Accelerate your wealth with Wright Portfolio Management Service.

India's premier quant driven portfolio management service. Welcome to the future!

Introduction video.

Introduction video.

Why Wright Portfolio Management Service?

Our quantitative edge, razor focus on finding diversified opportunities in the market and strong risk management differentiate us.

Factor Investing

Analyzing 100+ factors helps us

identify best investments for you.

Regime Modeling

Markets do not stay the same. Our regime models forecast market cycles.

Momentum Investing

Momentum is the strongest factor in India and an important part of our philosophy

Risk Modeling

Risk Management is at the core of our investing. We have a multi-level approach.

Asset Allocation

The best mix of investment assets is chosen for any market condition.

Artificial Intelligence

We use AI & machine learning models to forecast risk and reward in the market.

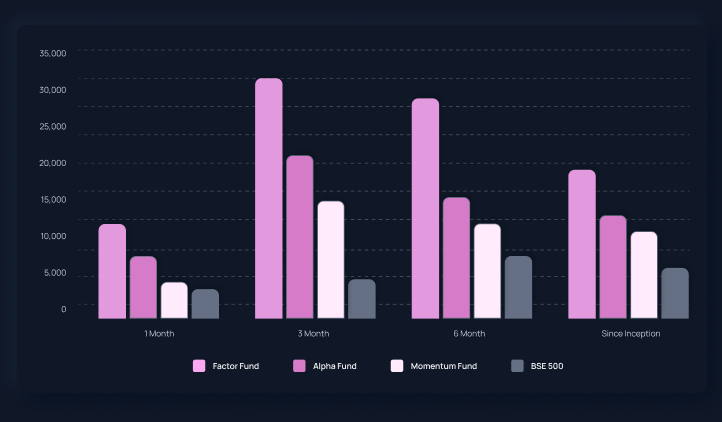

Meet Our PMS Quant Funds

Our top PMS portfolios take a data driven approach by focusing on factor investing, tactical allocation and forecasting market regimes. We use cutting-edge AI & machine learning to build long only, high-performance portfolios to generate high returns.