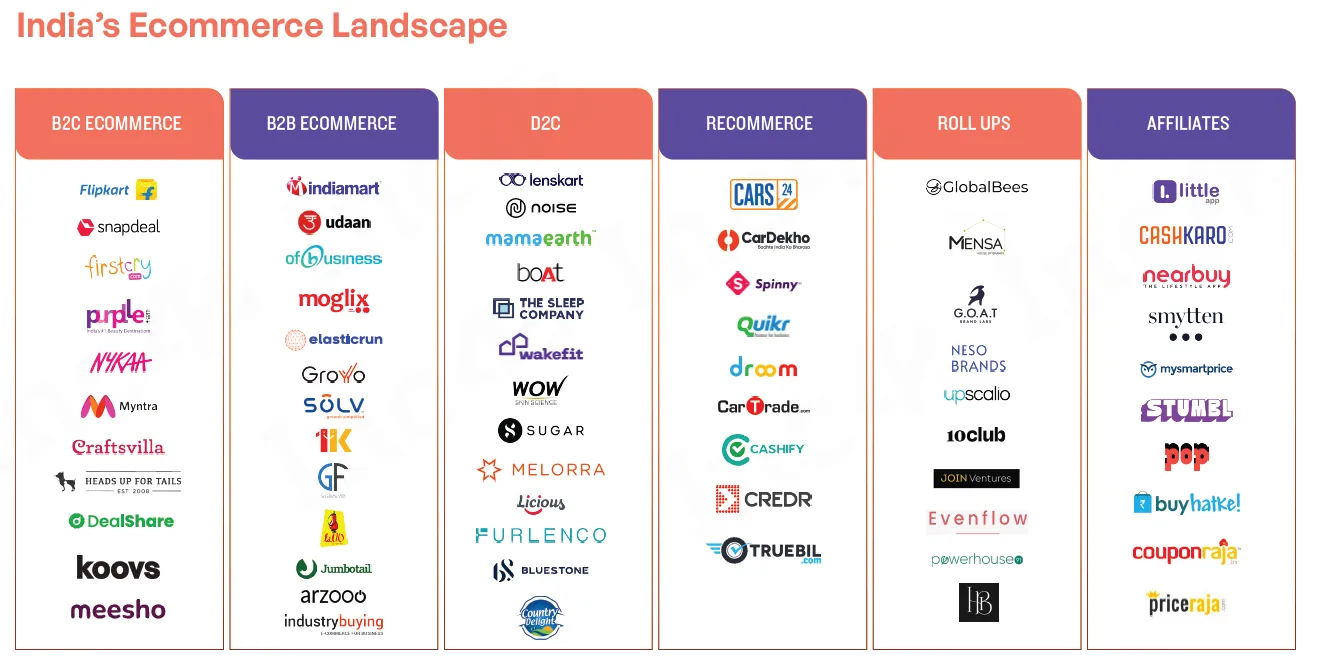

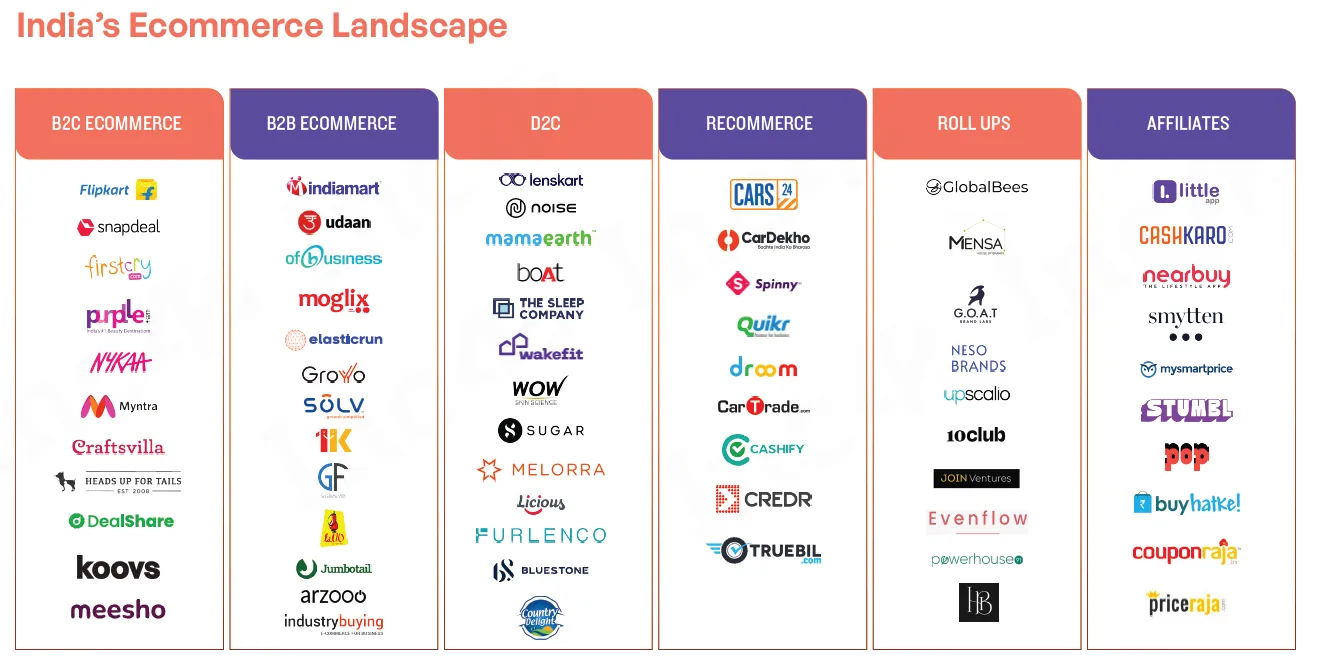

As quick commerce gains traction, the line between quick and traditional e-commerce is blurring. The sector’s rapid growth and diversification pose a significant challenge to established players. With investments flowing in and new entrants entering the market, India’s e-commerce landscape is poised for an intense and transformative competition.

Today, let’s look at the growth potential of this $400 billion booming industry.

Why Is E-commerce Expected to Continue Growing?

India’s digital economy continues to expand at an unprecedented pace, providing fertile ground for e-commerce. By 2030, India is expected to have over 500 million online shoppers, a 12% CAGR increase from 2022.

Key Enablers Include:

Key Enablers Include:

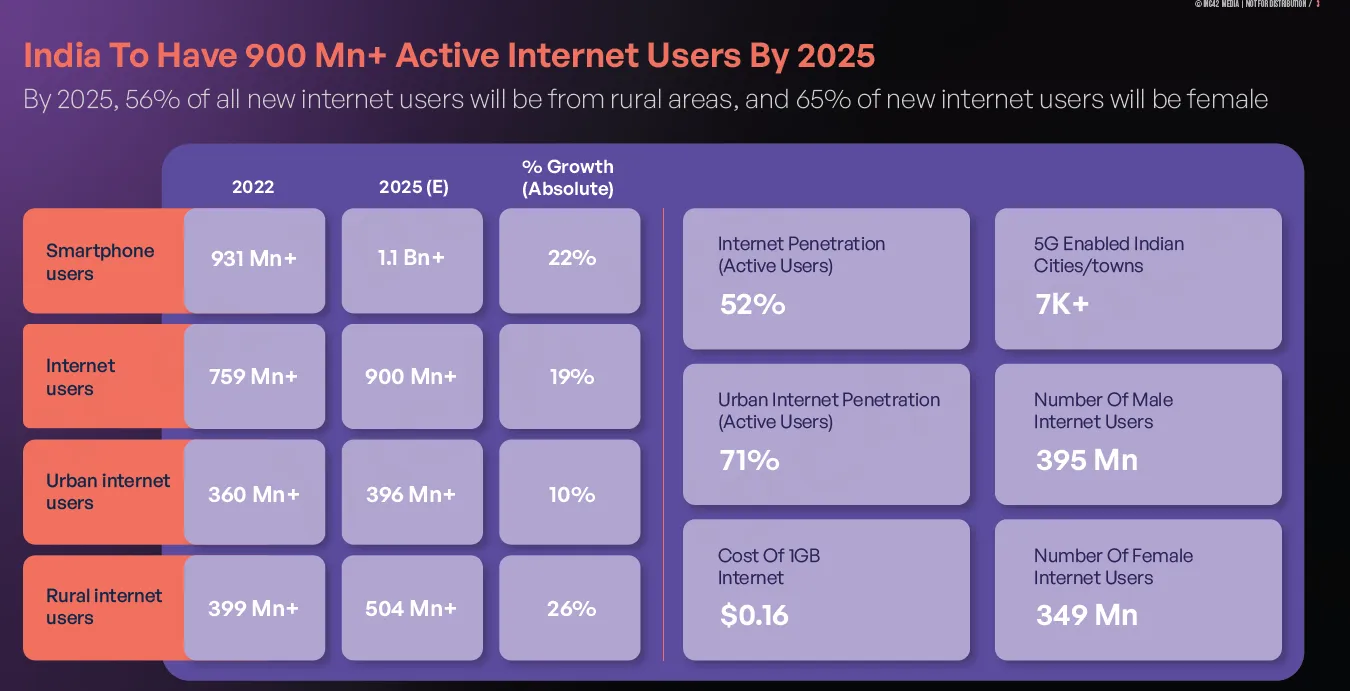

Growing Internet Users:

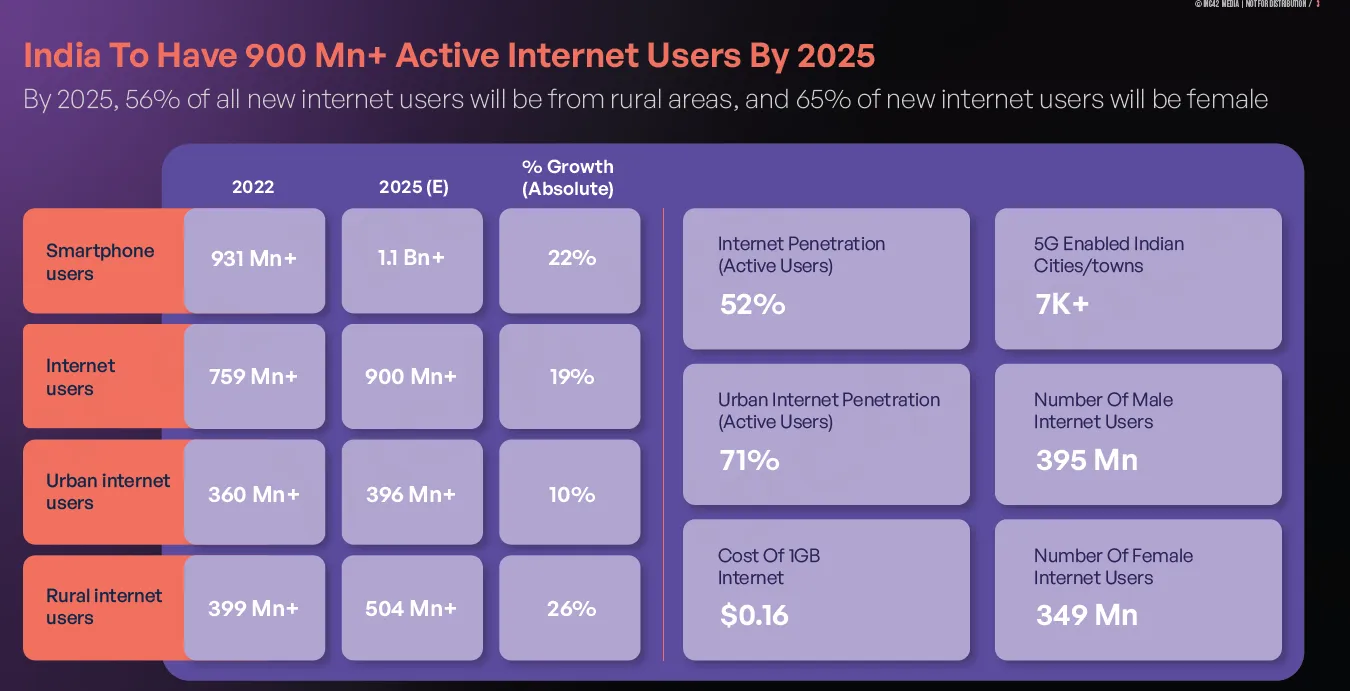

India boasts the second-largest internet user base globally with 881 million users.

India is projected to reach over 900 million active internet users by 2025, with a significant 56% of new users hailing from rural areas.

This is coupled with a notable rise in female internet users, who will account for 65% of new users, marking a shift towards inclusivity and empowerment. The growing digital presence also highlights how media affects the share market , as increased access to information influences investment decisions and market trends.

Key Trends Shaping Indian E-commerce

Rise of Tier-2 and Tier-3 Cities:

The majority of new shoppers and sellers are emerging from Tier-2+ cities. For instance, during Amazon’s "Great Indian Festival," 80% of shoppers and 65% of sellers were from these regions, indicating a significant shift in e-commerce penetration beyond metropolitan areas.

