Alarm bells over Adani’s ventures began in 2022 when Sri Lankan officials alleged undue influence by the Indian government to secure renewable energy contracts for the group. This was dismissed at the time, and subsequent geopolitical partnerships, such as a $533 billion U.S.-backed Adani port project in Sri Lanka, seemed to normalize the situation. However, recent events—spanning Kenya, Bangladesh, and now a U.S. grand jury indictment—have reignited scrutiny over Adani’s global operations and their potential impact on Brand India.

The recent allegations and legal actions surrounding the Adani Group have highlighted serious vulnerabilities in India’s geo-economic strategy, exposing the risks of blending geopolitical ambitions with crony capitalism. This unfolding controversy demands a closer look at the implications for Indian businesses, governance, and international credibility.

Unpacking the Adani Indictment Allegations

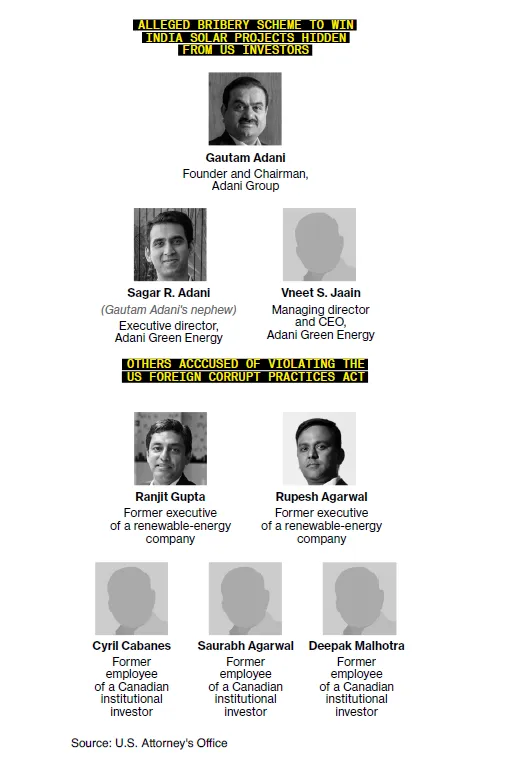

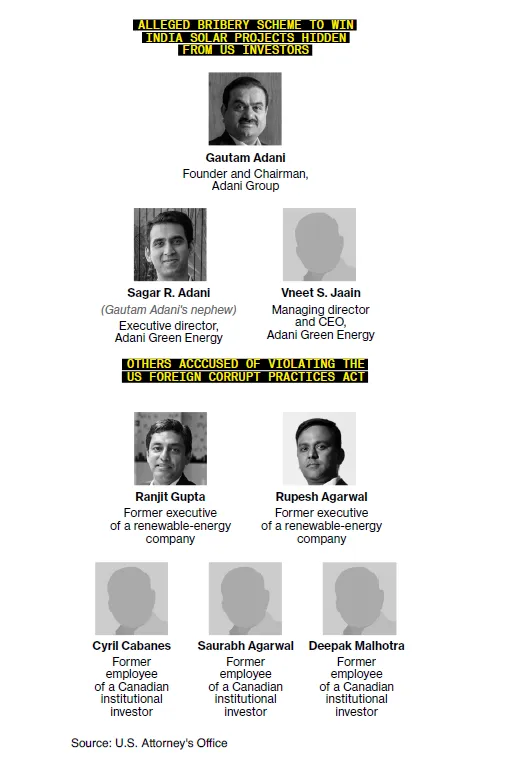

The U.S. indictment of Gautam Adani accuses the group of orchestrating a $250 million bribery scheme to secure solar energy contracts in India. Adani faces 5 charges under U.S. anti-bribery laws, alongside senior executives Sagar Adani and Vneet Jaain.

The charges are linked to alleged misrepresentations to U.S. investors, triggering jurisdiction under U.S. law. The charges include:

Corruption in Solar Projects: Alleged bribery to win contracts with state-run Solar Energy Corporation of India (SECI).

Misrepresentation to U.S. Investors: Adani Green Energy allegedly misled U.S. investors by falsely claiming compliance with anti-bribery laws while raising $750 million in bonds.

Concealment: Prosecutors contend that the bribery scheme was deliberately hidden to maintain access to U.S. capital markets. Officials used nicknames like “Mr. A” and “Numero Uno” and allegedly destroyed evidence to evade detection.

Involvement of Foreign Firms: The Securities and Exchange Commission (SEC) has alleged that Azure Power Global Ltd., another renewable energy company, played a role in the bribery scheme, underscoring systemic issues in India’s renewable energy sector.

The indictment, under the U.S. Foreign Corrupt Practices Act, extends the reach of U.S. jurisdiction due to the involvement of American investors and markets. This represents one of the most significant legal challenges faced by the Adani Group.

Key Issues At Play In The Adani Bribery Charges

Crony Capitalism and Geopolitical Overreach: The Modi government’s overt support for Adani’s overseas ventures reflects a strategy likened to South Korea’s chaebols: leveraging state support to globalize domestic conglomerates. However, the line between state-sponsored business promotion and cronyism has blurred, with allegations of corruption casting a shadow on the credibility of these ventures.

Dependence on External Financing:Unlike China’s state-backed firms that rely on domestic financial resources, Indian companies, including Adani, have heavily borrowed from Western markets to fuel their global expansions. This dependence exposes them to the regulatory frameworks and legal systems of those markets, as evidenced by the U.S. indictment under anti-bribery laws.

Global Fallout:Countries like Kenya and Bangladesh are reconsidering contracts with the Adani Group, signaling broader reputational damage. This scrutiny not only impacts the group but also erodes confidence in Indian businesses as reliable partners.

Role of Governance:India’s political-business nexus, long entrenched domestically, faces new challenges on the global stage. While political influence once shielded businesses within India, international exposure has brought these practices under the purview of stricter laws and enforcement mechanisms abroad.

Adani Group’s Response To The Bribery Charges

The conglomerate has categorically denied the allegations, labeling them as “baseless,” and reiterated its commitment to governance and compliance. In a strongly worded statement, the conglomerate reaffirmed its adherence to governance and regulatory standards, stating:

It is “steadfastly committed to maintaining the highest standards of governance, transparency, and regulatory compliance.”

Legal measures will be pursued to counter the allegations, ensuring protection of stakeholder interests.

Adani Stock Performance Post The Bribery Allegations

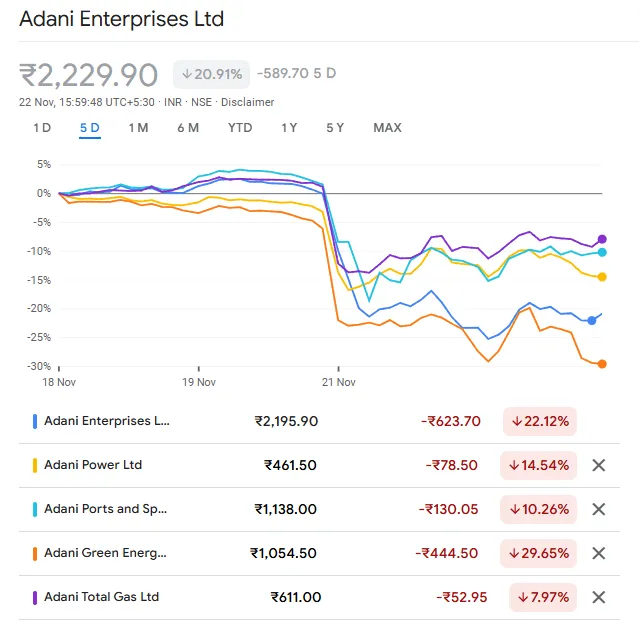

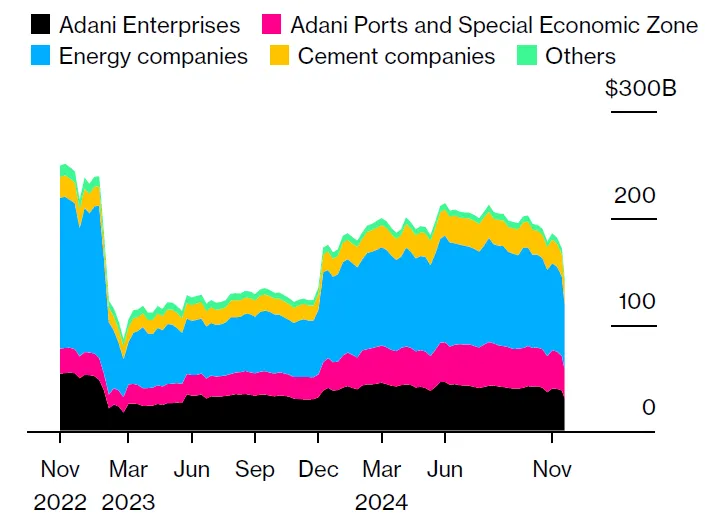

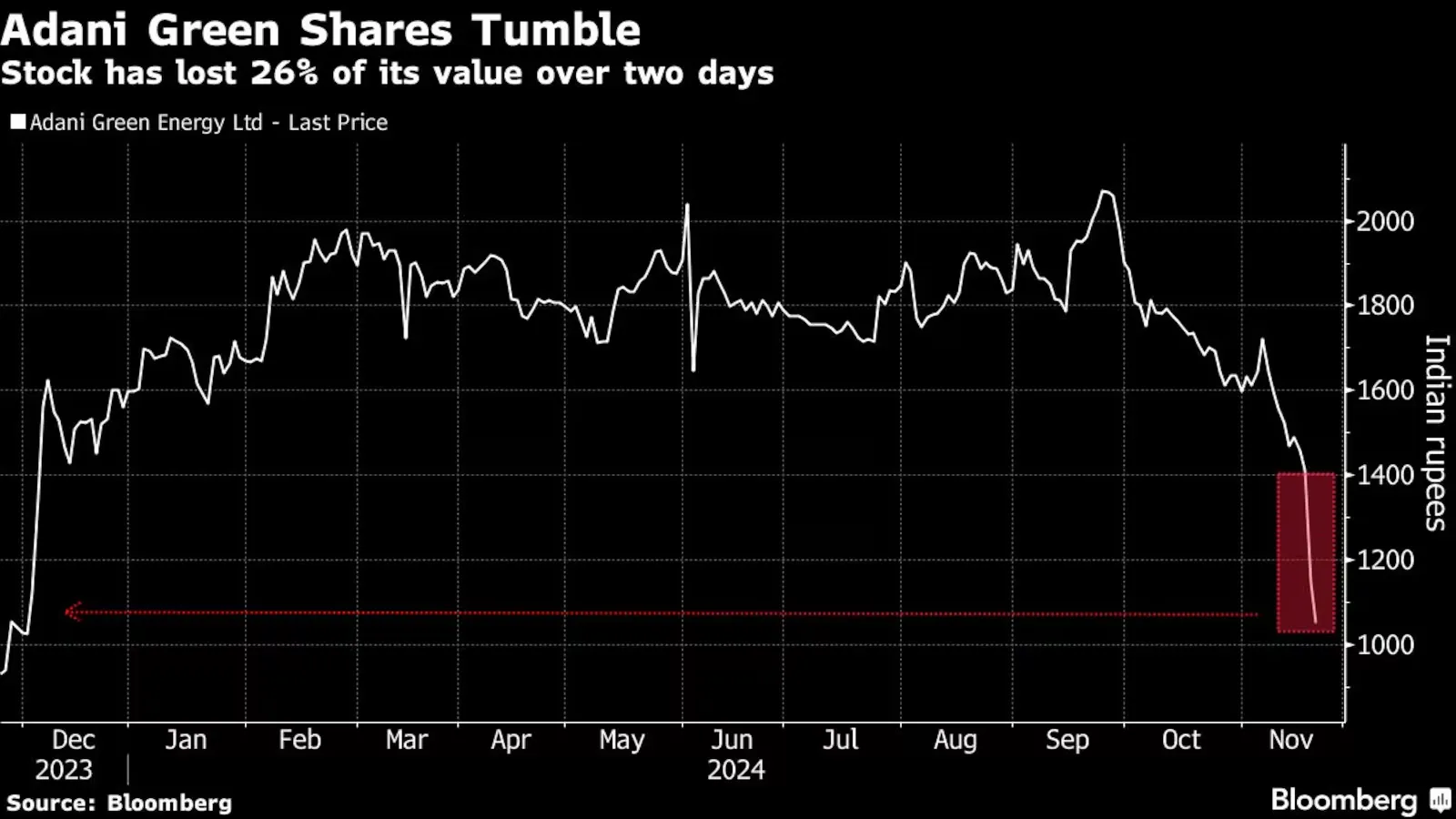

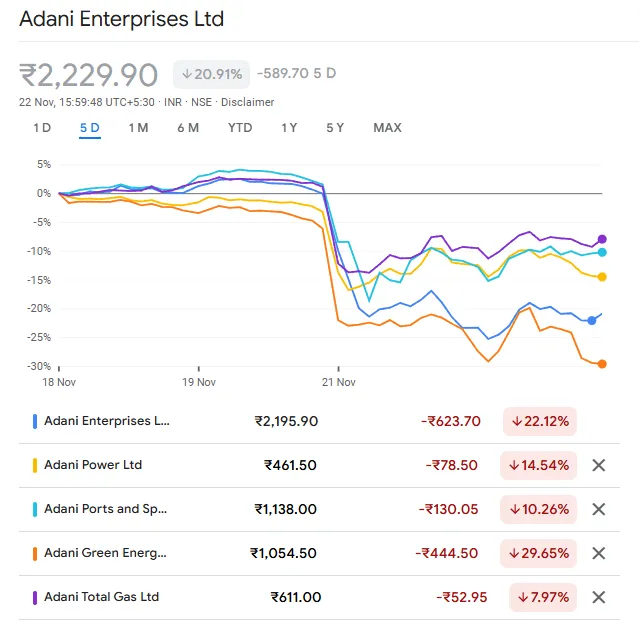

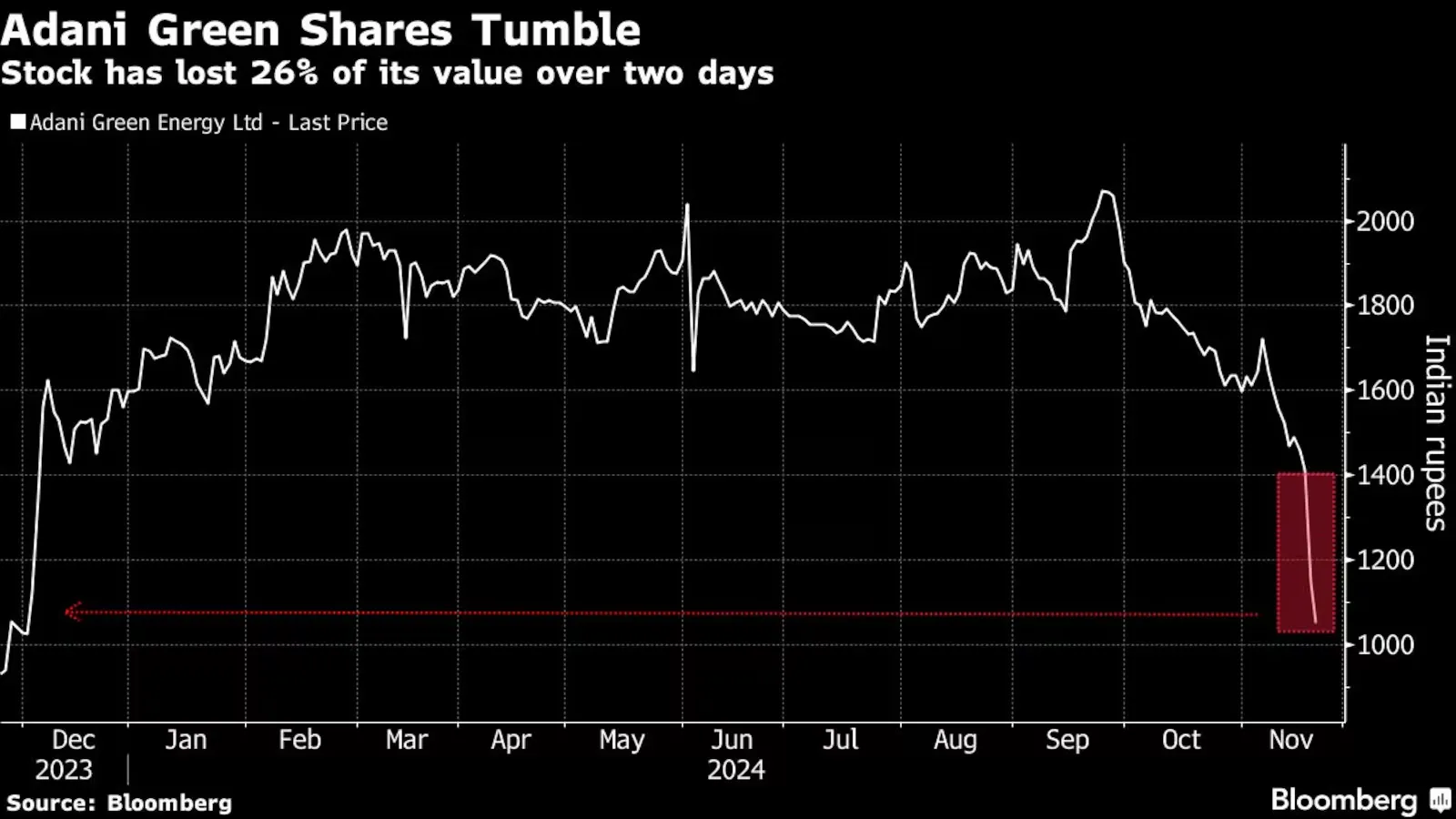

The Adani Group's stock performance has shown signs of stabilization following a tumultuous period marked by significant allegations and market reactions. The indictment had an immediate and severe impact on the Adani Group’s market standing.

Stock Sell-Off: The group’s stocks lost $30 billion in market value, reflecting investor anxiety over the legal and reputational risks.

Bond Market Fallout: A planned $600 million bond issuance was abruptly canceled, indicating difficulties in raising international capital.

Rating Agency Concerns: Moody’s described the situation as “credit negative” for the group, citing potential disruptions to capital flows and governance concerns.

On Friday, 6 out of the conglomerate's 10 listed companies registered gains, indicating a partial recovery from the sharp declines experienced the previous day. Notably, Adani Green Energy continued to face challenges, with its shares declining by 8.2%, partly due to the cancellation of a planned $600 million fundraising through U.S. dollar-denominated bonds.

The group's overall market capitalization decreased by ₹10,383 crore on Friday, settling at ₹11.9 trillion. This decline is modest compared to the substantial ₹2.2 trillion loss recorded on Thursday, following the U.S. Securities and Exchange Commission's charges against Gautam Adani and seven others in a bribery and fraud case.

Adani Bribery Allegations Rattle Indian Markets, Amplify Foreign Fund Exodus

Adani’s limited representation in India’s $4.4 trillion stock market does little to insulate the broader equity market from the fallout. The indictment casts a spotlight on corporate governance practices in India, further shaking investor confidence already strained by a downturn in corporate earnings. The NSE Nifty 50 Index, now at a five-month low, has dropped 11% from its September peak, fueled by a mix of downgrades and concerns over slowing economic growth, inflation, and weak consumer demand.

The Adani scandal comes at a time when Indian markets are grappling with:

Earnings Weakness: Downgrades from major financial institutions like Goldman Sachs and Citigroup highlight sharp declines in earnings growth.

Global Competition: The “ sell India, buy China ” trade has gained traction among international investors seeking better returns.

Macroeconomic Pressures: Tight monetary policies and a cooling credit cycle are adding to the overall economic slowdown.