About 73% of internet users engage in content in Indian languages, creating a market of 540 million regional language users valued at $53 billion.

Quick Commerce Dominance: Quick commerce focuses on ultra-fast deliveries, grew by 77% in GMV between 2022 and 2023, making it the fastest-growing sub-sector within e-commerce.

AI and GenAI Integration: Technologies like generative AI (GenAI) are revolutionizing e-commerce. GenAI applications, such as personalized marketing, predictive analytics, and automated customer support, are expected to contribute between $150 billion to $275 billion to the fashion industry alone by 2030.

Increasing Mergers and Acquisitions (M&A):

Funding constraints and investor demand for exits are driving consolidation in the Direct-to-Consumer (D2C) segment, making M&A a critical strategy for scaling businesses.

We have seen acquisitions from companies across the board - Zomato, Swiggy, Nykaa, Amazon etc.

Rapid Growth of Quick Commerce

Quick commerce aligns with the demand for convenience and speed in urban and semi-urban areas. The hyperlocal delivery sector, driven by players like Swiggy, Zomato, Zepto, Bigbasket (owned by Tata now) & others, all valued at $6.1 billion in 2024 and projected to reach $40 billion by 2030.

Quick commerce platforms have moved away from charging a premium for instant deliveries, opting instead to match prices with e-commerce platforms. This shift is driving a fierce price war, with both sectors competing for consumer loyalty.

46% of surveyed consumers reported reduced purchases from traditional kirana stores due to the convenience of last-minute grocery delivery.

Competitive pricing strategies have reduced the premium for instant delivery, making quick commerce increasingly attractive to price-sensitive customers.

New Investments in the Space

Quick commerce players are attracting substantial investments:

Swiggy, Zomato, and Zepto are aggressively raising funds and expanding their services.

Tata’s Neu Flash and Reliance Retail have entered the segment, leveraging their extensive networks and resources to compete.

Reliance is integrating quick commerce into its retail strategy to prepare for its $100 billion IPO.

E-commerce leaders are taking proactive steps to counter quick commerce:

Flipkart has launched Flipkart Minutes, achieving 50,000-60,000 daily orders during peak sales events.

Amazon and Flipkart are under pressure to shorten delivery times and maintain their market share.

Challenges Ahead

While quick commerce is disrupting the e-commerce market, it faces challenges:

Logistics complexities as it scales.

Increasing competition from both incumbents and new entrants like Tata and Reliance.

Profitability pressures as aggressive pricing strategies lead to thin margins.

Get the right portfolios to invest in the stock market!