The Adani charges could intensify the “risk-off” sentiment already driving foreign fund withdrawals . With Indian equities trading at a premium — the MSCI India Index is valued at 22 times forward earnings — the market appears vulnerable to prolonged weakness.

While foreign investors retreat, domestic institutions have propped up the market, purchasing over $50 billion in net shares this year, a record. Historically, such interventions have shielded Indian equities from external shocks, including the Adani-linked Hindenburg report earlier this year and geopolitical tensions in the Middle East. However, the current economic context is less supportive, making a swift recovery less likely.

Adani’s Earlier Troubles and Recurring Allegations

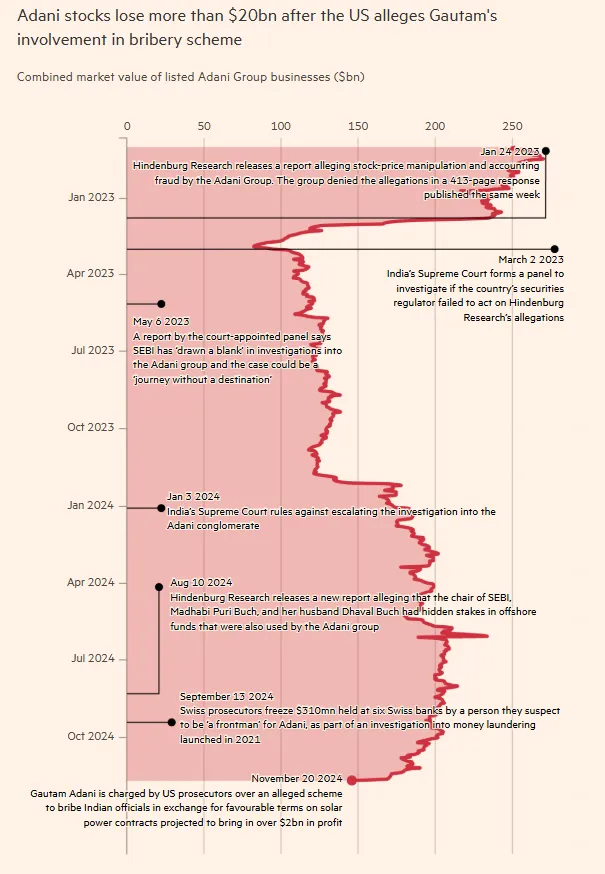

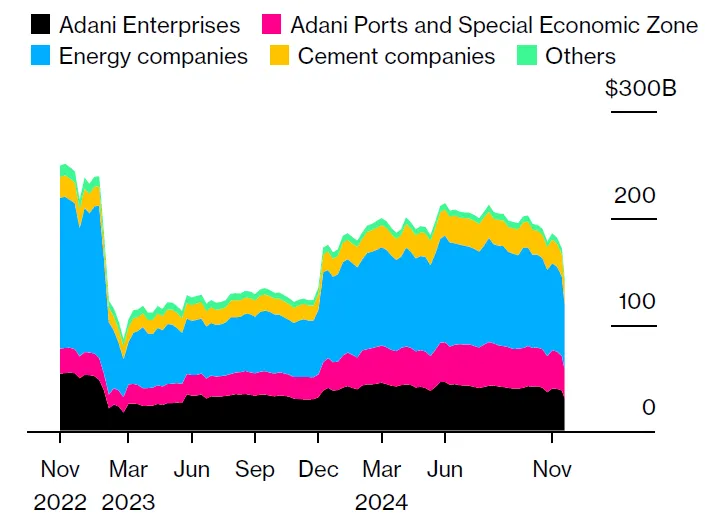

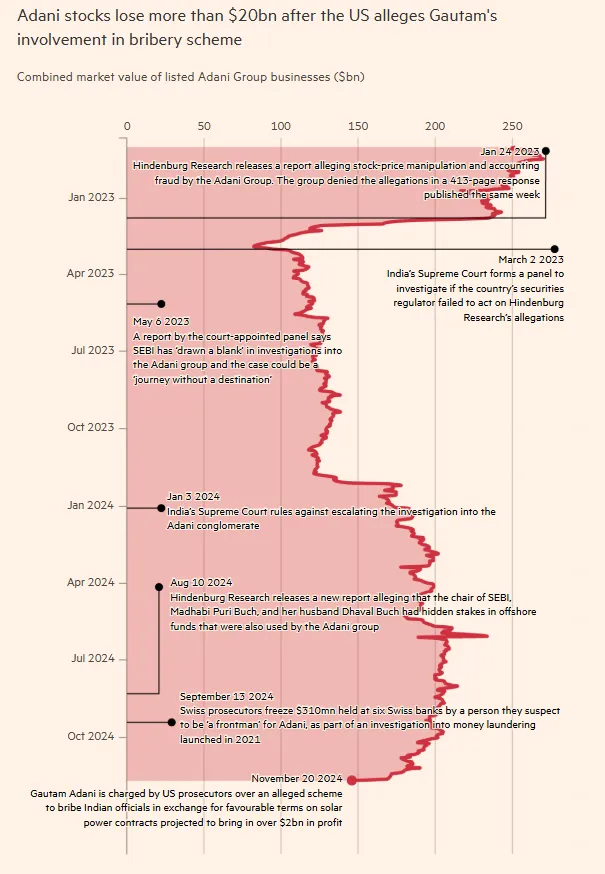

Some investors are drawing parallels to the aftermath of the 2023 Hindenburg Research report, which initially halved the Adani Group's market capitalization. The group managed to recover to ₹19.4 trillion by June 2024, demonstrating resilience in the face of adversity. International watchdogs have raised concerns about the environmental and social impact of Adani’s projects, from coal mining in Australia to port developments in Sri Lanka. The indictment is the latest in a series of challenges faced by the Adani Group in the last 1 year:

1. January 2023: Hindenburg Research Report

Hindenburg Research accused the Adani Group of stock price manipulation and accounting fraud. This triggered a sharp decline in the group's market capitalization as investors reacted to the detailed allegations. Adani’s denial, accompanied by a 413-page rebuttal, did little to restore confidence.

2. March 2023: Supreme Court Intervention

India’s Supreme Court formed a panel to investigate regulatory lapses by SEBI in connection with the Hindenburg allegations. This marked a formal legal escalation, causing heightened uncertainty and investor nervousness, reflected in continued market value erosion.

3. May 2023: Court-Appointed Panel Report

A court panel stated that SEBI had made limited progress in its investigations, describing the case as potentially a “journey without a destination.” This raised doubts about the effectiveness of regulatory oversight, keeping pressure on the stock price.

4. August 2024: Renewed Allegations

Hindenburg Research released another report, implicating SEBI’s chair and her husband in connections to offshore funds linked to the Adani Group. This sparked another major drop in Adani Group’s valuation, as the allegations suggested deeper systemic issues within India’s regulatory framework.

5. September 2024: Swiss Bank Freezes

Swiss prosecutors froze $310 million across six banks, alleging the funds were linked to Adani through suspected money laundering. This added an international dimension to the scrutiny, further denting the group's credibility and market stability.

Find high trending stock portfolios in India!

Visit Now

Wider Stock Market Fallout From Adani’s Bribery Charges Allegations

Indian Banks Exposure to Adani Group Stocks

Post the Adani indictment announcement, Adani Group shares plummeted by as much as 20%, while public sector banks such as SBI, PNB & BoB faced declines of up to 7% in their stock prices. Based on disclosures made by Indian banks, several major public and private sector banks have significant outstanding loans to the Adani Group:

State Bank of India (SBI): The largest lender to the Adani Group, with outstanding exposure of ₹27,000 crore as of December 2022.

Punjab National Bank (PNB): Reported an exposure of ₹3,300 crore.

Bank of Baroda (BoB): Disclosed an exposure of ₹5,300 crore.

Axis Bank: Exposure stood at ₹7,160 crore.

Power Finance Corporation (PFC) and Rural Electrification Corporation (REC): Both state-owned entities had exposures of ₹8,300 crore and ₹7,000 crore, respectively.

Experts argue that PSBs are well-positioned to weather the fallout. Key indicators support their resilience:

Banks have improved asset quality. For example, SBI’s net non-performing asset (NNPA) ratio improved to 0.53% in Q2FY25, down from 0.57% a year ago. PNB and BoB also reported improvements in their NNPA ratios.

Analysts suggest that banks have made sufficient provisioning for corporate loans, including those to the Adani Group, reducing the risk of significant financial fallout.

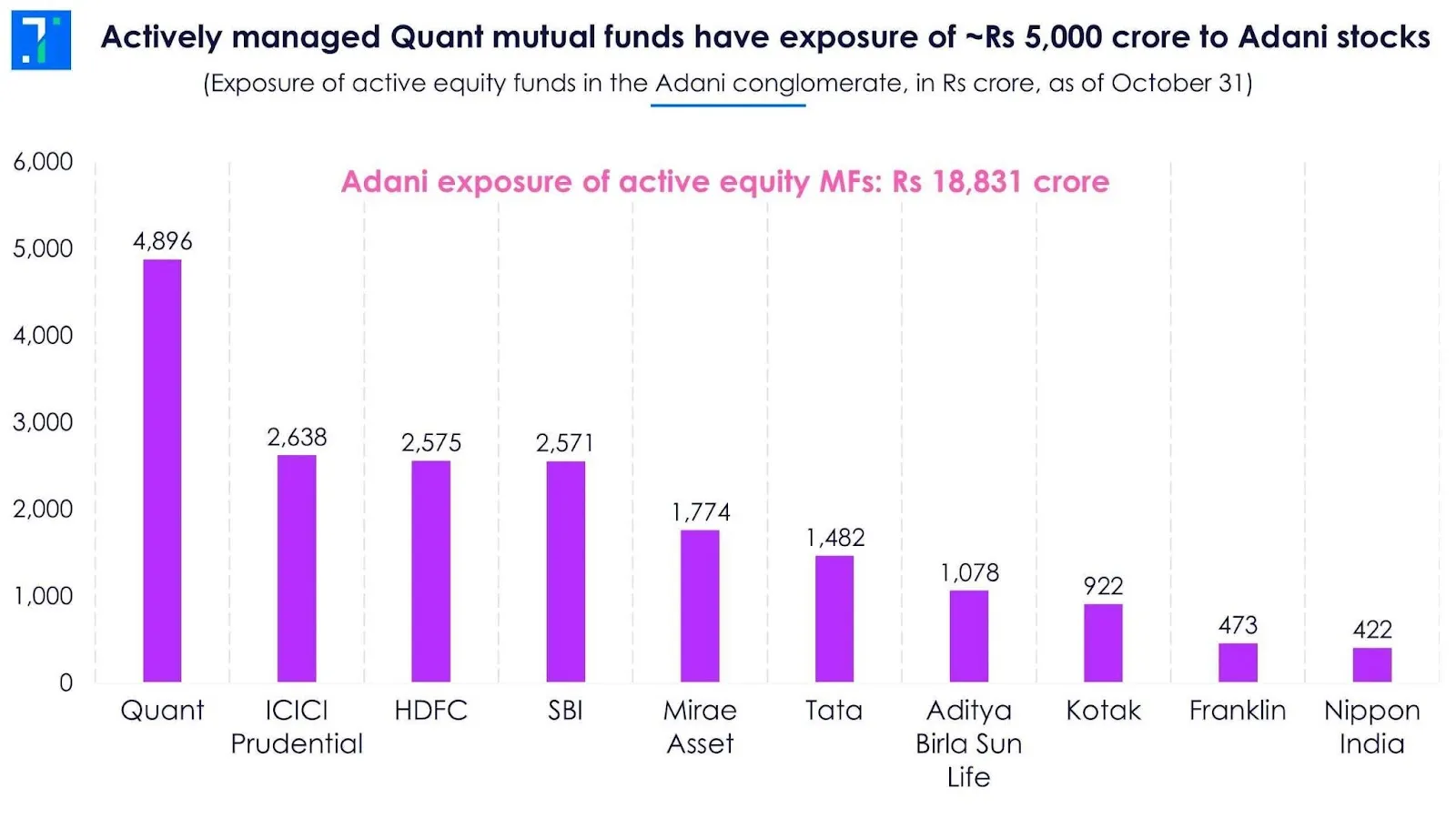

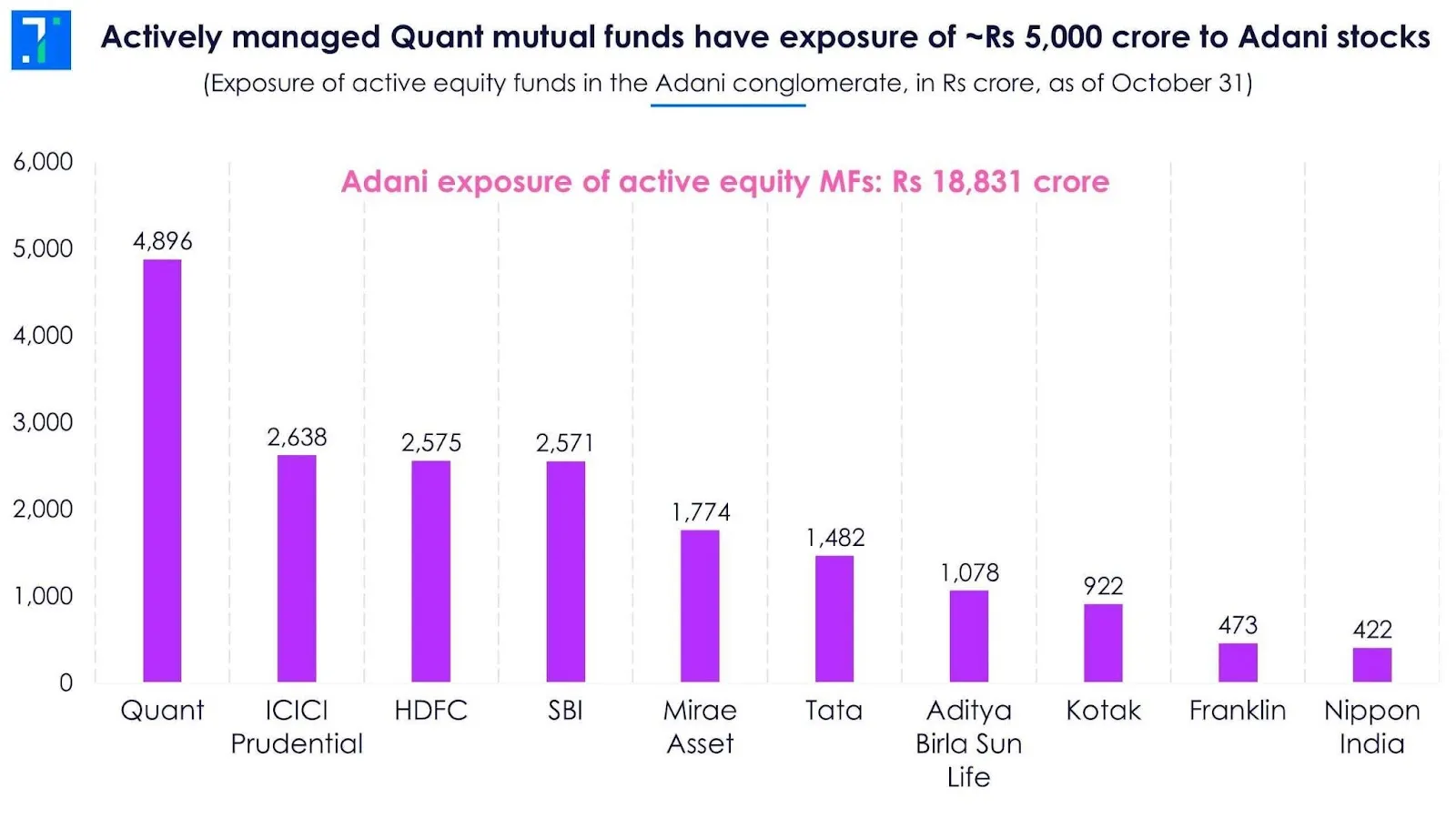

Indian Mutual Funds' Exposure to Adani Group Stocks

Mutual funds, especially actively managed ones, also hold significant positions in Adani Group stocks. As of October 31, the total exposure of active equity mutual funds to Adani stocks was ₹18,831 crore. Key players include:

Quant Mutual Funds: The largest exposure at ₹4,896 crore.

ICICI Prudential and HDFC Funds: With exposures of ₹2,638 crore and ₹2,575 crore, respectively.

SBI Mutual Funds: Exposure stood at ₹2,571 crore.

Other Funds: Mirae Asset, Tata, Aditya Birla Sun Life, and Kotak also have notable exposures ranging from ₹922 crore to ₹1,774 crore.

As of October 2024, Adani Ports had received the highest investments from mutual funds (₹12,102 crore), with ₹5,308 crore from active funds. Ambuja Cements saw active mutual fund holdings rise to ₹10,100 crore, nearly all of its mutual fund exposure. Adani Enterprises holdings increased significantly, reaching ₹8,714 crore by October 2024, of which ₹5,988 crore was held by active funds.

Several active equity mutual funds have significant allocations in Adani Group companies. Below are some notable holdings:

Quant Mutual Funds emerged as the most active investors, with schemes like Quant ELSS Tax Saver Fund allocating 7.6% of its net assets to Adani Power.

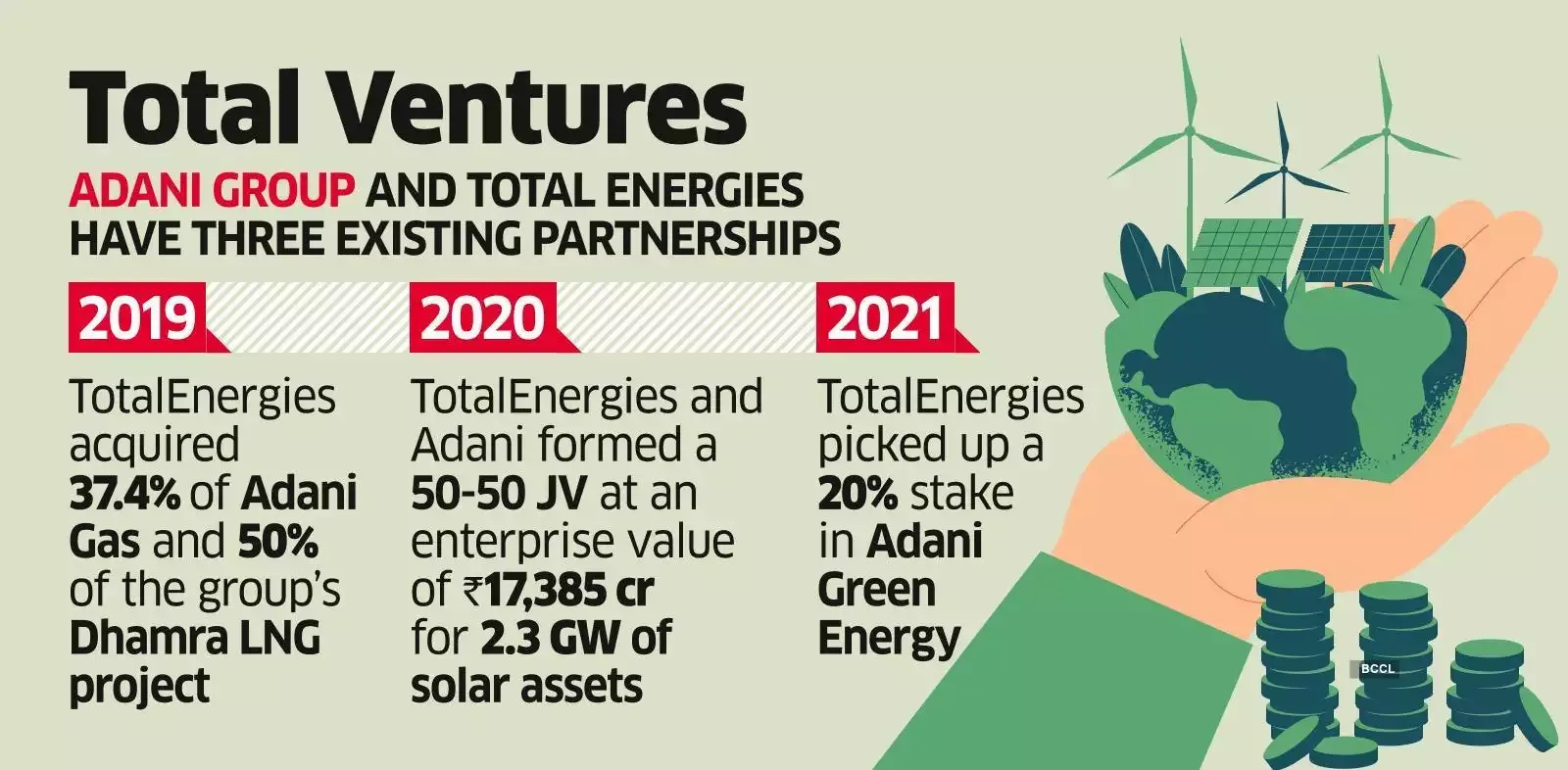

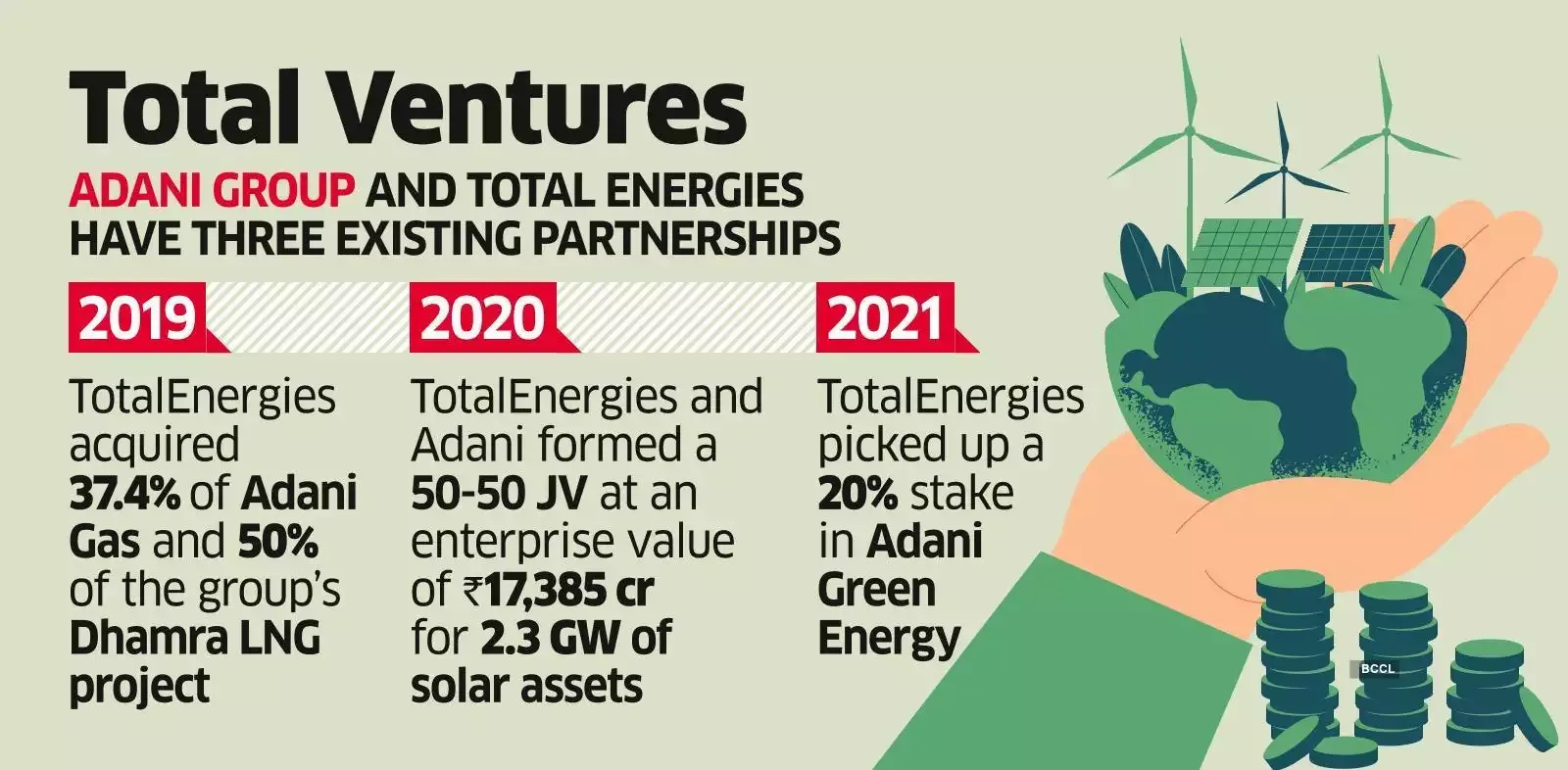

Total Energies & Adani Group Partnership

In September 2024, Total Energies invested $444 million for a 50% stake in 1.15 gigawatts of solar installations at the Khavda solar park, a central asset in the bribery allegations. U.S. prosecutors claim that between July 2021 and 2024, improper payments were made to Indian officials to secure the solar project’s success. Despite these allegations, Total Energies is not named in the criminal case.

The French energy giant had previously acquired a 20% stake in Adani Green Energy in January 2021, shortly after the Indian company secured a massive solar order and just months before the alleged bribery scheme began.

If Total Energies was unaware of the U.S. investigation at the time of the deal, the lack of disclosure could intensify scrutiny on Adani’s corporate governance and transparency. Conversely, if Total Energies was informed, its decision to proceed may face criticism for ignoring significant legal risks.

Global ESG Funds Under Fire

Approximately 770 ESG funds worldwide hold shares of Adani Green, which is facing allegations of using bribes to secure solar energy contracts in India. Many of these funds are marketed as promoting or prioritizing ESG metrics, with oversight supposedly more rigorous than traditional investment funds. The indictment wiped $27 billion off the Adani Group’s combined market value, with ESG funds heavily exposed to Adani Green.

Despite accounting for less than 1% of the net assets of most of these funds, the case has magnified ESG funds’ persistent shortcomings:

Misplaced Confidence in Ratings: Adani Green used its ESG “A” rating from MSCI Inc. to attract investors for a 2021 bond sale. Although MSCI downgraded the company to “BBB” in 2023, the ESG ratings process has been criticized for inadequate due diligence.

Lack of Proactive Oversight: ESG funds have been caught off guard before, including holding Russian assets during the Ukraine invasion and Silicon Valley Bank before its collapse. Adani Green adds another instance of poor governance screening.

ESG funds often rely on surface-level metrics without accounting for deeper governance issues, particularly in emerging markets like India, ranked 93rd in Transparency International’s Corruption Perceptions Index.

Adani Green’s centrality to India’s renewable energy ambitions - targeting 50 gigawatts by 2030—had made it attractive to ESG investors. The scandal jeopardizes trust in similar projects in emerging markets.

Canadian Pension Funds Caught in Adani Bribery Scandal

With assets totaling C$452 billion, CDPQ is a part owner of Azure, a solar power operator which is accused of indirectly funding some bribes. The SEC alleges that Cyril Cabanes, a former CDPQ employee and Azure board member, “schemed” to facilitate the bribes by giving Adani Green a larger stake in a lucrative Andhra Pradesh power project.

Omers (Ontario Municipal Employees Retirement System), Azure’s second-largest shareholder with a 21% stake, expressed concern over the allegations but emphasized its minority status since entering in 2021. Azure’s collapse has translated into substantial losses for both pension funds, highlighting the financial risks of investing in entities with poor governance.

The Foreign Corrupt Practices Act allows U.S. prosecutors to target entities linked to bribery if U.S. markets or investors are involved. Both CDPQ and Azure fall within this jurisdiction due to their business operations and capital raising in the U.S. Both have committed to cooperating with U.S. authorities, with CDPQ already taking steps to address governance failures by removing implicated employees.

Global Implications of Adani Bribery Charges

The indictment has far-reaching consequences for India’s business and geopolitical ambitions:

Erosion of Investor Confidence: The scandal risks damaging the global perception of Indian companies as ethical and reliable partners. This could have a chilling effect on foreign investment, particularly in sectors like renewable energy where Adani has been a dominant player.

Challenges to India’s Geo-economic Strategy: The Adani Group has been a key instrument in India’s geo-economic expansion, securing critical infrastructure projects in South Asia, the Middle East, and beyond. The legal challenges in the U.S. threaten to derail these efforts by restricting the group’s access to international capital and markets.

Strain on U.S.-India Relations: With the U.S. legal system now directly involved, the case introduces a new layer of complexity to bilateral ties. While the U.S. and India maintain an extradition treaty, any effort to extradite Adani or other executives could become a diplomatic flashpoint.

Corporate Governance in India in Crisis

Byju’s: From Edtech Unicorn to Corporate Disaster

Once valued at $22 billion, Byju’s saw its valuation crash below $1 billion amid allegations of mismanagement and financial lapses.

Key investors, owning 30% of the company, have called for an Extraordinary General Meeting (EGM) to oust CEO Byju Raveendran and his family members from the board.

Lack of oversight and accountability in financial management eroded trust, raising questions about the role of independent directors and auditors.

Paytm: Regulatory Roadblock

On January 31, the Reserve Bank of India barred Paytm Payments Bank from accepting deposits and credit transactions after repeated warnings since 2022.

The board failed to act decisively despite ample time for corrective measures, leaving the fintech giant in regulatory limbo.

The episode reflects poor governance, with the board unable to safeguard operational compliance and stakeholder interests.

Satyam Computer Services (2009)

The Indian IT services company’s chairman admitted to inflating profits by $1.5 billion over several years.

A compliant board failed to scrutinize financial irregularities.External auditors (PwC) were complicit in overlooking fraudulent accounting practices.

Kingfisher Airlines (2012)

The Indian airline collapsed due to mounting debt, unpaid salaries, and operational mismanagement.

Founder Vijay Mallya dominated decision-making, sidelining board oversight. Poor financial management and failure to adapt to market dynamics led to unsustainable operations.

Kingfisher defaulted on loans, and Mallya fled India amid allegations of financial fraud.

Broader Failures in Corporate Governance

Sony-Zee Deal Collapse: Two years of negotiation failed due to governance lapses and shareholder dissatisfaction, reflecting a weak board dynamic.

Religare Boardroom Drama: Allegations of misgovernance by the executive chairperson and board interference in shareholder decisions tarnish the company’s credibility.

Find high trending stock portfolios in India!

Visit Now

Adani Group: Is It Too Big to Fail?

Financial Stability and Liquidity Cushion

The Adani Group's financial position is substantial, with a total debt of ₹2.4 lakh crore and cash reserves of ₹59,791 crore, leaving a net debt of ₹1.81 lakh crore. The cash holdings cover 24.77% of total debt, ensuring liquidity to meet debt obligations for the next 30 months. These metrics signal adequate stability to maintain operations, mitigating immediate concerns for creditors.

Public sector banks, which hold considerable exposure to Adani’s debt, and the Indian government are unlikely to permit the group’s collapse due to the systemic risks it could pose to the broader economy. This ensures that creditors remain confident in the group’s ability to service its obligations.

Domestic Influence vs. International Pressure

Despite U.S. legal troubles, Adani’s domestic clout remains unshaken. With significant backing from public sector banks and its close relationship with the Indian government, the group is well-positioned to weather the storm locally. However, reliance on domestic banks for future funding could restrict its ability to scale internationally.

The allegations could hinder global operations, delaying key projects such as solar manufacturing and infrastructure deals in Africa and Southeast Asia. Access to international credit markets may also tighten as risk-averse foreign investors take a step back, particularly after these high-profile allegations.

What’s Next?

While Adani’s immediate operations appear secure, the indictment complicates its long-term prospects. A U.S. trial could stretch for years, prolonging uncertainty. If Gautam Adani is extradited or voluntarily appears in U.S. court, a conviction could result in severe financial penalties and possible imprisonment. Such outcomes would undoubtedly tarnish the group’s reputation and limit its global ambitions.

Legal Proceedings: The U.S. case is expected to take years to resolve, with potential implications for other jurisdictions where Adani operates. The role of the incoming U.S. president Donald Trump may influence the pace and trajectory of the legal process as he detests his own justice department, and is on good terms with PM Modi - however this would come at a cost.

Corporate Reforms: Indian regulators and policymakers must seize this moment to strengthen governance frameworks and ensure that public-private partnerships are built on transparency and accountability.

Short-Term Resilience: With domestic liquidity and government support, the Adani Group is not at immediate risk of collapse.

Global Setbacks: International expansion plans are likely to slow, as ongoing scrutiny raises questions about governance and ethical practices.