Explore Now

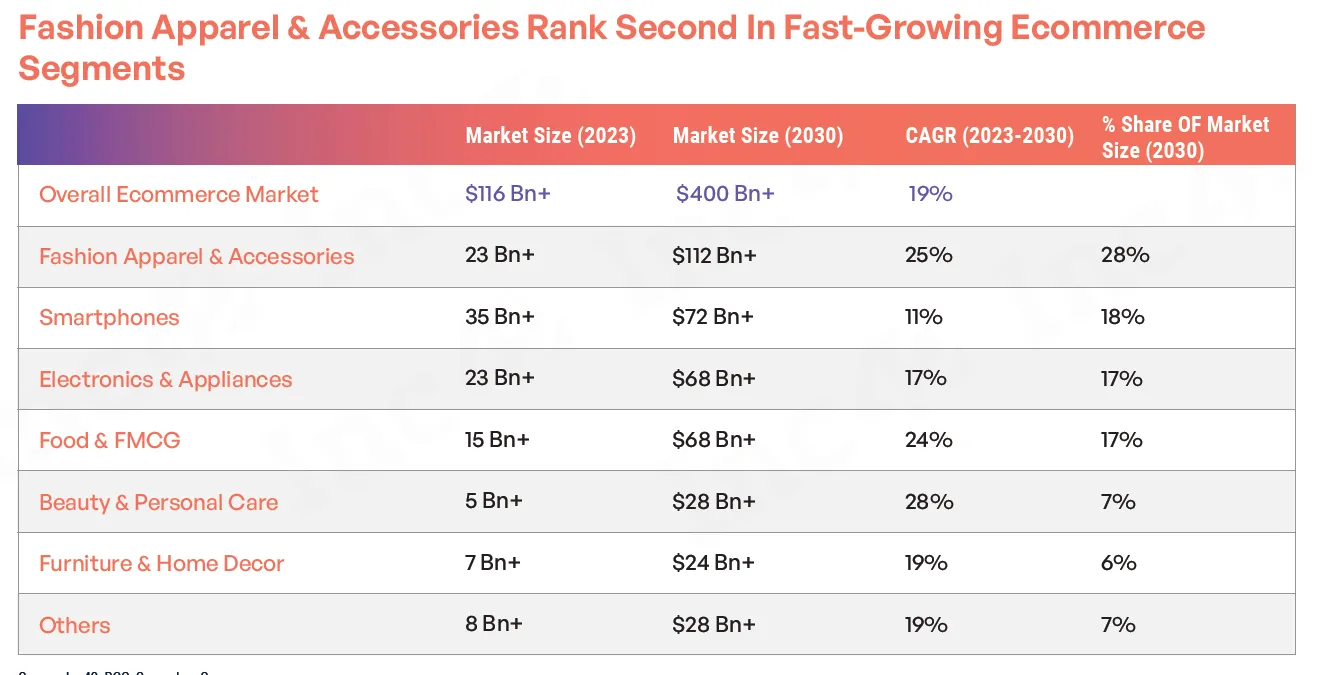

Fashion E-commerce

Fashion e-commerce is the fastest-growing and most lucrative segment in Indian e-commerce, with a 24% CAGR expected through 2030. The Indian fashion e-commerce market is highly segmented, with women’s fashion leading the space.

Key highlights include:

A diverse price range allows brands to cater to all market segments, from luxury fashion (above ₹50,000) to affordable clothing (below ₹2,000).

E-commerce provides significant advantages such as reduced costs, broader market reach, personalized marketing strategies, and real-time consumer insights. This positions online platforms as a cornerstone for scaling fashion brands.

India’s E-commerce vs. Global Giants

Although India’s e-commerce market lags behind the US and China in absolute size, its growth trajectory is unmatched.

India’s Strengths:

India’s internet penetration and the rapidly growing number of online shoppers position it as a high-potential market.

The market opportunity of $400 billion by 2030 is bolstered by digital adoption in rural and semi-urban areas.

Global Comparisons:

China dominates with an e-commerce market size of $6 trillion by 2030, followed by the US at $1.5 trillion.

India’s growth rate, however, outpaces both, offering unparalleled opportunities for investors and entrepreneurs.

Key Challenges for E-Commerce

Consumer Education: Many consumers remain unfamiliar with online shopping benefits.

Reverse logistics, including returns, exchanges, and repairs, poses a major operational challenge for fashion e-commerce. 37% of online shoppers in India return fashion items, underlining the need for efficient return management.

Infrastructure: Rural areas need improved internet access and logistical networks.

Regulatory Compliance: Platforms must navigate evolving government rules promoting domestic businesses.

Regulatory Oversight for E-Commerce

The Indian government is also actively regulating the sector to prevent monopolies and promote fairness. Proposals for a national open-source e-commerce platform aim to create a level playing field for all providers. Legislation set in 2022 introduced measures to regulate sales practices, ensure transparency about product origins, and prevent preferential treatment of specific sellers on major platforms.

Small Retailer Concerns

The Confederation of All India Traders (CAIT) has frequently accused e-commerce companies of violating FDI rules and using unfair practices that harm small retail businesses. Alleged practices include:

Predatory pricing, which undercuts local retailers.

Anti-competitive behavior under investigation by the Competition Commission of India (CCI).

Recent Enforcement Actions

The Enforcement Directorate (ED) recently searched 19 premises of vendors linked to Amazon and Flipkart across multiple cities, including Delhi, Gurugram, Hyderabad, and Bengaluru, as part of an investigation into FDI violations.

These searches focused on "preferred vendors" suspected of breaching regulations.

Anti competition

The CCI is examining complaints about anti-competitive practices, ensuring compliance with fair business practices. This reflects the government’s broader effort to create a level playing field in India’s growing e-commerce sector.

Get the right portfolios to invest in the stock market!

Explore Now

Conclusion

India’s e-commerce landscape is poised for exponential growth, supported by a tech-savvy population, government reforms, and robust investments from global players. Mobile commerce, digital wallets, and regional expansion will be key drivers of the next phase of growth.

So are you bullish on the Indian E-commerce Story?

Key Enablers Include:

Key Enablers Include: